Bitget Daily Morning Report: CME launched ADA, LINK, and XLM futures on February 9; Bitmine's latest purchase includes 24,068 ETH

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: CME launched ADA, LINK, and XLM futures on February 9; Bitmine's latest purchase includes 24,068 ETH

Polygon recently laid off 30% of its workforce to advance its transition into stablecoin payment business.

Author: Bitget

Today's Outlook

1. CME will launch ADA, LINK, and XLM futures on February 9.

2. Bitcoin Magazine reports that $BTC has recently become one of the most searched Cashtags on X.

3. BlackRock and Microsoft’s AI collaboration project has raised $12.5 billion, with a target of $30 billion.

Macro & Hotspots

1. BlackRock CEO Fink: If you believe in the power of AI, then there is a strong rationale for rate cuts.

2. Federal Reserve's Goolsbee: Bringing inflation back down to 2% remains the top priority.

3. Analysis: The incoming CFTC chair faces dual regulatory challenges in crypto and prediction markets.

Market Trends

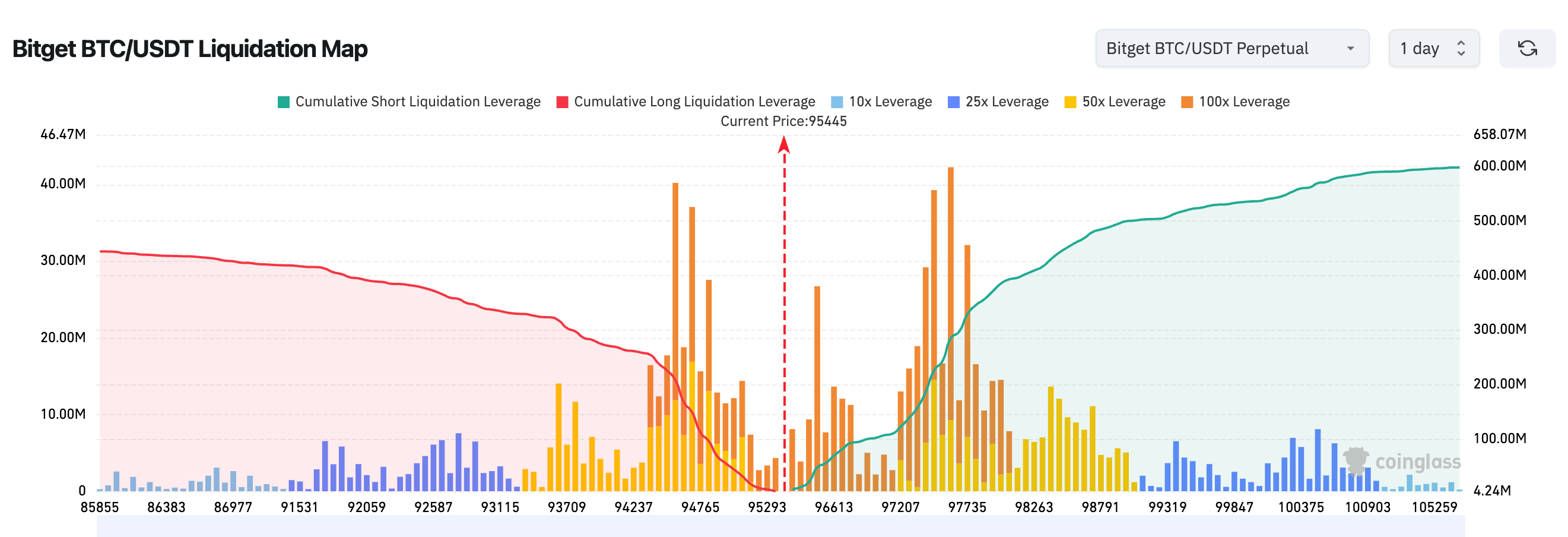

1. Over the past 24 hours, total liquidations in the crypto market reached $319 million, with $259 million from short positions. BTC liquidations amounted to approximately $81 million, while ETH liquidations reached about $57 million.

2. U.S. stocks: Dow +0.6%, Nasdaq +0.25%, S&P 500 +0.26%. Additionally, CRCL (Circle) -9.67%; MSTR (MicroStrategy) -4.7%, NVDA (NVIDIA) +2.13%.

3. Bitget BTC/USDT liquidation map shows dense liquidation zones both above and below the current price level near $95,400. The area above $97,000–$98,000 concentrates large volumes of high-leverage short positions (50x, 100x), which could trigger a short squeeze if broken with strong volume. Below, around $94,000, significant long liquidation risks have accumulated—once key support is breached, it may lead to cascading stop-losses and accelerated downside movement in the short term.

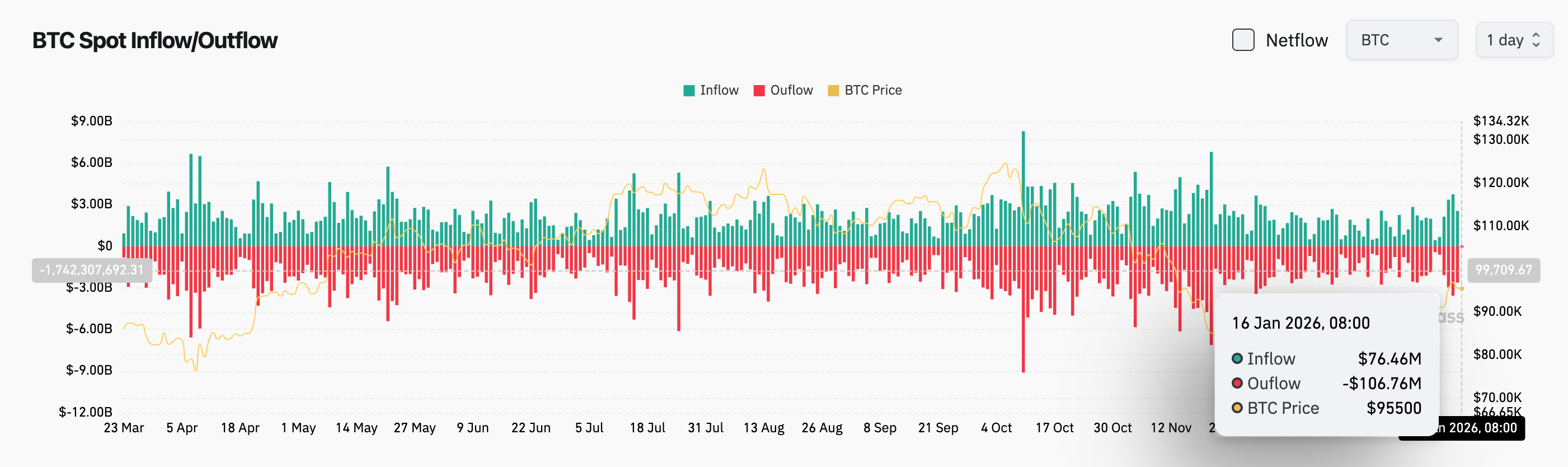

4. In the past 24 hours, BTC spot inflows were approximately $76 million, outflows around $106 million, resulting in a net outflow of $30 million.

News Updates

1. X discontinues post rewards and bans "InfoFi"-type apps from incentivizing users to post content.

2. State Street launches a digital asset platform, entering the tokenized deposits and stablecoin market.

3. Swift partners with Chainlink and several European banks to complete a pilot on interoperability for tokenized assets.

Project Developments

1. A whale converted 363 BTC into 10,390.5 ETH over the past two days.

2. Whale “0xE9D” purchased 11,089 AAVE (worth $1.9 million) from Kraken.

3. Ethereum treasury firm Bitmine acquired 24,068 ETH (~$80.57 million) 10 hours ago.

4. BeInCrypto reports, citing insiders, that Polygon conducted large-scale internal layoffs recently, dismissing approximately 30% of its workforce this week. The layoffs follow Polygon’s strategic shift toward stablecoin payments.

5. Trump family’s crypto project WLFI is hiring a Chief Financial Officer for its proposed crypto bank.

6. Ripple invests $150 million into LMAX to promote institutional settlement use of RLUSD stablecoin.

7. Anchorage Digital partners with Spark to launch an institutional-grade DeFi lending custody solution.

8. MetaMask officially integrates the Tron network, supporting native operations for TRX and USDT.

9. Hyperliquid moves $FOGO from pre-listing contracts to standard contracts, enabling up to 3x leverage trading.

10. Sentient releases tokenomics: 44% allocated to community activities and airdrops.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News