Cold water alert: most DAT companies are heading towards their end

TechFlow Selected TechFlow Selected

Cold water alert: most DAT companies are heading towards their end

They mimicked Strategy's balance sheet but did not replicate the capital structure.

Author: Decentralised.Co

Translation: TechFlow

Strategy built a $70 billion asset reserve by holding Bitcoin.

Today, every token project wants to become an asset-backed company.

The problem: a quarter of Bitcoin-reserve companies already have market caps below the value of their holdings.

Here’s why most will fail.

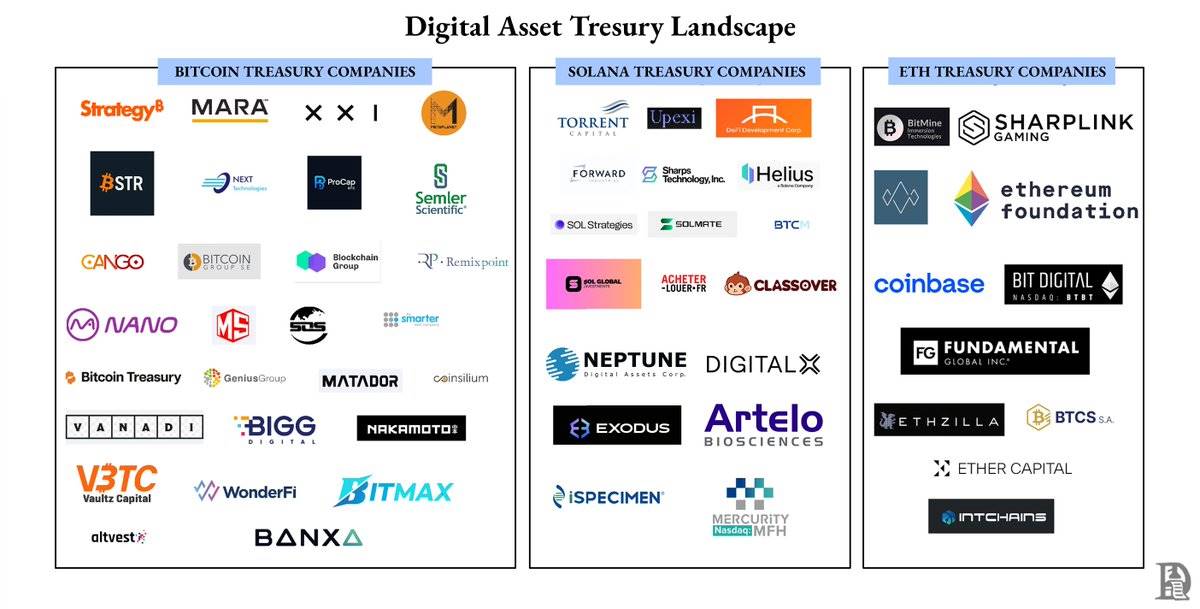

Asset-reserve companies have become one of the fastest-growing categories in crypto.

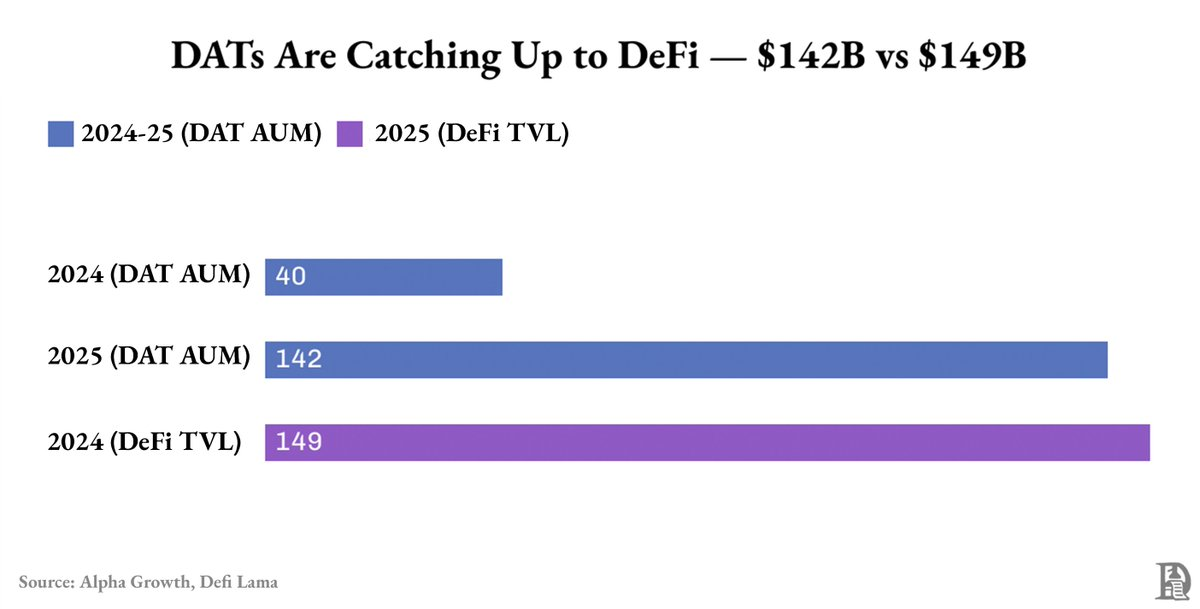

In just one year, their total assets surged from $40 billion to $142 billion—nearly matching DeFi's entire total value locked (TVL).

Nearly 90% of these assets are Bitcoin and Ethereum.

But this “growth” is mostly driven by rising prices of Bitcoin and Ethereum, not business cash flows or financial engineering.

Even this growth is unevenly distributed.

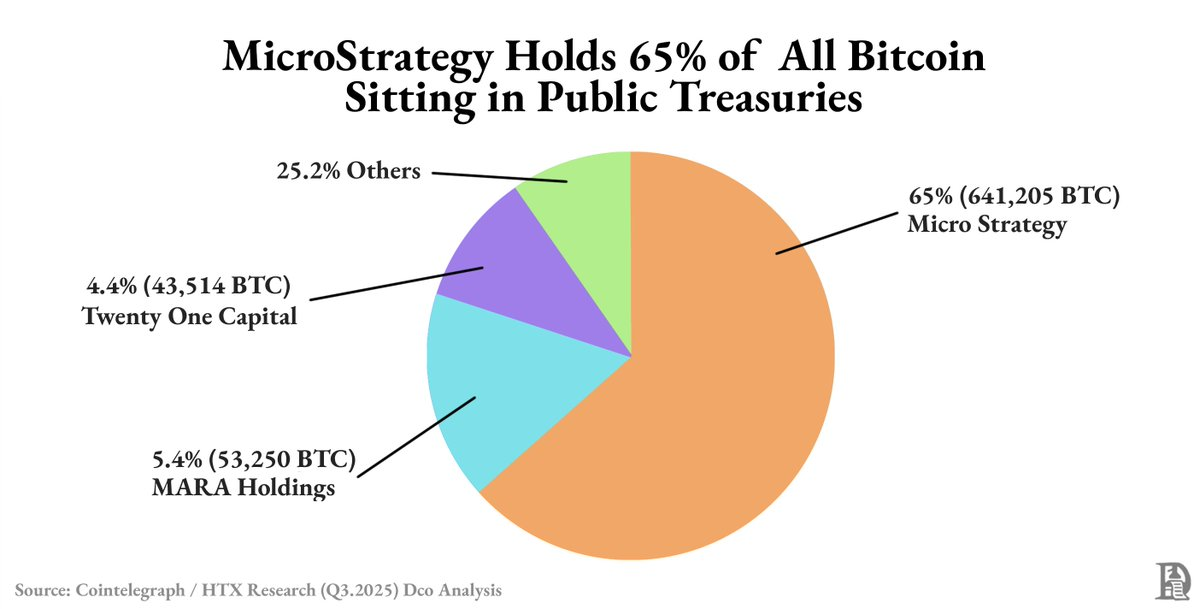

Strategy alone holds nearly 63% of all publicly disclosed Bitcoin reserves. Most of the rest is controlled by the top six firms.

Outside these giants, most digital asset reserve companies (DATs) suffer from thin liquidity and fragile premiums, with valuations swinging on market sentiment rather than performance.

Why?

When markets are strong, asset-reserve stocks trade at a premium above their net asset value. This premium exists because they offer compliant exposure to Bitcoin or Ethereum. Issuing new shares at a premium raises capital and boosts book value.

Each funding round adds more crypto assets, pushing both total assets and share prices higher. This creates a reflexive cycle: price gains enable value-accretive financing, which funds more asset purchases, driving valuations up—until the premium vanishes.

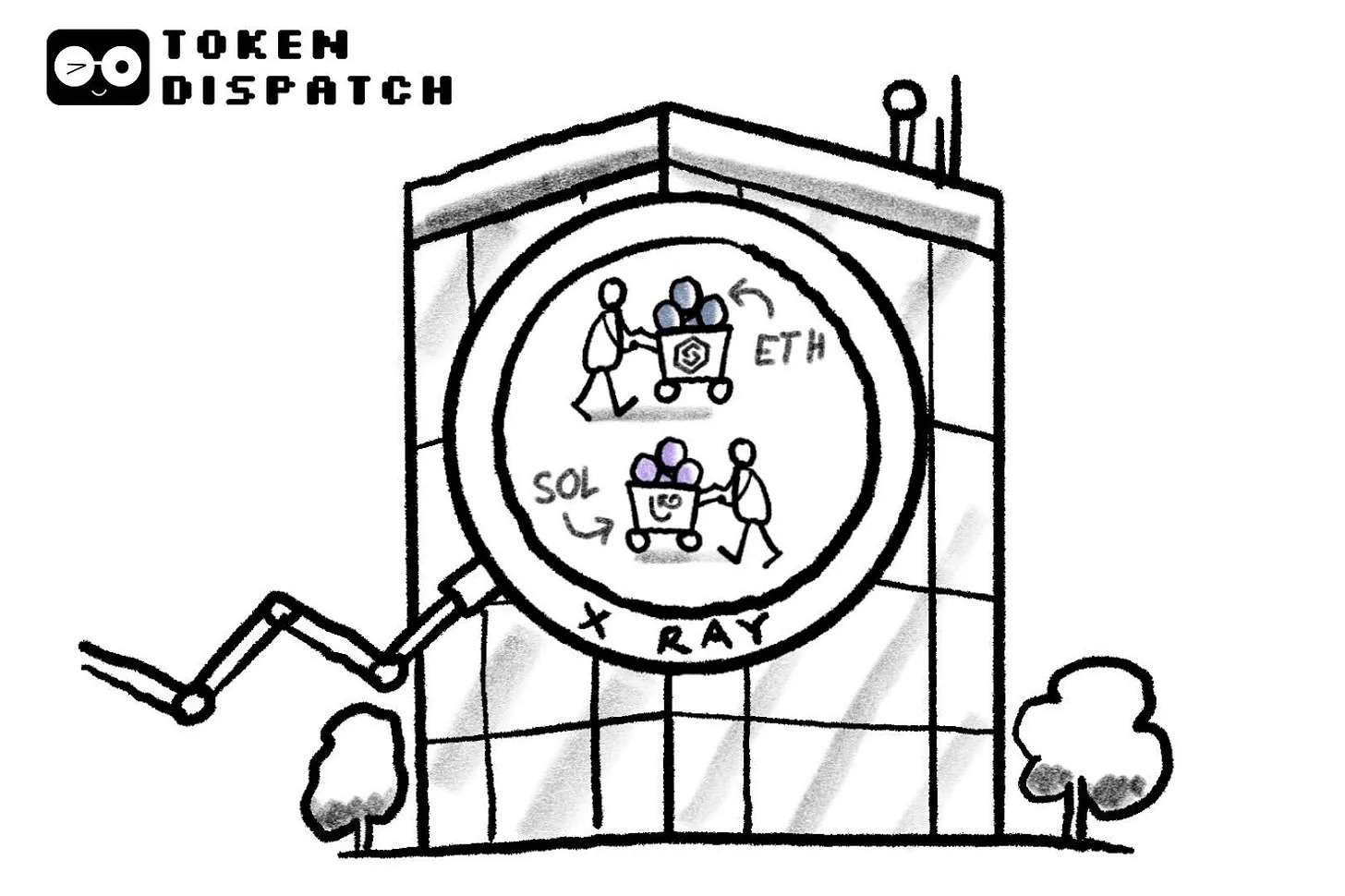

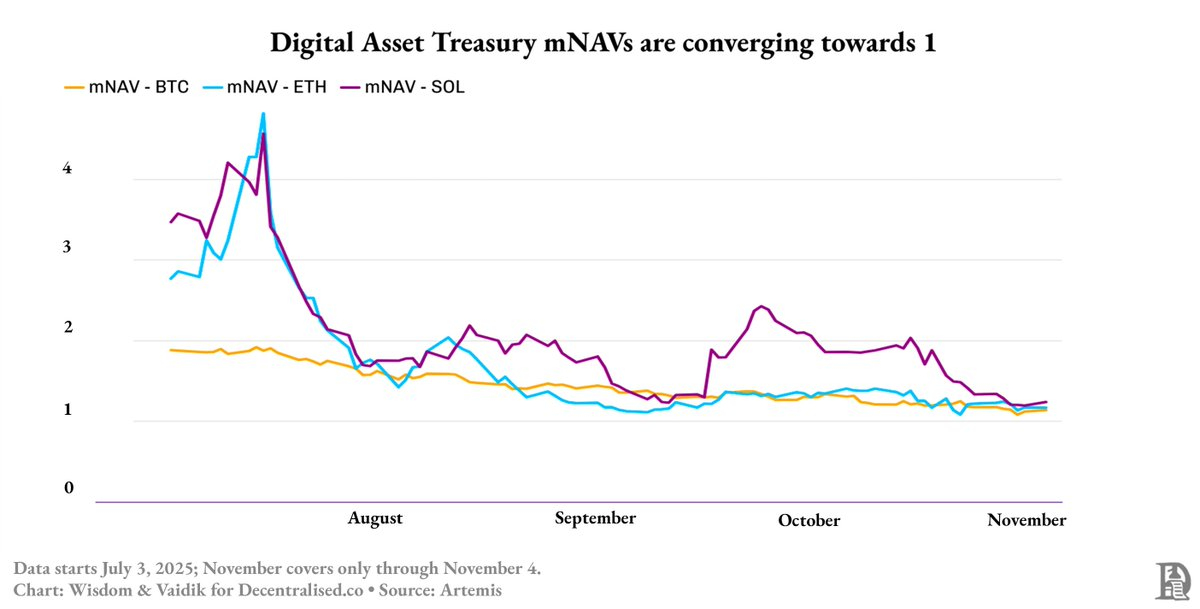

By mid-2025, this cycle broke: Bitcoin-reserve company premiums fell from 1.9x to 1.3x, while Ethereum and SOL (Solana) reserve premiums dropped from 4.8x to around 1.3x within two months.

So how did Strategy survive?

Because it didn’t just build an asset reserve—it created a financial instrument.

While most reserve companies raise capital by issuing equity to buy more crypto, Strategy raised $4 billion through convertible bonds and senior notes—long-term loans at around 0.8% interest.

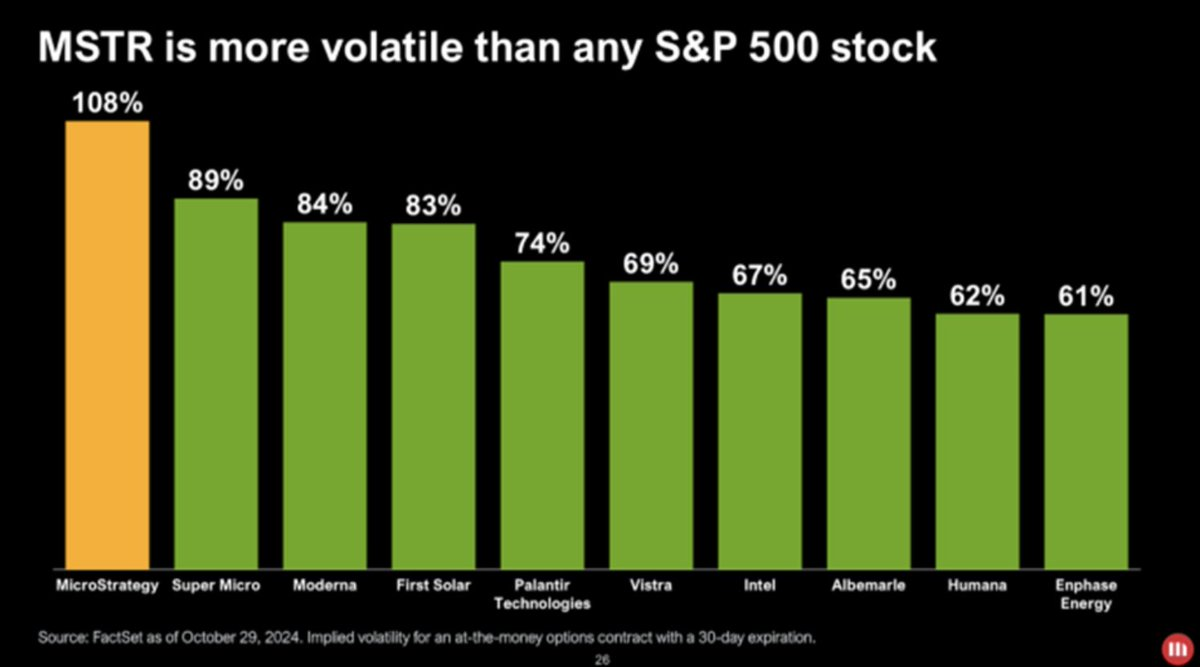

Its stock became a high-beta version of Bitcoin. When Bitcoin moves 1%, its stock amplifies that move slightly in the same direction. By using debt to buy Bitcoin, Strategy magnifies each price swing, offering investors a leveraged, compliant way to bet on Bitcoin without holding it directly.

This tradable volatility attracts new investors: funds, ETFs, and even a debt market built around it.

Traders profit from Strategy’s volatility. Even though their capital is locked until note maturity, they earn returns from stock price swings.

Thanks to higher stock liquidity and stronger volatility than Bitcoin, traders can profit before note maturity.

Most new asset-reserve companies copied Strategy’s model—but only replicated the simple parts.

They mimicked the balance sheet, but not the capital structure.

Strategy has convertibles, senior notes, and liquidity—elements that allow it to turn volatility into funding power.

Others lack these tools. Unable to raise capital, they chase yield via staking, lending, or buying tokenized Treasuries.

Using yield instead of real financing works well during price rallies. Yields stay high, liquidity seems strong—making the model appear viable.

But this masks equity-like reflexive risks.

Most DATs lock assets in staking or lending to earn yield, while allowing investors free entry and exit.

When the market cycle turns, redemptions rise and yields fall, forcing them to sell locked assets at a loss.

This is exactly what’s happening now.

As market confidence weakens, stocks once trading at 3–4x premium to assets have collapsed to par.

Even “yield-driven” asset-reserve companies based on Ethereum (ETH) or Solana (SOL) aren’t immune—their solvency still hinges on token prices.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News