8.8 Billion Dollars Fleeing as MSTR Becomes the Black Sheep of Global Index Funds

TechFlow Selected TechFlow Selected

8.8 Billion Dollars Fleeing as MSTR Becomes the Black Sheep of Global Index Funds

The final outcome will be revealed on January 15, 2026, and the market has already started voting with its feet.

Recently, Bitcoin has taken a major hit, and MicroStrategy isn't faring well either.

MSTR's stock price has plummeted from a high of $474 to $177, a 67% drop. Over the same period, Bitcoin fell from $100,000 to $85,000, a 15% decline.

Even more critical is mNAV—the premium of market capitalization relative to Bitcoin net asset value.

At its peak, the market was willing to pay $2.50 for every $1 of Bitcoin held by MSTR. Now, that figure is just $1.10—almost no premium remains.

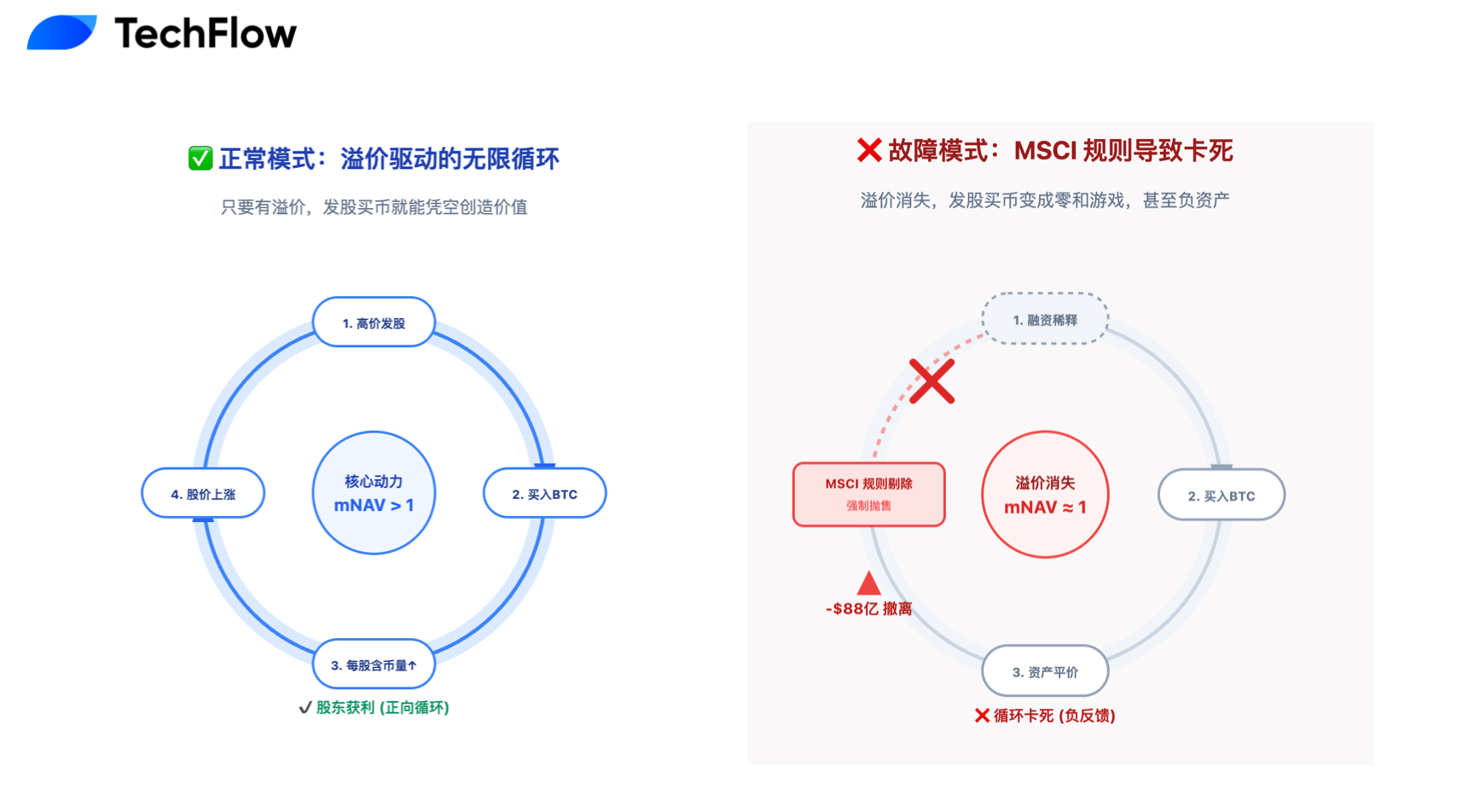

The old model was: issue shares → buy Bitcoin → stock rises (due to premium) → issue more shares. With the premium gone, issuing new shares to buy Bitcoin has become a zero-sum game.

Why is this happening?

Certainly, Bitcoin’s recent downturn is part of the reason. But MSTR’s fall has been far steeper than BTC’s, driven by a deeper fear:

MSTR may be kicked out of major global stock indices.

In short, trillions of dollars in global funds are "passive investors." They don’t pick stocks—they mechanically buy all components within an index.

If you’re in the index, they automatically buy you; if you’re removed, they must sell you, no exceptions.

This power lies with a few large index providers, with MSCI being the most important.

Now, MSCI is considering a key question: When a company holds Bitcoin as 77% of its assets, is it still a legitimate operating company? Or is it effectively a Bitcoin fund disguised as a public corporation?

On January 15, 2026, the answer will be revealed. If MSTR is indeed delisted, around $8.8 billion in passive funds will be forced to exit.

For a company whose entire business model relies on issuing shares to buy Bitcoin, this would be nearly a death sentence.

When Passive Funds Can No Longer Buy MSTR

What is MSCI? Think of it as the "college entrance exam board" of the stock market.

Trillions of dollars in global pension funds, sovereign wealth funds, and ETFs track indices created by MSCI. These funds do not conduct research or analyze fundamentals—they simply replicate the index exactly: whatever is in the index, they buy; anything not included, they ignore completely.

In September this year, MSCI began discussing a question:

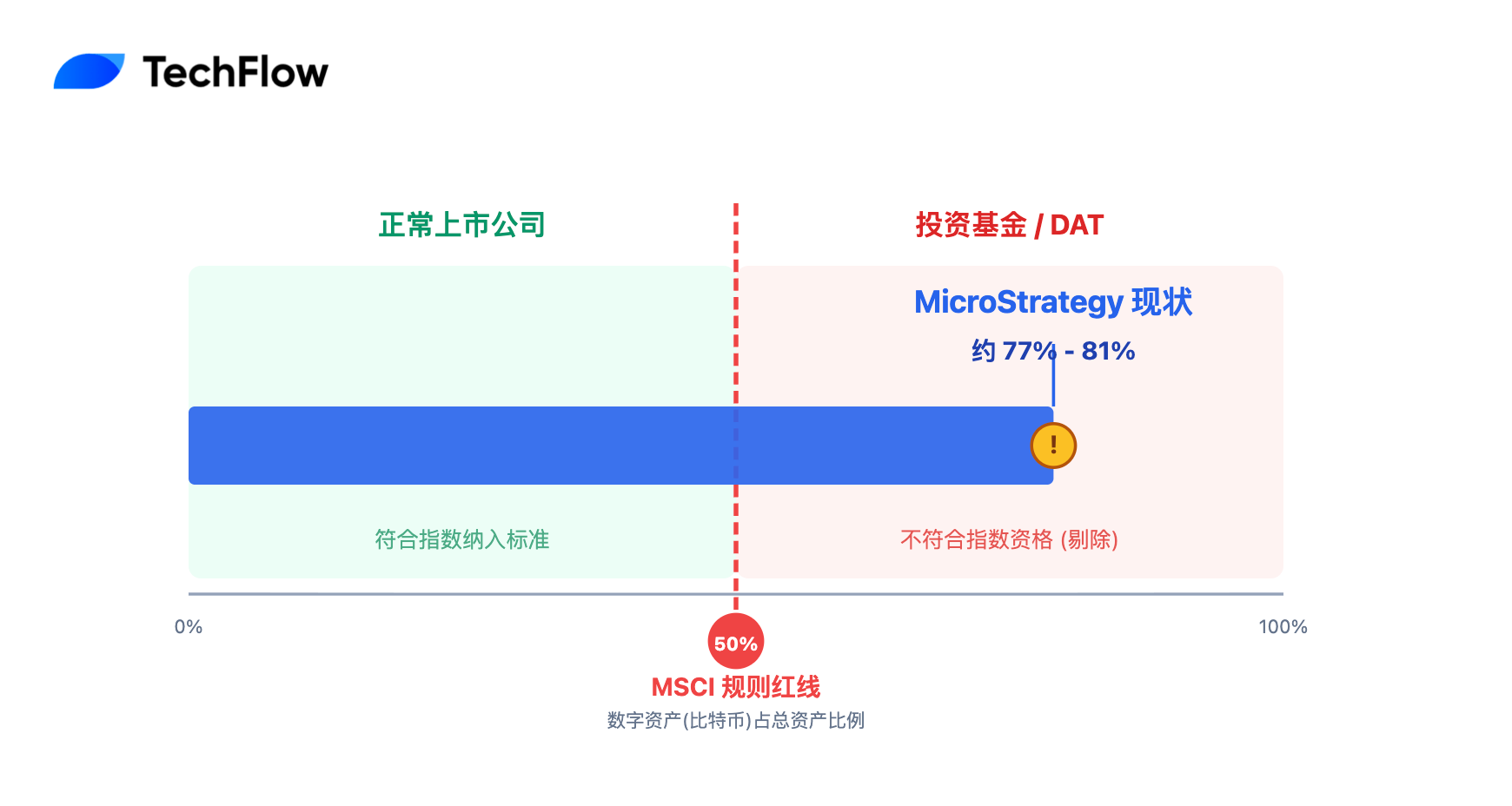

If a company’s digital assets (mainly Bitcoin) exceed 50% of total assets, can it still be considered a “normal public company”?

On October 10, MSCI released a formal consultation paper. Its logic is straightforward: companies holding large amounts of Bitcoin resemble investment funds more than operating businesses. And investment funds have never been allowed into stock indices—just as you wouldn’t place a bond fund into a tech stock index.

What’s MicroStrategy’s current situation? As of November 21, the company holds 649,870 Bitcoins, valued at approximately $56.7 billion. Its total assets stand at roughly $73–78 billion. Bitcoin’s share: 77–81%.

Far exceeding the 50% red line.

Worse still, CEO Michael Saylor has never hidden his intentions.

He has publicly stated multiple times that the software business generates only $116 million quarterly in revenue, existing primarily to “provide cash flow for debt servicing” and “offer regulatory legitimacy for the Bitcoin strategy.”

What happens if it gets delisted?

According to a November 20 JPMorgan report, if MSTR is excluded from MSCI alone, it could face about $2.8 billion in passive outflows. But if other major index providers follow (Nasdaq, Russell, FTSE, etc.), total outflows could reach $8.8 billion.

MSTR is currently included in several major indices: MSCI USA, Nasdaq-100, Russell 2000, among others. Passive funds tracking these indices collectively hold approximately $9 billion worth of MSTR stock.

Once removed, these funds must sell. They have no choice—it’s written into their charters.

How significant is $8.8 billion? MicroStrategy’s average daily trading volume is about $3–5 billion, but this includes heavy high-frequency trading. If $8.8 billion in one-way selling pressure hits in a short window, it would be like two to three consecutive days of pure sell orders and no buyers.

Keep in mind, MSTR’s average daily volume is $3–5 billion, including HFT and market-maker liquidity. $8.8 billion in one-directional selling equals 2–3 full days’ worth of total trading volume—all on the sell side. The bid-ask spread could widen from the current 0.1–0.3% to 2–5%.

History shows index adjustments are merciless.

In 2020, when Tesla was added to the S&P 500, its trading volume spiked tenfold in a single day. Conversely, when General Electric was removed from the Dow Jones Industrial Average in 2018, its stock dropped another 30% within a month of the announcement.

December 31 marks the end of the consultation period. On January 15 next year, the final decision will be announced. Based on the current MSCI proposal, delisting appears almost certain.

The Stock-for-Bitcoin Flywheel Has Jammed

MicroStrategy’s core strategy over the past five years can be simplified into a loop: issue shares → raise cash → buy Bitcoin → stock rises → issue more shares.

This model works only if the stock trades at a premium. If the market pays $2.50 for every $1 of Bitcoin held by the company (mNAV = 2.5x), then issuing new shares to buy Bitcoin creates value.

Diluting 10% of shares might increase assets by 15%, leaving shareholders better off overall.

At its 2024 peak, MicroStrategy’s mNAV did reach 2.5x—and briefly touched 3x. Reasons for the premium included Saylor’s execution ability, first-mover advantage, and serving as a convenient institutional gateway to Bitcoin.

But now mNAV has fallen to 1x—essentially par value.

The market may already be pricing in MSTR’s potential removal from MSCI.

Once delisted from major indices, MicroStrategy would shift from a mainstream stock to a niche Bitcoin investment vehicle. A precedent is Grayscale Bitcoin Trust (GBTC), which went from a 40% premium to a long-term 20–30% discount after better Bitcoin ETFs emerged.

When mNAV approaches 1x, the flywheel stops spinning.

Issuing $10 billion in new shares to buy $10 billion in Bitcoin leaves total company value unchanged. It’s just moving money from one hand to the other—diluting existing shareholders without creating value.

Debt financing remains an option—MicroStrategy has already issued $7 billion in convertible bonds. But debt must be repaid, and during a stock decline, convertibles turn into pure debt burdens rather than quasi-equity.

Saylor’s Response and Market Sentiment

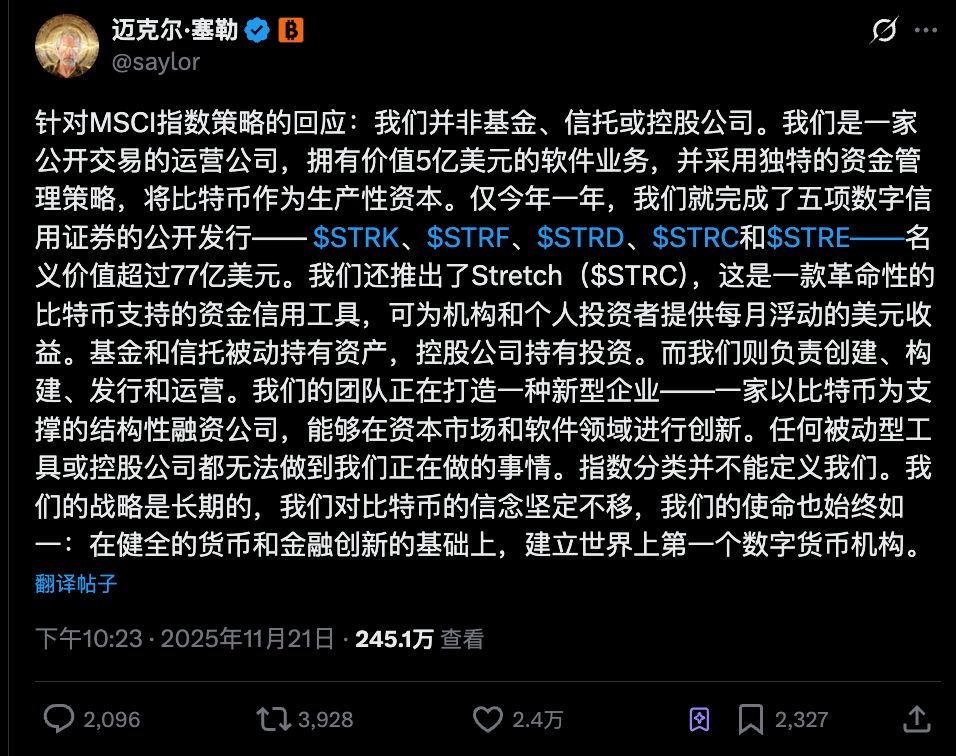

In response to the potential MSCI delisting, Michael Saylor reacted in classic fashion.

On November 21, he posted a lengthy thread on X, arguing that MicroStrategy is not a fund, not a trust, nor a holding company. He used careful wording to avoid MSCI’s classification:

"We are a listed operating company with a $500 million software business, employing a unique Bitcoin capital strategy."

He emphasized that funds and trusts merely passively hold assets, while MicroStrategy is actively “creating, building, launching, and operating.” This year, the company completed five public offerings of digital credit securities: STRK, STRF, STRD, STRC, and STRE.

The implication: we’re not just hoarding Bitcoin—we’re conducting complex financial operations.

Yet the market seems unimpressed by these arguments.

MSTR’s stock movement has decoupled from Bitcoin—not just lower correlation, but falling harder than BTC itself. This likely reflects growing concern over its index eligibility.

Joy Lou, partner at Cycle Capital, pointed out that after delisting, average daily trading volume could plunge 50–70% within 90 days.

More critically, there’s the debt issue. MSTR has $7 billion in convertible bonds, with conversion prices ranging from $143 to $672. If the stock falls into the $180–200 range, debt pressure will sharply increase.

Her outlook is bleak. After liquidity dries up, the risk of MSTR dropping below $150 surges.

Other community analyses echo similar pessimism. For example, once MSTR is removed from indices, automatic ETF sell-offs could drive the stock down, triggering a downward spiral in Bitcoin—a so-called "double whammy."

This "double whammy" refers to a sharp stock decline caused by both shrinking valuations and falling earnings per share.

Interestingly, analysts consistently highlight one word: passive.

Passive fund sell-offs, passively triggered debt clauses, passively lost liquidity. MSTR, once an active Bitcoin pioneer, has become a passive victim of the rules.

The market consensus is becoming clearer: this isn’t about whether Bitcoin rises or falls, but about a change in the rules of the game.

In recent interviews, Saylor continues to insist he’ll never sell Bitcoin. MSTR proved that a company can go all-in on Bitcoin—but MSCI may be proving that doing so comes at the cost of exile from mainstream markets.

Beyond the 50% Rule: Is DAT Still a Viable Business?

MicroStrategy isn’t the only public company holding large amounts of Bitcoin. According to MSCI’s preliminary watchlist, 38 firms are under review—including Riot Platforms, Marathon Digital, Metaplanet, and others. All are watching closely for what happens on January 15.

The rule is clear: 50% is the red line. Cross it, and you’re deemed a fund, not a company.

This draws a stark boundary for all DAT companies: either keep crypto holdings below 50% to remain in mainstream markets, or exceed it and accept marginalization.

No middle ground. You cannot simultaneously enjoy passive fund buying and function as a Bitcoin fund. MSCI’s rules disallow such arbitrage.

This is a blow to the entire corporate crypto-holding playbook.

For years, Saylor has evangelized persuading other CEOs to add Bitcoin to their balance sheets. MSTR’s success—its stock rising tenfold at one point—was the best advertisement. Now, that ad may be pulled.

In the future, companies wanting significant Bitcoin exposure may need new structures, such as:

-

Establishing independent Bitcoin trusts or funds

-

Holding Bitcoin indirectly via Bitcoin ETFs

-

Staying below the 49% "safe threshold"

Of course, some argue this is beneficial. Bitcoin should not depend on corporate financial engineering. Let Bitcoin be Bitcoin, and companies be companies—each returning to their proper roles.

Five years ago, Saylor pioneered the corporate Bitcoin strategy. Five years later, it may be ended by a dry financial regulation. But this may not be the end—it could force the market to evolve new models.

The MSCI 50% rule won’t cause MicroStrategy to collapse or Bitcoin to zero. But the era of unlimited “printing shares to buy Bitcoin” is over.

For investors still holding MSTR and other DAT stocks: are you bullish on Bitcoin, or on Saylor himself? If it’s the former, why not just buy Bitcoin or an ETF directly?

After index delisting, MSTR will become a niche investment. Liquidity will shrink, volatility will rise. Can you accept that?

The final verdict arrives on January 15, 2026—but the market has already begun voting with its feet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News