Why do we still firmly allocate to Bitcoin when gold is leading the rally?

TechFlow Selected TechFlow Selected

Why do we still firmly allocate to Bitcoin when gold is leading the rally?

Several investment experts recommend increasing gold allocation to 10%-15% and bitcoin allocation to 5%.

Author: Lyv

Introduction

This year, gold has been in the spotlight—amid trade tensions, U.S. debt volatility, and geopolitical strains, gold has outperformed Bitcoin, the Nasdaq index, and all major asset classes, reigniting calls of a "king's return" with gains exceeding 50%. In contrast, Bitcoin—the so-called "digital gold" that has gradually gained safe-haven status in recent years—has risen only about 15%. This stark divergence has sparked heated market debate over “why is gold strong while Bitcoin weak?” and “is Bitcoin still worth investing in?”

By carefully analyzing the historical pricing patterns and buying logic of gold, we maintain that Bitcoin, as an emerging digital-age safe-haven tool, is currently going through a historical phase of “dual nature: both risk and safe-haven.” In the long term, Bitcoin’s uniqueness and scarcity mean it holds comparable strategic allocation value to gold; meanwhile, its current under-allocation in global portfolios implies greater leverage and upside potential.

This article systematically outlines our allocation framework in Q&A format, covering the evolution of safe-haven logic, hedging mechanisms between gold and Bitcoin, long-term allocation ratios, tail-risk pricing, and incorporates views from leading global institutions and investors to further argue why Bitcoin deserves higher strategic weighting in current and future global asset portfolios.

Q1. Theoretically, both gold and Bitcoin have safe-haven attributes, but how do they differ in their safe-haven roles?

Answer: The market generally views gold as a mature safe-haven asset in the traditional “carbon-based world.” Bitcoin, by contrast, can be seen as an emerging store of value in the “silicon-based world,” not yet a mature safe-haven instrument, and still exhibits strong characteristics of a risk asset. We observed that before the approval of Bitcoin ETFs in early 2024, Bitcoin’s price had a correlation of up to 0.9 with the Nasdaq index; after ETF approval, this correlation dropped to 0.6, and Bitcoin began clearly tracking global M2 liquidity, showing “inflation-resistant” traits similar to gold.

Goldman Sachs analysis indicates that while Bitcoin offers higher returns than gold, it also carries far greater volatility. During periods of high risk appetite, Bitcoin behaves similarly to equities; when stock markets fall, Bitcoin provides weaker hedging than gold. Thus, gold remains more reliable as a safe-haven today, while Bitcoin is still transitioning from a risk asset toward a safe-haven asset.

Ray Dalio, founder of Bridgewater Associates, emphasized that investors seeking portfolio diversification and neutrality could consider either gold or Bitcoin, but he personally prefers gold—a historically tested hedge. He noted that while Bitcoin has limited supply and some store-of-value potential, it is far from matching gold’s established safe-haven status backed by centuries of history.

Q2. What have been the main drivers of gold prices since 2007? Why did central banks become the primary buyers of gold after the 2022 Russia-Ukraine war?

Answer: Since the 2007 global financial crisis, U.S. real interest rates have become one of the key drivers of gold prices. Because gold generates no yield (a “zero-coupon” asset), its price is inversely correlated with real interest rates—when real rates rise, the opportunity cost of holding gold increases, often leading to lower prices; when real rates fall (or turn negative), gold becomes relatively more attractive, pushing prices higher. This relationship has been very pronounced over the past fifteen years: for example, after the Fed cut rates post-2008, lowering real yields and triggering a gold rally, while rising real rates starting in 2013 pressured gold prices. During the Fed’s negative rate period in 2016, we saw significant inflows into North American ETFs.

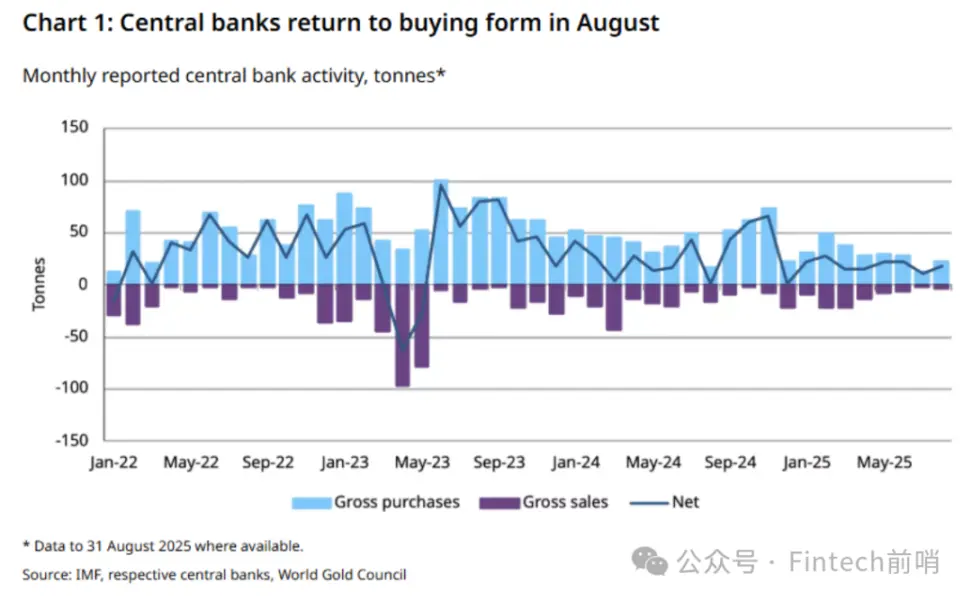

After the outbreak of the Russia-Ukraine war in 2022, global central banks significantly increased gold purchases, becoming a new dominant force driving gold prices. That year, net central bank gold buying hit a record high, and annual purchases have exceeded 1,000 tons every year since. Data from Metals Focus shows that since 2022, annual central bank purchases have far surpassed the previous average (457 tons from 2016–2021), with around 900 tons expected in 2025. These official purchases accounted for 23% of global annual gold demand (over 40% of investment demand) from 2022–2025—double the share seen in the 2010s. Currently, global central banks hold nearly 38,000 tons of gold, over 17% of the world’s above-ground gold, representing 44% of non-jewelry, non-technology investment demand—and there is still room for growth.

The latest World Gold Council survey shows central banks remain optimistic about gold. An overwhelming majority (95%) expect global central bank gold reserves to increase over the next 12 months; a record 43% anticipate their own country’s reserves will rise, and none expect a decline.

The rationale behind central banks’ “gold rush” stems from two main considerations: 1) Geopolitical hedging, and 2) Reserve diversification. Western sanctions following the Russia-Ukraine conflict froze half of Russia’s foreign reserves, prompting many emerging economies to consider replacing part of their dollar assets with gold. As U.S. debt surges and credit outlook deteriorates, the appeal of U.S. Treasuries and other dollar-denominated assets declines, further enhancing gold’s attractiveness as a reserve and safe-haven asset.

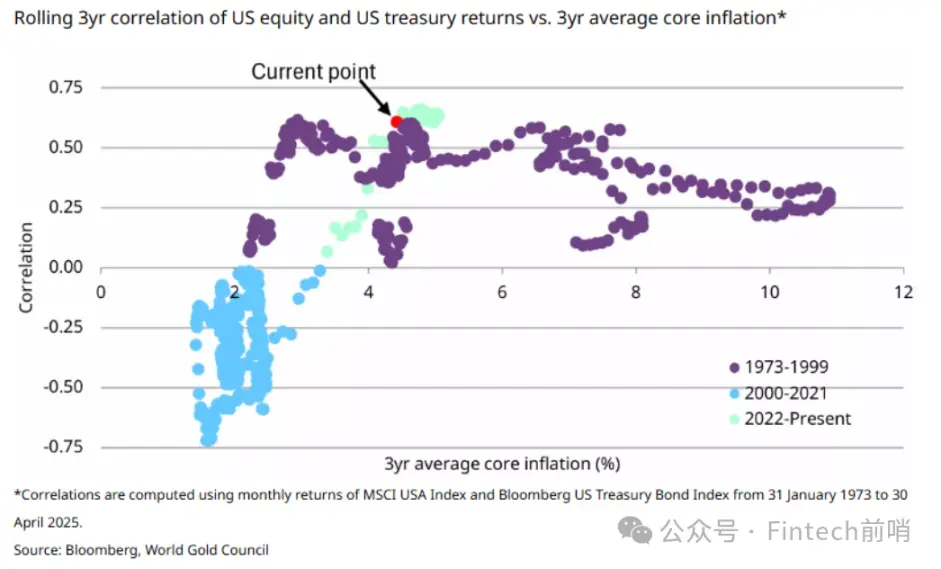

Additionally, large long-term institutional investors are increasing allocations due to the growing failure of the traditional “stocks-bonds seesaw”: since 2022, stocks and bonds have shown increasingly positive correlation, diverging from the familiar “60/40 portfolio” narrative of the past two decades:

Q3. Which major tail risks does gold primarily hedge against?

Answer: From the above analysis, gold’s future safe-haven value should mainly lie in hedging two relatively independent extreme tail risks:

-

U.S. debt or inflation crisis (i.e., dollar credit / sovereign debt risk)

-

Major geopolitical and economic conflicts

First, in scenarios of runaway debt or high inflation, fiat currencies may sharply devalue or face a credibility crisis, making gold’s role as a long-term store of value and inflation hedge especially prominent. A World Gold Council survey of nearly 60 central banks found that the primary reason for holding gold is precisely its function as a long-term value reserve and inflation hedge, as well as its strong performance during crises. Officials also view gold as an effective portfolio diversifier against economic risks (e.g., stagflation, recession, or default) and geopolitical risks.

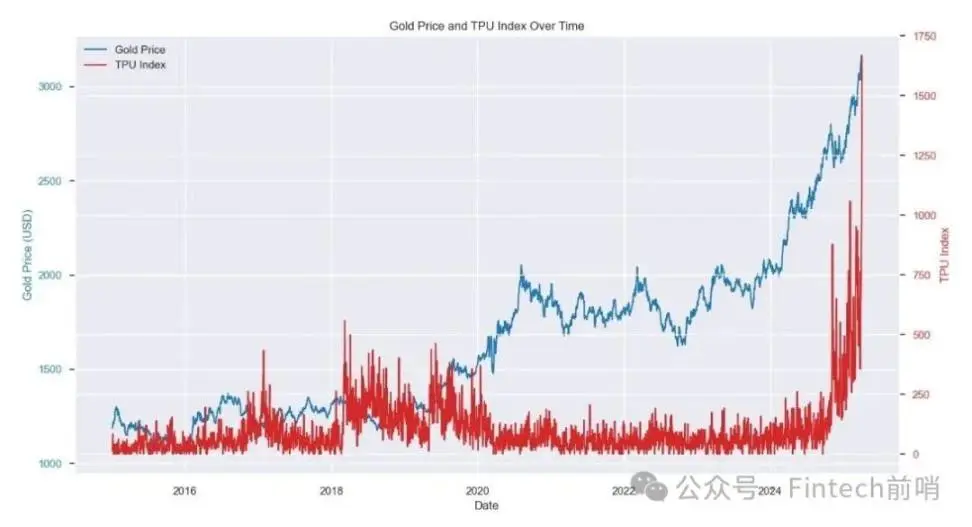

For instance, rising U.S. debt fuels concerns over the long-term value of the dollar, and gold acts as a “shield” in such extreme conditions. Second, in geopolitical conflicts, gold is seen as a safe haven during turmoil. Whenever wars or international tensions erupt—such as the 2018 China-U.S. trade war, the 2022 Russia-Ukraine war, or the 2025 U.S. tariff shocks—safe-haven capital typically flows into gold, pushing prices up. Historical backtesting also reveals a positive “power-law” relationship over the past decade between gold prices and the Trade Policy Uncertainty Index:

This explains why gold has recently outperformed Bitcoin: amid a renewed escalation in China-U.S. trade tensions, central banks and long-term institutional investors—the main allocators—naturally favor the asset they know best: gold, especially given rising uncertainty over the long-term bull market in U.S. Treasuries.

Q4. In an ideal portfolio, how should the allocation to gold reflect expectations of tail risks?

Answer: Gold is often likened to “insurance” for a portfolio—it may drag returns in normal times but provides protection during crises. Therefore, when managers perceive rising risks of extreme events, they tend to increase gold holdings as a hedge. Gold can significantly mitigate potential portfolio losses during financial stress and demonstrates stable diversification benefits during severe market downturns (left-tail events). Moreover, because part of gold demand comes from central banks, tech industries, and consumers, its price movements do not fully correlate with financial assets. Some asset allocation frameworks specifically designate gold for tail-risk hedging—for example, certain insurance and pension funds treat gold as a highly liquid asset that can be liquidated in emergencies to offset losses elsewhere.

In short, the weight of gold in a portfolio can be seen as a reflection of portfolio managers’ perceived probability of extreme tail events. If a manager believes the likelihood of the aforementioned two tail events occurring within the next 5–10 years is rising, increasing gold’s share in the portfolio is justified. Such allocation is akin to buying insurance for the portfolio, with the size reflecting the manager’s subjective assessment of disaster risk.

We can now conduct a simple and interesting thought experiment: if we believe the probability of these two major risks materializing over the next five years is 10% (say, 5% + 5%), then our allocation to hedge these risks should likewise rise to 10%; if looking ahead ten years, the probability rises to 15–20%, our allocation should increase accordingly to 15–20%. Over time, we believe the probability of these tail risks being realized will only grow.

Q5. What are the current global portfolio allocations to gold and Bitcoin? What do market participants suggest regarding increasing their weights?

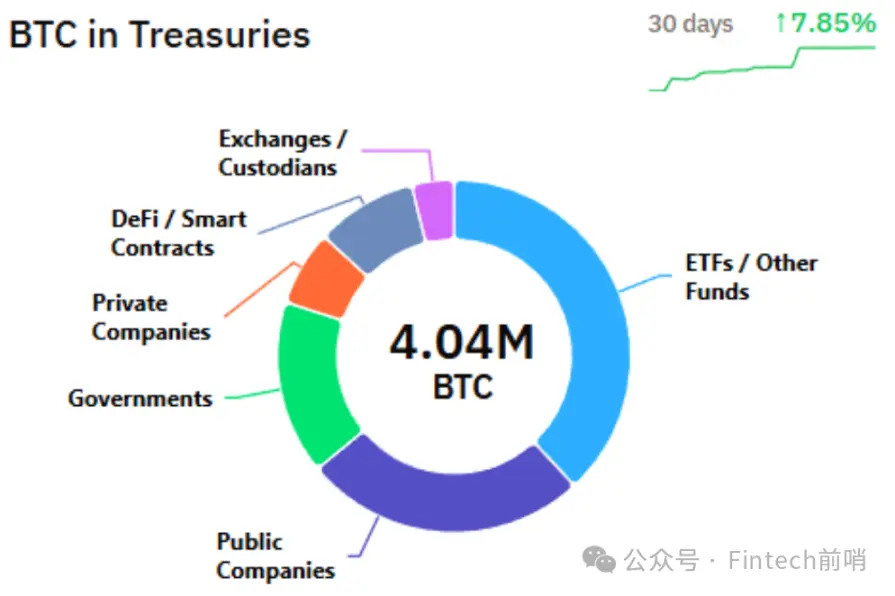

Answer: According to a recent Goldman Sachs report, gold currently accounts for about 6% of global investment portfolios, while Bitcoin represents only about 0.6%—roughly one-tenth of gold’s share (and even smaller in terms of total market cap)—indicating Bitcoin remains in early stages of adoption as an allocable asset (whereas gold is already mainstream).

Given recent macroeconomic turbulence, several prominent institutions and investors have called for higher allocations to gold (and to some extent, Bitcoin). Ray Dalio of Bridgewater recently stated clearly that, from a strategic asset allocation perspective, gold should make up 10–15% of portfolios—significantly higher than the typical advisor recommendation of around 5%. Notably, Dalio previously recommended only 1–2% allocation to Bitcoin/gold combined in 2022, but now recommends up to 15%, reflecting his reassessment of the importance of safe-haven assets amid rising risks.

Other notable investors echo this view: Jeffrey Gundlach, founder of DoubleLine Capital, recently said allocating nearly a quarter (25%) of a portfolio to gold would not be excessive. Some research and historical backtests also support higher gold weights: a long-term simulation by an asset manager showed optimal risk-adjusted returns when gold allocation reached about 17%.

On Bitcoin, as institutional sentiment shifts, some advocate moderate increases. Grayscale, for instance, suggests treating Bitcoin as one of the “core assets,” with a suggested allocation of 5–10%. Overall, while current global gold allocation far exceeds that of Bitcoin, there is broad consensus that both should see increased weightings in traditional portfolios to enhance resilience against extreme risks.

Q6. Returning to our thought experiment: if we assume a 10% tail-risk probability over the next five years and 20% over ten years, how should we proportionally increase allocations to hedging assets like gold and Bitcoin?

Answer: Under such non-negligible tail-risk assumptions, investors should significantly raise their safe-haven allocations compared to baseline levels. Experience shows that proactively allocating to hedging assets like gold and Bitcoin ahead of potential extreme events helps protect portfolios. This approach resembles a “black swan” hedging strategy—using a small cost to hedge against low-probability, high-impact risks.

Mapping probabilities directly, to hedge 20% tail risk, the portfolio should allocate an equivalent 20% to safe-haven assets—i.e., the combined allocation to gold and Bitcoin should reach 20%. Suppose we raise gold to 15% and Bitcoin to 5%. Gold’s share in global holdings would rise from ~6% to 15%, a 2.5x increase; Bitcoin would rise from ~0.6% to 5%, an over 8x increase.

This suggests that in an idealized safe-haven portfolio, Bitcoin’s relative allocation upside (compared to current baseline) far exceeds that of gold. As a mature asset, gold already has high global ownership and allocation, so doubling it requires massive capital inflows. Bitcoin, starting from a much lower base, could increase several-fold without significantly altering its overall footprint in global assets. This disparity in scalability also means Bitcoin’s price is more sensitive to incremental inflows—small amounts of capital can significantly boost its price.

In practice, institutional investors are already acting on this idea. Some major banks have recently introduced crypto allocation caps to guard against systemic risks. Morgan Stanley’s Global Investment Committee, in its latest guidance, included Bitcoin in its asset allocation model for the first time, recommending up to 4% allocation to crypto assets for aggressive-growth portfolios (2% cap for balanced portfolios, none for conservative ones).

Some analysts also note that if Bitcoin gradually attains a reserve status similar to gold, its market cap could eventually approach that of gold. While this depends on many conditions, from a pure allocation standpoint, Bitcoin offers greater global portfolio leverage than gold (8.0x vs 2.5x). This is why, alongside advocating higher gold allocations, many institutional investors are beginning to allocate modest amounts to Bitcoin: combining both allows hedging traditional financial risks while capturing outsized returns from the rise of a new safe-haven asset.

Q7. Compared to gold, what are the key advantages or unique value propositions of including Bitcoin in a portfolio?

Answer: We believe that from a purely economic design perspective, Bitcoin could ultimately serve as a more suitable safe-haven asset than gold, potentially offering stronger hedging capabilities against the two aforementioned tail risks.

First, supply rigidity. Bitcoin’s issuance is permanently capped at 21 million coins, unlike fiat currencies that can be infinitely printed, or commodities where new reserves may be discovered or recycling efficiency improves. This “silicon-based digital scarcity” makes it a scarce asset akin to gold, with long-term inflation-resistant store-of-value potential. More importantly, Bitcoin’s annual inflation rate fell below 1% after the 2024 halving, far below gold’s annual supply growth of 2.3%.

Second, “Buy and Hold” ownership remains low. Our analysis shows that mainstream institutional investors currently allocate minimal portions to Bitcoin, with true “Buy and Hold” participants holding less than 10% of supply. Even including all ETF holders, the figure reaches only 17% (noting that ETFs include many hedge funds and retail investors who cannot be fully classified as “Buy and Hold”). By comparison, “Buy and Hold” ownership in gold reached 65% of investment-use gold by end-2024, with central banks accounting for 44% and ETFs just 4%.

This implies vast potential for future allocation growth as recognition spreads. BlackRock CEO Larry Fink recently called Bitcoin “the next generation of gold” and supports its inclusion in long-term funds like pensions.

Third, on-chain transparency. All Bitcoin transactions are recorded on a public blockchain, verifiable by anyone. This unprecedented transparency boosts market trust, allowing investors to monitor Bitcoin’s circulation and reserves in real time, eliminating “black box” risks. In contrast, central bank gold reserves and OTC trades often lack real-time transparency.

Fourth, decentralized censorship resistance. The Bitcoin network is maintained by countless nodes worldwide, with no central authority able to unilaterally control or invalidate transactions. This decentralization grants strong censorship resistance—no country or institution can freeze or seize Bitcoin accounts, nor dilute its value via supply increases. In extreme cases, even non-physical gold holdings carry counterparty risk; during wars, gold faces risks of embargo or confiscation, whereas Bitcoin only requires electricity, internet access, and private keys to preserve and transfer value.

In summary, Bitcoin’s fixed supply and technical architecture give it inherent traits of inflation resistance, low correlation, and censorship resistance. This positions it to play a new role in long-term asset allocation—as a digital-era store of value and risk hedge, complementing gold and other traditional safe-haven assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News