Harsh data: 88% of airdrop tokens don't survive beyond 3 months

TechFlow Selected TechFlow Selected

Harsh data: 88% of airdrop tokens don't survive beyond 3 months

The real value is not the token itself, but the user behavior it can drive.

Author: Sara Gherghelas

Translation and compilation: BitpushNews

Although airdrops have transformed the Web3 ecosystem by driving user growth and attention, it remains a key concern whether they can create lasting ecosystems or merely trigger short-lived speculative activity.

Airdrops have become one of the most powerful growth tools in Web3, capable of generating massive attention and attracting millions of users within days. Over the past two years, projects across decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain gaming have distributed billions of dollars worth of tokens to reward early adopters and attract new participants.

However, the real question is: do these distributions create sustainable ecosystems, or are they just fleeting speculative events? While airdrops continue to drive impressive surges in user growth and trading volume, their long-term impact on retention, engagement, and token value remains far less certain.

This report analyzes the outcomes of high-value airdrops in DeFi, NFTs, and gaming, focusing on how they influence user behavior, token performance, and on-chain activity.

Key Takeaways

-

Projects have distributed over $20 billion in airdropped tokens since 2017, with $4.5 billion in 2023 alone, making airdrops one of the most powerful—and expensive—growth strategies in Web3.

-

88% of airdropped tokens lose value within three months, highlighting the gap between short-term hype and long-term sustainability.

-

Airdrops reliably generate massive activity spikes: Arbitrum reached 2.5 million daily transactions at launch, while Blur captured over 70% of NFT trading volume overnight.

-

Retention remains weak: on average, activity settles within weeks to only 20–40% above pre-airdrop levels, with most recipients choosing to cash out.

1. What Are Airdrops and How Do They Shape Web3 Growth?

In the Web3 ecosystem, an airdrop refers to the distribution of free tokens to a set of wallets, typically to reward past activity or incentivize future participation. Unlike ICOs (Initial Coin Offerings), which require users to purchase tokens, airdrops place tokens directly into users’ hands. The underlying logic is simple: by giving up ownership, projects can bootstrap communities, decentralize governance rights, and create immediate liquidity for their tokens.

Airdrops come in various forms:

-

Retroactive Airdrops: Reward users who previously interacted with a protocol (e.g., Uniswap in 2020, Arbitrum in 2023).

-

Incentive Airdrops: Encourage ongoing behaviors such as trading, staking, or referrals (e.g., Blur’s points system).

-

Community Airdrops: Reward NFT holders, developers, or social community members (e.g., BONK on Solana).

-

Since 2017, airdrops have evolved from a quirky way to spread news into one of the most effective marketing strategies in Web3. Instead of paying for ads, projects now distribute ownership.

The idea is that users who feel like stakeholders are more likely to try a product, spread the word, and remain loyal.

Key milestones in airdrop history:

-

2017–2018, First Wave: Emerged during the ICO era. Many projects used airdrops to cheaply grow Telegram groups and wallet lists. Impact was mostly speculative, with few users staying engaged after claiming.

-

2020, UNI Sets the Gold Standard: Uniswap’s $UNI airdrop established a benchmark. By distributing 400 UNI tokens to each historical user (worth ~$1,200 at launch, peaking above $12,000), Uniswap turned early adopters into evangelists. It also cemented retroactive airdrops as a fair way to reward “true believers.”

-

2021–2022, The Airdrop Playbook Era: Airdrops became part of the standard playbook: dYdX, ENS, LooksRare used them to attract traders, domain service users, or NFT collectors. Some succeeded; others were overwhelmed by “farmers.”

-

2023–2025, The Super Airdrop Era: Arbitrum ($1.97 billion), Blur ($818 million), and Worldcoin (ongoing airdrops to over 10 million users) demonstrated how large-scale distributions can reshape entire ecosystems overnight.

Although precise tracking is difficult, estimates show:

-

Hundreds of airdrops have occurred since 2017 across DeFi, NFTs, gaming, and infrastructure.

-

Total value distributed via airdrops exceeds $20 billion, with $4.5 billion in 2023 alone (including Arbitrum, Blur, Celestia, etc.).

-

Major airdrops typically target 100,000 to 1 million addresses, while global campaigns like Worldcoin aim for tens of millions.

-

Studies suggest about 88% of airdropped tokens lose value within three months of launch, underscoring that while airdrops succeed as marketing, they rarely ensure long-term token strength.

Why do airdrops work as a marketing tool?

-

Low barrier: Users claim free tokens → try the product.

-

Viral effect: Large airdrops make headlines (“free money”), creating viral buzz.

-

Decentralization: Tokens spread ownership, grant governance rights, and (at least theoretically) align users with the project’s future.

-

Competitive pressure: Airdrops can rapidly shift market share (e.g., Blur vs. OpenSea).

Yet they come with challenges: airdrop farming, immediate sell-offs, and retention struggles. Still, as of 2025, airdrops remain one of the most effective—if imperfect—marketing weapons in the dapp industry.

2. DeFi and Layer-2 Airdrops: Driving User Growth or Feeding Farmers?

The DeFi space has been central to the airdrop phenomenon. From decentralized exchanges to Layer-2 scaling networks, protocols have used token distributions to reward early users, decentralize governance, and most importantly—acquire new users. In fact, many of the largest and most discussed airdrops in Web3 history originated from DeFi and network scaling solutions.

L2 Network Airdrops

The most notable case is Arbitrum’s March 2023 airdrop. By distributing 1.16 billion ARB tokens (about 11.6% of total supply) to over 600,000 addresses, Arbitrum created the highest-valued airdrop in the industry at the time. At its peak, these tokens were worth nearly $2 billion. The on-chain impact was immediate: on claim day, daily transaction volume surged to over 2.5 million, briefly surpassing Ethereum itself.

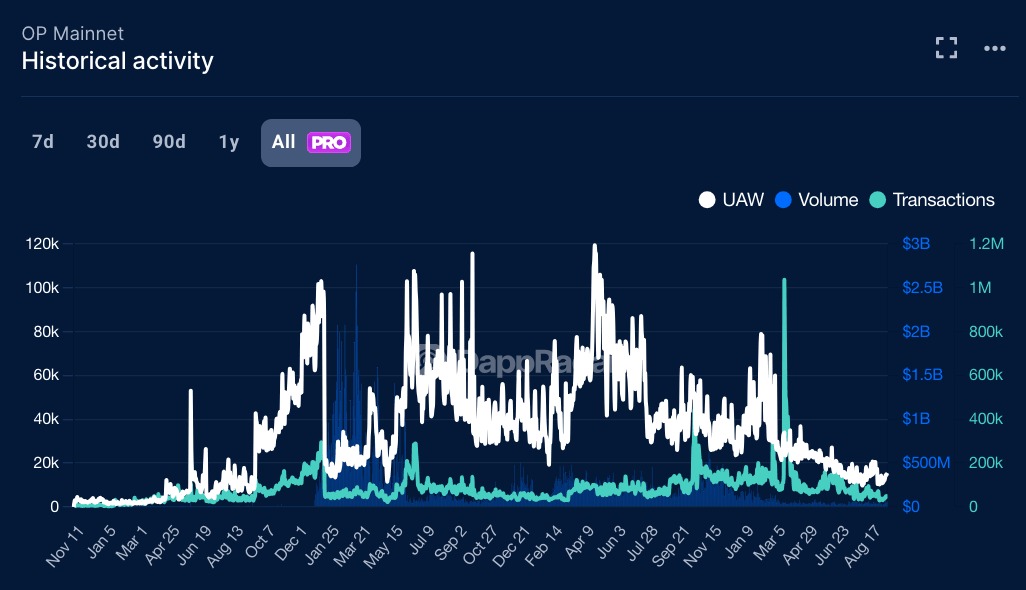

Although the hype inevitably cooled, Arbitrum maintained a higher baseline of activity than pre-airdrop levels. Two months later, the network still processed around one million daily transactions, with unique active wallets (UAW) up 531%. However, the retention story is more complex. Our data shows that during this period, only about 5% of transactions came from wallets that actually received ARB. Many recipients simply sold their tokens and left, while actual usage was driven by new users or existing DeFi users attracted by Arbitrum’s growing ecosystem. Unsurprisingly, the ARB token itself followed a familiar pattern: launched around $1.30–$1.40, it fell by over 75% within two years.

Optimism offers a useful comparison. Instead of a one-off large event, it has conducted phased airdrops since 2022. The second wave in 2023 distributed 11 million OP tokens, targeting governance participants like DAO voters and delegates. Compared to Arbitrum, this approach generated smaller activity spikes but more deliberately aligned incentives and strengthened Optimism’s governance structure. Our data confirms Optimism also saw sharp jumps in UAW and transaction volume during claim periods, though activity faded faster. The OP token has lost 42% of its value since launch three years ago.

DeFi Airdrops

DeFi protocols follow patterns similar to L2 networks. dYdX’s early airdrop to active traders created a surge in volume, but activity declined once incentives waned, and its token has since lost about 70% of its value. 1inch distributed multiple rounds of tokens, driving short-term wallet growth, but governance participation remains low; the token dropped 52% soon after the airdrop and over 90% five years later. ENS’s smaller retroactive airdrop in late 2021 performed better, with its token falling only about 40% over four years while cultivating a relatively loyal governance community among Ethereum domain holders.

Across the industry, data reveals a consistent pattern. Airdrops drive immediate user growth, often doubling or tripling daily activity and causing TVL spikes as users move assets to qualify or claim. However, within weeks, activity typically settles to a baseline only slightly above pre-airdrop levels. Token prices reflect this: most DeFi airdrop tokens lose 60% to 90% of their launch value within months as “farmers” exit positions.

Airdrops are unmatched in accelerating user acquisition, but long-term retention depends on product-market fit. Arbitrum sustained higher usage because its network already offered strong DeFi utility and lower costs. Optimism demonstrated how mechanism design can shape user behavior beyond speculation by structuring airdrops around governance. Yet for protocols lacking compelling ecosystems or thoughtful design, airdrops are at best an expensive marketing exercise—enriching opportunistic claimers without ensuring lasting adoption.

3. NFT Airdrops: Trading Liquidity vs. Community Loyalty

If DeFi and Layer-2 networks use airdrops to scale infrastructure, the NFT space uses them as weapons to capture market share. Blur is the prime example—a marketplace that disrupted OpenSea’s long-standing dominance through one of the most aggressive airdrop strategies in Web3 history.

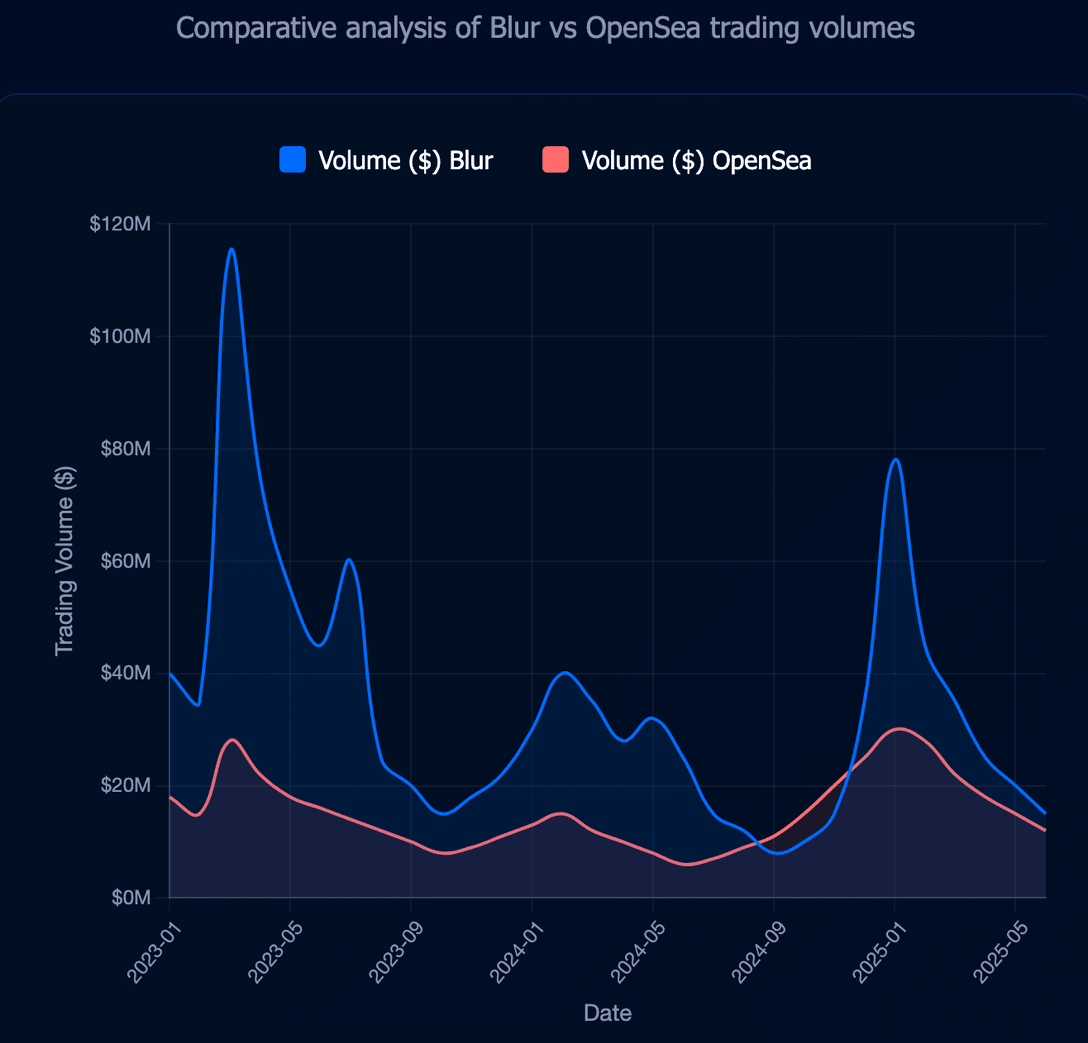

Prior to its February 2023 token launch, Blur ran months of “seasons” where traders earned points by listing NFTs, providing liquidity, and demonstrating platform loyalty. When the BLUR token finally launched, 51% of its total supply was allocated to the community, with the airdrop peaking above $800 million in value. The result was immediate and dramatic. Within days, Blur captured over 70% of Ethereum’s NFT trading volume, forcing OpenSea to cut fees and reconsider creator royalties. Our data shows the speed of liquidity shift—despite serving fewer active wallets, Blur’s volume sometimes exceeded OpenSea’s by more than fivefold.

Yet the nature of this activity tells a cautionary tale. Much of Blur’s volume was driven by a small number of high-frequency traders farming points for future rewards. Analyses at the time showed hundreds of wallets accounted for the majority of trades. While this created unprecedented liquidity, tight spreads, and faster execution for NFTs, it didn’t necessarily translate into broader community engagement. OpenSea continues to dominate in unique active wallets, remaining more popular among casual collectors and creators.

The BLUR token itself followed a familiar path. It debuted around $1.20 but quickly dropped as recipients sold, falling below $0.10 by 2025. Even ongoing reward seasons failed to stop gradual value erosion. By late 2023, Blur’s market share began declining, stabilizing in the 20–40% range after the initial surge.

Other NFT airdrops tell similar stories. LooksRare and X2Y2 in 2022 also employed “vampire attack” models, distributing tokens to OpenSea traders. Both briefly captured significant volume, much of it wash trading. Once rewards dried up, activity plummeted. Their tokens, once worth hundreds of millions, now trade at a fraction of their peak. More recently, meme-style NFT airdrops like Memecoin ($MEME) briefly excited collectors but failed to sustain any lasting ecosystem.

The key lesson from NFT airdrops is that while they’re highly effective at shifting liquidity, they struggle to build sticky communities. Traders follow rewards, but collectors and creators seek trust, usability, and cultural relevance—qualities that tokens alone cannot deliver.

As of 2025, the NFT marketplace landscape is more competitive than ever, shaped by these airdrops. OpenSea has adopted new professional trading tools, Blur continues to serve pro traders, and other platforms are experimenting with new models. But the fundamental question remains: can token incentives in NFT markets truly foster sustainable communities, or do they merely fuel temporary liquidity wars?

4. Gaming Airdrops: Limited Impact in the Play-to-Earn World

While DeFi and NFT platforms have turned airdrops into billion-dollar marketing campaigns, the gaming sector has been more cautious. Blockchain games typically focus on in-game economies and NFTs rather than large-scale token giveaways. As a result, high-value game airdrops have been rare over the past two years, and their impacts more fleeting compared to DeFi or NFT marketplaces.

Most other blockchain gaming projects have completely avoided major retroactive airdrops. Instead, they rely on launchpads, NFT mints, or in-game earning mechanics to distribute tokens. This strategy reflects lessons from the 2021 Play-to-Earn wave, when inflationary token economies collapsed under speculative pressure. By 2023–2025, developers appear wary of repeating those mistakes by distributing large token amounts without sustainable mechanisms.

Exceptions have emerged at the infrastructure level. Immutable, Polygon, and Ronin have experimented with incentives and token rewards for game developers and players, but these are structured as ongoing reward programs rather than one-time airdrops. Similarly, smaller game studios distribute NFTs or modest token airdrops to closed-test users, rewarding early participation without disrupting their economic systems.

For games, the real challenge isn’t using tokens to attract users, but keeping them entertained long enough to form lasting ecosystems.

Conclusion

Despite 88% of airdropped tokens losing value within months, each airdrop reaffirms one truth: in Web3, attention is the most valuable currency. Every large-scale token distribution proves that real value lies not in the token itself, but in the user behavior it unlocks. Today’s challenge for projects is no longer about capturing attention—but about converting that traffic into sustainable, thriving communities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News