Could it be that memes are actually the crypto money printers you can mine?

TechFlow Selected TechFlow Selected

Could it be that memes are actually the crypto money printers you can mine?

While most meme coin traders are losing money, the infrastructure builders who create the trading ecosystem are capturing most of the market value.

Author: Will Owens

Translation and compilation: Saoirse, Foresight News

Key Takeaways

-

Meme coins currently account for around 30% of Solana’s decentralized exchange (DEX) trading volume, down from 60% in January.

-

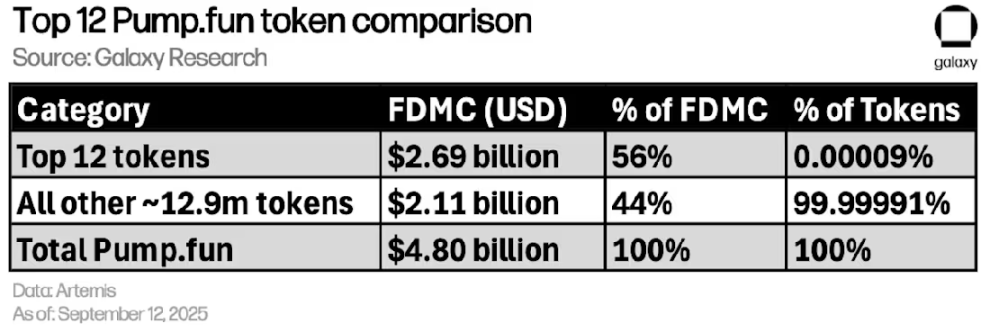

Out of approximately 12.8 million tokens launched on Pump.fun, only 12 (0.00009%) account for over 55% of the platform’s total fully diluted market cap (FDMC).

-

The total FDMC of tokens on Pump.fun exceeds $4.8 billion.

-

This figure represents over 85% of the total FDMC across all token launch platforms on Solana, surpassing all other platforms combined.

-

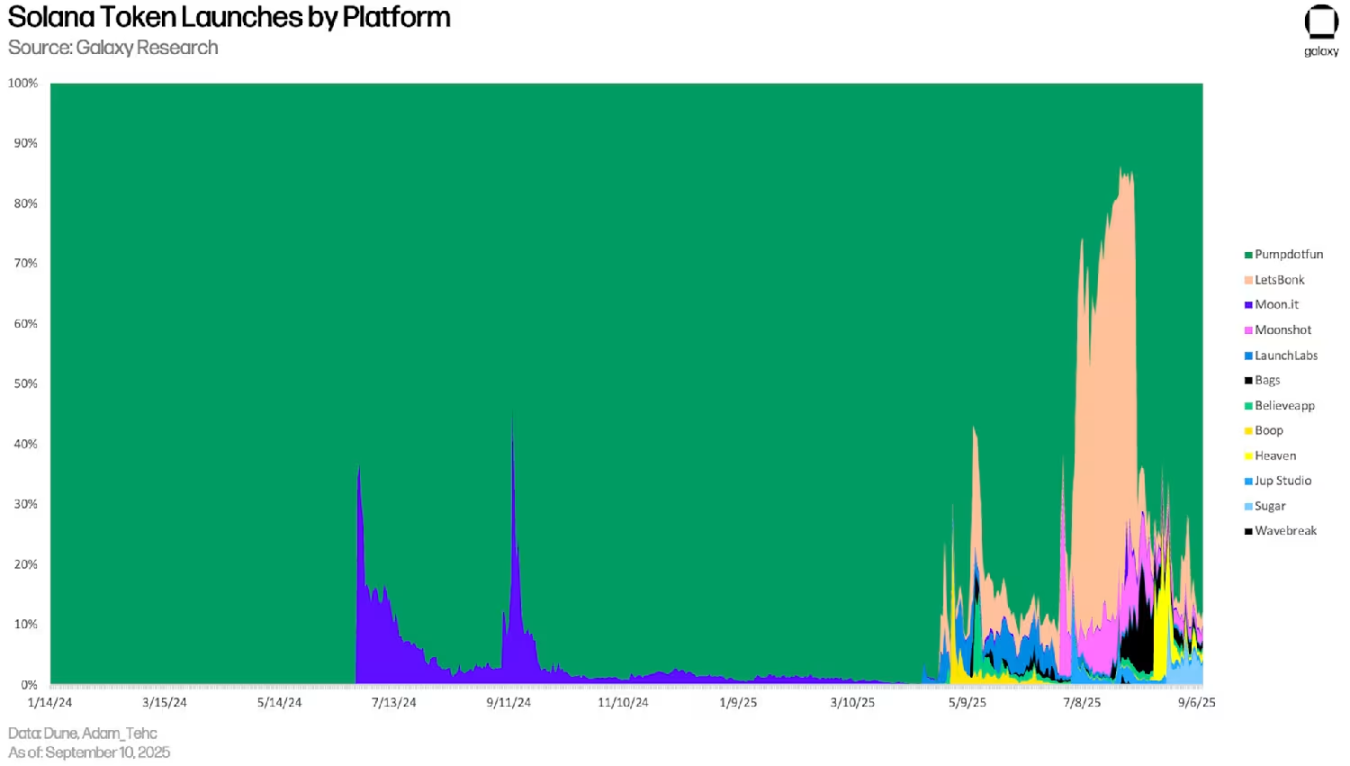

Pump.fun has maintained a dominant share of Solana’s launch platform market since its inception, briefly overtaken by others only twice.

-

This past summer, Bonk.fun was the only competitor to briefly surpass Pump.fun.

-

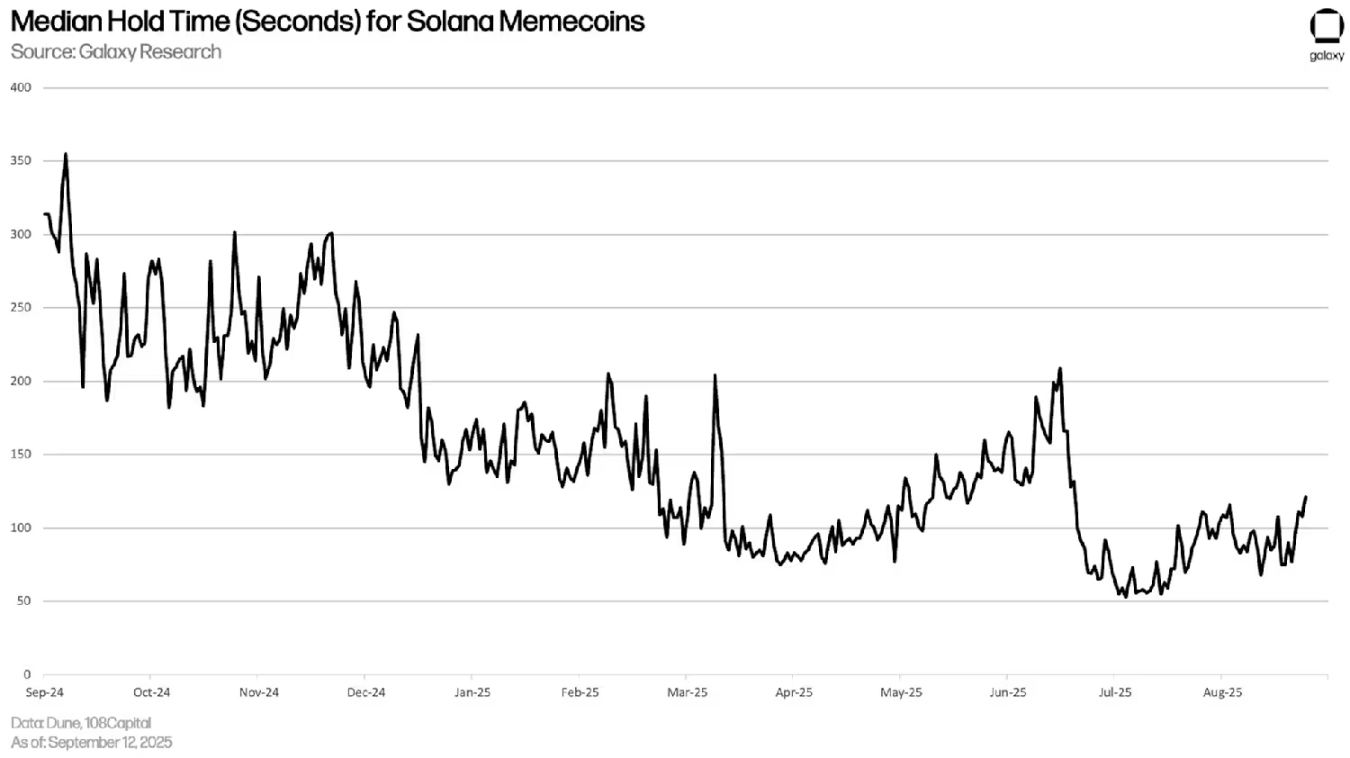

The median holding time for Solana meme coins is now about 100 seconds, down from 300 seconds previously.

-

This short-term speculation highlights the increasingly high-frequency, player-versus-player (PvP) nature of the trading environment.

-

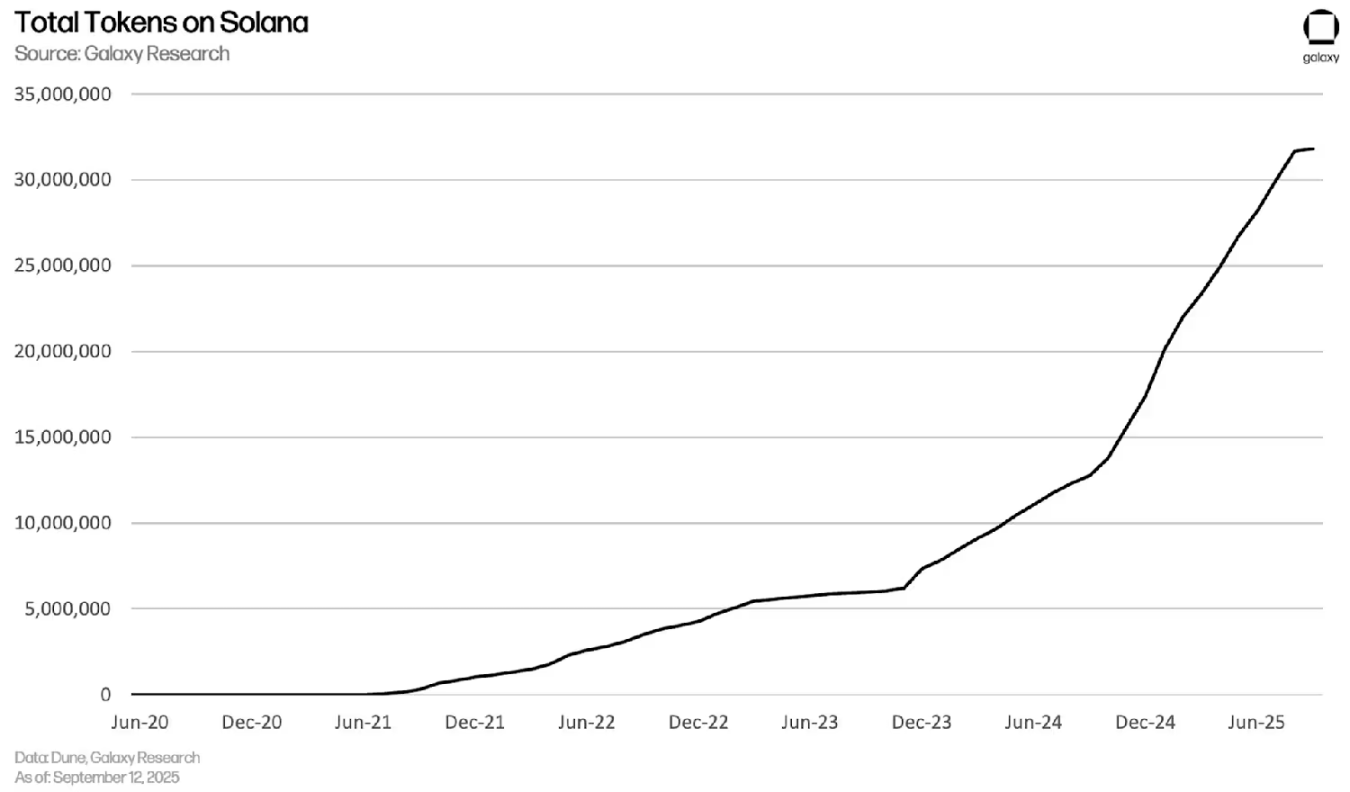

The number of tokens on the Solana blockchain now exceeds 32 million, compared to fewer than 8 million before Pump.fun launched in January 2024.

-

This means token count has grown by over 300% in less than two years.

-

Meme coins serve as compelling "on-ramps" into crypto, attracting new users to wallets and decentralized exchanges (DEXs).

-

The meme coin ecosystem follows a power-law distribution, where a small number of tokens capture the vast majority of market value.

Meme coins are a significant pillar of the cryptocurrency market, yet often carry stigma and controversy. Since most meme coins either trend toward zero or are outright scams, critics dismiss them as worthless assets — and fairly so, as this is true for the vast majority. Like all trading, the meme coin market is inherently zero-sum: one trader’s gain comes at another’s loss. But unlike assets with potential cash flows or real utility, meme coins offer little beyond cultural value, making losses not only more common but also more severe. In Galaxy's 2024 research report, we outlined these market dynamics and argued that meme coins should not be entirely dismissed. A year later, this space has become even more complex and important.

Although joke tokens have existed since early crypto days (e.g., Dogecoin launched in 2013, followed by the short-lived Coinye West in 2014), the modern era of meme coins began with Dogecoin’s price surge in 2017. This led to Shiba Inu, then BONK and Dogwifhat on Solana, culminating in the emergence of Pump.fun in early 2024. It was this launch platform that spawned millions of meme coins like MOODENG, Pnut, and TROLL.

Pump.fun has fundamentally reshaped the landscape. For the first time, it reduced the barrier to launching a meme coin to nearly zero: anyone can create a tradable, liquid token using a bonding curve model for just a few dollars and no coding skills. This marked a structural shift in the meme coin space — an explosion in token issuance and the rise of launch platforms as the “new standard.”

Pump.fun homepage, a quintessential example of "radical speculator" culture

While altcoins typically claim some form of “utility” (governance rights, fee sharing, access to services, etc.), meme coins are defined by their lack of utility. Their sole function is to act as “cultural tokens” — carriers of ideas, community builders, and symbols of collective identity, nothing more.

The core logic behind trading meme coins isn’t based on fundamentals, but rather what might be called “cultural arbitrage”: predicting or getting ahead of attention cycles. For instance, buying a meme coin before it goes viral on TikTok but before the broader market catches on.

In the long run, the vast majority of participants in meme coin trading will lose money, and in many ways, this activity resembles pure gambling. However, dismissing the entire space would be overly hasty and overlook its deeper significance.

The meme coin ecosystem faces numerous challenges, especially on the Solana blockchain — which dominates overall meme coin trading volume. Within minutes of a token’s launch, “snipers” and “bundlers” grab large portions of supply, setting the stage for future sell pressure. The median holding time for meme coins is measured in seconds, as traders flip new pairs quickly for short-term gains.

Yet meme coins have become a permanent category in crypto markets. In an increasingly digital world, purely cultural assets have intrinsic legitimacy. More importantly, they serve as on-ramps into crypto: they attract new retail users to wallets and DEXs who otherwise might never engage with such products. For many, meme coins are their first step into crypto-native infrastructure, opening doors to deeper DeFi participation.

Market Size and Trading Activity

Since early 2024, the meme coin market has expanded at an astonishing pace. On Solana alone, over 32 million distinct tokens have been created — a scale unimaginable before Pump.fun’s launch. Simply by improving UX and removing technical barriers to token creation, the entire ecosystem was transformed. Previously, launching a token required manual liquidity pool management and significant capital; now, anyone with internet access can instantly deploy a tradable token at minimal cost.

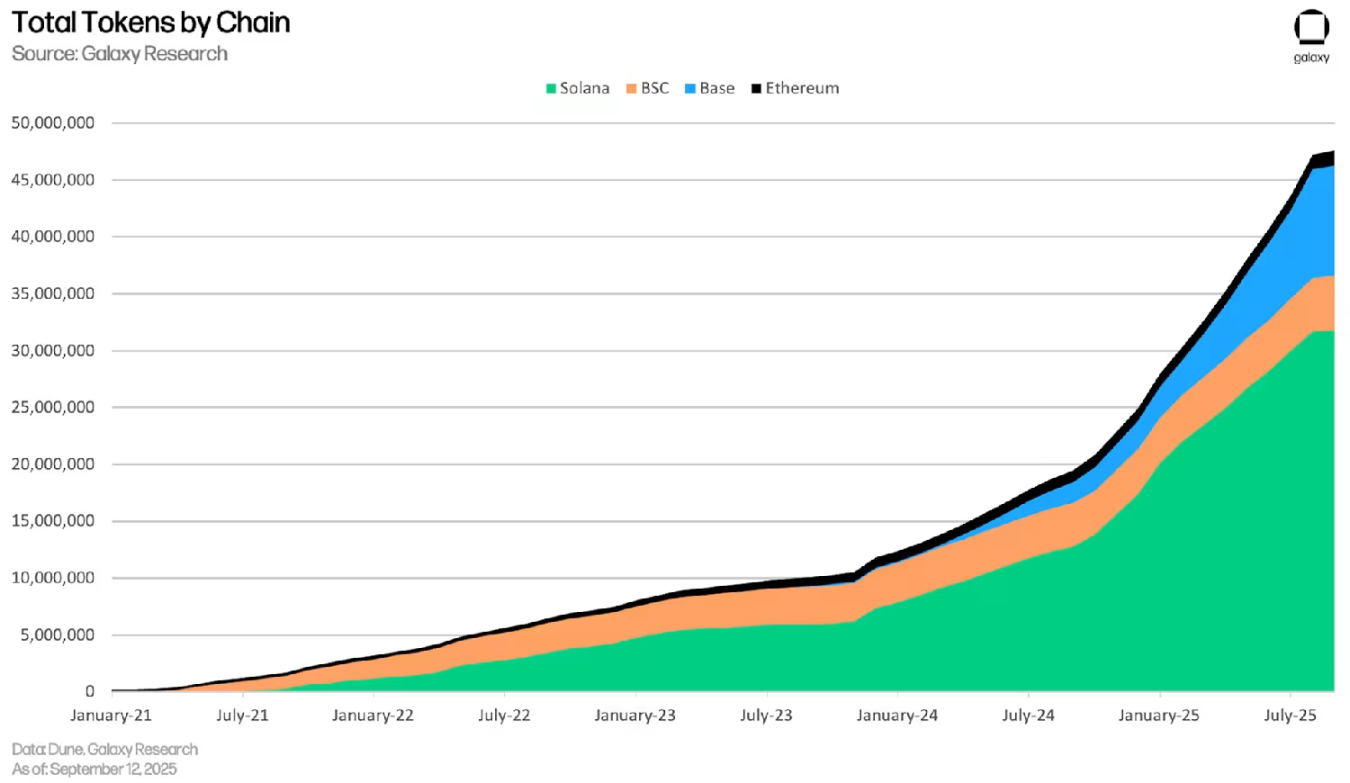

Solana’s high throughput and low fees make it a natural breeding ground for token launches, far outpacing other blockchains in token count. However, in terms of spot trading volume for meme coins, Binance Smart Chain (BSC) leads — driven by platforms like four.meme. Recently, AsterDEX’s TGE further boosted visibility for the BSC ecosystem.

Total number of tokens on Solana

This trend holds when expanding to Ethereum, Base (Coinbase’s L2), and BSC. Together, these chains host over 57 million tokens, with Solana accounting for 56%, leading the pack. Ethereum hosts more “traditional/community-driven” meme coins like PEPE, MOG, and SPX6900; Base’s meme coin market continues growing, particularly strong in SocialFi-style meme coins like those from Zora. In short: Solana is the epicenter of trending memes and cultural movements, Ethereum is home to established meme coins, and Base leads in niche launch platforms — especially AI-related and social tokens (Zora).

Notably, the Base team recently announced a cross-chain bridge between its Ethereum L2 and Solana, enabling liquidity flow between the two chains.

Token counts across blockchains

Next, we examine the competitive landscape among meme coin launch platforms. This past summer, Pump.fun briefly lost market share to Bonk.fun, but has since reclaimed absolute dominance in Solana token issuance. Competition in this space is fierce: new platforms constantly emerge, trying to differentiate via incentive tweaks or branding, but such advantages are often fleeting.

Sometimes, new platforms capture attention through niche innovations. For example, HeavenDEX experimented with novel tokenomics, quickly attracting liquidity and users, only to see its market share rapidly erode. This reflects a common crypto trend: traders swiftly move to the next “hot token,” with everyone racing to get in first.

Despite Solana traders’ attention spans rivaling TikTok videos, Pump.fun’s position remains solid. Currently, the launch platform market exhibits a “winner-takes-all” dynamic.

Solana token issuance by platform

Of the roughly 32 million tokens on Solana, Pump.fun alone accounts for about 12.9 million. The platform has effectively industrialized token issuance on Solana. No other platform comes close — its output exceeds the combined totals of all competitors.

Readers may recall celebrity-launched tokens like Kanye West’s TRUMP coin. These high-profile projects bypassed standard launch platforms, instead partnering directly with Meteora, a Solana-based DeFi protocol offering dynamic liquidity infrastructure. This allows teams to manually configure liquidity pools and manage distributions, giving them greater control while reducing risks of bots or snipers hoarding tokens cheaply during early stages.

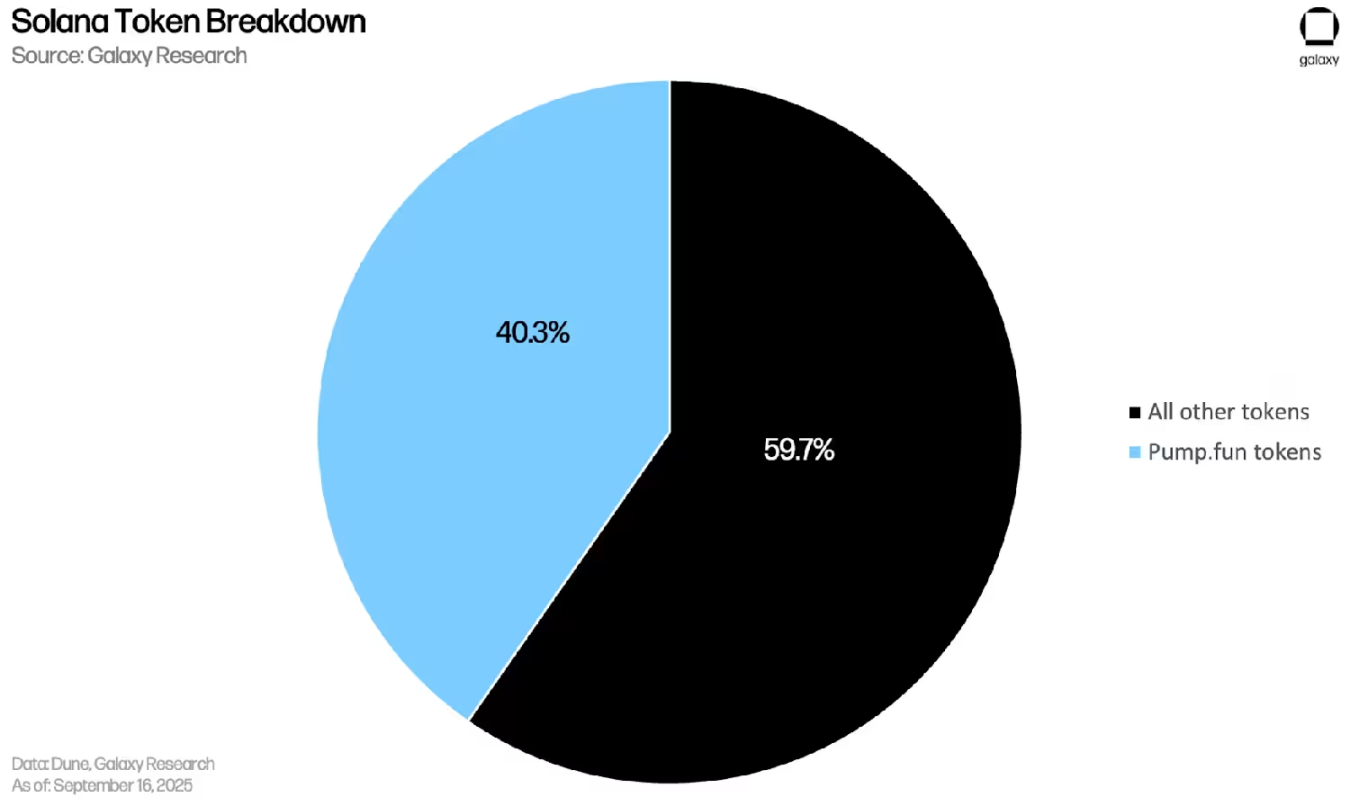

Composition of Solana tokens

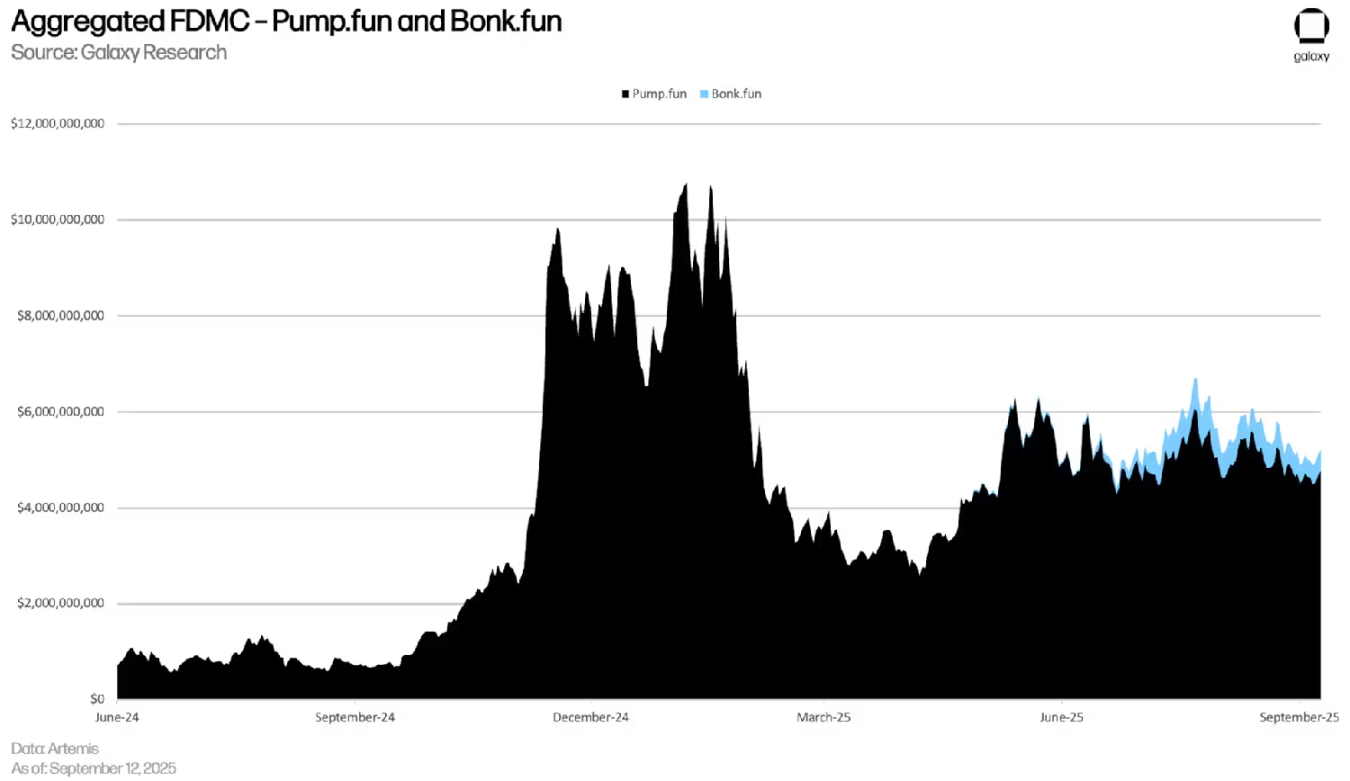

Market value distribution shows a similar pattern. The total FDMC of tokens on Pump.fun now exceeds $4.8 billion, far surpassing its nearest rivals. In the chart below, black represents Pump.fun’s FDMC and blue represents Bonk.fun’s; Pump.fun’s market cap peaked above $10 billion in January.

Fully diluted market cap of Pump.fun vs. Bonk.fun

This scale reveals two key insights: first, meme coins have reached a size too large to ignore — tens of millions of tokens with billions in market value; second, the space is highly centralized — Solana dominates other chains, Pump.fun dominates Solana, and within Pump.fun, a tiny fraction of tokens hold the vast majority of value.

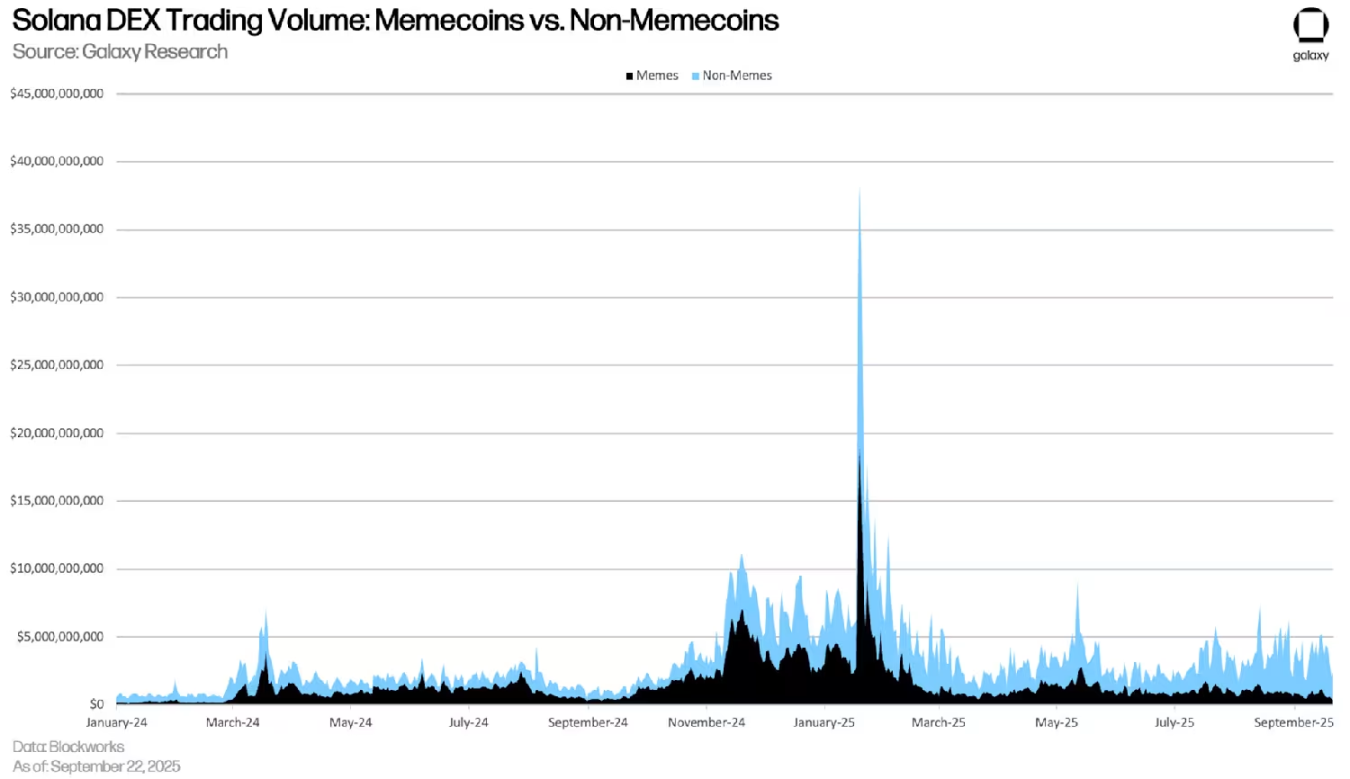

While Solana’s DEX volumes have performed strongly this cycle, tracking changes in meme coin trading share is also insightful. Blockworks data shows that over the past year, meme coin volume as a share of total DEX volume has steadily declined, spiking only once around Trump’s TRUMP token launch.

Solana DEX volume: Meme coins vs. other tokens

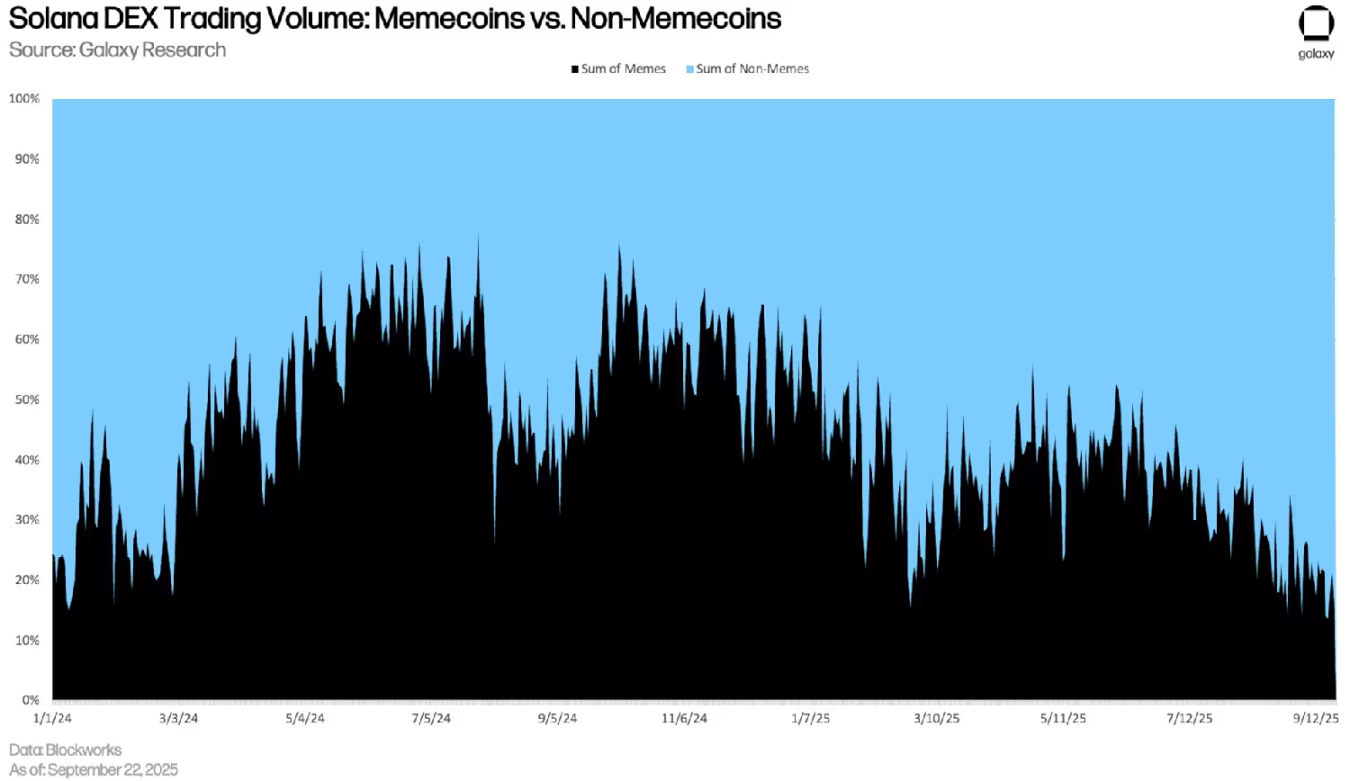

The 100% stacked area chart below shows that in Q4 2024, meme coin trading accounted for over 50% of Solana DEX volume, but has since dropped to 20–30%. This indicates increased activity in SOL/USDC pairs, stablecoin swaps, and other DEX trades, now exceeding meme coin volume. While Pump.fun lowered issuance barriers, it also contributed to market “maturation”: endless token creation has fragmented liquidity and intensified competition, making parabolic rallies like those seen in late 2023 to early 2024 increasingly rare. Additionally, the rise of trading apps on competing chains — especially Hyperliquid’s perpetual futures — has further diverted meme coin trading volume.

Solana DEX volume: Meme coins vs. other tokens (stacked)

On-Chain Dynamics

Market size data reveals the sheer scale of the meme coin system, while user on-chain behavior helps us understand how these assets operate. The most striking features are extreme short-termism, high-frequency flipping, and a power-law distribution of value.

The first key metric is holding duration. For wallets that buy and fully sell within seven days, the median holding time for Solana meme coins has dropped to about 100 seconds, far below the near-300 seconds observed a year ago. This means the average participant doesn’t hold a token for hours, let alone days — they rapidly switch positions, profiting from small percentage gains in a PvP trading game against other traders.

Visualization of Solana’s "trading frontline"

Underlying infrastructure reinforces this behavior. Platforms like Axiom offer “instant trade” features, allowing traders to execute orders with a single click. Trading on “1-second candles” has become trivial, creating a high-frequency flipping environment. Combined with human psychology — where most participants panic-sell at lows rather than take profits at highs — it’s clear that for most people, the expected value (EV) of such trading is inherently negative (except for issuers, insiders, and KOLs, discussed later).

Median holding time for Solana meme coins (seconds)

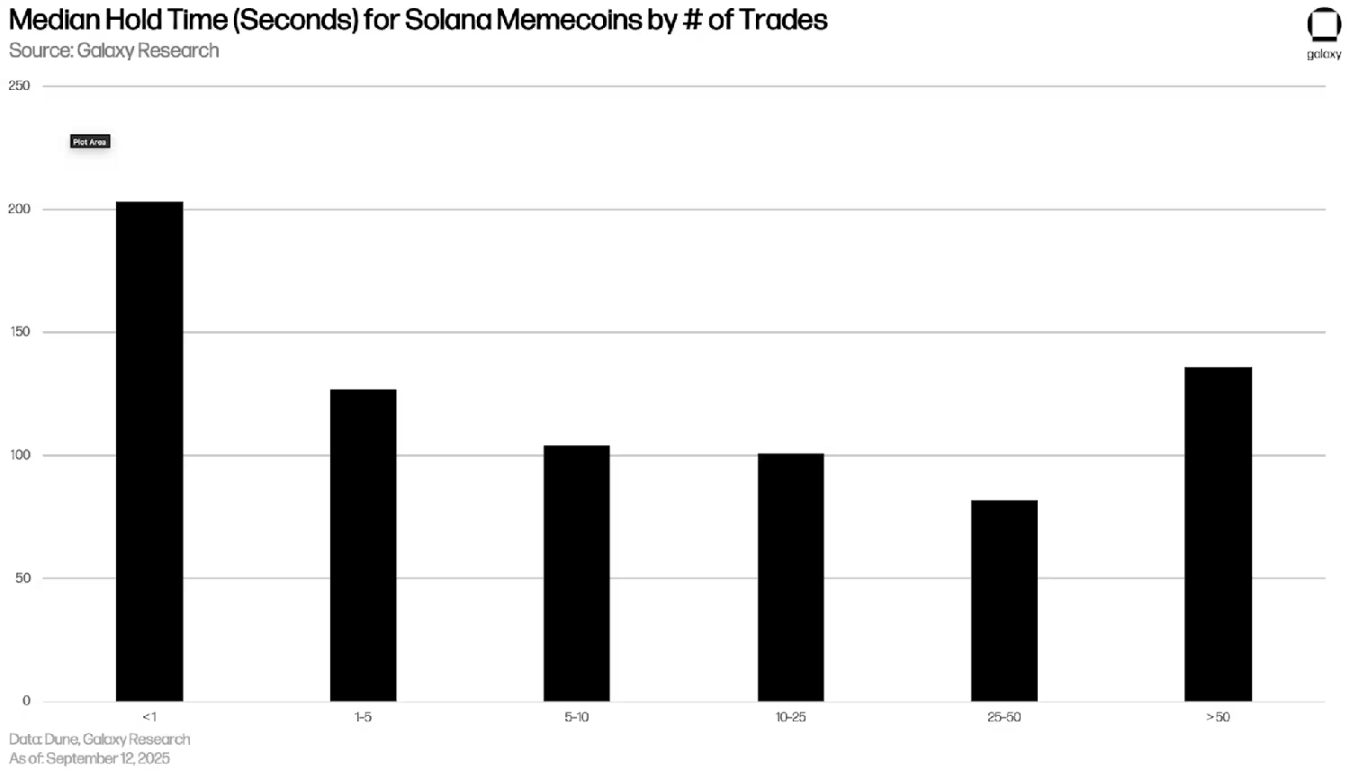

The chart below shows median holding times over the past year, segmented by daily trade frequency: wallets trading less than once per day hold tokens over 200 seconds; as trade frequency increases, median holding time plummets to 80–120 seconds; only the most active wallets (over 50 trades/day) show slightly longer holding periods.

Overall, all wallet types hold meme coins for mere seconds.

Median holding time by daily trade frequency

The power-law distribution of value on Pump.fun is staggering: among nearly 12.9 million tokens launched, just 12 account for over half the total FDMC. These 12 tokens have a combined market cap of $2.69 billion, representing 56% of Pump.fun’s $4.8 billion total, while the remaining 44% is split among millions of others.

In other words, a mere 0.00009% of Pump.fun’s tokens control the majority of its value.

The meme coin ecosystem operates almost like a lottery: nearly all newly launched tokens crash within hours, with only a rare few gaining sustained attention. For most traders, meme coins are essentially a negative-EV game, but these rare success stories keep fueling speculation, driving continuous participation in the “casino.”

Top 12 Pump.fun tokens vs. all others

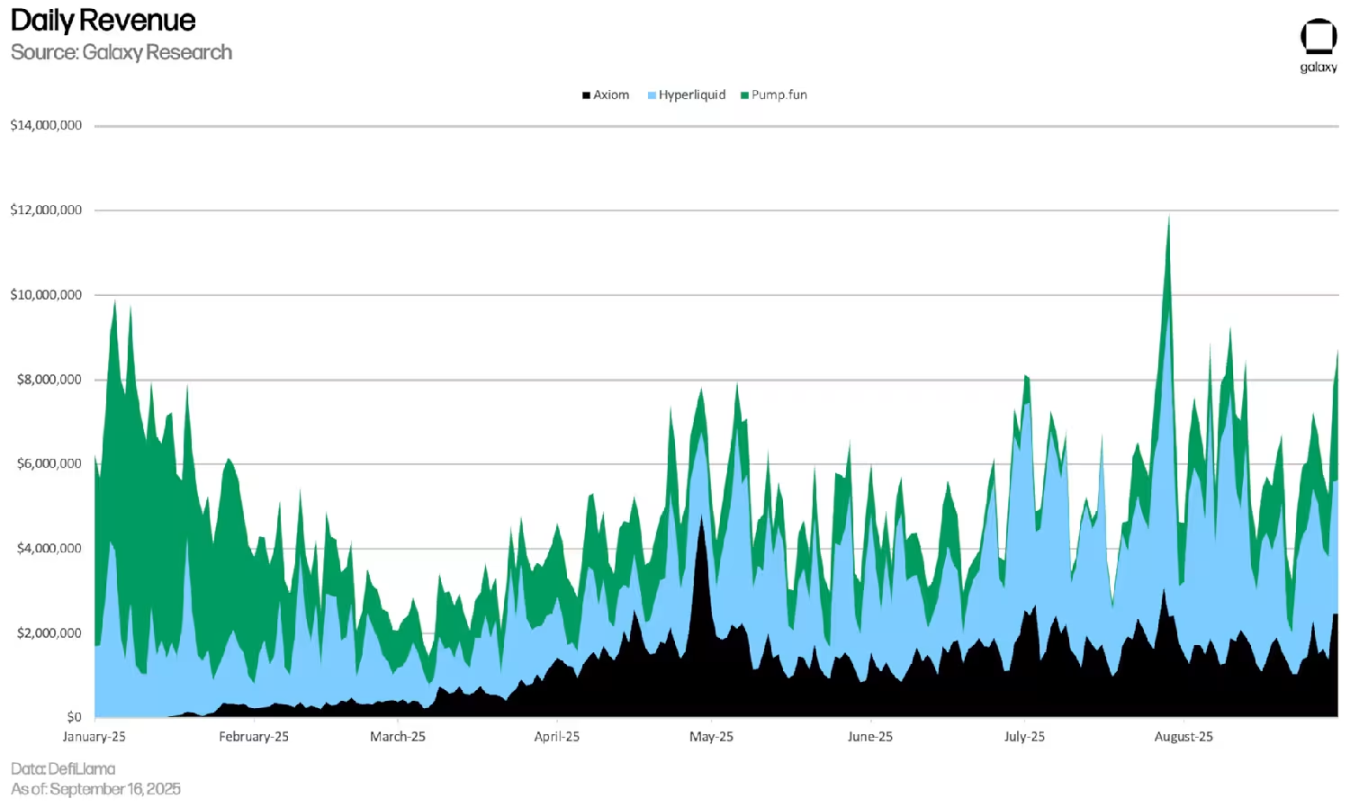

While most meme coin traders lose money, the infrastructure builders capturing fees reap most of the value. The chart below compares revenue from Pump.fun, Axiom, and Hyperliquid (included for comparison despite not focusing on meme coins). Notably, Axiom’s team is tiny (under 10 people), yet generates millions in monthly revenue from trading fees.

Value flows not to tokens themselves, but to platforms and tools enabling issuance and trading

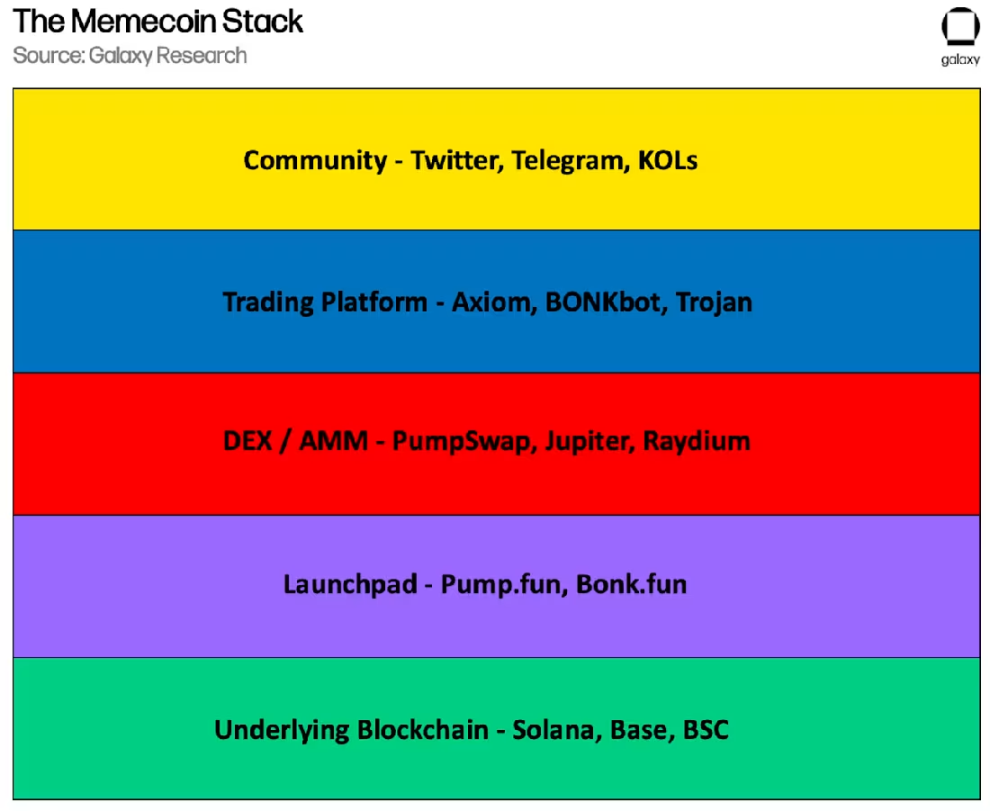

Meme coin ecosystem stack

The meme coin ecosystem can be understood as a layered “stack,” each level built atop the previous:

Base Blockchain

-

The vast majority of meme coin activity occurs on Solana. Its low fees, high throughput, and alignment with “radical speculation culture” make it the dominant chain for PvP trading.

-

Base and BSC also host significant meme coin activity; Ethereum hosts larger-scale tokens with a relatively less cutthroat trading culture.

Launch Platforms

-

Pump.fun drastically lowers the barrier to entry, enabling anyone to easily create tradable tokens. Its bonding curve model ensures immediate liquidity upon launch.

-

Competitors like Bonk.fun, Believe, and HeavenDEX have emerged but failed to sustain meaningful market share. Data shows the launch platform market is “winner-takes-all.”

DEX Aggregators / AMMs

-

After launch, tokens trade on automated market makers (AMMs). Pump.fun operates its own internal AMM, PumpSwap, to retain liquidity, while broader price discovery happens via Jupiter, Raydium, Orca, and others.

-

This layer ensures tokens can be traded instantly, 24/7, by anyone, anywhere.

Trading Bots and Automation Tools

-

Execution speed is key in meme coin trading. Tools like Axiom, BONKbot, and Trojan help users “snipe” newly launched tokens (buying the instant they go live) and enable instant execution.

-

This infrastructure further reduces median holding times, turning the market into a highly PvP environment — making it nearly impossible for new entrants to profit meaningfully.

Communities

-

X (formerly Twitter) communities and Telegram groups are central to meme propagation and coordinated “pump campaigns.” Members have strong incentives to drive price up, replacing fundamentals with collective belief.

-

This layer distinguishes between “PvP lottery” tokens and “PvE (player-vs-environment)” meme coins — the latter potentially evolving into long-lasting “cult communities” or cultural movements (e.g., SPX6900, MOG, TROLL, FARTCOIN).

-

KOLs play a crucial role in this layer…

Due to their outsized influence in “making or breaking” meme coins, below is a list of key active X accounts driving meme coin narratives (non-exhaustive):

Note: CT stands for “Crypto Twitter”

Key opinion leaders list (simplified)

“Creator Capital Markets”

A major recent trend in the meme coin space is the rise of “creator capital markets.” In September 2024, Pump.fun launched “Project Ascend,” positioning tokens as direct monetization tools for content creators. This mechanism replaces fixed developer fee models with a dynamic, market-cap-linked fee structure: lower-market-cap tokens pay creators a higher percentage of trading fees (providing more growth funding for new projects), while higher-market-cap tokens reduce the rate. For example, tokens under $300K market cap pay significantly higher fees than those at $20M.

At the same time, a new group — “Pump.fun livestream creators” — has emerged. These content creators integrate token launches directly into live streams, creating immersive “trading + interaction” experiences with three key benefits:

-

Early participation rewards: viewers joining early can buy promising tokens and profit quickly as stream热度 rises.

-

Viral spread incentives: token holders are strongly motivated to share the stream and attract new viewers — since price performance is tied to attention, sometimes leading to aggressive promotion tactics.

-

Redefining creator economics: livestream creators earn far more from trading fees than traditional ad or subscription revenue on platforms like Twitch or Kick, making “tokenized streaming” a compelling alternative to legacy monetization.

Whether this model is sustainable remains to be seen — if traders focus solely on speculation over content, it could spiral out of control. But in the short term, aligned incentives between creators and traders position Pump.fun as a native financial platform for the attention economy.

Risks

Meme coins carry unique risks within crypto, explaining why many market participants avoid them.

Many tokens not launched via standardized platforms carry underlying smart contract risks, the most common being “honeypot” traps: these tokens allow buying but block selling. On price charts, honeypot tokens show steep green candles, misleading traders into believing explosive gains are possible, only to discover they cannot exit when attempting to sell. Once developers extract enough value, prices collapse instantly.

Example of a honeypot scam price chart: new buyers push price up, but cannot sell

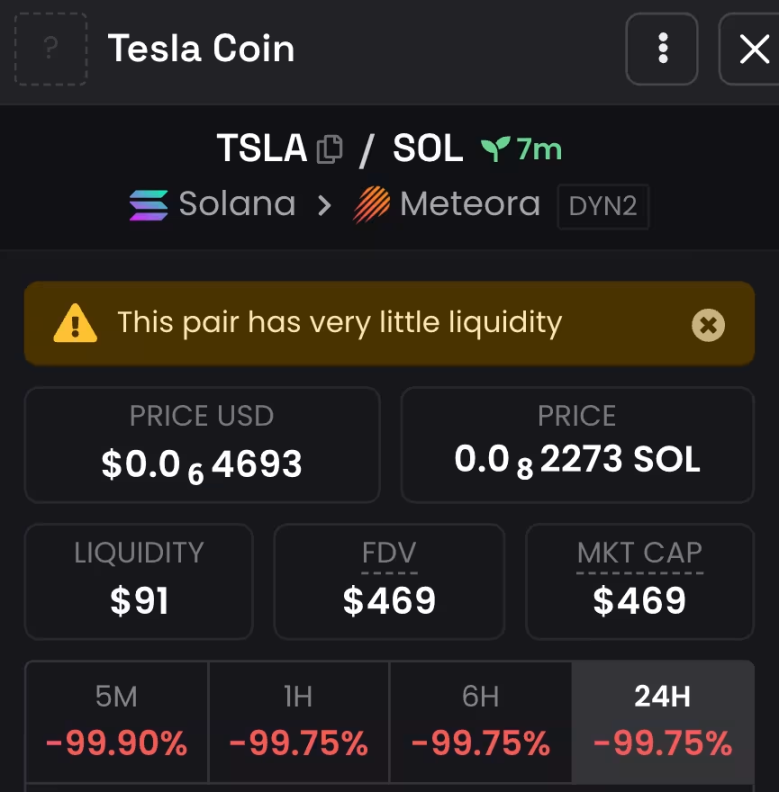

Another persistent risk is “rug pulls.” Even seemingly legitimate tokens often collapse after initial hype fades. Developers and insiders often hold large supplies (sometimes via hidden “side wallets”) and may dump heavily when retail provides liquidity. Additionally, for tokens with manually managed liquidity pools, providers can suddenly withdraw liquidity — meaning even small sell orders can trigger massive price drops. Traders often realize too late: once liquidity is pulled, actual available liquidity may drop to just a few dollars or less.

After liquidity withdrawal, Dexscreener shows the pair is essentially untradeable (note: this token has no relation to Tesla)

Meme coins are also vulnerable to “vampire attacks”: clone tokens attract more attention (often via insider groups or paid KOL promotions) and overtake originals. For example, a token called “67” might succeed on Bonk.fun, only to be cloned on Pump.fun with stronger backing and ultimately surpass the original. Even if a trader identifies a trend correctly, buying the “wrong version” can still lead to losses.

Finally, regulatory risk remains. While U.S. regulators have recently taken a “wait-and-see” approach to meme coins (only clarifying they “are not securities”), the blurry line between “harmless gambling” and “retail exploitation” makes them easy political targets — tighter regulation could sharply reduce trading volume. A notable case is the LIBRA token: promoted by Argentine president Javier Milei on social media, it crashed shortly after launch, costing traders millions while insiders like Hayden Davis made millions. Such events reinforce the negative narrative of meme coins exploiting retail investors.

Outlook

Meme coins are not a passing fad but a lasting component of crypto’s “attention economy.” Their importance lies more in the “culture + finance” infrastructure they’ve built.

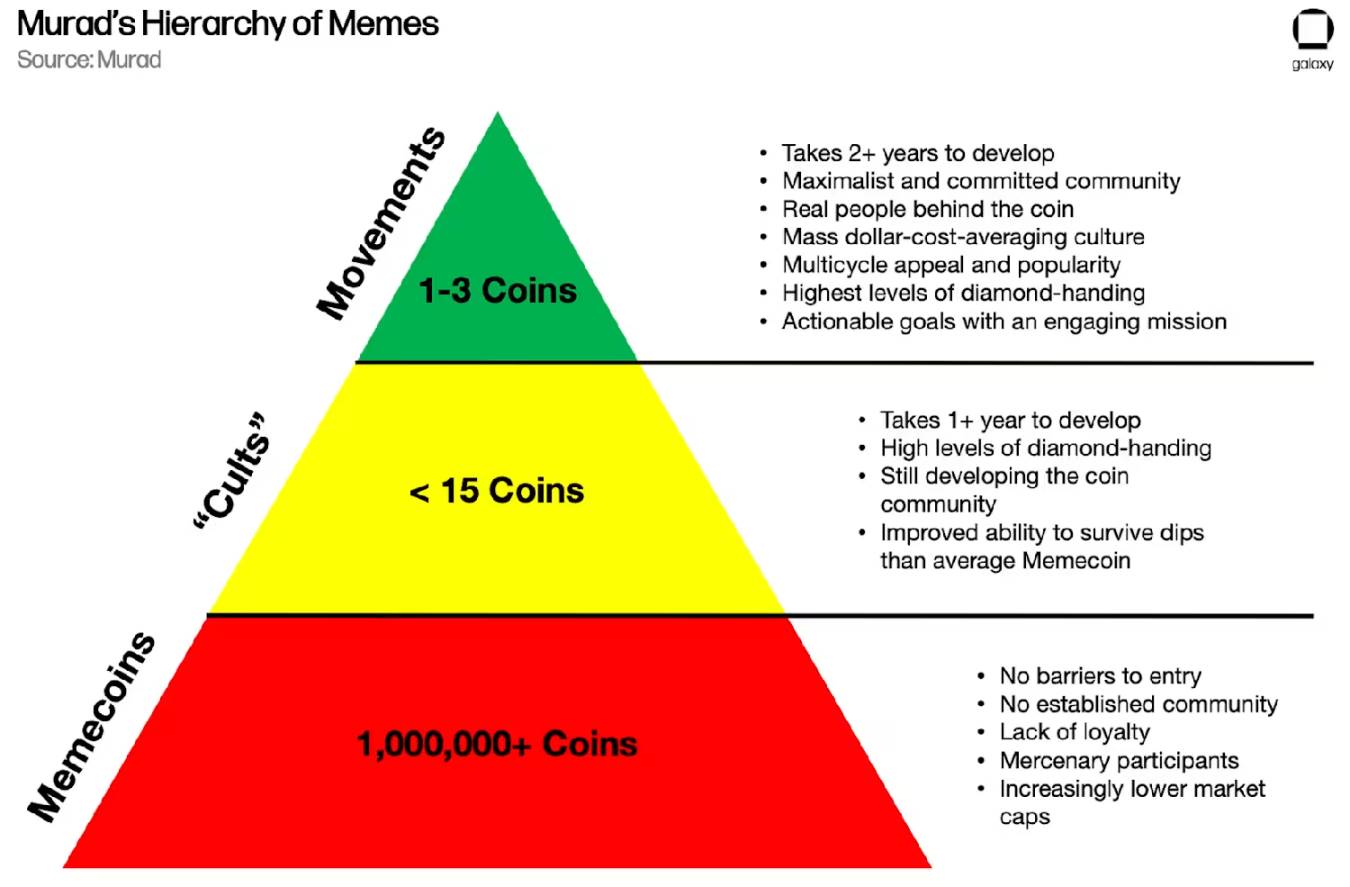

As noted by prominent blogger Murad, the meme coin ecosystem forms an “attention and longevity pyramid”:

-

Base layer: millions of “one-off tokens,” essentially PvP gambling chips, lasting minutes or hours, dominated by bots and high-frequency traders.

-

Middle layer: dozens of “cult-community tokens” (e.g., TROLL, MOODENG) with loyal followings, lasting months or years.

-

Top layer: a rare few “transcendent cultural symbols” (or “quasi-religious assets”) that endure across multiple crypto cycles — e.g., Dogecoin (DOGE), PEPE, SPX6900, and perhaps MOG.

Murad’s meme coin hierarchy model

Each crypto cycle brings breakout tokens that attract external capital and legitimize the space. These events reshape the meme coin stack: clones proliferate, fees spike, and new “power-law winners” emerge. Celebrity and political tokens (like TRUMP) will continue appearing in “cyclical bursts,” highly volatile and media-effective.

For most participants, the expected value (EV) of daily meme coin trading remains negative. Real advantage lies with “ecosystem distributors” — owning the casino beats gambling inside it. For example, Axiom’s under-10-person team has already earned over $200 million cumulatively. For institutional investors, safer bets are “meme coin infrastructure” and a select few “cross-cycle cult assets,” not the flood of newly issued tokens.

But meme coins play a broader role in digital asset evolution: many users’ first blockchain experience is buying a meme coin on a DEX; from there, they gradually try cross-chain transfers, stablecoin swaps, or even lending protocols. By turning speculation into a social, low-barrier activity, meme coins reduce the psychological friction of entering crypto.

Moreover, meme coins serve as “stress tests” for blockchain infrastructure — few use cases stress chain performance as intensely as “meme coin mania.” For instance, during the TRUMP token launch, Jupiter recorded over 42 million failed transactions in a single weekend.

In summary, the meme coin space is a flywheel system powered by infrastructure, user acquisition, and cultural speculation. Going forward, it will remain noisy and fast-evolving, while a few platforms leverage ecosystem advantages to sustain growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News