SharpLink and Upexi: DATs with Their Own Strengths and Weaknesses

TechFlow Selected TechFlow Selected

SharpLink and Upexi: DATs with Their Own Strengths and Weaknesses

Can cryptocurrency national debt scale up its revenue engine?

Author: Prathik Desai

Translation: Block unicorn

Introduction

I honestly don't know how I've managed recently. I was nearly buried under an avalanche of financial statements. I'm starting to question my love for numbers—not because I’ve analyzed too much, but because each of the six financial reports I wrote over the past three weeks revealed rare insights into corporate financials that we almost never see.

The financial health of Digital Asset Treasuries (DATs) is intricately tied to DeFi strategies, making analysis of company performance extremely challenging.

Upexi and SharpLink Gaming released their quarterly earnings this week—two companies I’ve recently studied in depth.

On the surface, they appear to be ordinary businesses: one sells consumer brands, the other runs affiliate marketing for sports betting. But only upon closer inspection does it become clear that what truly drives their valuation, determines profitability, and shapes their overall identity isn’t warehouses or e-commerce platforms—it’s cryptocurrency.

Upexi and SharpLink have entered a space where corporate finance and crypto treasury management blur.

In today’s article, I’ll walk you through what I discovered inside Ethereum and Solana treasuries, and what investors should watch out for before gaining exposure to crypto through these vehicles.

SharpLink's ETH Division

Less than a year ago, I would have described SharpLink as a niche sports affiliate marketing company—one that only comes to mind during the Super Bowl. Its financials looked no different from other mid-sized peers: thin revenue, performance subject to seasonal fluctuations based on the sports calendar, and a profit-and-loss statement frequently in the red.

Nothing suggested the company had a $3 billion balance sheet.

That changed in June 2025, when the company made a decision that redefined its identity: designating Ethereum as its primary treasury asset and becoming one of the leading corporate holders of ETH.

Since then, the company has restructured its operations around Ethereum management, led by Joe Lubin. The Ethereum co-founder, Consensys founder and CEO, joined SharpLink at the end of May as Chairman of the Board.

Over recent months, SharpLink has directly allocated capital into native staking, liquid staking, and DeFi protocols, shifting its core business toward Ethereum. Three months later, the transformation is already showing results.

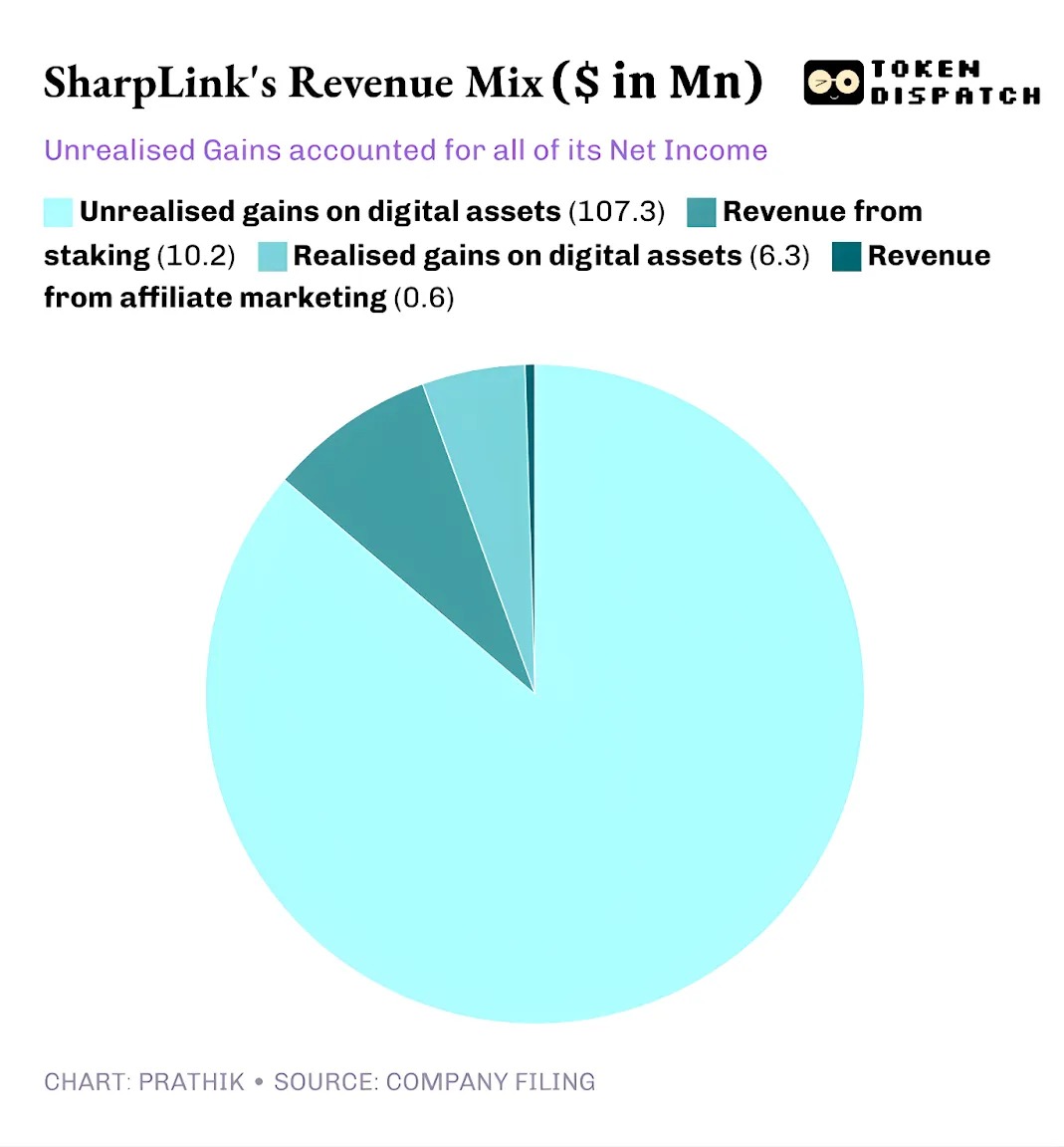

SharpLink reported quarterly revenue of $10.8 million, up 11-fold from $900,000 a year earlier. Of that, $10.2 million came from staking income generated by its ETH treasury, while only $600,000 originated from its traditional affiliate marketing business.

SharpLink’s total assets grew from $2.6 million on December 31, 2024, to $3 billion on September 30, 2025.

At quarter-end, SharpLink held 817,747 ETH, increasing to 861,251 ETH by early November. It is now the second-largest corporate holder of ETH. Its 11-fold revenue growth is entirely attributable to this treasury.

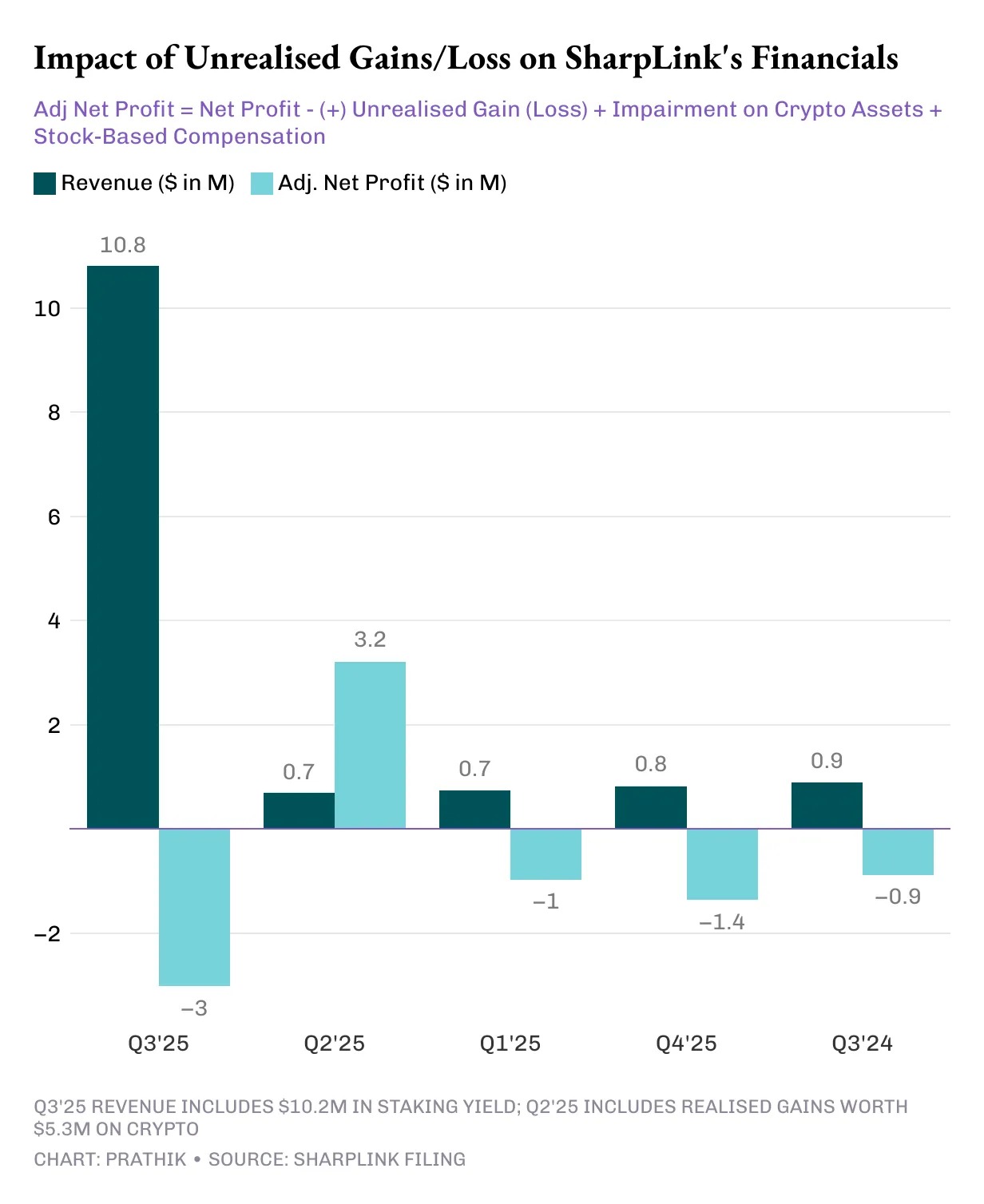

Nearly 95% of SharpLink’s revenue this quarter came from gains earned through ETH staking. While net profit surged 100-fold to $104.3 million compared to a $900,000 net loss in Q3 2024, there's a hidden issue. Like most other DAT projects, all of SharpLink’s profits stem from unrealized gains on its ETH holdings.

This is due to U.S. GAAP accounting rules, which require companies to value assets at fair market value at the end of each reporting period. Contributions from affiliated operations are negligible.

As a result, all these gains are essentially non-cash. Even the income SharpLink earns from staking rewards is paid in ETH, not regularly converted into fiat. This is precisely where my concern lies.

While non-cash income still counts as revenue under accounting standards, the company burned $8.2 million in operating cash over nine months to cover salaries, legal and audit fees, and server costs.

And where did those dollars come from?

Like most other DATs, SharpLink funded its ETH accumulation by issuing new shares. The company raised $2.9 billion through equity offerings this year, followed by a $1.5 billion stock buyback authorization to offset dilution.

This mirrors the DeFi flywheel effect increasingly common among DATs.

SharpLink issues stock, uses proceeds to buy ETH, stakes ETH to earn yield, books unrealized gains as ETH appreciates, reports higher accounting profits, and thus gains the ability to issue even more stock. The cycle repeats.

As I’ve noted in other DAT cases, this model works well during bull markets. Even across bear cycles, it can remain viable as long as corporate cash reserves are sufficient to cover expenses. Rising ETH prices strengthen the balance sheet, treasury growth outpaces operating costs, and the market gains a liquid, yield-bearing public proxy for Ethereum.

Vulnerability emerges when prices stagnate over the long term—a familiar scenario for Ethereum holders—especially when combined with high corporate overhead.

We’ve seen similar risks play out with Strategy, the Bitcoin treasury giant.

I expect nearly every DAT project to face such risks regardless of which cryptocurrency they invest in, unless they possess strong cash reserves and healthy core profitability supporting their DAT strategy. Yet we rarely see profitable enterprises fully commit to crypto treasuries.

This is exactly what happens when Strategy chases BTC and SharpLink bets on ETH. The same applies to Solana treasuries.

Upexi's Solana Operation

While SharpLink has almost completely transformed from a betting affiliate into an Ethereum treasury, Upexi retains the shell of a consumer brand company but has fully embraced Solana.

I’ve been watching Upexi for some time. Operationally, over the past five fiscal years, most of its performance metrics were positive. Brand acquisitions, revenue growth, and gross margins were all solid. Yet at the corporate level, Upexi recorded net losses in each of the past four fiscal years.

Possibly this prompted the company to incorporate digital assets into its financials. Over the last two quarters, this shift was subtle but visible. This quarter, however, digital assets dominate its financial reporting.

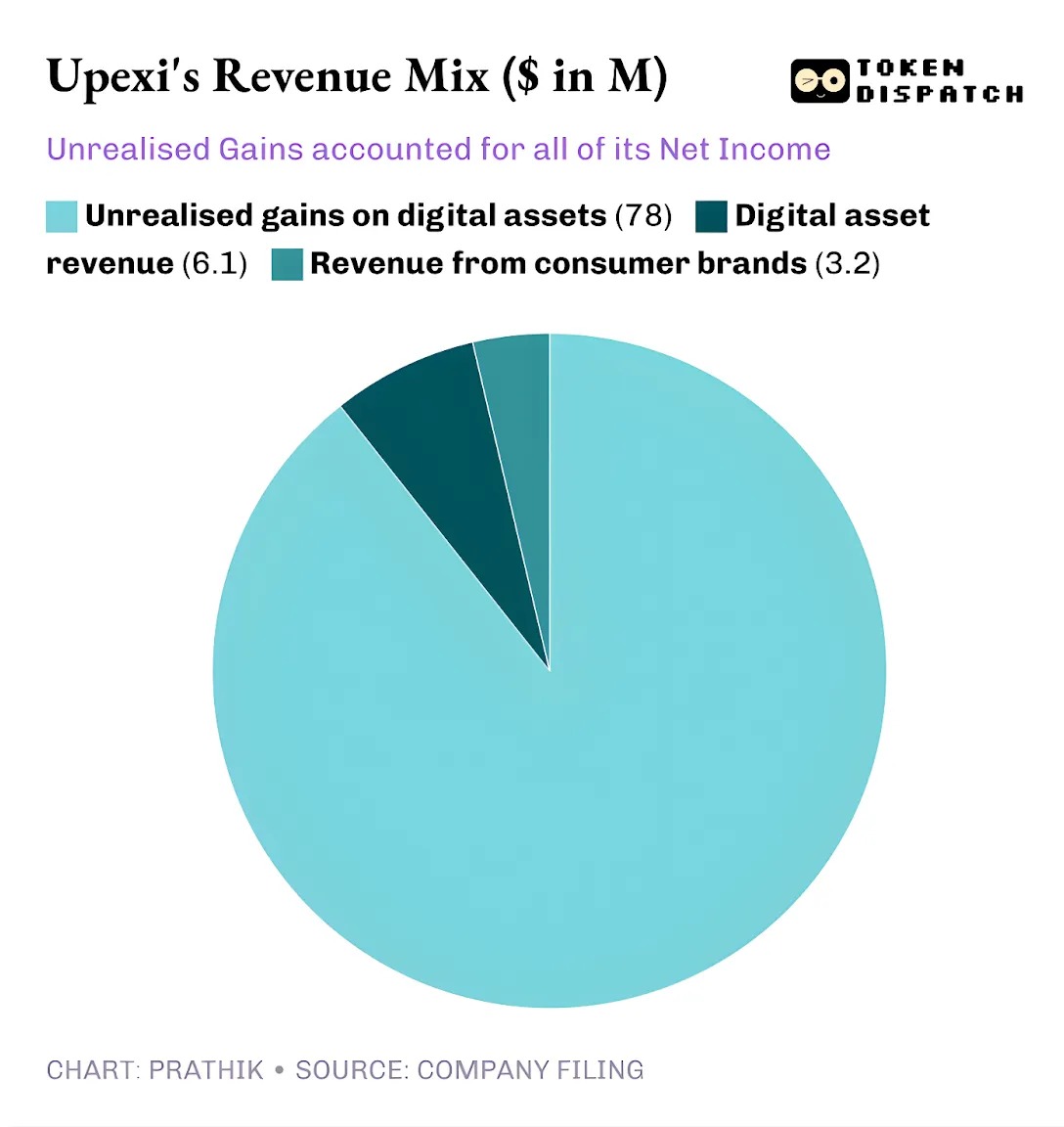

In Q3 2025, Upexi generated $9.2 million in revenue, of which $6.1 million came from SOL staking and the remaining $3.1 million from its consumer brand business. For a consumer goods company that reported zero crypto-related income last quarter, having two-thirds of revenue derived from digital asset staking represents a massive leap.

Upexi currently holds 2.07 million SOL tokens worth over $400 million, with approximately 95% staked. This quarter alone, they earned 31,347 SOL in staking rewards.

What sets Upexi apart from other DATs is its strategy for acquiring locked SOL.

The company purchased around 1.05 million locked SOL tokens at an average 14% discount to market price, with unlock dates ranging from 2026 to 2028.

Locked tokens cannot be sold immediately, hence trade at a discount. As these locked SOL tokens unlock, their value naturally converges with regular circulating SOL, allowing Upexi to benefit both from staking yields and built-in price appreciation.

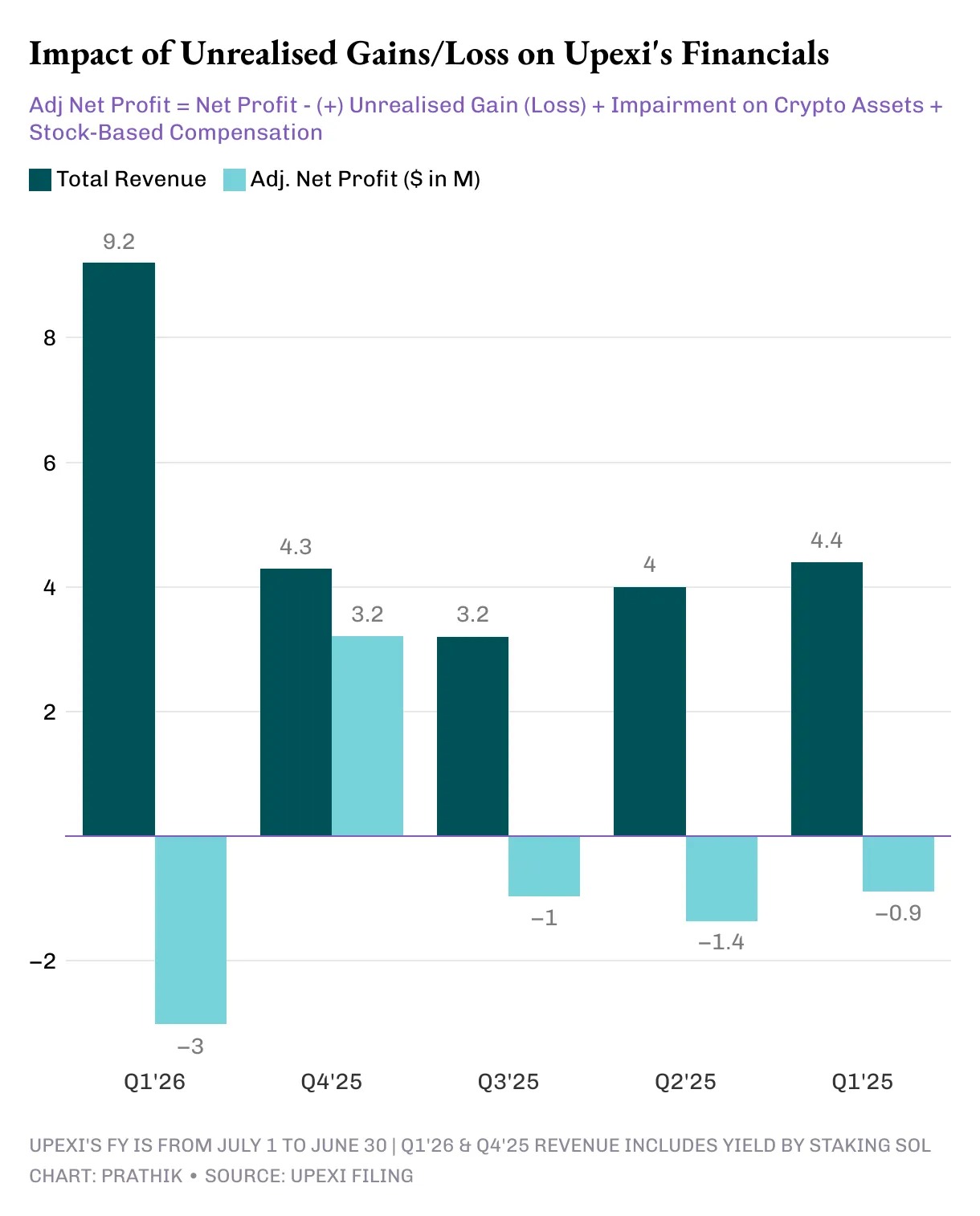

This approach resembles hedge fund tactics more than typical DAT behavior. But when you examine Upexi’s cash flow, the same concerns arise—identical to SharpLink.

Such strategies are common in hedge funds, not ordinary DATs (Digital Asset Treasuries). Yet when reviewing Upexi’s cash flows, the same issues as SharpLink reappear.

Despite reporting a net profit of $66.7 million—including $78 million in unrealized gains—the company recorded $9.8 million in negative operating cash flow. Since staking income in SOL is not converted into fiat, it remains non-cash. Consequently, like other capital-dependent DATs, the company turned to financing.

Upexi raised $200 million via convertible bonds and secured a $500 million equity funding facility. Its short-term debt increased from $20 million to $50 million.

The same flywheel, similar risks. What happens if SOL stagnates for a year?

Both SharpLink and Upexi are building clever systems. But that doesn’t mean they’re sustainable.

No Easy Answers

There’s a pattern I can’t ignore: both companies operate financial models that make sense in favorable economic conditions. They’ve built treasuries that scale with network activity; they’ve structured yield mechanisms that supplement income; and through these moves, they’ve become top-tier public proxies for two of the world’s most important Layer-1 blockchains.

Yet nearly all their profits derive from unrealized gains, earned token income lacks liquidity, there’s no systematic effort to monetize treasury assets to realize profits, operating cash flow is negative, and they rely on capital markets to pay bills.

This isn’t so much a critique as it is a reality and trade-off every company adopting a DAT structure must confront.

For this model to be sustainable, one of two things must happen: either staking must genuinely become a corporate cash engine, continuously funding digital asset purchases; or the company must incorporate planned sales of digital assets into its treasury strategy to systematically realize profits.

This isn’t impossible. SharpLink earned $10.3 million from ETH staking, and Upexi earned $6.08 million from SOL staking.

These amounts are not trivial. If even a portion were systematically converted back into fiat to support operations, the outcome could change significantly.

Until then, both Upexi and SharpLink face the same dilemma: balancing extraordinary innovation with capital market liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News