Solana's official Perp protocol revealed, launching DEX counteroffensive

TechFlow Selected TechFlow Selected

Solana's official Perp protocol revealed, launching DEX counteroffensive

Solana has the opportunity to provide a real-world application scenario for Perp DEX infrastructure that can handle traditional financial asset trading demands, rather than remaining limited to crypto-native asset trading.

By: Haotian

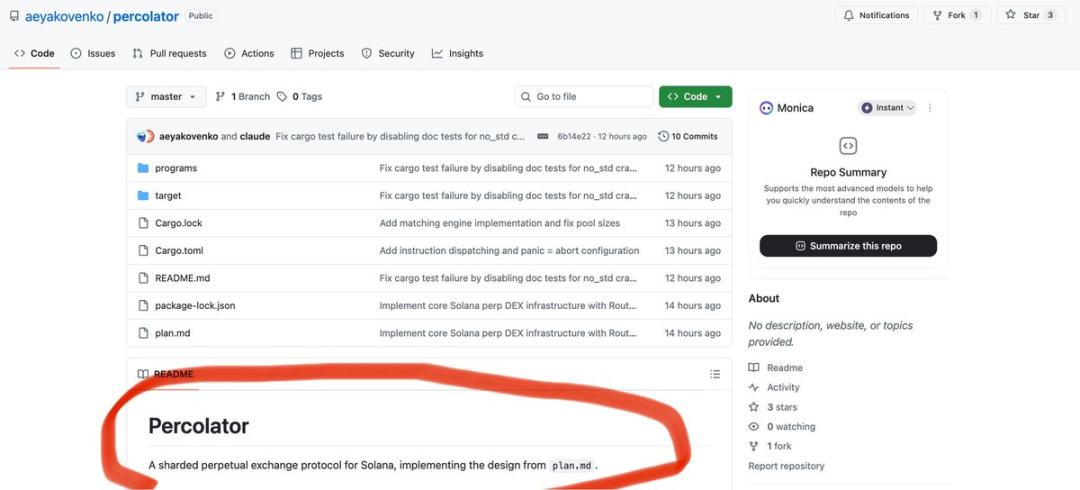

Earlier, I wrote an analysis stating that Perp Dex would inevitably explode within the Solana ecosystem. Now, @aeyakovenko accidentally leaked a GitHub repository—an experimental sharded perpetual contracts protocol framework called Percolator—drawing significant attention:

1) Its architectural innovation primarily involves splitting the order book into multiple shards for parallel processing, including a global Router for routing and margin management, plus independent Slab matching engines. It also incorporates high-frequency trading optimizations and risk control designs, such as a two-phase reserve-commit execution mechanism to prevent MEV attacks.

Interestingly, in comment section interactions, Toly mentioned the potential introduction of a prop AMM competition experiment mechanism, allowing LPs to customize their own matching engines and risk parameters.

2) Unexpectedly, instead of supporting emerging native Solana Perp DEXs like @DriftProtocol, @pacifica_fi, and @bulktrade, Solana has elevated this effort to a strategic level managed directly by Solana Labs. This shows just how eager Solana is to sustain the Perp Dex momentum.

3) The underlying logic is clear: in my view, Perp Dex is uniquely positioned to simultaneously support high-frequency, high-leverage, and large-volume trading. After over a year of performance optimization through Alpenglow consensus and the Firedancer client—proven capable of handling peak loads during Meme seasons—now is the perfect time to leverage this infrastructure for explosive growth in Perp Dex adoption.

Moreover, ongoing improvements at the validator layer, along with @doublezero’s further network bandwidth optimizations, continue to raise Solana’s performance ceiling. @jito_sol has already demonstrated that specialized validator-level optimizations are viable. From a technical standpoint, it’s entirely feasible for the Solana ecosystem to produce a Perp Dex on par with @HyperliquidX.

4) On this point, core executives like Toly and @calilyliu might feel indignant—given Solana’s strong infra foundation, why should projects like @Aster_DEX and @Lighter_xyz, whose capabilities remain unproven, get so much spotlight?

The key issue is that current Perp DEXs driven behind the scenes by centralized exchanges suffer from fake volume incentivized by token airdrops, unsustainable "trading-as-mining" models, and lack genuine high-frequency trading demand—giving Solana ample justification to step in and take control.

5) With its foundational moves in tokenizing U.S. equities and long-term positioning in the ICM (Internet Capital Market), Solana has the opportunity to provide Perp DEX infrastructure with a real use case for traditional financial asset trading—not limited merely to crypto-native assets.

Imagine: once U.S. stocks are tokenized, users could directly open leveraged long/short positions on Tesla or NVIDIA directly on Solana, settle trades in $SOL or stablecoins, with fees flowing back into the ecosystem. Doesn’t this “on-chain Nasdaq” narrative offer a far higher ceiling than simply trading perpetual contracts on BTC, SOL, or ETH?

That's all.

Next, let’s see how Solana’s Perp Dex counterattack will unfold!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News