Will Figure Be the Next "Crypto Legend" to Disrupt the Trillion-Dollar U.S. Loan Market?

TechFlow Selected TechFlow Selected

Will Figure Be the Next "Crypto Legend" to Disrupt the Trillion-Dollar U.S. Loan Market?

At the industry level, Figure's IPO, together with Circle and Bullish this year, forms three pathways for "crypto finance entering the mainstream market."

Author: US Stock Investment Network

Following the successful listings of Circle (CRCL), the first stablecoin company, and Bullish (BLSH), the first regulated exchange company, Wall Street's "sweetened finance trilogy" is entering its third act. Figure Technology Solutions, trading under FIGR on the U.S. stock market, is set to debut on Nasdaq next Thursday.

Unlike the previous two companies, Figure does not rely on "crypto narratives," but instead chooses to embed blockchain into the most traditional and largest segment of the U.S. financial system—home equity lines of credit (HELOC) and asset securitization.

As such, this IPO transcends the significance of a single company; it resembles more of an industry-wide examination: Can blockchain truly step beyond the bubble of digital assets and enter the core of traditional finance?

Company Overview and Core Business

Founded in 2018 by Mike Cagney, co-founder of SoFi, Figure allows Cagney to demonstrate once again his ability to bring internet thinking into consumer finance. At Figure, however, he has chosen a more disruptive path: using blockchain to reshape lending and asset transfer processes.

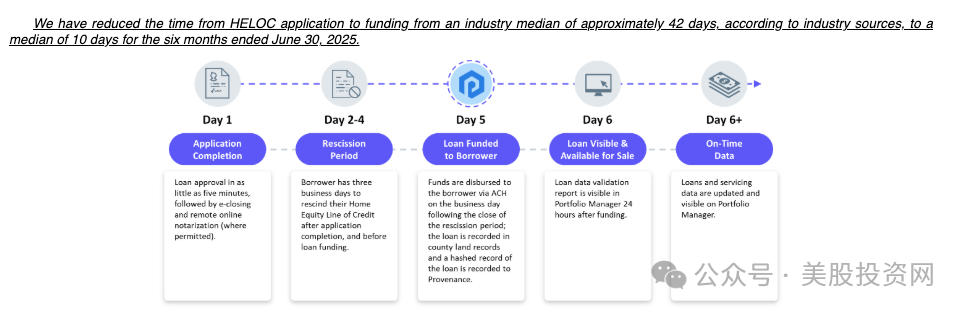

Basing operations in San Francisco, Figure initially entered the home equity line of credit (HELOC) market—a common financing method among American households. Yet traditional HELOC processes are cumbersome, averaging over 40 days. Leveraging its proprietary Provenance blockchain, Figure has reduced approval times to around 10 days. This efficiency gap has become the key factor behind its rapid rise. By 2025, the company had originated over $16 billion in HELOC loans.

However, Figure did not stop at originating its own loans. It gradually built a more comprehensive fintech platform: offering loan origination systems (LOS) to financial institutions, launching a loan marketplace (Figure Marketplace), developing digital asset registration technology (DART), and even venturing into stablecoins and DeFi. The company clearly understands that its story is no longer about being a "blockchain company," but rather a "next-generation financial infrastructure provider."

Core Business

Figure’s business can be broken down into three layers.

The first layer is lending. HELOC remains Figure’s core business, contributing approximately 75% of revenue in the first half of 2025. Its main advantage lies in operational efficiency, with approval speeds reaching one-fourth of traditional institutions. However, HELOC is highly dependent on the real estate market and interest rate conditions, carrying inherent cyclical risks.

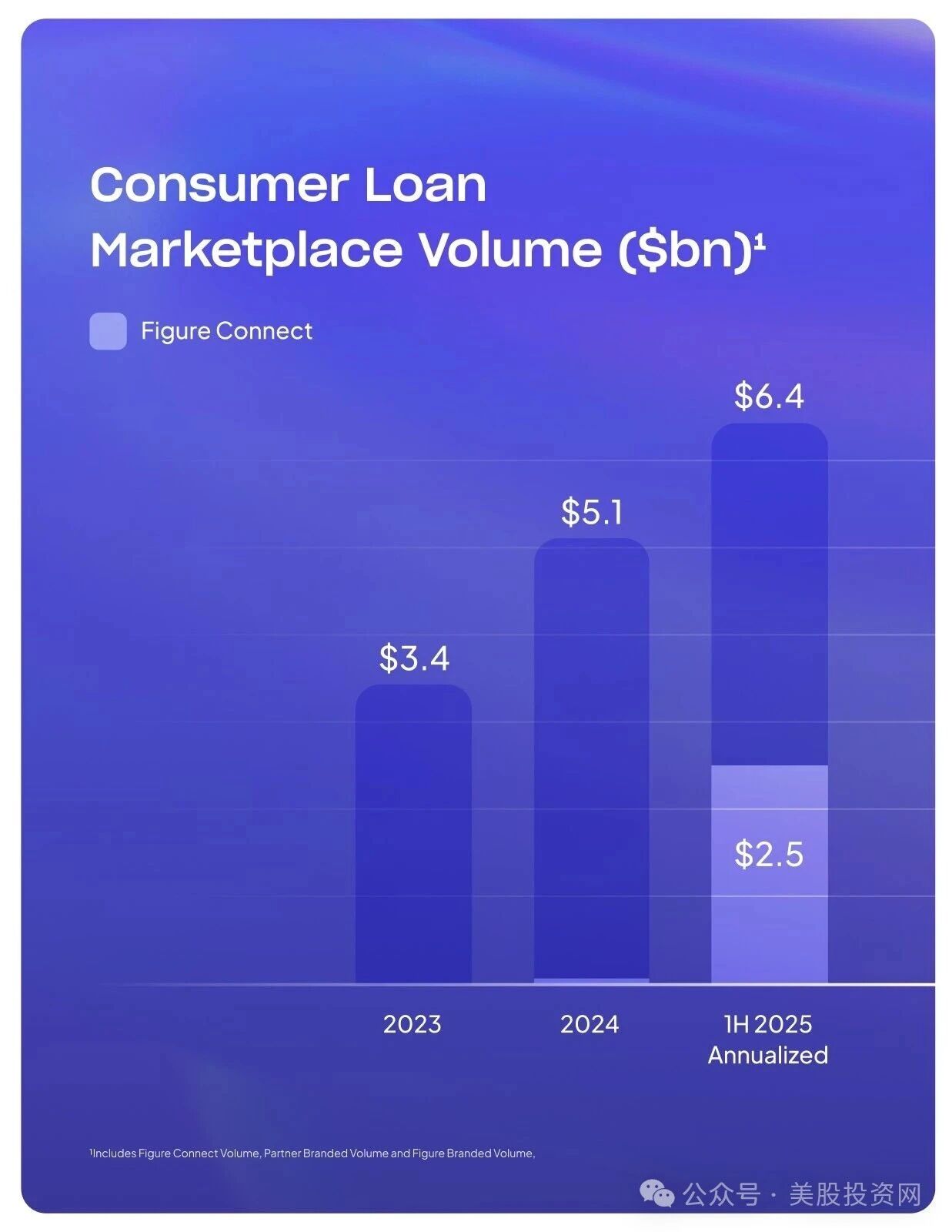

The second layer is platform services. Figure provides LOS systems to banks and lenders, enabling them to originate loans at scale. It also operates the Figure Marketplace, matching loan supply and demand. Platform transaction volume reached $3.4 billion in 2023, increased to $5.1 billion in 2024, and hit $2.5 billion in the first half of 2025, putting it on track to exceed $6.4 billion for the full year. This indicates Figure is transitioning from a "lender" to a "loan marketplace," generating revenue through services and matchmaking.

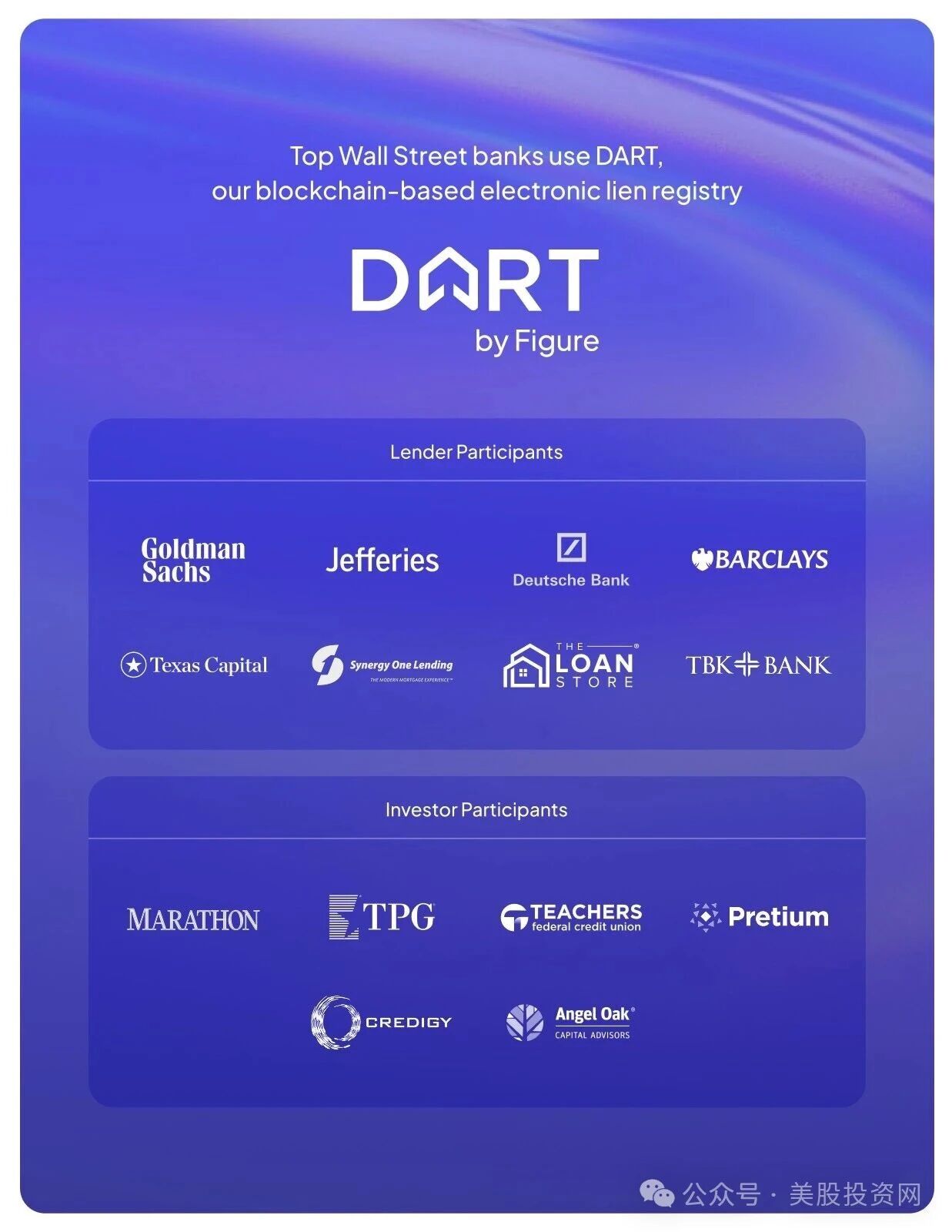

The third layer involves asset management and securitization. Figure developed the DART system, enabling loan assets to be registered and transferred on-chain. Major Wall Street firms including Goldman Sachs, Jefferies, Deutsche Bank, and Barclays have become clients—serving as one of Figure’s strongest endorsements.

In 2025, Figure launched a blockchain-based asset securitization product that received AAA ratings from Moody’s and S&P—the first such achievement in financial history. Simultaneously, Figure introduced the world’s first SEC-approved interest-bearing stablecoin, further expanding the possibilities for "compliant DeFi."

Financial Performance

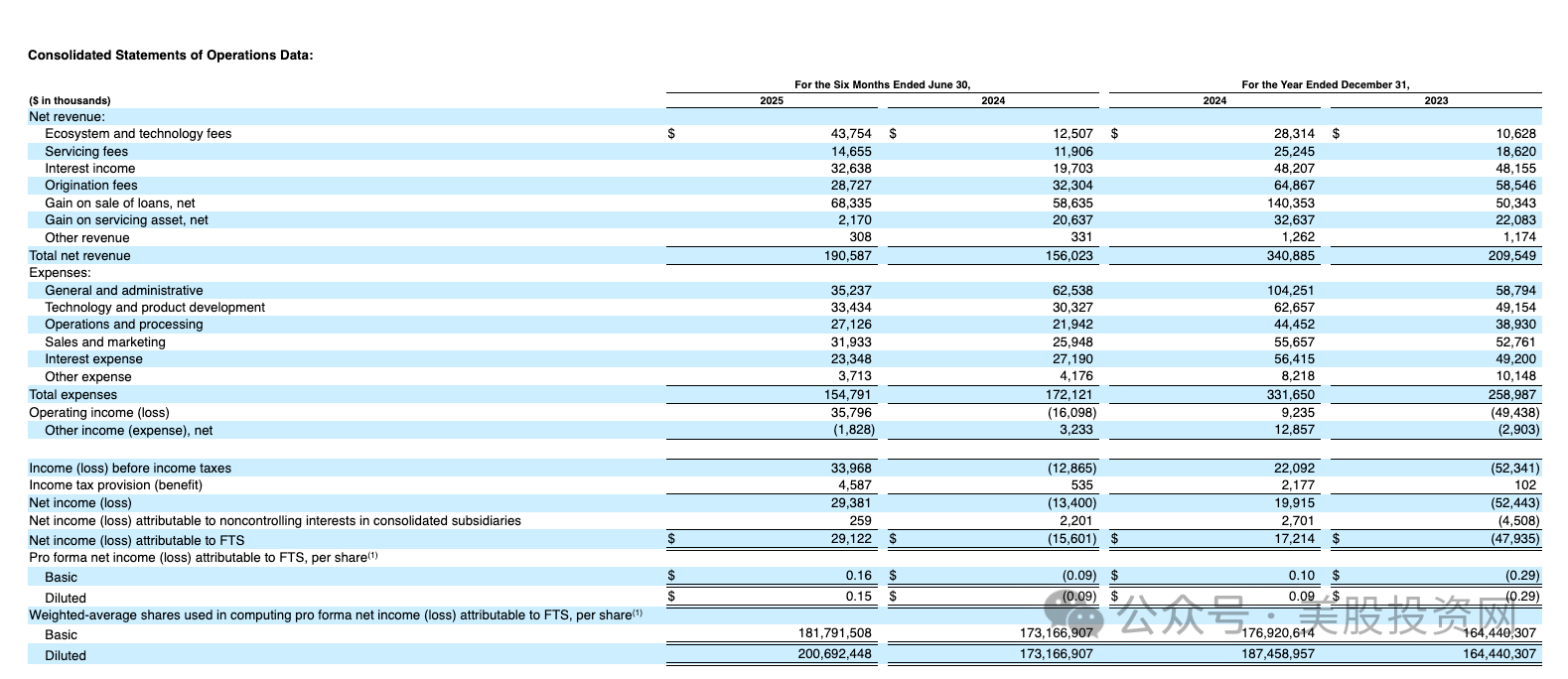

From a financial standpoint, Figure demonstrated substantial improvement in the first half of 2025. Total revenue reached $191 million, a significant increase from $156 million during the same period in 2024. Net profit also turned positive: $29.38 million in net income was recorded in the first half of 2025, compared to a loss of $12.86 million in the same period of 2024.

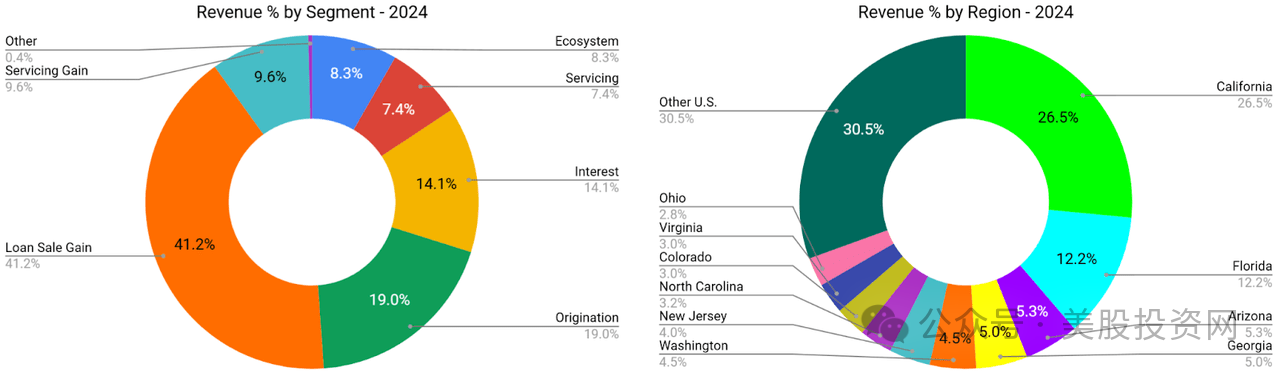

In terms of revenue composition, gains from loan sales and interest income remain the primary sources, together accounting for over half of total revenue. Meanwhile, ecosystem and technology fees reached $43.75 million, indicating growing contributions from platform-based operations.

On the expense side, Figure’s total operating expenses amounted to $155 million, including $35.24 million in general and administrative costs, $33.43 million in technology and product development, and $31.93 million in sales and marketing. These figures represent a manageable cost structure relative to revenue, reflecting ongoing efficiency improvements through cost optimization.

Notably, Figure reported a loss of $52.44 million in 2023, achieved a net profit of $19.92 million in 2024, and expanded net profit to nearly $30 million in the first half of 2025—indicating a clear trend toward sustained profitability.

Nevertheless, the company has experienced significant profit volatility over the past few years, particularly enduring prolonged high losses between 2021 and 2022. This historical burden reminds investors that its business model still requires further validation.

Overall, Figure appears to have reached a financial turning point—revenue continues to grow, losses have steadily narrowed and reversed into profits—but the sustainability of profitability remains to be seen. From a revenue composition perspective, it remains heavily reliant on loan sales and interest income. While platform and ecosystem fees are growing rapidly, their share is still insufficient. Whether the company can further reduce its "asset-heavy" nature will determine the longevity of its profitability.

Industry Environment and Competitive Landscape

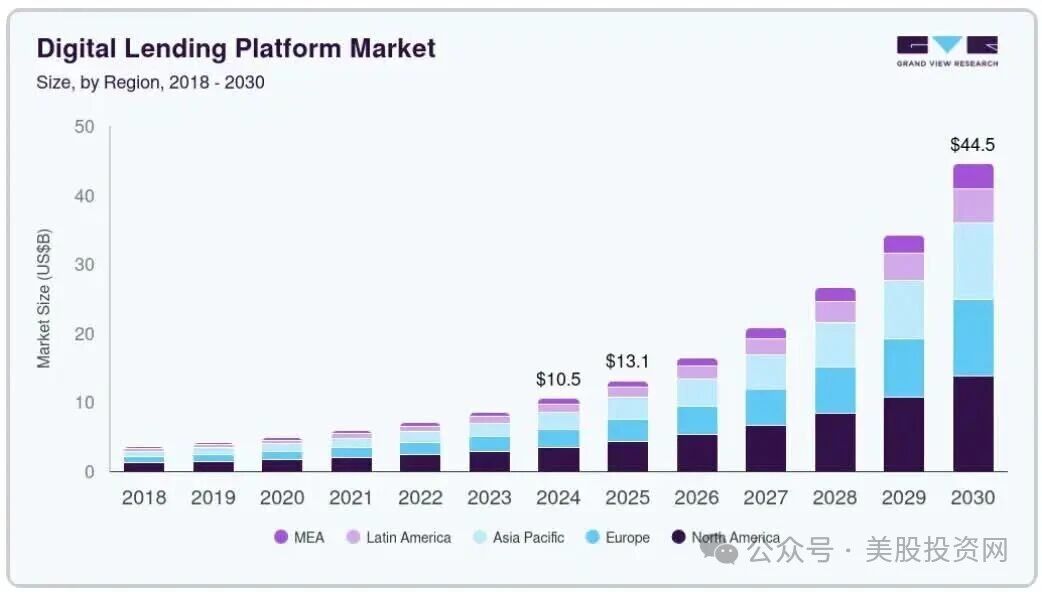

The digital lending market in which Figure operates is experiencing rapid growth. According to Grand View Research, the market size was $10.6 billion in 2024 and is projected to reach $44.5 billion by 2030, representing a compound annual growth rate of 27.7%. Consumers increasingly demand faster loan processing, while financial institutions are accelerating digital transformation.

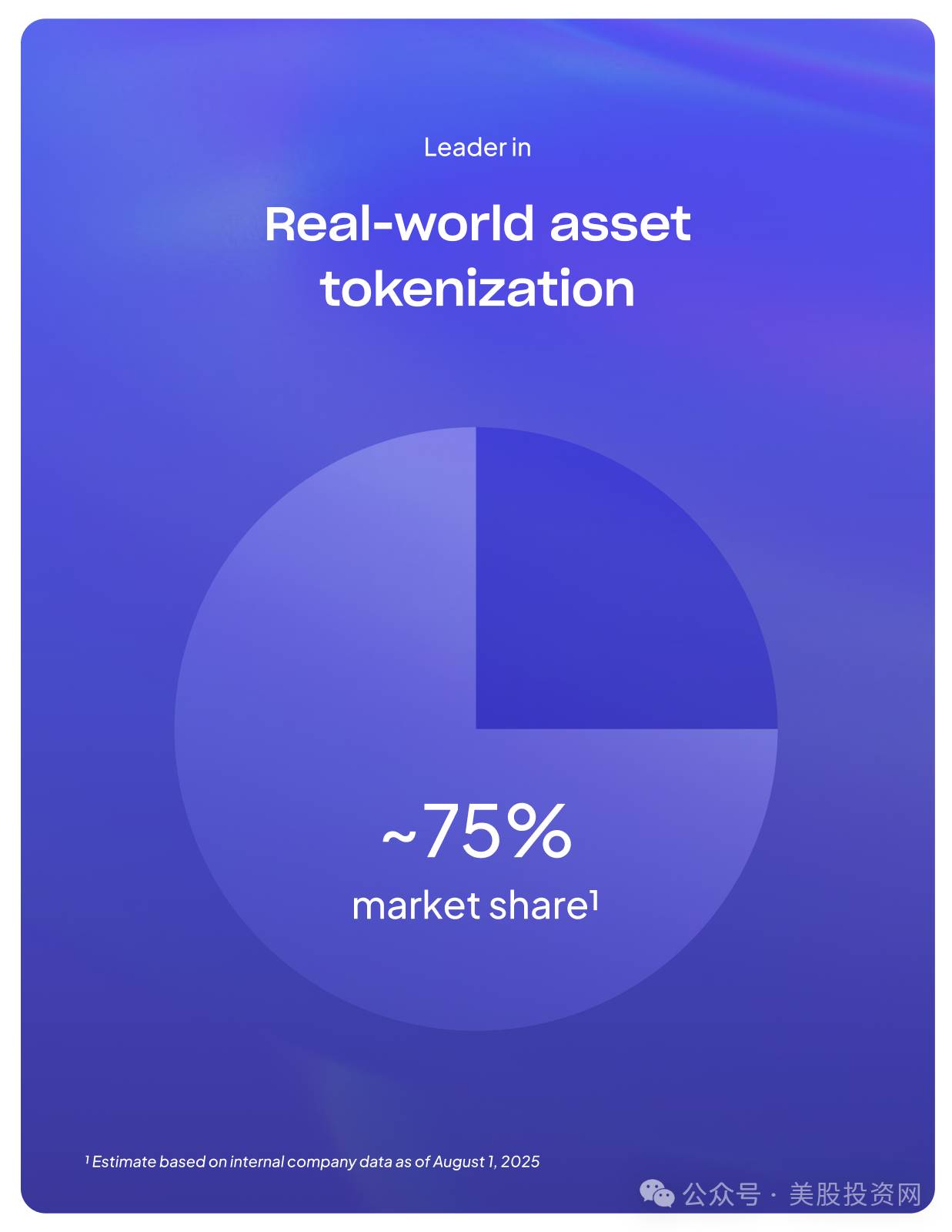

In the real-world asset tokenization (RWA) space, Figure already holds a leading position. The company reports a market share of 75%, nearly achieving monopoly status. This means Figure is not merely a "lending company," but one of the earliest players to apply blockchain at scale in asset securitization. If Figure can continue making breakthroughs in compliant stablecoins and on-chain securitization, it may successfully build a true bridge between Wall Street and blockchain.

Unlike BNPL platforms such as Klarna and Affirm, Figure focuses on secured lending, differentiating itself from peers. But competition remains intense. Publicly traded companies like SoFi, Upstart, and LendingClub have years of experience across various lending niches. New entrants such as OppFi, Coinbase, and Ledn are exploring different forms of digital lending. Meanwhile, traditional banks are rapidly digitizing, gradually closing the gap with fintech firms.

In other words, Figure’s strengths lie in efficiency and technology, but to emerge as a long-term winner, it must convert its first-mover advantage into sustainable scale and ecosystem strength—or risk being overtaken by better-resourced institutions.

Risks and Challenges

The first risk is revenue concentration. Currently, HELOC accounts for 75% of revenue. Should the U.S. real estate market enter a downturn, the company’s revenue would be directly impacted.

The second risk concerns cash flow. Although Figure achieved profitability in the first half of 2025, its free cash flow over the past 12 months remains negative at $40.3 million, meaning its expansion and R&D funding needs still depend on capital markets.

The third challenge is regulatory uncertainty. Stablecoin and DeFi operations in the U.S. still lack a clear regulatory framework. Tighter regulations could increase compliance costs and directly constrain Figure’s new business initiatives.

The fourth issue is competitive pressure. Both fintech firms like SoFi and Upstart, and increasingly digital traditional banks, could erode Figure’s market share.

Finally, the company faces high partner concentration. In the first half of 2025, the top ten loan origination partners accounted for 57% of transaction volume. Any disruption in key partnerships could impact business stability.

IPO and Future Outlook

Figure plans to raise $526 million through its IPO, with a proposed price range of $18–20 per share, implying a valuation of approximately $4.1–4.3 billion. After listing, the company will adopt a dual-class share structure: Class A shares carry one vote per share, while Class B shares carry ten votes per share, ensuring the founding team retains firm control. Underwriters include Goldman Sachs, Jefferies, and BofA Securities—evidence of Wall Street’s endorsement of its narrative.

From an industry perspective, Figure’s IPO, together with this year’s Circle and Bullish listings, represents three distinct pathways for "crypto finance entering the mainstream." Circle stands for regulated stablecoins, Bullish for regulated exchanges, and Figure for regulated lending and asset securitization. These three companies serve as entry points for crypto-economics to penetrate traditional finance: payments, trading, and credit.

TechFlow analysis suggests that Figure’s success hinges on whether it can transform blockchain advantages into stable cash flows and establish a durable moat within a compliant environment. If successful, it could become the "first publicly traded blockchain financial infrastructure company"; if not, it may remain just another short-lived experiment in capital markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News