Interview with Websea CEO: Gen Z is taking over the crypto market, and Websea aims to be young people's "first stop" and "safe harbor"

TechFlow Selected TechFlow Selected

Interview with Websea CEO: Gen Z is taking over the crypto market, and Websea aims to be young people's "first stop" and "safe harbor"

Step into the era of "young people taking over Web3" and explore Websea's product strategy, data performance, and future roadmap.

Author: TechFlow

Young people are taking over the crypto market, and young exchanges are winning their hearts.

On August 28, 2025, digital asset exchange Websea celebrated its 2nd anniversary. Over the past two years, Websea has surpassed 1 million registered users, with average daily trading volume exceeding $4 billion. The platform has obtained compliance licenses in the U.S., Canada, Australia, and expanded its community presence across key markets including Asia-Pacific and the Middle East.

To mark this milestone, we sat down for an in-depth conversation with Websea CEO Calvin.

Regarding user positioning, Calvin shared with us the core insights behind Websea’s “youth strategy”:

“Millennials are increasingly taking control of global wealth distribution and investment decisions. Younger generations naturally rely less on traditional finance, are more familiar with digital assets, emphasize decentralization, openness, and fairness, and seek community co-creation and identity—making them the natural backbone of the Web3 market. Meanwhile, most current exchanges target professional traders, leaving a gap for younger users. Websea aims to fill this void by building an open, inclusive Web3 ecosystem where young users can thrive.”

When asked about the key drivers behind Websea’s million-user growth, Calvin highlighted two recently popular features—‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’:

“The crypto trading market lacks closed-loop risk hedging. Under constant fear of losses, users hesitate to try. Principal-Guaranteed Copy Trading and Contract Insurance transplant traditional financial risk management thinking into the Web3 derivatives space, using mechanisms like trader payouts and insurance claims to provide a safety net, allowing users to explore diversely within reasonable security boundaries.”

Based on young users’ Web3 trading preferences, how does Websea build innovative products that truly resonate?

In an ever-competitive exchange landscape, what are the core competitive advantages Websea sees as critical to standing out?

After reaching this two-year milestone, where will Websea focus next?

In this article, let’s follow Calvin’s perspective to explore Websea’s product strategy, data performance, and future roadmap against the backdrop of ‘young people conquering Web3’.

Young People Are Taking Over the World: Websea Builds an Entry Point and Harbor for Youth Exploring Web3

TechFlow: Thank you for your time. To begin, could you please introduce yourself?

Calvin:

Hello everyone, I’m Calvin, CEO of Websea.

I’ve been with Websea since its earliest days, and on August 28, 2025, we celebrate our official second anniversary. I’m thrilled and honored to share with you Websea’s journey—its past, present, and future.

TechFlow: Websea recently held a series of events for its second anniversary. At this memorable moment, could you summarize the past two years using key metrics or milestones?

Calvin:

We’ve done extensive reflection during this two-year milestone, and have meaningful data and achievements to share with investors, partners, and users alike.

In terms of trading volume, from zero on August 28, 2023, to today on August 28, 2025, our average daily trading volume has surpassed $4 billion. In user registration, we previously set a goal of one million users as a phased target for our second anniversary—and we achieved this milestone ahead of schedule on June 30, 2025.

Regionally, we’ve established operational centers across multiple core Asia-Pacific markets and built mature exchange communities in regions like the Middle East. We’ll continue deepening both the depth and breadth of our regional operations.

On compliance and branding, we’ve secured regulatory approvals in the U.S., Canada, and Australia, and are maintaining close communication with regulators in South Korea, Japan, Europe, and other regions—with substantial progress expected soon.

Beyond data, operations, and compliance, I’d like to highlight our product development. Over the past two years, Websea has experimented extensively and ultimately identified two distinct yet impactful product lines: reducing risk and lowering barriers. These correspond directly to our two flagship products—‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’.

As for ‘Principal-Guaranteed Copy Trading,’ copy trading itself isn’t new, but many followers end up losing money, making long-term trust in traders difficult to establish. Websea’s version introduces a principal protection mechanism: even if trades lose money, the trader compensates the loss, significantly reducing users’ learning curve, trading risks, and psychological anxiety around losses—advancing our vision of becoming ‘the first stop for young people in Web3 crypto.’

With ‘Contract Insurance,’ traditional financial markets offer rich risk hedging tools—from options and futures to insurance—but in crypto, exchanges typically only provide trading functionality, offering no additional safeguards or closed-loop risk management. This leaves users virtually exposed when risks occur—an unfair situation, especially for inexperienced traders. We believe the issue isn’t whether contracts themselves are dangerous, but whether risks can be properly managed. That’s why we created ‘Contract Insurance,’ bringing traditional financial risk management principles into the Web3 derivatives market to provide a safety net through hedging mechanisms.

Over the past two years, we’ve firmly believed that serving users throughout their lifecycle is paramount. We’re willing to sacrifice short-term gains to earn long-term trust. We’ve already proven to the market that we’ve not only survived but thrived. Going forward, we aim to prove we can last longer and deliver greater value to users.

TechFlow: A project name often encapsulates its vision. Websea appears to combine ‘Web3’ and ‘Sea.’ Could you share the brand vision and thinking behind this name?

Calvin:

Exactly as you said, Websea is a portmanteau of ‘Web3’ and ‘Sea.’

When naming the project, we asked ourselves a fundamental question: Who is this platform really for?

Web3 represents the foundational logic of future digital economies and asset trading.

‘Sea’ carries three layers of meaning: First, the sea embraces all rivers—we want our platform to be all-encompassing, welcoming users from diverse regions and ecosystems worldwide. Second, the sea symbolizes the unknown and adventure. In this uncharted world of Web3, we hope Websea provides Web2 and Web3 users alike with a free space to boldly explore without fear of risk causing them to miss discovering new continents. Third, marine life doesn’t exist in isolation—they depend on each other for prosperity. We envision Websea not just as an exchange, but as an ocean-like, inclusive ecosystem where users, projects, and partners grow together.

We hope Websea becomes the first stop for youth entering the crypto world—though certainly not the last.

We hope our users start and grow here in this sea, and even if they later flow into deeper, wider streams, when they look back, Websea will always remain their most trusted harbor.

TechFlow:

We’ve noticed Websea uses the slogan ‘The Web3 Digital Asset World for Global Youth.’ Why did you choose to focus your brand strategy specifically on ‘young people’? What are the core insights behind this positioning? What unique traits do young users exhibit in Web3 trading behavior?

Calvin:

This question can be broken down into several parts: First, globally, millennials and Gen Z are gradually taking over more wealth allocation and investment decision-making power. Numerous surveys suggest that by 2030, millennials will control over 50% of the world’s disposable assets. As an exchange, we can’t ignore who holds the money.

Second, millennials inherently rely less on traditional finance and are more familiar with digital assets. They deeply value concepts like decentralization, openness, and fairness, and aren’t content being passive investors—they want to participate in co-creation, aligning perfectly with Web3 ideals. This makes them the natural main force in the Web3 market.

Third, we believe there’s currently a gap in the market for younger generations: Many exchanges target professional traders, with complex UI designs and product logic that raise the learning curve for new users, often creating a sense of exclusion among young people. Websea aims to fill this gap.

Young users’ trading behaviors do show clear characteristics.

First, they’re more willing to take risks but weaker at risk management. We often see emotionally driven trades among youth—that’s precisely why we launched risk-hedging products like Principal-Guaranteed Copy Trading and Contract Insurance.

Second, young users are highly self-motivated, particularly regarding community belonging and identity. They’re easily influenced by community atmosphere, enjoying the process of trading, sharing, and learning together. They seek belonging and recognition, wanting to impact others. This is one reason Websea introduced social features—users post, interact, chat, and livestream on the Websea Plaza, quickly forming tight-knit circles and building community cohesion.

TechFlow: When discussing youth-focused exchanges, many think of Robinhood. How does Websea’s ‘focus on youth’ strategy compare to Robinhood’s? What are the fundamental similarities and differences in brand tone and values?

Calvin:

Let’s start with the similarities.

First, Websea and Robinhood share similar user targeting—we both prioritize young users as our primary audience.

Second, our product philosophies align—we both simplify complex financial derivatives to make them more accessible and intuitive, inviting newcomers to enter the market confidently.

Robinhood leans more toward stock and options markets, while Websea focuses squarely on Web3-native assets.

Robinhood emphasizes ‘financial democratization,’ enabling everyone equal access to capital markets and bringing youth into the Wall Street game. For Websea, the underlying Web3 logic is already inherently equal, so our philosophy leans more toward co-exploration and ecosystem co-creation. In short, Robinhood is like a gateway bringing youth into capital markets, while Websea is more like an open, inclusive Web3 ocean where youth can freely express themselves.

Product-wise, due to different domains, Robinhood offers more trading-centric tools focused on enabling faster, better-priced trades. Websea emphasizes user companionship, protection, and helping users hedge and manage risks.

Another key difference: Robinhood still operates within traditional financial frameworks, limiting its growth under strict national/regional regulations. Websea targets Web3 natives—a more multipolar, diverse, and decentralized market—with greater potential to shape new rules.

TechFlow: We’ve noticed Websea has maintained a relatively low profile over the past two years. Given how fast-paced the crypto world is, what strategic considerations led to this ‘low-key’ approach?

Calvin:

From my perspective, as a young exchange, seeking attention or exposure too early or aggressively isn’t necessarily beneficial. Crypto’s development path resembles that of earlier internet and fintech industries—without solid foundations, louder voices may backfire.

Externally, the crypto industry hasn’t yet reached full compliance. Any exchange chasing excessive visibility faces dual pressures: inherent user distrust toward new brands, and heightened scrutiny from regulators. In other words, stepping into the spotlight too early risks magnifying flaws or inviting misinterpretation.

Second, as a platform still in its infancy, we believe ‘running steadily’ matters more than ‘running fast.’ Our internal logic is to first focus inward—refining our core products and social features mentioned earlier—to build a tangible foundation visible to users. When we eventually step onto the broader stage, users will recognize that Websea isn’t built on hype, but on real substance.

Additionally, from a brand and long-term development standpoint, many of our team members are industry veterans. Drawing from collective experience, we agree that short-term exposure might bring traffic, but such users often seek quick profits or incentives—leading to data-driven illusions rather than healthy, sustainable user retention. Ultimately, retaining users requires long-term brand building and trust accumulation.

For these reasons, we chose to slow down, refine our products, serve our users well, and earn organic loyalty—where users genuinely stay, engage, and recommend our platform. To us, this is truly the most valuable and precious traffic resource.

Loss Anxiety Is the Core Issue; Risk Control Mechanisms Are the Right Answer

TechFlow: While crypto user numbers keep growing, many users limit their on-chain activity to basic token transfers. What do you see as the main barriers preventing deeper exploration of crypto? And what key initiatives has Websea taken to enhance the Web3 trading experience?

Calvin:

I touched on this earlier. We believe current crypto experiences suffer from high risk, low trust, and low engagement.

High risk: Every on-chain trade carries personal consequences. Without risk control tools, trial-and-error costs real money, deterring many users.

Trust issues: On-chain projects vary wildly—especially during meme coin waves—many lack transparency, often consisting of just a name, image, and smart contract. There’s no trust between project and user; investing feels like gambling. Users might accept one or two losses, but repeated harm makes continued participation unlikely.

Lack of support: Many platforms are cold transaction tools—nothing more than isolated interfaces. Without habits or motivation to actively learn or seek opportunities in communities, this solo-mode experience feels lonely and passive.

Therefore, we believe the barrier isn’t technical—it’s trust and experiential. Thus, Websea’s solutions focus on three directions:

-

Low barriers: Features like ‘Principal-Guaranteed Copy Trading’ let beginners learn before doing, avoiding vicious cycles of blowing up accounts and quitting in frustration.

-

High fault tolerance: Through features like ‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance,’ Websea embeds risk management into products, replacing users’ immature risk controls. Making mistakes doesn’t mean forced exit—there’s room for recovery. Maintaining confidence in the market is crucial.

-

Inclusivity: Websea leverages diverse social scenarios—Plaza, livestreams, chat rooms—to transform isolated traders and new users from lone operators into active community builders, truly enabling ‘learn, share, and trade together.’

These initiatives aim to ensure that whether newbies or young users, no one enters the industry with fear and loneliness, but instead with sufficient safety, belonging, and a sense of shared growth.

TechFlow: Compared to standard copy trading, how does Websea’s ‘Principal-Guaranteed Copy Trading’ further reduce loss anxiety and achieve true ‘principal protection’?

Calvin:

Let’s break this down from the original mechanics of copy trading.

Standard copy trading merely replicates top traders’, KOLs’, or experts’ strategies onto followers—without addressing the deepest user pain point: fear of risk and loss. Higher leverage means bigger opportunities, but also greater risks and potential losses.

I don’t believe anyone can become a perfect trading god—even the best traders may lose. So users’ fear of losing money persists, amplified when copy trading, as it effectively hands financial control to someone else. Our research shows that if a follower loses money on their first trade, most immediately lose trust and churn.

‘Principal-Guaranteed Copy Trading’ was designed precisely to address this pain point. Its core logic is keeping loss risks within bearable limits while keeping profit expectations within reach—enabling users to dare to follow.

Under this feature, even if a copied trade results in loss, the platform’s guaranteed payout mechanism ensures the user’s principal is refunded—immediately upon subscription period end. This ensures that even if new users don’t profit, they won’t quit prematurely due to losses. It allows them to ease anxiety and focus on learning how to profit. With a calmer mindset, trust in the platform grows, leading users to organically recommend and spread the product.

We’ve gathered relevant data: Compared to standard copy trading, ‘Principal-Guaranteed Copy Trading’ achieves nearly 10x higher user retention, significantly transforming user lifecycles. Of course, this feature isn’t about getting rich overnight—it gives more users longer time to learn deeply, survive longer, and truly integrate into the crypto trading ecosystem. Meanwhile, it also brings benefits to signal providers, helping them build personal brands and gain community traction. It’s a mutually beneficial model.

TechFlow: What specific user pain points does Websea’s ‘Contract Insurance’ function solve during trading? What unique challenges do insurance products face in Web3 compared to traditional finance?

Calvin:

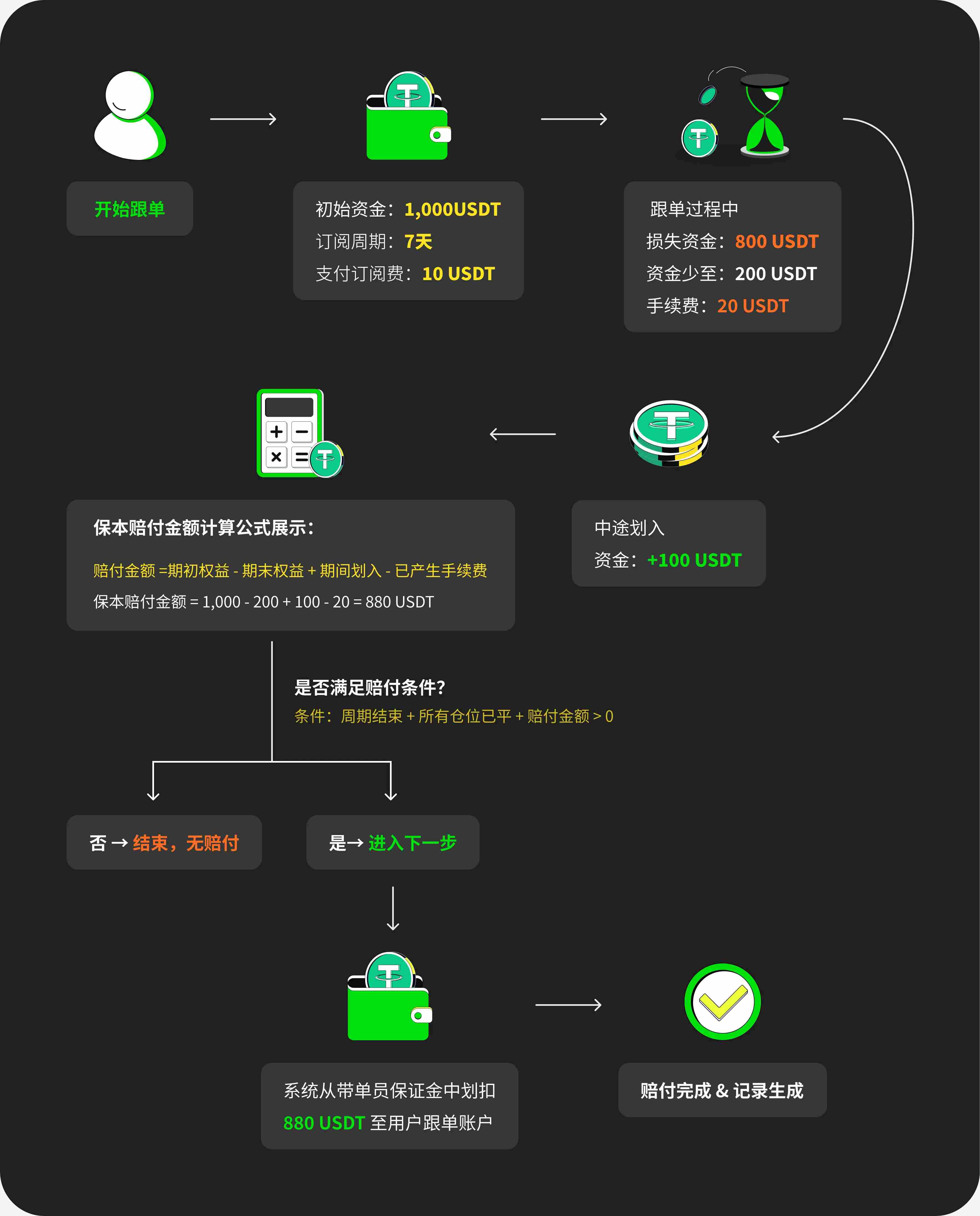

The logic of ‘Contract Insurance’ mirrors traditional financial insurance—insuring users against losses from contract trading. Payouts come from a Websea-managed insurance pool, aiming to safeguard users’ principal in contract trading, lower the psychological barrier for first-time contract traders, and allow users to experiment with diversified strategies within what they perceive as reasonable safety boundaries.

When actual losses occur, the insurance mechanism protects the user’s principal. Though payouts take time, funds eventually arrive via insurance claims—indirectly boosting users’ long-term engagement in the Websea ecosystem and reducing churn over extended periods.

Now, what challenges does Web3 insurance face compared to traditional finance?

First, crypto markets are far more volatile—traditional actuarial models struggle to apply directly. Traditional insurance precisely calculates probabilities of rare events and spreads risk across pools. But in crypto, predicting exactly how many users will lose money in the next second during contract trading is nearly impossible. Under such high volatility, risk pricing and model design for crypto insurance are far more complex, requiring real-time market data and dynamic risk management to support ‘Contract Insurance.’

Another challenge lies in managing the insurance pool, because under this model, we must ensure sufficient funds to balance speed of user protection—making this balancing mechanism critical.

To address these, we partnered with a licensed financial institution experienced in insurance. Based on their actuarial models, Websea launched ‘Contract Insurance’ to further protect users.

TechFlow: Why did ‘Contract Insurance’ adopt the architecture of ‘Node + 72-Hour Activation + 100-Episode Staggered Airdrop’? What advantages does this bring?

Calvin:

The Node + 72-Hour Activation + 100-Episode Staggered Airdrop design behind ‘Contract Insurance’ reflects an innovative fusion of Web3 traits and traditional financial insurance logic.

First, node-based design.

An “insurance node” is essentially a digitized policy. Each time a user accumulates $100 in losses, a corresponding insurance node is generated—a standardized policy. Advantages include:

1. Quantified payout logic ensuring 100% full compensation, avoiding vague or arbitrary reimbursement;

2. Each node is independent—no cross-subsidization between users—ensuring clear, transparent, and fair payout rights.

Second, 72-hour activation mechanism.

This borrows from traditional insurance’s “waiting period.” Its purposes are threefold:

1. Gives users a cooling-off period during extreme market conditions, preventing impulsive insurance toggling;

2. Provides time buffer for the insurance fund to manage risk and allocate capital;

3. Makes the entire system more robust, protecting the insurance mechanism from shocks during sudden high-volume events.

In short, it constrains user trading habits while safeguarding the stability of the insurance pool.

Third, 100-episode staggered airdrop.

Unlike traditional insurance with extremely low claim rates, ‘Contract Insurance’ sees daily payouts. To prevent the insurance pool from being drained rapidly, Websea adopted staggered payouts—splitting a single claim into 100 installments.

Benefits include:

1. Ensures continuous stability of the fund, protecting long-term interests of all node holders;

2. Makes payouts feel like traditional financial “annuity claims”—steady and ongoing, rather than unsustainable lump-sum compensation.

In summary, the three pillars—standardized nodes, 72-hour buffer, and 100-episode staggered payouts—form the core architecture of Websea’s Contract Insurance, guaranteeing fairness, transparency, and sustainability in payouts while maintaining platform stability even during extreme market conditions.

TechFlow: During extreme market conditions, does Websea have additional risk control mechanisms to protect user interests?

Calvin:

From my view, I don’t think extreme market conditions and risk controls should be directly equated, because I believe that as a crypto trader, extreme conditions represent both risk and opportunity. If markets were flat every day, no one would play. Volatility is the norm in crypto, and as an exchange, we don’t directly influence asset pricing or market-making—we serve as a bridge connecting users to the market.

That said, we focus on several areas to ensure users enjoy a stable, secure trading environment amid market swings.

First, stricter project listing screening. Before listing any new token, Websea conducts multi-round due diligence covering team background, technical capability, tokenomics, market potential, etc., rejecting short-term speculative, potentially fraudulent, or unsustainable projects. This reduces users’ exposure to high-risk assets at the source.

Second, regular evaluation of market maker risk profiles. Websea employs a dynamic assessment system for market makers, closely monitoring liquidity maintenance, fund security, and execution capability during extreme conditions. During sharp volatility, skilled market makers can effectively stabilize liquidity and price ranges, minimizing flash crashes or manipulation. Tight oversight enhances trading stability for users.

Third, technology: Websea focuses on strengthening trading system stability. After multiple iterations, we’ve adopted a distributed multi-layer backup architecture, cold-hot data separation, elastic scaling, and other designs—ensuring smooth order processing under high concurrency, preventing missed trading or risk response opportunities during extreme conditions. Additionally, intelligent risk control systems monitor sensitive accounts and abnormal market fluctuations in real time, triggering temporary protective measures when needed—such as raising margin requirements or delaying suspicious transactions—to maximize protection of ordinary users’ funds.

Lastly, I’d emphasize that beyond daily safeguards, during extreme conditions, ‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’ deliver powerful protection—backed by real data. Recently, when the Fed released interest rate projections, Websea’s ‘Principal-Guaranteed Copy Trading’ paid out $1.2 million to users that day alone. We also observed a significant spike in ‘Contract Insurance’ triggers—indicating widespread adoption and real, tangible user protection.

In sum, high volatility is a double-edged sword. Websea’s ultimate goal is to provide a safer, more stable, and controllable trading environment—so even during extreme conditions, users can confidently seize market opportunities.

TechFlow: As key product strategies, have ‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’ driven significant user growth and increased trading activity since launch?

Calvin:

Definitely.

Our data shows: Since launching ‘Principal-Guaranteed Copy Trading,’ cumulative participants have exceeded 200,000, representing one-fifth of registered users—an impressive ratio. More notably, among new contract traders, over 60% use ‘Principal-Guaranteed Copy Trading’ as their first contract trading experience, proving it dramatically lowers the psychological barrier for beginners.

Similar trends appear with ‘Contract Insurance.’ Previously, many users were highly risk-averse and hesitant to try contracts. After learning about our insurance, they began small-scale trials. To date, triggered payout nodes exceed 30,000, with total payouts around $3 million. This means many users preserved their principal thanks to insurance, avoiding the “blow-up and quit” outcome.

Data confirms these two products are not just growth engines—they’ve evolved into core differentiators defining Websea’s brand. We embraced “risk management” as a platform responsibility early on and delivered it through products. The results validate our approach. Now, several industry peers are launching similar features—further confirming the value of our innovation.

So I believe—from initial skepticism, to user acceptance, to industry imitation—Websea has forged its own path in risk-management products and is poised to become a leader in the trading protection segment.

Value Accumulation Through Ecosystem: Building a Sustainable Exchange

TechFlow: In your view, what will be the core competitive elements for Web3 exchanges in the future? Technology, product, service, ecosystem—or synergy across multiple factors?

Calvin:

I believe future competition among crypto asset platforms won’t hinge on single capabilities, as technology, products, and services can all be matched over time. Future competition, in my view, will be a multidimensional, systemic battle.

Within this system, technology forms the foundational layer—whether matching engines, risk controls, or Web3 on-chain interaction capabilities.

Products shape users’ most direct perception of the platform. For standard offerings like spot trading and wealth management, users care about “stability and smoothness.” For differentiated products like ‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’, platforms innovate based on positioning and niches, developing unique approaches.

Yet a common industry phenomenon exists: truly outstanding products gain rapid market recognition and widespread imitation. This validates their value but also suggests eventual partial homogenization—since once-proven features are widely adopted to meet core user needs.

Thus, I believe lasting market success and user stickiness won’t stem from a single differentiator, but from daily experiences users touch and feel—like timely customer support, reliable infrastructure, multilingual community operations, and whether users find belonging and support. These details reflect humanity and reliability, essential for global expansion.

Linking these elements together leads to one core idea: ecosystem building. A sustainable platform cannot remain just a “trading tool”—it must evolve into a value network. Only when our ecosystem integrates trading, community, content creation, gaming, asset appreciation, and even fund management will users’ time and value truly accumulate here.

This echoes our earlier point about “moving slow vs. fast.” Over the past two years, we chose to “build the foundation first,” anchoring on technology and security, then constructing a closed-loop ecosystem atop. This approach may be slower, but steadier—and more likely to endure.

TechFlow: At this two-year milestone, looking ahead to the next two years, what will be Websea’s primary focus?

Calvin:

I see Websea’s strategic priorities moving in three main directions:

First, institutionalization.

We aim to elevate risk management from a “feature” to an “institution.” We’ll continue expanding proven innovations like ‘Principal-Guaranteed Copy Trading’ and ‘Contract Insurance’ into broader markets, exploring integration with compliance standards and traditional financial insurance frameworks. Our goal is to make “controllable risk” a new industry standard—making user trading more predictable and protected.

Second, ecosystem application expansion.

Websea has already formed preliminary social and gaming ecosystems. Moving forward, we’ll deepen integration into DeFi and PayFi. Payment scenarios are a key direction—we’ll collaborate with existing social and gaming partners to build a cross-scenario application network. Ultimately, we aim to upgrade Websea from a “gateway to the digital asset world” into a practical, lifestyle-oriented, scenario-based entry point for broader Web3.

Third, user value accumulation.

From an industry perspective, Bitcoin-style “get-rich-quick” stories will grow increasingly rare. Users will need stable, sustainable ways to preserve value. Therefore, Websea will focus more on helping users accumulate long-term value. We’ll gradually integrate funds, staking, and wealth management components into the platform, exploring convergence with traditional finance to bring Web2’s “financial vitality” into Web3. Through diversified product combinations, users of all risk appetites—aggressive or conservative—can find suitable asset management tools on Websea.

TechFlow: Recently, the topic ‘Gen Z is taking over crypto’ has sparked debate. As a youth-focused digital asset exchange, how does Websea view this trend of younger talent entering crypto? And personally, what advice do you have for young people wanting to better participate in the crypto industry?

Calvin:

Gen Z taking over crypto is inevitable—a natural historical progression, much like how the ’80s dominated real estate and the ’90s shaped the internet. Gen Z grew up with internet education and mobile devices, giving them stronger foundations and higher affinity for understanding crypto assets and digital identities. So their dominance in crypto is a product of era-defining forces—Gen Z simply follows history’s flow into this industry.

As a youth-focused exchange, Websea designs products with risk control and low operational barriers in mind, incorporating social, community, and gamified interactions—allowing youth to learn, trade, and grow through engaging experiences.

As for advice to young people on better participating in crypto, here are some personal thoughts.

First, start with learning. Don’t blindly follow trends. Begin with simulated trading or demo funds offered by exchanges. Then, use low-risk copy trading products to learn from seasoned traders, gradually forming your own trading philosophy before attempting real trading. This is a healthier path.

Second, try to become an ecosystem participant, not just a passive observer buying tokens. Join DAOs and events, experiment with various DeFi applications. If you’re tech-inclined, study blockchain fundamentals, advanced concepts, or AI-integrated chain abstractions. These efforts build comprehensive industry understanding and help clarify your future role.

Finally, maintain a long-term perspective and respect for the market—this is the most important point. Short-term volatility is increasing, but real opportunities lie in long-term value discovery. In this cycle, whether Bitcoin’s bull run or Ethereum’s recent surge, many users fail to hold. Those who benefit are often patient, steadfast investors—the ones with strong conviction and long-term vision. With personal risk management in mind, I urge everyone not to chase short-term gains at the expense of ignoring market risks. For Gen Z and youth, only trade within your capability and risk tolerance—avoid gambling mindsets that lead to irreversible downfall.

Overall, I believe Gen Z is indeed the group most likely to shape the next golden decade. That’s why Websea hopes to grow alongside this generation, becoming their first stop in the Web3 digital asset world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News