Founders Fund Investment Philosophy Explained: Prophet, Disciples, Gospel, and Kingdom

TechFlow Selected TechFlow Selected

Founders Fund Investment Philosophy Explained: Prophet, Disciples, Gospel, and Kingdom

For individuals, the true scarce resource is not capital, but the courage to push thinking to the extreme and willingly stake everything on it.

Silicon Valley never lacks star investment firms, but only Founders Fund has consistently backed super-unicorns like PayPal, Facebook, SpaceX, Airbnb, and Anduril over 20 years—while maintaining a dual reputation of “high returns + high controversy.” This venture fund, built by Silicon Valley godfather Peter Thiel, not only established an investment philosophy that defies mainstream VC norms but has also continuously reshaped the power dynamics of the venture capital world.

Mario Gabriele spent 18 months writing four in-depth articles totaling 35,000 words to answer one question: How did Peter Thiel turn an ordinary venture fund into Silicon Valley’s most irreplicable investment empire?

We believe understanding Founders Fund is not just about understanding a fund—it's about grasping an extreme manifestation of Silicon Valley’s spirit. It's about walking a lonely path toward the future, balanced between rationality and rebellion, calculation and faith.

In today’s fast-moving information flood, a truly “epic” tech report is exceedingly rare. Mario Gabriele, founder of The Generalist, eventually set his sights on one of Silicon Valley’s most influential venture funds—Founders Fund—when searching for institutions worthy of an “epic” narrative.

Leveraging his industry reputation and unprecedented cooperation from the fund’s PR team, he gained deep access to 12 core members of Founders Fund and obtained previously unreleased fund return data. To construct this report, Mario combined interviews with AI tools to map timelines, fill in context, and structured the story around four themes: “Prophet, Disciples, Gospel, Empire,” tracing the spiritual lineage of Founders Fund. He firmly believes only honest storytelling—including its flaws—can earn readers’ trust.

1. Four Chapters: A Condensed Version

Peter Thiel and his Founders Fund have maintained astonishing accuracy in the ever-changing world of venture capital. Reviewing their core portfolio reveals a clear pattern: capital concentration. Data shows the fund allocates over 60% of its capital on average to its top five investments—nearly all major wins stem from heavy bets on a “few, elite projects.”

1. Prophet: Macro Narratives Guide Investment Bets

In the past two years, two phrases frequently used by Peter Thiel are key to understanding his investment direction:

-

"Industrial Re-Onshoring" — Betting on supply chain sovereignty

This trend has driven the fund into strategic sectors such as hydrogen metallurgy, rare earth refining (e.g., MP Materials), and industrial robotics (Figure AI). From energy security to industrial automation, the underlying logic is that “reshoring manufacturing to the U.S.” will unlock the next decade’s windfall.

-

"AI ≠ AGI" — Rejecting hype, seeking practical breakthroughs

Amid the large model boom, Founders Fund avoids blindly chasing “application-layer bubbles,” instead heavily backing AI companies like Cognition that demonstrate “code-level reasoning capabilities.” According to SVTR.AI’s AI venture database, Founder Fund—despite holding vast capital—remains highly selective and restrained in AI investments, but goes all-in once it identifies a winner. So far, it has invested over $30 billion across 48 AI startups. Visit svtr.ai for detailed analysis.

2. Disciples: Building a Talent Lineage and Chain of Product Belief

Founders Fund has always emphasized the transmission of “talent pedigree” and “technical belief.” From the original editorial board of The Stanford Review, to the Paypal Mafia, to today’s partners and founders of portfolio companies, they’ve formed a deep network of connections.

This talent system functions like a “belief incubator,” where both investors and entrepreneurs engage in deep collaboration and long-term co-development around shared technological visions.

3. Gospel: Heavy Bets Remain the Key to High Returns

Bold, concentrated bets remain Founders Fund’s winning formula. Whether entering early, doubling down repeatedly, or precisely timing exits, their strategy reflects “focus and patience.”

For example, the fund invested $671 million in SpaceX, generating returns of $18.17 billion—a 27.1x return. Early bets on Airbnb, Palantir, and Postmates also delivered over 10x returns. The core of this strategy lies in deep conviction in a future trend, then backing it with capital.

4. Empire: Dual Engine of Soft Power and Capital Structure

Founders Fund is more than a fund—it’s a hybrid of a think tank + media engine + investment machine.

From Peter Thiel founding The Stanford Review on campus, to publishing the globally acclaimed startup book *Zero to One*, to launching podcast media today, the fund has created an influence loop through “narrative leadership → public dissemination → investment conversion.”

-

The podcast Anatomy of Next has expanded into a full documentary series, strengthening its voice in frontier tech;

-

The media platform Pirate Wires now exceeds 2 million monthly active users, with strong agenda-setting power;

On the capital side, while LPs (limited partners) were historically dominated by Middle Eastern capital and university endowments, Founders Fund is now attracting increasing numbers of family offices and sovereign wealth funds. This diversified LP base enhances its resilience and funding stability across economic cycles.

2. Investment Philosophy: Three Core Principles + Twelve Commandments

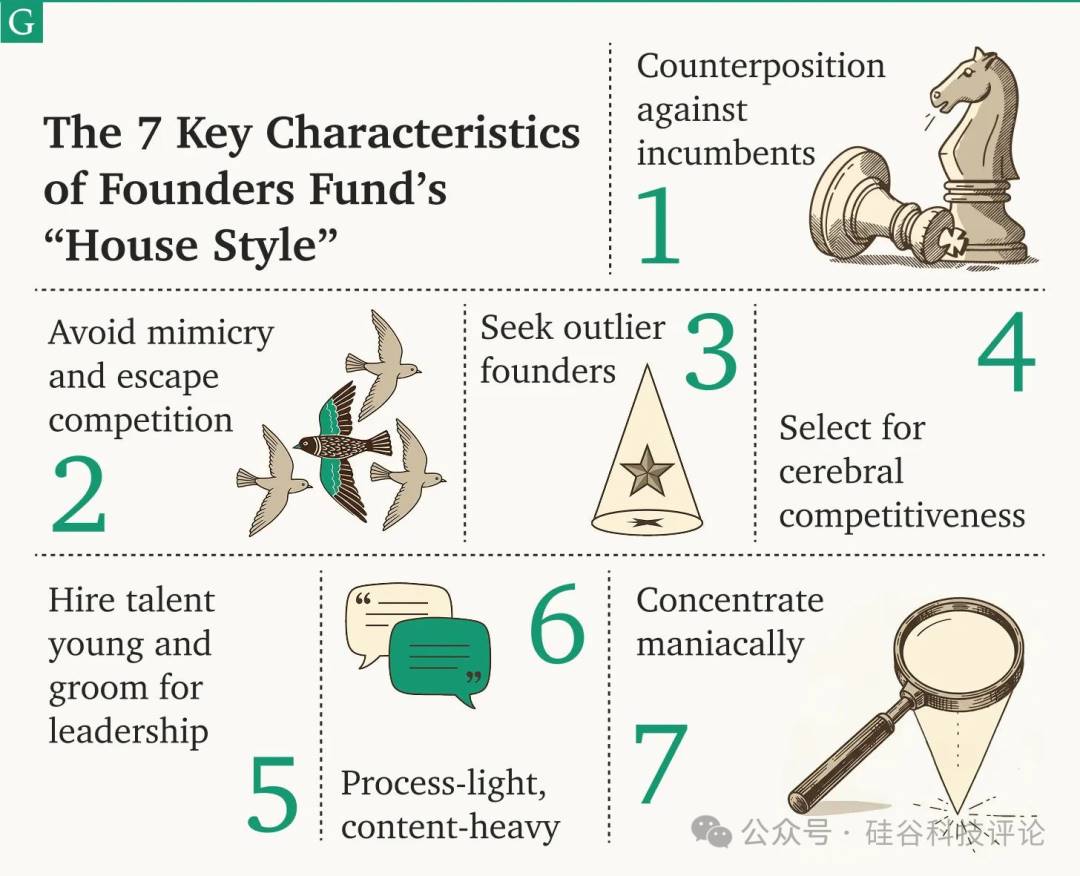

In the turbulent world of venture capital, Founders Fund stands out with its distinct style and unwavering beliefs—a true “bet against consensus.” Rather than merely betting on the future, they’ve built a systematic cognitive framework combining high-level philosophical thinking with practical decision rules.

The dual engine of Pirate Wires (media) and Founders Fund (capital) repeatedly proves that the most valuable brand asset remains authentic ideas.

1. Three Core Principles: Cognition-Driven, Anti-Consensus Bets, Talent Above All

-

First understand where the world is heading, then decide what to invest in

Truly successful investments arise from foresight into macro trends. In Founders Fund’s worldview, investing isn’t a fill-in-the-blank exercise—it’s deduction. For instance, their early bets on SpaceX and Palantir weren’t based on financial models, but on recognizing misalignments between national capabilities and technological innovation.

-

Dare to bet against consensus—but only after deep due diligence

Going against the mainstream isn’t emotional—it’s the result of informational advantage. Partner Napoleon Ta’s internal investment decision-making tool, the “Super Excel” (add Kevin’s WeChat for details), is no gimmick, but a quantitative risk-return modeling system reflecting extreme rationality and self-validation. Acting without preparation is just another form of speculation.

-

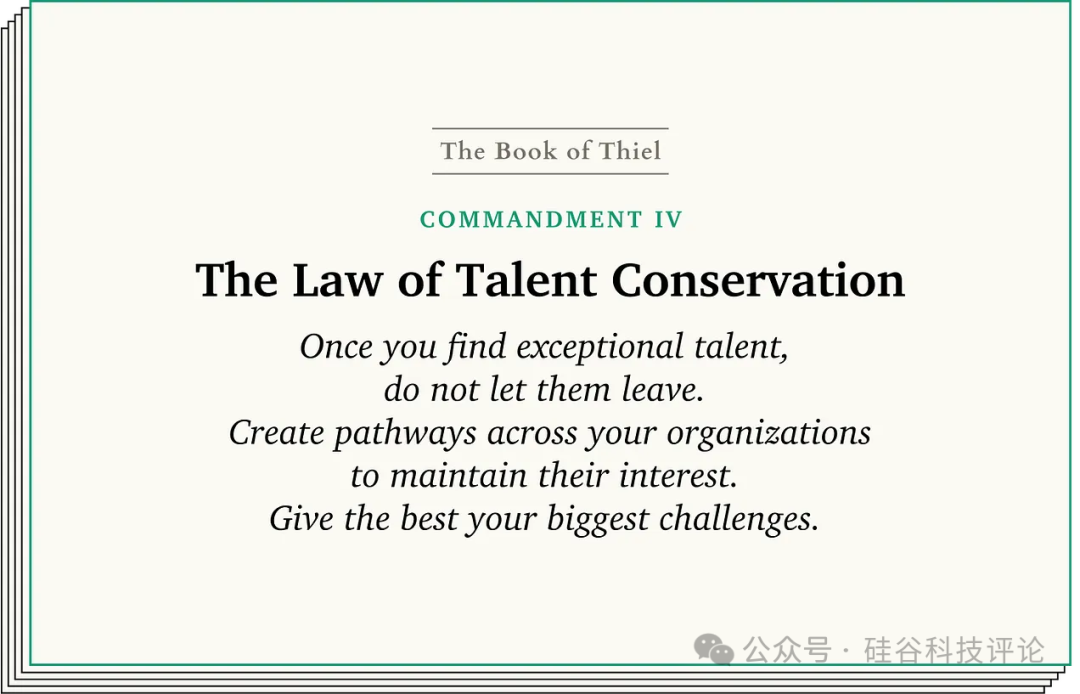

Talent over market

To Peter Thiel, a company’s ceiling isn’t determined by market trends but by the complexity of the founder’s mental model. Signs of top-tier talent: raw intelligence, intense curiosity, and open-mindedness. Founders Fund is often called the training ground for the Thiel School—and that reputation is well earned.

2. Twelve "Investment Commandments": How to Bet on the Future Amid Uncertainty

-

Insiders undervalue break-up startups

-

Back the founders religiously

-

Mimesis rules everything around us

-

The law of talent conservation

-

The world does not need more apps

-

Move away from heat

-

Invert, always invert

-

Make variance your friend

-

Pro rata is lazy thinking

-

A college degree is a faulty credential

-

Find cerebral gladiators

-

Hire talent, not experience

3. Next Frontier: Biotech & Energy’s “Anti-Consensus” Window?

Mario admitted in interviews that he “can’t see the next chapter of FF clearly.” But according to SVTR.AI’s deep tracking, Founders Fund’s investment trajectory from 2024–2025 reveals emerging clues:

-

Industrial biomanufacturing: Teaming up with Laura Deming, it has quietly taken stakes in synthetic enzyme factory Solugen-II and bio-jet fuel project Koloma.

-

Small Modular Nuclear Fission (SMR): Participated in Radiant’s Series B, betting on beryllium-graphite technology.

-

Hydrogen metallurgy / rare earth refining: Increased stake in MP Materials and led the round for ElectraSteel, laying the material foundation for “reindustrialization.”

These areas share three traits: long cycle, high CAPEX, extremely high technical barriers—precisely matching Founders Fund’s historical preference for “uncharted territory.”

4. Summary

Mario writes at the end of his piece:

“The world will devour every good idea and then ask you: ‘What’s next?’”

For Founders Fund, the next “big narrative” may lie in biotech, energy, or deeper in defense industries. But no matter the direction, the “triangular engine” built on macro vision + anti-mimetic thinking + elite talent networks will continue driving them to discover value first in uncharted territories.

For individuals, the true scarcity isn’t capital, but the courage to push thinking to the extreme and be willing to bet on it. If Founders Fund has one replicable secret, it’s granting oneself enough intellectual freedom to cross the boundaries of common sense.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News