Ethereum Holdings Analysis: Who Are the Key Players?

TechFlow Selected TechFlow Selected

Ethereum Holdings Analysis: Who Are the Key Players?

After Bitcoin ETFs brought in billions in new capital, the "portfolio reallocation" for ETH has only just begun.

Author: Biteye

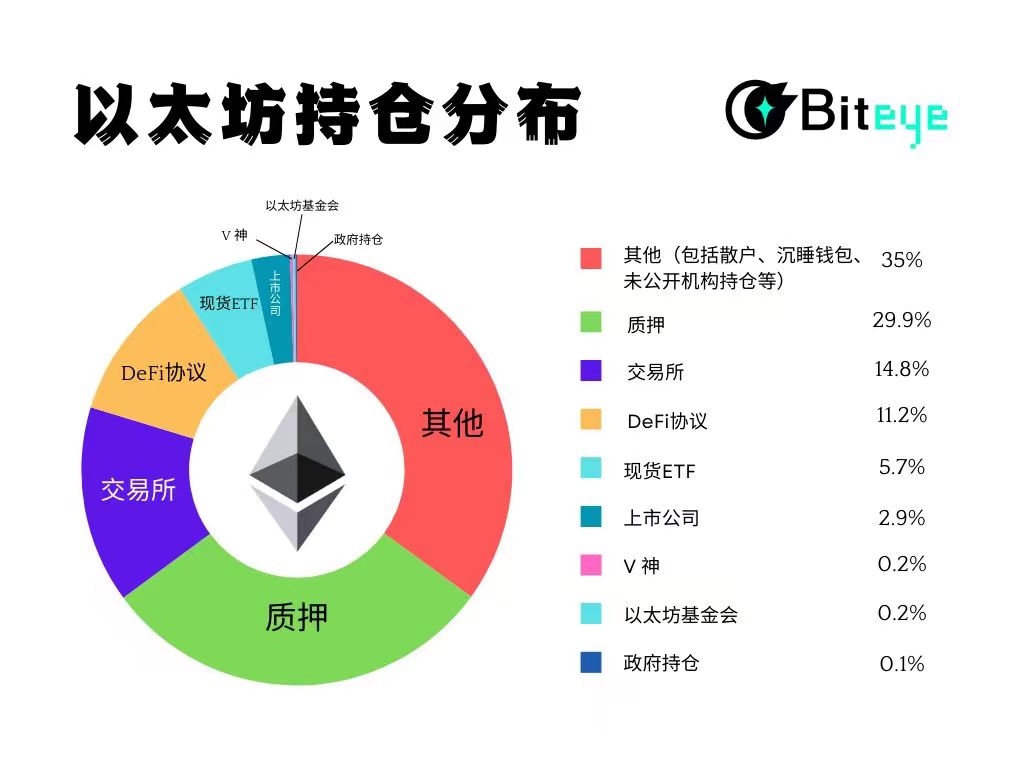

First, why is studying the holdings structure important? Everyone knows narratives in the crypto market evolve quickly. So: Who's buying? How much are they buying? Who's selling? Where is the selling pressure concentrated? Which funds are long-term locked, and which could exit at any moment?

These questions determine ETH's price elasticity and its upside potential in the next cycle. Take Bitcoin as an example: incremental ETF buying has made Wall Street capital part of the price floor. Ethereum is now following the same path.

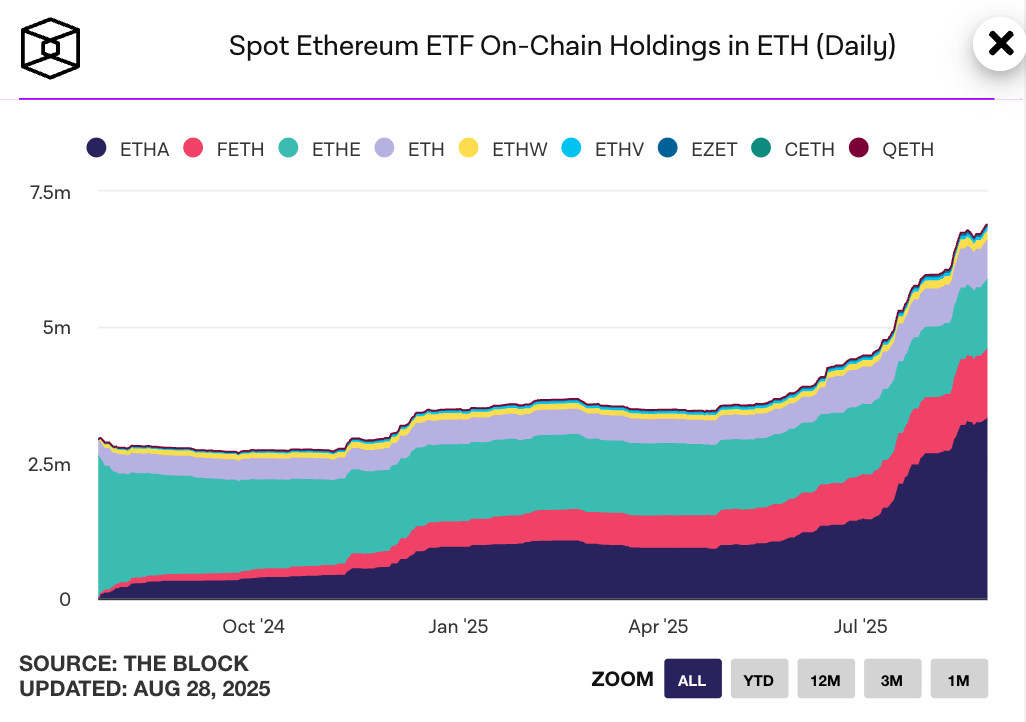

1. Spot ETFs

Over the past year, Ethereum's most significant capital inflow channel has been spot ETFs.

As of August 28, nine U.S. spot ETFs collectively hold about 6.9 million ETH, representing 5.75% of total supply (approximately 120.71 million ETH). The significance of this capital goes beyond size—it represents:

"Compliant capital," backed by pension funds, investment banks, and brokerage clients. Once in the market, this capital is relatively stable and unlikely to panic-buy or sell like retail investors.

Specifically:

-

BlackRock iShares ETHA: ~3.32 million ETH.

-

Grayscale ETHE & ETH Mini: ~2 million ETH combined.

-

Fidelity, Bitwise, VanEck, etc.: ~1.58 million ETH combined.

2. Public Companies

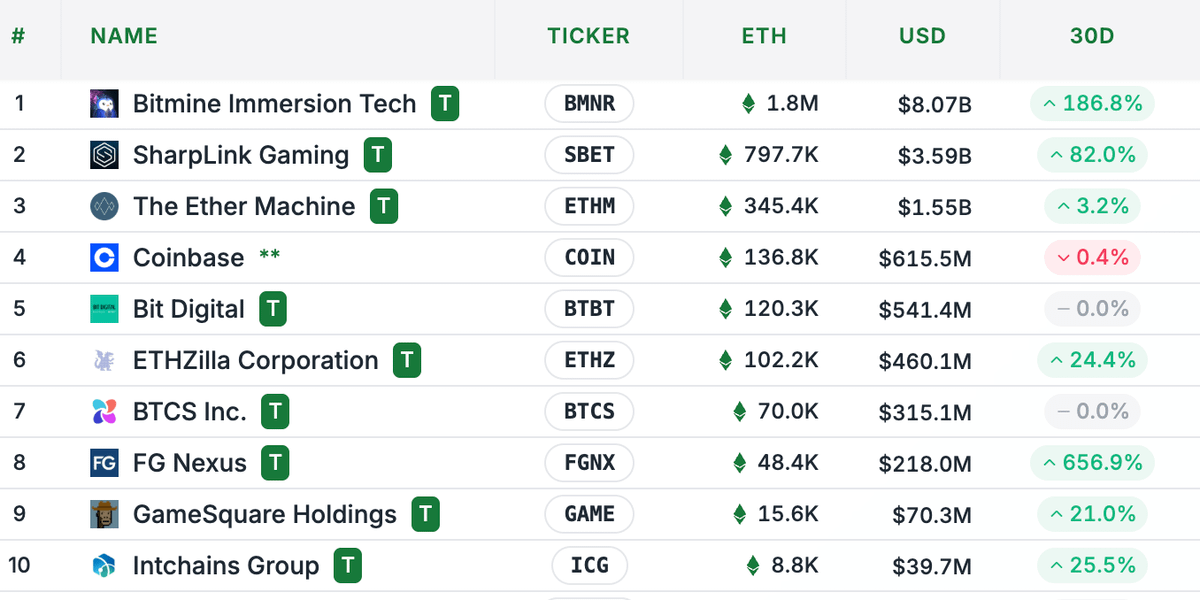

To date, 17 public companies collectively hold 3.5 million ETH, or 2.9% of Ethereum’s total supply. The top ten hold approximately 3.8 million ETH, including:

– Bitmine Immersion: 1.8 million ETH, +186.8% change within 30 days, currently the largest single institutional holder.

– SharpLink Gaming: 797,000 ETH, +82.0% change within 30 days.

– The Ether Machine: 345,000 ETH, +3.2% change within 30 days. Others such as ETHZilla and FG Nexus are also gradually increasing their positions.

Overall, Bitmine and SharpLink have shown the most aggressive accumulation, representing emerging "crypto stocks"; while Coinbase and Bit Digital show more steady accumulation.

3. Foundations

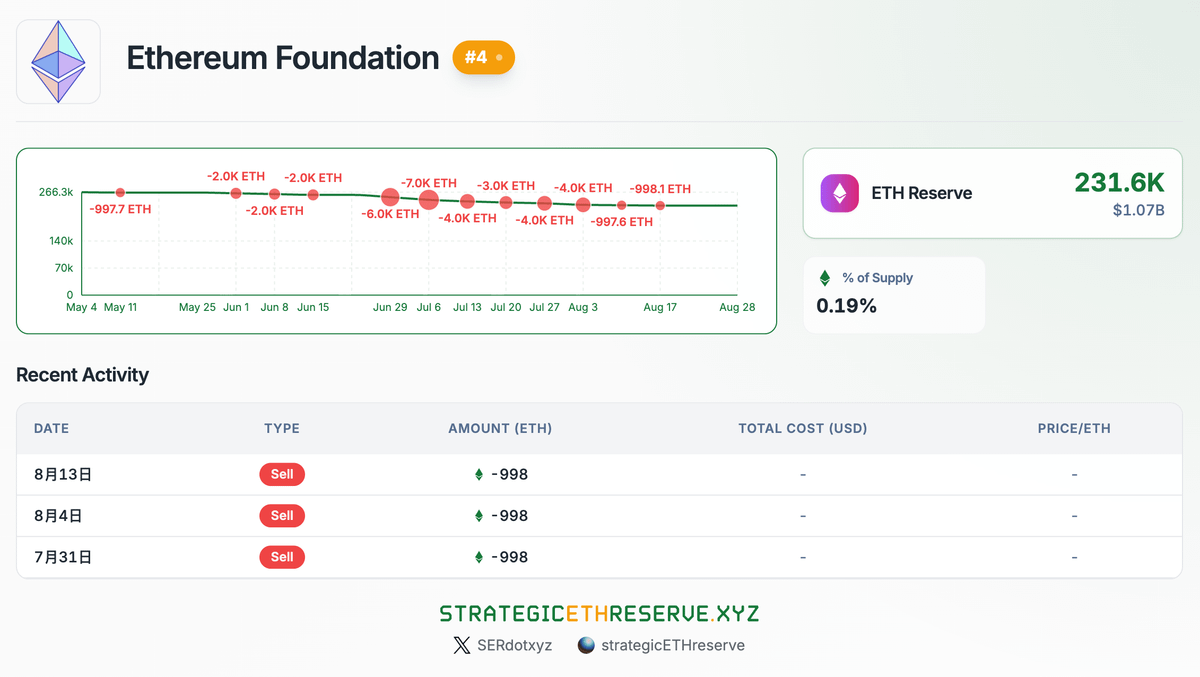

The Ethereum Foundation currently holds about 231,600 ETH, roughly 0.19% of total supply. While not large in scale, this is a long-term strategic reserve. The foundation periodically sells small amounts of ETH to fund development, community grants, and operations—an essentially "healthy selling pressure."

4. Staking

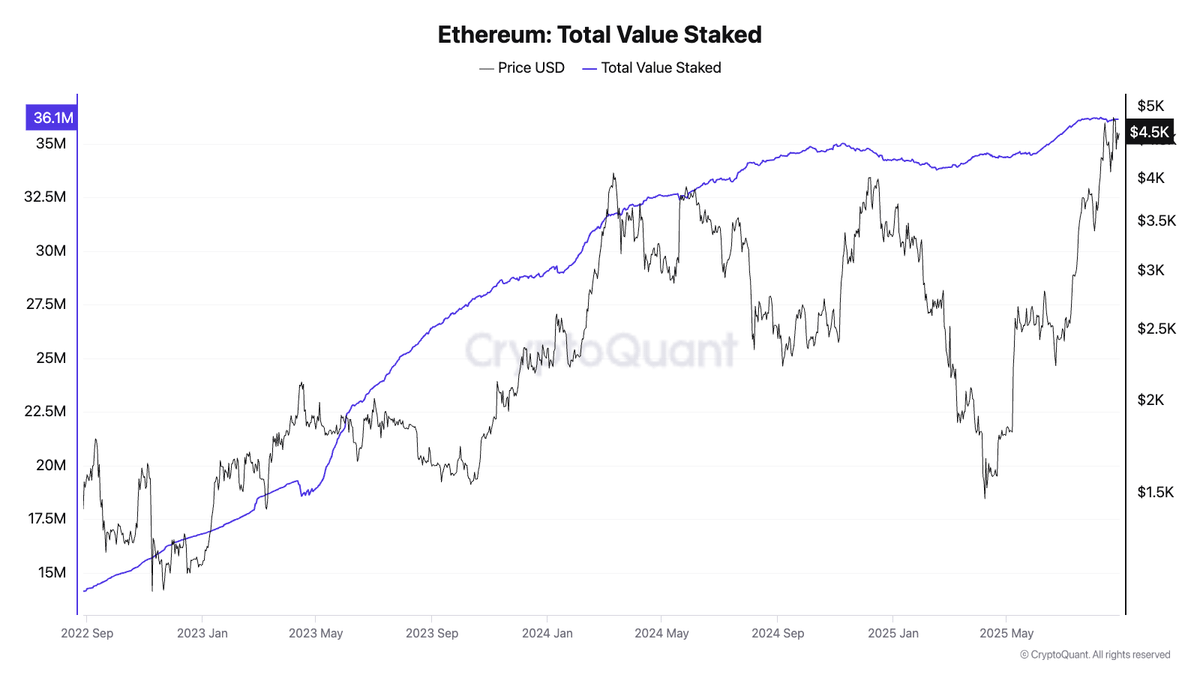

About 36.137 million ETH are currently staked, nearly 30.1% of current total supply, reaching new highs consistently. This locked-up ETH effectively reduces circulating supply and alleviates selling pressure from a supply-demand perspective.

Staking reduces liquidity but has simultaneously given rise to new derivative sectors such as LSTs and restaking. This is one of the biggest differences between ETH and BTC—ETH is a yield-generating productive asset.

5. Exchanges and Whales

-

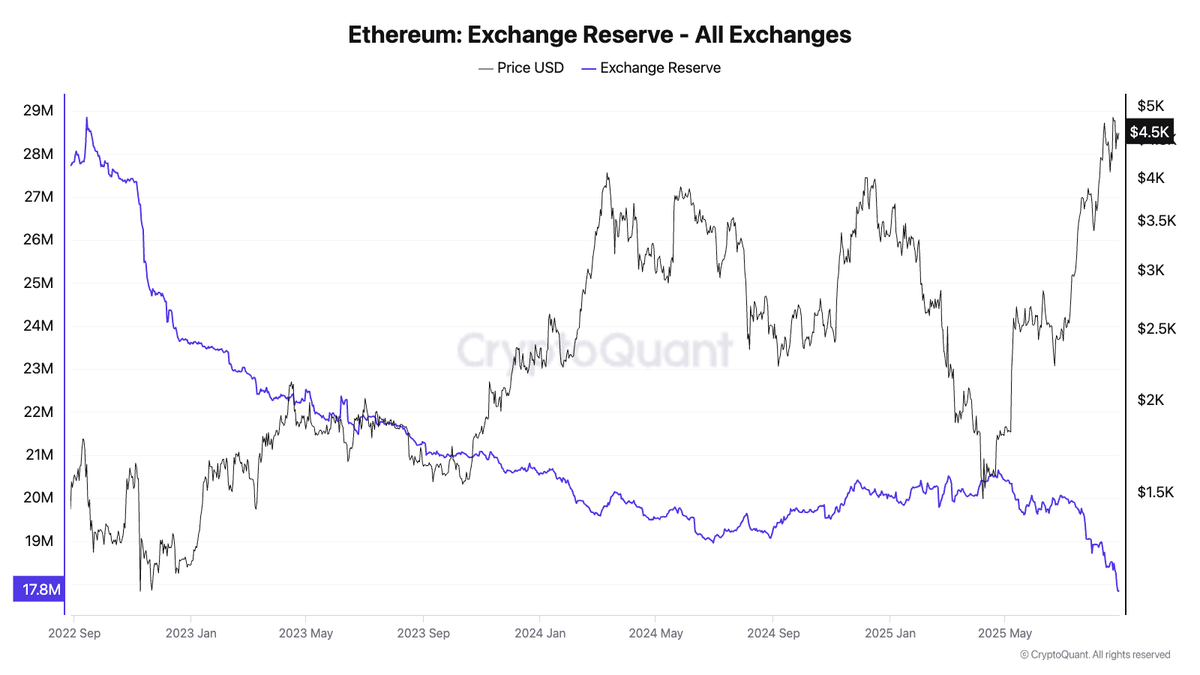

Exchange reserves: Currently about 17.845 million ETH, or 14.8%, near recent lows. This suggests more users are choosing to stake or hold ETH long-term, reducing available ETH for sale on exchanges.

-

Whales: A few whales still control hundreds of thousands of ETH on-chain and may trigger significant market volatility at any time. For example, Rain Lohmus, founder of LHV Bank, holds 250,000 ETH (~0.2% of total supply), worth over $1 billion today, with no transactions since 2015—possibly due to lost private keys. Another example is the "7 Siblings" (a mysterious whale group) holding over 1.2 million ETH. As of 2025, whale addresses (holding 10k–100k ETH) collectively control about 22% of ETH supply.

Recently, on-chain tracking revealed a mysterious institutional whale quietly accumulating over 200,000 ETH in mid-August, with funding sources including FalconX, Galaxy Digital, and BitGo.

Such large-scale capital movements often amplify market volatility.

6. DeFi Protocols

About 41.35% of ETH is now locked in staking, DeFi, and other contracts—almost half of circulating supply. Approximately 13.5 million ETH (~11.25% of total supply) are locked in various DeFi protocols and cross-chain bridges, indicating ETH is widely used in ecosystem applications rather than sitting idle.

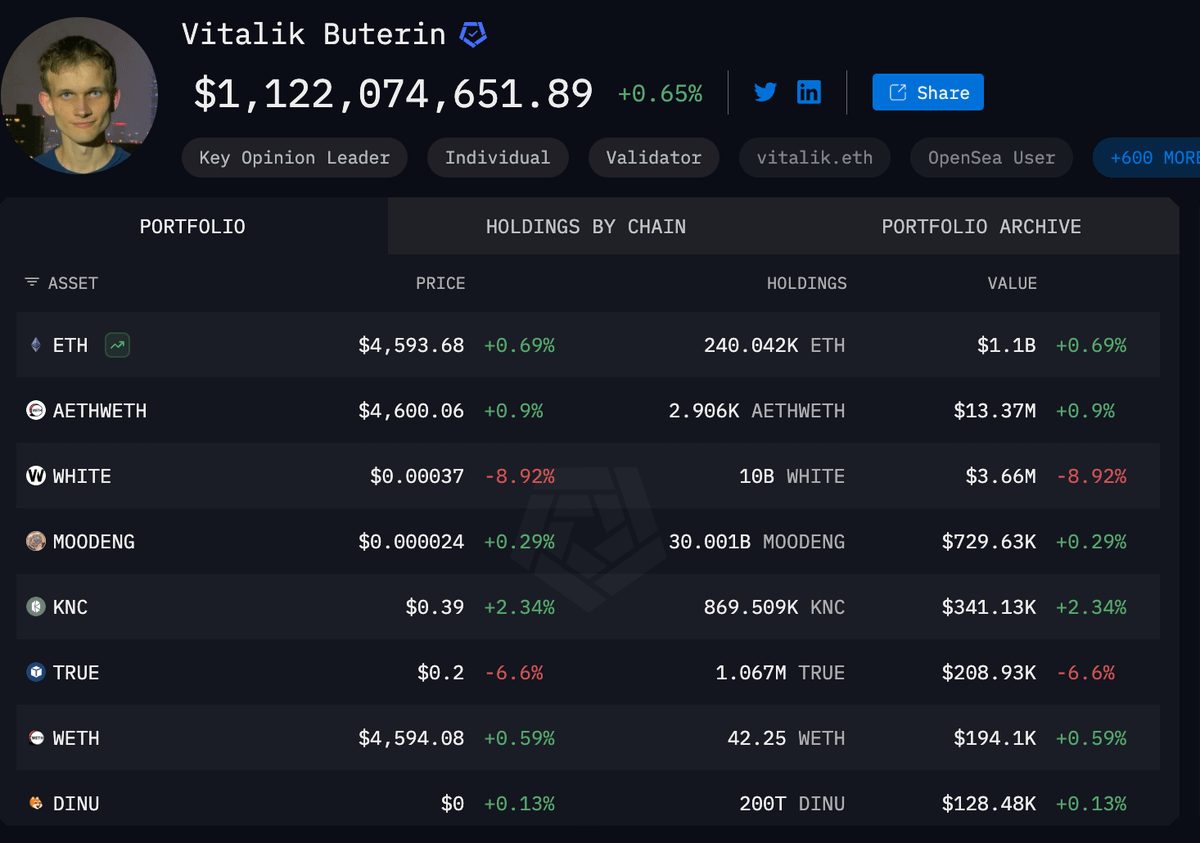

7. Vitalik Buterin (Vitalik)

According to Arkham data, Vitalik personally holds about 240,000 ETH (~0.2%). While small relative to ETH’s 120 million total, the significance lies more in its "signal effect": If he sells, the market speculates whether it's for donations or simple profit-taking. If he accumulates, it signals confidence in ETH’s long-term value.

Thus, market participants even treat Vitalik’s transfers as "short-term indicators." This level of attention reinforces ETH’s unique narrative.

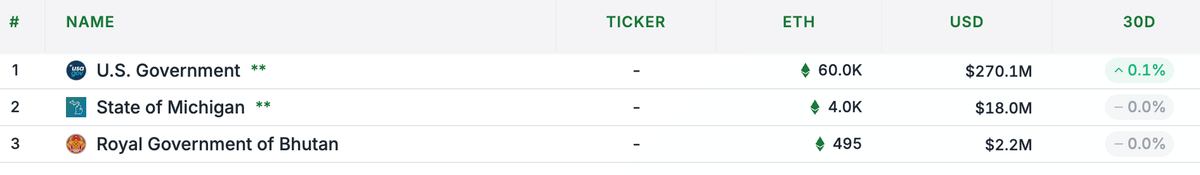

8. Government Holdings

Based on disclosed data, governments collectively hold about 64,500 ETH (~0.05% of total supply). Though smaller than ETFs and public companies, this sends a stronger "legitimization signal."

-

U.S. Government: ~60,000 ETH, valued at ~$270 million.

-

Michigan State Government: ~4,000 ETH, valued at $8 million.

-

Kingdom of Bhutan: ~495 ETH, valued at $2.2 million.

9. Celebrity Endorsements

Beyond capital structure, here are recent celebrity endorsements of ETH:

-

@sassal0x, co-founder of EthHub: Six months ago predicted ETH would surpass $15,000 in 2025, and remains bullish recently.

-

@CryptoHayes, co-founder of BitMEX: Recently reiterated his view that ETH could reach $10,000–$20,000.

-

Tom Lee@fundstrat, CEO of Bitmine: Believes ETH could hit $15,000 within this year.

-

@Jackyi_ld, founder of LD Capital: Says ETH may break new highs against BTC, targeting over $10,000, and ushering in a broader altcoin rally.

10. Other Holders

Besides staking, ETFs, exchanges, and foundations, over 55 million ETH fall into the "other" category, primarily composed of:

1. Retail investors: Large in number but highly dispersed, with small individual holdings—collectively forming the market base.

2. Early dormant wallets: Accounts with lost private keys, such as LHV Bank founder Rain Lohmus, who still holds ~250,000 ETH untouched.

3. Undisclosed institutional holdings: Some VCs and private firms hold ETH without disclosing in public filings.

Summary

Viewed together, ETH's ownership has formed a stratified capital network. After Bitcoin ETFs brought in hundreds of billions in new capital, ETH’s "ownership redistribution" is just beginning. If ETH’s valuation was previously based on "technology + narrative," the future will increasingly hinge on "capital + liquidity." This shift suggests ETH may be closer than ever to becoming a truly institutionalized asset.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News