2025 Digital Asset Treasury Company (DATCo) Report

TechFlow Selected TechFlow Selected

2025 Digital Asset Treasury Company (DATCo) Report

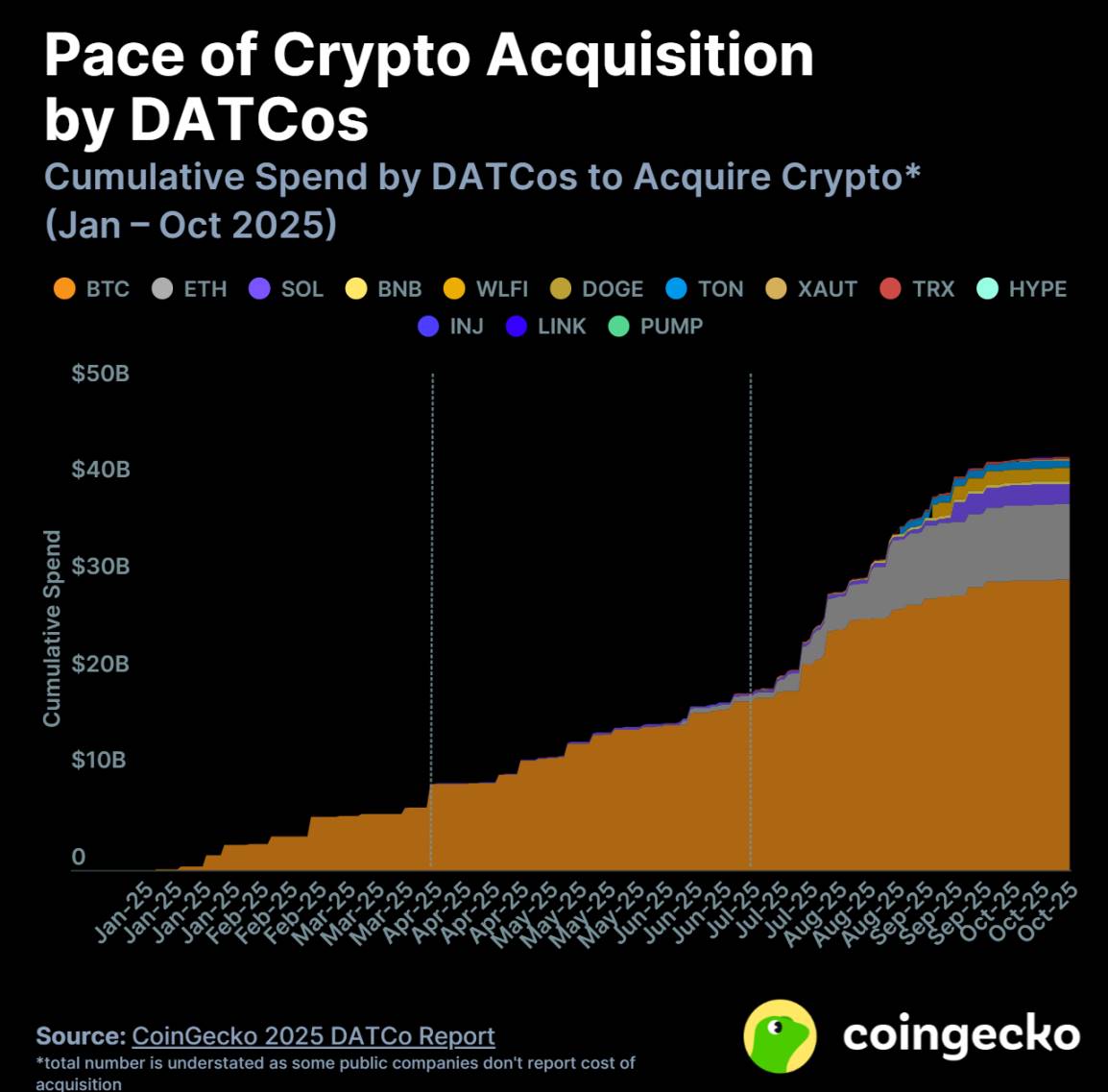

DATCo invested a total of $42.7 billion in 2025, with more than half occurring after the third quarter.

Author: CoinGecko

Translation: AididiaoJP, Foresight News

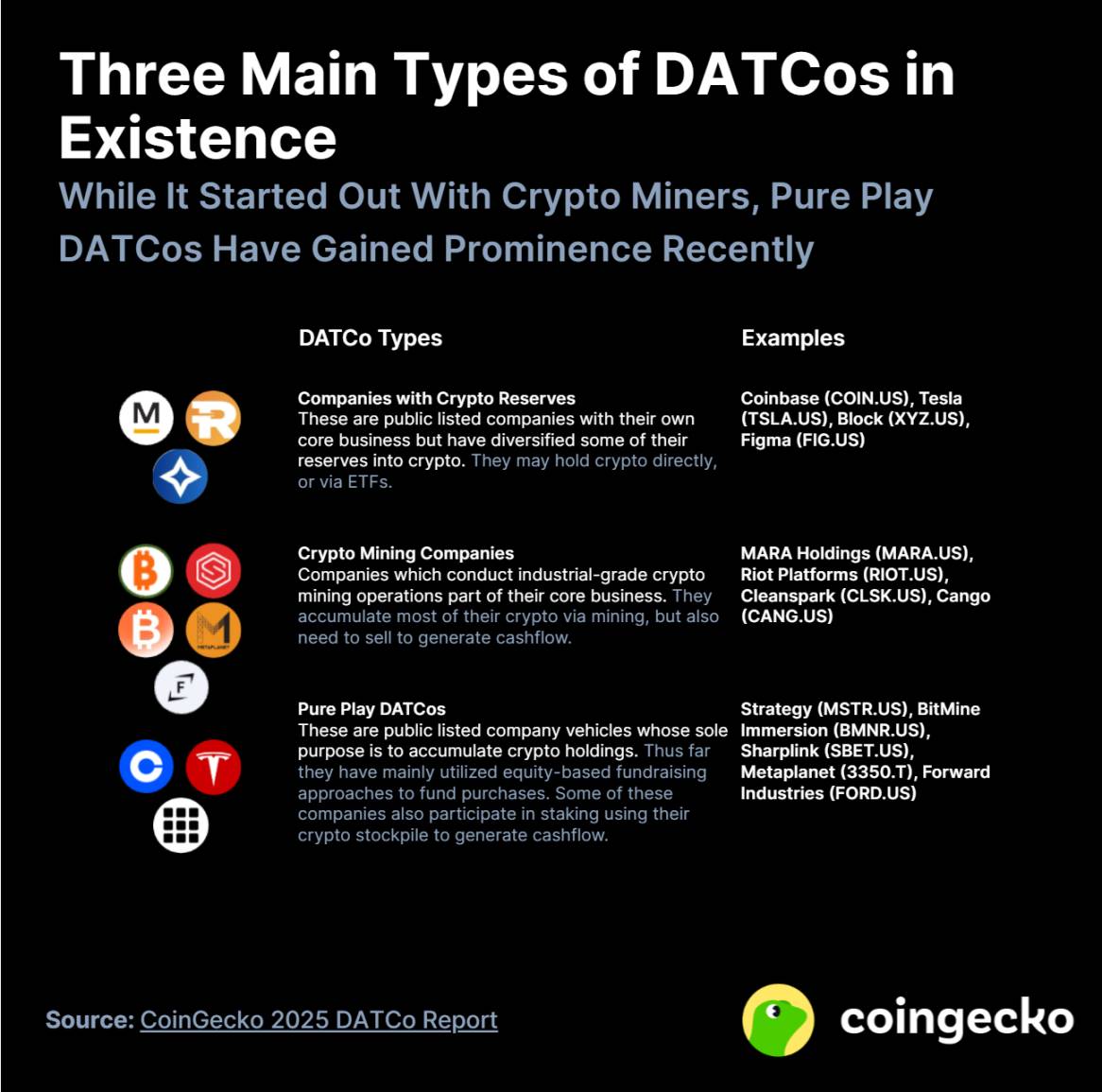

Since 2020, the rise of digital asset treasury companies (DATCo) has become one of the most iconic developments in the cryptocurrency space. While media attention has largely focused on ETFs, meme coins, and next-generation DeFi protocols, DATCos have quietly emerged as a powerful force in the market.

How did DATCos evolve from niche corporate experiments into a dominant $130 billion force spanning Bitcoin, Ethereum, and various altcoins?

This article explores how digital asset treasury companies have become the standout performers of this cycle.

Summary

-

Publicly listed companies began adding crypto to reserves in 2017; Strategy's emergence brought pure-play DATCos into focus.

-

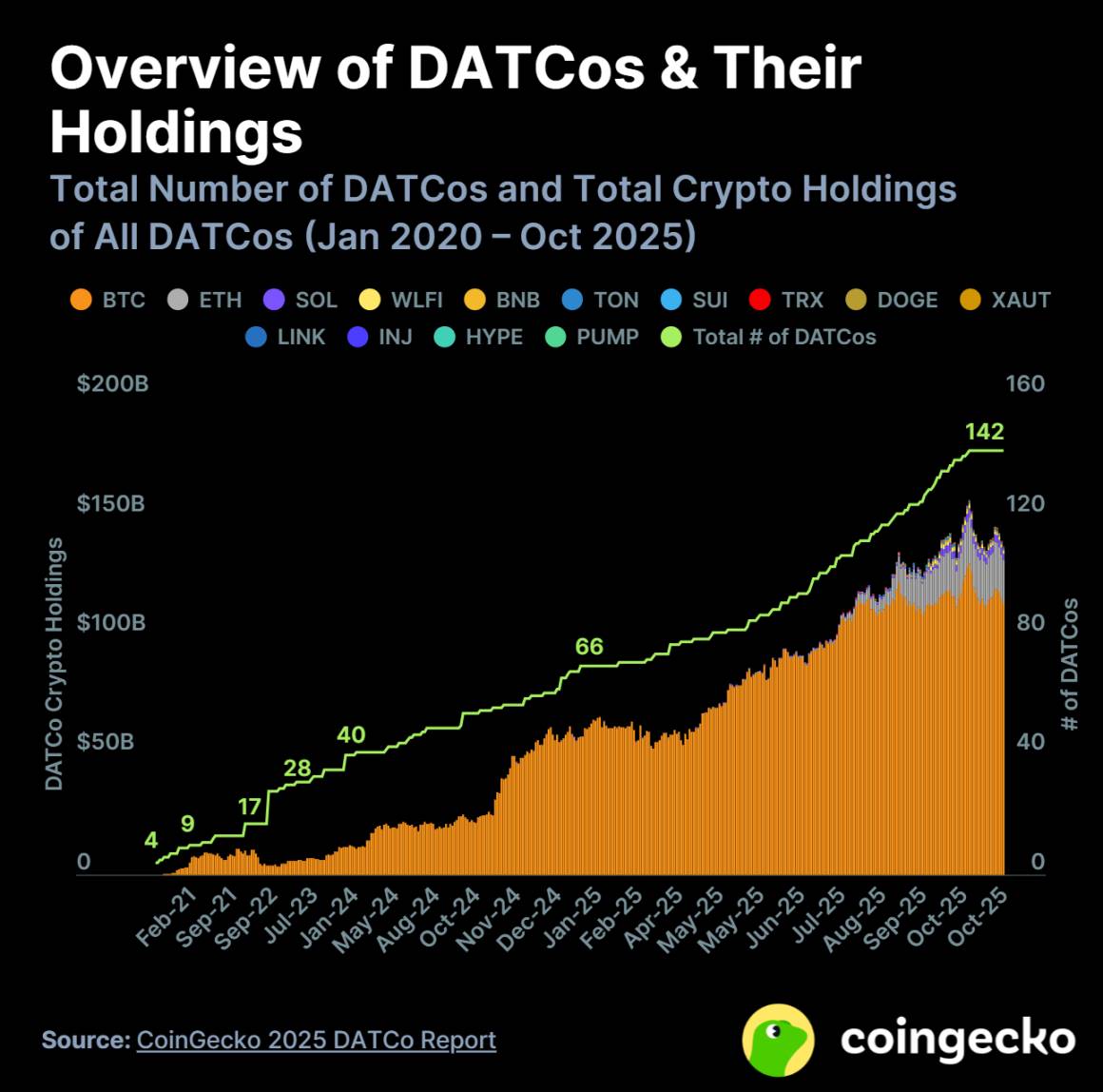

The number of DATCos surged from 4 in 2020 to 142 by 2025, with 76 established in 2025 alone.

-

DATCos deployed $42.7 billion in 2025, more than half occurring after Q3.

-

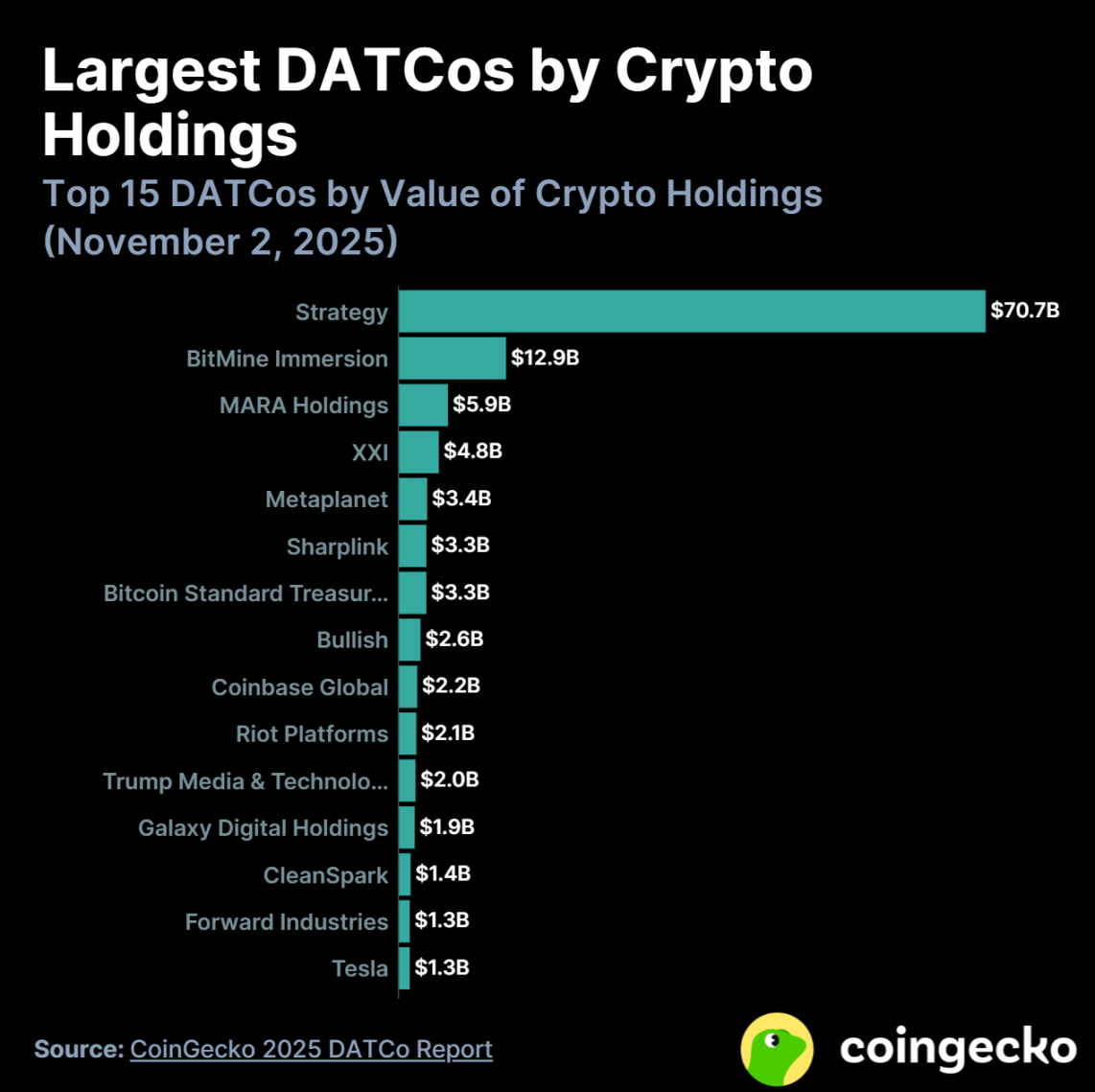

Strategy dominates the sector with $70.7 billion in assets, representing about 50% of all DATCo crypto holdings.

-

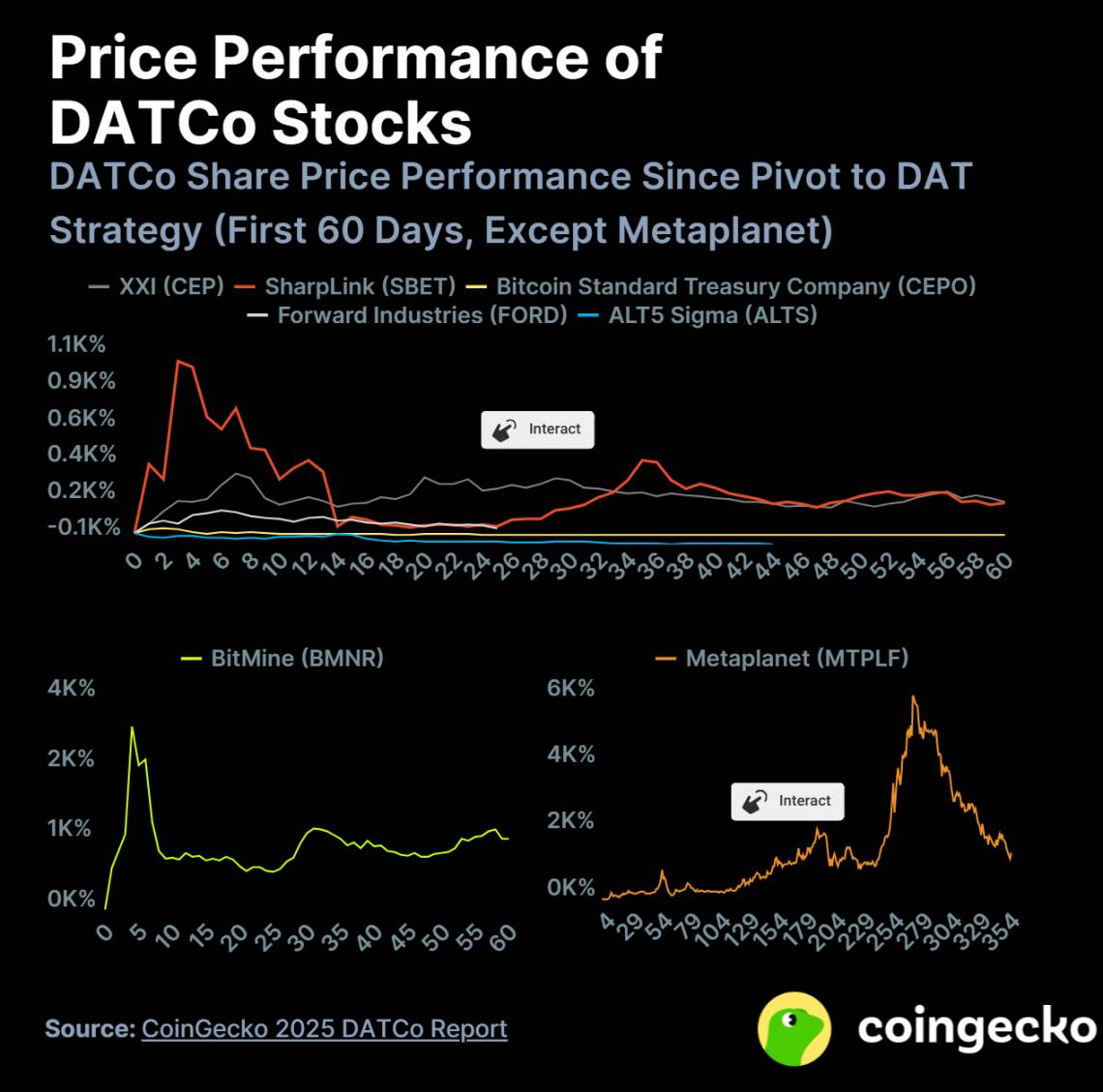

DATCo stocks surged initially—e.g., BitMine rose 3,069% in 10 days—followed by broad pullbacks.

Strategy’s Rise Puts Pure-Play DATCos in the Spotlight

Digital asset treasury companies first appeared in 2017, initially consisting mainly of publicly listed cryptocurrency mining firms. Strategy emerged in August 2020 as the first pure-play DATCo, sparking a wave of similar companies.

By the end of 2023, the Financial Accounting Standards Board (FASB) introduced new accounting guidelines allowing DATCos to report their crypto assets at fair value and recognize unrealized gains on their income statements—a move that significantly boosted balance sheet performance.

In addition, pro-crypto sentiment from former U.S. President Donald Trump, combined with surging prices of assets like Bitcoin, attracted substantial Wall Street capital into the space—including DATCos.

Against a backdrop of weakening fiat currencies, many public companies without core crypto operations have also started allocating digital assets to hedge against currency depreciation.

As of October 2025, There Are 142 DATCos, With 76 Founded in 2025

The first DATCo was Hut 8 Mining Corp, a Bitcoin mining company listed on the Toronto Stock Exchange in November 2017. From 2017 to 2020, crypto mining firms dominated the DATCo landscape. That changed in August 2020 when Strategy became the first pure-play DATCo.

By the end of October 2025, the total value of crypto assets held by all DATCos reached $137.3 billion—an increase of over 139.6% since the beginning of the year.

Among the 142 DATCos, 113 (79.6%) hold Bitcoin as part of their reserves, while 15 and 10 hold Ethereum and Solana respectively. In dollar terms, Bitcoin accounts for 82.6% of all DATCo crypto holdings, followed by Ethereum (13.2%) and Solana (2.1%).

Geographically, the U.S. leads with 60 DATCos (43.5%), followed by Canada (19) and China (10). Japan has only eight but is notable for hosting Metaplanet—the fifth-largest DATCo and the largest outside the U.S.

DATCos Spent $42.7 Billion in 2025, Over Half in Q3 Alone

In Q3 2025, crypto-focused DATCos spent at least $22.6 billion acquiring new assets—the highest quarterly expenditure to date. Altcoin-focused DATCos contributed $10.8 billion (47.8%) of that total. Since the start of 2025, DATCos have spent at least $42.7 billion purchasing digital assets.

Bitcoin-focused DATCos were the biggest buyers, accumulating at least $30 billion worth of BTC since early 2025—representing 70.3% of all DATCo crypto purchases.

Ethereum-focused DATCos ranked second, reporting at least $7.9 billion in purchases during 2025. Most of these acquisitions occurred in August, when ETH purchases totaled at least $7.1 billion—coinciding with Ethereum’s price surge to an all-time high above $5,000.

Other assets such as Solana, BNB, and WLFI accounted for 11.2% of 2025 acquisitions. As more altcoins are added to corporate treasuries, this share is expected to grow. Nevertheless, Bitcoin and Ethereum remain the preferred holdings among DATCos.

Strategy Holds Nearly 50% of All DATCo Crypto Assets

With $70.7 billion in Bitcoin holdings, Strategy far surpasses all other DATCos. Among the top 15 DATCos, only three are altcoin-focused: BitMine Immersion (ranked #2), Sharplink (#5), and Forward Industries (#14). Notably, all three transitioned to DATCos after June 2025, highlighting their rapid accumulation pace.

Of the top 15, seven are pure-play DATCos, while only three are traditional crypto miners.

Among the five public companies holding crypto reserves, four operate in crypto-related businesses—Tesla being the sole exception.

Currently, Strategy holds 3.05% of Bitcoin’s total supply; BitMine Immersion holds 2.75% of Ethereum’s supply; Forward Industries holds 1.25% of Solana’s total supply.

DATCo Stocks Surge in First 10 Days, Then Typically Retrace

Most DATCos experience sharp stock price rallies within the first 10 days after announcing their transition, typically followed by a pullback.

Some stocks have risen dozens of times in value within 10 days, with BitMine Immersion achieving a return of up to 3,069%.

The only current outlier is Metaplanet, whose stock rose about 100% in the first 10 days but took 269 days to reach a peak return of approximately 6,200%.

Many DATCo stocks begin moving sharply even before official announcements, benefiting mostly early investors or insiders. These patterns have sparked controversy, with the U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) conducting insider trading investigations.

However, these gains often prove unsustainable. Most DATCo stocks decline significantly within days of the formal transition. For example, ALT5 Sigma fell 71% 44 days after its transformation. Its WLFI holdings have similarly underperformed, dropping 56% since listing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News