The Fed's "hawkish rate cut" and crypto market profit-taking

TechFlow Selected TechFlow Selected

The Fed's "hawkish rate cut" and crypto market profit-taking

For long-term investors, the core strategy is to ignore short-term noise and focus on long-term value and trends.

Author: Hotcoin Research

Crypto Market Performance

Currently, the total cryptocurrency market cap stands at $3.71 trillion, with BTC accounting for 59.3% ($2.2 trillion). The stablecoin market cap is $307.1 billion, down 0.59% over the past 7 days. Notably, stablecoin supply recorded negative growth this week, with USDT representing 59.69%.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: ZEC gained 58.98% over 7 days, VIRTUAL rose 57.8%, DASH increased 47.23%, ZEN surged 79.8%, and HNT gained 29.57%.

This week, U.S. Bitcoin spot ETFs saw a net outflow of $800 million; U.S. Ethereum spot ETFs recorded a net inflow of $16.4 million.

Market Outlook (November 3 - November 7):

The current RSI index is 46.56 (neutral zone), the Fear & Greed Index is 32 (down from last week, in fear territory), and the Altseason Index is 43 (lower than last week).

BTC core range: $107,000–112,000

ETH core range: $3,600–4,100

SOL core range: $175–205

This week, the Federal Reserve cut interest rates by 25 basis points as expected, but Powell took a "hawkish" stance regarding a potential December rate cut, which had a certain market impact. Some long-term holders took profits, leading to a "buy the rumor, sell the news" scenario. Going forward, focus should be placed on new statements affecting rate decisions and the inflow/outflow status of spot ETFs—these are key market variables. Overall, the market is at a critical technical juncture, and next week will likely be a period of consolidation and directional decision-making.

For long-term investors, the core strategy is to ignore short-term noise and focus on long-term value and trends.

For short-term traders, next week will be a crucial technical battleground requiring more flexible and responsive actions. When direction is unclear, maintain low or even zero leverage to avoid forced liquidation due to sharp volatility.

Understanding the Present

Review of Weekly Major Events

1. On October 27, after two days of talks in Kuala Lumpur, Malaysia, the Chinese and U.S. economic and trade teams concluded their negotiations. Reuters reported this was the fifth face-to-face meeting between the two sides since May. After the talks, U.S. Treasury Secretary Bessent stated in an interview that both sides reached a "very substantive framework agreement," and the U.S. "is no longer considering" imposing 100% tariffs on China;

2. On October 27, gold futures opened sharply lower by $40 at the start of trading on Monday before rebounding, currently trading at $4,102 per ounce;

3. On October 26, the U.S.-Thailand joint statement announced that the U.S. will maintain its 19% tariff on Thailand. Thailand will eliminate tariff barriers on approximately 99% of goods, covering all U.S. industrial products as well as food and agricultural products;

4. On October 28, GMGN officially stated on social media that, in response to recent false rumors about a hacker attack resulting in user fund losses, it had immediately launched a comprehensive security audit. The platform has now confirmed there are no security issues and user funds are safe;

5. On October 28, Coinbase Asset Management (CBAM), the wholly-owned investment management arm of Coinbase Global, announced a strategic partnership with Apollo (NYSE: APO) to jointly launch a stablecoin-based credit strategy. This initiative aims to bridge stablecoins, private credit, and asset tokenization, unlocking high-quality credit opportunities within the rapidly expanding stablecoin ecosystem;

6. On October 29, according to TheBlock, Visa will accept payments in four stablecoins across four separate blockchains, which can be converted into two fiat currencies and further exchanged into over 25 traditional fiat currencies;

7. On October 30, Reuters, citing sources, reported that OpenAI is preparing for an IPO with a potential valuation of up to $1 trillion. Sources indicated the company is considering filing documents with regulators as early as the second half of 2026, aiming to raise at least $60 billion, with the final valuation and timing dependent on business growth and market conditions. OpenAI CFO Sarah Friar told some parties the company aims to go public by 2027;

8. On October 30, Axios reported that Consensys, the parent company of MetaMask, has hired JPMorgan and Goldman Sachs to lead its initial public offering (IPO). The IPO could take place as early as 2026, though details on size and valuation were not disclosed;

9. On October 31, Ethereum Foundation researchers officially set a date for the mainnet hard fork (codenamed "Fusaka"). During Thursday's "All Core Developers" call, researchers announced Fusaka will launch on December 3;

10. On October 31, CNBC reported that Coinbase's Q3 earnings exceeded expectations, with net profit rising from $75.5 million ($0.28 per share) in the same period last year to $432.6 million ($1.50 per share). Earnings per share surpassed the analyst consensus estimate of $1.10 compiled by LSEG;

11. On October 31, Bloomberg reported that Strategy released its Q3 results after market close, posting a quarterly net profit of $2.8 billion, driven largely by unrealized gains from the appreciation of its ~$69 billion cryptocurrency holdings.

Macroeconomic Overview

1. On October 29, the Bank of Canada lowered its benchmark interest rate by 25 basis points to 2.25%, in line with market expectations, marking its second consecutive rate cut;

2. On October 30, the Federal Reserve's FOMC announced it will end its balance sheet reduction program on December 1. (Currently reducing $5 billion in Treasuries and $35 billion in MBS monthly);

3. On October 30, the Federal Reserve cut its benchmark interest rate by 25 basis points to 3.75%-4.00%, the second consecutive rate-cutting meeting, in line with market expectations;

4. On October 31, according to the Fed Funds Rate Monitor, the probability of a 25 basis point rate cut in December is 60.8%.

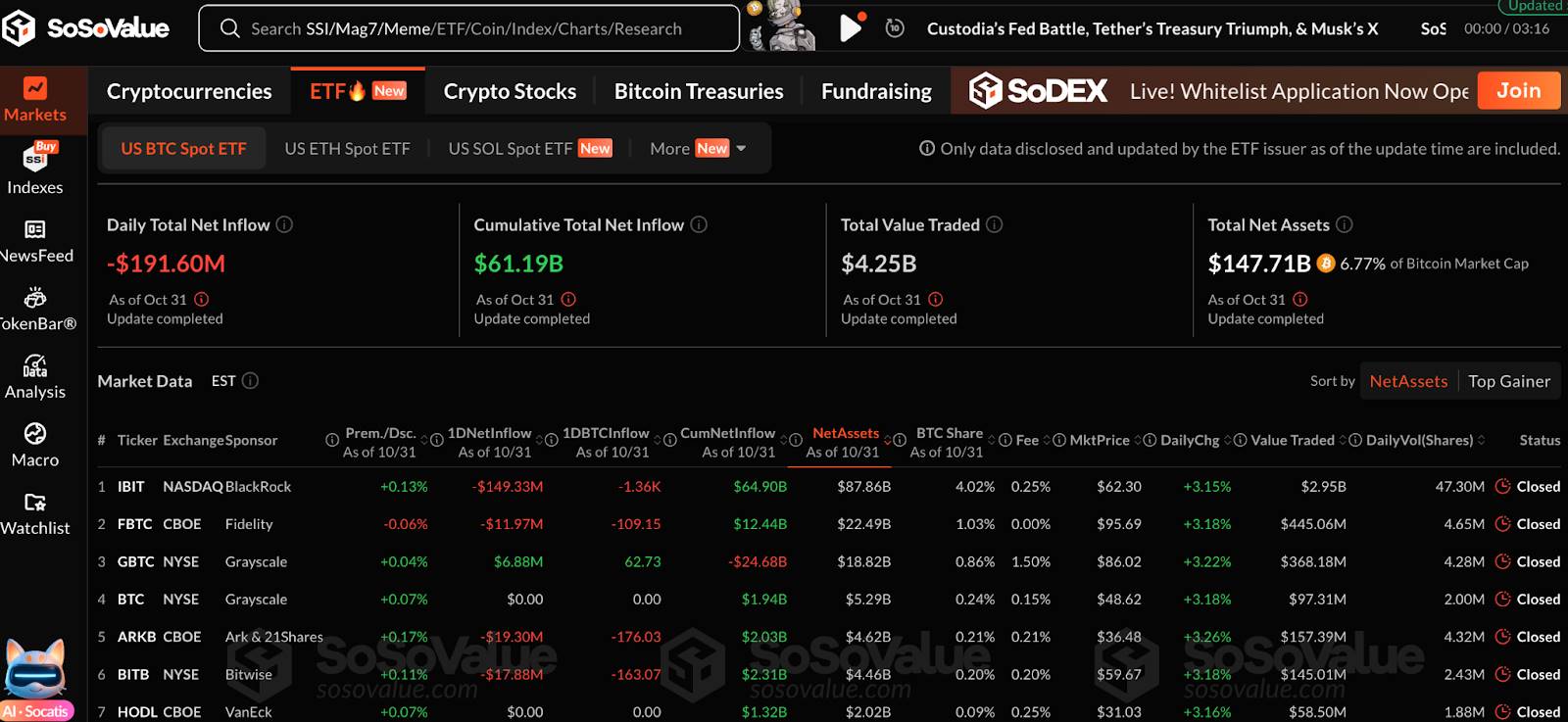

ETF

Data shows that from October 27 to October 31, U.S. Bitcoin spot ETFs recorded a net outflow of $800 million. As of October 31, GBTC (Grayscale) has seen cumulative outflows of $24.638 billion, currently holding $18.833 billion, while IBIT (BlackRock) holds $88.421 billion. The total market cap of U.S. Bitcoin spot ETFs is $149 billion.

U.S. Ethereum spot ETFs recorded a net inflow of $16.4 million.

Anticipating the Future

Event Calendar

1. Bitcoin MENA will take place at the Abu Dhabi National Exhibition Centre (ADNEC) on December 8–9;

2. Solana Breakpoint 2025 will be held in Abu Dhabi from December 11 to 13.

Project Updates

1. LOL Land’s in-game loyalty and rewards token LOL, the first project launching on the YGG Play Launchpad platform, will officially debut and begin trading on DEX on November 1;

2. The deadline to claim the Monad airdrop is November 3.

Key Events

1. Nasdaq has applied to the U.S. SEC to add XRP, SOL, ADA, and XLM to its cryptocurrency index, with a final decision expected by November 2;

2. The trial date related to the Bitcoin privacy wallet Samourai Wallet has been set for November 3, 2025.

Token Unlocks

1. Sui (SUI) will unlock 43.96 million tokens on November 1, valued at approximately $103 million, representing 1.21% of circulating supply;

2. EigenCloud (EIGEN) will unlock 36.82 million tokens on November 1, valued at approximately $33.99 million, representing 12.10% of circulating supply;

3. Omni Network (OMNI) will unlock 7.99 million tokens on November 2, valued at approximately $17.34 million, representing 30.30% of circulating supply;

4. Memecoin (MEME) will unlock 3.45 billion tokens on November 3, valued at approximately $5.23 million, representing 5.98% of circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our "Weekly Insights" and "In-Depth Reports," we dissect market trends. With our exclusive column "Top Picks" (powered by AI and expert dual screening), we help you identify promising assets and reduce trial-and-error costs. Each week, our analysts engage directly with you through live streams to explain hot topics and forecast trends. We believe that warm, human-centered support combined with professional guidance can help more investors navigate market cycles and seize Web3 value opportunities.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News