Black Tuesday for US retail investors: Meme stocks and crypto tumble under earnings reports and short-seller pressure

TechFlow Selected TechFlow Selected

Black Tuesday for US retail investors: Meme stocks and crypto tumble under earnings reports and short-seller pressure

Despite retail investors still net buying $560 million on the day, they failed to prevent the Nasdaq from plunging over 2%.

Author: Bao Yilong

Source: Wall Street Insights

U.S. stocks faced a "Black Tuesday" as CEOs from several major Wall Street banks publicly warned of a potential market pullback, directly fueling investor anxiety.

The Nasdaq and S&P 500 recorded their largest single-day declines in nearly a month, with tech and high-valuation stocks hit hardest. Six out of the seven tech giants fell, and the Philadelphia Semiconductor Index plunged 4%.

Amid deteriorating risk sentiment, cryptocurrencies continued to slump. Bitcoin dropped below $100,000 for the first time since June, while Ethereum tumbled 10%. According to Coinglass, over the past 24 hours, 342,000 positions were liquidated globally, with more than $1.3 billion in losses—85% of which came from long positions.

For retail investors who chase popular stocks, Tuesday night marked the worst trading session since April.

On Tuesday, previously favored retail stocks and assets suffered heavy selling pressure, triggered by Palantir's earnings report, prominent short-sellers increasing bearish bets, and turmoil in the crypto market.

The Goldman Sachs-tracked U.S. retail favorite stock index plummeted 3.6%, roughly triple the decline of the S&P 500, marking its largest single-day drop since April 10.

"Black Tuesday" in U.S. equities spilled into Asian markets, as concerns over stretched valuations in tech stocks dampened overall market risk appetite.

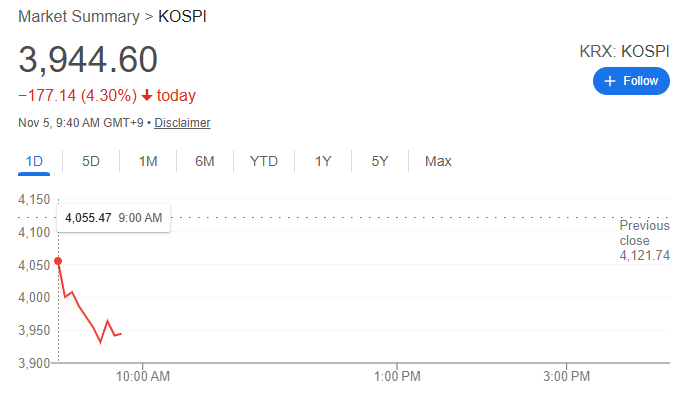

On Wednesday, U.S. equity futures slid further during Asia’s morning session, with Asian markets broadly opening lower. South Korea led the declines with over 4% loss, and the Kospi 200 futures briefly dropped more than 5%. At 9:46 a.m. local time, South Korea triggered its "Sidecar" mechanism, halting algorithmic sell orders for five minutes.

Black Tuesday: U.S. Stocks Plunge, Retail Investors Stunned

On Tuesday, all three major U.S. indexes suffered sharp losses. The Nasdaq Composite dropped over 2.5%, and the semiconductor index fell 4%. Six of the seven tech giants declined, and the Philadelphia Semiconductor Index sank 4%. Palantir plunged 7.94%. Metsera surged 20% after Novo Nordisk raised its acquisition offer.

According to Goldman Sachs’ retail favorite stock index, it dropped 3.6% on the day—about three times the S&P 500’s decline—marking the biggest single-day fall since April 10.

Retail trading enthusiasm did not immediately vanish at Tuesday’s market open. Data compiled by JPMorgan showed that by 11 a.m. New York time, retail investors were still net buyers of individual stocks and ETFs worth $560 million.

This may have contributed to an intraday rebound earlier in the day, helping narrow the S&P 500’s losses. However, the rally failed to hold, and markets turned downward again. Melissa Armo, CEO of trading education platform Stock Swoosh, described Tuesday’s move:

“This is what happens when people start panicking and selling.”

In detail, two key events directly triggered the sell-off in retail-favorite stocks. First was Palantir’s earnings report, which sparked concerns over its growth outlook.

As noted by Wall Street Insights, Palantir delivered strong Q3 results, but doubts remain about the sustainability of its high valuation. The stock, which had surged over 150% this year and was a retail favorite, saw a sharp reversal yesterday, closing nearly 8% lower and continuing to weaken in after-hours trading.

Palantir's stock price plunges

Crypto Market Bloodbath Again! Bitcoin Falls Below $100K for First Time Since June, Ethereum Drops 10%

Besides direct shocks from the stock market, turmoil in the cryptocurrency sector further pressured retail investors and dragged down crypto-related stocks.

Cryptocurrencies continued to slide, with Bitcoin briefly falling below $100,000 for the first time in over four months, and Ethereum dropping more than 10% intraday.

Analysts attribute the selling pressure to Fed Chair Powell’s hawkish comments last week, in which he downplayed market expectations of a December rate cut and reinforced the narrative that rates will stay higher for longer. This shift strengthened the dollar, putting direct pressure on non-yielding assets like Bitcoin.

Meanwhile, data shows investors pulled over $1.8 billion from Bitcoin and Ethereum-related ETF products over the past four trading sessions, further tightening market liquidity.

Analysts warn that failure to defend current levels could lead to deeper corrections. Traders are closely watching the $96,000 level as a critical support zone.

This crypto downturn comes just weeks after a historic liquidity crisis, during which billions of dollars in leveraged crypto positions were forcibly liquidated.

Looking ahead, market sentiment remains tense. Melissa Armo stated, she is preparing for another potential drop on Wednesday. She advised:

“If traders can endure some pain, they might start preparing a list of potential stocks to buy. If not, I suggest selling.”

Asian Markets Also Affected

After a strong global equity rally driven by AI hype and rate-cut expectations, rising concerns over stretched valuations are now triggering broad market pullbacks. Tech stocks are bearing the brunt, while risk warnings from Wall Street executives further intensify safe-haven demand, prompting capital to shift toward traditional defensive assets.

This sell-off is spreading from Wall Street to Asia. Following Tuesday’s U.S. market decline, U.S. equity futures continued to fall during Asia’s morning session, with Nasdaq 100 futures leading the losses.

As a result, Asian markets opened lower, with South Korea’s benchmark index briefly plunging over 4%. Prior to this, the MSCI World Index had already posted its largest single-day drop in nearly a month.

As investors reduce risk exposure, safe-haven sentiment is clearly rising. U.S. Treasury prices rose across the yield curve.

The Japanese yen, a traditional safe-haven currency, strengthened against the dollar for the second consecutive day, while the Bloomberg Dollar Spot Index reached its highest level since May.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News