If the global internet goes down for a day, how can Bitcoin survive the internet outage crisis?

TechFlow Selected TechFlow Selected

If the global internet goes down for a day, how can Bitcoin survive the internet outage crisis?

Even if World War III breaks out, Bitcoin will continue to exist... but not necessarily in the form we know today.

Author: Liam 'Akiba' Wright

Translation: Chopper, Foresight News

Imagine the global internet backbone collapsing in a single day.

Whether due to human error, a catastrophic software bug, a malicious computer virus, or direct military conflict—if the physical internet exchange hubs connecting the world suddenly go dark, what would become of Bitcoin?

If Frankfurt, London, Virginia, Singapore, and Marseille all simultaneously lost connectivity, the Bitcoin network would split into three isolated partitions.

Communications across the Atlantic, Mediterranean, and major trans-Pacific routes would halt. The Americas, Europe-Africa, Middle East, and Asia-Pacific regions would each develop independent transaction histories until network connections are restored.

In each partition, miners would continue producing blocks based on remaining hashpower

Targeting one block every 10 minutes, regions with 45% hash rate would produce about 2.7 blocks per hour, those with 35% about 2.1 blocks, and those with 20% about 1.2 blocks. Since nodes cannot exchange block headers or transaction data across partitions, each region would unknowingly extend its own valid blockchain independently.

Eventually, as time passes and hashpower distribution changes, natural fork lengths would grow continuously.

This partition rhythm makes chain splits inevitable. We assign approximate hash rate shares to each region: Americas 45%, Asia-Pacific 35%, Europe-Africa 20%, and simulate accordingly.

The American partition would add roughly 6 new blocks every two hours, Asia-Pacific around 4–5, and Europe-Africa around 2–3.

After a full day, the number of split blocks would exceed one hundred—beyond the scope of normal reorganizations—forcing services to treat regional confirmations as temporary.

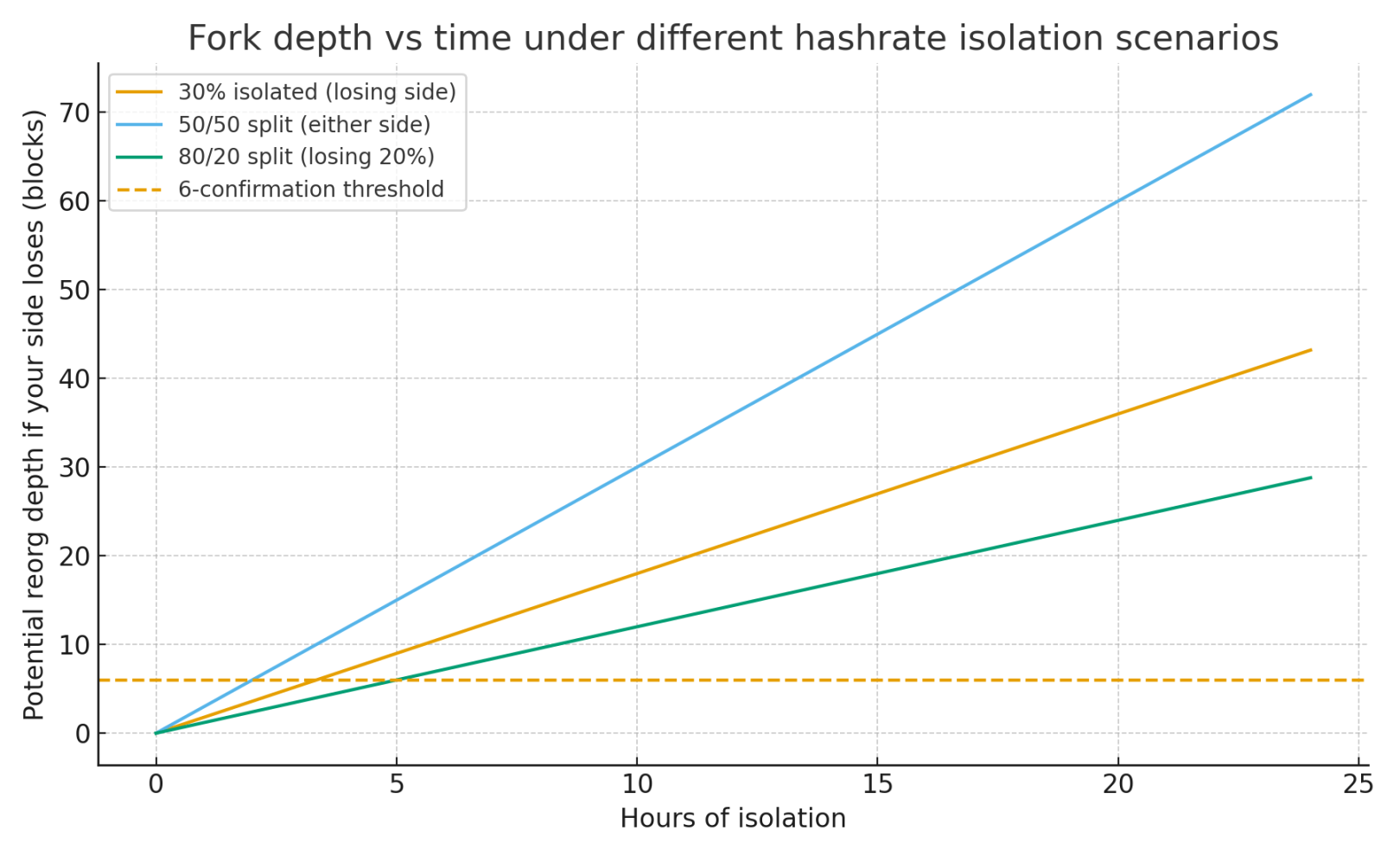

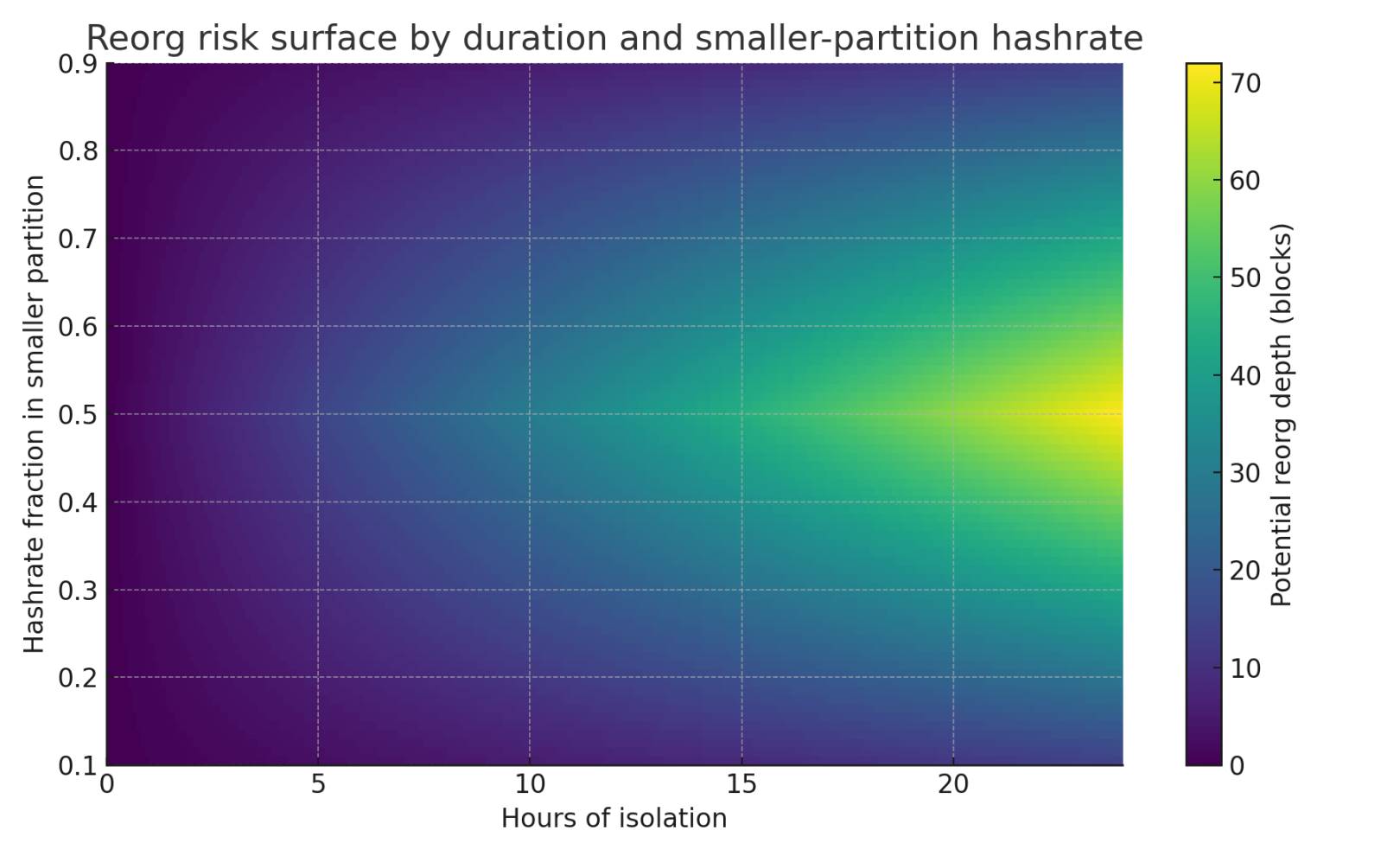

Potential reorganization depth for failed partitions rises linearly with isolation time

Local mempools would immediately fragment. A transaction broadcast in New York cannot reach Singapore, so recipients outside the sender’s partition will not see the transaction at all until network connectivity resumes.

Fee markets within each partition would become localized. Users must compete for limited block space against local hash rates, meaning fees rise fastest in regions with low hash share but high demand.

When transaction confirmations lose global finality, exchanges, payment processors, and custodial wallets typically pause withdrawals and on-chain settlements; Lightning Network counterparties face uncertainty—as transactions confirmed in minority partitions may later become invalid.

Automatic coordination upon network recovery

When connectivity is restored, nodes initiate an automatic coordination process: each node compares different blockchains and reorganizes onto the valid chain with the greatest cumulative work.

The actual cost manifests in three main areas:

-

Reorganizations cause blocks in minority partitions to become orphaned, with depth depending on split duration;

-

Transactions confirmed only on failed chains must be rebroadcast and reprioritized;

-

Exchanges and custodians require additional operational checks before resuming services.

In a 24-hour network split, tens to hundreds of blocks from minority partitions may be orphaned upon reconnection. Related services may need several additional hours to rebuild mempools, recalculate balances, and restore withdrawal functionality.

Due to manual reviews required for fiat on/off ramps, compliance checks, and channel management, full normalization of economic activity often lags behind protocol-level recovery.

Simulating isolation by "reachable hash rate share" rather than hub count better illustrates dynamic changes:

-

When 30% of hash rate is isolated, the minority partition produces about 1.8 blocks per hour. This means standard 6-block confirmation payments in that partition face reversal risk after approximately 3 hours and 20 minutes—if the remaining 70% of the network builds a longer chain, those 6 blocks could be orphaned.

-

In near 50/50 split scenarios, both partitions have similar cumulative work. Even brief splits can result in competing “confirmed” transaction histories, making post-reconnection outcomes random.

-

In an 80/20 split, the majority partition almost certainly prevails; about 29 blocks produced by the minority over one day would be orphaned during merge, reversing many previously confirmed transactions in that region.

Reorg risk is the product of "time" and "minority partition hash rate"—most dangerous when long isolation combines with near-equal hash rate splits

The role of existing resilience tools

Several tools already exist to enhance network resilience, affecting real-world impact during disconnections:

Satellite downlinks, HF radio relays, delay-tolerant networks, mesh networks, and Tor bridges—alternative transmission methods—can deliver block headers or compact transaction streams over damaged routes.

These paths have narrow bandwidth and high latency, but even intermittent cross-partition data transfer can reduce fork depth by allowing some blocks and transactions to leak between partitions.

Miner pool node interconnect diversity and geographic distribution increase the likelihood of partial data propagation via side channels, limiting reorganization depth and duration when backbone connectivity resumes.

Thus, operational guidelines for market participants during network splits are straightforward:

-

Suspend cross-partition settlements, treat all transaction confirmations as provisional, and optimize fee estimation mechanisms to handle local fee spikes;

-

Exchanges can switch to proof-of-reserves mode while pausing withdrawals, raise confirmation thresholds to mitigate minority partition risks, and publish clear policies—adjusting required confirmations based on isolation duration;

-

Wallets should clearly warn users of regional finality risks, disable automatic channel rebalancing, and queue time-sensitive transactions for rebroadcast after network recovery;

-

Miners should maintain diverse upstream connections and avoid manually altering the standard "longest chain selection rule" during coordination.

By design, the protocol itself survives—upon reconnection, nodes automatically converge on the chain with the greatest cumulative work.

But user experience during splits deteriorates significantly, as economic finality depends on consistent global data propagation.

In the worst-case scenario of multi-hub outages lasting a full day, the most likely outcome is: temporary collapse of cross-border availability, sharp and uneven fee surges, and deep reorganizations invalidating regional confirmations.

Once the network recovers, software deterministically repairs the ledger, and services resume full operations after completing operational checks.

The final step: once balances and transaction history align on the winning chain, withdrawals and Lightning Network channels are reopened.

What if the split can never be repaired?

What happens if the backbone hubs mentioned earlier never recover? In this dystopian scenario, the Bitcoin we know ceases to exist.

Instead, permanent geographic partitions emerge—functioning like independent Bitcoin networks: sharing the same rules but unable to communicate with each other.

Each partition continues mining, adjusts difficulty at its own pace, and develops separate economic systems, order books, and fee markets. Without restored connectivity or manual coordination to select a single chain, no mechanism can reconcile divergent transaction histories across partitions.

Consensus and difficulty adjustment

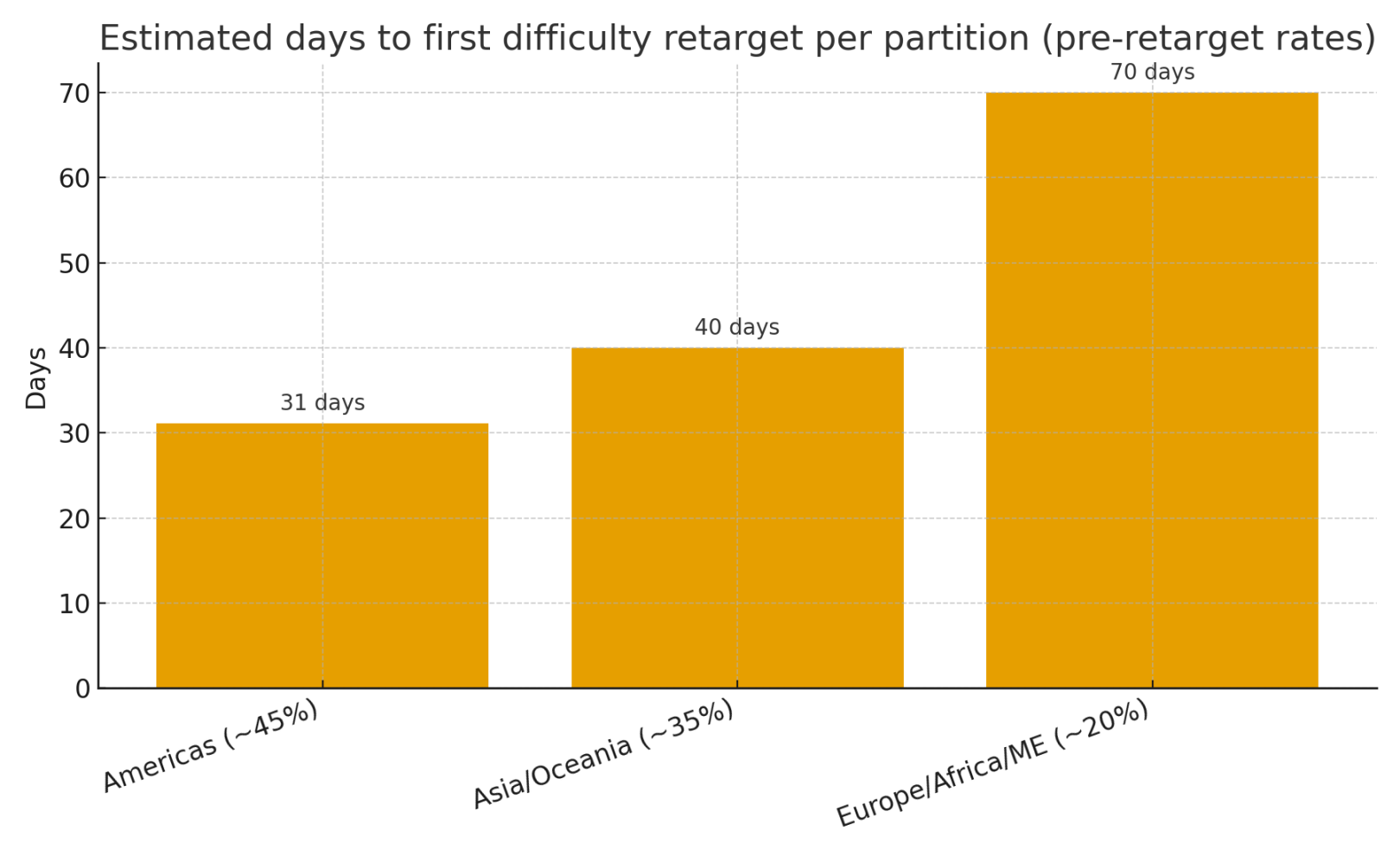

Prior to completing the next 2016-block difficulty adjustment cycle, block times in each partition will run faster or slower depending on accessible hash rate. After adjustment, each partition stabilizes block production back to approximately 10 minutes.

Based on previous hash rate estimates, the first difficulty adjustment times for each partition are as follows:

After the first adjustment, each partition maintains ~10-minute blocks, then independently undergoes halvings and future difficulty adjustments.

Without transoceanic connections, regions take 31, 40, and 70 days respectively to reach their first difficulty retarget

Because halving heights are reached at different speeds before the first difficulty adjustment, halving dates gradually drift apart in real time across partitions.

Supply and the "definition of Bitcoin": fees, mempool, and payments

Within each partition, the single-chain cap of 21 million bitcoins remains intact. But globally, the total bitcoin supply across all partitions exceeds 21 million—because each chain independently issues block rewards.

Economically, this creates three incompatible BTC assets: they share addresses and private keys, but have distinct unspent transaction output (UTXO) sets.

A private key controls tokens across all partitions: if a user spends the same UTXO in two regions, both transactions are valid on their respective local chains, ultimately creating "split tokens"—sharing identical pre-split history but entirely different post-split histories.

-

Mempools become permanently localized; cross-partition payments cannot propagate; any attempt to send funds to users in another partition fails to reach them.

-

Fee markets reach local equilibrium: during the extended period before first difficulty adjustment, smaller-hash-rate partitions face tighter capacity, normalizing afterward.

-

Cross-partition Lightning Network channels cannot route: Hash Time-Locked Contracts (HTLCs) time out, counterparties publish commitment transactions, and channel closure operations are only valid within the local partition—cross-partition liquidity freezes.

Security, markets, and infrastructure

Each partition’s security budget equals its local hash rate plus fees. A region with only 20% of the original hash rate faces much lower attack costs than the former global network.

Long-term, miners may migrate toward partitions with higher token prices and lower energy costs, reshaping regional security dynamics.

Since block headers cannot be transmitted between partitions, an attacker in one partition cannot alter another’s transaction history—attacks remain confined to specific regions.

-

Exchanges become regionalized, trading pairs diverge—effectively creating BTC-A (Americas), BTC-E (Europe-Africa), BTC-X (Asia-Pacific) with different prices, even if all still call it BTC.

-

Fiat on/off ramps, custody services, derivatives markets, and settlement networks focus on specific regional chains. Index providers and data services must either select one chain per platform or publish composite data across multiple regional chains.

-

Cross-chain assets and oracles relying on global data sources either fail or fragment into regional versions.

Protocol rules remain consistent unless changed through intra-partition coordination, but upgrades in one partition won’t apply elsewhere, leading to gradual divergence in rule sets over time.

Mining pool software, block explorers, and wallets must build separate infrastructure for each partition. Multi-homed services without manual strategies cannot coordinate balances across chains.

Can partitions recombine without hub connectivity?

If communication paths can never be restored, protocol-level convergence becomes impossible.

The only way to return to a single ledger is through social and operational coordination—for example, collectively agreeing to adopt one partition’s chain as canonical while abandoning or replaying transactions from others.

After weeks of deep divergence, automatic reorganization back to a single chain is no longer feasible.

Operational guidelines

We must treat permanent splits as hard forks that share pre-split history:

-

Manage private keys carefully to securely spend post-split tokens;

-

Use only region-specific transaction outputs to avoid accidental cross-partition transaction replays;

-

Establish separate accounting, pricing, and risk management systems for each partition.

Miners, exchanges, and custodians should designate a primary partition, publish chain identifiers, and set deposit/withdrawal policies for each chain.

In short, if backbone hubs never recover and no alternative paths bridge the communication gap, Bitcoin does not die—it evolves into multiple independent Bitcoin networks, forever unable to reunite.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News