The Berkshire Path for Crypto Asset Treasuries

TechFlow Selected TechFlow Selected

The Berkshire Path for Crypto Asset Treasuries

Some DATs are expected to become the "for-profit public company equivalents" for cryptocurrency foundations.

Author: Ryan Watkins, Co-founder of Syncracy Capital

Translation: Chopper, Foresight News

Digital Asset Treasuries (DATs) currently hold $105 billion in assets and control a significant portion of the token supply across major blockchains. The speed of DAT expansion is staggering, yet few have paused to consider the deeper implications behind Wall Street's latest "gold rush."

To date, market discussions around DATs remain confined to short-term speculation: how much funding was raised, how long premiums can last, and which asset will capture attention next.

This isn't entirely unjustified—many DATs lack intrinsic value beyond financial engineering and could fade into obscurity once market enthusiasm wanes. However, this excessive focus on short-term speculation causes the market to overlook the long-term economic potential of the few DATs that will ultimately emerge as leaders.

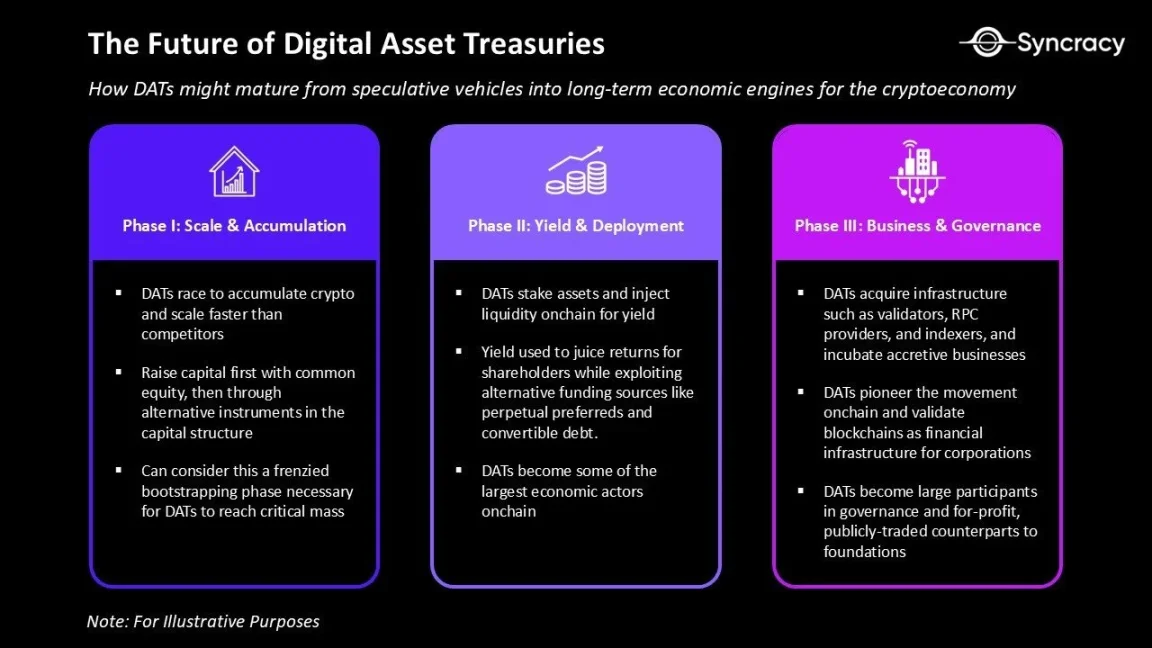

We believe this current period will eventually be seen as the "frenzied launch phase" of DATs—the necessary starting point for them to reach critical scale and outpace their peers. In the coming quarters, leading DATs will refine their capital structures, adopt more sophisticated asset management strategies, and expand into service areas beyond mere fund management.

In short, we believe some DATs have the potential to become for-profit, publicly traded counterparts to cryptocurrency foundations. But unlike foundations, they will take on broader missions: injecting capital into their ecosystems, running businesses based on treasury size, and participating in governance. A handful of DATs already hold more assets than the protocol foundations they are built upon—and their ambitions for further expansion continue to accelerate.

Yet to understand the future of DATs, we must first revisit the core attributes of cryptocurrency itself. Only then can we see how DATs may evolve from speculative instruments into long-term economic engines of the crypto economy.

Programmable Money

Bitcoin's code embeds principles such as deterministic issuance and peer-to-peer transfers, making it digital gold. Bitcoin's proof-of-work (PoW) consensus combined with small block sizes ensures sovereign-level censorship resistance and ease of verification for end users, maximizing system trust through simplicity.

But this conservatism comes at a cost: while Bitcoin's security is unmatched, its design limitations result in poor scalability, ultimately restricting it to basic transfer functionality.

In contrast, Ethereum positions itself as a world computer, where smart contracts allow developers to create new assets and define arbitrary custody logic. Its proof-of-stake (PoS) consensus enables final settlement and greater scalability. Together, these features lay the foundation for a fully programmable financial system.

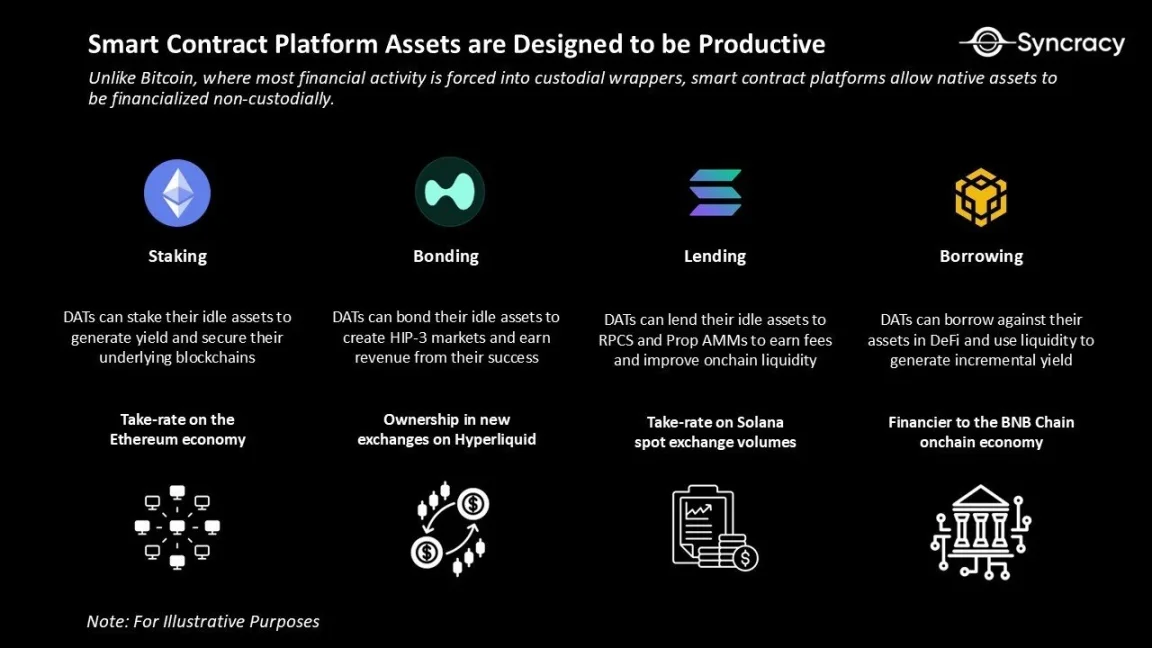

Today, the scalability of Ethereum and other smart contract platforms (such as Solana and Hyperliquid) is making money itself programmable. Unlike Bitcoin, smart contract platforms allow native assets to be financialized in non-custodial ways. This not only reduces counterparty risk but also unlocks more possibilities for "activating" asset value.

At the basic level, this means "staking assets to secure network safety and earn fees" or "using native assets as collateral to borrow and generate yield." But these are just the tip of the iceberg: programmability also enables re-staking and gives rise to entirely new forms of financial activity.

The unique aspect of these on-chain applications is that they require substantial native capital to launch operations, improve product quality, and scale.

For example, on Solana, RPC providers and market makers who stake more SOL tokens gain advantages in transaction confirmation stability and spread profit capture. On Hyperliquid, exchange front-ends that stake more HYPE tokens can offer lower fees or higher revenue shares without increasing user costs. These native capital requirements may limit the growth of smaller players, while many businesses would greatly benefit from direct access to a permanent pool of native assets.

Capital Allocation Games

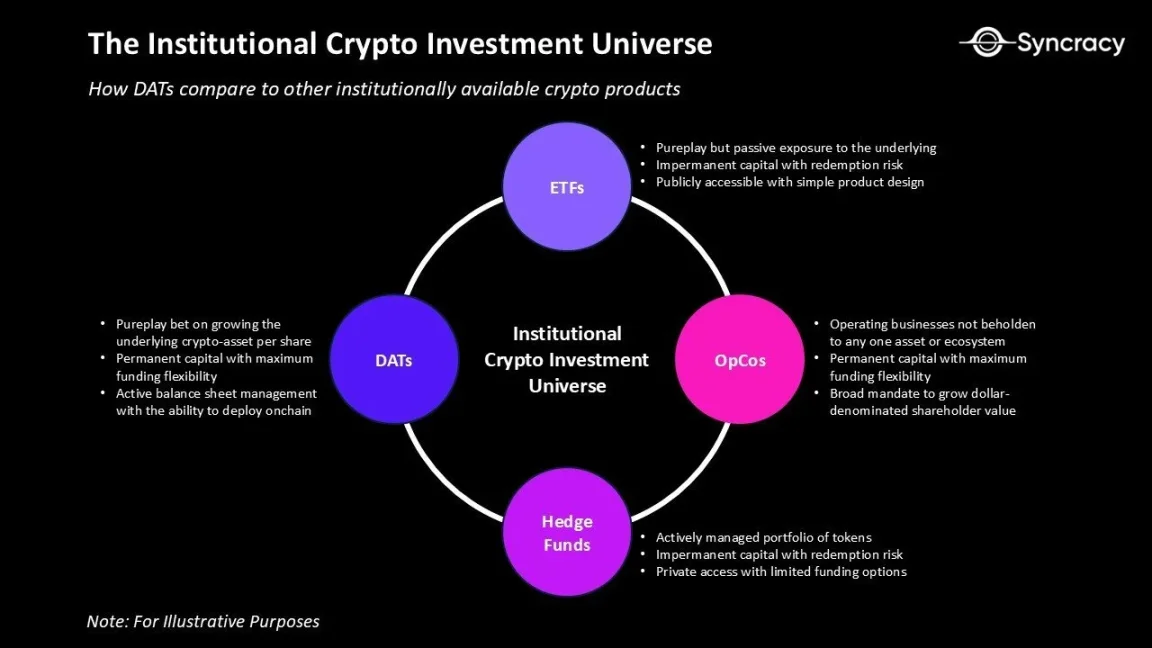

Programmable money has fundamentally changed the logic of DAT balance sheet management. Take Strategy (MSTR), for instance—it can only adjust its capital structure around "holding Bitcoin." In contrast, DATs focused on assets like ETH and SOL can operate flexibly on both sides of their balance sheets.

These DATs combine key characteristics from multiple traditional business models: they adopt the long-term capital structures of closed-end funds and real estate investment trusts (REITs), the balance-sheet-driven approach of banks, and Berkshire Hathaway’s philosophy of long-term compounding.

Their uniqueness lies in measuring returns in units of "crypto per share," making them pure investment vehicles in their underlying projects rather than fee-charging asset managers. This structural advantage in capital allocation cannot be replicated by traditional funds or foundations.

-

Long-term capital: Similar to closed-end funds or REITs, the capital raised by DATs is long-term and does not allow redemptions. This shields them from liquidity pressures, eliminating forced asset sales during downturns. Instead, they can opportunistically accumulate during volatility, focusing exclusively on "compounding crypto per share."

-

Flexible financing tools: DATs can expand their balance sheets by issuing common stock, convertible bonds, or preferred shares—financing avenues unavailable to traditional funds, offering structural advantages in investor returns. For example, after securing low-cost capital, they can engage in traditional finance (TradFi) → decentralized finance (DeFi) arbitrage; meanwhile, yields from assets like ETH and SOL enable DATs to manage financing costs more effectively than static treasuries like Strategy.

-

High-yield balance sheets: As DATs begin staking tokens, providing liquidity to DeFi, and acquiring core ecosystem assets (such as validators, RPC providers, indexers), their treasuries evolve into "high-output engines." This generates sustainable revenue streams and grants DATs economic and governance influence within their ecosystems. For instance, a leading DAT could leverage its treasury to push through a controversial governance proposal.

-

Ecosystem compounding: While foundations aim to sustain ecosystems, their non-profit status limits reinvestment. DATs, as for-profit counterparts, can reinvest profits into asset accumulation, product development, and ecosystem expansion. Over time, the best-managed DATs could become the Berkshire Hathaways of the blockchain world—achieving capital compounding while shaping the direction of entire ecosystems.

-

Experimentation and innovation: DATs are among the most motivated public companies to drive "on-chain transformation." Initially, this may involve tokenizing equity or executing M&A on-chain; long-term, even payroll and supplier payments could migrate fully on-chain. If executed well, DATs could provide a roadmap for other public companies and validate blockchain as corporate financial infrastructure.

Viewed through this lens, the key to DAT success becomes clear: teams cannot win merely by announcing asset purchases or repeating bullish talking points on TV. As competition intensifies, winners will need professional capital allocators and efficient operators to enhance shareholder value.

First-generation DATs center on financial engineering, modeled after Strategy; next-generation DATs will become active capital allocators, generating returns through on-chain treasuries.

But in the long run, surviving DATs will be far more than simple buy-and-hold token accumulators. They will increasingly resemble operating companies, using treasury scale to run actual businesses—or else their net asset value premium will inevitably collapse.

Risks and Dangers

As the frenzied launch phase of DATs progresses and greed rises, speculators are flooding in. We expect this to amplify risky behaviors, ultimately triggering industry consolidation.

Currently, DAT activity centers on three main assets: BTC, ETH, and SOL. However, the model of "raising funds to buy their own tokens and selling them at a premium to public equity investors" is extremely tempting for speculators. Once this path is validated with mainstream assets, capital will inevitably flow toward higher-risk assets. This mirrors the logic of the 2017 ICO boom and the 2021 Web3 venture capital frenzy. Now, it's Wall Street's turn.

As of this writing, DAT capital is primarily raised through common stock, with low leverage and minimal risk of forced liquidations. Moreover, there are strong constraints against actions like "selling underlying assets at a discount to fund buybacks": structurally, existing mechanisms don't require it; socially, selling core assets violates the DAT "social contract" of long-term alignment with token holders.

But this may simply reflect current expectations. In a true crisis, shareholders might demand action "by any means necessary to boost net asset value per share." When premiums turn to discounts, balance sheet experimentation increases, and new financing tools emerge, "prudent compounding" could give way to "aggressive financial engineering."

In fact, we believe this trend is hard to avoid: most DAT operators are either inexperienced or view the company's purpose only within the context of the current hype cycle. Ultimately, we expect widespread DAT mergers and acquisitions; excessive trading will occur, and distressed DATs may even sell unfavored assets to chase market trends.

Bubble or Boom?

The deeper one studies DATs, the harder it becomes to resist the question: Is this discussion of long-term fundamentals merely post-hoc justification? Can these vehicles truly become the "Berkshire Hathaways of blockchain," or are they just speculative wrappers born from a craze of "some guy levering up to buy a dying software company and stacking Bitcoin"?

At the very least, compared to previous fundraising booms in crypto (like ICOs), DATs represent progress: they are regulated, aligned with investor interests, and carry significantly lower fraud risk. Additionally, DATs bring positive structural changes to markets by reducing circulating supply without affecting prices. Years of meme coin mania and altcoin stagnation have eroded retail confidence, fostering short-termism and pessimism. Thus, the emergence of any form of "long-term, committed buyer" is a positive signal.

But perhaps the question of "post-hoc justification" isn't even relevant. The world evolves with "path dependency"—regardless of our opinions, public company balance sheets now hold massive amounts of cryptocurrency. The real question is: what happens next?

Wall Street is gradually recognizing the achievements of the crypto industry over the past few years, while blockchain stands at an inflection point of regulatory clarity and the emergence of killer applications. Even if only a fraction of this value integrates into the operations of public companies and financial institutions, DATs will mark a major victory for crypto as an asset class. Even if they merely attract a new cohort of buyers to crypto assets, their impact will be significant.

On Twitter and mainstream media, concerns about DATs abound. Short-term markets are inherently noisy, but taking a longer view, one might find reasons for optimism. History shows that, over time, markets tend to favor the optimists.

Not every DAT will reach its promised destination, but the few that succeed will leave a lasting impact on the crypto economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News