Huobi Growth Academy | Digital Asset Treasury (DAT) In-Depth Research Report: A New Financial Innovation Paradigm from On-Chain HODLing to Equity Flywheel

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Digital Asset Treasury (DAT) In-Depth Research Report: A New Financial Innovation Paradigm from On-Chain HODLing to Equity Flywheel

DAT is not only a new asset allocation tool, but also an institutional experiment combining equity financing with on-chain assets, representing the deep coupling of two major financial systems.

Author: Huobi Growth Academy

I. DAT Market Overview

Digital Asset Treasuries (DAT) have recently emerged as a new phenomenon at the intersection of capital markets and the crypto market. The core logic involves raising funds through public equity financing tools—such as listed company stocks, convertible bonds, ATM follow-ons, and PIPE private investments—and allocating mainstream crypto assets like Bitcoin and Ethereum onto the balance sheet, generating returns for shareholders through operations and yield management. Essentially, it's "using equity financing to purchase on-chain assets," enabling traditional secondary market investors to gain leveraged, structured, and tradable exposure to crypto assets via stock ownership. This mechanism not only bridges on-chain and traditional finance but also creates new trading logic and investment narratives within the market.

Compared to ETFs, DATs show clear differences across multiple dimensions. First is liquidity path. ETFs rely on cumbersome creation and redemption mechanisms requiring authorized participants and market makers, with fund settlement often taking one to two days. In contrast, DAT stocks can be traded instantly on secondary markets, aligning more closely with the liquidity characteristics of on-chain assets. Second is pricing basis. ETFs typically anchor to net asset value (NAV), exhibiting relatively limited volatility, making them better suited for long-term allocation. DAT stocks, however, are driven by market value (MV), featuring greater price elasticity and higher volatility, allowing hedge funds and arbitrage firms to perform structured trades based on premiums and discounts. The third difference lies in leverage structure. ETFs generally lack leverage at the fund level, while DAT companies can layer on leverage via convertible bonds, ATM follow-ons, and PIPE financing, expanding their balance sheets and amplifying excess returns during bull cycles. Finally, there's discount protection. ETF premiums/discounts are quickly corrected by arbitrage mechanisms, whereas when a DAT stock falls below its treasury NAV, it effectively allows investors to buy underlying crypto assets at a discount, theoretically forming a downside protection. However, this protection isn't absolute; if the discount stems from forced deleveraging, where companies sell underlying assets to repurchase shares, it could instead trigger even stronger downward pressure.

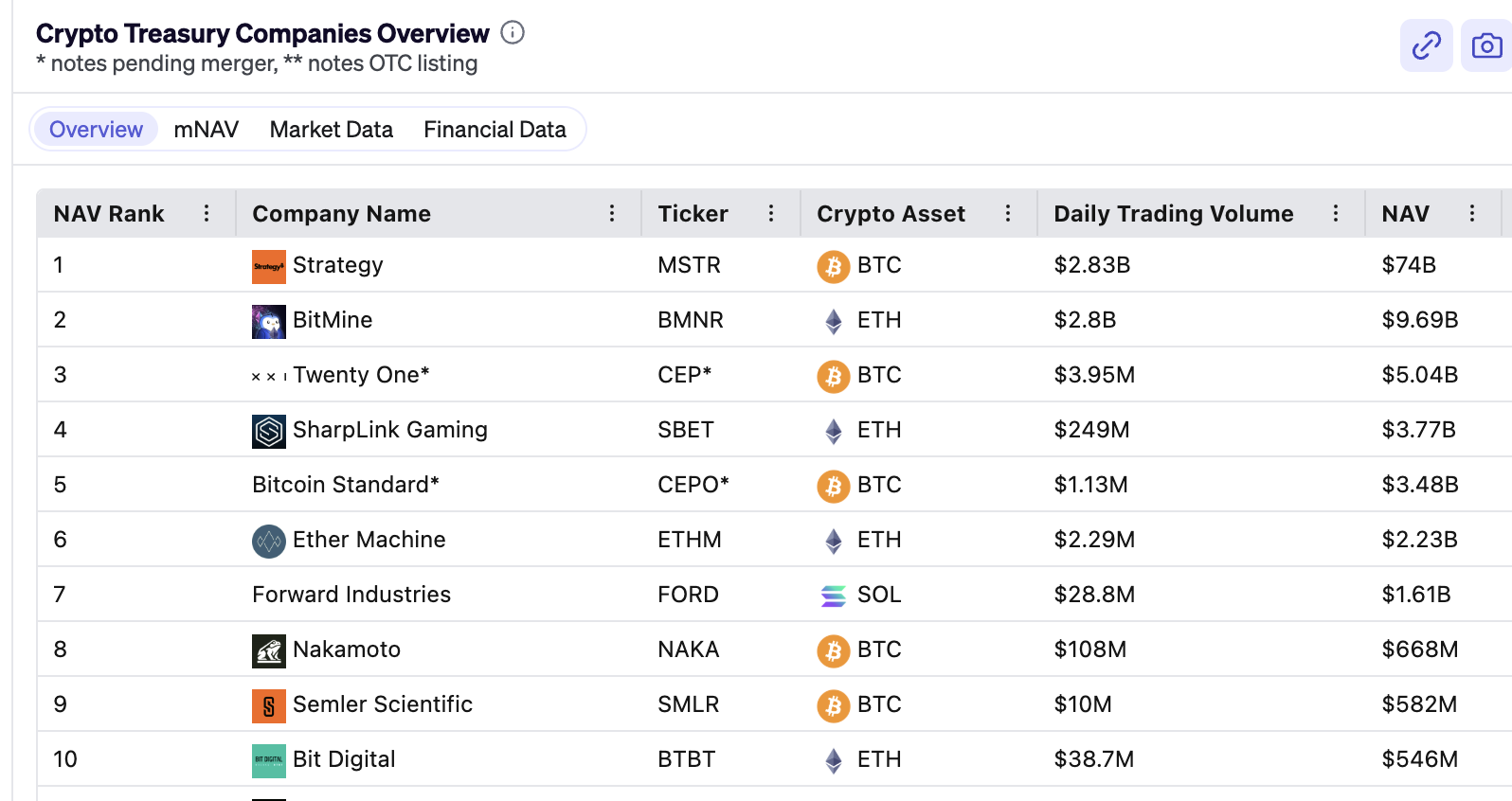

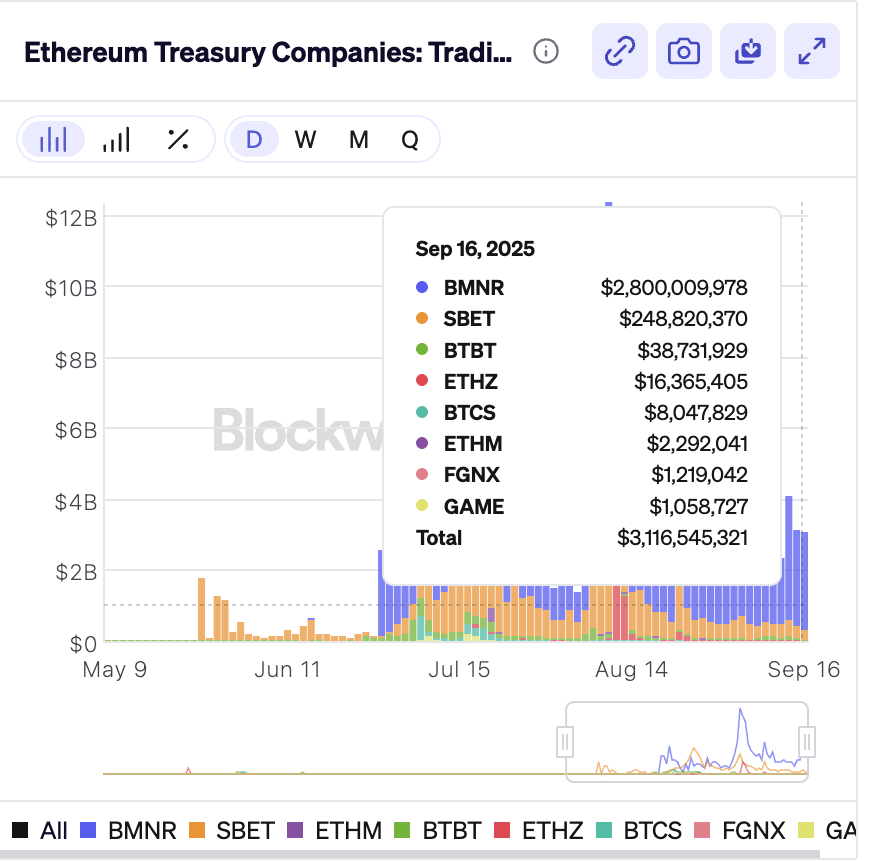

Since 2025, DATs have accelerated development in the Ethereum direction, becoming a focal point of market attention. BioNexus was the first to announce an Ethereum treasury strategy, marking the inaugural year of corporate ETH holding; BitMine (BMNR) disclosed holdings of 1,523,373 ETH in August, becoming the world’s largest Ethereum treasury with a market cap reaching several billion dollars; SharpLink (SBET) continuously increased its ETH holdings through frequent ATM financing, accumulating over 800,000 ETH, nearly all staked, directly converting Ethereum’s productive asset attributes into cash flow. These companies channel traditional investor capital into crypto assets through equity market fundraising, driving institutionalization and financialization of Ethereum prices. Meanwhile, DEX activity reflects the liquidity traits of this new mechanism. In August 2025, Hyperliquid’s spot trading volume briefly surpassed Coinbase on a single day, indicating rapid capital migration between on-chain trading, equity markets, and derivatives markets, with DATs emerging as critical nodes in cross-market capital flows. Some companies have even introduced innovative shareholder incentives. For example, BTCS announced ETH dividends and loyalty rewards to attract long-term investors, enhancing market stickiness and countering short-selling via stock lending.

Nevertheless, DAT risks cannot be ignored. The model relies on a premium flywheel in bull markets: rising stock prices enable fundraising and share issuance, proceeds used to buy more crypto assets, whose appreciation further increases mNAV, fueling continued stock price growth. This cycle generates substantial returns during uptrends but may amplify risk during bear markets. When mNAV shifts from premium to discount, investor confidence in management erodes, and companies attempting to stabilize valuations often sell underlying assets to repurchase shares, creating a negative feedback loop. If multiple DATs simultaneously enter discount territory and take similar actions, systemic risk may arise. Leverage presents another key concern. DATs widely use convertible bonds, short-term financing, and equity issuance to add leverage—amplifying gains during rallies but potentially triggering margin calls or forced liquidation during downturns. Should on-chain asset prices fall sharply, concentrated selling could shock the market, especially given high concentration in assets like Ethereum.

Market research has modeled potential scenarios. Under a base case, off-exchange transactions gradually adjust positions, exerting limited downward pressure on ETH prices; under a severe scenario, if 20%–30% of Ethereum treasury holdings are dumped within weeks, prices could fall to $2,500–$3,000; under an extreme scenario, regulatory tightening or funding chain breaks forcing over 50% of holdings to liquidate could drive ETH down to $1,800–$2,200. While extreme cases are unlikely, their potential impact must not be underestimated. Notably, DAT executives’ compensation is often tightly linked to stock prices, incentivizing short-term actions like selling coins to buy back shares and boost market cap rather than adhering to long-term holding strategies. This misalignment of governance and incentives makes DATs more prone to pro-cyclical risk amplification under stress.

Despite these concerns, DAT prospects remain promising. Over the next three to five years, DATs could develop alongside ETFs in a complementary framework. ETFs offer stable β exposure suitable for passive investors; DATs provide high elasticity and financial engineering-driven return opportunities, better fitting hedge funds, family offices, and institutions seeking alpha. More importantly, the DAT model is expanding beyond Bitcoin and Ethereum to include quality altcoins, offering some projects a capital market gateway akin to an “IPO moment,” accelerating crypto industry institutionalization. Gradually clearer regulation, improved disclosure mechanisms, and diversified shareholder incentive tools will collectively determine the long-term sustainability of DATs. Overall, DAT represents a significant experiment in the convergence of capital and crypto markets—it may become a milestone for next-generation institutional financial instruments, or, due to its pro-cyclical nature, turn into a market volatility amplifier. For investors, skillfully leveraging the complementarity between ETFs and DATs, and flexibly adjusting strategies around mNAV premiums and discounts, may become a core theme in the future era of crypto finance.

II. Industry Development and Key Events

In 2025, the most notable evolution in the Digital Asset Treasury (DAT) market was the concentrated surge in Ethereum-focused treasuries. Unlike earlier reserve strategies centered on Bitcoin, Ethereum is increasingly becoming the centerpiece of corporate treasuries. BioNexus announced its Ethereum treasury strategy in March, formally adding ETH to its corporate balance sheet and expanding holdings through equity financing. This move was seen as a landmark event, symbolizing the beginning of the corporate holding era for Ethereum. Unlike exchanges such as Coinbase that hold ETH for operational needs, BioNexus treats Ethereum as a strategic reserve asset, sending a strong institutional signal to the market. This not only elevated the company’s visibility in capital markets but also signaled growing acceptance of Ethereum as a reserve asset on par with Bitcoin. Subsequently, BitMine (BMNR) pushed this trend to new heights. In August, the company revealed it held 1.52 million ETH, valued at over $6 billion, representing approximately 1.3% of Ethereum’s circulating supply. This scale rapidly positioned BMNR as the “Ethereum version of MicroStrategy,” gaining significant traction in both capital and on-chain narratives. BMNR’s model mirrors that of MicroStrategy: continuous balance sheet expansion via convertible bonds and equity financing, creating a “fundraise-buy coin-valuation rise-refinance” flywheel that reinforces the interplay between stock price and on-chain assets. Market reactions were polarized: some view BMNR as a milestone in Ethereum institutionalization, while others worry excessive leverage and concentrated holdings could amplify systemic risk during market reversals. Regardless, BMNR has become one of the most watched DATs in 2025 and has directly reshaped ETH’s capital landscape.

In parallel, SharpLink (SBET) adopted a more frequent and aggressive balance sheet expansion strategy. SBET continuously issued shares via ATM financing, disclosing new fundraising and purchases almost weekly. By late August, the company had accumulated over 800,000 ETH, nearly all staked on-chain. This strategy directly converts Ethereum’s productive asset properties into cash flow, giving the company not just unrealized gains on its balance sheet but actual income returns. SBET’s approach attracted widespread attention—its weekly disclosures and high transparency build investor confidence while making its strategy easier for the market to quantify, track, and trade against. Critics argue that this “full staking” strategy increases exposure to protocol security and liquidity risks on-chain, but supporters emphasize that transforming ETH into productive assets may represent best practice for DATs.

Notably, BTCS demonstrated another innovative approach in this competitive landscape. The company launched a combined “ETH dividend + loyalty reward” program, distributing dividends in held ETH while introducing loyalty terms that encourage shareholders to transfer shares to a designated transfer agent and hold until early 2026. This way, investors receive both cash and ETH dividends, plus additional incentives for long-term holding. This approach enhances shareholder stickiness and partially suppresses stock borrowing and short-selling, helping stabilize market sentiment. While questions remain about the sustainability of “paying dividends in ETH,” this clearly showcases the flexibility and creativity of DATs in financial engineering, highlighting differentiated strategies companies adopt in response to stock discount risks.

Meanwhile, changes at the trading level are equally noteworthy. In August 2025, decentralized exchange Hyperliquid’s spot trading volume briefly exceeded Coinbase’s on a single day—an event rich in symbolism. For years, CEXs have been seen as the core of crypto liquidity, but with the rise of DAT stock financing and deeper interaction between on-chain capital and equity markets via DEXs, the liquidity landscape is being restructured. Hyperliquid surpassing Coinbase is not an isolated incident but a signal of growing integration between capital markets and on-chain trading. Capital is now flowing through a new cycle: “DAT stock financing → corporate purchase of on-chain assets → staking/re-staking generating yield → investor arbitrage and trading.” This cycle accelerates the fusion of on-chain and traditional markets but could also amplify liquidity shocks under market stress.

Overall, the 2025 evolution of the DAT market reveals the emergence of a new ecosystem. BioNexus opened the door to ETH treasury strategies, BitMine established itself as an industry leader through massive holdings, SharpLink explored alternative paths via high-frequency financing and full staking, and BTCS created unique shareholder incentive tools through financial engineering. At the same time, Hyperliquid’s trading volume shift reflects liquidity realignment between capital and on-chain markets. Together, these cases illustrate that DATs are far more than a simple “companies buying coins” model—they’ve evolved into comprehensive financial innovations encompassing fundraising, asset allocation, yield management, and shareholder governance. Going forward, this ecosystem will continue to expand and evolve, potentially acting as an accelerator for crypto institutionalization, or, due to leverage and liquidity mismatches, becoming a source of amplified market volatility. Regardless of outcome, DATs have profoundly reshaped the capital market narrative around crypto assets in 2025 and have become a key focus for global financial observers.

III. Risks and Potential of DATs

As the DAT model grows rapidly, its hidden risks and systemic concerns are becoming increasingly evident. On the surface, digital asset treasuries provide new sources of capital and liquidity support, but closer analysis reveals their operational mechanics are inherently pro-cyclical—amplifying gains in bull markets and exacerbating losses in bear markets. This double-edged sword makes the role of DATs in capital and crypto markets particularly sensitive and complex. First is leverage risk. DAT balance sheet expansion often relies on share issuance and convertible bond financing. During bull markets, rising stock prices and market caps allow companies to raise large amounts of capital at low cost, enabling further accumulation of Bitcoin or Ethereum, creating a flywheel effect between valuation and holdings. However, this leverage model can quickly backfire when markets turn. If underlying asset prices suffer sharp corrections, debt repayment obligations and margin clauses may be triggered, forcing companies to passively sell holdings to cover funding gaps. Leverage magnifies both returns and risks—especially dangerous given the high volatility of crypto assets.

Second is discount crisis. DAT valuations are anchored to mNAV—the ratio between a company’s market cap and the fair value of its crypto holdings. In bull markets, mNAV is usually well above 1, as investors pay premiums for future growth and earnings. But once market sentiment reverses and stock prices fall below asset net value, turning mNAV from premium to discount, investor trust in management rapidly erodes. In such cases, companies often attempt to repair valuations and calm markets by selling ETH or BTC to repurchase shares, trying to pull stock prices back toward NAV. However, this essentially sacrifices long-term holding strategy for short-term price recovery, potentially shrinking the discount temporarily while imposing additional selling pressure on the market, creating a vicious cycle.

Liquidity shock is another concern. As DATs accumulate larger volumes of crypto assets, the market impact of concentrated releases could exceed expectations. Especially when decentralized exchange liquidity is thin, coordinated selling by multiple DATs could trigger cascading price drops. Past experience shows that highly concentrated assets undergoing forced deleveraging often see non-linear price declines. In other words, even if total sales represent only a small fraction of circulating supply, insufficient liquidity absorption can cause severe volatility. This risk is particularly pronounced for tokens like Ethereum with high holding concentration. Regulatory uncertainty looms as another sword over the DAT model. There remains no unified standard for accounting treatment, disclosure requirements, leverage limits, or retail investor protections for treasury-type companies. Divergent attitudes across jurisdictions could abruptly alter the operating environment for DATs. For example, regulators might require disclosure of on-chain addresses and staking risks, impose leverage caps, or ban token-based dividends—all measures that could significantly impact DATs’ fundraising ability and market narratives. For DATs heavily reliant on capital markets and investor confidence, such regulatory shifts mean not only higher costs but potentially undermining the very sustainability of their business models.

Moreover, misaligned governance and incentive structures pose potential issues. Most DAT executives’ compensation is directly tied to stock price, which motivates aggressive expansion in bull markets but may push management toward short-termism in bear markets. When stock prices fall into discount territory and investor confidence wanes, executives may prioritize selling underlying assets to buy back shares and prop up market cap—protecting personal compensation rather than sticking to long-term holding strategies. This incentive misalignment undermines strategic stability and increases the likelihood of pro-cyclical selling, heightening market fragility. Beyond risk analysis, scenario modeling offers clearer insights. In a base case, assuming a mild ETH price correction, DATs might gradually exit positions via OTC deals, smoothing market impact with limited price shock. In a severe case, if 20%–30% of ETH treasury holdings are dumped in a short period, the market may fail to absorb the volume, pushing ETH prices down to $2,500–$3,000—a roughly 30% decline from current levels, enough to reshape market sentiment. In an extreme case, if over 50% of holdings are forcibly liquidated due to funding chain breaks, regulatory crackdowns, or systemic crises, ETH could crash to $1,800–$2,200. Such a drop would erase all gains since the DAT wave began, resetting the market to early 2025 levels. While extreme cases are less likely, given DATs’ heavy reliance on financing and leverage, their occurrence would have profound market implications. Overall, the rise of DATs has undoubtedly injected new narratives and liquidity into crypto markets, but it is not a stable “new normal.” Its pro-cyclical nature means it acts as both a bull market amplifier and a bear market risk source. For investors, understanding the leverage chains, mNAV premium/discount dynamics, and management incentive structures within the DAT model is key to assessing its sustainability. Without robust regulation and risk isolation, DATs resemble high-leverage financial experiments—potentially advancing crypto institutionalization or becoming sparks for market turmoil. In the coming years, DATs’ risk management capabilities and regulatory maturity will determine whether this model evolves from speculative narrative to stable financial instrument.

Looking ahead three to five years, Digital Asset Treasuries (DATs) are likely to develop in parallel with ETFs, jointly shaping the institutional investment landscape of crypto markets. ETFs have already proven their strengths in compliance, stability, and low cost, offering passive investors, pension funds, and sovereign wealth funds reliable β exposure. In contrast, DATs—with higher elasticity, complex capital engineering, and direct on-chain asset ownership—are naturally better suited for hedge funds, family offices, and active institutions pursuing alpha. This market segmentation suggests ETFs and DATs aren’t zero-sum competitors but complementary forces driving deeper integration between traditional capital and crypto markets. From an asset expansion perspective, DAT portfolios will likely extend beyond BTC and ETH. As the industry matures, quality altcoin projects may gain an “IPO moment” via public company treasury financing, building large-scale on-chain positions early on. This could provide institutional endorsement for relevant tokens and create entirely new capital market narratives. For instance, Layer2 protocols, decentralized data networks, or core stablecoin systems could become future DAT holdings. If this trend materializes, DATs won’t just be leveraged tools for BTC/ETH but become “accelerators” for next-gen blockchains and protocols in capital markets, profoundly impacting the crypto ecosystem.

In terms of operations, yield engineering will become the next frontier for DATs. Currently, some companies are already exploring staking held tokens to earn on-chain yield and convert it into cash flows for shareholders. In the future, this model could expand into options hedging, basis arbitrage, re-staking, and governance participation. Unlike traditional ETFs that simply track prices, DATs could actively operate to form “dynamic treasuries,” capturing on-chain yields while increasing influence over underlying ecosystems. This means DATs may not only be asset holders but also key governance participants in on-chain protocols, even evolving into “institutional players” within the crypto economy. Gradually clearer regulatory frameworks will be critical to DAT sustainability. Currently, jurisdictional attitudes toward DATs remain inconsistent, with unresolved issues around disclosure, accounting standards, leverage ratios, and retail protection. However, as market size and investor base grow, regulatory pressure will inevitably increase. Future regulations may require DATs to disclose on-chain addresses, clarify holding sizes and staking ratios, and standardize dividend distribution methods to ensure transparency and investor protection. In this sense, stricter regulation could enhance DAT credibility and attract more institutional capital, though it may also reduce flexibility in capital engineering. Regulatory tightening is both a challenge and a necessary step for DATs to evolve from “financial experiments” to “institutional tools.”

In the long run, DATs have the potential to become quasi-financial intermediaries in crypto markets. Their uniqueness lies in connecting equity capital markets with on-chain asset markets, forming cross-market capital allocation bridges. When investors buy DAT stocks, they indirectly participate in the holding and operation of on-chain assets, while DAT companies bring traditional capital into crypto through equity financing. This two-way interaction will make DATs play an increasingly important role in global capital flows and asset allocation. Especially in contexts where cross-border capital faces difficulty directly investing in crypto, DATs could serve as compliant channels offering “indirect exposure,” broadening the investor base for crypto assets. Yet behind this bright outlook lie significant systemic vulnerabilities. The pro-cyclical nature of DATs means they may accelerate price rises in bull markets but deepen downturns in bear markets. Unlike ETFs’ passive holdings, DATs heavily depend on equity market financing and mNAV premiums. Once market conditions reverse, their funding chains may snap quickly, leading to widespread forced deleveraging. In other words, while DATs have vast potential, whether they can truly mature into stable institutional segments depends on their performance in risk management and regulatory adaptation.

Overall, over the next three to five years, DAT development will follow two parallel trajectories. On one hand, they will keep innovating—expanding asset scope, embedding yield engineering, and deepening on-chain engagement—to build unique competitive advantages as high-elasticity complements to ETFs. On the other hand, they will undergo real-world tests of regulatory constraints, leverage control, and market volatility, gradually forging more robust and sustainable models. DATs are both symbols of capital and crypto market integration and reflections of pro-cyclical risk. Only by balancing institutionalization with innovation can they truly emerge as new intermediaries in the global financial system, helping move crypto assets from the periphery to the mainstream.

IV. Conclusion

The rise of Digital Asset Treasuries (DATs) is undoubtedly one of the most emblematic events in 2025 at the intersection of capital markets and the crypto industry. It is not merely a new asset allocation tool but a formalized experiment combining equity financing with on-chain assets, signifying deep coupling between two financial systems. At its core, DAT binds the fundraising power of public companies directly to the high volatility of blockchain assets, creating an unprecedented investment logic and market narrative. For investors, it offers both new avenues for amplified returns and new sources of amplified risk. During bull markets, the DAT model operates smoothly: stock price premiums lift mNAV, enabling easier fundraising via convertible bonds, PIPEs, or ATM follow-ons. Proceeds are then converted into purchases of ETH, BTC, and other crypto assets, balance sheet expansion boosts market cap, forming a “premium-funding-increased holdings” flywheel. This mechanism makes DATs powerful catalysts for market rallies, with far greater valuation elasticity than traditional ETFs, turning them into prime targets for hedge funds and high-net-worth investors. Under this narrative, DATs are not just products of financial innovation but central participants in bull market capital flows and valuation expansion.

However, in bear markets, DATs may present a completely different picture. When prices fall and mNAV shifts from premium to discount, market confidence in management weakens. To repair stock prices, companies may sell underlying assets to repurchase shares, temporarily narrowing the discount. Yet such actions often increase selling pressure, accelerate price declines, and push more DATs into deleveraging traps. Under this pro-cyclical mechanism, DATs cease to be market stabilizers and may instead become amplifiers of systemic risk. In other words, DAT risk isn’t just individual company risk—it’s the collective market impact that could arise when multiple treasury-backed companies simultaneously dump holdings. At the investment level, the functional division between DATs and ETFs is becoming increasingly clear. ETFs are better suited as foundational tools for long-term allocation, providing transparent, low-cost, and predictable β exposure; DATs, with their high leverage, high elasticity, and active yield management, serve as incremental allocation options, especially attractive to institutions and individuals seeking alpha who are willing to assume higher risk. For family offices or active managers, DATs offer capital engineering advantages unreplicable by traditional ETFs, albeit with exposure to potential liquidity risks and governance uncertainties. Going forward, how investors find optimal combinations between ETFs and DATs will become a core issue in portfolio strategy.

Over the next three to five years, DATs may evolve into an institutional segment standing alongside ETFs. Their development path will hinge on three key factors. First, regulatory clarity. Only when standardized norms emerge around accounting treatment, disclosure, leverage limits, and shareholder protection can DATs attract broader institutional capital inflows. Second, information transparency. Public disclosure of on-chain addresses, holding sizes, and staking ratios will become crucial for investors to assess risk and valuation, and a prerequisite for DATs to build long-term trust. Third, market resilience. Whether the crypto market can withstand potential pro-cyclical shocks will directly determine if DATs act as positive forces for institutionalization or become sources of amplified volatility.

If these conditions are met, DATs may become another milestone in financial history, much like ETFs did for index funds decades ago. Evolving from initial market experiments to widespread adoption, DATs could redefine the boundaries between capital and crypto markets, bringing crypto assets into much larger investment portfolios. But if these conditions fail to materialize, DATs may prove to be nothing more than a fleeting spectacle—ultimately remembered as “a high-stakes gamble between financial innovation and risk management.” History shows that every new financial tool brings both efficiency gains and unknown risks. The emergence of DATs is an inevitable product of our times, merging traditional financing logic with decentralized assets to create novel value capture mechanisms. Yet their longevity depends not just on market enthusiasm, but on regulatory rationality, governance soundness, and mature risk controls. Investors, companies, and regulators must all recognize that DATs are not risk-free arbitrage tools, but new challenges to the entire market structure. Ultimately, the future of DATs rests on co-evolution between markets and institutions. If regulation and market mechanisms can interact constructively, DATs may become vital bridges for crypto institutionalization. Otherwise, their pro-cyclical nature and leverage chains may deepen market instability, turning them into failed cases of “financial alchemy.” Just as ETFs were once questioned two decades ago but are now foundational to global markets, the fate of DATs may likewise be decided in the coming decade. Regardless, their emergence has already carved a lasting mark in the river of capital market history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News