Peso crisis escalates, stablecoins become Argentinians' "lifeline"

TechFlow Selected TechFlow Selected

Peso crisis escalates, stablecoins become Argentinians' "lifeline"

The role of cryptocurrency in Argentina has undergone a fundamental transformation.

By: Maria Clara Cobo

Translation: Luffy, Foresight News

Bitcoin sign outside a cryptocurrency exchange in Buenos Aires

With midterm elections approaching, Argentine President Javier Milei has tightened foreign exchange controls to support the peso, while Argentines like Ruben López are turning to cryptocurrencies to protect their savings.

A new strategy has emerged: using dollar-pegged stablecoins to exploit the gap between Argentina’s official and parallel exchange rates, where the peso is currently about 7% stronger under the official rate. Cryptocurrency brokers say the process works as follows: first buy dollars, immediately convert them into stablecoins, then exchange those stablecoins for cheaper pesos on the parallel market. This arbitrage maneuver, known as "rulo," can yield profits of up to 4% per transaction.

Milei at a campaign rally in Buenos Aires on October 17

"I do this trade every day," said López, a stockbroker from Buenos Aires, who uses crypto to hedge against inflation.

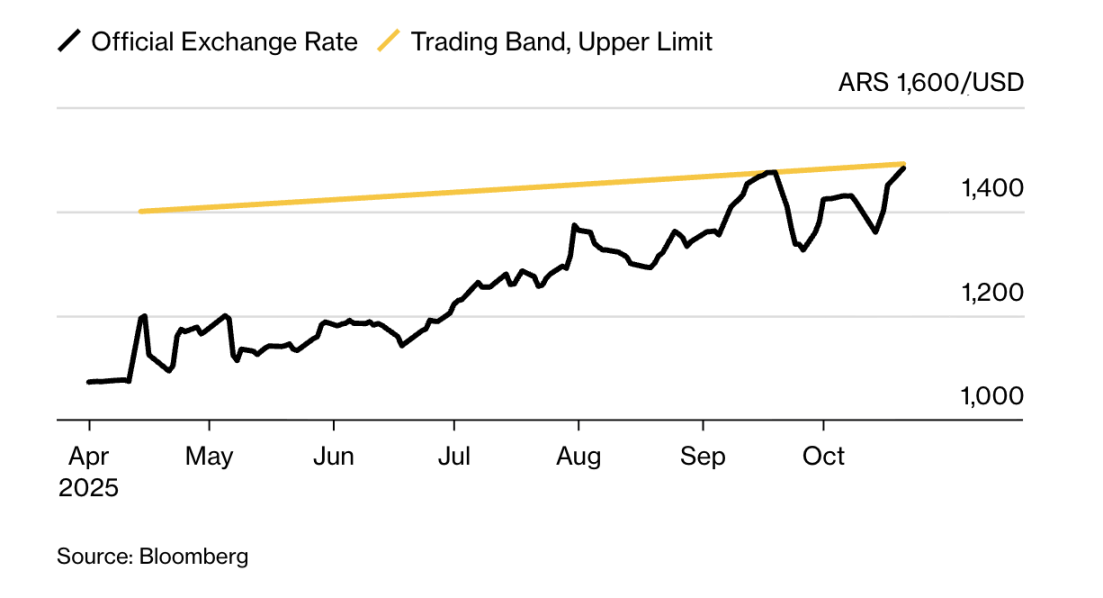

This crypto activity reflects a shift in how Argentines are coping with renewed economic turmoil. Ahead of the October 26 election, Argentina is burning through its dollar reserves trying to prop up the peso and prevent it from breaking out of its trading band. Despite strong U.S. backing, investors still expect further depreciation after the vote.

Argentina's central bank recently introduced rules banning individuals from reselling dollars within 90 days to curb fast arbitrage trades, prompting the rapid emergence of the "rulo" strategy. On October 9, platform Ripio reported that “weekly trading volume of stablecoins for pesos surged by 40%,” due to users “capitalizing on exchange rate fluctuations and market opportunities.”

For many Argentines, such maneuvers have become essential. The country has defaulted on its debt three times this century. When Milei was elected in 2023, he promised to end these financial crises. He made some progress—slashing annual inflation from nearly 300% down to around 30%. But the peso has depreciated sharply, both due to Milei’s initial devaluation policy upon taking office and growing investor anxiety ahead of the election.

Peso nearing the upper limit of its trading band

The rise of "rulo" shows a fundamental shift in the role of cryptocurrency in Argentina—from a novelty once embraced with curiosity even by Milei himself, to a practical financial tool for safeguarding savings. In the U.S., crypto is often used speculatively; in Latin America, it has become a path toward stability. In countries like Argentina, Venezuela, and Bolivia, cryptographic technologies help people navigate the triple pressures of currency volatility, high inflation, and strict capital controls.

"We provide users a way to buy crypto with pesos or dollars and sell later for profit—that's our core business," said Manuel Beaudroit, CEO of local exchange Belo. "Clearly, exchange rate differences offer attractive returns." He noted traders have recently earned 3%-4% per trade, though cautioned that "this level of return is very rare."

Cryptocurrency exchange services outside a shop in La Paz, Bolivia

Other exchanges report similar trends. Local platform Lemon Cash said that on October 1—the day Argentina’s central bank implemented its 90-day dollar resale ban—its total crypto trading volume (including buys, sells, and conversions) jumped 50% above average levels.

"Stablecoins are undoubtedly a tool for accessing cheaper dollars," said Julián Colombo, Argentina head at exchange Bitso. "Crypto remains in a regulatory gray zone—authorities haven’t clearly defined how to regulate stablecoins or restrict their liquidity, creating fertile ground for 'rulo' arbitrage."

Still, growth in stablecoin trading isn't solely driven by arbitrage. As Milei’s government faces a critical election and economic pressure mounts, many Argentines are also using crypto as a hedge against potential further peso depreciation.

"Inflation and political uncertainty have made us more conservative, so I don’t hold any savings or investments in pesos—only use pesos for daily expenses," said Nicole Connor, head of Argentina’s “Women in Crypto” alliance. "My savings are in cryptocurrencies and stablecoins, and I try to generate yield through them."

Exchange rate board inside a store in Buenos Aires

Nonetheless, crypto operations aren't risk-free. In Argentina, stock market gains are tax-exempt, but profits from crypto trading are subject to taxes of up to 15%. Frequent transactions may also attract scrutiny from banks, which often require proof of fund origins from users making repeated large transfers.

But analysts believe that as economic hardship persists, Argentina’s reliance on stablecoins could deepen. Across Latin America, more people are increasingly turning to these tools to protect assets amid fiscal instability and electoral shocks.

"Stablecoins will remain," said stockbroker López. "The dollar plays a vital role in Argentine society and daily life because it serves as our safe haven from local currency risks."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News