If Polymarket doesn't launch a token, what else can be traded in prediction markets?

TechFlow Selected TechFlow Selected

If Polymarket doesn't launch a token, what else can be traded in prediction markets?

Overview of six prediction market projects.

By: Ludi Xiao Gong

With Trump returning to the White House, prediction markets are experiencing an unprecedented wave of mainstream adoption. The latest major development is that Polymarket, the world's largest prediction market, has received tens of millions of dollars in investment from Donald Trump Jr.'s venture capital fund. The president's son is not only investing through his firm 1789 Capital but will also join Polymarket’s advisory board.

This investment in Polymarket may suggest that its path toward an IPO is far more likely than launching a token. 1789 Capital has also backed high-profile companies such as Anduril and SpaceX. According to sources, Omeed Malik, founder of 1789 Capital, and Shayne Coplan, CEO of Polymarket, began discussions 18 months ago, but the investment was only finalized after the company secured a clear legal pathway in the U.S. market.

Another interesting phenomenon is that most prediction market projects remain without issued tokens, leaving relatively few options for secondary market investors. Even for a giant like Polymarket, the most direct investment opportunity available is the UMA protocol, which provides oracle services to it.

Against this backdrop, BlockBeats has selected six key projects in the prediction market space. From Flipr, which achieved a hundredfold return in two months by embedding trading into social media for viral spread, to infrastructure-layer providers serving the entire industry such as UMA and Azuro, and emerging protocols leveraging AI algorithms for fully autonomous trading decisions—these projects not only differ significantly in technical architecture but also exhibit distinct development paths in business models and user experience. It should be emphasized that this article is for informational and analytical purposes only and does not constitute any investment advice.

Flipr: A Hundredfold Social Prediction Market in Two Months

Flipr positions itself as the "social layer of prediction markets," with its core innovation being the integration of prediction market betting directly into the X (Twitter) platform, allowing users to place bets without ever leaving their social feed.

Users simply mention @fliprbot in a tweet, stating their position and amount, and the bot parses the instruction and executes the trade instantly. The executed order is then automatically posted as a quoted tweet, placing bets on Polymarket and Kalshi. Others can one-click copy, reverse bet, or share the trade. This design transforms traditional prediction markets from isolated website interfaces into a viral social experience, where every trade naturally becomes shareable content, drastically reducing user acquisition costs. Additionally, Flipr offers up to 5x leverage, stop-loss/take-profit features, and advanced order types.

On the team and funding front, as of August 2025, the identities of the project’s team members remain undisclosed, operating anonymously, and no equity funding rounds or venture investors have been announced.

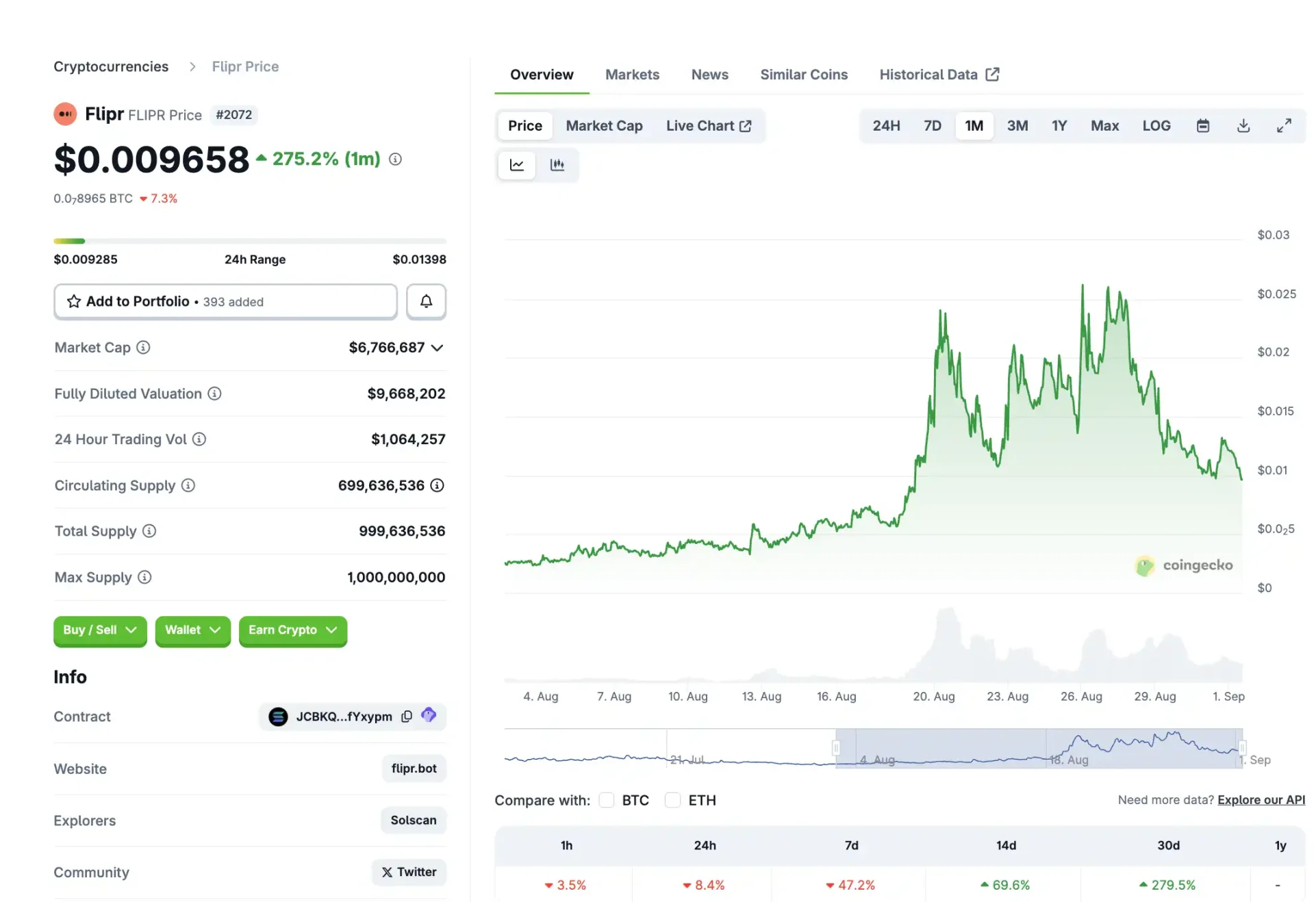

Regarding tokenomics data, according to CoinGecko, as of September 1, 2025, $FLIPR is priced at $0.009951 with a market cap of approximately $6.96 million. Notably, the token achieved a hundredfold surge within two months, rising from under $2 million to a peak market cap of $21 million, demonstrating strong market momentum. However, after reaching a historical high of $0.02804 on August 25, the current price is down 64.5% from its peak, indicating a significant pullback.

UMA: The Infrastructure King of Prediction Markets

UMA’s role in the prediction market space needs little introduction, as prominent protocols like Polymarket and Across rely on UMA for dispute resolution.

UMA (Universal Market Access) defines itself as an “Optimistic Oracle” protocol, with its core innovation being a dual-layer architecture combining the Optimistic Oracle and Data Verification Mechanism (DVM). According to UMA’s official documentation, the protocol operates on a “assume correct, verify upon dispute” model: anyone can assert an external truth on-chain with a bond, and if no one challenges it during the designated challenge period, it is accepted as true. This design enables results to be delivered in seconds with minimal on-chain cost in most cases, while disputes are resolved via off-chain voting by UMA token holders within 48–96 hours.

In terms of funding, according to RootData, UMA has raised a total of $6.6 million since its launch in 2018, primarily in early stages. In December 2018, it secured $4 million in seed funding led by Placeholder, with participation from notable institutions including Coinbase Ventures, Dragonfly, Blockchain Capital, and Bain Capital Ventures. Notably, in July 2021, the project raised $2.6 million through an innovative Range Token structure, providing DAO treasuries with low-sell-pressure liquidity solutions, with participants including Amber Group, Wintermute, and BitDAO. Compared to newer DeFi projects raising tens of millions, UMA’s conservative fundraising reflects the team’s focus on product-driven growth over capital-led expansion.

UMA ensures network security through a staking mechanism. As per the documentation, stakers lock UMA tokens in the DVM 2.0 contract to vote on oracle disputes, earning a target annual yield of around 30% plus redistributed penalties from incorrect voters. On August 12, UMA activated the “Governance Optimistic Oracle V2” contract for Polymarket, restricting market resolution proposals to whitelisted members.

With Binance adding a UMA trading pair on August 26, market expectations for improved liquidity are rising. However, long-term performance will depend on whether the protocol can effectively guard against token holder capture risks while maintaining its decentralization principles.

As of September 1, 2025, $UMA is priced at $1.38 with a market cap of approximately $123.8 million, showing a 14-day gain of 8.9% and a 30-day increase of 13.8%, reflecting positive short-term momentum. The token reached a historical high of $41.56 on February 4, 2021, meaning the current price is down 96.7% from its peak, though recent trends have been relatively stable.

Augur: Pioneer of Decentralized Prediction Markets

Augur is the first open-source decentralized prediction market protocol on Ethereum and can be considered the pioneer of decentralized prediction markets.

In a November article on prediction markets, Vitalik Buterin mentioned Augur: “Back in 2015, I became an active user and supporter of Augur (my name appears in the Wikipedia article). During the 2020 U.S. presidential election, I earned $58,000 from betting.”

The Augur protocol relies on REP token holders to crowdsource reporting of real-world event outcomes. Inaccurate reports face token slashing, while reporters aligned with consensus receive a share of platform fees. More uniquely, Augur features a “fork-to-resolve-disputes” mechanism: when disputes cannot be settled, REP holders can migrate to a new parallel universe, making attacks on the oracle extremely costly. It serves as an alternative approach to UMA.

On the team side, Augur was co-founded by three individuals with deep technical and financial expertise. According to Forbes, co-founder Joey Krug currently serves as Co-CIO at Pantera Capital. He initially developed an interest in prediction markets through building horse racing analytics spreadsheets and eventually designed Augur’s game-theoretic mechanisms, leading Ethereum’s first ICO. The other two founders, Jeremy Gardner and Jack Peterson, remain active in the blockchain ecosystem. The advisory team includes heavyweights such as Ethereum founder Vitalik Buterin and Ron Bernstein, founder of Intrade.

On the funding front, the project conducted its ICO between August and October 2015, selling 8.8 million REP tokens at $0.602 each, raising approximately $5.3 million. Key investors included Pantera Capital, Multicoin Capital, and 1confirmation.

In terms of market response, $Augur is undergoing a community-led revival. The project is advancing liquidity incentive programs and new research directions but faces challenges due to insufficient liquidity, underperforming compared to earlier prediction platforms. As of September 1, 2025, REP is priced at $1.05, with a total supply of approximately 8.06 million fully released, resulting in a market cap of $8.5 million. It has gained 41.2% over 30 days and 178% over the past year.

Azuro: A Team from the Traditional Betting Industry

Azuro positions itself as an open, white-label infrastructure layer, enabling anyone to launch on-chain sports and event prediction applications within minutes. According to its technical documentation, the protocol builds a complete prediction market tech stack using three plug-and-play modules: singleton liquidity pools (allowing apps to tap into a shared pool and pay fees, with LPs earning floating yields and sharing house profits/losses), data provider/oracle layer (approved providers create “conditional” markets with initial enhanced capital and margin), and frontend hooks (ready-made React components enabling branded sportsbooks or prediction games to launch without backend development). This design makes Azuro the “Shopify of sports betting,” where frontend apps retain their own UI/UX, pay a revenue share to the protocol, and avoid licensing and capital pool requirements.

The protocol’s technical strength lies in its LiquidityTree virtual automated market maker (vAMM) and shared singleton LP architecture, which handles odds setting, liquidity management, oracle data, and settlement, freeing frontends from building their own trading engines. According to the official website, as of August 2025, Azuro supports over 30 live applications, with cumulative betting volume exceeding $530 million and around 31,000 unique wallets participating. Compared to traditional sports betting, its permissionless liquidity and transparent on-chain settlement allow frontend developers to offer competitive fixed odds while dramatically lowering entry barriers. The protocol currently runs on Polygon, Base, Chiliz, and Gnosis, with Polygon dominating, indicating Azuro has gained significant traction and strategic positioning within the Polygon ecosystem.

On the team side, Azuro is led by founders with deep roots in traditional betting. Founder and CEO Paruyr Shahbazyan previously founded Bookmaker Ratings and brings over 10 years of experience in the iGaming industry. Funding history shows Azuro raised a total of $11 million across three rounds, with investors including Gnosis, Flow Ventures, Arrington XRP, AllianceDAO, Delphi Digital, and Fenbushi.

As of September 1, 2025, $AZUR has a total supply of 1 billion tokens, with 222.95 million (22%) in circulation, priced at $0.007894, resulting in a market cap of approximately $1.81 million. The token hit a historical high of $0.2396 on July 20, 2024, meaning the current price is down 96.6% from its peak. However, it has shown strong recent rebound momentum, gaining 41.5% in 24 hours and 41.8% over seven days.

PNP Exchange: A Permissionless Prediction DEX on Solana

PNP Exchange positions itself as a permissionless prediction market DEX on Solana, with its core innovation allowing any user to create yes/no markets on “any imaginable topic” and earn 50% of trading fees from their joint curve pool. According to the project’s website, the platform uses an automated bonding curve pricing mechanism to enable instant on-chain settlement. Innovatively, PNP integrates an LLM oracle system that uses consensus from Perplexity and Grok, combined with on-chain data sources, to automatically resolve market outcomes—successfully settling its first token-based market without human intervention.

The recently launched “Coin MCP” module highlights the project’s rapid technical iteration, enabling users to create prediction markets on any token’s price, liquidity, or market cap with one-hour settlement. According to the founder’s social media announcement on August 28, an upcoming SDK will allow AI agents to programmatically create and trade markets, while gas costs are expected to drop by 90% within the next 2–3 days. This “Pump.fun-style prediction market” differentiates itself from traditional platforms like Kalshi and Polymarket by removing listing barriers, making it a user-generated, meme-driven prediction trading venue.

$PNP adopts a fully circulating token model with a total supply of approximately 965 million tokens. According to Birdeye data, as of September 1, 2025, the token is priced at $0.001665 with a market cap of about $1.6 million. It has surged 148.8% over 30 days, with a 24-hour trading volume of $176,000, all executed on Meteora DEX.

Hedgemony: AI-Powered Autonomous Trading Algorithms

Hedgemony positions itself as a “fully autonomous AI trading algorithm” specialized in real-time predictive trading based on global news and political sentiment. According to DexScreener, the algorithm scans around 2,500 real-time news and political information sources per second, including Trump’s X account, Bloomberg, Reuters, and national media channels.

Hedgemony uses millisecond-latency Transformer language models to detect directional bias in global macro headlines, executing high-frequency leveraged futures trades up to 60 seconds before information becomes widely disseminated.

The protocol’s innovation also lies in its “intent-driven execution layer” design philosophy. As described officially, Hedgemony provides users with an AI agent capable of assembling exchange routing, dollar-cost averaging plans, yield delegation, and narrative-based portfolio strategies through prompt-based input. The system currently runs an MVP on Arbitrum, with plans to expand to Base, HyperEVM, and Monad networks.

On funding, Hedgemony has completed an extended seed round, self-reporting a valuation of approximately $1 billion, though the actual funding amount remains undisclosed. It should be noted that this valuation claim has not been independently verified by media reports or public blockchain disclosures. Investors should exercise caution regarding such figures, especially given the project’s early-stage development.

On tokenomics, $HEDGEMONY has a total and circulating supply of 1 billion tokens, fully released from inception. As of September 1, 2025, the token is priced at $0.005306, with a market cap and fully diluted valuation both at $5.3 million. It has gained 64% over seven days, reflecting positive short-term momentum.

On-chain data shows 557 token holders, with $371,000 in total liquidity, 251 transactions in 24 hours, and 78 unique trading addresses. Notably, the top 10 holdings account for 66.57% of the total, with the largest single address holding around 50%, indicating high concentration risk. The project remains in a very early, speculative adoption phase, exhibiting extremely high risk-reward dynamics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News