Bitget Daily Morning Report: Fidelity Solana Spot ETF Launches Tonight on U.S. East Coast Markets, Global Public Companies Net Buy Over $847 Million Worth of BTC Last Week

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Fidelity Solana Spot ETF Launches Tonight on U.S. East Coast Markets, Global Public Companies Net Buy Over $847 Million Worth of BTC Last Week

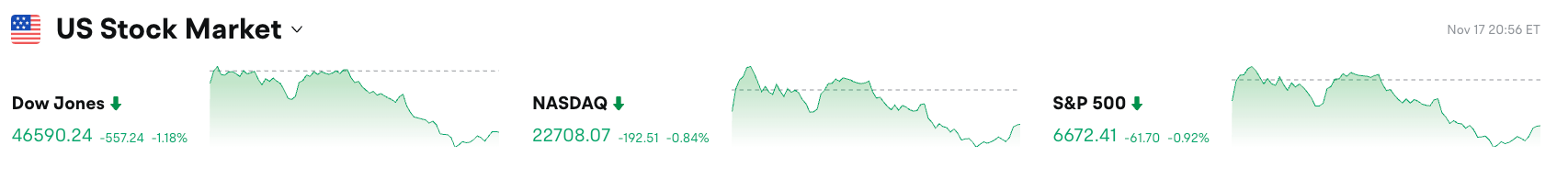

The three major U.S. stock indices closed lower collectively.

Author: Bitget

Today's Outlook

1. Fidelity Solana Spot ETF ($FSOL) will officially launch on the U.S. East Coast market on November 18, 2025, tracking the Fidelity Solana Reference Index and including SOL staking yields;

2. Arthur Hayes: Bitcoin may first drop to $80,000–$85,000 before surging toward $200,000–$250,000 by year-end;

3. Sovereign Day, hosted by Cosmos & Interop Ventures, will take place in Buenos Aires, Argentina at 20:00 on November 18, 2025, exploring blockchain’s reshaping of the global financial system.

Macro & Highlights

1. SoSoValue data shows that global listed companies (excluding mining firms) net purchased over $847 million worth of BTC last week, with Strategy (formerly MicroStrategy) adding 8,178 BTC for $835.6 million, bringing its total holdings to 649,870 BTC;

2. VanEck Solana ETF (VSOL) has officially started trading, advancing Solana’s adoption in mainstream finance;

3. The White House is reviewing a Treasury Department proposal to strengthen IRS oversight of overseas crypto accounts and implement taxation, potentially joining the OECD's Crypto-Asset Reporting Framework (CARF);

4. Between November 17 and 24, 2025, more than $297 million worth of tokens are scheduled for large-scale unlocking, with notable circulation changes expected for projects including LayerZero (ZRO), YZY, and ZKsync.

Market Trends

1. BTC and ETH remain range-bound in the short term. Total liquidations across markets amounted to approximately $814 million in the past 24 hours, with long positions accounting for $531 million and short positions $283 million;

2. U.S. major stock indices closed lower yesterday, led by tech sector declines, weighing on global market sentiment;

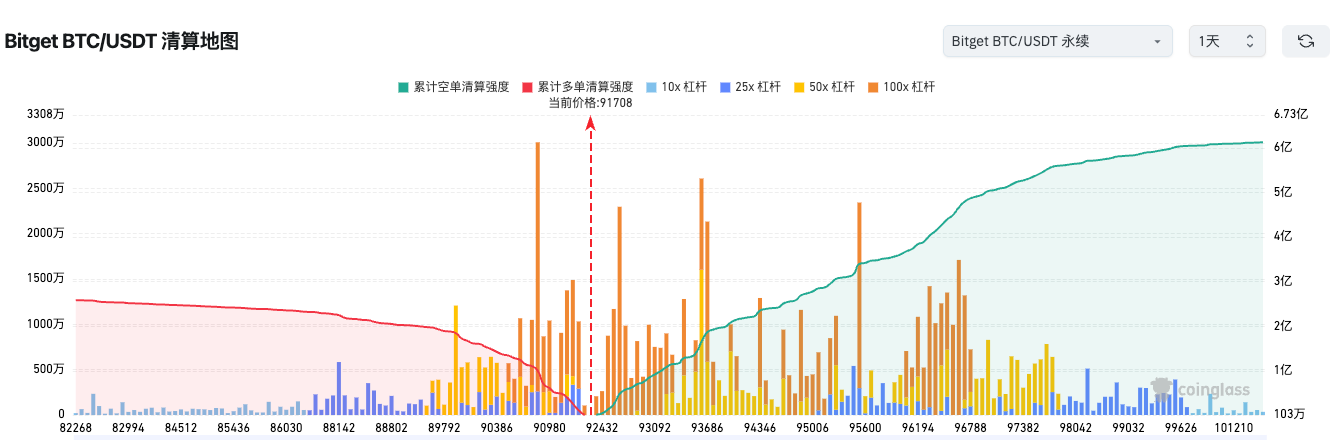

3. According to Bitget's liquidation map data, BTC/USDT is currently trading at $91,708. BTC is located in a dense zone of long and short liquidations—any minor price movement could trigger leveraged cascades. A breakout above $93,000 may lead to consecutive short squeezes, while a drop below $90,200 could trigger concentrated long liquidations.

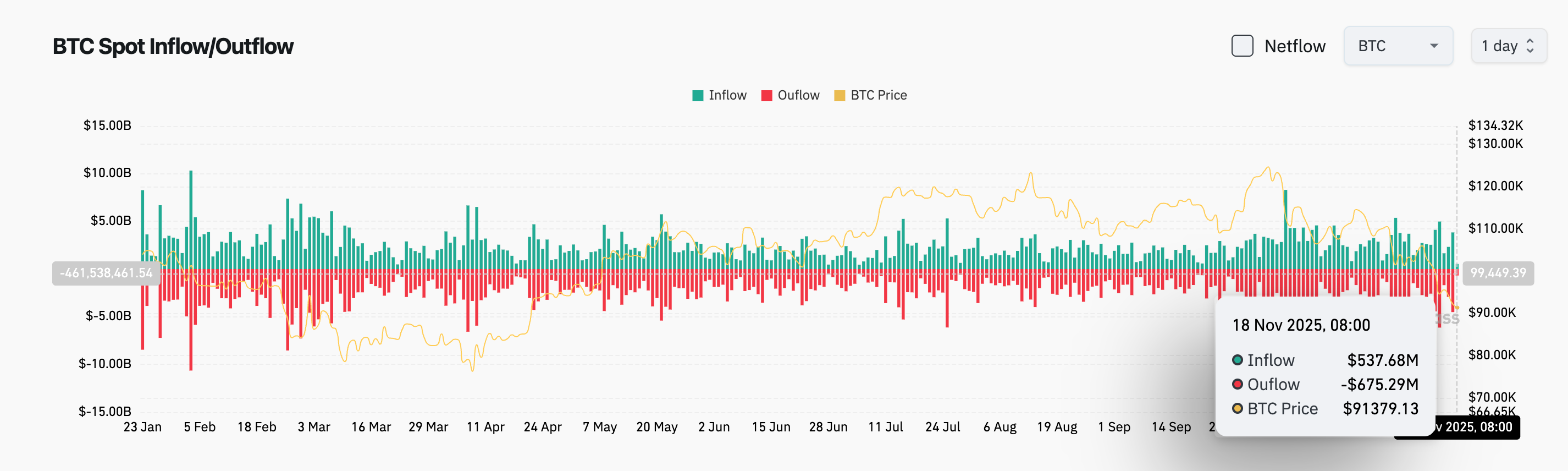

4. In the past 24 hours, BTC spot inflows totaled $537 million versus outflows of $675 million, resulting in a net outflow of $138 million;

5. Over the past 24 hours, BTC, ETH, USDT, XRP, BNB and other cryptocurrencies saw leading contract trading net outflows, indicating potential trading opportunities.

News Updates

1. Japan’s Financial Services Agency is considering classifying cryptocurrencies as financial instruments subject to insider trading regulations and plans to reduce capital gains tax rates to 20%;

2. El Salvador has again purchased 1,090 BTC, worth approximately $100 million;

3. Singapore Exchange (SGX)’s derivatives division announced it will launch BTC and ETH perpetual futures contracts on November 24;

4. The Chicago Board Options Exchange (CBOE) plans to launch Bitcoin and Ethereum continuous futures contracts on December 15.

Project Updates

1. Avalanche: Granite upgrade set to activate on November 19, enhancing network efficiency;

2. Data: Global listed companies net purchased $847.64 million worth of BTC last week;

3. SOL Strategies will provide staking services for VanEck’s Solana ETF;

4. Merlin Chain (MERL) will unlock 36.14 million tokens worth approximately $12.49 million on November 19, 2025 at 00:00;

5. Vitalik released "Kohaku", a privacy-focused Ethereum framework;

6. Yala published a liquidity event analysis report for the YU token and plans to finalize a recovery roadmap and clear action plan by December 15;

7. ApeCoin: Unlocked 15.38 million tokens worth approximately $5.38 million on November 17;

8. Caldera: Unlocked 7.22 million tokens worth approximately $1.92 million on November 17;

9. Forward Industries deposited 1,443,507 SOL worth approximately $201 million into Coinbase Prime; intent to sell remains unclear;

10. Bitcoin ETFs saw a net outflow of 8,794 BTC yesterday, while Ethereum ETFs recorded a net outflow of 87,460 ETH during the same period.

Disclaimer: This report is AI-generated. Human input was limited to information verification. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News