Why Bitcoin is a Better "Gold"?

TechFlow Selected TechFlow Selected

Why Bitcoin is a Better "Gold"?

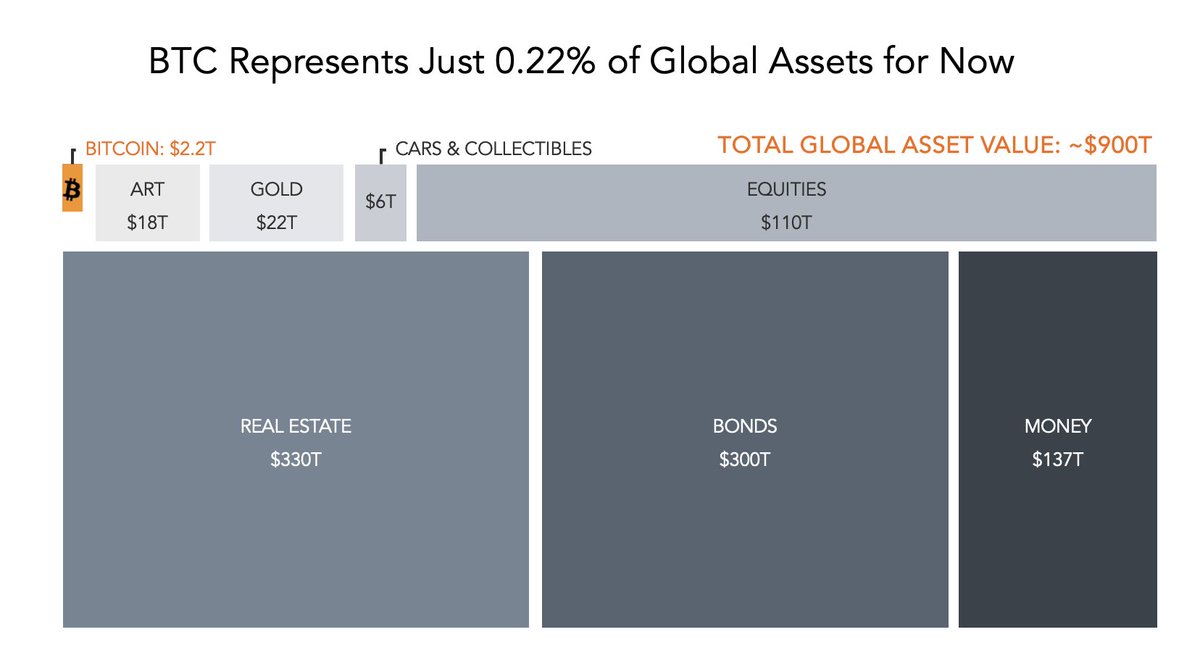

After 16 years of development, Bitcoin still represents only 0.22% of the world's $90 trillion in wealth, remaining a relatively small asset.

Author: Bill Qian

This article is a companion piece to "How to Protect Your Wealth in Turbulent Times," where we will systematically explore the following questions. First, what exactly is wealth storage? Second, why did gold emerge as the winner in modern times? Third, why might Bitcoin be the superior "gold" of the 21st century and beyond?

Over the past 5,000 years, competition for the "best store of value" has always existed. Gold gradually became the king of wealth storage due to its scarcity and the value consensus built over millennia. Yet at the same time, Bitcoin is slowly eroding and shaking gold's market position, presenting our generation with an epic opportunity for wealth creation and transfer.

The History of Money

To compare gold and Bitcoin, let’s first discuss the broader category: money. Money has three core functions: medium of exchange, unit of account, and store of value. From seashells and copper coins to modern fiat currencies (like the US dollar and euro), the medium of exchange and unit of account have continuously evolved. Meanwhile, gold, silver, land, and blue-chip stocks have long served as mainstream stores of value. In monetary history, the US dollar during the Bretton Woods System was one of the rare currencies that could simultaneously fulfill all three roles—medium of exchange, unit of account, and store of value—but this was an exception rather than the norm. Moreover, the dollar’s triple role began to unravel after Nixon’s televised speech in 1971. Some may ask: then why do many people in emerging markets still prefer using and saving in US dollars—even though data shows the dollar is constantly depreciating? I believe the answer is: because they have no better alternative; their local currencies are worse. This topic leads into stablecoins, which we’ll cover next time.

How Did Gold Become Today’s “Gold”?

A good candidate for wealth storage must satisfy five characteristics: scarcity, durability, portability, divisibility, and social consensus. Silver, land, and diamonds all struggle to outperform gold across these five metrics. Thus, after tens of thousands of years, gold finally won humanity’s consensus and mindshare, becoming nearly the sole asset for storing wealth.

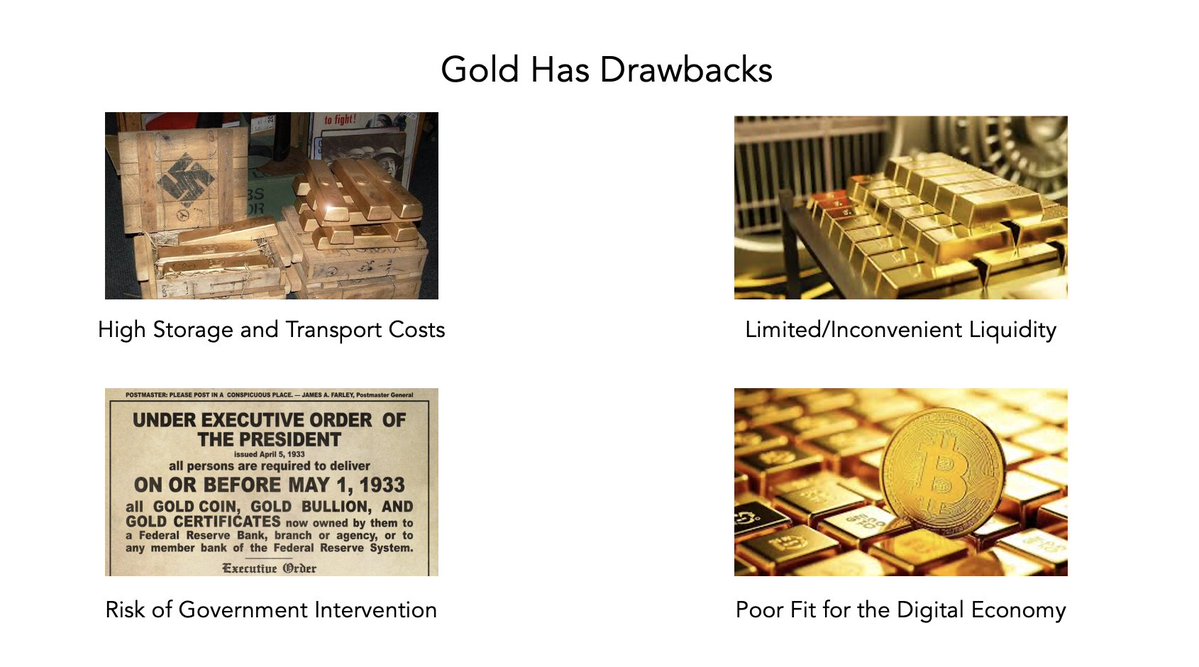

What Are Gold’s Limitations?

-

Storing gold requires expensive vaults and insurance, and sometimes even transportation costs—the larger the amount, the higher the expense. During World War II, the gold in bank vaults in Paris was directly looted by German forces. The biggest lesson I take from this is: the safe in the bank is not safe at all.

-

In extreme times, the cost of liquidating gold can be very high. During WWII, similar situations occurred—whether you were in Shanghai, Paris, or Amsterdam, gold transactions often faced steep discounts, typically 30–50% below spot prices, and even deeper in high-risk environments. Worse yet, trading gold in conflict zones often carries serious personal risks—if others know you hold gold bars, robbery or kidnapping become real threats.

-

Governments can further undermine gold’s reliability through confiscation and price controls. For example, in 1933, the U.S. required citizens to surrender most of their gold at a fixed price below market value, under threat of severe penalties. Note: At that time, the U.S. government mandated citizens hand over gold at $20.67 per troy ounce. Then, in 1934, the Gold Reserve Act was passed, revaluing the official price of gold to $35 per troy ounce. This effectively "devalued" citizens’ gold holdings by about 41% within a single year. The U.S. collected over 2,600 tons of gold, fundamentally altering monetary policy and laying the groundwork for the complete end of the gold standard in 1971—all this happening in the 20th-century United States, widely seen as the beacon nation for private property rights.

-

Beyond that, in today’s digital economy, gold’s lack of “digital” nature is a clear limitation. For instance, you cannot send one kilogram of gold to your friend—or another address—via any digital wallet.

In 2009, Bitcoin Appeared! What Exactly Is It?

In 2009, Bitcoin—created by the pseudonymous Satoshi Nakamoto—became the first decentralized digital currency. **It operates on a global, public, open computer network (commonly known as blockchain—a term I’ve always found hard to grasp): a shared digital ledger that anyone can participate in and verify.** New bitcoins are created through "mining": computers solve complex mathematical puzzles to bundle transactions into new "blocks" added to the blockchain, and "miners" are rewarded with newly generated bitcoins. This process ensures the security and smooth operation of the entire system.

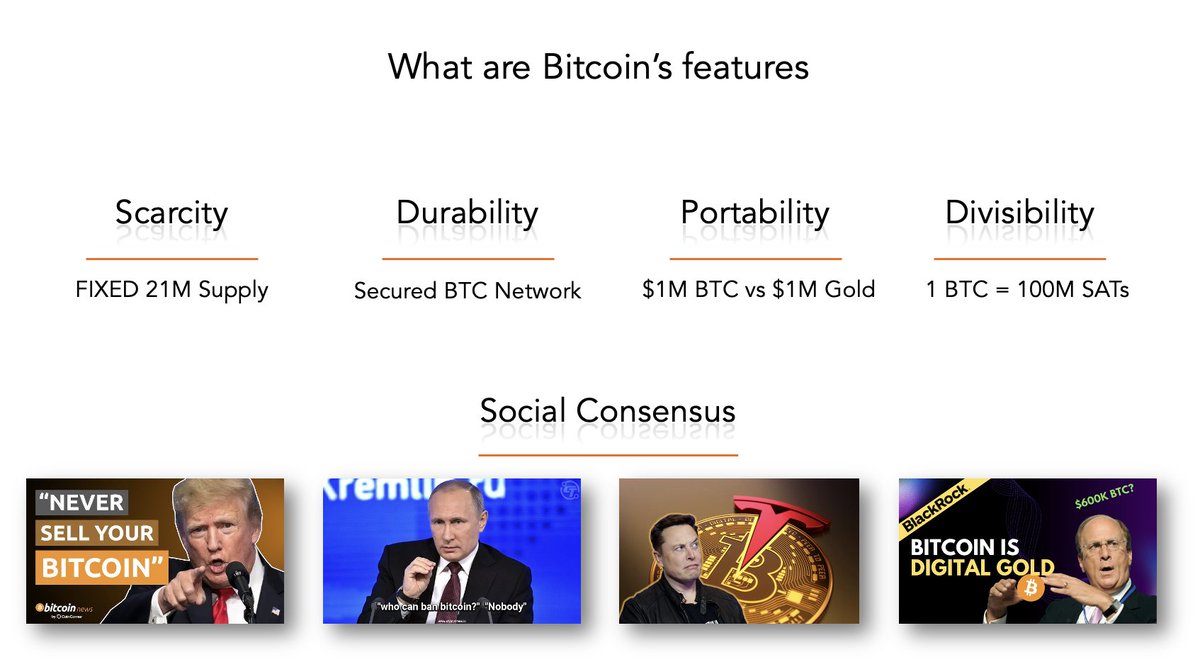

What Are Bitcoin’s Characteristics?

Scarcity: With a capped supply of 21 million coins, Bitcoin avoids the 1.5%–2% annual inflation that gold experiences due to ongoing mining.

Durability: As a digital asset, it is permanently durable and immune to physical degradation.

Portability: Today, carrying $1 million worth of gold through a war zone is nearly impossible. At current prices, that amount weighs 12.4 kilograms—you can’t bring it on a plane, and driving with it would be even more dangerous. Bitcoin faces no such issue.

Divisibility: Bitcoin is highly divisible, down to one hundred millionth of a coin (a satoshi), which is already small enough for practical use.

Social Consensus: This has been the most debated aspect over the past 16 years—and the main motivation behind other cryptocurrencies challenging Bitcoin. Regardless of what Bitcoin and its community have done right over the past 16 years, we must now accept a fact: it has formed an initial social consensus. By 2024, the world’s most powerful figures—Trump and Putin—have both acknowledged Bitcoin, albeit for different reasons. Trump sees it as innovation, a debt monetization tool, and a free-market playground for his family. Putin recognizes Bitcoin because Russians discovered that NATO sanctions, after years of being feared, were merely paper threats—without access to SWIFT, they still had the blockchain network. Additionally, Larry Fink, founder of BlackRock—the world’s largest asset manager—has publicly supported Bitcoin since 2023 and launched a Bitcoin ETF in 2024, calling it "digital gold." Larry manages $12.5 trillion, equivalent to 11% of global GDP in 2024. And Musk, the world’s richest entrepreneur, has given so many endorsements that they need no further elaboration.

Let’s Examine Bitcoin’s Market Performance

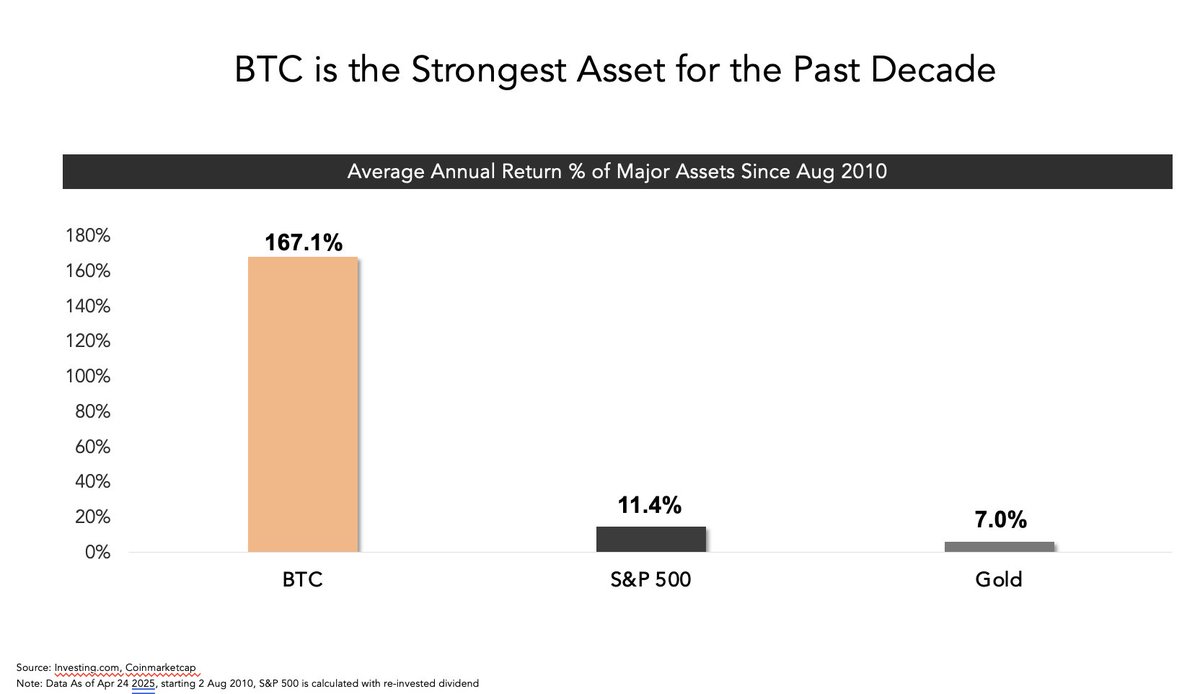

Since 2010, Bitcoin has delivered an average annualized return of 167%, 14 times that of the S&P 500 Index and 24 times that of gold. Today, its $2.3 trillion market cap has surpassed both global silver ($2.1 trillion) and Saudi Aramco—the world’s largest energy provider ($1.8 trillion). As a “one-person company,” Bitcoin is arguably the most leveraged enterprise in history. When discussing leverage for individual talent, four types are usually recognized: labor, capital, code, and media. But the driving force behind all four, I believe, is storytelling ability—after all, the world is ultimately shaped by storytellers, from religious leaders to Marx, to Satoshi Nakamoto. Satoshi is a great storyteller.

Bitcoin’s Future Outlook

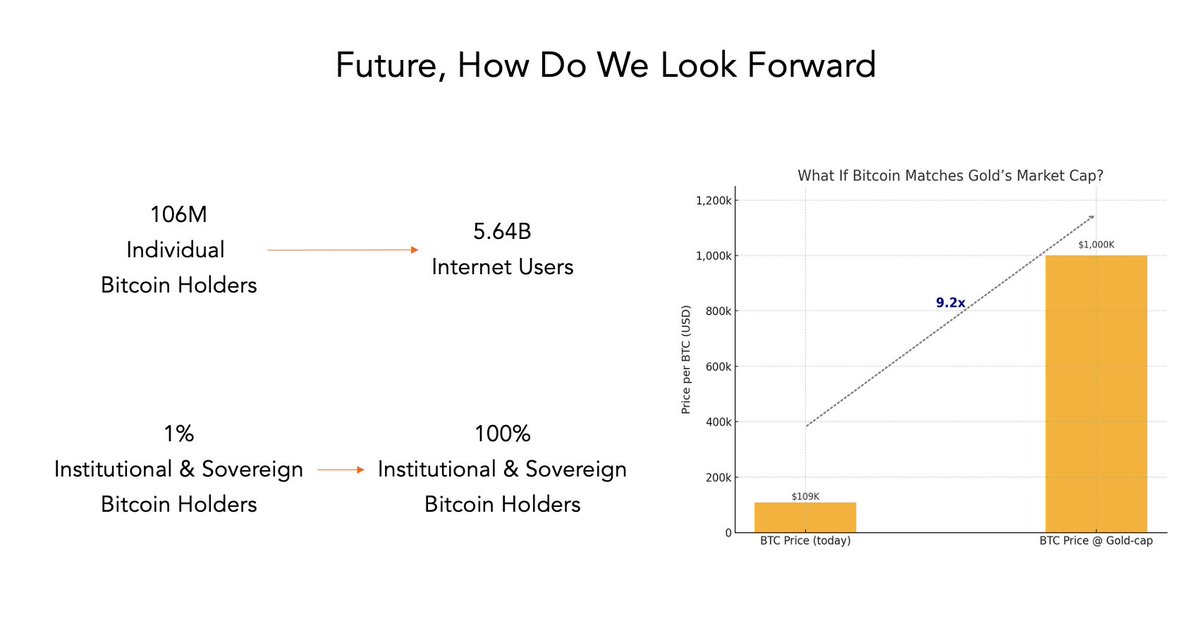

After 16 years of development, Bitcoin represents only 0.22% of the world’s $900 trillion in wealth—still a tiny asset. Currently, there are around 100 million Bitcoin holders, just 2.5% of the 5.6 billion internet users. This means adoption is still in its early stages, equivalent to the "innovators phase" of a broader market. This situation resembles internet adoption between 2000–2001—when there were about 400 million users, comparable to today’s roughly 450 million cryptocurrency users—both marking an initial growth period.

If in the future, Bitcoin ownership grows from 100 million to 5.6 billion (matching today’s internet user base) and gains widespread adoption among global institutions and sovereign governments, what might the price reach? This is precisely why many people speculate Bitcoin could soon hit $1 million—because at that price, Bitcoin’s market cap would roughly match that of gold today.

Finally, what can you do? Start building your own Bitcoin position.

First, define your investment horizon. Historical data shows most investors perform poorly at market timing. Unless you possess exceptional tools, discipline, and access to high-frequency signals, long-term strategies—such as passive investing, dollar-cost averaging (DCA), and disciplined rebalancing—are generally more effective than trying to predict market swings. A time-weighted approach—for example, consistently investing in Bitcoin over the next 12–36 months—is a prudent strategy. Friends often ask me lately, as beginners, whether they should go all-in at once. I always believe everyone should strive to become a rational contrarian—maintaining skepticism and caution when everyone else is euphoric. This is also why I strongly recommend DCA: it’s an acknowledgment of our own limitations as ordinary individuals in predicting markets. And recognizing one’s own limitations is itself a victory over most people.

Second, determine your appropriate allocation. Allocating at least 5% of household net worth to Bitcoin is a cautious starting point. This aligns with traditional portfolio strategies—typically allocating 5–15% to gold (a safe-haven asset) to enhance stability and reduce risk. Take Ray Dalio’s All Weather Portfolio as an example, which allocates **15% to Hard Assets (**gold/commodities). Therefore, I believe 5% is a solid starting point.

Third, take action. You can simply ask an AI assistant: "As a KYC-verified user living in [insert jurisdiction], how can I buy Bitcoin?"

You are welcome.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News