Circle's favored project Arc is launching a token—can retail investors profit from it?

TechFlow Selected TechFlow Selected

Circle's favored project Arc is launching a token—can retail investors profit from it?

Arc's core innovation lies in embedding USDC into the network's base layer, avoiding the volatility issues of traditional gas tokens.

By: 1912212.eth, Foresight News

On November 12, stablecoin giant Circle released its Q3 business update, revealing it is exploring the issuance of a native token on Arc, its newly launched stablecoin blockchain.

Circle aims to transform from a pure stablecoin provider into a more comprehensive blockchain ecosystem builder. As the issuer of USDC, this move could further solidify Circle's leadership in the stablecoin financial sector while injecting new momentum into the Arc network.

Arc, launched by Circle, is a stablecoin-dedicated blockchain—not a general-purpose chain like Solana or Sui—but rather a platform optimized for stablecoin payments, foreign exchange, and capital markets.

As a Layer 1 blockchain project led by Circle, Arc’s core team is driven by Circle’s executive leadership, reflecting the stablecoin giant’s strategic infrastructure positioning. Circle CEO Jeremy Allaire also serves as co-founder of Arc, overseeing overall strategy, vision, and operational execution.

The chief product manager is Sanket Jain, who also holds the same role at Circle and is co-founder of Gateway. A Cornell University graduate in applied economics, he previously worked as a financial analyst at Fountain Financial, LLC and conducted corporate restructuring analysis at Houlihan Lokey. The chief software engineer is Adrian Soghoian, formerly of Trigger Finance and Google Chrome, with extensive development experience.

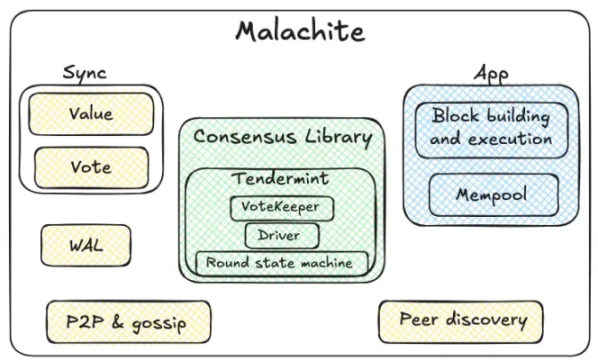

Arc’s core innovation embeds USDC at the network level, eliminating the volatility issues associated with traditional gas tokens. Users can directly pay fees in USDC, enabling seamless stablecoin transaction experiences. In August, Circle Internet Group (CRCL) acquired Informal Systems’ high-performance consensus engine Malachite, adopting a permissioned Proof-of-Authority mechanism where validator nodes are operated by known authoritative entities.

At the end of October, Arc launched its public testnet, opening access to developers and enterprises. Over 100 institutions have already joined. The Circle Payments Network now includes 29 financial institutions, with new partnerships added including Brex, Deutsche Börse, Finastra, Fireblocks, Kraken, Itaú, and Visa.

Circle Internet Group’s Q3 financial report shows revenue increased 66% year-on-year to approximately $740 million, with a significant rise in net profit. This strong performance was driven by the surge in USDC circulation—by the end of the reporting period, USDC’s market cap exceeded $75 billion, making it the second-largest stablecoin globally after Tether’s USDT.

In an increasingly stringent global regulatory environment, Circle’s compliance advantage stands out. USDC has gained recognition under the EU’s MiCA regulation and is widely adopted across major centralized exchanges and DeFi protocols.

Unlike traditional blockchains, Arc uses USDC as its native gas token, meaning transaction fees can be paid directly in USDC, enabling instant settlement and privacy options. The network is EVM-compatible, facilitating easy application migration, and is deeply integrated with Circle’s ecosystem tools such as USDC, CCTP (Cross-Chain Transfer Protocol), and Gateway.

In its Q3 report, Circle stated clearly: "We are exploring the possibility of issuing a native token on the Arc network, which would encourage network participation, drive adoption, better align the interests of Arc stakeholders, and support the long-term growth and success of the Arc network."

Although still in the “exploratory” phase, this statement has already sparked significant market speculation.

Why Issue a Token?

In the stablecoin market, Tether—the issuer of USDT—has actively built its own blockchain ecosystem through Plasma and Stable networks, directly pressuring Circle to accelerate exploration of a native token on Arc to maintain its competitive edge.

Plasma, the stablecoin blockchain backed by Tether, is optimized for USDT payments, supports zero-fee USDT transfers, and is EVM-compatible. Its token launch and deposit programs have attracted massive investor participation and attention. Currently, its token XPL has a market cap of $490 million and an FDV of $2.6 billion. Another Tether-supported stablecoin chain, Stable, attracted massive inflows after opening deposits—its first phase with a $1 billion capacity was quickly filled, and the second phase, initially capped at $500 million, was expanded due to overwhelming demand, ultimately reaching nearly $1.8 billion in total deposits.

Tether maintains its market dominance through expansion of stablecoin blockchains, exchanges, and trading pairs. USDC remains in catch-up mode.

U.S. Treasury Secretary Bessent said today that stablecoin market size could grow tenfold from $300 billion to $3 trillion by 2030.

The market has shown strong appetite for the stablecoin blockchain narrative. Previously, USDE reached nearly $15 billion in market cap within just two years; since then, numerous stablecoins have emerged on various blockchains and DeFi protocols.

Circle is listed in the U.S., serving American investors but failing to meet the needs of its native community. A native token would be a powerful tool to attract genuine community engagement.

It could not only draw more participants and incentivize network activity but also boost Arc’s adoption rate. In its report, Circle emphasized the token will “drive network growth,” suggesting potential integration with the USDC ecosystem to form a closed-loop economic model. Adding a native token would make the ecosystem more attractive, significantly drawing in DeFi, RWA (real-world assets), and cross-border payment applications.

Arc’s native token could address current pain points in stablecoin networks, such as high gas fees and cross-chain fragmentation. Through governance incentives, Arc could become the preferred platform for RWA and DeFi, attracting institutional capital like BlackRock—Circle already partners with BlackRock on a USDC fund.

Additionally, amid the convergence of AI and Web3, integrating Circle’s AI tools with a token could accelerate developer ecosystem growth. However, challenges remain: launching a token requires balancing centralization and decentralization. Arc’s current permissioned design may limit community involvement, and poor token design could trigger speculative bubbles. Competition is fierce—established L1s like Solana and Base already dominate, so Arc must prove its unique value as a stablecoin-dedicated chain.

In the long term, this initiative aligns with blockchain evolution—from general-purpose platforms toward vertical ecosystems. Circle’s Q3 profit growth demonstrates the sustainability of its business model, and a native token could act as a catalyst.

Currently, participants can claim testnet tokens and engage by deploying contracts on the testnet. Official detailed tutorial documentation has been published.

With Plasma and Stable attracting massive participation through deposit programs, and Coinbase launching its token launchpad with Monad as the first project, it remains unknown whether Arc will offer ICO allocations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News