An old letter ignites loyalty crisis, Ethereum Foundation faces renewed criticism

TechFlow Selected TechFlow Selected

An old letter ignites loyalty crisis, Ethereum Foundation faces renewed criticism

Ethereum's biggest enemy is the Ethereum Foundation.

Author: David, TechFlow

"I feel like I'm a somewhat useful fool for the Ethereum Foundation."

On October 19, a public letter written a year and a half ago was posted on Twitter, and this sentence quickly ignited discussions across the crypto community.

The author isn't some fringe Ethereum critic, but Péter Szilágyi:

The former lead of Geth, the Ethereum client that once powered over 60% of nodes, and a core developer who has worked in this ecosystem for nine full years.

Does this feel familiar?

If you've followed Ethereum long enough, you'll notice this scene repeats every few months:

Criticism toward the Foundation (EF) suddenly erupts, the community dives into heated debate, Vitalik responds, and then everything calms down—until the next explosion.

In 2022 it was concerns about centralization after The Merge, in 2023 it was researcher conflicts of interest, in 2024 it was L2 fragmentation.

Now, the powder keg has been ignited by an old letter.

The phrase "useful fool" acts like a knife, puncturing a long-maintained illusion and striking a nerve with many Ethereum contributors.

Rarely outspoken core contributors—including Polygon founder Sandeep and DeFi pioneer AC—have one after another stepped forward. Their shared message can be summed up in one sentence:

We’ve been let down.

The specific issues they raise cut straight to the core: Where did the money go? Why do the most loyal get the least? And who is truly steering Ethereum’s direction?

These questions aren’t new, but when voiced by Ethereum’s innermost contributors, their weight and context are entirely different.

We can start by closely reading this letter to understand what a nine-year technical leader experienced to describe himself as a fool.

Nine Years of Loyalty, One Letter of Disappointment

On May 22, 2024, when Péter Szilágyi wrote this letter, he may have been trapped in a painful cycle.

The letter begins sincerely. Péter says he had grown increasingly confused and pained over the years about Ethereum and his role within the Foundation. He tried to clarify his thoughts—that's why this letter exists.

The entire content reflects the numerous problems a loyal developer witnessed throughout his career regarding Ethereum and the Foundation.

-

Issue One: Called a Leader, Treated as a Useful Fool

Péter bluntly states he feels used by the Foundation as a "useful fool".

He explains that whenever internal controversies arise—such as researchers receiving money from external companies creating conflicts of interest, or new proposals clearly favoring certain interest groups—the Foundation would push him, the "troublemaker", to speak out against them.

Reviewing Péter’s past tweets, there’s indeed a sharp, candid tone—he often discussed various issues within the Ethereum ecosystem. But this long letter reveals those statements were more like performances staged to serve the Ethereum Foundation’s collective interests.

This way, the Foundation could claim: "Look how democratic we are—we have internal dissent."

The problem is, each time Péter challenged powerful figures or well-connected insiders, his credibility eroded a little. Supporters of the other side attacked him, accusing him of obstructing progress. Over time, he and the Geth team became seen as troublemakers.

"I could choose silence and watch Ethereum’s values trampled, or I could speak up and gradually destroy my own reputation," he wrote. "Either way, the outcome is the same—Geth will be marginalized, and I’ll be excluded."

-

Issue Two: Six Years, $600K—High Effort, Low Pay

During Péter’s first six years at Ethereum (2015–2021), he earned a total of $625,000. Note: this is the sum over six years, pre-tax, with no equity or bonuses. That’s roughly $100,000 per year on average.

During the same period, ETH’s market cap grew from zero to $450 billion.

As the person responsible for maintaining the network’s most critical infrastructure, Péter’s pay might have been lower than that of a fresh graduate programmer in Silicon Valley.

He mentioned that salaries in other Foundation departments—operations, DevOps, even some researchers—were even lower.

Why is this? Péter quoted something Vitalik once said: "If someone isn’t complaining about low pay, the pay is too high."

Staying focused on tech, not caring much about compensation—this does fit the ideal image of certain tech geeks and cypherpunks. But the issue is, long-term low pay creates negative consequences.

Those truly dedicated to protocol development, unable to earn decent salaries within Ethereum, are forced to seek compensation elsewhere.

Thus arise various conflicts of interest: researchers consulting for outside projects, core developers accepting private sponsorships.

Péter stated directly: "Almost all early Foundation employees have already left, because that’s the only reasonable way to receive compensation matching the value they created."

-

Issue Three: Vitalik and His Inner Circle

The sharpest part of the letter analyzes Ethereum’s power structure.

Péter admits he deeply respects Vitalik personally, but points out a fact:

Whether or not Vitalik intends to, he unilaterally decides Ethereum’s direction. Wherever Vitalik focuses his attention, resources follow;

Whatever project he invests in succeeds;

Whatever technical path he endorses becomes mainstream.

Worse, around Vitalik has formed a "ruling elite of 5–10 people." They invest in each other, serve as mutual advisors, and control resource allocation across the ecosystem.

New projects no longer do public fundraising—they go straight to these 5–10 individuals. Securing their investment equals a ticket to success.

"If you get Bankless (a prominent podcast) to invest, they’ll hype you on their show. If you get a Foundation researcher as advisor, technical resistance drops."

This resembles a familiar office politics game—success doesn’t come from technology or innovation, but from winning over the people around Vitalik.

-

Issue Four: Idealism Hurts Most

Toward the end, Péter’s tone shifts from anger to sorrow. He says he turned down countless high-paying offers over the years because he believed in Ethereum’s ideals.

But now the entire ecosystem chants, "It’s just business." He can’t accept this mindset, yet sees no way forward.

"I feel that within Ethereum’s grand vision, Geth is seen as a problem—and I am at the center of that problem."

This letter was written in May 2024. A year later, in June 2025, Péter left the Ethereum Foundation. Reportedly, he rejected a $5 million offer from the Foundation and spun Geth out as a private company.

He chose to leave completely, rather than turn ideals into business.

Chain Reaction: Big Names Speak Up

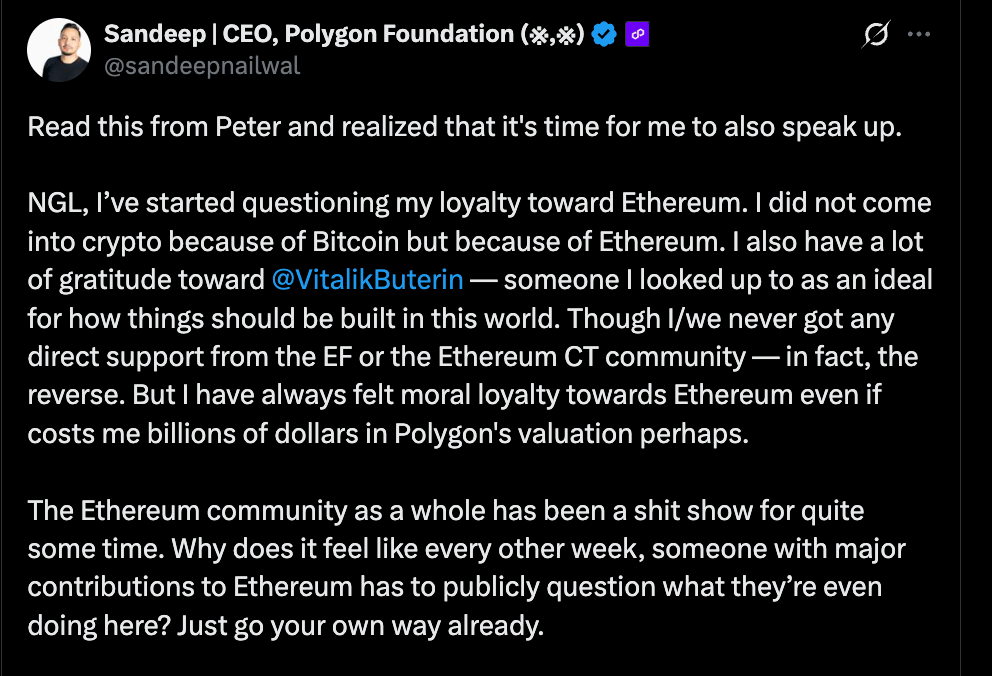

Within 24 hours of Péter’s letter going public, Polygon founder Sandeep Nailwal couldn’t stay silent, quoting Péter’s post to share his own feelings.

Polygon is one of Ethereum’s largest Layer 2 projects, processing massive transaction volume and hosting numerous apps including the prediction market Polymarket.

You could say Polygon has made enormous contributions to Ethereum’s scalability.

But Sandeep says, Ethereum’s community has never truly accepted Polygon.

There’s a strange double standard in the market, he writes. "When Polymarket succeeds, media calls it a 'win for Ethereum.' But Polygon itself? Not considered Ethereum."

This isn’t just about recognition—it translates to real financial loss.

Sandeep goes further: if Polygon declared itself an independent L1 instead of an Ethereum L2, its valuation could instantly jump 2–5x.

For example, Hedera Hashgraph, a relatively niche L1, has a market cap exceeding the combined total of four major L2s: Polygon, Arbitrum, Optimism, and Scroll.

As for why not switch to L1, Sandeep says it’s due to moral loyalty to Ethereum—even though that loyalty may cost him billions in valuation.

But what has this loyalty earned?

People in the community keep saying Polygon isn’t a real L2. Growth tracking site GrowthPie refuses to include Polygon’s data. Investors don’t count Polygon in their “Ethereum ecosystem” portfolios.

In Sandeep’s original post, there’s a particularly painful rhetorical question:

"Why does an Ethereum contributor question themselves every single week?"

He tells the story of his friend Akshay, who initially supported Polygon but was turned off by how the Ethereum community attacks successful projects while promoting “political correctness.” In the end, Akshay took his talent to Solana and helped build its empire.

Even Polygon’s shareholders question his decisions, asking: You have a fiduciary duty to Polygon—why sacrifice company value for so-called loyalty?

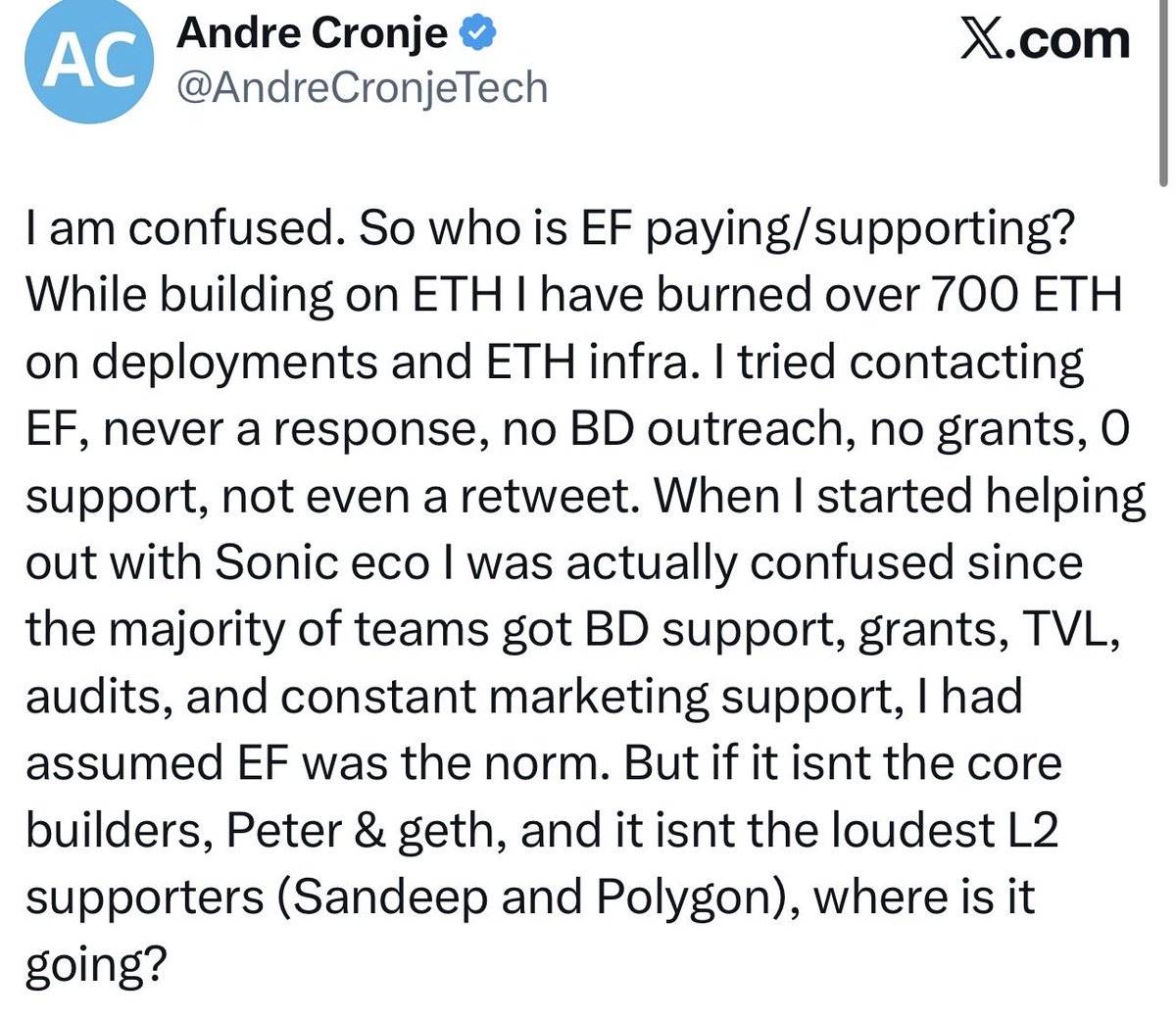

Another voice joining in is DeFi legend Andre Cronje.

Andre’s post is brief but sharp:

"I’m confused. Who exactly is EF paying/sponsoring? When I built on ETH, I burned over 700 ETH just deploying contracts and infrastructure. I tried reaching out to EF—no response, no BD outreach, no funding, zero support, not even a retweet."

700 ETH is worth about $2.66 million at current prices—all paid out of Andre’s own pocket.

The irony deepens: when AC started helping the Sonic ecosystem, he was surprised to find most teams received ongoing BD support, funding, liquidity, and audit assistance.

Then comes an even more painful soul-searching question:

"If the money didn’t go to core builder Peter and Geth, or to the loudest L2 supporter Sandeep and Polygon, where did it go?"

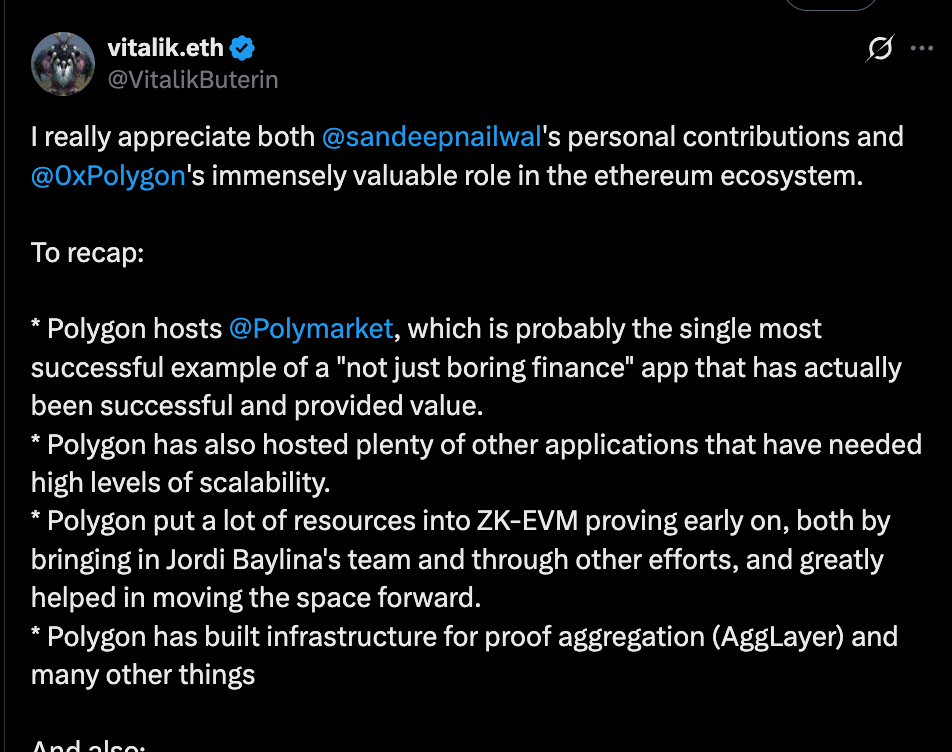

Vitalik Responds—Dodging the Real Issues

In response to these criticisms, Vitalik issued a reply on October 21 to Sandeep’s comments. His response was long and included:

-

A detailed list of Polygon’s contributions (hosting Polymarket, advancing ZK tech, etc.)

-

Extended praise for Sandeep’s charitable work (donating medical supplies to India)

-

Thanks for Sandeep returning $190 million in SHIB token profits

-

A suggestion for Polygon to adopt the latest ZK upgrades

But upon closer reading, you’ll notice he didn’t address a single word about the three core issues: low pay, lack of funding transparency, or the closed power circle.

This evasion might itself be an answer.

These responses together point to a truth everyone sees but no one wants to state: Ethereum’s resource allocation is seriously flawed.

The most loyal contributors get no support, while those skilled at “playing the game” receive abundant resources. The Foundation sold over $200 million in ETH in 2025, but clearly, that money didn’t go to those actually building the protocol.

Ethereum’s Greatest Enemy Is the Ethereum Foundation

The storm triggered by Péter’s letter may be buried under new headlines in two weeks, but the problems it revealed won’t disappear.

In fact, collective criticism of the Ethereum Foundation repeats every few months.

For today’s Ethereum, its greatest enemy isn’t Solana or other chains—it’s the Ethereum Foundation itself.

Ethereum has grown from a geek project into a multi-hundred-billion-dollar ecosystem, yet its governance structure and culture remain stuck in the early days.

In Péter’s words, the Foundation is still managing a massive system requiring “additive thinking” with a “subtractive mindset.”

The deeper reason may be that Ethereum has fallen into classic big-company disease.

All growing startups face issues like bureaucracy, factionalism, and innovation stagnation—and Ethereum is no exception.

The difference is, traditional companies can respond with equity incentives or management reform, but Ethereum, as a decentralized project, can neither admit it’s centralized nor achieve true decentralization.

So we see a core contradiction: it must maintain the appearance of decentralization while operating in practice through highly centralized decision-making.

Vitalik’s existence epitomizes this contradiction.

On one hand, the community needs his vision and leadership; on the other, his very presence negates decentralization.

This creates a strange “decentralization theater”—everyone performs decentralization, yet everyone knows where real power lies.

The cost of this performance is enormous.

As Sandeep pointed out, Ethereum’s community pretends to embrace egalitarianism while being controlled by tight-knit circles—more hypocritical than pure capitalism.

At least on Solana or other centralized chains, the rules of the game are clear.

Now, the ball is in Vitalik and the Foundation’s court. Their choices will shape not just Ethereum, but the entire trajectory of the crypto movement. Will they continue the decentralization theater, or bravely confront reality?

Time will tell. But one thing is certain: those “useful fools” like Peter won’t stay silent forever.

The next eruption may be more than just a letter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News