When the boundary between investing and gambling collapses: who is blurring the rules of the game?

TechFlow Selected TechFlow Selected

When the boundary between investing and gambling collapses: who is blurring the rules of the game?

With just a tap on your phone, you can bet on football matches, elections, and stock prices hours later.

By Lu Wang, Bloomberg

Translated by Saoirse, Foresight News

In September, Mahesh Saha placed a high-risk bet on a wildly fluctuating stock while en route to a subway station in New York City. The 25-year-old law student opened a mobile app and spent $128 buying call options—giving him the right to purchase shares of uranium producer Cameco Corp. at $80 within a week. If the share price rose above that level, his return could be many times his initial investment; if not, the options would expire worthless, amounting to a total loss.

Saha said investor optimism around Cameco surged that day, so less than 90 minutes later, he cashed out, locking in an 84% profit. On other days, he has used his phone to wager on events ranging from a college football game between Georgia Tech and the University of Colorado, to New York City’s mayoral primary, and whether President Donald Trump would establish a bitcoin reserve. “My goal is to grow my money,” said Saha, a second-year student at Cardozo Law School in Manhattan. “If it grows enough to cover tuition, that’d be great.”

(Saha at Union Square in New York. Photographer: Kholood Eid for Bloomberg Markets)

Saha’s extracurricular activities reflect how the line between investing and gambling is increasingly blurring. A recent example: In October, Intercontinental Exchange Inc., parent of the New York Stock Exchange, announced it would invest up to $2 billion in Polymarket, a crypto-based betting platform. Meanwhile, derivatives operator CME Group Inc. is partnering with online sportsbook FanDuel to launch financial contracts tied to everything from sporting events and economic indicators to stock prices.

Since the pandemic, a new generation of traders has flooded into markets through apps that blend brokerage services, gambling features, and social media flair. Their tools emphasize speed, risk, and engagement: zero-day-to-expiration (0DTE) stock options can swing by thousands of percentage points in minutes; leveraged ETFs amplify daily gains or losses threefold; “event contracts” let users bet on consumer price index (CPI) readings, corporate earnings calls, or National Football League (NFL) games; and then there are meme coins and tokenized stocks.

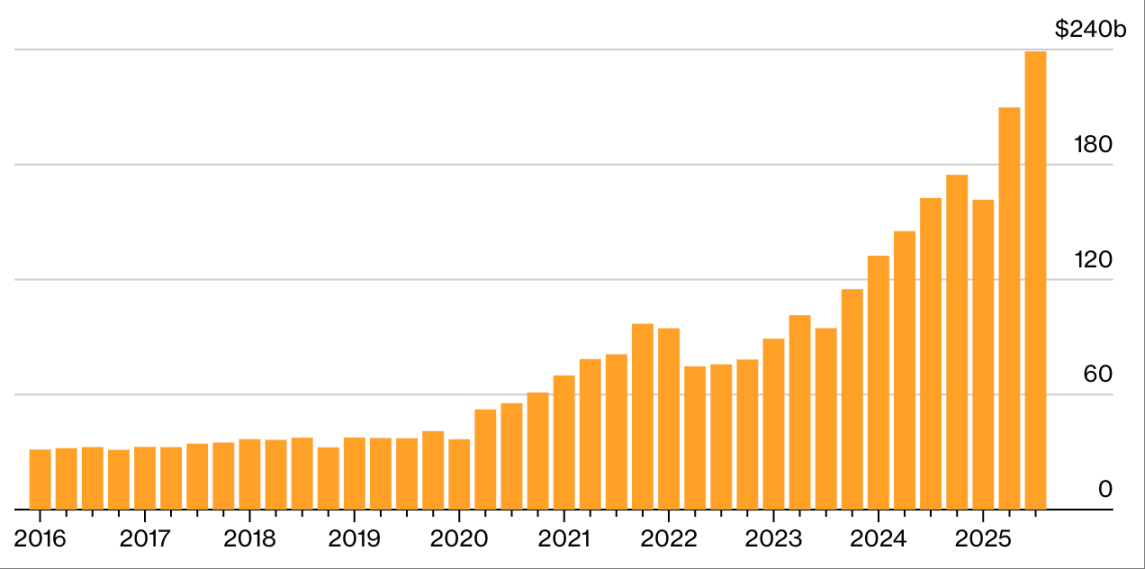

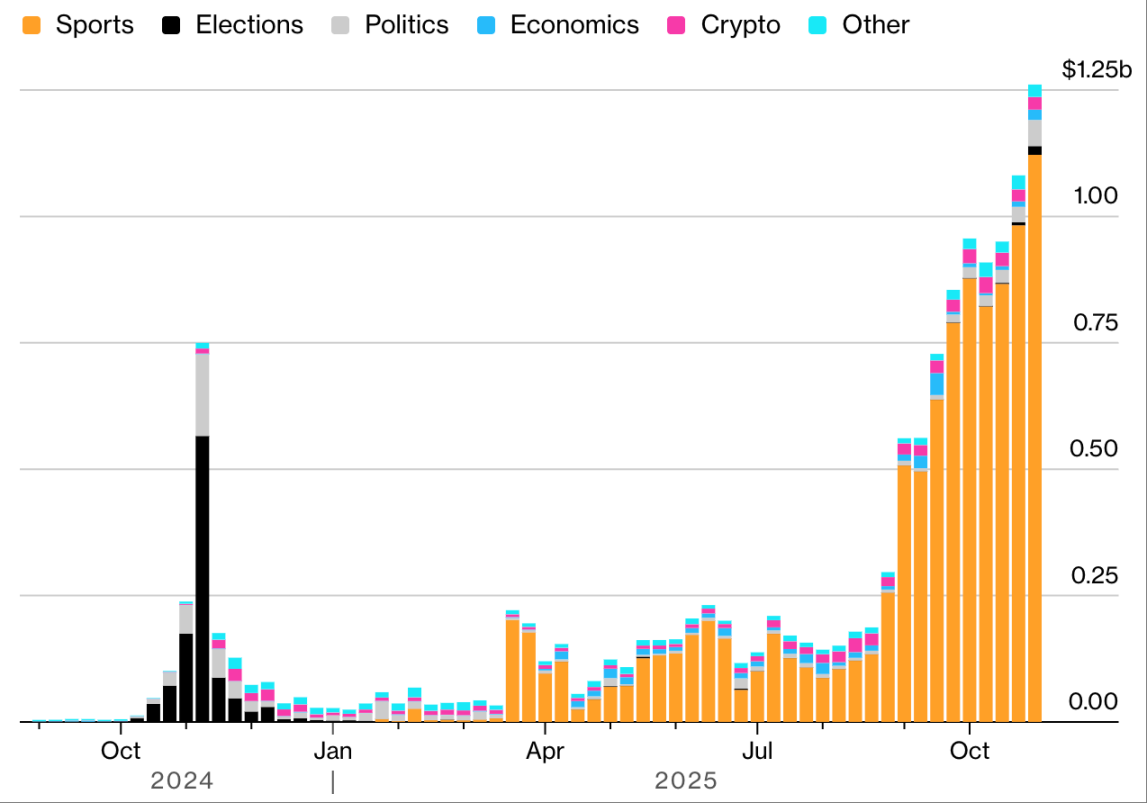

Today, more than half of daily options trading volume on the S&P 500 comes from 0DTE options—tools that barely existed five years ago. Since the pandemic began, assets under management in leveraged ETFs have surged sixfold to $240 billion. Sports betting contracts are essentially a form of gambling: during opening week of this NFL season, one of the largest prediction markets, Kalshi, saw $507 million in trading volume. Day after day, Wall Street—long boasting about “risk management”—keeps inventing new ways to take risks: more tradable assets, more chances to “win,” and more dopamine hits.

Chasing the Thrill

Assets under management in leveraged ETFs at quarter-end:

Source: Bloomberg

Note: Q3 2025 excludes fund assets established on September 30, 2025.

In the past, the physical act of going to a casino or withdrawing cash posed some barrier to gambling—but those obstacles are gone. Mobile apps now allow people to bet on anything, anytime. Lin Sternlicht, co-founder of New York’s Family Addiction Specialists, says patients she treats for gambling problems are getting younger and losing larger sums. “They think they’re investing because they’re not going to a brick-and-mortar casino, but what they’re doing is no different from gambling—sometimes worse, because it’s so accessible and available 24/7,” she said.

For regulators, the risk is no longer just financial but existential: If every interface becomes a casino, who is responsible? The trader, the technologist, or the system itself? During the Joe Biden administration, the Commodity Futures Trading Commission (CFTC), which oversees derivatives markets, tried to halt election- and sports-related contracts.

(From the December/January issue of Bloomberg Markets. Illustration: Arif Qazi for Bloomberg Markets)

But prediction market platforms Kalshi and PredictIt sued to block the agency’s move. Kalshi argued its contracts help businesses hedge real-world risks—for instance, a company worried about a tax-hiking politician winning office, or an ice cream shop concerned about cold weather hurting sales. Aristotle International Inc., operator of PredictIt, called its data a “clear public service.” Similarly, Polymarket says its products outperform polls and aid decision-making. All three position themselves as tools to “help the public forecast trends and manage risk.”

Under U.S. law, betting on a baseball game is illegal in some states—but wagering on Dogecoin volatility based on a hunch is perfectly legal. “Let’s be clear: we’re all gambling,” said Isaac Rose-Berman, a professional sports bettor and researcher at the Institute for Boys and Men, a think tank focused on male well-being—a group disproportionately affected by gambling issues. “The difference is only in degree.”

Still, most experts agree some behaviors clearly fall under “investing”: buying and holding diversified mutual funds, especially those tracking broad market indices, or Warren Buffett’s long-term ownership of companies like Coca-Cola and Apple.

Under the Trump administration, the CFTC shifted course: it ended its legal dispute with Kalshi and authorized PredictIt as a “regulated exchange.” That sent a signal: the authority to define “qualified investing” was slipping from federal and state control.

This moment has historical precedent. In the late 19th century, so-called “bucket shops”—unregulated or illicit financial venues—let retail punters bet on stock prices without owning shares. Quotes were transmitted via telegraph, often delayed, creating the illusion of market participation while allowing operators to profit from the lag. It was speculation disguised as investment, amplified by technology of the time. Investors frequently lost everything, prompting the SEC to step in with protective regulations after the 1929 crash.

Since then, a cycle has repeated: deregulation → financial disaster → tighter rules → eventual relaxation. In the 1990s, the internet lowered barriers and boosted convenience, sparking another speculative wave: as markets shifted from paper to electronic trading, penny stocks exploded, day traders operated from home, and over-the-counter systems flourished. At the start of the next decade, dot-com stocks collapsed, but other hot assets quickly took their place. Then, sophisticated investors used derivatives to leveraged bets on real estate, inflating a housing bubble that ultimately burst, nearly collapsing the global financial system in 2008—and triggering another round of regulatory tightening.

A World of Bets

Kalshi’s weekly notional trading volume by category:

Source: Dune, Kalshi

Note: Weekly period runs Monday to Sunday.

Today’s trading tools are faster and flashier: speculative instincts aren’t just awakened—they’re engineered. Meme-stock mania, where day traders collude to inflate shares like GameStop, and crypto frenzies echo earlier speculative episodes. But today’s difference is institutionalization—the casino isn’t across the street from the exchange; it’s in the same building.

In sports betting, retail participants are often called “square”—they typically bet for entertainment or team loyalty, making them easy targets for savvy players. Platforms like Robinhood lure them with “event contracts.”

Chris Dierkes, a professional sports bettor who once worked as an analyst in billionaire Stan Druckenmiller’s family office and now leads trading at Novig, a prediction market firm focused on sports, knows he can’t compete with giants like Citadel Securities or Jane Street in options markets. But in sports betting, it’s a different story. “I don’t want to compete with smart people—I want to play against the suckers,” he said. “The biggest markets on Robinhood are exactly where the dumbest customers are—that’s where I want to be.”

If the line between gambling and investing keeps fading, how should regulators redraw it? Ilya Beylin, a Seton Hall University law professor studying financial regulation, offers a scientific approach. In a recent paper titled *Exchanges Are Using Federal Derivatives Law to Offer Gambling Products to Retail Traders: A Descriptive Account With Recommendations for Regulatory Intervention*, he proposes a formula:

P = E - C + M

The framework quantifies “trading intent” by weighing economic value, cost, and motivation: trading payoff (P) = expected value (E) – cost (C) + psychological experience (M). If driven by return potential, it’s “investment”; if the thrill of gambling dominates, it’s “gambling.” By this standard, buying and holding shares of AI chipmaker Nvidia is “investment,” while repeatedly trading “3x to 5x daily leverage ETFs” is “gambling.”

But Karl Lockhart, a DePaul University professor studying securities regulation, argues many supposed distinctions don’t hold up. Take “investment rewards effort, gambling doesn’t”: roulette is pure luck, blackjack offers limited edges, yet disciplined gamblers might find clearer advantages in political or sports betting than in stock investing.

Another contested point is “purpose”: investment should serve to “hedge real-world risk.” Viewed this way, commodity futures and prediction markets both function as tools against adverse outcomes. Yet most users have no hedging intent—they’re purely speculative, meaning these products still operate in the realm of gambling.

In a paper titled *Betting on Everything*, published in the Boston College Law Review in October 2025, Lockhart warns that as overlap between investing and gambling grows, the current legal framework for distinguishing them is unsustainable. Regulators may end up banning “politically themed wagers deemed contrary to public interest” while allowing trading in meme coins and 0DTE options—even non-libertarians can spot the contradiction.

Beylin suggests the CFTC should scrutinize new products more strictly, blocking exchanges from listing instruments that fail to advance hedging or price discovery; set participation thresholds based on trader income, wealth, or sophistication; raise approval standards for derivatives; restrict access to high-risk products; and clarify each platform’s purpose—is it for “price discovery” or “speculative entertainment”? “I don’t believe people have a ‘right to go bankrupt,’” Beylin said. “Because when they do, the social safety net bears the cost. Everyone shouts ‘freedom,’ but no one really knows what they mean by it.”

Some firms are already drawing lines. Vanguard Group Inc., the investment giant and pioneer of index funds, has removed 0DTE options from its brokerage offerings and refuses to offer leveraged ETFs. It also flags clients who “chase hot stocks” or trade excessively. “If options trading is the bullseye for gambling behavior, 0DTE is the center of that target,” said James Martielli, head of investment products for individual investors at Vanguard.

Short-dated options are designed so massive profits can appear—and vanish—instantly. You’re betting whether a stock will hit a certain price on the same day you buy or sell the contract. Such bets can yield stunning returns—or become worthless within minutes or hours (the latter being far more common for average users). A 2023 academic paper estimated retail traders lose a net $358,000 per day on 0DTE options.

Maria Konnikova, a psychologist and bestselling author who spent a year becoming a world-class poker player, believes the idea that “investing is rational” is often a “fantasy”—a euphemism market participants use to dress up luck. Many investors, she says, chase an illusion of control, and some become obsessed with it. “To think banning gambling eliminates gambling behavior is self-deception,” she said. “I don’t believe the environment creates addicts: some people will become addicted, and if they never encountered gambling, maybe they wouldn’t—but they might get addicted to something else.”

(Konnikova (center) at the 2018 World Series of Poker in Las Vegas. Photographer: John Locher / AP)

Konnikova references the late Nobel laureate and psychologist Daniel Kahneman, who challenged the concept of the “rational economic agent.” His research showed even professionals are misled by randomness—mistaking short-term gains for skill, correlation for causation. Kahneman wrote that most fund managers’ performance “is indistinguishable from chance.” As markets grow more gamified, the awkward truth emerges: modern investing often hinges on luck, not analysis. “Trading 0DTE options is gambling,” said John Arnold, a billionaire former energy trader turned philanthropist. “In my view, it’s clearly not investing—this distinction is black and white, but the industry is full of gray areas, and that’s precisely the CFTC’s challenge.”

Saha, the law student, grew up in a working-class family in Queens, New York. During the pandemic, unable to find part-time work, he turned to options and meme-stock trading, gradually developing his own portfolio strategy. He browses websites of sportsbooks like FanDuel and DraftKings Inc. on online platforms, looking for “pricing anomalies” to exploit through bets.

In stock investing, Saha follows nearly 70 accounts on social platform X. After identifying a stock, he studies price charts to determine entry and exit points. He avoids companies with market caps below $1 billion and usually refrains from trading in the first hour after market open—he sees that period as unusually volatile. Saha hasn’t recently tracked his event-betting performance, but as of mid-November, his stock portfolio had returned over 70% (he declined to disclose his total investment). “I’m trying to manage risk in a strategic, quantifiable way,” he said. “If I can control risk and ensure my reward always exceeds it, then fundamentally, this is more investing than gambling.”

Maybe so. Maybe not.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News