JPMorgan says: Bitcoin is still too "cheap"

TechFlow Selected TechFlow Selected

JPMorgan says: Bitcoin is still too "cheap"

This Wall Street giant clearly stated that Bitcoin is significantly undervalued relative to gold.

By: BitpushNews

"Bitcoin's volatility has dropped to historic lows, making it more attractive than gold in the eyes of institutional investors," JPMorgan bluntly stated in its latest research report, with the Wall Street giant clearly indicating that bitcoin is significantly undervalued relative to gold.

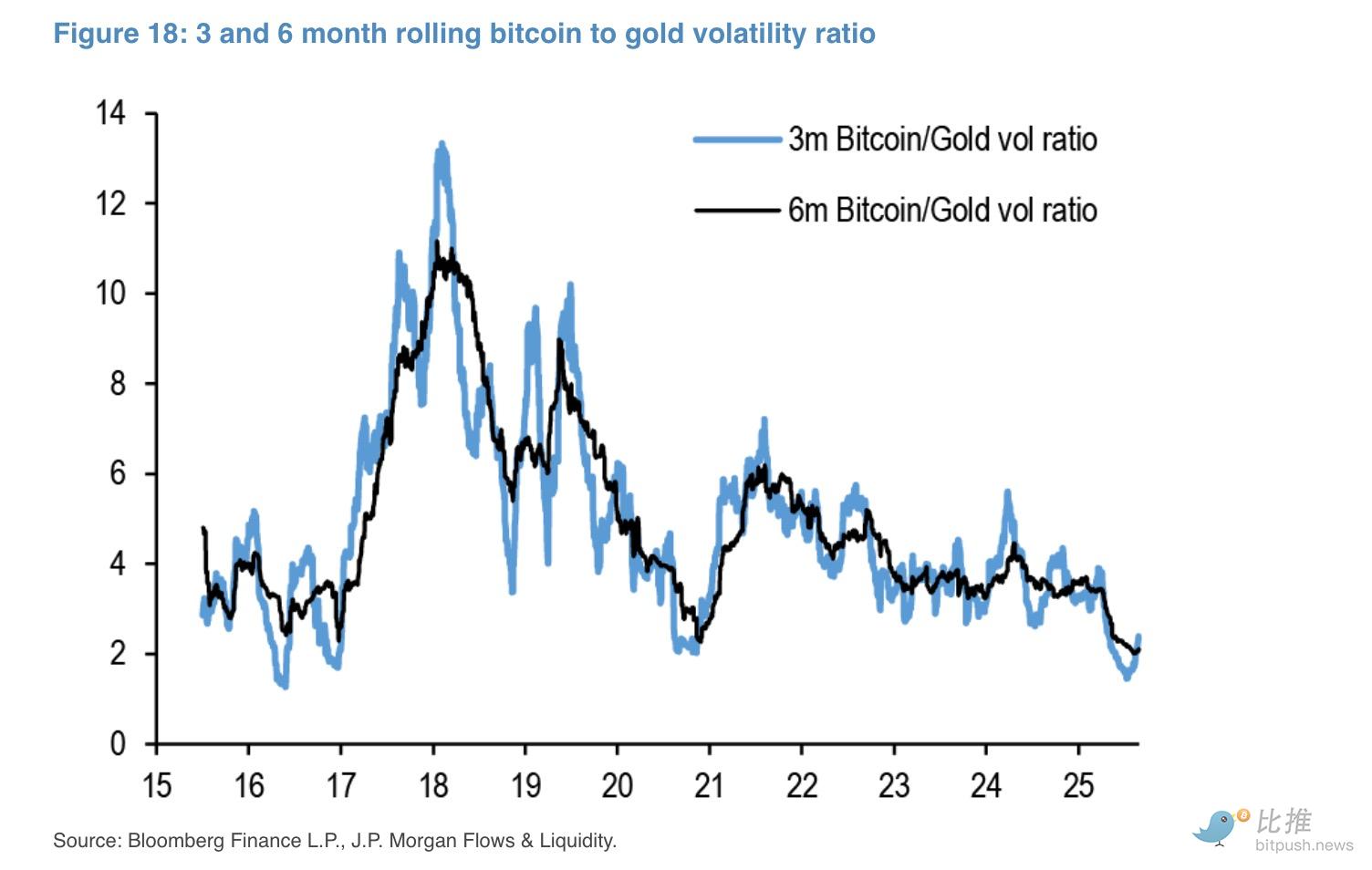

According to JPMorgan's analysis, bitcoin's six-month rolling volatility has plummeted from nearly 60% at the beginning of the year to around 30%, hitting a historical low. At the same time, the volatility ratio between bitcoin and gold has also reached an all-time low, with bitcoin now only twice as volatile as gold.

Volatility Plummets, Value Reassessment Underway

Volatility has long been the main barrier preventing traditional institutional investors from fully embracing bitcoin. Now, this obstacle is rapidly disappearing. JPMorgan's analyst team elaborated on this shift in their latest report.

The sharp decline in bitcoin's volatility is not merely a technical indicator change but reflects a significant increase in market maturity. The report指出 that falling volatility directly mirrors a transformation in bitcoin's investor base—from retail-dominated to institutionally led.

This shift resembles the calming effect central bank quantitative easing had on bond volatility. Corporate treasuries are now playing a role akin to a "bitcoin central bank," reducing circulating supply through continuous buying and holding, thereby dampening price fluctuations.

JPMorgan applied a volatility-adjusted model to conduct a detailed comparison between bitcoin and gold. Analysis shows that bitcoin's market cap would need to rise 13% to match the $5 trillion value of gold in private investment portfolios. This calculation yields a fair value for bitcoin of approximately $126,000—leaving substantial upside potential compared to current prices.

ETF Battle: An Unprecedented Capital Migration

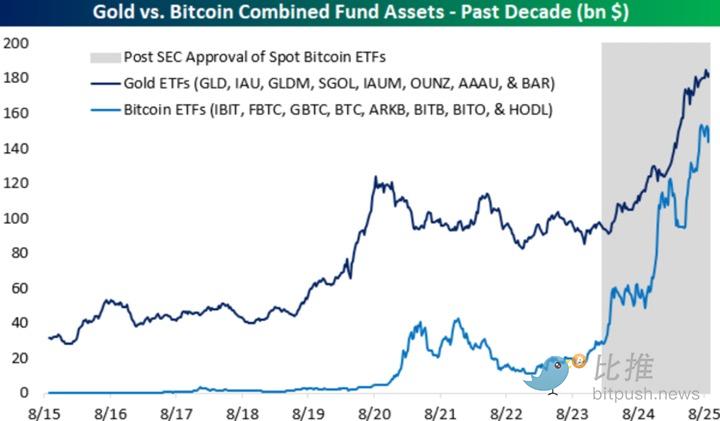

If declining volatility marks bitcoin's internal maturation, then the approval and launch of spot bitcoin ETFs serve as the external catalyst accelerating institutional adoption. This landmark event has opened unprecedented investment channels for both retail and institutional investors, directly triggering an "assets under management (AUM)" race between bitcoin and gold.

Latest data from Bespoke Investment Group shows that bitcoin funds have reached approximately $150 billion in AUM, while gold funds stand at about $180 billion. The gap has narrowed to just $30 billion, demonstrating astonishing catch-up speed.

At the individual fund level, the world's largest gold ETF, SPDR Gold Shares (GLD), holds around $104.16 billion in assets, while top-tier bitcoin ETFs such as BlackRock’s IBIT have accumulated approximately $82.68 billion within just one year. This not only reflects a shift in investment preferences but also confirms bitcoin’s growing importance in global asset allocation.

JPMorgan analysts believe: "Bitcoin is becoming increasingly attractive, especially for institutional portfolios. Declining volatility combined with greater regulatory clarity has created a perfect environment for adoption."

Technical Outlook

Following JPMorgan's report release, bitcoin saw a modest rebound before pulling back. According to TradingView data, at the time of writing, bitcoin rose as much as 2.3% during the day to approximately $113,479, then retreated by about 1% to hover around $112,272.

Sophisticated trader Peter Brandt believes that despite the recent bounce, bitcoin must break above the key resistance level of $117,570 to fully overcome its medium-term bearish sentiment.

However, from a longer-term perspective, multiple technical indicators still point upward. Bitcoin's ability to hold steady above $110,000 suggests institutional investors are steadily accumulating during every pullback, building momentum for volatile upside movements in the coming months.

JPMorgan's $126,000 target may be just a starting point. If bitcoin continues absorbing institutional capital at its current pace, the narrative of "digital gold" surpassing traditional gold may no longer be theoretical speculation, but gradually become reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News