Looking Ahead to USDT: The King of Liquidity and the Dream of a Digital Dollar

TechFlow Selected TechFlow Selected

Looking Ahead to USDT: The King of Liquidity and the Dream of a Digital Dollar

The foundation of today's market prosperity lies in dollar-pegged stablecoins, with all the shared brilliance stemming from liquidity. USDT remains the dominant player, capturing over half of the market share.

By Ping

Looking back at various institutions' predictions for 2022, most focus on shifts in underlying public blockchains and application-layer trends. One overlooked yet crucial area is stablecoins.

Today, dollar-backed stablecoins form the foundation of market prosperity—every success story stems from liquidity—and USDT remains the dominant player, holding over half the market share.

A curious phenomenon exists: despite ongoing skepticism toward USDT, most people cannot do without it.

Tether, the issuer of USDT, has long faced criticism over insufficient and opaque collateral, with some viewing it as a potential systemic risk within the blockchain industry. However, Tether actively responded to these concerns last year by disclosing more details about its reserves. In August, an asset quarterly report audited by Moore Cayman revealed that commercial paper and certificates of deposit constitute the majority of Tether’s backing assets. Tether emphasized that most of these instruments are highly liquid and have strong credit ratings (Moody’s A2 or above). In December, another audited report was released by Moore Cayman, while Tether also began publishing a “daily updated reserve balance sheet” on its website (https://wallet.tether.to/transparency), underscoring that reserve assets consistently exceed the amount of issued stablecoins.

Beyond the crypto space, USDT's influence is increasingly extending into the real world.

In February last year, USDT even became the official currency of Myanmar’s shadow government—a move that significantly reinforced the U.S. dollar’s status as the global hegemonic currency and strengthened its influence across geopolitical and digital activities.

Connor Spelliscy, founder of Blockchain Association—a U.S.-based blockchain policy advocacy group—argues that stablecoins do not threaten the dollar; instead, they expand USD circulation and generate greater demand for dollar usage. He further notes that even though controversies surround USDT, the largest stablecoin in the market, it would be unwise for the U.S. Federal Reserve, which lacks an official digital currency plan, to impose overly strict regulations on private stablecoins while other countries race to launch central bank digital currencies (CBDCs). Such rigidity could push the blockchain industry overseas or toward alternative CBDC ecosystems, making balanced regulation of dollar-backed stablecoins even harder to achieve.

The tangible impact of USDT and other stablecoins in global markets is now deeply intertwined with the development of the broader cryptocurrency sector and the global political-economic landscape, significantly shaping the trajectory of U.S. stablecoin regulatory policy.

Overall, I believe the global stablecoin market will continue growing in 2022, and compared to other stablecoins like USDC, PAX, and TUSD, USDT enjoys superior liquidity and global reach—a trend unlikely to be disrupted anytime soon.

The Market Logic of Stablecoins

Stablecoins serve two primary purposes. First, they meet the need for liquidity in cryptocurrency trading markets by creating a widely accepted, stable-value transaction medium within the crypto ecosystem. Dollar-pegged stablecoins, particularly USDT, have gradually become the consensus standard in centralized exchanges, dominating trading volume shares. The second function is serving as a substitute for traditional dollars. As cryptocurrencies gain global adoption and USDT maintains reliable convertibility worldwide, increasing numbers of users view dollar-backed stablecoins as viable alternatives to physical USD. USDT holds clear advantages here: in cross-border transactions, it offers significantly faster speeds and lower fees than traditional financial systems for dollar exchange.

In short, stablecoins like USDT play key roles both on-chain and off-chain.

Unlike other cryptocurrencies that blend characteristics of both money and equity markets, stablecoins deliberately exclude the price volatility inherent in equity markets, focusing solely on fulfilling the role of a monetary instrument—providing stable liquidity.

As Nobel laureate Bengt Holmstrom outlines in "Understanding the Role of Debt in the Financial System," money markets and stock markets operate under fundamentally different logics. Stock markets exist to manage risk. Participants are highly sensitive to information, demanding transparency so they can assess company value and risk, reflected through price discovery mechanisms that establish current market consensus.

Money markets work differently. Rather than managing risk, their core purpose is facilitating liquidity. Under normal conditions, money markets lack dynamic price discovery based on new information. Instead, participants prioritize liquidity and universality. There is an implicit mutual understanding—or “symmetric ignorance”—about the issuer’s backing, meaning participants don’t require detailed disclosures and remain relatively indifferent to informational nuances.

Holmstrom argues that opacity is intrinsic to money markets. Excessive disclosure risks disrupting this state of symmetric ignorance, turning otherwise uninformed participants into informed ones who may react emotionally—sparking panic or euphoria—that triggers unnecessary price fluctuations, thereby undermining the stability and liquidity essential to money markets.

Therefore, the benchmark for evaluating stablecoin success should not center on whether full collateralization exists or how transparent the issuer is, but rather on liquidity. This explains why TerraUSD (UST), despite lacking any real asset backing, saw its issuance surge to tens of billions of dollars—driven entirely by liquidity generated within the Terra ecosystem and its integration with IBC.

By releasing audited quarterly reports and daily updated reserve statements, Tether emphasizes that USDT issuance remains over-collateralized with credible assets—enough to sustain market confidence and preserve the symmetric ignorance necessary for broad consensus.

USDT’s current level of transparency likely does not harm liquidity—in fact, it may enhance it—aligning with the inherent logic of money markets and reinforcing effective monetary consensus, accelerating USDT’s global expansion.

Liquidity Advantage

USDT’s liquidity advantage manifests primarily in the number of on-chain trading pairs, trading depth, OTC liquidity against fiat currencies, and secondarily in off-chain usage.

According to CoinMarketCap data from December 30, USDT’s daily spot trading volume reached $64.7 billion, accounting for 87.13% of total stablecoin trading volume ($74.3 billion)—far surpassing BUSD ($4.3 billion) and USDC ($3.6 billion).

Although TerraUSD (UST) rapidly grew to a $10 billion market cap, its daily trading volume stood at only $129 million—a mere 1.3% turnover ratio. In contrast, USDT’s ratio is 83%, indicating most UST remains locked in DeFi yield pools rather than circulating actively. Clearly, UST and USDT serve different monetary functions.

USDT still leads in the number of trading pairs on centralized exchanges, remaining the preferred stablecoin for converting between crypto assets. Outside North America, local exchanges often offer only USDT-to-local-fiat trading pairs. Similarly, USDT dominates the OTC market. Its unmatched global liquidity and interoperability represent USDT’s most irreplaceable strength. While other stablecoins may better satisfy regulatory requirements in North America, they fail to meet global liquidity demands, leaving them unable to challenge USDT’s dominance.

Not only do most USDT-to-local-fiat pairs enjoy stable liquidity, but USDT often trades at a premium over USD itself when converted to local currencies. For example, MAX—the most popular fiat gateway in Taiwan—only supports USDT deposits. Here, USDT/TWD trades at 27.83, slightly above the official USD/TWD rate of 27.64, creating a subtle but persistent state where USDT holds higher value than USD. A similar premium appears on Binance’s TRY/USDT pair in Turkey, further boosting USDT’s regional trading volumes.

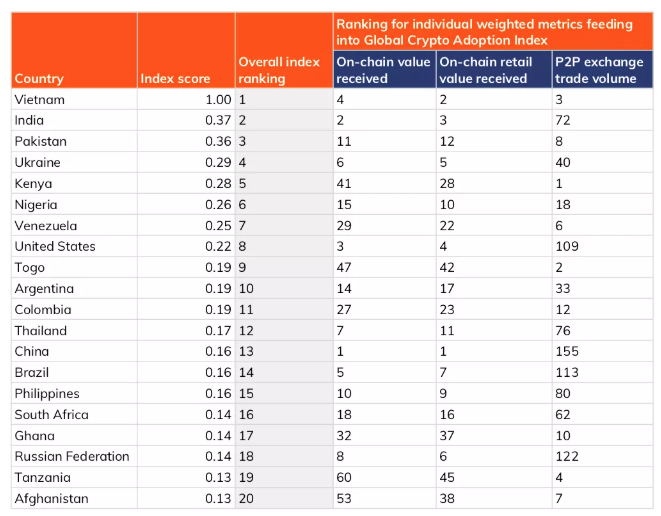

According to Chainalysis’ Cryptocurrency Adoption Index, top-ranking countries such as Vietnam, India, Pakistan, and Ukraine rely heavily on USDT-based OTC markets for onboarding. Local centralized exchanges in India and Ukraine support only USDT for fiat-to-stablecoin conversions, while other stablecoins like USDC and GUSD show almost no liquidity against local currencies.

Looking at trading volumes across Binance—the largest exchange—most fiat-to-crypto trades still go through USDT rather than directly purchasing BTC or ETH. Even on Binance, fiat-to-BUSD pairs remain niche, with far lower volume than USDT. USDT’s unparalleled global liquidity and deep integration with real-world economies remain beyond the reach of competitors.

The Dream of a Digital Dollar

Currently, USDT’s biggest rival in the crypto space is USDC. Though both aim to become de facto digital dollars, their growth strategies differ.

USDT thrives in trading environments—where high liquidity is paramount—while USDC gains traction through DeFi use cases such as lending and yield farming.

For USDC to maintain high growth, it must deepen its penetration into DeFi ecosystems. However, a major obstacle lies ahead: in today’s multi-chain environment, each blockchain ecosystem is launching and promoting its own native dollar-pegged stablecoin—BSC with BUSD, Terra and Cosmos with UST, and the new DeFi alliances with MIM—thereby diluting USDC’s influence within DeFi.

Last year, USDC also faced a crisis of trust. Initially claiming full cash backing, Circle disclosed in its July 2021 reserve report that only 61% of reserves consisted of cash and U.S. Treasuries, with the remainder made up of Yankee certificates of deposit (13%), commercial paper (9%), corporate bonds (5%), municipal bonds, and agency securities (0.2%). This sparked backlash and scrutiny. Subsequently, Circle pledged to shift USDC reserves entirely to cash and short-term U.S. Treasuries. In October, Circle received a subpoena from the SEC requesting information on certain projects.

Though both USDT and USDC act as free riders on dollar hegemony, USDT’s widespread circulation and accessibility actually reinforce the dollar’s dominant role in pricing digital assets. Stablecoins drive increased global usage of digital dollars, enhancing the dollar’s presence and penetration across cyberspace and international finance.

Stablecoins do more than facilitate exchange—they profoundly impact real-world politics and economics. Thanks to low and fast transaction fees, USDT serves as a cost-effective tool for cross-border remittances, bypassing traditional banking fees. It also acts as a hedge in countries suffering currency instability, sometimes even replacing local currencies outright.

In December 2021, Myanmar’s opposition-led National Unity Government (NUG) declared USDT its official currency to circumvent surveillance and enable domestic circulation, even issuing government bonds denominated in USDT.

During Turkey’s recent currency depreciation crisis, many switched TRY into USDT as a safe haven. Recently, dental clinics in Taiwan have started accepting USDT for medical payments—evidence that USDT’s value as a stable currency has gained broad recognition globally, spawning numerous real-world payment applications unmatched by other stablecoins.

Moreover, the U.S. government’s seemingly hardline stance on stablecoins may reflect only the views of a few conservative policymakers. Reality is more nuanced. During a recent Senate Banking Committee hearing on stablecoins, Democratic senators Elizabeth Warren and Sherrod Brown labeled all stablecoins as potentially dangerous scams requiring stringent crackdowns. Republican senator Patrick Toomey, however, advocated for a balanced regulatory framework that encourages blockchain innovation.

Connor Spelliscy of the Blockchain Association reiterates that stablecoins do not endanger the dollar—they strengthen it by expanding USD usage and reinforcing dollar hegemony. Aggressively suppressing or rejecting stablecoins would undermine the dollar’s current global standing.

From a macro perspective, until a fully state-controlled digital dollar can replace USDT, imposing excessive regulation on the largest dollar-backed stablecoin would be a self-defeating move that harms U.S. monetary dominance and global influence—a scenario unlikely to materialize.

However, USDT’s absence from the booming decentralized application sector poses a long-term concern. Currently, there are no flagship DApps built around USDT. Only basic DeFi services utilize it extensively. Leading decentralized exchanges like Uniswap favor WETH and USDC, while PancakeSwap relies on WBNB and BUSD. Emerging sectors like NFTs and GameFi rarely use USDT for pricing or transactions—this gap represents a genuine vulnerability.

In summary, USDT benefits from substantial over-collateralization and possesses an unrivaled liquidity advantage. It is not only the cornerstone stablecoin in centralized trading but is also increasingly bridging the crypto and fiat worlds, effectively functioning as a real-world digital dollar—a position and trend unlikely to be overturned anytime soon.

TechFlow is a community-driven platform dedicated to delivering valuable insights and thoughtful analysis.

Community:

WeChat Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: TechFlowPost

To join our WeChat group, add assistant WeChat: TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News