Bitcoin briefly falls to $106,000—Is it really over?

TechFlow Selected TechFlow Selected

Bitcoin briefly falls to $106,000—Is it really over?

After the Fed's rate cut took effect, market short-term sentiment reversed, but macro data still supports mid-term easing.

By ChandlerZ, Foresight News

In the early hours of October 30, the Federal Reserve announced its latest interest rate decision, cutting rates by 25 basis points as expected, lowering the federal funds rate range to 3.75%–4.00%, and declaring it would halt its balance sheet reduction starting December 1. Immediately after the announcement, market reaction was muted—S&P 500 and Nasdaq-100 rose slightly, while gold and Bitcoin briefly narrowed their declines. But minutes later, Fed Chair Jerome Powell stated at a press conference that another rate cut in December was “not on autopilot,” revealing clear divisions within the committee.

This comment swiftly shifted market sentiment. U.S. stocks, gold, Bitcoin, and Treasuries all declined in tandem, with only the dollar rising.

On the 31st, this mood continued. Bitcoin dropped from around $111,500 to $106,000; Ethereum fell even deeper, dipping below $3,700, and SOL dropped beneath $180. According to CoinAnk data, total liquidations across the market reached $1.035 billion over the past 24 hours, with long positions accounting for $923 million and short positions $111 million. Bitcoin accounted for $416 million in liquidations, Ethereum $193 million.

Meanwhile, by the close of U.S. markets, all three major indices were sharply lower, led by the Nasdaq. Crypto-related stocks suffered broad losses: Coinbase (COIN) down 5.77%, Circle (CRCL) down 6.85%, Strategy (MSTR) down 7.55%, Bitmine (BMNR) down 10.47%, SharpLink Gaming (SBET) down 6.17%, American Bitcoin (ABTC) down 6.02%, among others.

After the excitement at the start of the month, the market has shifted from "rally" to "consolidation." Anticipated inflows have materialized, narratives remain unfulfilled, and arbitrage opportunities are shrinking. For most holders, this phase implies prioritizing profit-taking and defensive positioning.

Crypto Markets Hit in Succession, Shadow of Black Swan Lingers

In fact, signs of this volatility were evident earlier. Since the "black swan" crash on October 11, Bitcoin’s price recovery has remained incomplete. Within just 72 hours, nearly $40 billion in market value evaporated, total liquidations exceeded $11 billion, and the fear index plunged to 22. Subsequent rebounds stalled at $116,000, until Powell’s recent remarks triggered fresh panic.

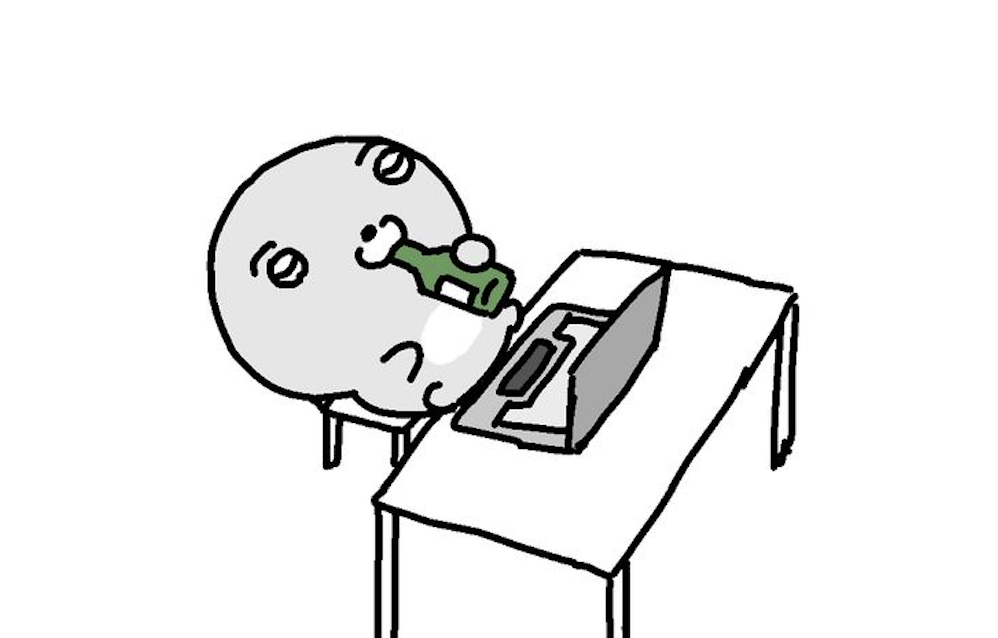

On ETF flows, according to SoSoValue, Bitcoin spot ETFs saw a total net outflow of $488 million yesterday, with none of the twelve ETFs recording net inflows. The largest single-day outflow came from BlackRock’s IBIT ETF, which lost $291 million. IBIT’s historical cumulative net inflow now stands at $65.052 billion. Second was Ark Invest and 21Shares’ ARKB ETF, with a daily net outflow of $65.62 million, bringing ARKB’s total historical net inflow to $2.053 billion.

Ethereum spot ETFs collectively recorded a net outflow of $184 million, with all nine ETFs showing outflows. BlackRock’s ETHA ETF saw the largest single-day outflow at $118 million, with ETHA’s total historical net inflow now at $14.206 billion. Bitwise’s ETHW ETF followed with a $31.14 million outflow, bringing its historical net inflow to $399 million.

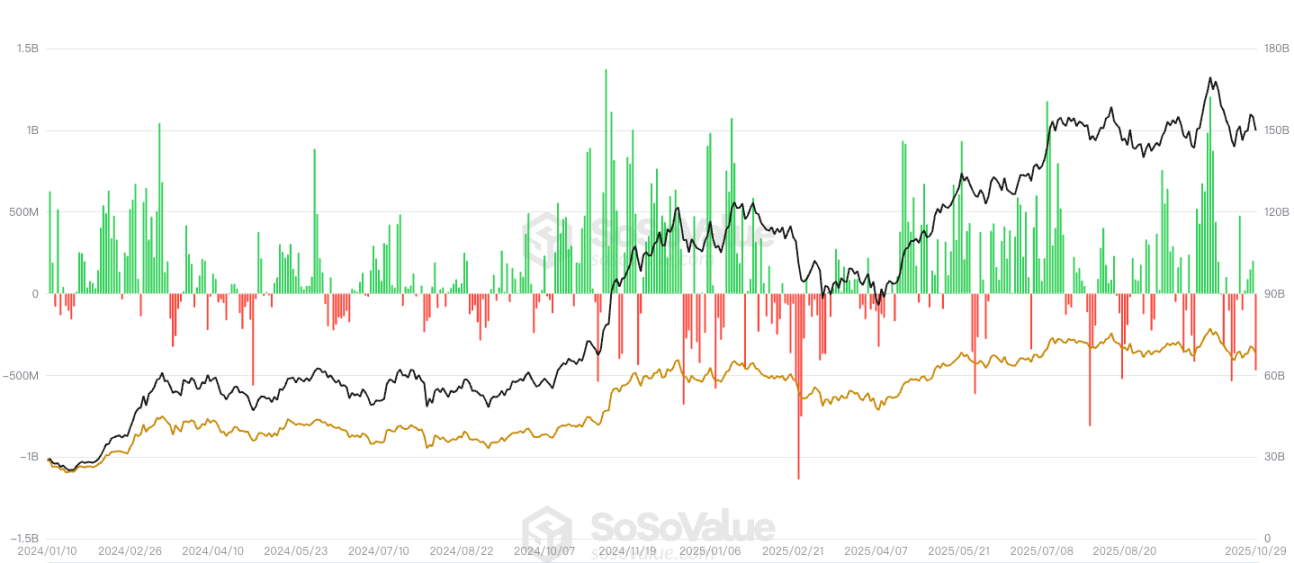

According to Glassnode analysis, since mid-July, long-term Bitcoin holders have maintained steady selling pressure, capping the market below $126,000. Data shows average daily sales by long-term holders rose from around $1 billion (7-day moving average) in mid-July to $2–3 billion by early October. Unlike previous high-selling phases during this bull run, the current distribution pattern is gradual and sustained rather than sharp and short-lived.

A deeper breakdown by holding duration reveals that investors who held for 6–12 months contributed over 50% of recent selling pressure, particularly pronounced in the later stages of the price peak. Near Bitcoin’s all-time high of $126,000, this group’s average daily sell-off reached $648 million (7-day MA), more than five times above early 2025 baseline levels.

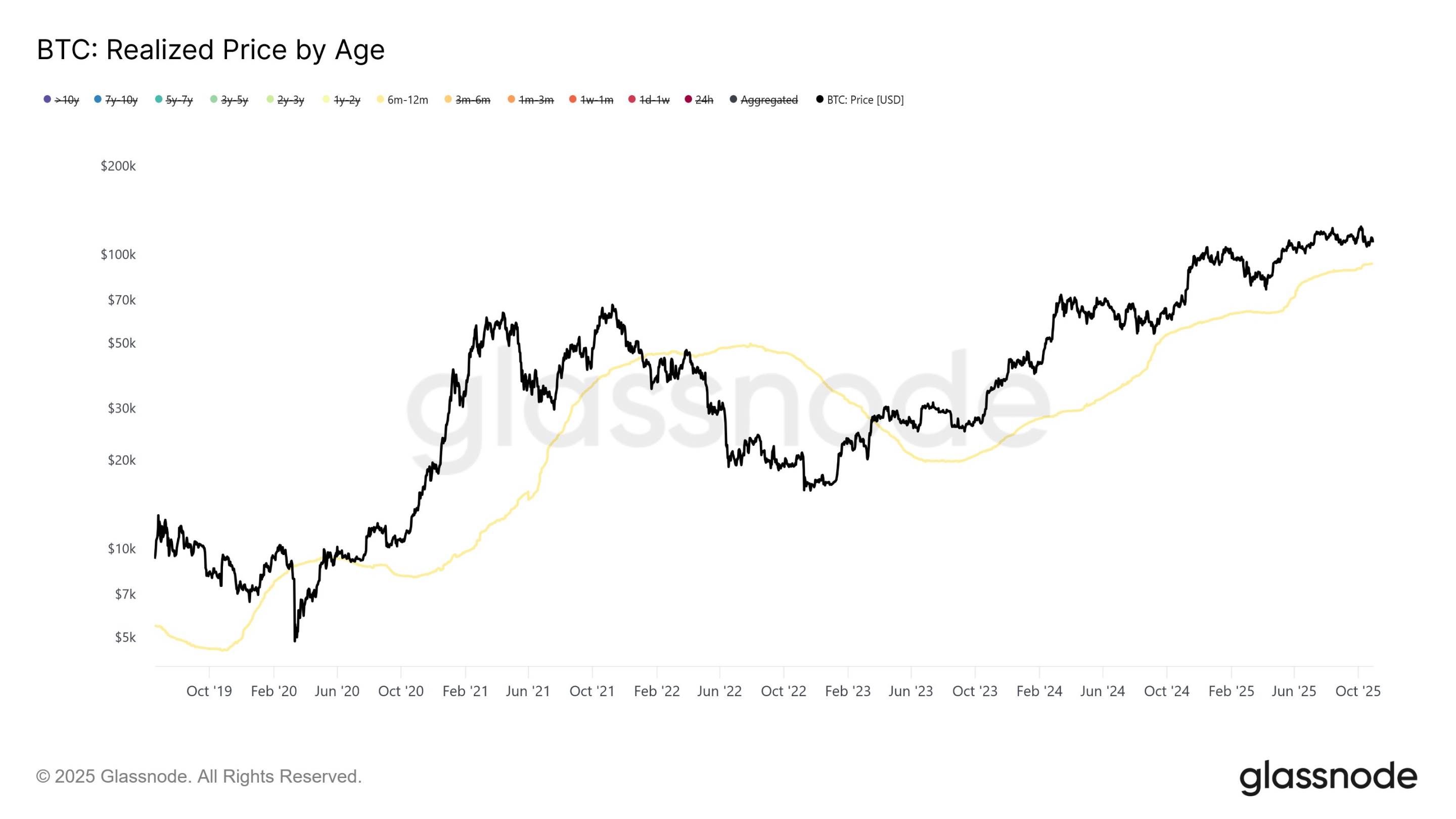

Data also shows these investors accumulated heavily between October 2024 (during the U.S. election) and April 2025, with a cost basis between $70,000 and $96,000, averaging around $93,000. Analysts note that if Bitcoin falls below the $93,000–$96,000 range, this cohort will face maximum loss pressure.

Some market observers believe the October 11 crash and subsequent pullback have already formed a “minor cycle top,” and Powell’s comments this week reinforced short-term defensive positioning.

Liquidity Repricing

Following the black swan crash, the crypto market has entered a period of deep restructuring. The two main drivers behind the altcoin boom in recent years—retail traders’ high-frequency speculation and institutional speculative absorption—are simultaneously unraveling. Market makers are deleveraging, VCs are pausing investments in primary markets, and retail investors, battered by repeated liquidations, are stepping back. Market liquidity is nearly dried up.

Bitcoin and Ethereum have reemerged as dominant liquidity assets. Price discovery mechanisms for long-tail tokens have failed; market caps and narratives are being forced into retreat. Except for a select few infrastructure projects with real cash flows and user bases—such as stablecoin issuance, RWA asset mapping, or payment settlement systems—most altcoins are stuck in prolonged states of token dilution and absent buying demand. Behind the altcoin retreat lies a broader contraction in capital logic. The market is shifting from narrative-based pricing to cash-flow-based pricing. Capital is no longer paying for concepts. Tokens have lost their rationale for sustained value growth, and compelling narratives are becoming an exclusive privilege of a few core projects.

Additionally, the DAT model popular in the first half of this year is essentially a structure where tokens are exchanged for equity. Its feasibility relies on one premise: secondary market participants willing to absorb supply. When incremental liquidity dries up, this closed loop collapses. Projects still seek funding, financial advisors continue arranging deals, but buyers are gone. Strategy released its Q3 2025 earnings report, showing a net profit of $2.8 billion; BTC holdings increased from 597,325 to 640,031 coins; yet its stock price fell nearly 14% during the same period, narrowing its market premium relative to BTC holdings.

Long-tail DAT tokens see almost no trading volume. New fundraising increasingly becomes hedging between on-chain tokens and book-value equity. For example, Nasdaq-listed Litecoin treasury firm Lite Strategy announced its board has approved a $25 million share buyback program, with timing and quantity dependent on market conditions. For project teams and early investors, this means short-term fundraising remains feasible; for secondary market investors, it means nearly no exit path. DAT models lacking cash flow support, audited custody, or buyback mechanisms are gradually exposing characteristics of idle circulation and circular staking.

At a deeper level, this bubble burst reflects a breakdown of trust between crypto’s primary and secondary markets. Without genuine buyer demand, on-chain treasury valuations lose meaning. Capital patience is waning; tokens are losing their fundraising function; DAT is shifting from innovation to risk.

Short-Term Volatility, Long-Term Dovish Outlook Unchanged

The crypto market’s volatility is part of a repricing process. Powell’s comments abruptly soured short-term sentiment, but this shock resembles an expectation correction rather than a trend reversal. Barclays’ latest report supports this view: Powell’s real intent was to dispel market overconfidence in inevitable rate cuts, not to return to a hawkish stance. Macroeconomic data still supports further easing—labor demand continues to slow, core inflation is nearing the 2% target, and economic cooling has become a consensus.

From a cyclical perspective, the Fed’s policy space is reopening. The current rate range of 3.75%–4.00% is significantly above core inflation, indicating monetary policy remains restrictive. Yet, amid broad global economic slowdown, the marginal benefit of maintaining high rates is diminishing. The question now isn’t whether to cut, but when to restart stronger easing. With balance sheet reduction ending in December, the likelihood of the Fed returning to quantitative easing will gradually increase.

For the crypto market, this implies the medium-term liquidity environment remains favorable. Despite sharp short-term swings, the liquidity anchor still points to accommodation. Improved USD liquidity will boost risk appetite, pushing asset valuations upward again. Historical patterns show that after each easing cycle begins, Bitcoin typically sees a sustained rebound 1 to 2 quarters later. This current correction may simply be creating room for the next leg up.

From a capital structure standpoint, institutions are waiting for macro confirmation—stable inflation within target range, clear labor market weakening, and explicit signals of rate cuts from the Fed. Once this combination emerges, ETF inflows and rebuilding of futures long positions will restart. For retail and small-to-mid-sized investors, real opportunity lies not in short-term panic, but in the second wave of inflows following the establishment of a new easing cycle.

Whether viewed through the lens of the Fed’s policy focus or institutional asset allocation logic, the transition is underway—from the end of rate hikes toward the beginning of easing. Short-term turbulence is inevitable, but the long-term return of liquidity is now an established trend. For investors still in the market, the key is not predicting the bottom, but ensuring survival until QE restarts. When that day comes, Bitcoin and the broader crypto market will enter a new pricing cycle fueled by liquidity revival.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News