The Truth Beyond Price: How Did the U.S. Seize Chen Zhi's Bitcoin?

TechFlow Selected TechFlow Selected

The Truth Beyond Price: How Did the U.S. Seize Chen Zhi's Bitcoin?

Price reflects position, while legal documents state facts.

By: Daii

Just now, Bitcoin once again fell below the $100,000 mark. That long red candle amplified the noise on social media to maximum volume:

Some claimed "the algorithm was broken, so funds fled," while others directly translated "held in U.S. custody" as "the U.S. calculated the private key." Price reflects sentiment, but that doesn't mean it reflects facts.

This is not an article urging you to go long or short—when volatility is most glaring, the best thing to do is lay out the documents and straighten the timeline:

What exactly did the U.S. seize, how did they seize it, and does it have anything to do with "algorithm being cracked"?

Next, we'll clarify this step by step based on confirmed events: first untangling the "sequence of rumor ignition," then distinguishing between "algorithm vs access," and finally using publicly disclosed cases and procedures to answer a simple question—

How did Chen Zhi's batch of Bitcoin go from personal self-custody to being held under U.S. judicial supervision?

First, here's the timeline:

October 10 (Friday): After the U.S. President announced new measures imposing 100% tariffs on Chinese imports, leveraged positions began to unravel; that night into the next day triggered a chain of forced liquidations. Within 36 hours from October 10–11, about $19 billion in leveraged positions were wiped out. Bitcoin briefly dropped to the $104,7xx range; Ethereum and mid-to-small cap coins fell even more sharply, ushering in the narrative of a "black weekend." (Reuters)

October 11 (Saturday): Records for exchange and perpetual contract platform liquidations were broken: headlines declaring the "largest single-day forced liquidation in history" dominated news feeds and social media trending lists. Public attention focused on "who triggered this round of liquidity stampede." (coinglass)

October 14 (Tuesday): The U.S. Department of Justice (DOJ) unsealed an indictment charging Chen Zhi, chairman of太子 Group, with conspiracy to commit wire fraud and money laundering, and filed the largest civil asset forfeiture action in history over approximately 127,271 Bitcoins—stating explicitly in the indictment that these Bitcoins were previously stored in "unhosted wallets," with private keys controlled by Chen Zhi himself, and are now "under U.S. government custody." On the same day, the U.S. Treasury’s OFAC and the UK government simultaneously issued broad sanctions. (justice.gov)

In the 48 hours following October 14, several types of content distorted "custody in the U.S." into "cracked by the U.S.":

-

News aggregators and自媒体 rewrites simplified "judicial seizure of non-custodial wallets" into "government computed the private key." (Example: UK news briefs and secondary reposts repeatedly emphasized "127,271 BTC now under U.S. control," often omitting the legal context of "judicial seizure / custody" during reader redistribution.) (theguardian.com)

-

Exchange communities and forum posts used titles like "U.S. government wallet adds 127,000 BTC" to drive clicks, with comment sections featuring highly upvoted speculation about "algorithm being cracked," further amplifying misinterpretation. (Reddit)

-

Mainstream media and portals highlighted phrases like "largest in history" and "now under U.S. custody" in headlines, yet readers often interpreted "gained access/control" as "technically breaking Bitcoin." (cbsnews.com)

October 15–21: Contrary to the crypto market's deleveraging, gold hit record highs: after surpassing $4,100 on the 13th, it broke $4,200 on the 15th, and reached a peak near $4,381 per ounce on the 20th–21st. The narrative quickly shifted to "gold is safer." (Reuters)

October 31 (Friday): Bitcoin recorded its first monthly decline in October since 2018.

Thus, many people hastily concluded: "The algorithm was cracked, so prices fell and capital moved to gold." This rumor appears plausible because price—news—fear were stitched together into a false causal chain.

Now you should clearly understand: this is a classic case of post hoc fallacy and narrative stitching. The main reason for Bitcoin's drop was deleveraging and liquidity withdrawal; DOJ documents refer to transfer of access and control—not algorithmic breach; gold's strength stems more from macro-level risk aversion and interest rate expectations.

However, there's one thing you may still not fully grasp: how exactly did the U.S. gain control over Chen Zhi’s Bitcoin?

1|What exactly did the U.S. "crack"?

If we examine the original indictment, the answer becomes almost obvious:

The U.S. did not "crack the algorithm," but rather obtained "access and control" over these coins.

In its October 14, 2025 press release, the Department of Justice announced the largest civil forfeiture in history involving approximately 127,271 Bitcoins, explicitly stating these assets are "currently in U.S. custody"—a term referring to possession and control, not "computing the private key." The same document notes these Bitcoins were previously held in unhosted wallets with private keys under Chen Zhi’s sole control, further indicating that access shifted from an individual to law enforcement—not due to any algorithmic compromise.

Supporting actions on the same day confirm the "judicial and sanctions" narrative: the Treasury Department imposed unprecedented joint sanctions on太子 Group’s transnational criminal organization, naming Chen Zhi and freezing associated entities and channels; the UK government simultaneously issued enforcement notices and asset freezes. This is a classic "case pathway"—indictment + forfeiture + sanctions—entirely different in logic and agency jurisdiction from "technical decryption." (home.treasury.gov)

More detailed facts lie within official documents: indictments and forfeiture complaints released by the U.S. Attorney’s Office for the Eastern District of New York detail the legal and evidentiary chain of "how assets were located and forfeiture claimed," but never assert that 256-bit private keys were mathematically reverse-engineered. In other words, what was transferred was the "right to use" the key—not the mathematics underlying Bitcoin; "in U.S. custody" means judicially supervised holding and enforcement—not "algorithmic failure." (justice.gov)

Reverse-engineering Bitcoin private keys through mathematical computation, though a dream for many, remains an impossible earthly task before practical quantum computers emerge.

2|Why is "breaking" Bitcoin nearly impossible?

Let’s first clarify the material of Bitcoin’s "door."

Bitcoin uses elliptic curve digital signatures with the secp256k1 curve; each private key is a random 256-bit number, and signature security equates to solving an elliptic curve discrete logarithm problem. This isn’t an engineering task you can brute-force with GPUs—it’s a mathematical challenge for which no known efficient algorithm exists to solve within feasible timeframes. The U.S. National Institute of Standards and Technology (NIST) evaluates 256-bit elliptic curves at roughly 128-bit security strength, considered a long-term acceptable baseline; Bitcoin developer documentation also confirms: private keys are 256-bit random data used with secp256k1 to generate public keys and signatures. (nvlpubs.nist.gov)

Many "algorithm broken" rumors love to wield "quantum" as a hammer. Indeed, Shor’s algorithm theoretically breaks discrete logarithms—but only with fault-tolerant large-scale quantum computers. In reality, academia in 2025 can only demonstrate cracking 5-bit scale elliptic curve toy models on 133-qubit hardware—a microscopic model experiment, astronomically distant from production-grade 256-bit strength. Because both industry and regulators understand this timescale, NIST published its first ** post-quantum cryptography (PQC) standards (FIPS 203/204/205) in 2024 to prepare for future migration, but this does not mean today’s ECDSA is already compromised. ** Misinterpreting forward planning as current decryption is a common rhetorical sleight-of-hand. (arxiv.org)

In short, ECDSA has never been breached by real-world computing power; what frequently fails instead are human access and operational practices—not the algorithm itself. (bitcoinops.org)

So how did the U.S. obtain the private keys originally controlled by Chen Zhi?

3|How exactly did the U.S. "obtain the private key"?

There are typically only two paths: person or object—either someone handed it over, or it was found in physical form.

Past major cases show that the "key" is rarely extracted from mathematics, but rather retrieved from people or devices.

October 1, 2013: FBI arrested Ross Ulbricht at a public library in San Francisco. He was accused of operating Silk Road, a major darknet drug and crime marketplace. Investigators created a disturbance on-site, seized him and his laptop, executed a search warrant, and obtained forensic access to the device, gaining entry to backend systems and wallets.

2015–2016: During the "Playpen" operation, FBI took control of a dark web server hosting child abuse images and obtained court authorization for Network Investigative Techniques (NIT) search warrants—to conduct ** limited, targeted remote forensics ** on "anonymous computers logging into the site." Court-approved probes were deployed to target machines to capture unlock passwords or sensitive memory fragments.

This sparked widespread debate across multiple circuit courts over the Fourth Amendment and Federal Rule of Criminal Procedure 41: under what circumstances can judges issue "remote search warrants"? Where lies the boundary for NIT usage? Since 2016, Rule 41(b)(6) has been amended to grant clearer procedural frameworks for such investigative powers in specific scenarios. (congress.gov)

This is precisely why many security guides emphasize: private keys and recovery phrases must be stored offline.

Fast forward to November 2021: Law enforcement recovered hardware and records from a safe and a popcorn tin hidden in James Zhong’s bathroom cabinet during a home search, legally seizing 50,676 Bitcoins—proceeds from his earlier telecom fraud exploiting a withdrawal vulnerability in Silk Road. (justice.gov)

Connecting the dots across these cases reveals that so-called "U.S. cracking Bitcoin" actually refers to breaches of "access"—devices, passwords, cloud backups, accomplices, and suspects’ psychological defenses—not the cryptographic barrier upheld by secp256k1 and 2^256.

For the Chen Zhi case, public documents only state that "the keys are now in U.S. hands," without disclosing specifics on how they were obtained. So let’s make a bold assumption: what if the U.S. really had cracked Bitcoin’s algorithm?

4|Counter-evidence: What would happen if the algorithm were truly cracked?

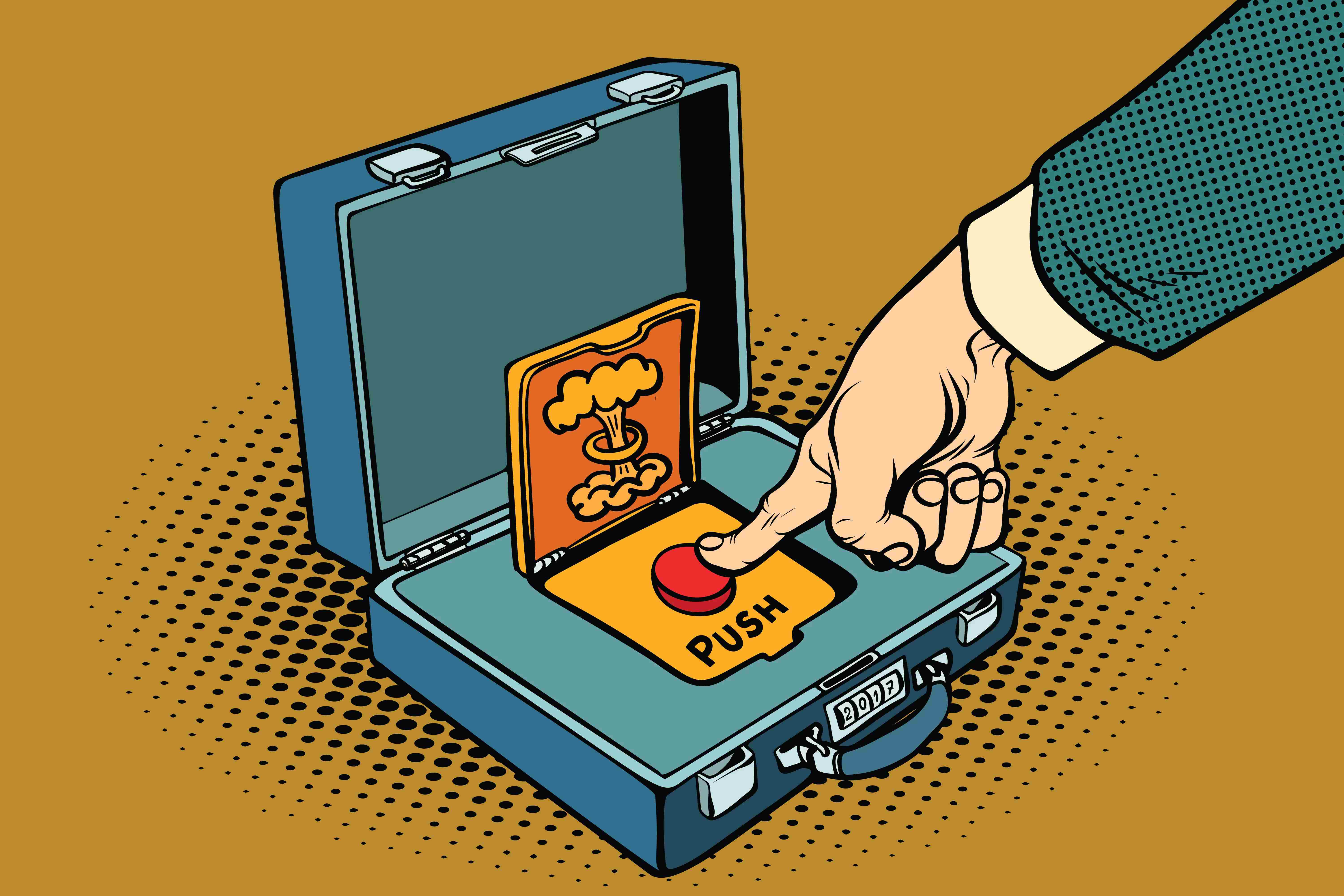

Consider a thought experiment: suppose an institution truly "broke" ECDSA/secp256k1. That would mean they possess the "nuclear button" to the entire global financial system. Under such circumstances, the least likely thing they would do is publicly announce the seizure of Chen Zhi’s 127,000 BTC via press release—that would be equivalent to openly declaring: "We can pick this lock."

If a true "mathematical nuke" shattered the secp256k1 signature scheme, blockchain wouldn’t just give you a headline—it would scream simultaneously on-chain and off-chain.

The first to move would be the most vulnerable coins: early P2PK-address "Satoshi-era" Bitcoins and reused public key legacy P2PKH addresses. Chaincode Labs provides a narrower estimate: roughly 600,000 to 1.1 million "Satoshi-era" Bitcoins remain in P2PK addresses where public keys are fully exposed. If public key → private key became reversible, these would be the first targets. Such a panic-driven migration and mass theft couldn’t happen quietly—block explorers would spike like seismographs, and social media plus blockchain intelligence accounts would erupt within minutes. (Deloitte)

The second visible signal would be movement in the "founder’s wallet." The industry consensus that Satoshi’s ~1.1 million early miner coins have remained untouched since 2009–2010 is etched into Bitcoin’s collective memory. Any "large-scale activation of prehistoric UTXOs" would be instantly detected by global monitors and pushed by media as a "black swan." If ECDSA were truly broken, you’d see these oldest coins being tested first. But in reality, these coins remain completely still—every false alarm gets quickly debunked, forming a reverse evidentiary chain proving the algorithm remains intact. (The Digital Asset Infrastructure Company)

A third ripple effect would spill beyond crypto: much of the internet’s "signatures" would simultaneously fail. Once the "mathematical foundation" collapses, it’s not just wallets burning—bank websites, browser HTTPS locks, enterprise certificates would all face massive replacement. You wouldn’t just read about "one case of seizure," but witness emergency migration announcements across certificate authorities and regulators. No such systemic collapse has occurred in reality. (nvlpubs.nist.gov)

Contrasting this "expected world" with our actual reality grounds the logic:

If ECDSA were truly broken, you’d first see intense, synchronized, unmistakable shocks across blockchains and internet infrastructure—not a misreading of "custody language" in one isolated case as "algorithm cracked."

This is the "fingerprint-level" method to distinguish rumor from fact.

Conclusion

The recent long red candle placed "fear" front and center on everyone’s screen. Prices do speak—but only in the language of emotion: leveraged liquidations, liquidity drains, risk-off shifts—all pull the curve down, but none prove the algorithm was broken. Interpreting "procedural transfer of access rights" as "mathematical breach" is merely fear rationalizing itself.

Please separate these two things: price reflects positioning, while judicial documents state facts.

The market will keep fluctuating—that’s its nature; but common sense shouldn’t fall along with it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News