Error-prone Fed, leveraged tech stocks, and angry voters

TechFlow Selected TechFlow Selected

Error-prone Fed, leveraged tech stocks, and angry voters

The current financial system is entering a more fragile phase than the market anticipated.

Written by: arndxt

Translated by: AididiaoJP, Foresight News

Over the past few months, my stance has shifted significantly:

Initially, I moved from bearish to bullish, viewing the market as merely experiencing the kind of widespread pessimism that typically sets the stage for a short squeeze. But now I genuinely worry that the system is entering a more fragile phase.

This isn't about a single event, but rather five reinforcing dynamics:

Risk of policy missteps is rising. The Federal Reserve is tightening financial liquidity amid data uncertainty and visible signs of economic slowdown.

The AI / mega-cap tech complex is shifting from cash-rich to leveraged growth. This shifts risk from pure equity volatility to more classic credit cycle issues.

Private credit and loan valuations are beginning to diverge, with early but concerning model-based pricing pressures emerging beneath the surface.

Economic bifurcation is hardening into a political issue. For an increasing share of the population, the social contract is no longer credible—and this will eventually manifest in policy.

Market concentration has become both a systemic and political vulnerability. When roughly 40% of index market cap is effectively held by a handful of tech monopolies sensitive to geopolitics and leverage, it becomes a matter of national security and policy targeting—not just a growth story.

The base case may still be that policymakers ultimately "do what they always do": reinject liquidity into the system and support asset prices before the next political cycle arrives.

But the path to that outcome appears bumpier, more credit-driven, and politically less stable than what the standard "buy the dip" playbook assumes.

Macro Stance

For much of this cycle, a "bearish but constructive" stance was reasonable:

-

Inflation was high but decelerating.

-

Policy remained broadly supportive.

-

Risk assets were overvalued, but corrections were typically met with liquidity interventions.

Now, several elements have changed:

-

Government shutdown: We experienced a prolonged shutdown, disrupting the release and quality of key macro data.

-

Statistical uncertainty: Senior officials themselves admit damage to federal statistical agencies, meaning confidence in data series anchoring trillions in positions has declined.

-

Hawkish pivot amid weakness: Against this backdrop, the Fed chose to adopt a more hawkish stance on both rate expectations and its balance sheet, tightening even as forward-looking indicators deteriorate.

In other words, the system is tightening amid ambiguity and emerging stress, not moving away from it—a very different risk profile.

Tightening Policy Amid Uncertainty

The core concern isn't just policy tightening, but where and how it's tightening:

-

Data uncertainty: Key data (inflation, employment) were delayed, distorted, or questioned post-shutdown. The Fed’s own "dashboard" became less reliable precisely when it was most needed.

-

Rate expectations: Despite forward indicators pointing toward disinflation early next year, hawkish Fed commentary has pulled back market-implied near-term rate cut probabilities.

-

Balance sheet: The stance of the balance sheet under quantitative tightening, and the bias toward pushing more duration into the private sector, is inherently hawkish for financial conditions—even if the policy rate holds steady.

Historically, the Fed's mistakes have usually been about timing: hiking too late, cutting too late.

We may be repeating that pattern: tightening policy amid slowing growth and murky data, rather than preemptively easing.

AI and Mega-Tech Becoming a Leveraged Growth Story

A second structural shift is the changing nature of mega-cap tech and AI leaders:

Over the past decade, the core "Magnificent Seven" were effectively equity-like bonds: dominant businesses, massive free cash flow, large buybacks, limited net leverage.

Over the past two to three years, that free cash flow has increasingly been redirected into AI capex: data centers, chips, infrastructure.

We're now entering a phase where incremental AI capex is increasingly financed via debt issuance, not just internally generated cash.

The implications:

Credit spreads and credit default swaps are starting to move. As leverage rises to fund AI infrastructure, companies like Oracle are seeing widening credit spreads.

Equity volatility is no longer the only risk. We’re seeing the beginnings of classic credit cycle dynamics in sectors previously thought "unbreakable."

Market structure amplifies this. These same companies dominate major indices; their shift from "cash cows" to "leveraged growth" alters the entire index’s risk profile.

This doesn’t automatically mean the AI "bubble" is ending. If returns are real and sustainable, debt-financed capex can be justified.

But it does mean the margin for error is much smaller—especially in a higher-rate, tighter-policy environment.

Early Fault Lines in Credit and Private Markets

Beneath the surface of public markets, private credit is showing early signs of stress:

The same loan is being valued at significantly different prices by different managers (e.g., one at 70 cents on the dollar, another at ~90).

This divergence is a typical precursor to broader mark-to-model vs. mark-to-market disputes.

This pattern resembles:

-

2007—rising NPLs and widening spreads while equity indices remain relatively calm.

-

2008—markets once seen as cash equivalents (e.g., auction rate securities) suddenly freeze.

Additionally:

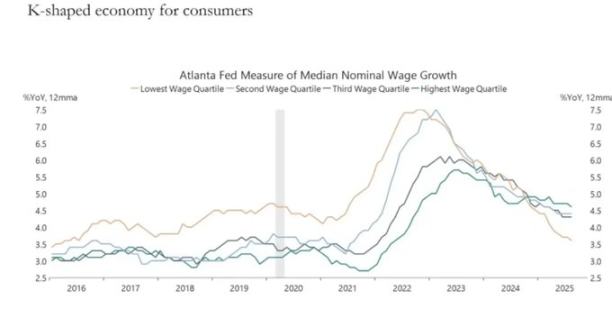

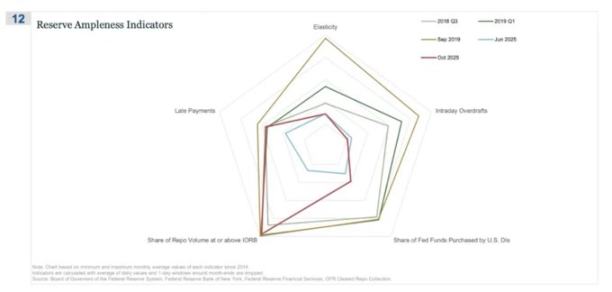

Fed reserves are starting to decline.

There’s growing internal recognition that some form of balance sheet re-expansion may be needed to prevent dysfunction within the financial system.

None of this guarantees a crisis. But it aligns with a system where credit is quietly tightening, while policy remains framed as "data-dependent" rather than preemptive.

The repo market is where the "reserves no longer abundant" story first emerges.

On this radar chart, the share of repo transactions conducted at or above the IORB rate is the clearest signal that we’re quietly exiting a true abundant-reserves regime.

In Q3 2018 and early 2019, that line was relatively contracted: ample reserves meant most secured funding traded comfortably below the interest on reserve balances (IORB) floor.

By September 2019, just before the repo market seized up, the line sharply expanded outward, as more repos traded at or above IORB—classic symptoms of collateral and reserve scarcity.

Now compare June 2025 vs October 2025:

The light blue line (June) remains safely inward, but the red line (October 2025) extends outward, approaching the 2019 contour, showing a rising share of repo trades hitting the policy rate floor.

In other words, dealers and banks are pushing up overnight funding rates because reserves are no longer comfortably abundant.

Combined with other indicators (more intraday overdrafts, higher Federal Home Loan Bank purchases of fed funds, rising payment delays), the message is clear.

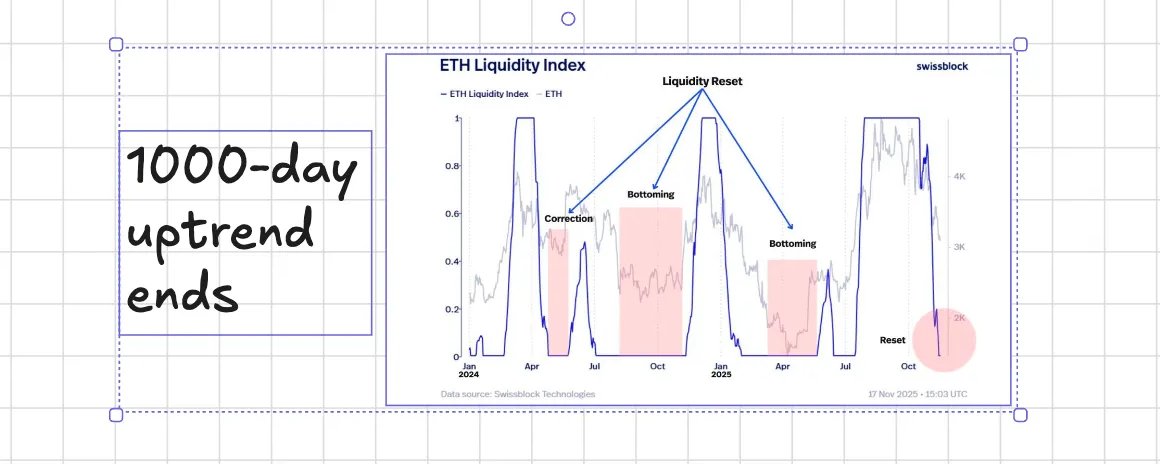

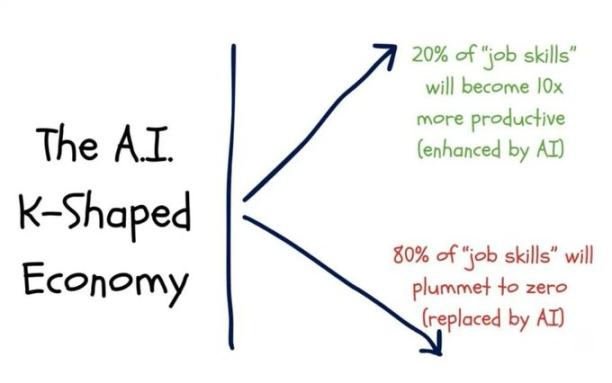

K-shaped economy becoming a political variable

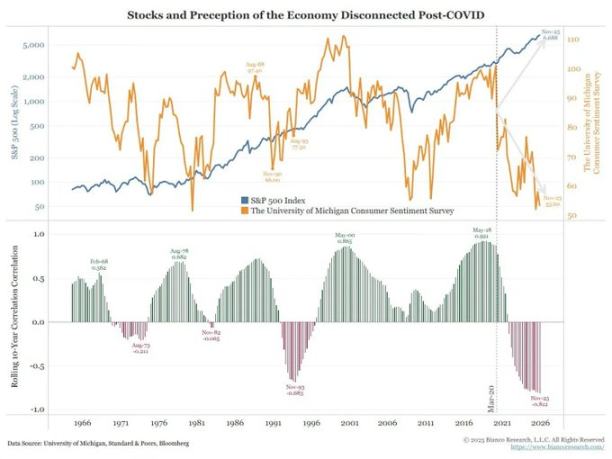

The economic bifurcation we call "K-shaped" has, in my view, now become a political variable:

Household expectations are diverging. Long-term financial outlooks (e.g., 5-year expectations) show striking gaps: some groups expect stability or improvement; others expect sharp deterioration.

Real-world stress indicators are flashing:

-

Rising delinquency rates among subprime auto borrowers.

-

Homeownership postponed later in life, median age of first-time buyers nearing retirement age.

-

Marginally rising youth unemployment indicators across multiple markets.

For an increasing share of the population, the system isn't just "unequal"—it's broken:

No assets, limited wage growth, almost no realistic pathway to participate in asset inflation.

The perceived social contract—"work hard, get ahead, build some wealth and security"—is unraveling.

In this environment, political behavior changes:

Voters no longer select the "best manager" of the current system.

They become increasingly willing to support disruptive or extreme candidates from both left and right, because downside feels limited: "It can't get worse."

This is the context in which future policies on taxation, redistribution, regulation, and monetary support will be shaped.

This is not neutral for markets.

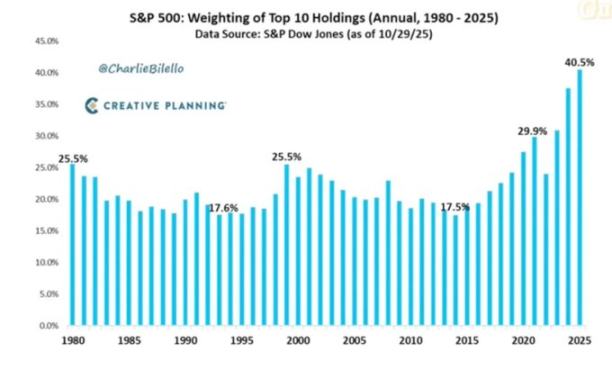

Market concentration becoming systemic and political risk

Market capitalization concentrated in a few firms is rarely discussed for its systemic and political implications:

Currently, the top 10 firms make up around 40% of the market cap of major U.S. equity indices.

These firms simultaneously:

-

Are core holdings in pensions, 401(k)s, and retail portfolios.

-

Are increasingly dependent on AI, exposed to China risks, and sensitive to interest rate paths.

-

Operate as de facto monopolies across multiple digital domains.

This creates three interwoven risks:

Systemic Market Risk

Shocks to these firms—whether from earnings, regulation, or geopolitics (e.g., Taiwan, China demand)—will rapidly transmit to household wealth writ large.

National Security Risk

When so much national wealth and productivity is concentrated in a few externally dependent firms, they become strategic vulnerabilities.

Political Risk

In a K-shaped, populist environment, these firms are obvious targets of discontent:

-

Higher taxes, windfall levies, buyback restrictions.

-

Antitrust-driven breakups.

-

Stricter AI and data regulation.

In other words, these firms aren't just growth engines—they're also potential policy targets, and the likelihood of them becoming targets is rising.

Bitcoin, gold, and (for now) the failure of the "perfect hedge" narrative

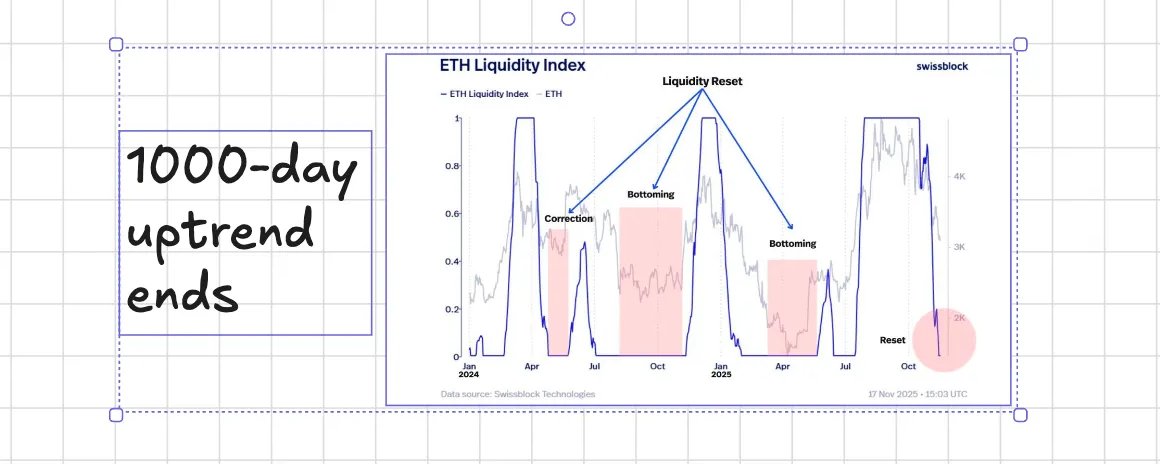

In a world of policy misstep risks, credit stress, and political instability, one might expect Bitcoin to thrive as a macro hedge. Yet:

Gold is behaving as a traditional crisis hedge: steadily stronger, low volatility, rising portfolio correlation.

Bitcoin trades more like a high-beta risk asset:

-

Closely tied to the liquidity cycle.

-

Sensitive to leverage and structured products.

-

Long-term holders are selling in this environment.

The original decentralized/monetary revolution narrative remains conceptually compelling, but in practice:

-

Today's dominant flows are financialized: yield strategies, derivatives, volatility-selling.

-

Bitcoin's empirical behavior is closer to tech beta than a neutral, robust hedge.

I still see a plausible path where 2026 could become a major inflection point for Bitcoin (next policy cycle, next stimulus round, further erosion of trust in traditional assets).

But investors should recognize that, at present, Bitcoin does not deliver the hedging properties many expect—it is part of the same liquidity complex we are worried about.

A Plausible Scenario Framework Toward 2026

A useful way to frame the current environment is as a managed deflation of a bubble to create space for the next round of stimulus.

The process might unfold as follows:

Mid-2024 to Mid-2025: Controlled tightening and pressure

-

Government shutdowns and political dysfunction create cyclical drag.

-

Fed leans hawkish in rhetoric and balance sheet, tightening financial conditions.

-

Modest widening of credit spreads; speculative areas (AI, long-duration tech, parts of private credit) absorb initial shocks.

Late 2025 to 2026: Re-liquification entering political cycle

-

As inflation expectations fall and markets correct, policymakers regain "space" to ease.

-

We see rate cuts and fiscal measures aimed at supporting growth and electoral goals.

-

Inflationary consequences appear after key political junctures due to lags.

Post-2026: Systemic repricing

Depending on the scale and form of the next stimulus, we either get:

-

A new cycle of asset inflation, accompanied by higher political and regulatory intervention,

-

Or a sharper confrontation with debt sustainability, concentration, and social contract issues.

This framework isn't deterministic, but it aligns with current incentives:

-

Politicians prioritize re-election over long-term equilibrium.

-

The easiest toolkit remains liquidity and transfers, not structural reform.

-

To reuse the toolkit, they first need to deflate some of today’s bubbles.

Conclusion

All signals point to the same conclusion: the system is entering a more fragile phase of the cycle.

Indeed, historical patterns suggest policymakers will ultimately respond with massive liquidity injections.

Reaching that next phase requires navigating a period defined by:

-

Tightening financial conditions,

-

Rising credit sensitivity,

-

Political volatility,

-

And increasingly nonlinear policy responses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News