Grants DAO has allocated over $180 million in funding, fully supporting the prosperity of the JustLend DAO ecosystem and enhancing the value of JST

TechFlow Selected TechFlow Selected

Grants DAO has allocated over $180 million in funding, fully supporting the prosperity of the JustLend DAO ecosystem and enhancing the value of JST

Grants DAO comprehensively promotes the healthy development of the JustLend DAO ecosystem and the steady growth of JST value through systematic initiatives such as user incentives, developer support, market security maintenance, and ecosystem value enhancement.

Recently, JustLend DAO, a core DeFi protocol within the TRON ecosystem, successfully completed the first large-scale destruction phase of its "JST buyback and burn" initiative—destroying approximately 559 million JST tokens, equivalent to 5.66% of the total token supply. This strong deflationary move quickly attracted widespread attention across the crypto market.

Throughout the implementation of the entire JST buyback and burn program, JustLend Grants DAO (shortened as Grants DAO) has not only served as the core executor but will also oversee the regular quarterly burn operations going forward, playing an indispensable role in driving the full-cycle execution of this deflationary mechanism.

As a sub-DAO under JustLend DAO, Grants DAO is a community-driven incentive organization committed to providing solid support for projects and builders contributing to the development of JustLend DAO and the broader JUST ecosystem through diverse means, while also taking responsibility for building safeguards for the ecosystem's secure growth.

The scope of Grants DAO extends far beyond managing treasury funds; it serves as the core engine powering the growth of the JustLend DAO ecosystem and the appreciation of JST value. From resource support and developer incentives to precise market risk management, Grants DAO’s influence spans all key aspects of ecosystem development. It systematically drives the comprehensive advancement of JustLend DAO and the JUST ecosystem while ensuring that the interests of all participants—including JST holders and liquidity providers—are maximally protected and enhanced.

Grants DAO: The Core Driver and Executor Behind the JST Buyback and Burn Program

In fact, every stage of this JST buyback and burn process relied on the leadership and execution by Grants DAO. From the initial community proposal and formal voting, to the completion of the first burn, and onward to the planned recurring quarterly burns, Grants DAO has consistently played a central role.

During the execution of this JST buyback and burn program, Grants DAO first allocated over $59 million USDT from JustLend DAO’s existing earnings. Then, it burned 30% of these accumulated earnings, equivalent to about 559 million JST tokens, or 5.66% of the total token supply. The remaining 70% of earnings will be gradually burned over the next four quarters and are currently deposited into the SBM USDT lending market to generate yield, with future returns also dedicated to buying back and burning JST.

According to the burn rules, subsequent quarterly JST buyback and burn operations will be fully managed by Grants DAO. For the first four quarters, at the beginning of each quarter, an amount equal to “17.5% of JustLend DAO’s incremental net income from the previous quarter plus 17.5% of residual earnings” must be burned. Once the USDD multi-chain ecosystem generates over $10 million in revenue, it too will be integrated into this burn mechanism.

It can be said that behind this series of sophisticated economic operations involving JST buybacks and burns, Grants DAO is both the consistent core executing body and a key catalyst propelling the continuous advancement of the JustLend DAO ecosystem. Through this buyback and burn initiative, Grants DAO has transitioned from a behind-the-scenes executor to a well-recognized pivotal player, now standing as a crucial pillar in the value construction of the JustLend DAO ecosystem.

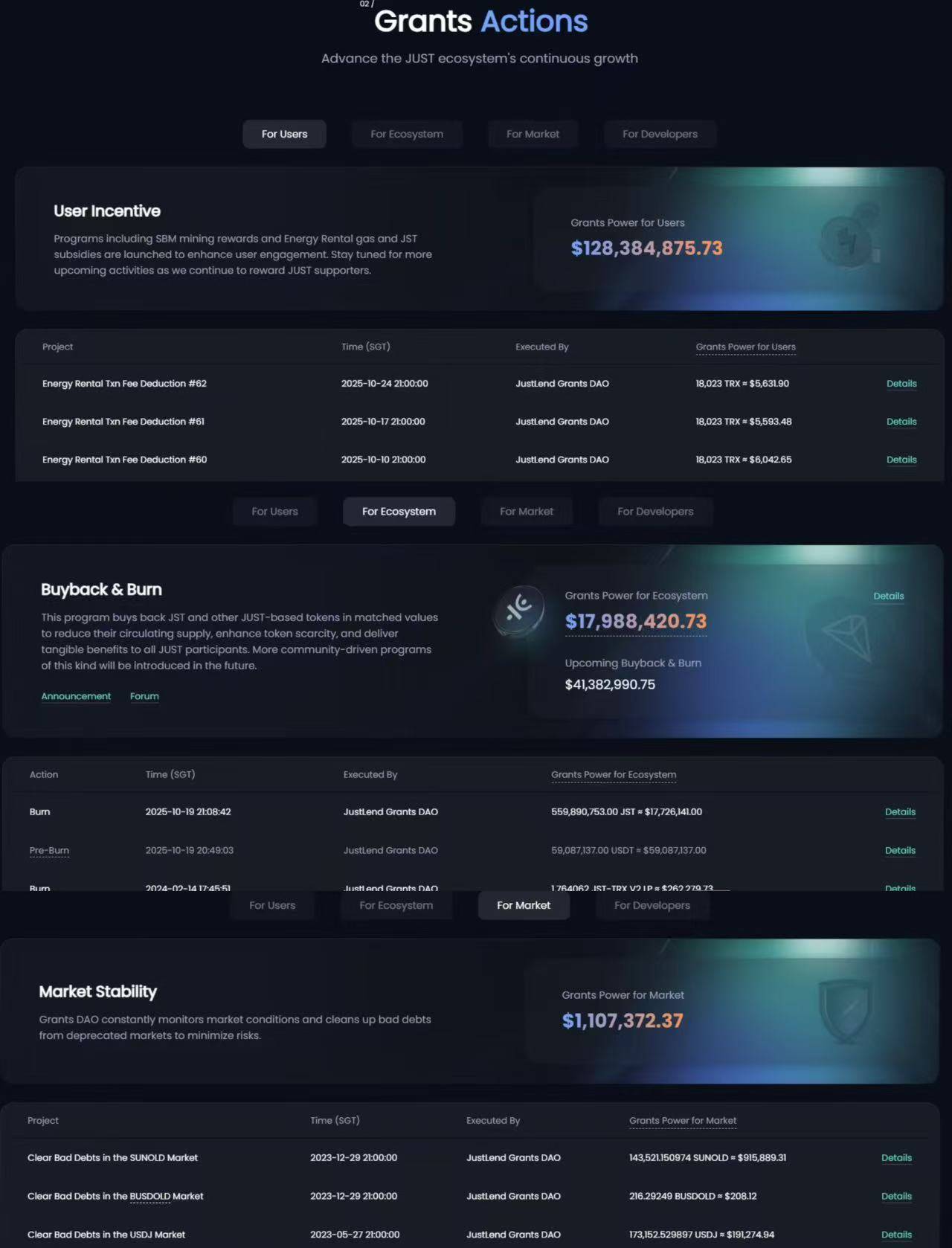

Currently, the Grants DAO website discloses detailed data related to the JST buyback and burn program, offering high transparency with key information clearly visible—including the number of tokens already burned and the amount pending destruction. Quarterly burn data will continue to be updated on this page, allowing users to instantly grasp real-time progress and core metrics of the JST buyback and burn without needing additional queries, providing clear visibility into the deflationary process.

In addition, on October 29, the JustLend DAO website launched a new “Transparency” page disclosing its financial status, profit distribution, and the implementation progress of the JST buyback and burn program.

Grants DAO Allocates Over $180 Million to the JustLend DAO Ecosystem via Its "Grants Pool," Managing Treasury Funds

For Grants DAO, executing the JST buyback and burn is just one of many core responsibilities. As a community-led incentive body and central empowering institution within the JustLend DAO ecosystem, Grants DAO’s primary mission is to provide comprehensive support for developers, contributors, and all ecosystem-building initiatives, while also promoting market stability and prosperity.

As of October 29, the Grants DAO treasury has cumulatively disbursed over $188 million to the JustLend DAO ecosystem, strongly fueling its expansion. These funds have been precisely allocated to critical areas such as energy leasing subsidies, JST buyback and burn activities, and market bad debt clearance, comprehensively safeguarding stable and efficient ecosystem operations across infrastructure, deflationary mechanisms, and risk control dimensions.

Leveraging its core mechanism—the Grants Pool—Grants DAO enables flexible allocation and efficient circulation of treasury funds, delivering holistic empowerment to the JustLend DAO ecosystem and boosting JST value. It stands as the essential catalyst for the ecosystem’s development.

Specifically, Grants DAO consolidates JUST ecosystem reserves and partner-contributed funding into the Grants Pool, serving as a centralized reservoir of capital. It then systematically empowers key ecosystem components through user incentives, ecosystem funding, market stabilization, and developer support. Ultimately, this allows JST holders, voters, liquidity providers, and all ecosystem participants to share in the benefits of growth, creating a self-reinforcing, value-generating ecosystem built on shared participation and sustainable cycles.

Funding for Grants DAO’s Grants Pool comes from two main sources: one part originates from internal ecosystem reserves, including accumulations from the JUST ecosystem, stablecoin reserves, and a portion of interest paid by borrowers; the other stems from partner funds, including targeted donations and special support from ecosystem partners through various channels.

This dual-driven funding model—“internal ecosystem self-circulation + external cooperation empowerment”—ensures that Grants DAO’s financial support is not a “one-time injection,” but rather a sustainable source of ecosystem nourishment. Internal reserve funds directly reflect JustLend DAO’s “self-sustaining” capability, with fund size closely tied to ecosystem activity, forming a symbiotic relationship where “the more prosperous the ecosystem, the fuller the treasury.” Meanwhile, inflows of external cooperative funds not only expand the treasury’s capacity but also establish bridges between JustLend DAO and external ecosystems, laying the groundwork for cross-scenario collaborations and ecosystem expansion.

On the ecosystem development front, Grants DAO’s funding actions precisely target core needs, covering comprehensive areas such as user incentives, developer support, market risk prevention, and ecosystem scenario expansion—each fund disbursement linked to a clear objective of enhancing ecosystem value.

To date, Grants DAO has disbursed approximately $188 million to advance the JustLend DAO ecosystem. This includes: around $128 million allocated to user incentives through programs like SBM mining rewards and gas subsidies for energy leasing; asset value from JST-related burns totaling approximately $17.98 million (including $17.72 million recently burned plus $260,000 from the stUSDT grant burn in RAW products in February 2024), with about $41.38 million still pending destruction; and over $1.1 million in bad debt resolved for market security.

If this JST buyback and burn represents the “visible action” through which Grants DAO has become widely recognized, then the cumulative $188+ million in ecosystem funding serves as the “invisible foundation” supporting JustLend DAO’s long-term growth, providing sustained and powerful momentum for its past expansion.

Thus, the value of Grants DAO extends far beyond being merely the “ammunition depot” for the JST buyback and burn plan—it is the core “ignition fuel” enabling JustLend DAO’s evolution from “basic functionality deployment” to “diverse scenario expansion,” supplying the essential power for advanced ecosystem development.

Grants DAO Holistically Empowers JustLend DAO Ecosystem Growth and JST Value Appreciation

Grants DAO is not merely a manager of treasury funds but also the central hub for resource allocation and strategic development within the JustLend DAO ecosystem. It has established a comprehensive support system focused on user incentives, ecosystem prosperity, market stability, and developer empowerment, advancing JustLend DAO from “stable operation” toward “autonomous prosperity” while simultaneously boosting JST value.

In terms of user incentives, Grants DAO has launched multiple targeted incentive programs covering various user engagement scenarios, including SBM mining rewards (e.g., supplying USDD on JustLend DAO earns users not only base interest but also additional mining rewards); gas fee subsidies for energy leasing transactions (users of JustLend DAO’s energy leasing service receive platform subsidies covering up to 90% of on-chain transaction energy fees); and JST token mining subsidies. Going forward, Grants DAO plans to introduce more community-driven initiatives, transforming users from “ecosystem users” into “ecosystem co-builders” who share in the benefits of growth.

Regarding ecosystem empowerment, Grants DAO enhances JST token scarcity through its “buyback and burn” mechanism, thereby driving token value appreciation and delivering tangible benefits to all ecosystem users. As of October 29, Grants DAO has conducted two buyback initiatives, cumulatively destroying assets worth over $17.98 million.

· First (February 2024): Part of the proceeds from stUSDT, a RWA product in the TRON ecosystem, was used to repurchase and burn JST and TRX tokens, amounting to $260,000 in value destroyed;

· Current round: A long-term JST buyback and burn program has been established across the JustLend DAO and USDD multi-chain ecosystems, extracting over $59 million from JustLend DAO’s existing earnings. The first 30% burn has been completed, with the remaining ~$41.38 million to be executed in stages. In the future, Grants DAO will launch additional community-led buyback and burn proposals.

In maintaining market stability, Grants DAO has established a dedicated monitoring mechanism for the JustLend DAO market, tracking key indicators such as lending rates, bad debt ratios, and token prices in real time. Upon detecting abnormal fluctuations, Grants DAO can swiftly initiate response measures and promptly remove outdated or potentially risky assets to minimize losses and ensure stable and healthy market development. This “proactive defense” market stabilization mechanism has enabled JustLend DAO to remain resilient through multiple extreme crypto market conditions, with no service disruptions or large-scale user losses caused by market volatility to date.

For developer support, Grants DAO has built a comprehensive empowerment framework combining “funding + resources + incentives.” This includes two main aspects: first, encouraging developers to build DeFi applications and tools based on the JustLend DAO protocol to participate in the growth of the decentralized ecosystem; second, running bug bounty programs to incentivize community members to report errors or vulnerabilities, improving protocol security. Additionally, Grants DAO organizes events such as “developer hackathons” and “ecosystem collaboration summits” to create platforms for developer exchange and collaboration. This comprehensive developer support fosters technological innovation and progress, acting as the “core engine” behind JustLend DAO’s ecosystem expansion while also strengthening overall system security and stability.

From incentivizing community users to supporting developers, from securing market safety to promoting overall ecosystem value growth, Grants DAO is systematically and multidimensionally advancing the healthy development of the JustLend DAO ecosystem and the steady appreciation of the JST token. This holistic, long-term strategic approach lays a solid foundation for JustLend DAO’s continued prosperity.

For the JustLend DAO ecosystem, the value of Grants DAO cannot be reduced to mere “burn execution” or “grant disbursement.” It functions as an “ecosystem life-support system,” leveraging the robust foundation of the entire JUST ecosystem and the powerful backing of TRON, the world’s largest stablecoin network, to provide continuous funding that equips JustLend DAO with the capacity for “long-term operations” in the fiercely competitive DeFi market. At the same time, it acts as an “ecosystem value connector,” skillfully linking users, developers, partners, and all participants so that every contribution translates into ecosystem value and is returned to participants through deflationary mechanisms and incentive programs. Moreover, it serves as an “autonomy incubator,” advancing decentralized governance through community-driven decision-making.

Looking ahead, as more empowerment initiatives from Grants DAO come online—such as USDD multi-chain ecosystem mining rewards and cross-chain DeFi tool development support—the boundaries of the JustLend DAO ecosystem will further expand. Grants DAO will continue to drive the ecosystem toward higher-quality autonomous development, fulfilling its multifaceted roles as executor, sustainer, and enabler.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News