Why has Bitcoin's biggest buyer stopped "frenzied buying"?

TechFlow Selected TechFlow Selected

Why has Bitcoin's biggest buyer stopped "frenzied buying"?

Did Bitcoin fall because institutions stopped buying?

Author: Oluwapelumi Adejumo

Translation: Luffy, Foresight News

For much of 2025, Bitcoin’s support level appeared unshakable due to an unexpected alliance between corporate digital asset treasuries (DAT) and exchange-traded funds (ETFs), jointly forming a solid foundation.

Corporations purchased Bitcoin through stock and convertible bond offerings, while ETF inflows quietly absorbed newly mined supply. Together, they built a stable demand base that helped Bitcoin withstand tightening financial conditions.

Now, this foundation is beginning to weaken.

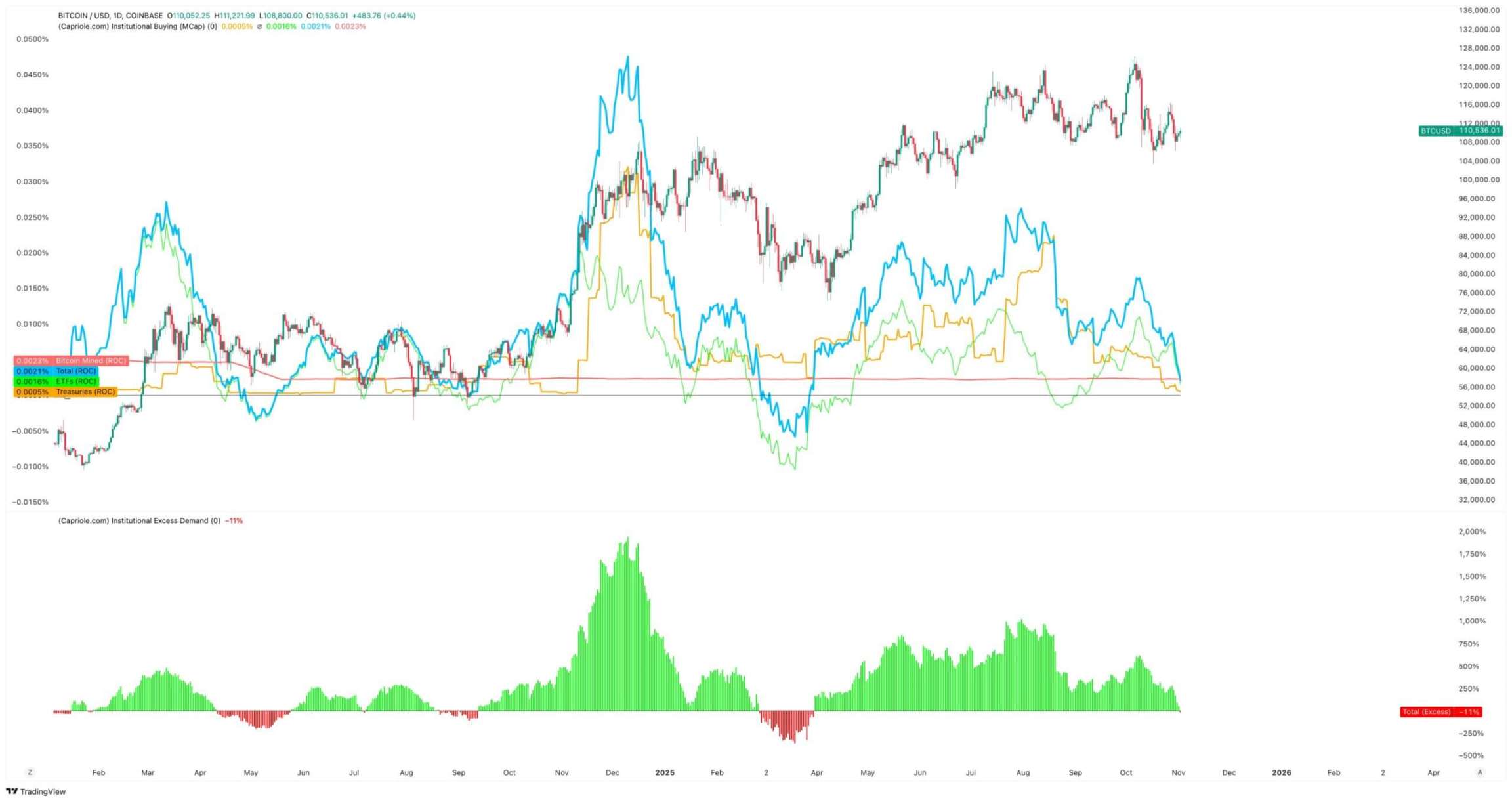

On November 3, Charles Edwards, founder of Capriole Investments, posted on X that his bullish outlook has diminished as institutional accumulation slows.

He noted: "For the first time in seven months, institutional net buying has fallen below daily mining supply. This is not good."

Institutional Bitcoin Buying, Source: Capriole Investments

Edwards stated that even when other assets outperformed Bitcoin, this metric remained the key reason for his optimism.

But currently, around 188 companies hold significant Bitcoin positions, many of which have relatively narrow business models beyond their Bitcoin exposure.

Slowing Corporate Treasury Accumulation

No company better represents corporate Bitcoin trading than MicroStrategy, recently renamed "Strategy".

Under Michael Saylor's leadership, the software maker has transformed into a Bitcoin treasury firm, now holding over 674,000 BTC and firmly maintaining its position as the world’s largest single corporate holder.

However, its buying pace has significantly slowed in recent months.

Strategy added only about 43,000 BTC in Q3, marking its lowest quarterly purchase volume so far this year. This is unsurprising given that its daily Bitcoin purchases dropped at times to just a few hundred coins during this period.

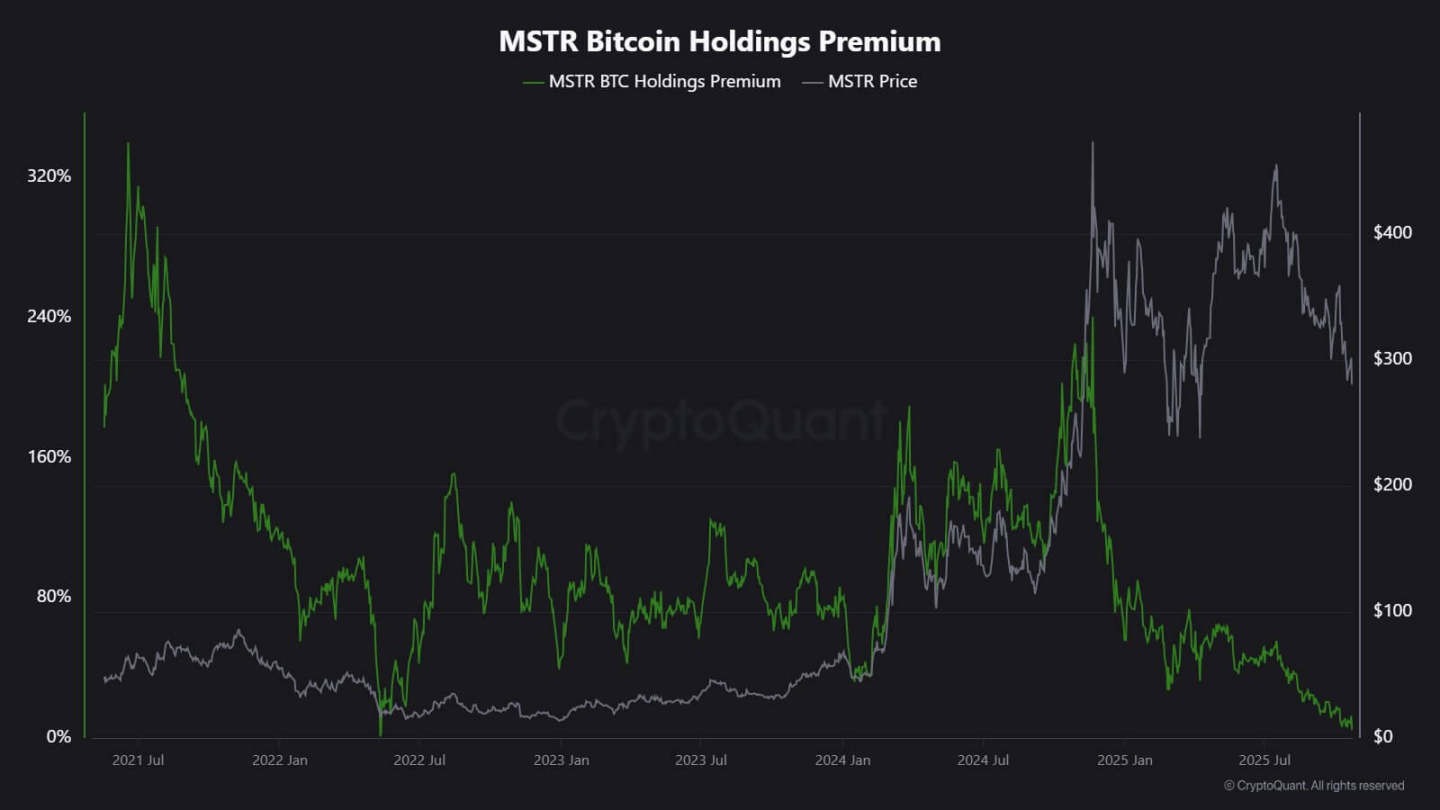

J.A. Maarturn, analyst at CryptoQuant, explained that the slowdown may be linked to declining net asset value (NAV) premiums for Strategy.

He said investors previously paid a high "NAV premium" for every dollar of Bitcoin on Strategy’s balance sheet, effectively leveraging shareholder exposure to Bitcoin gains. But since mid-year, this premium has sharply narrowed.

As valuation benefits fade, raising capital via new share issuance no longer generates significant added value, reducing the incentive for corporations to finance further accumulation.

Maarturn pointed out: "Raising funds has become harder; the stock issuance premium has dropped from 208% to 4%."

Strategy Stock Premium, Source: CryptoQuant

Meanwhile, the cooling trend isn't limited to Strategy alone.

Tokyo-listed Metaplanet followed the U.S. pioneer’s model, but after a sharp decline in its share price, it recently traded below the market value of its Bitcoin holdings.

In response, the company approved a share buyback program and introduced new financing guidelines to expand its Bitcoin treasury. While signaling confidence in its balance sheet, this move also highlights waning investor enthusiasm for the "crypto treasury" business model.

In fact, slowing accumulation by asset treasuries has already led to consolidation among some firms.

Last month, asset manager Strive announced the acquisition of smaller Bitcoin treasury firm Semler Scientific. After the merger, these combined entities will hold nearly 11,000 BTC.

These cases reflect structural constraints rather than shaken conviction. When issuing stocks or convertible bonds no longer commands market premiums, funding dries up and corporate accumulation naturally slows.

What About ETF Flows?

Solid Bitcoin ETFs, long seen as "automatic absorbers" of new supply, are showing similar signs of fatigue.

For most of 2025, these financial instruments dominated net demand, with creation volumes consistently exceeding redemptions—especially during Bitcoin’s surge to all-time highs.

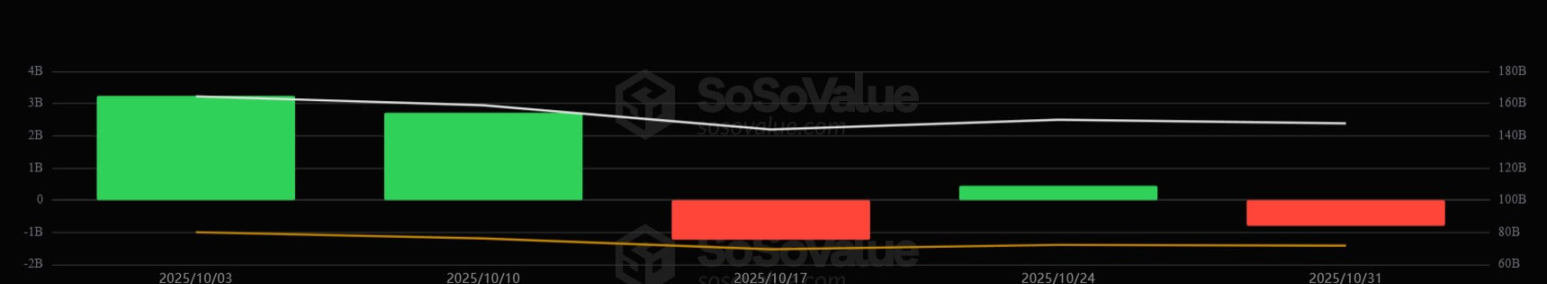

But by late October, their flows turned volatile. Influenced by shifting interest rate expectations, portfolio managers adjusted positions and risk teams reduced exposures, pushing weekly flows into negative territory at times. This volatility marks a new behavioral phase for Bitcoin ETFs.

The macro environment has tightened, hopes for rapid rate cuts have faded, and liquidity conditions have cooled. Still, demand for Bitcoin exposure remains strong—but has shifted from "steady inflows" to "pulse-like inflows".

Data from SoSoValue clearly illustrates this shift. In the first two weeks of October, crypto investment products attracted nearly $6 billion in inflows; however, by month-end, over $2 billion in redemptions erased part of those gains.

Weekly Bitcoin ETF Flows, Source: SoSoValue

This pattern suggests Bitcoin ETFs have matured into genuine two-way markets. They still offer deep liquidity and institutional access, but are no longer one-way accumulation tools.

When macro signals fluctuate, ETF investors can exit as quickly as they entered.

Market Implications for Bitcoin

This shift doesn’t necessarily mean Bitcoin is headed for a downturn, but it does signal rising volatility. As corporate and ETF absorption weakens, Bitcoin’s price movements will increasingly depend on short-term traders and macro sentiment.

Edwards believes new catalysts—such as monetary easing, regulatory clarity, or renewed equity market risk appetite—could reignite institutional buying.

But for now, marginal buyers are more cautious, making price discovery more sensitive to global liquidity cycles.

The impact manifests in two ways:

First, structural buying that once served as support is weakening. During periods of insufficient absorption, intraday volatility may intensify due to a lack of sufficient stabilizing buyers to dampen swings. The April 2024 halving mechanically reduced new supply, but scarcity alone cannot guarantee price appreciation without sustained demand.

Second, Bitcoin’s correlation profile is shifting. As balance sheet-driven accumulation cools, the asset may once again move in sync with broader liquidity cycles. Periods of rising real yields and a stronger dollar could pressure prices, while accommodative environments might restore Bitcoin’s role as a leading performer during risk-on rallies.

In essence, Bitcoin is re-entering a macro-reflective phase, behaving more like a high-beta risk asset than digital gold.

At the same time, this does not invalidate Bitcoin’s long-term narrative as a scarce, programmable asset. On the contrary, it reflects the growing influence of institutional dynamics—mechanisms that once shielded Bitcoin from retail-driven volatility now tie it more closely to capital markets.

The coming months will test whether Bitcoin can maintain its store-of-value properties without automatic inflows from corporations and ETFs.

If history is any guide, Bitcoin tends to adapt. When one demand channel slows, another emerges—possibly from national reserves, fintech integration, or retail resurgence during a macro easing cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News