Can mainstream crypto trading platforms return to the U.S. as regulators ease stance again?

TechFlow Selected TechFlow Selected

Can mainstream crypto trading platforms return to the U.S. as regulators ease stance again?

CFTC's "Crypto Sprint" is a real sprint.

Author: kkk

On August 28, the U.S. Commodity Futures Trading Commission (CFTC) issued a major signal: advisory opinions from the Foreign Board of Trade (FBOT) provide necessary regulatory clarity for legitimate onshore trading activities. This means overseas exchanges, long blocked from entering the U.S., now have a legal pathway to return.

In recent years, giants like Binance and Bybit were forced under regulatory pressure to restrict or even fully exit the U.S. market. Countless American traders have either been stuck on domestic platforms with limited offerings or resorted to accessing overseas platforms illegally. Now, the CFTC has made it clear: as long as platforms register through FBOT, they can legally serve U.S. customers without having to become a "Domestic Commodity Market" (DCM).

Acting Chair Caroline D. Pham stated outright that this move aims to "bring back trading activity that was driven out of the United States." Against the backdrop of the Trump administration's push for the "Crypto Sprint," this document serves as a clarion call, signaling a complete shift in U.S. regulatory direction.

Why Now?

For the past few years, the U.S. approach to the crypto industry could best be described as "enforcement-driven." During Biden’s term, former SEC Chair Gary Gensler championed a "regulate through enforcement" strategy, targeting everyone from Binance to numerous project teams. In 2023, Binance was fined $4.3 billion and effectively forced to "fully withdraw" from the U.S. market—an event that sent shockwaves across the entire industry.

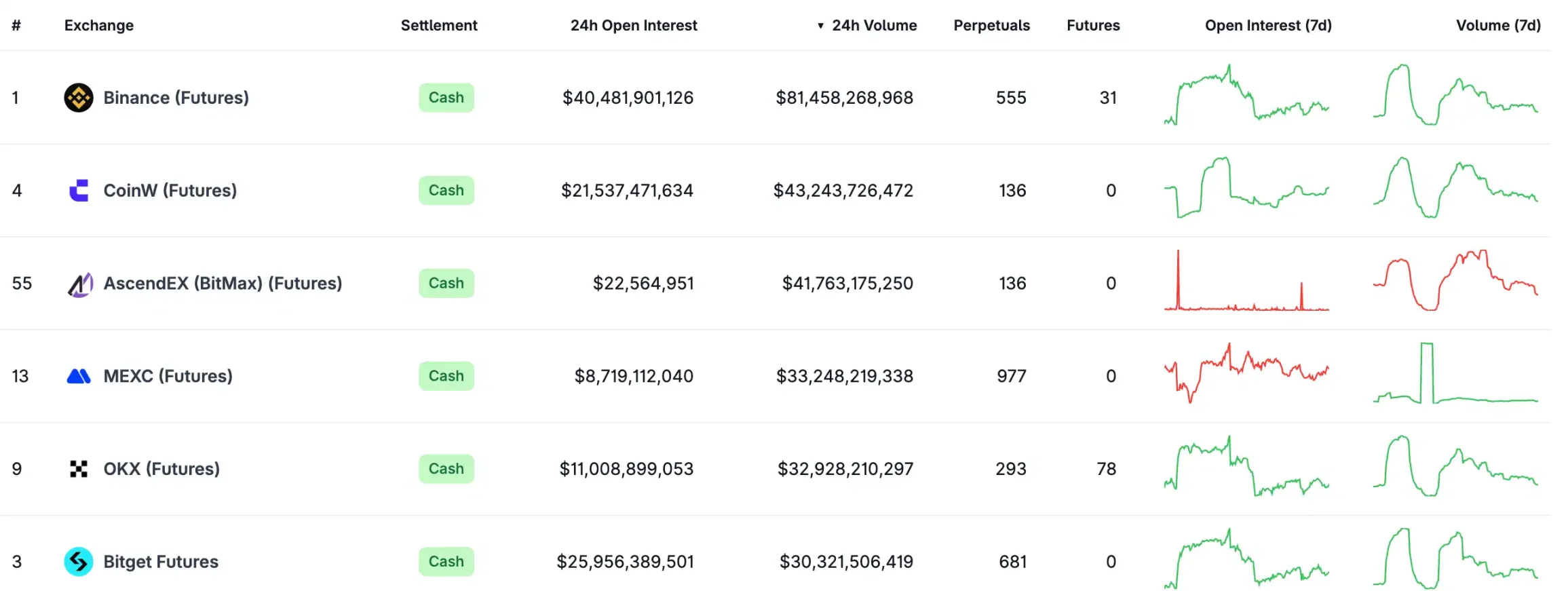

What the U.S. lost wasn't just a few exchanges, but an entire segment of the market: domestic users migrated overseas, taking capital with them; overseas platforms solidified their dominance in derivatives, with Binance, OKX, and Bitget routinely achieving tens of billions in daily trading volume, while U.S. exchanges were relegated to second-tier status. Coinbase, for example, sees only about $6 billion in daily derivatives volume—a gap largely due to previous SEC restrictions on perpetual futures, staking, and leverage. Meanwhile, Singapore, Hong Kong, and the EU have rapidly introduced more flexible frameworks, steadily eroding America’s once-dominant "regulatory advantage."

It is precisely for these reasons that the CFTC’s move comes at such a critical time. In early August, the CFTC launched its "Crypto Sprint" initiative and opened public consultation on whether spot crypto assets can be listed on registered exchanges (DCMs). Within weeks, regulators received a flood of inquiries about how foreign exchanges might return to the U.S., prompting the CFTC to deliver a clear answer under mounting pressure from public and industry feedback.

The acceptance of overseas exchanges represents both a correction of years of over-regulation and the starting point for the U.S. to reclaim global market share. Under the broader "Crypto Sprint" agenda, this guidance is not merely procedural clarification—it’s an invitation: American traders deserve to stand in the same pool as global users, enjoying the deepest liquidity and most diverse product offerings.

New Compliance Landscape: Return, Expansion, and Competition

The CFTC’s FBOT advisory opinion directly brings American traders back into the global market mainstream. In the past, domestic exchanges—bound by regulation—offered limited products and shallow liquidity, forcing users to either accept subpar experiences or risk accessing offshore platforms. Now, with a clear compliance path, U.S. traders can finally enjoy the deep liquidity and rich product variety long available to their peers in Asia and Europe. This not only improves market efficiency but also reconnects the U.S. with the global financial stage. Some even predict this could boost liquidity in Bitcoin and Ethereum within the coming months.

For overseas exchanges long excluded, this is a long-awaited "green light." Giants like Binance, Bybit, and OKX previously cut off U.S. users due to compliance pressures, but now see a legitimate path to re-enter. The massive U.S. user base and strong trading demand have long made this market highly attractive, and the FBOT registration framework provides the key to legal expansion. For these platforms, it opens new growth opportunities; for users, it means more competition, leading to lower fees, better products, and improved services.

The significance of this advisory also lies in creating a fairer competitive environment for domestic exchanges. For years, the U.S. crypto market has been dominated by a handful of local players. Now, with the FBOT registration route open, overseas giants finally have a compliant way back. This means the market is no longer a "protected zone" for domestic exchanges, but enters a phase of genuine multi-party competition. More entrants will drive sharper price competition, faster product innovation, and higher service standards. For U.S. investors, this is a rare win—they no longer have to settle for limited choices, but can instead access world-class liquidity and innovation in a more open and equitable market.

Conclusion

This guidance does more than clarify a procedure—it repairs the image of U.S. regulation. For years, the U.S. has projected an image of rigidity and enforcement-first policy, marked by ambiguity and frequent crackdowns, driving capital and projects away. Now, the CFTC’s willingness to listen and correct course isn’t just a correction of overreach—it sends a message to the global market: the U.S. is shifting toward a transparent, open, rules-based era. Once this signal is absorbed by the market, it will inevitably restore confidence among investors and developers, drawing capital and innovation back to American shores. And this—more than slogans—is the true essence of the "Crypto Sprint": tangible institutional action.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News