Show portfolios, follow influencers, one-click copy: when investment communities become financial new infrastructure

TechFlow Selected TechFlow Selected

Show portfolios, follow influencers, one-click copy: when investment communities become financial new infrastructure

Platforms building this layer of infrastructure are creating a permanent market architecture for how retail investors operate.

Author: Boaz Sobrado

Translation: TechFlow

On January 23, 2025, Achi—the dog from the famous "Dogwifhat" meme—appeared at the New York Stock Exchange (NYSE) to ring the opening bell.

Dogwifhat (ticker: WIF) is a dog-themed memecoin built on the Solana blockchain, launched in November 2023, featuring a Shiba Inu wearing a knit cap as its mascot.

Image source: TIMOTHY A. CLARY / AFP, provided by TIMOTHY A. CLARY/AFP via Getty Images

When Benchmark led a $17 million Series A round for Fomo in November 2025, the Silicon Valley venture firm made an unusual bet in the crypto space. Benchmark rarely invests in cryptocurrency startups. Although it backed Chainalysis in 2018 and a few other crypto companies, crypto has not been a typical part of its portfolio. Yet partner Chetan Puttagunta chose to join Fomo’s board. Fomo is a consumer app enabling trading across multiple blockchains for millions of crypto tokens.

Benchmark’s investment wasn’t just another play on a trading app. It was a bet on the rapidly rising field of “social trading infrastructure,” which is becoming as essential to retail investors as brokerage services themselves.

More Than Just Speculators: The Blossom Social Case Study

The Blossom Social team with community members in front of Nasdaq

Image source: Blossom Social

Blossom’s CEO Maxwell Nicholson understands “user friction” better than most. When you build a social platform and require users to link their brokerage accounts during signup, you create a significant barrier early in the user journey. Most consumer companies would remove such hurdles, but Blossom makes it mandatory.

This decision seems counterintuitive—until you understand Nicholson’s vision. Blossom launched in 2021 during the GameStop-fueled retail trading frenzy. At the time, stock discussions on Reddit were entirely anonymous—you couldn’t see actual holdings, only opinions and claims. While StockTwits had amassed a large user base, most users shared unverified personal views.

Nicholson wanted to build a social network grounded in real investing, enabled by newly available APIs like SnapTrade that allow verified brokerage account linking. The technology was ready; the question was whether users would accept this “friction.”

It turns out they would. Today, Blossom has 500,000 registered users, about 100,000 of whom have linked their brokerage accounts, managing nearly $4 billion in assets under management (AUM). On Blossom, half of users’ holdings are ETFs (exchange-traded funds), not individual stocks. The most popular holding is the S&P 500 ETF.

The mandatory brokerage link ultimately shaped Blossom’s community culture. Nicholson observed that StockTwits later introduced brokerage linking as an optional feature. Despite technical support from services like Plaid or SnapTrade, StockTwits users didn’t widely adopt it because it wasn’t core to the platform’s DNA. On Blossom, nearly every active poster shares their real holdings and earns a verification badge. This culture emerged because the mandatory link filtered for users willing to share real portfolios.

This culture translated into commercial value. Blossom generated $300,000 in revenue in 2023 and $1.1 million in 2024. This year, it expects $4 million in revenue, with 75% coming from partnerships with ETF providers.

State Street pays Blossom to increase retail investor awareness of SPY (the S&P 500 ETF), preventing default adoption of Vanguard’s VOO. VanEck promotes thematic ETFs, while Global X advertises niche-focused funds. About 25 different fund providers now work with Blossom because the platform reaches retail investors actively choosing which funds to buy.

This business model works because Blossom users discover new investments through the community. Their goal isn’t short-term trading, but building portfolios for decades ahead. When users link accounts and discuss holdings, they generate content for others and produce data on real retail behavior.

Nicholson highlights Blossom’s quarterly reports on retail ETF inflows. These show how retail investors actually deploy capital, not what surveys claim they intend to do. Because the data comes from verified brokerage accounts, it’s credible—and ETF providers pay for access to see if their products resonate with retail investors.

The $4 billion in assets linked on Blossom represents real money whose allocation decisions stem from discussions on the platform. From an ETF provider’s perspective, this isn’t just entertainment—it’s critical infrastructure.

Retail Investors Rule the World—but Which Kind?

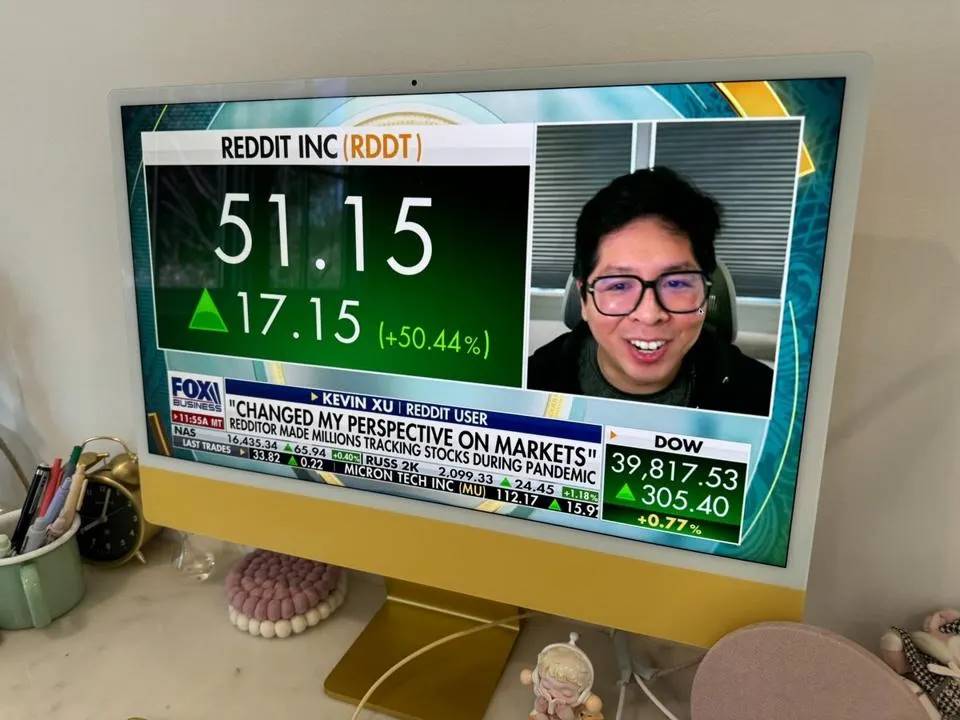

Kevin Xu, the famous Reddit investor, is founder of AfterHour and Alpha.

Image source: Kevin Xu

The explosion of social trading reveals a truth: retail investors aren’t a monolithic group. Platforms succeeding in this space serve distinctly different audiences, varying significantly in risk appetite, investment horizon, and motivation.

AfterHour targets WallStreetBets users. Founder Kevin Xu turned $35,000 into $8 million during the “meme stock” craze, transparently sharing every trade under the alias “Sir Jack” on WallStreetBets. He created AfterHour to serve this audience. Users share holdings under pseudonyms but verify portfolios by linking brokerage accounts. They share real dollar amounts, not just percentages. Stock-based chat rooms function like Twitch streams for trading.

AfterHour raised $4.5 million in June 2024 from Founders Fund and General Catalyst. The platform is clearly popular—reportedly 70% of users open the app daily. These aren’t passive investors checking statements quarterly, but active participants treating markets as entertainment and community. To date, the platform has delivered nearly 6 million trade signals and verified over $500 million in linked portfolio assets.

In contrast, Fomo focuses on crypto “degens”—enthusiasts eager to access millions of tokens across every blockchain. The founders attracted 140 angel investors from a list of 200 ideal backers through networking, including Polygon Labs CEO Marc Boiron, Solana co-founder Raj Gokal, and former Coinbase CTO Balaji Srinivasan.

The team behind Fomo, recently funded by Benchmark

Benchmark’s investment in Fomo came after introductions from three people who had worked with founders Paul Erlanger and Se Yong Park. All three previously worked at dYdX and supported their vision: building a super app giving users access to all crypto assets on any blockchain, with social features to follow friends and leaders’ trades in real time.

Fomo’s founders built a platform for 24/7 trading—whether Bitcoin or obscure memecoins, anything on any blockchain can be traded. The app charges a 0.5% fee but absorbs users’ on-chain gas fees, a major draw for traders focused on mainstream assets. When you can trade Solana tokens at 3 a.m. on a Sunday without worrying about network costs, traditional market limitations become glaring.

Fomo added Apple Pay support in June 2025, allowing instant trading upon downloading. Revenue surged to $150,000 per week, with daily volume hitting $3 million. By the end of its funding round in September, daily volume climbed to $20–40 million, generating $150,000 daily in fees, with over 120,000 users.

This growth validated Puttagunta’s thesis: social trading has evolved from a feature into infrastructure. Platforms supporting social trading are building permanent architecture for how retail investors explore, discuss, and execute trades.

Blossom intentionally attracts long-term investors who debate whether to tilt portfolios toward small-cap value or international stocks. About 37% of holdings are in the S&P 500 ETF, while the remaining 63% span dividend funds, covered call ETFs, crypto ETFs, fixed income, and single-stock ETFs. Users describe their strategy as “core-satellite”: broad market exposure supplemented by thematic satellite investments.

These platforms serve fundamentally different audiences. An investor linking their account on Blossom to discuss SCHD (Schwab’s high-dividend ETF) yield is worlds apart from someone trading Trump memecoins on Fomo at midnight. Both are retail investors, but their goals, risk preferences, and relationship with markets differ entirely.

These platforms succeed because of clear audience targeting. Blossom’s mandatory brokerage link filters for serious investors willing to share real portfolios; AfterHour’s pseudonymous transparency appeals to traders wanting credibility without revealing identity; Fomo’s multi-blockchain access serves crypto natives who treat 24/7 trading as normal. Theoretically, each platform could serve all retail investors, but they’ve chosen not to.

The Financial SuperApp Vision

New York, NY – July 29, 2025: Robinhood co-founders Baiju Bhatt (right) and Vlad Tenev walk along Wall Street on the day Robinhood announced its IPO. Despite the debut, Robinhood Markets Inc.’s stock fell about 5% on Nasdaq.

Image source: Spencer Platt/Getty Images

Robinhood’s launch of “Robinhood Social” in September 2025 unexpectedly validated the social trading trend. When the platform known for democratizing commissions added social features, it signaled structural change in the brokerage industry.

Robinhood CEO Vlad Tenev unveiled the vision at a live event in Las Vegas: “Robinhood is no longer just a trading platform—it’s your financial superapp.” The release included AI-driven personalized metrics, futures trading, short selling, overnight index options, and multi-account management. But the centerpiece was Robinhood Social—a trading community embedded in the app with verified trades and real user profiles.

These features mirror those offered by standalone social trading platforms. Users can view verified trade histories with exact buy/sell timestamps. They can discuss strategies, follow traders, and trade directly from the feed. They can see daily P&L, returns, and historical trades of followed users over the past year. Each profile belongs to a real person verified through KYC (“Know Your Customer”). Users can even follow politicians, insiders, and hedge funds based on publicly disclosed trades—even if those individuals don’t use Robinhood.

Robinhood made social features invite-only, signaling seriousness. With 24 million funded accounts, Robinhood has massive distribution power. It pioneered zero-commission trading and spent years defending its “payment for order flow” revenue model. Now, adding social features shows the brokerage industry itself faces intensifying commoditization.

Zero commissions are now standard across the industry. Mobile apps are table stakes; fractional shares are baseline. Robinhood’s 2015 differentiators are now fully replicated by legacy brokers like Charles Schwab, Fidelity, and TD Ameritrade. Community and interaction are the new battlegrounds.

Robinhood’s move confirms a reality: social trading is no longer just a feature—it’s infrastructure. When the largest retail broker adds social tools to compete with specialized platforms, it validates the space’s significance.

The timing also feels defensive. Blossom, AfterHour, and Fomo are capturing attention by targeting specific retail segments. These platforms don’t need to be brokers—they connect via API to existing ones, yet control the discovery and discussion phase, where investors decide what to buy. Robinhood controls execution, but if decisions happen elsewhere, it risks becoming a commoditized pipe.

Social layers create stickiness that execution alone cannot match. If your friends trade on AfterHour and respected investors share insights on Blossom, switching platforms means more than moving assets. You lose community, discussions, and the social context guiding decisions. Robinhood knows this and is responding—but in this domain, it’s gone from leader to follower.

Social Media Is Becoming Market Infrastructure

Howard Lindzon: How social trading is reshaping retail investing

April 14, 2011: Howard Lindzon, CEO of StockTwits, speaks at the Bloomberg Link Empowered Entrepreneur Summit in New York City. The summit brought together innovative entrepreneurs to discuss startup strategies, fundraising, and business growth with fellow founders, investors, and potential partners.

Photographer: Peter Foley/Bloomberg

Social trading platforms integrate two previously separate functions in retail investing—financial media and market infrastructure—into one seamless experience.

Imagine how Wall Street professionals work. They pay $24,000 annually for Bloomberg Terminal access. Its value lies not just in data or execution, but in seamless workflow. Professionals monitor markets, read news, analyze charts, message peers, and trade—all within one screen. Bloomberg’s chat system thrives because it’s embedded in the workflow, eliminating constant context switching.

Social trading platforms deliver similar workflows for retail investors. Take StockTwits, with 6 million users discussing markets in real time. Its founder, Howard Lindzon (creator of the “Fallen Angel Index”), launched it in 2008—years before today’s retail boom. Discussions focus on unfolding market events, not CNBC stories from three hours ago. During GameStop’s 2021 surge, the main battlegrounds were Twitter, StockTwits, and Reddit—not traditional financial media.

Blossom combines this concept with verified portfolio data. When users link accounts and discuss real holdings, they create content. The platform is both media and data source. ETF providers pay for exposure because retail investors discover funds through social feeds, not Morningstar ratings or advisor recommendations.

AfterHour pushes real-time signals when followed users trade. Instant notifications create urgency unmatched by traditional media. When a respected investor buys a stock, you see it immediately—not hours later via a CNBC headline.

Fomo lets you view other users’ holdings in real time while trading millions of cryptocurrencies. Feeds highlight tokens gaining traction—often before mainstream crypto media picks them up. Discovery happens through community, not centralized editorial judgment—reshaping how people make investment decisions.

This integration explains why traditional financial media struggle to attract young investors. CNBC uses a broadcast model: hosts discuss stocks, viewers watch passively. The gap between media consumption and trade execution creates friction. Young investors don’t watch cable TV or wait for market recaps. They consume content on phones in real time and act instantly.

Social trading platforms solve this by making media creation participatory. Users generate content through trading and discussion. These platforms are essentially media companies—but signals come from users. This reflects how younger generations consume all media: they don’t separate creation from consumption. Social trading maps this behavior onto financial markets.

Their business models reflect the fusion of media and infrastructure. Blossom earns revenue from ETF providers buying exposure—similar to media ad sales. But these ads are tied to verified portfolio data, letting providers see if products gain traction and pay based on performance. AfterHour and Fomo earn transaction fees, like brokers. But trades occur in social contexts driven by community discovery.

These platforms aren’t replacing CNBC or Bloomberg—they’re replacing the fragmented experience of consuming financial media separately from trading. Integration is the innovation. When discovery, discussion, and execution happen in one seamless workflow, platforms evolve from simple apps into infrastructure.

Trading Data as Product

Blossom Social hosted a large event in Toronto drawing 1,400 attendees at Rogers Centre—the site where the Blue Jays lost Game 7 of the World Series.

Blossom Social

Social trading platforms generate unprecedented datasets on retail market behavior. These datasets are standalone products, distinct from the social features that generate them.

Blossom’s $4 billion in linked assets reveal real retail behavior—not stated intentions. Traditional market research asks investors what they own or plan to buy, but surveys suffer from selection bias, memory errors, and aspirational answers. Blossom verifies data via brokerage connections, accurately tracking actual retail holdings.

The company releases quarterly reports on retail AUM flows into ETFs. These show which categories attract new money and which face outflows. These reports matter because retail investors now dominate trading volume. In 2021, retail activity reached levels forcing institutions to adapt. Even after the GameStop hype faded, retail remains active.

ETF providers pay for this data because it shows whether their products genuinely appeal to retail investors. State Street competes with Vanguard for retail investment in S&P 500 ETFs; VanEck and Global X battle for inflows into thematic ETFs. Providers need to know if retail investors are actually buying their funds—not just hearing about them.

Blossom gives them answers. When 37% of linked assets are in the S&P 500 ETF, it signals importance. Strong inflows into covered-call ETFs confirm demand for income-oriented products. Adoption of crypto ETFs proves retail interest extends beyond exchange speculation. This data comes from verified portfolios—not surveys or focus groups.

AfterHour’s verified portfolio data reveals gaps between what WallStreetBets users discuss and what they actually trade. Many stocks trend on social media but show little retail volume. AfterHour distinguishes noise from signal using real user holdings. The $500 million in linked portfolios represents capital deployed after community discussion.

Fomo’s trading data shows which crypto tokens gain real, sustained retail adoption beyond hype. The platform launched promising access to millions of tokens across all blockchains. While most tokens will fail, data reveals which sustain trading volume versus fleeting spikes. This is valuable for understanding retail behavior in crypto markets.

As retail trading grows as a share of market activity, the value of this data rises. Social trading platforms capture investor data traditional providers can’t track. Retail investors don’t file 13F forms or disclose holdings. Brokerage data is siloed and hard to aggregate. Social platforms bridge these gaps, consolidating data across brokers into a unified view.

These platforms’ business models work because they profit from information flow, not trading volume. Blossom doesn’t need users to trade frequently—just to share real portfolio data, enhancing data value. This aligns incentives differently from commission-based brokers or payment-for-order-flow models.

Moreover, these data products create strong moats. Once ETF providers rely on Blossom’s quarterly reports for strategy, they become dependent. Once AfterHour shows hedge funds real retail trading patterns, that data enters institutional processes. Social trading platforms aren’t just retail infrastructure—they’re becoming key tools for institutions and product providers to understand retail behavior.

Trading Has Become a Consumption Activity

Social trading infrastructure is now a permanent part of market architecture. Though segmented by audience, these platforms share core traits: verified holdings data, real-time conversation, and business models based on transparency rather than volume.

The technology enabling this infrastructure is irreversible. Brokerage-linking APIs exist and will only improve. Real-time portfolio verification is now accessible—any platform can use it. So the question isn’t whether social trading infrastructure exists, but which platforms attract which audiences.

Since the GameStop era, the retail trading wave hasn’t reversed. Retail investors who opened accounts in 2021 didn’t close them when meme stocks cooled. Data shows retail participation is sustained. These investors need infrastructure matching their workflow—a unified platform integrating asset discovery, discussion, and trading.

Traditional brokers can add social features, as Robinhood shows. But native platforms built around social features with integrated trading may have structural advantages. Blossom, AfterHour, and Fomo don’t need to be brokers—they connect via API to all of them. This means users can trade on preferred platforms while engaging socially elsewhere.

These business models have proven sustainable. Blossom grew revenue from $300,000 to $4 million in just two years, proving ETF providers will pay to reach retail investors. AfterHour’s daily active user metrics show social trading can form habits. Fomo’s volume growth shows crypto natives crave trading platforms with integrated social experiences. These aren’t novelties—they’re infrastructure meeting real demand.

The regulatory environment supports, rather than threatens, social trading infrastructure. These platforms don’t hold assets or execute trades—their core is community and discussion around verified portfolio data. This structure avoids much of the regulatory complexity faced by brokers. Instead, they choose to partner with regulated brokers, not compete with them.

Future development lies in further segmentation. More platforms will emerge targeting specific retail niches—some for options traders, others for dividend seekers, some for emerging markets. Each will build communities around verified data and integrate trading without becoming a broker.

Success lies in precise audience targeting, not trying to serve everyone. Retail investors aren’t a homogeneous group. Successful social trading platforms reflect this in product design, business models, and community culture. Benchmark’s investment in Fomo validates this approach. The firm didn’t back a platform trying to serve all retail investors, but one focused on crypto natives who want to trade millions of tokens with their community.

Social trading infrastructure doesn’t replace brokers—it adds a layer of community, discussion, and discovery atop them. This layer is becoming as important as the brokerages themselves. Platforms building this layer are creating permanent market architecture for how retail investors operate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News