A Comprehensive Analysis of the Waves Ecosystem: The Rise of Another Stablecoin System

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of the Waves Ecosystem: The Rise of Another Stablecoin System

This article introduces Waves from the perspectives of its origin, market position, and major ecosystem applications, with a particular focus on the design of its stablecoin USDN. We firmly believe that stablecoins are an essential requirement for future project launches, and USDN remains a key weapon for Waves to capture market share in the future.

Authors: TinyHand, y2z Ventures

This article introduces Waves from its origins, market presence, and major ecosystem applications, with a particular focus on the design of its stablecoin USDN. We firmly believe that stablecoins are essential for future project launches, and USDN remains a key weapon for Waves to capture market share.

Preface

Many people associate the rise in Waves token price with the Russia-Ukraine war. Beyond media hype, from a product functionality perspective, Waves today can indeed meet people's needs for asset protection and provide diverse user experiences.

Waves price surge during the Russia-Ukraine conflict

Reasons are as follows:

1. Waves operates its own exchange where users can directly purchase the USDN stablecoin via Waves Exchanges. This platform integrates both centralized and decentralized exchange functionalities, enabling direct fiat-to-USDN purchases with excellent trading experience.

2. Waves’ stablecoin system is well-designed. The introduction of NSBT largely solves the problem of insufficient USDN reserves, further ensuring USDN stability. When SWIFT or other payment infrastructures shut down, USDN can serve as a vehicle for transferring fiat value.

3. Waves offers DeFo (decentralized foreign exchange). Different countries can use DeFo tools to exchange USDN with algorithmic stablecoins such as EURN, RUBN, CNYN, JPYN, UAHN, NGNN, BRLN, GBPN, and TRYN, meeting diverse needs for stable asset transfers.

4. Beyond asset transfer, Waves’ public chain ecosystem is robust, encompassing secondary markets, lending/savings, NFTs, gaming, and more. Developers can leverage Waves development tools to build additional use cases, satisfying demand for financial services and entertainment.

Recently, some exchanges froze Russian account assets—an event highly unlikely to occur on Waves. Waves Enterprise, Waves’ enterprise-grade service platform, has long collaborated with numerous Russian industrial asset companies, handling projects ranging from large-scale industrial asset transfers to office property records at both corporate and governmental levels. Currently, only Waves Enterprise possesses this capability among blockchain platforms. As a provider of enterprise-level blockchain services, Waves would not take actions likely to alarm its business and government clients.

List of Some Russian Clients of Waves Enterprise

1. In addition to providing private-chain technology services to large enterprises like Microsoft, Waves also boasts a mature public chain ecosystem, having developed various consumer-facing applications including DeFi, NFTs, and game wallets.

Therefore, choosing Waves as a public chain for asset protection is logical. Despite the constant emergence of new public chains, Waves stands out as one of the few financial blockchain projects that have been tested over many years.

I. Origins

Waves was founded in 2016 by Ukrainian scientist Sasha Ivanov.

Ivanov majored in theoretical physics for seven years at university and spent seven years working in artificial intelligence afterward. In his spare time, he remained active in online communities dominated by scientists. As blockchain communities grew increasingly vibrant, Ivanov became deeply involved and eventually decided to develop enterprise-level blockchain applications.

Sasha Ivanov, Founder of Waves

Sasha Ivanov, Founder of Waves

Ivanov had a clear goal for Waves—to apply blockchain technology to finance and fintech fields such as securities, crowdfunding, and fiat money transfers—thus creating a financial public chain.

Today, the Waves ecosystem not only achieves internal circulation but also excels in cross-chain solutions, enabling broad interoperability with other public chains. Its issued stablecoin USDN is supported on multiple chains including ETH and BSC and is currently in market circulation.

II. Market Cap and Price

In 2016, Waves conducted an ICO by accepting donated Bitcoin, raising 30,000 BTC (approximately $16 million), making it briefly the third-largest blockchain crowdfunding project after The DAO and Ethereum.

As of March 17, 2022, according to data from coinmarketcap.com, Waves had a market cap of $3,422,333,753.19, ranking 45th globally, and is currently the largest public chain project in the Russian region.

Waves market cap trend

Waves price trend

Waves reached its historical high price in May 2021

at $41.86. Recently, Waves experienced a 10-week decline starting in October 2021, falling from $32.44 to $8.02. However, amid a general market downturn on February 21, 2022, Waves began a strong rebound, rising consecutively for three weeks from $8.02 to $32.93—a 300% increase—approaching its historical resistance level near $32–34.

III. Stablecoin USD-Neutrino (USDN)

1. Market Cap and Distribution

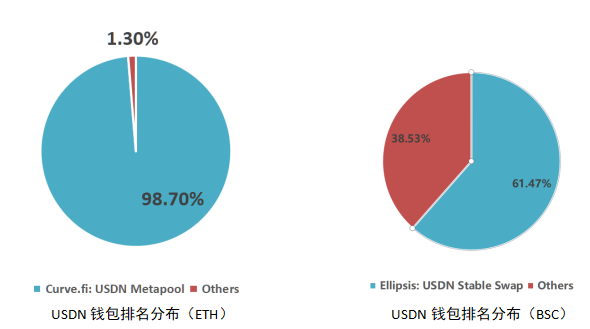

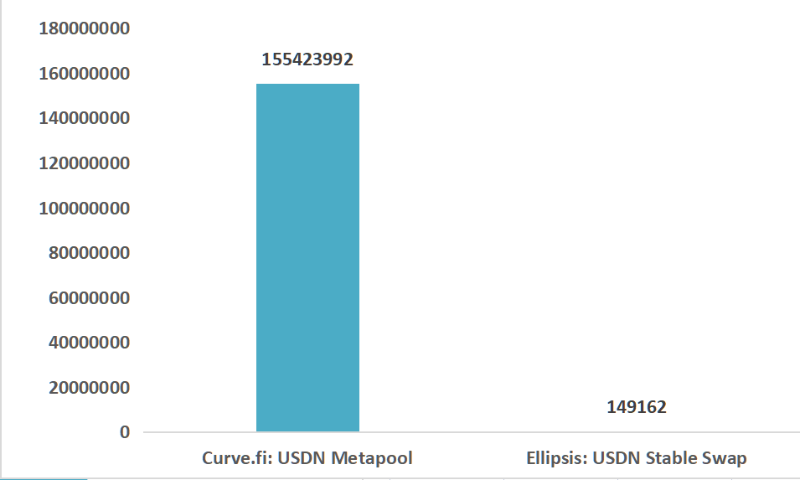

USDN ranks 8th among stablecoins by market cap, roughly half the size of Terra USD (UST), another algorithmic stablecoin with its own ecosystem. Almost all USDN on the ETH and BSC chains is used to provide liquidity within the Curve protocol, with significantly higher holdings on the ETH chain than on BSC.

Almost all USDN on the ETH and BSC chains is used to provide liquidity within the Curve protocol, with significantly higher holdings on the ETH chain than on BSC.

(Note: Ellipsis.finance is an authorized fork of Curve.fi, offering the Curve StableSwap protocol to users on the BNB Chain.)

Comparison of top wallet holdings of USDN on ETH vs BSC chains 2. Stablecoin System Design

The most widely adopted stablecoins in the market today—such as USDT and USDC—rely on real-world physical funds as reserves, which still lacks sufficient decentralization. The Neutrino protocol was designed specifically to address this issue.

First, unlike Tether’s USDT, Neutrino does not use fiat currency as reserves but instead employs an algorithmic stablecoin protocol backed by on-chain assets. Currently, the primary collateral asset is Waves. Second, while Neutrino still relies on “market incentives for automatic adjustment” to solve reserve shortages, it differs from Terra’s UST by introducing NSBT to achieve “secondary marketization of reserves.”

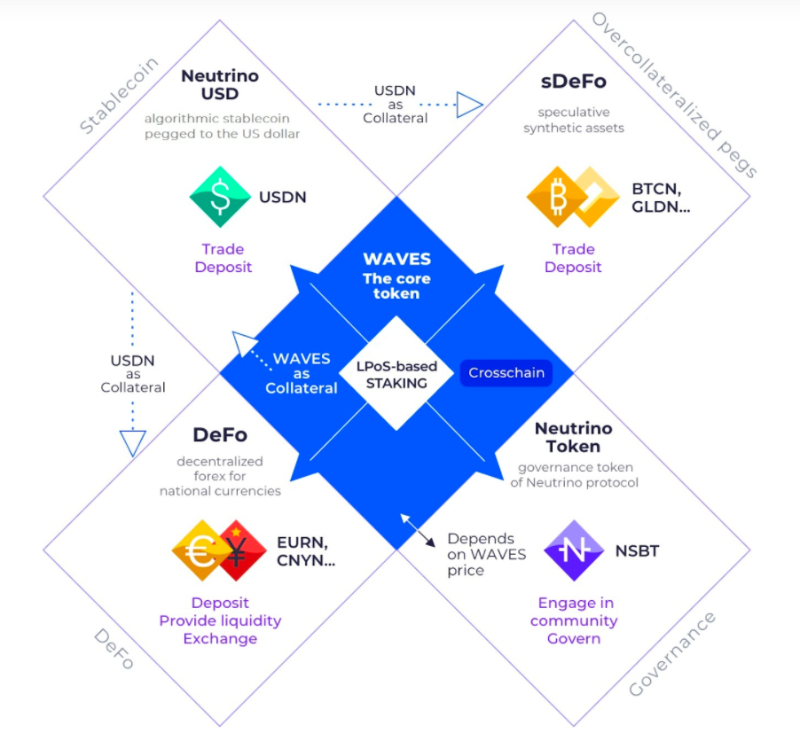

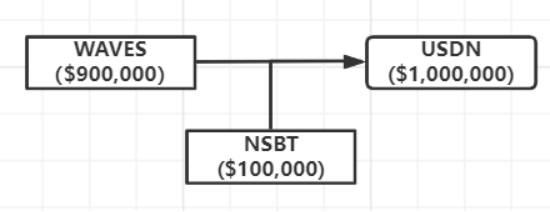

This stablecoin system consists of three components: Waves, USDN, and NSBT:

(1) Waves

The core token of the Waves ecosystem, used to pay transaction fees. It operates under an lPoS (leased proof-of-stake) consensus mechanism and serves as collateral for USDN within the Neutrino system.

(2) USDN

An algorithmic stablecoin pegged to the US dollar, usable as collateral for other assets.

The maximum supply of USDN depends on the maximum capitalization of the Waves token.

There is no pre-allocation or pre-mining of USDN. The increase or decrease in USDN supply is controlled by the market.

(3) NSBT

Neutrino’s governance token, generated through smart contracts based on the USDN reserve deficit value, used to maintain USDN stability. The market price of NSBT is determined jointly by supply and demand dynamics on cryptocurrency exchanges and the Neutrino smart contract.

Besides acting as a stabilizing intermediary between Waves and USDN, NSBT tokens can also be used to pay for protocol operations, create collateral positions (to mint USDN against Waves), and pay fees to form a “hedge fund” for generating new synthetic assets such as GLDN (gold) and EURN (euro). Waves Token Architecture Diagram

Waves Token Architecture Diagram

3. How USDN Maintains Stability

(1) Equilibrium State

USDN issuance is automatically handled by a smart contract system: when a certain value of Waves tokens is locked into a smart contract account, an equivalent value of USDN can be minted. Ideally, equilibrium is achieved when the market values of USDN and the locked assets are equal.

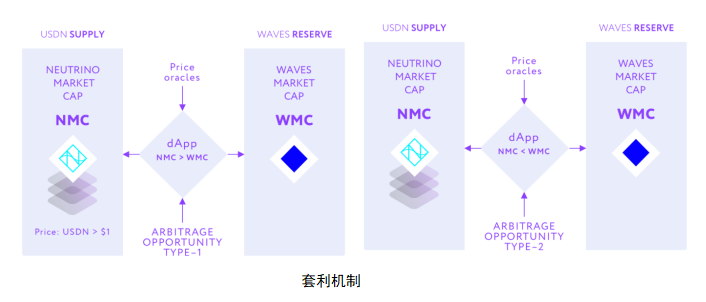

(2) Arbitrage Mechanism

When market demand for USDN increases, its price rises above $1. At this point, traders can exchange Waves for USDN via the Neutrino protocol and then sell USDN at a higher price on exchanges to profit. Such arbitrage increases USDN supply in the market, helping restore its price back to $1.

Conversely, if USDN supply surges on exchanges, causing its price to drop below $1, traders can buy USDN cheaply on the open market and redeem it for Waves via the Neutrino protocol, then sell those Waves for profit.

This mechanism resembles Terra’s UST arbitrage model, but the Neutrino protocol additionally uses NSBT issuance to mitigate risks caused by volatility in reserve asset prices.

4. Addressing Reserve Asset Price Volatility Impact on USDN

When Waves' price rises, the market value of the reserve asset (Waves) exceeds that of the USDN stablecoin. In this case, the smart contract detects excess reserves and mints additional USDN to repurchase NSBT, increasing USDN supply.

When Waves’ price falls, the reserve asset value drops below the corresponding USDN value. The smart contract detects insufficient reserves and initiates an auction to cover the shortfall, issuing NSBT that must be purchased using Waves (via the NSBT/Waves trading pair).

To better understand how NSBT works, consider this example:

Suppose USDN has a current value of $1 million, and the price of Waves (used as collateral) drops by 10%.

Now, the Neutrino protocol only holds $900,000 worth of reserves backing $1 million in USDN.

To fill this $100,000 gap, the smart contract issues NSBT. The amount issued depends on orders in the order book and discounts offered by traders.

Assume one trader places an order offering a 20% discount. This means they can receive $125,000 worth of NSBT by paying $100,000 worth of Waves.

When the Waves price recovers, the trader can liquidate their NSBT position at $125,000 or higher, earning a profit of $25,000 or more. Through this process, arbitrageurs profit while the Neutrino protocol fills the $100,000 reserve shortfall.

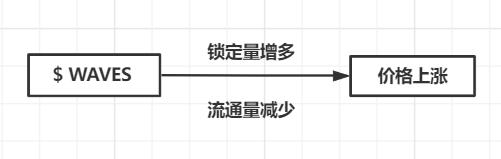

5. Impact of USDN on Reserve Asset Prices

As USDN gradually circulates in the market, this Neutrino mechanism begins to influence the reserve token itself (e.g., Waves).

(1) Deflationary Effect

The scale of Waves reserves determines the amount of USDN that can be issued. Conversely, when USDN demand exceeds supply, market forces and the Neutrino mechanism cause more Waves to be locked as collateral, reducing circulating supply. This deflationary pressure leads to rising Waves prices.

Notably, the Neutrino protocol isn’t limited to Waves—it can also provide deflationary mechanisms for DeFi-focused blockchains like Ethereum, EOS, and Cosmos.

(2) Lossless Transactions

In traditional token swaps, converting Waves to USD and back often results in slippage. Unlike third-party exchanges, Waves’ native ecosystem smart contracts avoid price changes due to bid-ask spreads or low liquidity, ensuring that conversions between Waves and USDN incur no value loss.

6. Risks and Mitigation Strategies

Below are identified risks along with corresponding mitigation plans:

7. Summary

By introducing NSBT, Waves balances the market caps of USDN and its reserves, solving the under-collateralization issue and expanding our thinking about algorithmic stablecoin designs. Although Waves incorporates security mechanisms, it still faces the aforementioned risks.

USDN's lower market cap compared to UST stems not only from its close correlation with Waves' market cap—which sets an upper limit on USDN issuance—but also from differences in application scope and narrative. Like Terra’s UST, when the Waves ecosystem expands and the USDN narrative grows stronger, both market caps will rise in tandem.

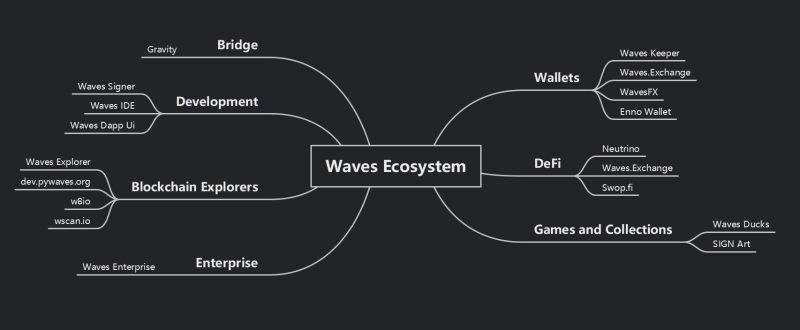

IV. Waves Ecosystem and Major Applications

1. Overview

Current major Waves applications include the Waves Enterprise service platform, Neutrino Protocol, Gravity Protocol, and others in DeFi and broader fintech domains, plus NFT collectibles and gaming apps. Waves Ecosystem Overview

Waves Ecosystem Overview

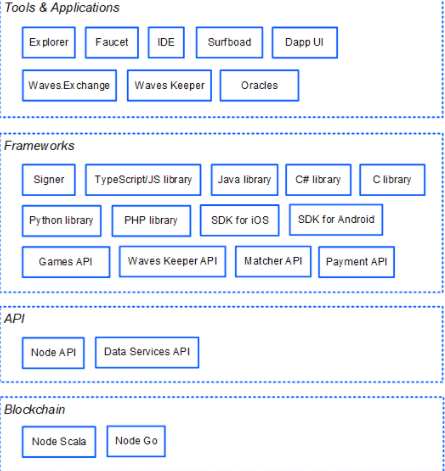

Additionally, Waves provides developers with its own Ride programming language and配套 developer tools.

Waves Developer Components

2. Waves Locked Asset Distribution

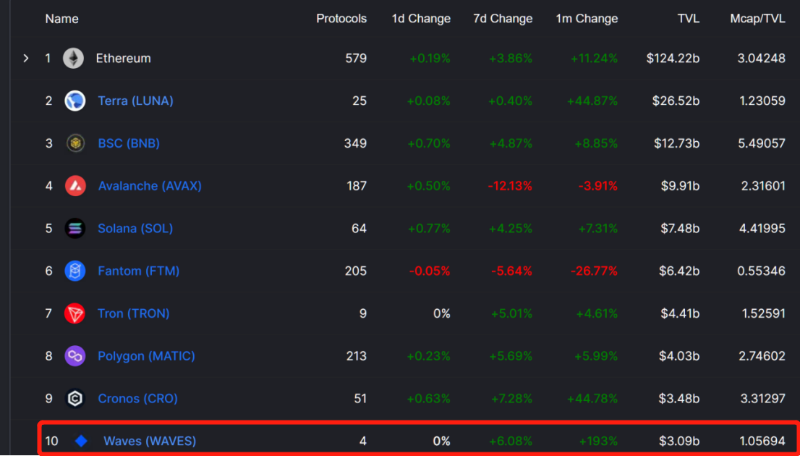

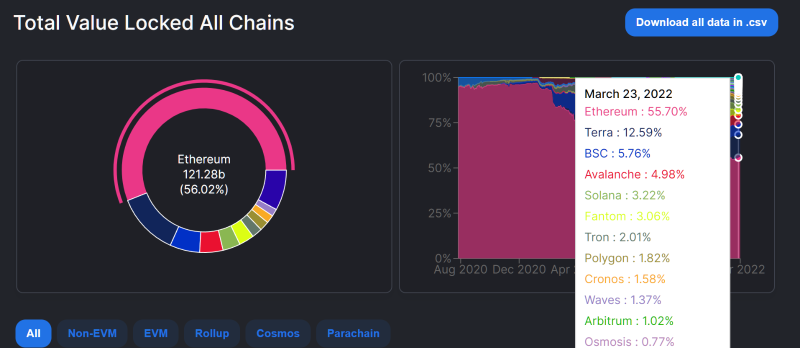

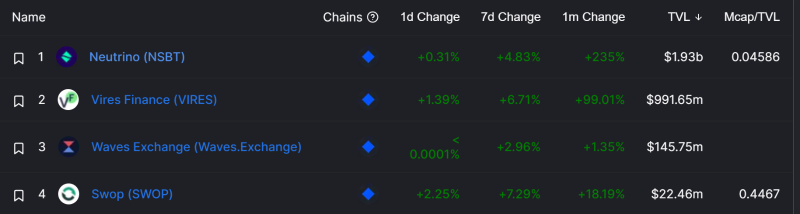

Although the number of protocols in the Waves ecosystem lags far behind the top nine, its Total Locked Value (TLV) ranks in the top ten, with most locked assets concentrated on the ETH chain, followed by the Terra chain. (Data source: defillama.com) Public Chain Total Value Locked Ranking

Public Chain Total Value Locked Ranking Waves Locked Assets Across Chains Ranking

Waves Locked Assets Across Chains Ranking Top Waves Protocols by TVL

Top Waves Protocols by TVL

It is evident that currently, locked assets in the Waves ecosystem are primarily distributed across Neutrino (NSBT) and Vires Finance (VIRES).

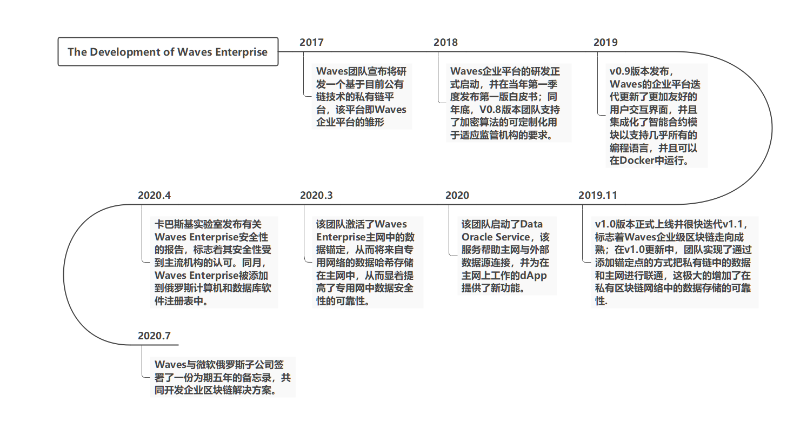

3. Waves Enterprise

Waves Enterprise is a platform dedicated to providing blockchain technology services to enterprises and governments.

Waves Enterprise uses a hybrid model, integrating public and private blockchains within a single ecosystem, combining the advantages of both. This allows Waves to retain decentralization, secure data storage, and privacy while maintaining regulatory compliance. Many confuse Waves Enterprise with Waves. In reality, Waves Enterprise is an independent project with its own team, ideologically aligned with the Waves ecosystem and able to share resources via the Gravity protocol. Waves Enterprise originated as a fork of the Waves protocol, but due to different target users, technical overlaps will diminish over time.

Many confuse Waves Enterprise with Waves. In reality, Waves Enterprise is an independent project with its own team, ideologically aligned with the Waves ecosystem and able to share resources via the Gravity protocol. Waves Enterprise originated as a fork of the Waves protocol, but due to different target users, technical overlaps will diminish over time.

Application areas of Waves Enterprise blockchain solutions include manufacturing, retail, arts, healthcare, oil & gas, fintech, education, etc., with customizable service packages available for enterprises.

Key partners include Alfa·bank (Russia’s largest private bank), RUSAL (top 10 global aluminum producer), X5 RETAIL GROUP (Russian retail giant operating 16,500 stores), ROSNEFT (Russia’s largest telecom company), Rosseti (Russia’s national power grid), among others. Additionally, a state electronic voting system developed in collaboration with the Russian government has already launched. Waves partnership with Microsoft

Waves partnership with Microsoft

Most of these are giants in traditional Russian heavy industry and telecommunications, though not limited to Russia alone. On July 16, 2020, Waves Enterprise signed a memorandum with Microsoft Russia to jointly develop enterprise blockchain solutions, establishing strategic cooperation in blockchain and cloud technologies. These assets range from heavy machinery to basic office equipment. Product Iteration Timeline

Product Iteration Timeline

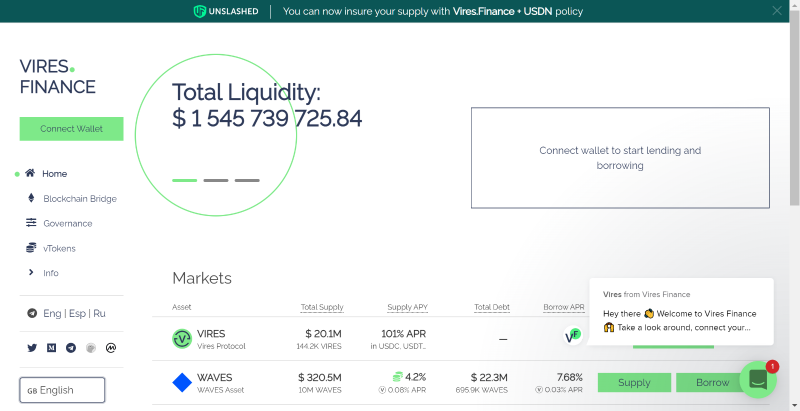

4. Vires Protocol

Vires Protocol is a lending protocol on the Waves blockchain. Users, wallets, and dApps can participate as depositors or borrowers. Depositors provide liquidity to earn passive income, while borrowers can obtain loans through over-collateralization.

On Vires.finance, all deposited funds equally participate in yield-generating activities. The greater the market demand for borrowed assets, the higher the APY earned by lenders. Supported tokens include WAVES, USDN, USDT, ETH, and BTC. Moreover, Vires.finance enables direct cross-chain asset transfers powered by Waves Exchange technology.

On Vires.finance, all deposited funds equally participate in yield-generating activities. The greater the market demand for borrowed assets, the higher the APY earned by lenders. Supported tokens include WAVES, USDN, USDT, ETH, and BTC. Moreover, Vires.finance enables direct cross-chain asset transfers powered by Waves Exchange technology.

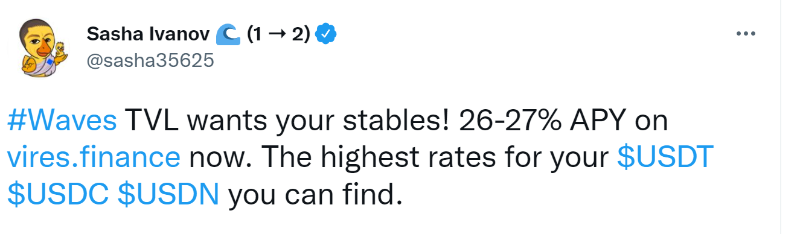

Previously, the founder of Waves tweeted that Vires.finance could offer over 25% APY, drawing comparisons to Terra’s Anchor, which attracted users with 20% APY. Similar to the Terra ecosystem—UST—Anchor Protocol loop, Waves has formed its own cycle: Waves ecosystem—USDN—Vires Protocol.

5. Waves Exchange

Waves Exchange is one of the earliest decentralized exchange (DEX) applications built on the Waves chain. It integrates features of centralized exchanges (CEX) and implements a decentralized automated market maker (AMM) mechanism. Users on Waves Exchange can utilize common CEX limit-order trading or DEX-style AMM mechanisms.

Waves Exchange Features:

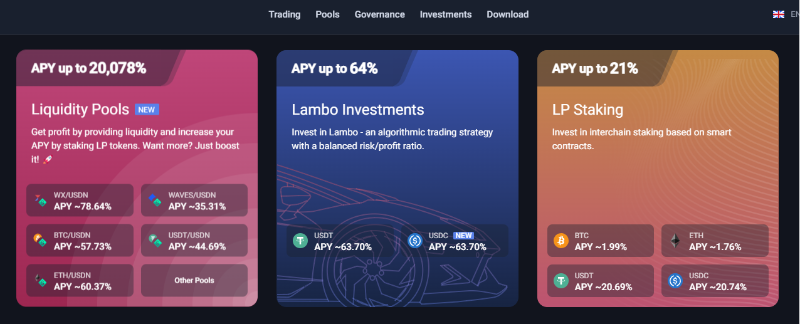

On Waves Exchange, users can do more than just use wallets—they can swap cryptocurrencies, trade stablecoins, earn passive income through investments, and even launch their own cryptocurrency with one click. It is a powerful tool for interacting with many functions provided by the Waves protocol. Partial Services Offered by Waves Exchange

Partial Services Offered by Waves Exchange

Staking USDN on waves.exchange yields 12–15% returns, settled daily, with instant withdrawal available.

6. Waves Keeper

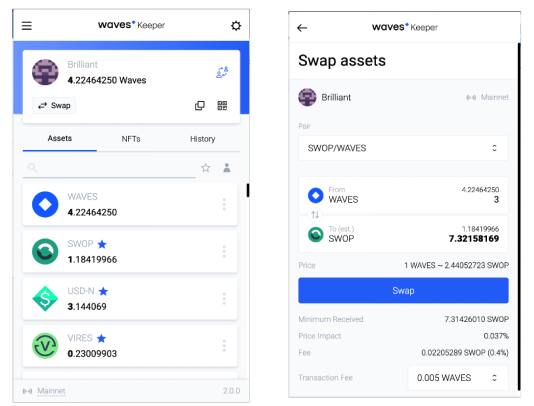

Waves Keeper is a wallet tool within the Waves ecosystem, currently compatible with all major browsers: Google Chrome, Firefox, Opera, and Microsoft Edge.

Waves Keeper Interface

Users can view account assets and NFTs via Waves Keeper, perform fund transfers within the interface, and directly swap assets through integration with Swop.fi.

7. Gravity Protocol

Gravity Protocol is the oracle solution within the Waves ecosystem, enabling on-chain/off-chain data interaction and inter-chain communication.

(1) Real Data

Gravity does not issue a native token, greatly simplifying integration for other applications. If an app wants to use Gravity’s oracle services, it can pay using its own protocol token, and Gravity nodes share in the revenue. Due to aligned incentives, nodes are strongly motivated to deliver accurate, reliable data.

(2) Open Ecosystem

Gravity fosters a more inclusive, open ecosystem, addressing scalability and stability. Beyond supplying data, Gravity nodes also contribute liquidity and enable cross-chain swaps.

Moreover, Gravity links any blockchain to the external world, allowing fully decentralized gateways to be built atop it. It facilitates asset locking and transmits lock information to another blockchain network, enabling seamless cross-chain asset transfers.

Gravity enhances crypto asset liquidity and capital efficiency, enabling diverse use cases for DeFi product development.

8. Waves Ducks

Waves Ducks is a digital duck NFT collection game. All characters, items, resources, and achievements in Waves Ducks are represented as NFTs.

Currently averaging 296,000 monthly active users, it has become the flagship game of the Waves community and actively promotes the growth of the Waves ecosystem.

Gameplay includes:

(1) Battles:Fight for different farms and earn tokens as rewards

(2) Growth:Raise ducklings into higher-tier NFTs, increasing their market value

(3) Breeding:Hatch NFT ducks to expand collections and earning opportunities. Unlike most NFTs, ducks generate EGG tokens usable or withdrawable in-game. Staking NFTs generates passive income.

(4) Guilds:For each activity, Waves Ducks organizes Telegram groups and other community channels. Waves Ducks Community Events

Waves Ducks Community Events

9. Swop.fi

Swop.fi is an AMM-based automated market maker that enables instant token swaps without requiring order creation or waiting for execution.Waves blockchain ensures every transaction completes within seconds, with smart contract call fees as low as 0.005 Waves.

The project is open to liquidity providers: any user can add funds to pools and earn SWOP rewards. Current total value locked (TVL): $21,471,027.

Liquidity providers earn a portion of each pool’s trading fees. Except for the Waves-BTC pool, all other pools include either USDN or EURN as one of the trading assets. USDN staking yields annual returns typically between 8–15%.

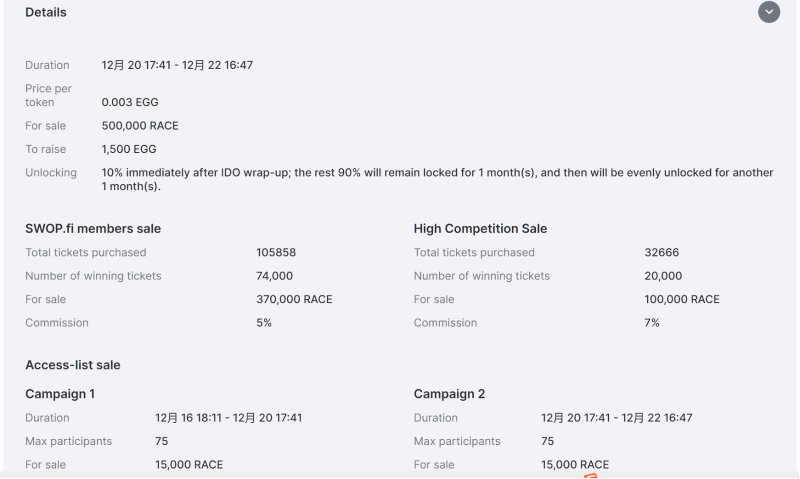

Beyond mining, swapping, and governance,Swop.fi also acts as a launchpad—users can purchase tickets based on SWOP staking amounts to participate in new projects. Swop.fi IDO Project Details

Swop.fi IDO Project Details

10. Waves Association

The Waves Association is a nonprofit organization dedicated to advancing Web 3.0 worldwide, promoting research within the Waves ecosystem and supporting projects built on the Waves protocol.

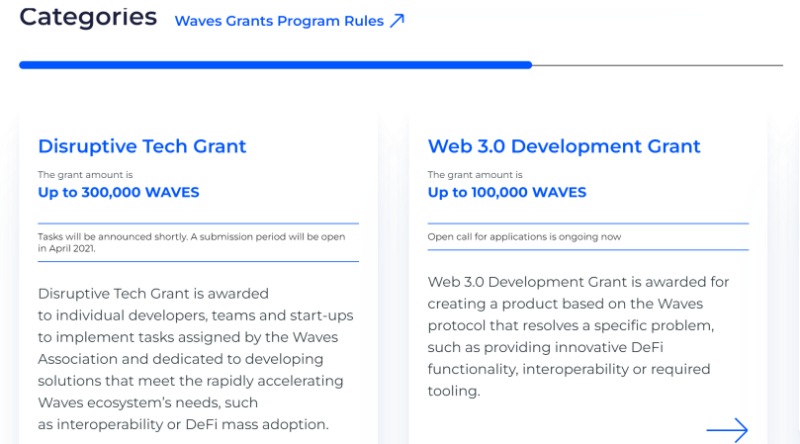

Similar to the Ethereum Foundation, Waves Grants runs funding programs to support individual developers, teams, and startups contributing to the Waves ecosystem.

Funding amounts are determined case-by-case, considering factors such as technical complexity, detail of proposed solutions, developer/team needs, project scale, importance, and other criteria.

All grants operate within the Waves system,grant disbursement and approval processes are executed via DAO.

Waves Association Support Program

The Waves Association recently announced a $1 million Waves grant program for projects developing on the Waves infrastructure. As a core and binding component of Waves Tech, the Waves Association provides governance and support for the entire ecosystem and nurtures Web3 talent.

11. Future Plans

Waves has outlined specific upgrades for version 1→2, including:

(1) Support for Ethereum Virtual Machine (EVM)

By providing extensive development and analytics infrastructure, Waves aims to make adoption easier for external development teams.

(2) Launch of a new DAO governance model

Participants will receive extra rewards and in-game "skins." Waves DAO will upgrade the old futarchy concept, introducing a new universal governance model reportedly surpassing current blockchain capabilities.

(3) Cross-chain Finance

Expand Gravity into a bridge connecting all industry chains, creating an integrated suite of universal bridging solutions.

(4) Expand Operations in the United States

In Q1 2022, Waves established Waves Labs, a U.S. company headquartered in Miami, currently hiring experienced leaders in engineering, business development, and marketing.

For version 2.0, Waves identifies the U.S. as a key market for driving mass adoption in 2022. A primary KPI will be the number of U.S.-based teams building products on Waves.

This spring, Waves announced a $150 million fund and incubation program to meet growing demand, continuing to cultivate talent and market opportunities. Additionally, an independent DeFi fund will launch in Q1 2022 to invest in selected Waves-based DeFi products.

Conclusion

The Waves ecosystem is vast, consistent with its positioning as a public chain focused on financial and fintech applications.

In terms of product composition, the Waves ecosystem connects everything—from DeFi apps like Swop.fi to games like Waves Ducks—through the stablecoin USDN. It also features its own Gravity oracle for reading stablecoin exchange rates, enabling cross-chain data interactions, and bringing off-chain data on-chain. Interoperability between Waves Exchange and DeFi applications creates a smooth user experience.

In terms of business focus, Waves Public Chain serves general consumers, while Waves Enterprise targets enterprises and governments, providing diverse use cases rarely seen on other public chains.

From a public chain perspective, Waves consistently follows technological trends—from DEX to DeFi to stablecoins—and maintains technical advantages. These accumulated capabilities benefit other ecosystem applications. For instance, Waves’ years of cross-chain expertise allow USDN and NSBT tokens to function not only on the Waves chain but also within ecosystems like Ethereum and Binance Smart Chain.

Regarding stablecoins, USDN’s algorithmic mechanism enhanced by the Neutrino protocol is relatively mature. However, its market cap ranking still has room to grow. As previously noted, USDN and Waves mutually influence each other. As the Waves ecosystem expands and the USDN narrative strengthens, USDN’s strategic positioning will attract more capital to Waves, enhancing consensus around both USDN and Waves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News