Bitget Daily Morning Report: Trump proposes $2,000 tariff "dividend" for every individual, market believes this could drive Bitcoin higher

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Trump proposes $2,000 tariff "dividend" for every individual, market believes this could drive Bitcoin higher

CBOE launches Bitcoin and Ethereum perpetual futures contracts.

Author: Bitget

Today's Outlook

1. The Bank of England will launch a stablecoin regulatory consultation on November 10, 2025, aiming to establish a complete regulatory framework by the end of 2026 to address financial stability risks arising from the spread of digital currencies;

2. The Chicago Board Options Exchange (CBOE) plans to launch bitcoin and ether perpetual futures contracts starting November 10, 2025, providing U.S. traders with long-term exposure to digital assets and risk management tools;

3. Jack Dorsey’s payment company Square will officially launch its bitcoin payment feature on November 10, 2025;

Macro & Highlights

1. The total market capitalization of the global cryptocurrency market has declined, with institutional funds continuing to flow out. Over the past 24 hours, the global crypto market cap fell to approximately 3.39 trillion USD, down 1.12%. Bitcoin ETFs saw 558 million USD in net outflows—the largest single-day outflow since October 10—while Ethereum ETFs recorded redemptions of 46.6 million USD. The Cleveland Fed's inflation forecast remains at 2.97%, reflecting clear market risk aversion;

2. Trump proposes distributing 2,000 USD "dividends" per person from tariffs, with Bessent suggesting this could be achieved through tax cuts or similar measures; markets believe this may drive bitcoin higher. In October, U.S. corporate layoffs exceeded 153,000, and the consumer confidence index dropped to 50.3, the lowest for this period in over two decades;

3. Approximately 4.64 million bitcoins have been moved from dormant wallets this year, valued at over 500 billion USD;

4. Arthur Hayes: The U.S. government is beginning to print money and distribute benefits, which may boost bitcoin and ZEC;

Market Trends

1. BTC around 105,000 USD, ETH around 3,579 USD; both declined short-term, with total liquidations reaching 349 million USD over the past 24 hours, predominantly short positions.

2. U.S. stocks closed mixed: Dow rose 0.16%, S&P 500 gained 0.13%, Nasdaq fell 0.21%;

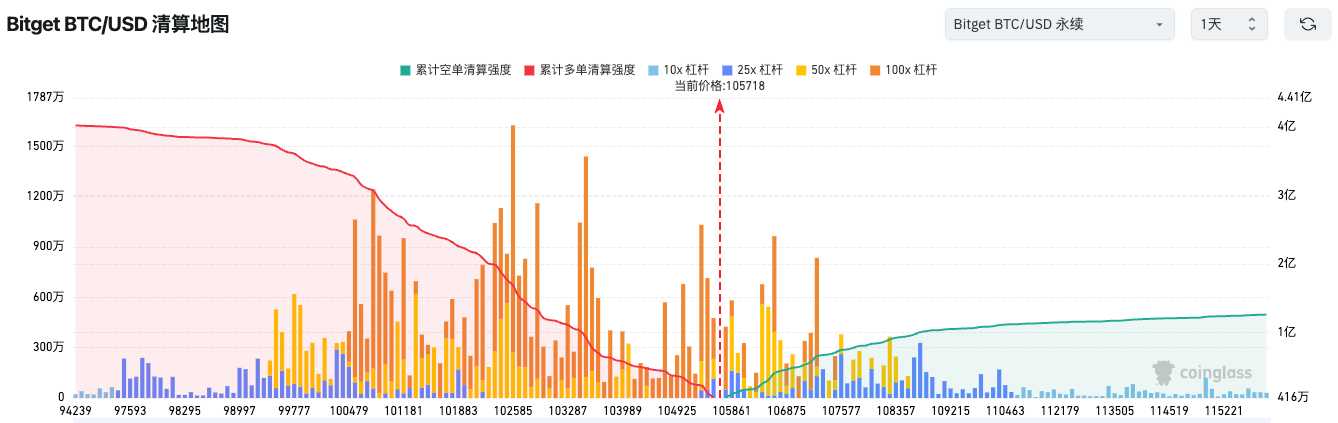

3. Bitget BTC/USDT current price at 105,718 USD; liquidation zones for long positions are dense, with high leverage (50x and 100x) concentrated here. A breakdown below this level may trigger rapid short-term downside;

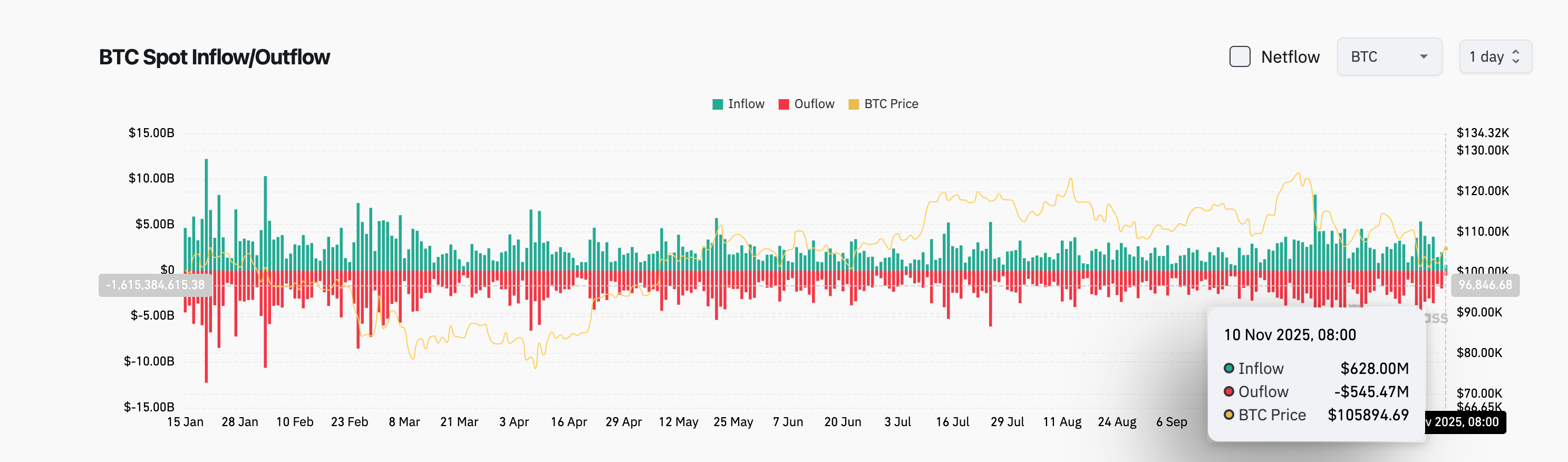

4. Over the past 24 hours, BTC spot inflows were 628 million USD, outflows 545 million USD, resulting in a net inflow of 83 million USD;

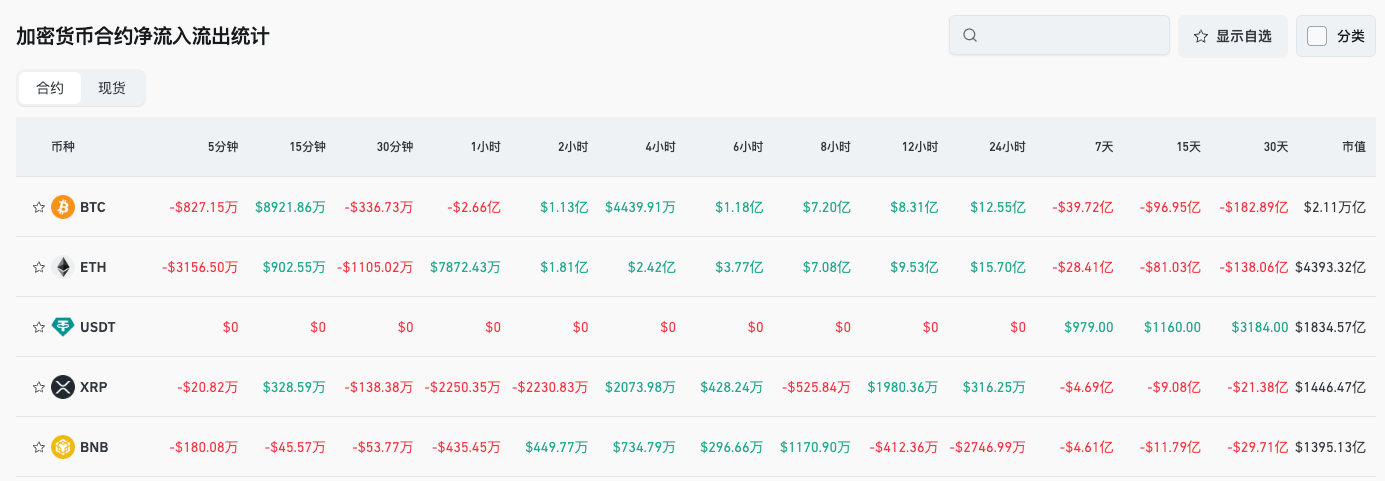

5. Over the past 24 hours, BTC, ETH, USDT, XRP, BNB and other tokens led in net outflows in contract trading, potentially indicating trading opportunities;

News Updates

1. The acting chair of the U.S. CFTC confirmed efforts to promote leveraged spot crypto trading on regulated exchanges;

2. Ledger is considering an IPO or fundraising in New York to meet surging global demand for hardware wallets;

3. A survey shows that 43% of hedge funds plan to integrate DeFi into their business operations;

4. Spanish crypto influencer CryptoSpain was arrested over alleged 300 million USD fraud and money laundering;

Project Updates

1. Cboe plans to launch bitcoin and ether perpetual futures contracts on November 10, enhancing long-term derivatives tools in the digital asset market;

2. Faraday Future has filed a utility patent for a blockchain-based car-sharing system, advancing integration between the automotive and blockchain industries;

3. Linea will unlock tokens worth 34.4 million USD on November 10, representing 16.44% of circulating supply;

4. Aptos will unlock tokens worth 33.4 million USD on November 11, accounting for 0.49% of total supply;

5. Avalanche will unlock tokens worth 28.2 million USD on November 13, with market attention on potential selling pressure;

6. Square will launch bitcoin payments on November 10, promoting cryptocurrency use cases in mainstream payment scenarios;

7. Yield Basis will migrate to an improved pool contract to correct fee distribution discrepancies;

8. Circle Internet will release its earnings report this week, potentially having significant impact on the stablecoin ecosystem and investor confidence;

9. Analysis: Five spot XRP ETFs have already appeared on the DTCC website, expected to officially launch this month;

10. 70% of top-tier bitcoin mining firms report their AI or high-performance computing projects have already generated revenue;

Disclaimer: This report is AI-generated, with human verification only for information accuracy. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News