Huobi Growth Academy | In-depth Research Report on Global Stablecoin Strategy: From Dollar Hegemony to Financial Operating System

TechFlow Selected TechFlow Selected

Huobi Growth Academy | In-depth Research Report on Global Stablecoin Strategy: From Dollar Hegemony to Financial Operating System

In the next two to three years, stablecoins will complete compliant model implementations across multiple jurisdictions, evolving from "off-chain channel assets" into the "foundation of the global financial operating system," profoundly transforming monetary transmission pathways and the production of financial services.

Executive Summary

Stablecoins have evolved from "crypto-native settlement tokens" to "infrastructure for global digital dollarization." Over the past two years, the total market capitalization of stablecoins has surged from approximately $120 billion to a new all-time high of around $290–300 billion. On-chain cross-border settlements and fund transfers have emerged as the strongest real-world use cases, while emerging markets' demand for "currency substitution" provides long-term structural tailwinds. The U.S. has anchored its federal regulatory framework through the GENIUS Act, creating a triangular resonance between "rules—supply—demand" alongside the expansion of dollar-backed stablecoins. Major economies including the EU, Hong Kong, and Japan have also established their own regulatory and industrialization pathways. Meanwhile, challenges such as structural over-concentration in dollar dominance, margin constraints between reserve assets and operational incentives, and the potential "crowding-out effect" of CBDCs (central bank digital currencies) will define the core of policy and commercial competition in the next phase.

1. Stablecoin Market Overview

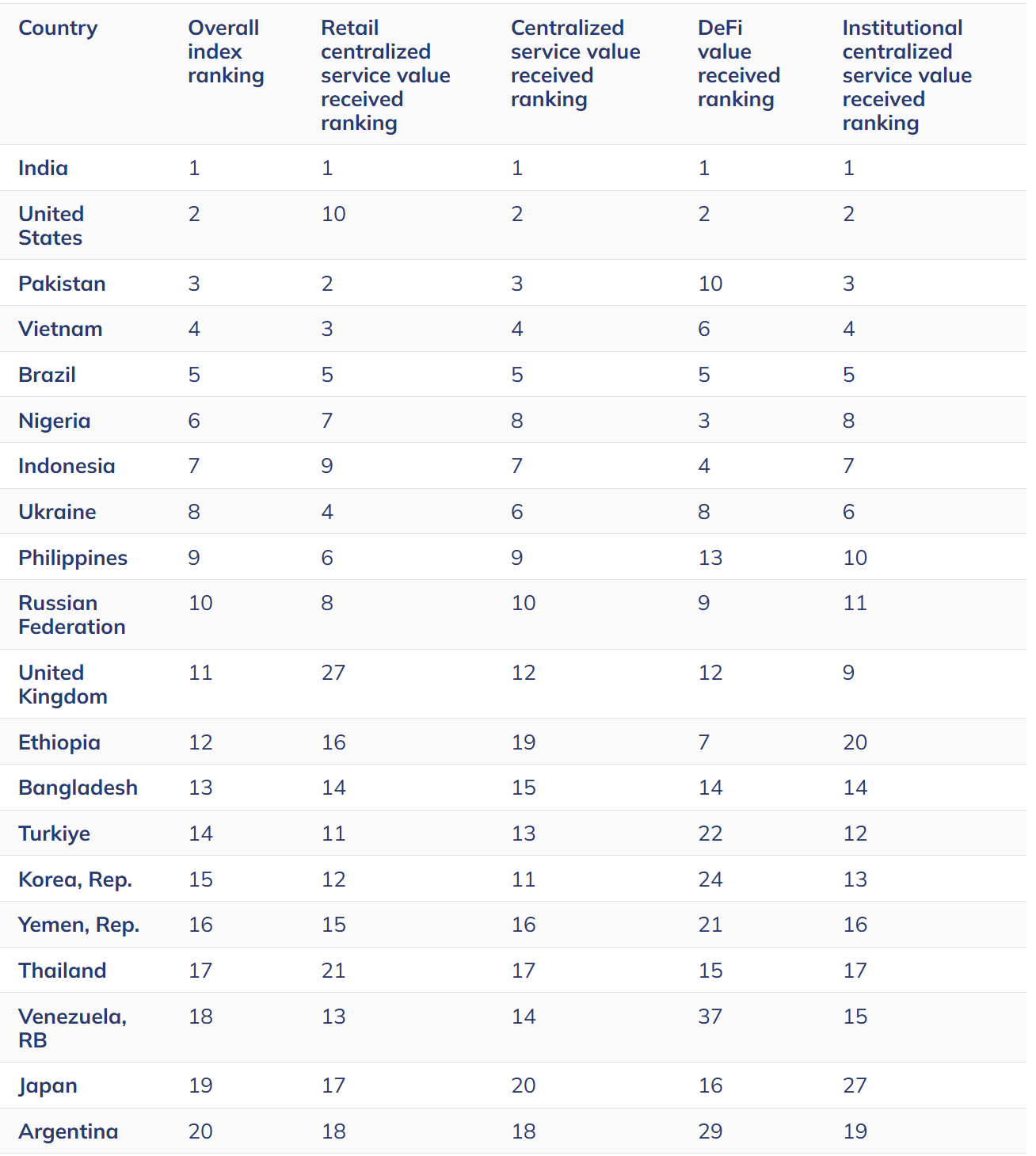

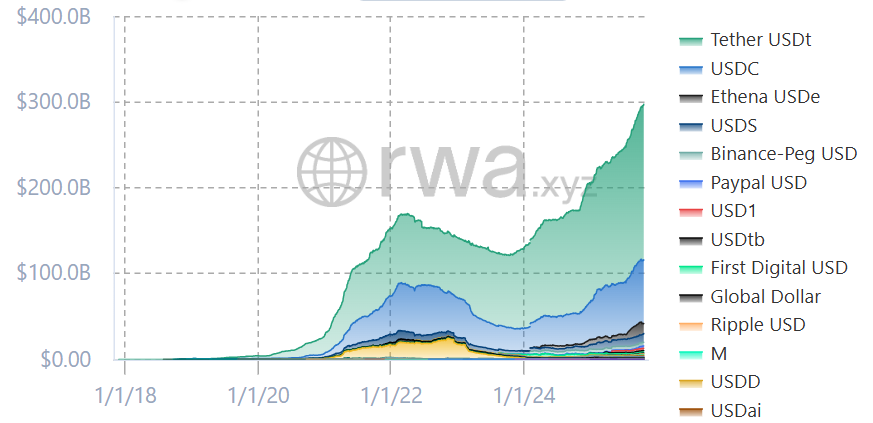

In terms of scale and structure, stablecoins are experiencing a triple inflection point across “scale—utility—efficiency.” First is the “scale” dimension: since Q3 2025, multiple authoritative and industry sources have consistently reported that stablecoin market cap is approaching or has surpassed $300 billion for the first time. The Association for Financial Markets in Europe (AFME), taking a more conservative stance, pegged it at $286 billion in its September report—a discrepancy largely due to differences in data windows and inclusion criteria. However, there is no dispute about the trend: stablecoin value has returned to and broken previous historical highs. AFME further noted that USD-denominated stablecoins account for 99.5% of the total, pushing the structural certainty of "unipolar dollarization" to an all-time peak. Additionally, FN London, under the Financial Times, analyzed issuer concentration and found a persistent duopoly led by USDT and USDC in both market share and liquidity, with combined dominance ranging between 70–80% across various metrics and time points—solidifying the anchoring power of dollar stablecoins over on-chain funding curves and pricing systems. Second is the “utility” dimension: cross-border payments/remittances and B2B fund transfers have become the primary engines of real-world adoption. Morgan Stanley Investment Management disclosed that in 2024 alone, Turkey's cross-border stablecoin payment volume exceeded $63 billion, with India, Nigeria, Indonesia, and others joining the ranks of high-adoption nations. This demand does not stem from internal crypto-market cycles but represents a systemic alternative to traditional cross-border financial friction and uncertainty. Furthermore, Visa’s latest white paper extends the technological reach of stablecoins beyond “payments” into “cross-border credit and on-chain credit infrastructure,” emphasizing that programmable money combined with smart contracts can automate and reduce friction across the entire lifecycle of global lending—from matching and contracting to fulfillment and clearing—while enhancing verifiability. This implies that the marginal value of stablecoins will shift from merely lowering cross-border payment costs to fundamentally rewriting the production function of cross-border credit. Third is the “efficiency” dimension: Ethereum L2s (e.g., Base) and high-performance public chains (e.g., Solana) now offer low-latency, low-cost “last-mile” settlement networks. Combined with compliant RWA and tokenized short-term Treasury pools, stablecoins are no longer just “transferable dollars,” but also “re-stakable dollars” integrated into funding curves—shortening capital turnover radius and maximizing per-unit efficiency. Together, these three dimensions are driving a paradigm shift from cyclical rebounds to structural penetration: thicker market caps, stronger dollar anchors, deeper use cases—and higher capital reuse transforming stablecoins from mere “intermediation tools” into foundational layers for working capital and credit generation. On this trajectory, short-term sentiment swings or isolated incidents (such as recent erroneous over-minting and quick rollback by a single stablecoin during internal transfers) serve mainly as stress tests for risk management and audit visibility, without altering the overarching trend: record-high aggregate value, extreme dollar concentration structurally, and functional expansion from “payment” to “credit.”

On the driver side, demand- and supply-side forces have formed a dual-curve convergence of “real-world necessity × regulatory windfall,” reinforcing the above triple growth. Demand originates first from emerging markets’ urgent need for “currency substitution.” Under macroeconomic conditions of high inflation and depreciation, on-chain dollars are increasingly adopted organically as hard currency and settlement media. Joint research by Morgan Stanley and Chainalysis shows that bottom-up cross-border payments and remittances represent the fastest-growing entry point for stablecoin adoption, exhibiting clear countercyclical characteristics—“the more volatile, the greater the uptake.” Secondly, demand stems from global enterprises facing constraints on working capital efficiency: e-commerce platforms, foreign trade firms, overseas developers, and gig economies all require T+0 or minute-level finality with low chargeback risks. Stablecoins thus become a “second rail” alternative to SWIFT and correspondent banking networks, continuously reducing last-mile costs thanks to technical dividends from multi-chain interoperability and L2 adoption. Cross-border settlements, B2B payments, and liquidity pool rotations have become the dominant real-world use cases. On the supply side, the main driver is the regulatory windfall curve: the U.S. GENIUS Act was signed into law on July 18, 2025, establishing for the first time a unified federal regulatory baseline for stablecoins. It mandates 100% highly liquid reserves (in USD or short-term Treasuries), monthly reserve disclosures, and clearly defines redemption, custody, oversight, and enforcement authority—effectively codifying “safety—transparency—redeemability” as strong legal requirements. Hong Kong’s Stablecoin Ordinance took effect on August 1, 2025, setting up a licensing framework and activity boundaries, with the HKMA releasing supporting pages and detailed rules to ensure穿透 supervision over reserve quality, redemption mechanisms, and risk controls. The EU’s MiCA regulation began phased implementation at the end of 2024, with ESMA successively issuing secondary and tertiary technical standards along with competence guidelines, marking Europe’s integration of stablecoins into a prudential regulatory regime at the level of financial infrastructure. Regulatory clarity brings two key outcomes: one, significantly reduced compliance uncertainty and cross-border compliance costs for issuers, settlement networks, and merchant acquirers, thereby continuously lowering friction for real-world adoption; two, transformation of the industry’s “risk—return—scale” function by internalizing externalities related to reserve safety and information disclosure into compliance costs—raising barriers to entry and accelerating consolidation among leading players. Combined with blockchain technology curves (L2 adoption/high-TPS chains) and RWA funding curves (tokenized short-term debt/money market funds going on-chain), stablecoins have expanded from being a “gateway for cross-border payments” to becoming the foundation layer for “cross-border credit and on-chain capital markets.” In its latest white paper, Visa explicitly states that stablecoins will form the base layer of a “global credit ecosystem,” where smart contracts enable automation in pre-loan matching, mid-loan monitoring, post-loan clearing, and asset disposal—shifting credit creation, transfer, and pricing from being primarily manual and document-based to code- and data-driven. This explains why, even amid record-high aggregate values and extreme dollar dominance, the industry logic has shifted from “cyclical rebound” to “structural penetration.” During this process, the simultaneous advances of U.S. federal anchoring, Hong Kong licensing implementation, and EU MiCA rollout create a transcontinental institutional synergy, elevating stablecoin expansion from a “commercial phenomenon” to a systematic project of coordinated policy and financial infrastructure development—and providing a credible, auditable, composable base layer of cash and settlement for future complex trade finance modules such as cross-border credit, accounts receivable securitization, inventory financing, and factoring.

On the driver side, demand- and supply-side forces have formed a dual-curve convergence of “real-world necessity × regulatory windfall,” reinforcing the above triple growth. Demand originates first from emerging markets’ urgent need for “currency substitution.” Under macroeconomic conditions of high inflation and depreciation, on-chain dollars are increasingly adopted organically as hard currency and settlement media. Joint research by Morgan Stanley and Chainalysis shows that bottom-up cross-border payments and remittances represent the fastest-growing entry point for stablecoin adoption, exhibiting clear countercyclical characteristics—“the more volatile, the greater the uptake.” Secondly, demand stems from global enterprises facing constraints on working capital efficiency: e-commerce platforms, foreign trade firms, overseas developers, and gig economies all require T+0 or minute-level finality with low chargeback risks. Stablecoins thus become a “second rail” alternative to SWIFT and correspondent banking networks, continuously reducing last-mile costs thanks to technical dividends from multi-chain interoperability and L2 adoption. Cross-border settlements, B2B payments, and liquidity pool rotations have become the dominant real-world use cases. On the supply side, the main driver is the regulatory windfall curve: the U.S. GENIUS Act was signed into law on July 18, 2025, establishing for the first time a unified federal regulatory baseline for stablecoins. It mandates 100% highly liquid reserves (in USD or short-term Treasuries), monthly reserve disclosures, and clearly defines redemption, custody, oversight, and enforcement authority—effectively codifying “safety—transparency—redeemability” as strong legal requirements. Hong Kong’s Stablecoin Ordinance took effect on August 1, 2025, setting up a licensing framework and activity boundaries, with the HKMA releasing supporting pages and detailed rules to ensure穿透 supervision over reserve quality, redemption mechanisms, and risk controls. The EU’s MiCA regulation began phased implementation at the end of 2024, with ESMA successively issuing secondary and tertiary technical standards along with competence guidelines, marking Europe’s integration of stablecoins into a prudential regulatory regime at the level of financial infrastructure. Regulatory clarity brings two key outcomes: one, significantly reduced compliance uncertainty and cross-border compliance costs for issuers, settlement networks, and merchant acquirers, thereby continuously lowering friction for real-world adoption; two, transformation of the industry’s “risk—return—scale” function by internalizing externalities related to reserve safety and information disclosure into compliance costs—raising barriers to entry and accelerating consolidation among leading players. Combined with blockchain technology curves (L2 adoption/high-TPS chains) and RWA funding curves (tokenized short-term debt/money market funds going on-chain), stablecoins have expanded from being a “gateway for cross-border payments” to becoming the foundation layer for “cross-border credit and on-chain capital markets.” In its latest white paper, Visa explicitly states that stablecoins will form the base layer of a “global credit ecosystem,” where smart contracts enable automation in pre-loan matching, mid-loan monitoring, post-loan clearing, and asset disposal—shifting credit creation, transfer, and pricing from being primarily manual and document-based to code- and data-driven. This explains why, even amid record-high aggregate values and extreme dollar dominance, the industry logic has shifted from “cyclical rebound” to “structural penetration.” During this process, the simultaneous advances of U.S. federal anchoring, Hong Kong licensing implementation, and EU MiCA rollout create a transcontinental institutional synergy, elevating stablecoin expansion from a “commercial phenomenon” to a systematic project of coordinated policy and financial infrastructure development—and providing a credible, auditable, composable base layer of cash and settlement for future complex trade finance modules such as cross-border credit, accounts receivable securitization, inventory financing, and factoring.

2. USD Stablecoin Trends and Analysis

Within the global stablecoin landscape, U.S.-issued dollar stablecoins are not merely market products—they are deeply embedded strategic pillars serving national interests and geopolitical finance. Their underlying rationale can be understood through three lenses: preserving dollar hegemony, alleviating fiscal pressures, and leading global rule-making. First, dollar stablecoins have become a new lever for maintaining the international status of the U.S. dollar. Traditional dollar dominance relies on reserve currency status, the SWIFT system, and petrodollar mechanisms. Yet over the past decade, despite gradual progress, global "de-dollarization" trends have steadily eroded the dollar’s share in settlements and reserves. In this context, the expansion of dollar stablecoins offers an asymmetric path—bypassing sovereign monetary systems and capital controls to directly deliver the “value proposition of the dollar” to end users. Whether in high-inflation economies like Venezuela and Argentina or in Africa and Southeast Asia’s cross-border trade corridors, stablecoins have effectively become the “on-chain dollar” voluntarily chosen by individuals and businesses, penetrating local financial systems at low cost and low friction. This penetration requires no military or geopolitical tools—it is achieved organically through market behavior, enabling “digital dollarization” that expands the reach of the dollar ecosystem. As highlighted in JPMorgan Chase’s latest research, stablecoin expansion could generate an additional $1.4 trillion in structural demand for the dollar by 2027, effectively offsetting part of the de-dollarization trend—meaning the U.S. has achieved a low-cost extension of monetary hegemony via stablecoins.

Second, dollar stablecoins have become important new buyers supporting the U.S. Treasury market at the fiscal and financial level. While global demand for U.S. Treasuries remains strong, persistent fiscal deficits and fluctuating interest rates place sustained pressure on U.S. government financing. The issuance mechanism of stablecoins inherently demands allocation to highly liquid reserves. Under the GENIUS Act, these reserves must primarily consist of short-term Treasuries or cash equivalents. This means that as stablecoin market cap grows from hundreds of billions toward trillions of dollars, their reserve holdings will become a stable and growing source of demand for U.S. debt—acting similarly to a “quasi-central bank buyer.” This can improve the maturity structure of Treasuries and potentially lower overall funding costs, offering a new “structural pillar” for U.S. fiscal sustainability. Multiple research institutions have modeled that by 2030, stablecoins could reach a potential size of $1.6 trillion, generating thousands of billions in incremental demand for U.S. debt. Finally, the U.S. has strategically shifted from “suppression” to “incorporation” in rule-making. Early regulatory attitudes were hostile, driven by concerns over monetary policy and financial stability. But as the market scaled, the U.S. quickly realized suppression was futile and pivoted to a strategy of “rights recognition—regulation—inclusion.” The GENIUS Act, enacted in July 2025, stands as a landmark legislation establishing a unified federal regulatory framework. Beyond mandating reserve quality, liquidity, and transparency, it legitimizes parallel issuance channels for banks and non-banks alike, while embedding AML/KYC, redemption mechanisms, and custodial responsibilities as hard compliance requirements—ensuring stablecoins operate within controllable boundaries. Crucially, this act grants the U.S. first-mover advantage in shaping international standards. Through the示范effect of federal legislation, the U.S. can export its regulatory logic onto multilateral platforms such as G20, IMF, and BIS—making dollar stablecoins not only dominant in the market but also the “default standard” institutionally.

In sum, the U.S. strategic logic on dollar stablecoins has achieved triple convergence: at the international monetary level, stablecoins extend digital dollarization, cheaply preserving and expanding dollar hegemony; at the fiscal-financial level, they create a new long-term buyer base for the Treasury market, easing fiscal strain; at the regulatory-institutional level, the GENIUS Act completes the rights recognition and incorporation of stablecoins, securing U.S. leadership in the future global digital financial order. These three strategic pillars reinforce each other, creating synchronized momentum: when dollar stablecoin market cap reaches several trillion dollars, it strengthens the dollar’s international standing, supports sustainable domestic fiscal financing, and establishes global standards legally and institutionally. This combined “institutional primacy” and “network first-mover advantage” makes dollar stablecoins not just market products, but vital instruments of U.S. national interest. In the future global stablecoin competition, this moat will persist long-term. While non-dollar stablecoins may find regional niches, they are unlikely to challenge the core position of dollar stablecoins in the near term. In other words, the future of stablecoins is not merely a market choice in digital finance, but a currency strategy shaped by great-power rivalry—and the U.S. has clearly seized the high ground in this contest.

3. Non-USD Stablecoin Trends and Analysis

The overall landscape of non-USD stablecoins exhibits a typical pattern of “globally weak, locally strong.” Back in 2018, their market share approached 49%, nearly matching dollar stablecoins. However, within just a few years, this figure has plummeted to less than 1%—mere basis points—with industry data platform RWA.xyz estimating an extreme low of 0.18%. Euro stablecoins stand as the only visibly significant presence in absolute terms, with a total market cap of about $456 million, occupying most of the non-USD space, while stablecoins tied to Asian, Australian, and other currencies remain in early or pilot stages. Meanwhile, the EU’s AFME reported in September that USD stablecoins now hold 99.5% market share, meaning global on-chain liquidity is almost entirely dependent on a single point—the U.S. dollar. Such excessive concentration creates structural risk: any extreme regulatory, technical, or credit shock originating in the U.S. could rapidly spill over into global markets through the settlement layer. Therefore, advancing non-USD stablecoins is not merely commercial competition, but a strategic imperative for safeguarding systemic resilience and monetary sovereignty.

Among non-USD players, the eurozone leads the way. The implementation of the EU’s MiCA legislation has provided unprecedented legal certainty for stablecoin issuance and circulation. Circle announced that its USDC/EURC products fully comply with MiCA and are actively pursuing multi-chain deployment. Driven by this, euro stablecoin market cap achieved triple-digit growth in 2025, with EURC alone rising 155%, from $117 million at year-start to $298 million. While still dwarfed by dollar stablecoins in absolute size, the growth momentum is clear. The European Parliament, together with ESMA and ECB, is intensively rolling out technical standards and regulatory rules, imposing strict requirements on issuance, redemption, and reserves—gradually building a compliant cold-start ecosystem. Australia’s path differs, leaning toward a top-down model led by traditional banks. ANZ and NAB, two of the country’s big four banks, launched A$DC and AUDN respectively, while licensed payment firm AUDD fills the retail gap, focusing on cross-border payments and efficiency optimization. However, overall development remains confined to limited institutional pilots and niche scenarios, lacking broad retail adoption. The biggest uncertainty lies in the absence of a national legal framework, while the Reserve Bank of Australia (RBA) is actively studying a digital Aussie dollar (CBDC). Once launched, it could replace or squeeze existing private stablecoins. If regulations open up,澳元 stablecoins could scale rapidly leveraging bank backing and retail payment integration—but their relationship with CBDC—whether substitutive or complementary—remains unresolved. South Korea presents a paradox: despite high public acceptance of crypto assets, stablecoin development has nearly stalled. The key bottleneck is severe legislative lag, with effective laws not expected before 2027, prompting conglomerates and major internet platforms to collectively wait and see. Coupled with regulators favoring “controlled private chains” and the scarcity and low yield of domestic short-term Treasuries, issuers face dual constraints in profitability and commercial incentives. Hong Kong is one of the rare cases where “regulation runs ahead.” In May 2025, the Legislative Council passed the Stablecoin Ordinance, which officially took effect on August 1, making Hong Kong the first major financial center to introduce a comprehensive stablecoin regulatory framework. The Hong Kong Monetary Authority (HKMA) subsequently released detailed implementation rules, clarifying compliance boundaries for HKD-pegged and onshore-issued stablecoins. However, despite regulatory leadership, the market has seen “localized cooling.” Some mainland Chinese institutions, under cautious regulatory signals from the mainland, have opted to proceed quietly or delay applications, dampening market enthusiasm. It is expected that by late 2025 or early 2026, regulators will issue a very small number of initial licenses, adopting a “prudent pace—gradual opening” rolling pilot approach. This means that although Hong Kong enjoys advantages as an international financial hub with forward-looking regulation, its development pace is constrained by mainland China’s cross-border capital controls and risk isolation considerations, leaving the breadth and speed of market expansion uncertain. Japan has carved out a unique path in institutional design, emerging as an innovative model of “trust-based strong regulation.” Through the amended Funds Settlement Act, Japan established a regulatory model of “trust custody + licensed financial institutions as lead issuers,” ensuring stablecoins operate fully within compliance frameworks. In autumn 2025, JPYC became the first compliant yen stablecoin, issued via Mitsubishi UFJ Trust’s Progmat Coin platform, with plans to cumulatively issue 1 trillion yen within three years. Its reserves are pegged to Bank of Japan deposits and Japanese Government Bonds (JGBs), targeting applications in cross-border remittances, corporate settlements, and DeFi ecosystems.

Overall, the current state of non-USD stablecoins can be summarized as “systemic困境, regional divergence.” Globally, the overwhelming dominance of dollar stablecoins has squeezed out alternatives, causing non-USD shares to collapse. Yet regionally, the euro and yen represent long-term paths grounded in “sovereignty and regulatory certainty,” potentially carving out differentiated competitiveness in cross-border payments and trade finance. Hong Kong maintains a unique position due to its financial centrality and regulatory foresight. Australia and South Korea remain in exploration and observation phases, with breakthroughs contingent on legal frameworks and CBDC positioning. In the future stablecoin ecosystem, non-USD stablecoins may not challenge dollar supremacy, but their existence carries strategic significance: serving as buffers and backup options against systemic risk, while helping nations preserve monetary sovereignty in the digital age.

4. Investment Outlook and Risks

The investment thesis for stablecoins is undergoing a profound paradigm shift—from the past “token-centric” mindset focused on price and market share, to a new “cash flow and rules-based” framework rooted in cash flows, institutions, and regulations. This shift reflects not only an upgrade in investor perspective but also the inevitable evolution of the entire industry from crypto-native origins toward becoming financial infrastructure. From a value chain segmentation standpoint, the most direct beneficiaries are undoubtedly the issuers. With the implementation of the GENIUS Act in the U.S., MiCA in the EU, and Hong Kong’s Stablecoin Ordinance, stablecoin issuers, custodians, auditors, and reserve managers now enjoy clear compliance pathways and institutional safeguards. While mandatory reserve requirements and monthly disclosures increase operating costs, they also raise industry entry barriers, accelerating concentration and strengthening the scale advantages of leading issuers. This enables top-tier institutions to generate stable cash flows through spread income, reserve asset allocation, and regulatory windfalls—creating a “winner-takes-all” dynamic.

Beyond issuers, settlement and merchant acceptance networks represent the next major investment frontier. Entities that can integrate stablecoins at scale into corporate ERP systems and cross-border payment networks will build sustainable revenue streams through payment fees, settlement charges, and working capital management services. The potential of stablecoins extends beyond on-chain exchange—they must become “daily monetary tools” in business operations. Once embedded, such integration unlocks long-term, predictable cash flows akin to the moats built by traditional payment networks. Another area worth watching is RWA (real-world assets) and short-term debt tokenization. As stablecoin scale grows, reserve funds will inevitably seek yield-generating opportunities. Tokenizing short-term Treasuries and money market funds satisfies reserve compliance while efficiently bridging stablecoins with traditional financial markets. Ultimately, a closed loop may emerge among stablecoins, tokenized short-term debt, and money markets—maturing the entire on-chain dollar liquidity curve. Additionally, compliance tech and on-chain identity management are promising fields. The U.S. GENIUS Act, EU MiCA, and Hong Kong regulations all emphasize the importance of KYC, AML, and blacklist management, making “regulatable open public chains” an industry consensus. Tech companies offering on-chain identity and compliance modules will play critical roles in the future stablecoin ecosystem. Regionally, the U.S. offers the largest scale dividend. The dollar’s first-mover advantage and clear federal legislation enable deep participation by banks, payment giants, and even tech firms. Investment targets include not only issuers but also builders of financial infrastructure. The EU’s opportunity lies in institutional-grade B2B settlements and euro-denominated DeFi ecosystems, with MiCA’s compliance framework and expectations around digital euro shaping a market centered on “stability + compliance.” Hong Kong, leveraging its regulatory-first-mover advantage and international resources, could become a bridgehead for offshore RMB, HKD, and cross-border asset allocation. Particularly given the low-profile advancement of Chinese institutions, foreign and local financial firms may gain faster access. Japan, through its “trust-based strong regulation” model, has created a highly secure benchmark. If JPYC and follow-on products reach trillion-yen issuance scale, they could alter supply-demand dynamics across certain JGB maturity segments. Australia and South Korea remain in exploratory phases, with investment opportunities likely emerging during pilot expansions and policy windfall windows. Regarding valuation and pricing models, issuer revenue can be simplified as interest income from reserve assets multiplied by AUM, adjusted for revenue-sharing ratios and incentive costs. Scale, spread, redemption rate, and compliance cost are key determinants of profitability. Revenue for settlement and acceptance networks comes primarily from transaction fees, settlement charges, and financial value-added services, with merchant density, ERP integration depth, and compliance loss rate as core variables. On-chain money market revenue correlates directly with net interest margin, programmable credit inventory, and risk-adjusted capital returns—hinging on asset sourcing stability and default resolution efficiency.

However, risks in the stablecoin space cannot be ignored. The most critical is systemic concentration. With USD stablecoins accounting for 99.5% of the market, global on-chain liquidity is almost entirely reliant on a single point. Any major legislative reversal, regulatory tightening, or technical incident in the U.S. could trigger a global deleveraging chain reaction. Regulatory repricing risk also exists—even with the GENIUS Act, evolving implementation details and inter-agency coordination could reshape cost structures and operational boundaries for non-bank issuers. MiCA’s stringent requirements may force some overseas issuers to exit the EU or operate under restricted modes; Hong Kong and Japan’s high compliance costs, strict custody, and top-up clauses raise capital and technical thresholds. The potential “crowding-out effect” of CBDCs must not be overlooked: once deployed, digital euro or digital Aussie dollar could gain institutional preference in public services, taxation, and welfare distribution, squeezing private stablecoins in domestic currency use cases. Operational risk is evident too—recent incidents of erroneous over-minting by some issuers, though quickly rolled back, highlight the need for real-time auditing of reserve reconciliation and mint/burn mechanisms. Interest rate and maturity mismatches pose another latent threat: if issuers chase yield by mismatching assets against redemption obligations, it could spark runs and market turmoil. Lastly, geopolitical and sanctions compliance risks are rising. As extensions of the dollar, stablecoins face heightened compliance pressure and complex blacklist management challenges in specific contexts. Overall, while the investment outlook for stablecoins is vast, it is no longer a simple “bet-on-scale” narrative, but a complex game of cash flows, rules, and institutional certainty. Investors must identify which entities can build stable cash flow models under compliance frameworks, which regions can unlock structural opportunities through regulatory evolution, and which sectors can deliver long-term value through compliance tech and on-chain credit expansion. At the same time, they must remain highly vigilant against systemic concentration and regulatory repricing shocks—especially in a landscape defined by dollar dominance and accelerating CBDC rollouts globally.

5. Conclusion

The evolution of stablecoins has reached a qualitative inflection point—not merely a story of “how high the market cap can go,” but a leap from dollar tokens to a global financial operating system. Initially serving as neutral-value assets for on-chain transactions, they then entered global B2B and B2C micro-payment settlements through network effects. Ultimately, empowered by both code and regulation, they evolve into a programmable cash layer capable of supporting complex financial services such as credit extension, collateralization, bills, and inventory financing. The U.S., aligning monetary, fiscal, and regulatory levers, has transformed dollar stablecoins into a tool of institutional export for digital dollarization—expanding global dollar penetration, stabilizing Treasury demand, and locking in international话语权. While non-USD stablecoins face inherent disadvantages in network effects and spreads, their existence supports regional financial sovereignty and systemic resilience. The EU, Japan, and Hong Kong are carving out survival spaces through compliance-first or institutional-design approaches. For investors, the key is completing a mental model shift—from speculation on token prices and market share to validating business models based on cash flows, rules, and compliance technology. Over the next two to three years, stablecoins will complete compliant model deployments across multiple jurisdictions, evolving from “off-exchange channel assets” into the foundational layer of a “global financial operating system,” profoundly reshaping monetary transmission pathways and the production of financial services.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News