When Dogecoin Wears an ETF Suit: The Wall Street Taming of Internet Memes

TechFlow Selected TechFlow Selected

When Dogecoin Wears an ETF Suit: The Wall Street Taming of Internet Memes

ETF is merely a vehicle that transforms cultural energy into institutional products.

By: Thejaswini M A

Translated by: Luffy, Foresight News

Exchange-traded funds (ETFs) were born out of crisis. On "Black Monday" in 1987, the Dow Jones Industrial Average plunged over 20% in a single day. Regulators and market participants realized they needed more reliable investment tools. Mutual funds could only be traded after daily market close, leaving investors helpless during market panics.

ETFs emerged as the solution. This "basket of securities" could trade like individual stocks, offering immediate liquidity during market turmoil.

ETFs simplified index investing, providing broad market exposure at low fees. They were designed to be "hands-off and highly transparent," tracking indices rather than trying to beat them. The first successful ETF—launched in 1993, the S&P 500 Index ETF—became the world's largest fund by promising "precise tracking of the S&P 500."

The original ETF was a pure and good idea. If you wanted to invest in "the entire stock market" without researching individual stocks or paying high management fees for fund managers, it was the optimal choice.

A Cross-Era Turning Point: The Arrival of Memecoin ETFs

In September 2025, Wall Street crossed a new threshold: packaging memecoins into regulated investment products and charging a 1.5% annual fee for doing so.

ETFs have evolved from "tools simplifying investment" into "complex vehicles capable of packaging any strategy." Investment methods such as portfolio construction, hedging, and timing are infinite, but the number of actual investable companies is finite.

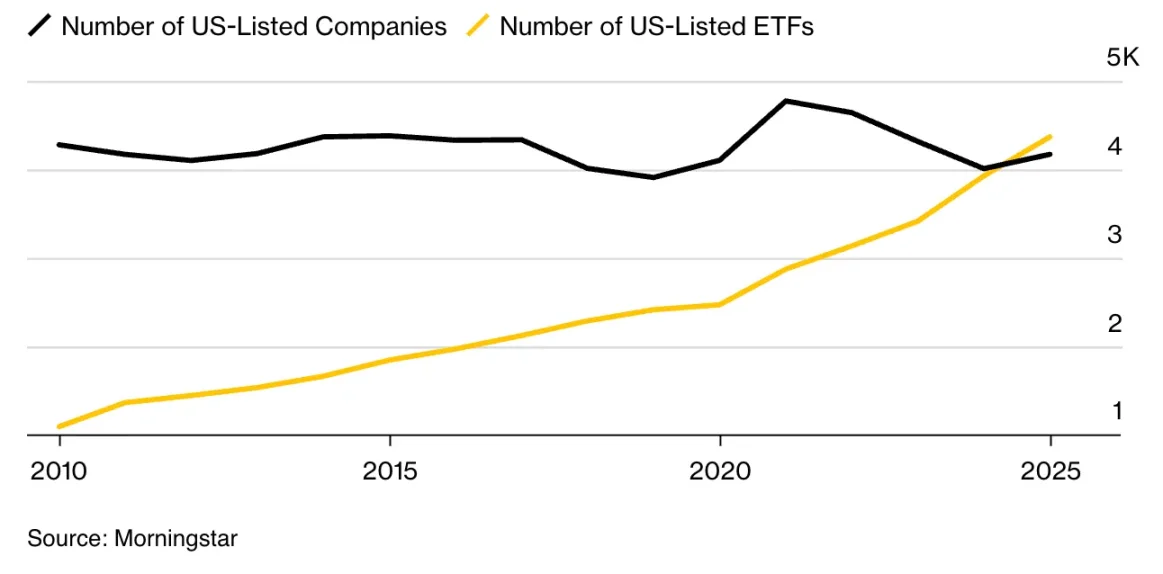

Today, there are over 4,300 ETFs in the U.S. market, compared to roughly 4,200 publicly listed companies. ETFs' share of all investment instruments has risen from 9% a decade ago to 25%. For the first time in market history, there are more funds than stocks.

This raises a fundamental issue: an excess of choice does not empower investors—it paralyzes them. Today’s funds cover every imaginable theme, trend, and even political stance. The line between serious long-term investing and entertainment-driven speculation has completely blurred. It is now nearly impossible to distinguish between products "designed to build wealth" and those "designed to chase trends."

Wait… this anxiety entirely misses the point. Dogecoin ETFs aren’t a distortion of crypto’s mission.

For 15 years, cryptocurrencies have been dismissed as "virtual currencies with no intrinsic value." Traditional finance labeled us "speculators obsessed with worthless tokens," insisting we could never build real things, gain institutional acceptance, or deserve serious regulatory treatment.

Now, they’re attempting to extract value from assets we created as jokes.

The crypto industry has created a new category of value that traditional finance cannot ignore, cannot suppress, and ultimately cannot stay outside of. That Dogecoin has its own ETF before half of the Fortune 500 companies do is the strongest proof of crypto culture’s dominance.

Alright, enough celebration. Let’s now seriously examine the nature of this victory.

Why would anyone pay a 1.5% annual fee for something they can “buy for free”?

The economic logic of memecoin ETFs makes no sense for investors—but perfect sense for Wall Street.

You can directly buy Dogecoin on Coinbase in five minutes, with no ongoing fees. Meanwhile, the REX-Osprey Dogecoin ETF offers the same exposure but charges a 1.5% annual fee. Consider that Bitcoin ETFs charge just 0.25%. Why would anyone pay six times the cost of “digital gold” for a memecoin?

The answer reveals the true target customers. Bitcoin ETFs serve institutional investors and experienced wealth managers who need to comply with regulations but understand crypto. They compete on fees because their clients have alternatives and know how to use them.

Memecoin ETFs, however, target retail investors who see Dogecoin on TikTok but don’t know how to buy it directly. What they’re paying for isn’t market exposure, but convenience and legitimacy. These investors won’t compare prices—they just want to click “Buy” in the Robinhood app and feel connected to a meme trend they hear about constantly.

Issuers fully understand how absurd this is, and that customers could buy Dogecoin elsewhere at lower cost. Their bet is that most people either won’t realize this or won’t bother navigating crypto exchanges and wallets. The 1.5% fee is essentially a tax on financial illiteracy, disguised as institutional legitimacy.

What assets truly deserve an ETF?

The traditional definition of an ETF is: "a regulated investment fund holding a diversified portfolio of securities, trading like a stock on an exchange, providing broad market exposure with professional regulation, custody standards, and transparent reporting mechanisms."

Classic models, like S&P 500-tracking ETFs, hold hundreds of stocks across multiple industries. Even sector-specific ETFs (e.g., tech, healthcare) typically include dozens of related stocks. They reduce risk through diversification while capturing market trends.

Now consider Dogecoin’s essence: created in 2013 by copying Litecoin’s code, adding a meme dog logo, purely as satire. It has no development team, no business plan, no revenue model, no technological innovation. It intentionally inflates supply by issuing 5 billion new coins annually—mocking Bitcoin’s scarcity.

This token has no economic utility: it cannot host applications, generate staking rewards, or serve any function beyond existing as an internet meme occasionally pumped by celebrity tweets.

What regulatory loophole made this possible?

The product’s listing path exposes the real game of "financial innovation": technically complying with legal wording while circumventing legal intent through regulatory arbitrage.

The REX-Osprey Dogecoin ETF (ticker: DOJE) did not launch under the Securities Act of 1933, which governs commodity ETFs. Instead, it used the framework of the Investment Company Act of 1940—a crucial choice. Under the 1940 Act, if the SEC does not object, applications automatically approve after 75 days, creating a regulatory shortcut. But here’s the problem: the Act was originally designed for "mutual funds diversified across multiple assets," not "speculative tools for a single memecoin."

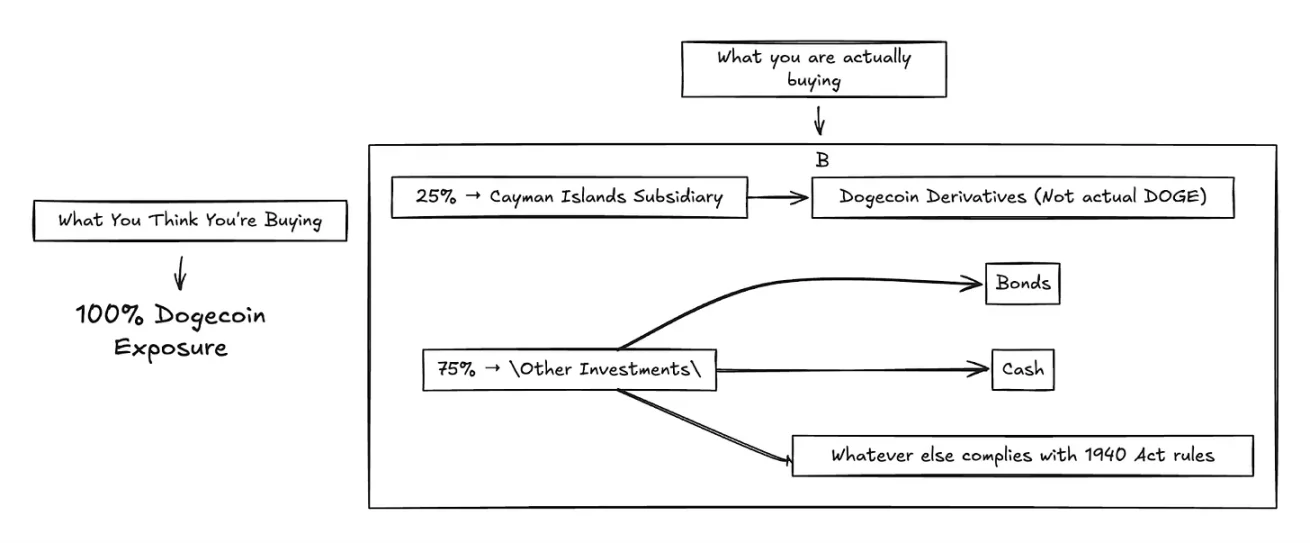

To meet diversification requirements, DOJE cannot directly hold Dogecoin. Instead, it gains exposure via derivatives through a Cayman Islands subsidiary, with holdings capped at 25% of assets. This creates an absurd outcome: a Dogecoin ETF can have at most 25% of its assets tied to Dogecoin.

This fundamentally alters how investors actually gain exposure. Direct-hold ETFs precisely track price movements, but offshore derivatives introduce tracking error, counterparty risk, and complexity, causing fund performance to diverge from actual Dogecoin price action.

This regulatory workaround also creates transparency issues. Retail investors buying a Dogecoin ETF want direct access to social media meme trends. But what they actually get is a "complex derivatives portfolio"—three-quarters of their investment unrelated to Dogecoin’s price, with returns diluted by the other 75% of fund holdings.

Worse, this structure completely undermines the protective intent of the 1940 Act. Congress mandated diversification rules to reduce risk through multi-asset allocation. Wall Street, however, exploits these rules to package high-risk speculation as regulated products, evading the scrutiny these instruments should face. The regulatory framework doesn’t protect investors from risk—it masks new risks under the guise of institutional legitimacy.

Compare this to Bitcoin ETFs. Most Bitcoin ETFs (like ProShares BITO or Grayscale’s spot Bitcoin ETF) operate under the Securities Act of 1933 or other commodity fund frameworks, allowing direct Bitcoin exposure (or via futures), without the 25% holding cap. They typically hold futures contracts or seek direct Bitcoin custody (once approved), enabling more accurate price tracking.

The Dogecoin ETF is a perfect storm of regulatory arbitrage. An ETF whose holdings are mostly unrelated to its underlying asset, investing in an asset openly declared as having no purpose, using a 1940s-era law designed to prevent such speculation. It’s the most cynical expression of financial engineering—exploiting loopholes to create speculative products under the pretense of investor protection.

Why this obsession with yield?

Wall Street no longer pretends to care about fundamentals. It chases yield at all costs, regardless of asset quality.

State Street data shows institutional portfolios are overweight equities at the highest level since 2008. Investors are pouring money into options-income ETFs promising monthly payouts, high-yield junk bonds, and crypto yield products offering double-digit returns through derivatives.

Money always chases yield first and asks questions later. When interest rates spiked, investors quickly shifted from safe investment-grade bonds to high-yield corporate debt. Thematic ETFs around AI, crypto, and meme assets are launching at record speed, catering to speculation rather than long-term value.

Risk appetite indicators are flashing green across the board. Despite macro uncertainty, the VIX volatility index remains low. After a brief shift toward defensive sectors following early 2025 market volatility, capital quickly flowed back into high-risk, high-return sectors like industrials, tech, and energy.

Wall Street has essentially concluded that in a world of infinite liquidity and constant innovation, yield trumps everything. As long as something delivers outsized returns, investors will find a reason to buy—ignoring fundamentals or sustainability.

Are we creating a bubble?

What happens when the number of investment products exceeds the number of actual investable assets?

We’ve already crossed the tipping point where "more ETFs exist than stocks"—a fundamental shift in market structure. We are effectively building "synthetic markets atop real markets," layering on fees, complexity, and potential failure points with each new product.

Matt Levine once noted: "As ETFs grow more popular and technology reduces implementation costs, more formerly customized trades become standardized ETFs. The number of potential trading strategies vastly exceeds the number of stocks... In the long run, the potential market size for ETFs is limited not by the shrinking pool of stocks, but by the infinite universe of trading strategies."

The memecoin ETF phenomenon accelerates this trend. Rex-Osprey has filed applications for TRUMP coin ETFs, Bonk coin ETFs, alongside ETFs for established crypto assets like XRP and Solana. The SEC currently has 92 pending cryptocurrency ETF applications. Each successful launch fuels demand for the next, regardless of whether the underlying asset has any real utility.

This mirrors the 2008 subprime crisis: Wall Street repackaged derivatives into new derivatives until financial products were completely detached from underlying assets. Today, we’ve simply replaced "mortgages" with "attention and cultural phenomena."

Markets appear more liquid than they really are, as multiple products trade around the same underlying asset. But when crisis hits, these products move in lockstep, and the illusion of liquidity vanishes instantly.

What does the memecoin ETF mean?

The deeper story is this: finance has evolved into a "comprehensive attention-capture mechanism." Anything that drives price movement can now be monetized.

ETF listings reinforce themselves through network effects. One month before DOJE launched, Dogecoin’s price rose 15% on expectations of institutional inflows. Price gains attract more attention, fuel more memes, increase cultural influence, and justify further financial products. Success breeds imitation.

Traditional finance monetizes productive assets—factories, technology, cash flows. Modern finance monetizes anything that moves prices—narratives, memes. The ETF wrapper transforms cultural speculation into institutional products, extracting fees from the very communities that created these phenomena.

The core question is: Is this innovation or extraction? Does financializing memes create new value, or merely extract value from organic cultural movements by layering on institutional costs?

Internet culture already generates massive economic value: advertising revenue, merchandise sales, platform traffic, creator economies...

I’ve been pondering what drives 2025’s multi-billion-dollar valuations for certain ventures. I recently ordered matcha from Mitico, a coffee roaster in Bangalore—not because I enjoy the taste of green powder, but because matcha has become a ritual symbol of "efficiency and quiet luxury," making me feel part of a global wellness aesthetic.

This is the state of internet culture today: a series of "participation fees" disguised as lifestyle choices. Monetization opportunities abound, ranging from the absurd to the ingenious.

Take 2025’s viral moments: Coldplay’s "kiss cam" incident turning an awkward moment into a corporate resignation scandal, with Gwyneth Paltrow inexplicably becoming a temporary spokesperson; the internet erupting over whether "100 men could beat a gorilla"; Labubu blind box mania turning $30 collectibles into "status symbols people fight over in stores."

Then there’s my perpetual language barrier. Gen Z slang evolves too fast. Last week someone called my outfit "bussin," and I genuinely didn’t know whether to be offended or flattered—it’s apparently a compliment? My nephew tried explaining "rizz" means "charisma," then started throwing around "skibidi" and "Ohio," and I suddenly realized I’m completely out of touch. I’m trying, but every time I attempt to use these terms correctly, I feel cringey. It’s peak "millennial trying too hard," not the vibe I’m going for.

Minutes after Taylor Swift and Travis Kelce’s engagement news broke, the entire marketing world pivoted: from Walmart to LEGO to Starbucks, every brand rushed to capitalize on the trend.

The key point is: this cultural momentum itself is an economic engine. When Katy Perry takes an 11-minute space flight and the internet debates it for a week, that attention translates into ad revenue, brand exposure, and cultural capital—monetizable in a dozen ways. When a TikTok couple popularizes "pookie" as a term of endearment, instant ecosystems emerge—"pookie playlists," "pookie merch."

Internet culture generates enormous economic value through creator economies, merchandise, platform traffic, and its ability to "move stock prices faster than earnings reports." If a single Elon Musk tweet can add billions to Dogecoin’s market cap, if Tesla’s valuation hinges more on cultural momentum than fundamentals, then "cultural phenomena" are legitimate economic forces deserving of institutional packaging like any other asset class.

The ETF "wrapper" doesn’t extract value from communities. It formalizes existing value, enabling participation by those previously excluded. A retiree in Ohio can now access internet culture through their 401(k), without needing to learn crypto wallets or join Discord servers.

But the flip side is real: that retiree might lose a large portion of their retirement savings on an "abandoned internet joke." Just the 1.5% annual fee alone would cost $1,500 per year on a $100,000 investment. And due to regulatory constraints, the ETF can have at most 25% exposure to Dogecoin—meaning the retiree may not even get the "cultural exposure" they thought they were buying.

"Financial accessibility" without financial education is dangerous. Making speculative assets easier to buy doesn’t reduce their risk—it simply hides the risk from people who don’t understand what they’re purchasing.

Yet, financializing memes might strengthen communities rather than exploit them. When cultural movements gain institutional investment backing, they gain stability and resources.

If internet culture can drive prices, it becomes an asset class. If social momentum creates volatility, it becomes a tradable instrument. ETFs are merely the vehicle converting cultural energy into institutional products.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News