From exclusive to the wealthy to a tool for the masses, stablecoin credit cards are redefining banking

TechFlow Selected TechFlow Selected

From exclusive to the wealthy to a tool for the masses, stablecoin credit cards are redefining banking

If your responsibility is to find new ways to grow revenue and better serve customers, you should definitely pay attention to the evolution of these cards.

Author: Simon Taylor

Compiled by: TechFlow

This week, I gave a keynote on stablecoins at a bank board meeting. While they learned a lot from the talk, what truly amazed them was when I used a card linked to a stablecoin to buy a coffee.

Everyone leaned in. Imagine if you could store your balance as stablecoins, spend anytime anywhere, use it for credit lending, and earn yield—what would be the point of banks? Of course, most domestic banking users won't adopt this model immediately.

But the genie is out of the bottle.

That £3.50 coffee showed them a future where banks become redundant.

To understand why that coffee matters, you need to see how card payments are exploding beyond traditional banking.

The Card Payment Space Is Expanding*

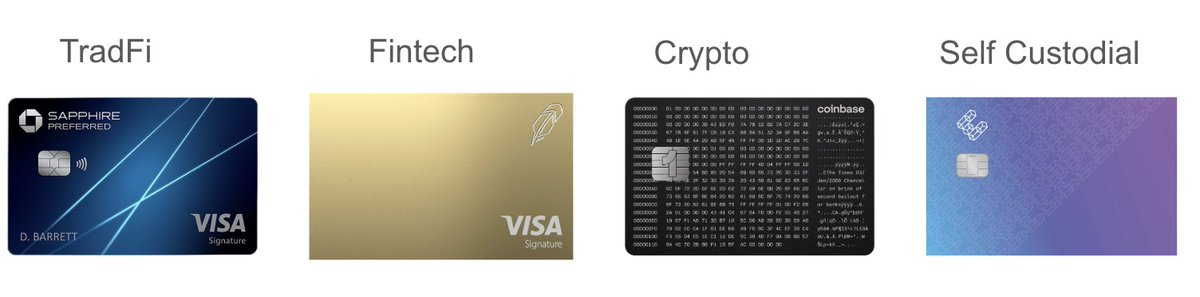

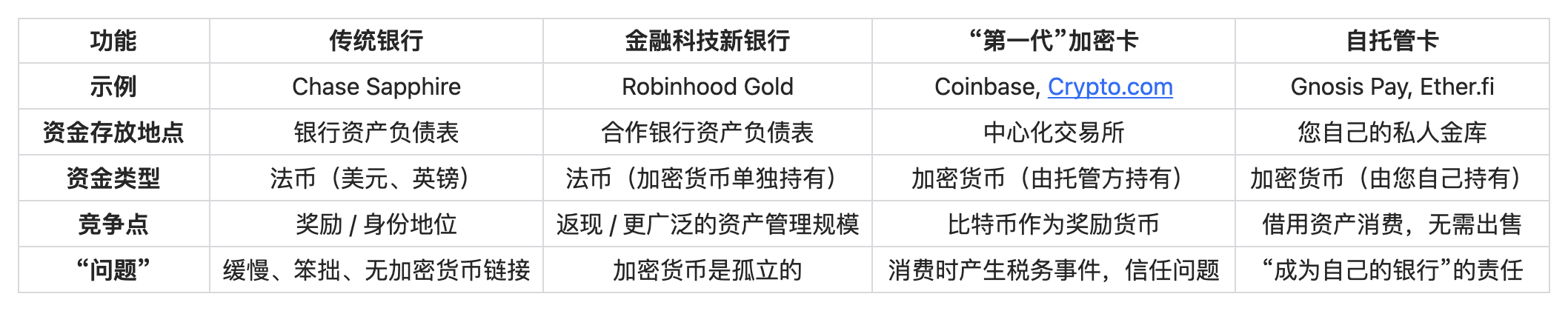

Three of these four categories barely existed a decade ago, yet today they're major players.

The affluent are now the key target.

A "stablecoin-linked" card can be issued by centralized exchanges (e.g., Coinbase) or take a "self-custody" form.

While there’s an issuer and program manager behind the card, no bank or central institution manages the underlying funds.

This fourth type of card has disruptive implications.

Let’s dive deeper.

(For clarity: theoretically, nothing prevents neobanks or traditional banks from allowing users to spend directly from stablecoin balances—but for now, distinguishing these four product categories remains useful.)

What Is a Self-Custody Stablecoin-Linked Card?

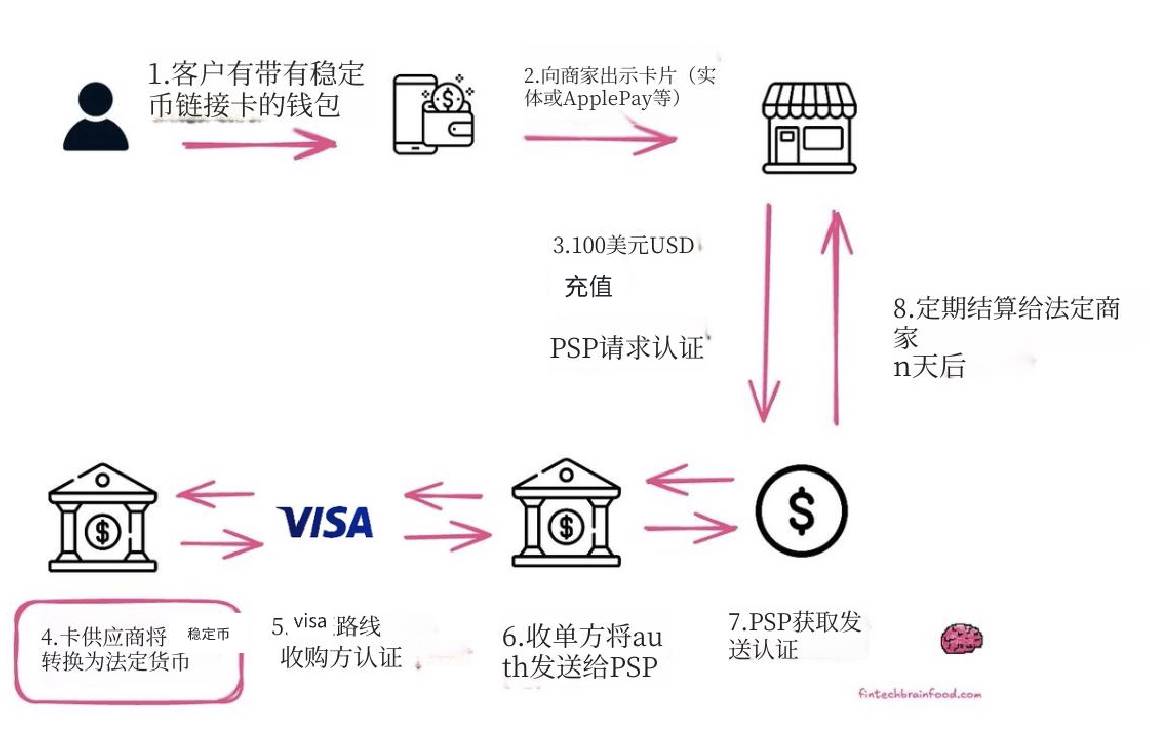

A stablecoin-linked card lets you spend stablecoins (like USDC or USDT) at any merchant accepting Visa or Mastercard networks. Pay special attention to step 4.

-

Assume a user holds a stablecoin-linked card with a stablecoin balance in their account. These stablecoins might have been paid as salary into their wallet (e.g., Metamask, Phantom, or similar).

-

The user goes to a store and uses a physical or virtual debit or credit card as usual.

-

The merchant's POS system treats the card like a regular bank card and sends an authorization request to the payment service provider (PSP).

-

The card issuer (e.g., Gnosispay, EtherFi) instantly sells the user’s stablecoins, converts them into fiat, and authorizes the transaction.

-

Visa then routes the authorized transaction to the acquiring bank (the merchant’s bank), marking it as approved.

-

The acquiring bank sends the transaction data to the PSP.

-

Upon receiving authorization, the PSP notifies the merchant to complete the sale, and the user leaves with their goods (payment completed).

Settlement occurs days later via traditional fiat payment systems.

For both consumers and merchants, the experience is nearly identical to using a traditional credit or debit card.

The biggest advantage of stablecoin-linked cards lies in their fully wallet-native design.

As a user, you manage these stablecoins through your own private keys. Self-custody cards create a new economic model for the entire card payment ecosystem—no intermediaries, direct control over assets.

How Self-Custody Stablecoin-Linked Cards Work

Bringing affluent payment models to the mass market.

Imagine connecting your Visa card directly to a private vault at home (which only you have the key to), while still being able to use it everywhere at checkout.

Your funds don’t sit in a “bank” or “Coinbase,” but in a smart contract wallet on the blockchain, fully under your control.

How it works:

-

You load your high-tech “vault” (wallet or treasury) with stablecoins, such as EURe (a euro-denominated stablecoin on-chain).

-

When you swipe for coffee, a treasury like Ether Fi instantly bridges your personal wallet to the Visa network. It pays the merchant in regular euros (fiat) while deducting the equivalent value in EURe from your vault.

-

There are already several examples like Etherfi, GnosisPay, Thorchain, Pyra—each differing in pricing, preferred blockchains, and service advantages. But Etherfi serves as an excellent explanatory case.

Cards Secured by Treasuries

Ether.fi’s “Borrow & Spend” Model

You deposit stablecoins and other crypto assets into Ether.fi’s treasury. In return, it offers around 10% yield and allows borrowing at 4% APR.

The card features two clever spending modes:

-

Direct Pay Mode: You spend directly from your stablecoin balance (e.g., USDC)—simple and straightforward.

-

Borrow Mode: This is the key. You can collateralize your entire portfolio (e.g., weETH, eBTC) to borrow fiat (at 4% APR) for spending.

-

No need to sell underlying assets—avoiding tax events.

-

You continue earning staking or restaking rewards on your assets.

-

A treasury is a place to lock up collateralized assets (like a bank safety deposit box), earning yield by lending them to protocols like Morpho, Aave, or Centrifuge. That 10% yield comes from others borrowing your funds and paying interest.

Why are these cards significant?

Ether.fi is essentially a wealth management tool disguised as a credit card, designed for DeFi natives. But why shouldn’t everyone have access to such tools?

True, most people aren’t comfortable parking all their assets in DeFi protocols for 10% APY. Yet the idea is intriguing—could collateralized credit cards combining yield and borrowing become a killer app?

Potential Issues

"Be Your Own Bank" Problem: Self-custody is a double-edged sword. If you lose your password (your “private key”), there’s no customer service hotline or “forgot password” link. Your funds are gone forever. This is a terrifying prospect for average users.

Complexity and Fees: Though getting simpler, using stablecoin-linked cards still requires interacting with blockchains. This may involve “Gas fees” (network transaction costs), which feel unfamiliar and off-putting to users accustomed to free debit cards.

Volatility of Collateral Assets: What happens if your crypto portfolio drops sharply in value? The protocol will automatically liquidate assets to repay loans. This can be extremely painful.

Capital Risk: Not all customers are willing to risk allocating 10% or more of their net worth to crypto, especially if the benefits aren’t clearly superior.

Yield May Not Be Sustainable: The current 10% APY reflects present crypto market conditions. In a bear market, these yields could drop significantly.

Today, stablecoin-linked cards are widely seen as ideal for Global South markets suffering from high inflation. Yet most people I speak with underestimate their potential adoption among affluent domestic populations.

For consumers in the Global South, stablecoin-linked cards represent freedom.

If you lack conventional credit or debit cards, you can’t use ChatGPT, AWS, or Netflix. For consumers and growing businesses outside the G20, stablecoin-linked cards are a game-changer.

Stablecoin-Linked Cards: Democratizing High-Net-Worth Lifestyles

The wealthy rarely sell assets—they borrow against them. This avoids taxes and often allows asset appreciation to outpace financing costs. Stablecoin-linked cards are bringing this high-net-worth wealth strategy to the masses.

For crypto millionaires, this is a bank alternative.

For crypto elites, this card is like a self-sovereign version of the Amex Black Card. It’s a capital-efficient tool declaring, “I can access my wealth anytime, anywhere, on my terms—without asking a bank.”

The ultimate “have your cake and eat it too” product: With this card, you earn 8% yield on your assets in DeFi while also using it to buy groceries. It turns your self-custody wallet into a high-yield checking account.

Should Neobanks Abandon Their Models and Build Stablecoin-Linked Cards Instead?

Not so fast.

These products still face systemic challenges:

Most businesses and consumers still live offline. The complexity and risks of going fully on-chain cannot be ignored.

-

User Experience Bottleneck: The bridge from “crypto-native” (managing gas fees, wallet permissions) to “simple spending” (one-click pay) still feels like a rickety rope bridge. To launch these products (Pyra being an exception), users must go through significant effort. You need stablecoins, but transferring balances to wallets on the right chain is frustrating.

-

Bull-Market-Only Cards: These cards thrive during bull markets, especially when U.S. regulation supports crypto. But remember Celsius: it offered incredible rewards, then collapsed when the market crashed. Rewards vanished, and users lost vast savings. In DeFi, there’s no bankruptcy court—when things go wrong, you’re simply liquidated.

-

Accountability Gap: What happens if these products become widespread and start bankrupting or liquidating mainstream consumers? This becomes a major unresolved issue.

Most self-custody cards today face a cold-start problem: you need to fund underlying DeFi protocols and treasuries. Plus, you must download new apps, create new wallets, and complete new KYC processes.

I believe two things will happen:

-

These cards and their underlying protocols will be integrated into fintech.

-

“On-chain/off-chain switching” will become invisible—users won’t perceive complex operations.

Not everyone is ready to go fully on-chain.

Fintech Frontend, Crypto On-Chain Backend

The “convert to fiat” step in our earlier diagram of how stablecoin-backed credit cards work is just a temporary phase. Over the next decade, more and more assets will move on-chain.

This trend will manifest in several ways:

-

On-chain yield and lending features will be integrated into fintech apps and wallets via treasuries (Vaults).

-

Native on-chain wallets will become the largest fintech companies of the future.

-

“On-chain/off-chain switching” for stablecoins will become seamless across most applications, invisible to users.

-

Instant settlement will become the killer app for stablecoins.

Treasuries are the key tool enabling on-chain lending to integrate into fintech.

For example, Morpho’s treasury product is a prime case. Morpho is a decentralized on-chain lending protocol, and its “treasury” product simplifies yield management on-chain. Users deposit funds (e.g., USDC) into the treasury, which automatically manages lending to deliver optimal risk-adjusted returns.

Coinbase now offers Bitcoin-backed loans to retail users. But when a user clicks “borrow,” Coinbase doesn’t lend from its own balance sheet. Instead, in the background, Coinbase sends the user’s Bitcoin as collateral to the Morpho protocol on-chain and obtains a USDC loan on their behalf. The user never sees “Morpho,” gas fees, or a crypto wallet—they just see a simple “borrow” button within the familiar Coinbase app.

(Side note: I believe these treasuries are far more significant than traditional peer-to-peer lending due to higher efficiency, better initial yields, and easier distribution. In a sense, they represent the ultimate form of embedded finance.)

If you were launching a fintech startup today, would you build on-chain or on fiat rails?

In today’s regulatory environment, it’s hard to justify building a fintech company on off-chain technology. Take Sling Money—a classic example. Founded by Monzo’s former Chief Product Officer, the company could have chosen any tech stack. But to build a global Venmo, they chose an on-chain solution better suited for cross-border payments.

Founder Mike explained why:

-

On-chain payments are now fast enough for everyday use.

-

They outsource about 70% of ledger-building and reconciliation complexity.

For anyone who’s built financial services products, reconciliation accounts for at least half the development workload—an arduous task full of edge cases. While on-chain payments aren’t perfect everywhere, they let products reach market faster and cheaper.

As apps increasingly embed on-chain finance, the cost and friction of “on-chain/off-chain switching” are rapidly decreasing.

Currently, converting USD stablecoins to fiat USD on consumer platforms may cost up to 2%. This inefficiency contradicts the cost-saving promise of stablecoins—but it’s changing quickly.

For instance, Revolut recently announced direct 1:1 conversion between stablecoins and fiat USD with zero spread. They’ve also launched zero-fee staking with yields up to 22%. Notably, Revolut is a fintech app with 65 million users.

In the future, “instant settlement” will emerge as stablecoins’ killer app. The current model—quickly converting stablecoins to fiat for settlement—will fade as more merchants and banks begin accepting stablecoins directly. Stablecoins will evolve into tokenized deposits settleable with central banks.

When card networks, acquirers, and issuers adopt this model more widely, the time gap between “swiping” and merchants receiving funds will shrink to zero. Currently, companies fake this immediacy by charging merchants 1%-2% to advance payments—but this model will also disappear.

The Stablecoin Era Has Arrived

When Revolut rolled out zero-fee stablecoin services to its 65 million users, the promise of 24/7 instant dollar payments became real.

Cards like Ether Fi or Pyra are early glimpses of the future.

Once treasury concepts are embedded in every fintech app, non-bank institutions can offer customers:

-

Borrow from DeFi markets at 4%–22% APY (depending on term).

-

Lend to DeFi markets, earning 7%–12% yield.

These fintech firms profit from the spread and margins, but they don’t engage in balance-sheet lending. This is a distributed, on-chain private credit model—and a new revenue stream for finance.

This model won’t fully replace balance-sheet-based credit card lending, but it offers an attractive platform for private credit, especially for BNPL fintechs or banks seeking income growth without increasing balance sheet risk.

The treasury concept isn’t limited to cards—it can apply to any form of lending. But once you’ve seen these cards in action, their potential is hard to ignore.

If your job is finding new revenue streams and serving customers better, you should absolutely track the evolution of these cards and how they can help meet customer needs.

That coffee I bought for the bank board? I think they saw their future—and they know it.

ST’s Notes:

-

Georges Lemaître’s “Big Bang theory” has extended into the card space.

-

Competitors like Centrifuge, Veda, and Aave are developing similar products.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News