Crypto projects are rushing into buybacks—why is only $HYPE rising?

TechFlow Selected TechFlow Selected

Crypto projects are rushing into buybacks—why is only $HYPE rising?

Repurchases can create scarcity, but scarcity does not equate to appeal.

Author: RichKing | RPS AI

Translation: TechFlow

During meetings with developers, we noticed that simple guides on on-chain liquidity management for early-stage teams are extremely rare. As liquidity providers (LPs) and on-chain market makers, we frequently observe common mistakes being overlooked—until they evolve into costly issues. Meanwhile, most centralized exchange (CEX) market makers don't seem to offer much guidance on managing on-chain liquidity either.

Heavendex AMM (Automated Market Maker) has implemented a mechanism where all trading fees are used to repurchase tokens. Heavendex's token $LIGHT also participates in these buyback systems.

TLDR: Scarcity ≠ Attractiveness

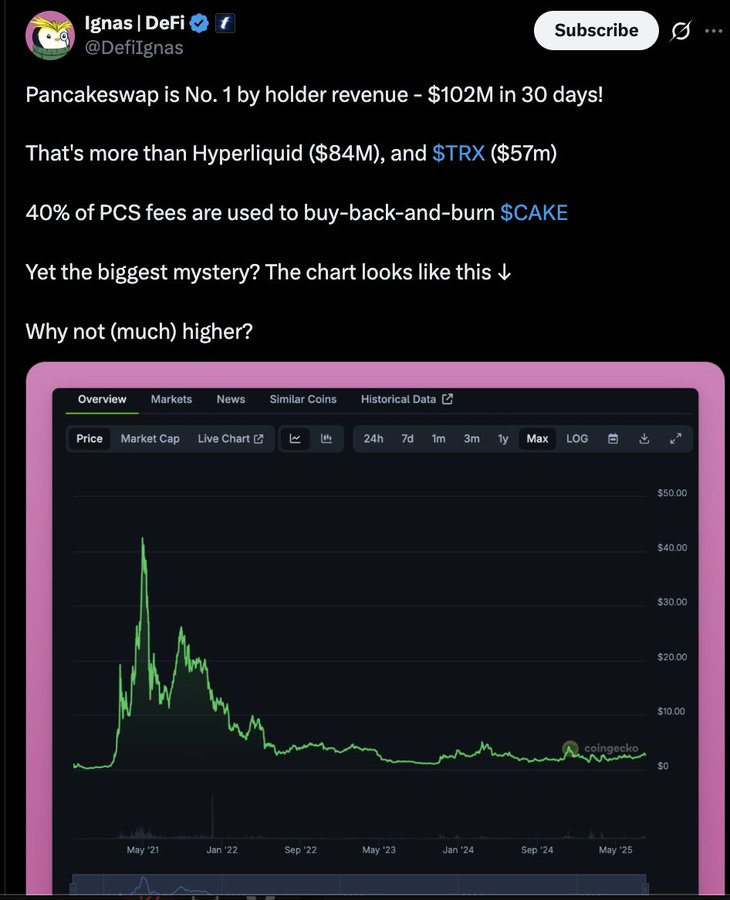

Token buybacks reduce supply. After supply decreases, people may assume demand will increase, thus driving up value. However, many crypto tokens lack intrinsic underlying demand. Most demand stems from attention and mindshare—which often becomes the primary focus for most projects.

As the industry matures, projects with stronger fundamentals will make buyback mechanisms more effective over time. We've already seen some projects experimenting with "flywheel effects" (protocol-level buyback mechanisms) designed to tie core revenue to token value. Whether these attempts succeed remains to be seen. In the meantime, buybacks are often used to mitigate negative sentiment or create short-term price movements, with inconsistent results.

What Do Token Buybacks Actually Achieve?

Before diving deeper into crypto buybacks, let’s first look at examples from Web2 companies.

In traditional public markets, buybacks are typically used for:

-

Boosting stock prices

-

Creating scarcity

-

Rewarding shareholders

-

Burning excess cash

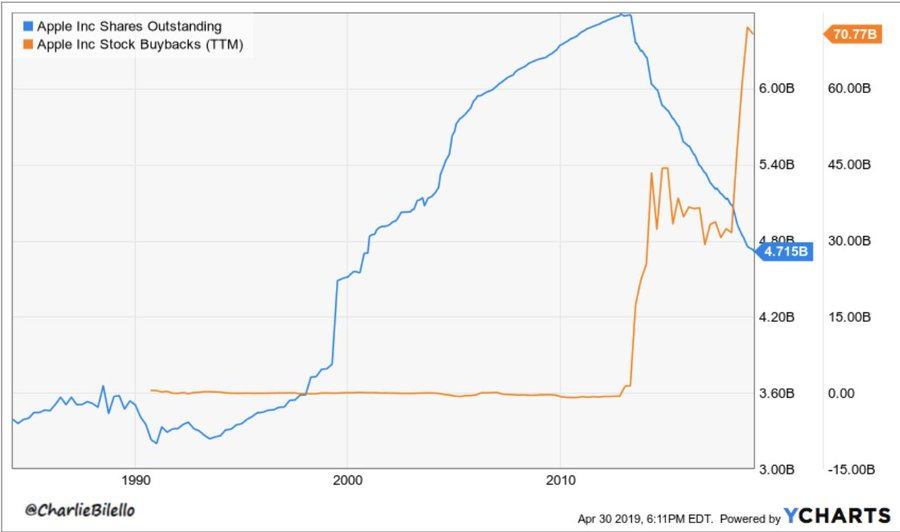

Apple is a classic example—having spent over $650 billion on buybacks since 2012, reducing its share count by about 40%. This strategy worked because Apple’s earnings continued growing. In contrast, buybacks by General Electric (GE), IBM, or some oil giants failed to stop their stock declines due to deteriorating fundamentals.

From 2010 to 2019, Apple reduced its outstanding shares by over 50% through a series of aggressive programmed buybacks. During the same period, its stock price rose from $11 to $40 per share—an increase of 300%.

Why Are Stock Buybacks More Meaningful Than Token Buybacks?

Will the crypto space start adopting EPS (Earnings Per Share) as a way to evaluate token value?

Stock buybacks directly boost EPS by reducing the number of outstanding shares. Investors closely watch EPS and valuation multiples.

However, in crypto, there's no equivalent metric to EPS. Prices are driven more by attention, liquidity, and narratives rather than financial comparisons.

Moreover, programmatic buybacks in crypto face another issue: revenue is cyclical, usually fluctuating with bull and bear markets.

Founder's Buyback Decision Checklist: Should You Buy Back?

Does your protocol have a stable income stream? (Or are you burning treasury reserves?)

Is your treasury strong enough to support buybacks without harming growth?

Are you aligning buybacks with fundamentals—such as product launches, partnerships, or user growth?

Is your goal price support or merely surface-level optics?

If the answer leans toward "optics," you're likely just enabling an exit pump.

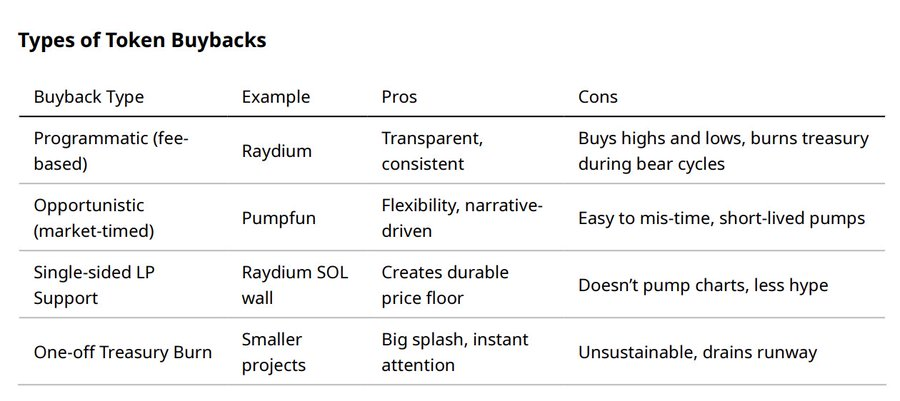

Types of Token Buybacks

Different buyback methods suit different contexts.

The Full Buyback Lifecycle: Before, During, After

-

Announcing the buyback plan: Sometimes market reaction occurs purely from the announcement (“pricing in” the news).

-

Executing the buyback: In some cases, execution can trigger selling—providing exit liquidity for holders waiting to sell.

-

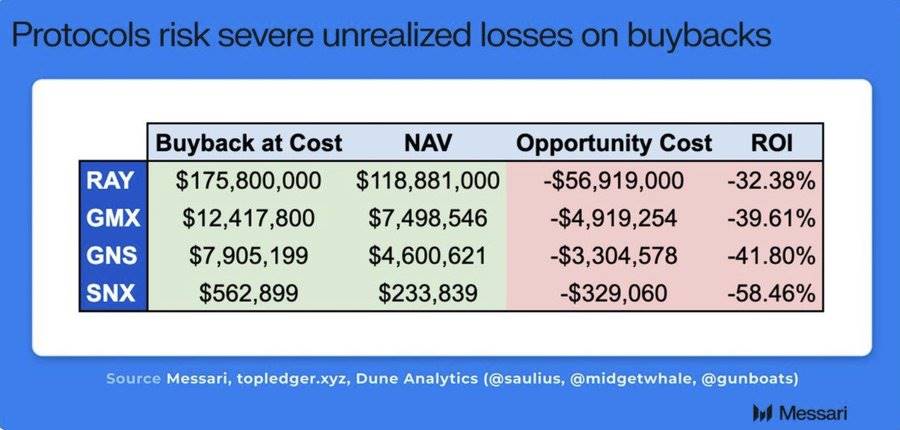

Programmatic buybacks: Considered optimal, but perform inconsistently when revenue fluctuates cyclically. For example, Raydium has burned over $175 million worth of RAY, yet its price still moves in cycles driven by market attention.

-

Overpaying: Conducting buybacks at high valuations consumes more treasury funds. Using algorithms or volume-weighted approaches can help smooth this process.

Case Studies

-

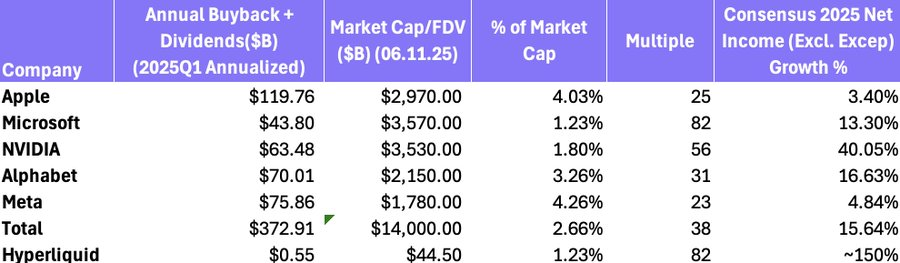

Hyperliquid ($HYPE): 97% of DEX revenue is allocated to daily buybacks (~$3M/day), projecting annual revenue of $650M. With strong revenue and bold buyback plans, $HYPE is often hailed as one of the most successful buyback projects. (The next question: When or if will the foundation sell?)

$HYPE’s buyback scale rivals Microsoft in Web2, with an 82x MCAP/FDV buyback ratio. The annual buyback volume relative to circulating supply is substantial.

-

Pumpfun ($PUMP): On-chain buyback and burn of 118,351 SOL triggered a 20% price rise, but prices reverted within a day. Scarcity didn’t translate into sustained appeal—competitor BONK continues to capture attention. (As of August 22, 2025, Pumpfun regained market share leadership, but $PUMP has not yet reacted.)

-

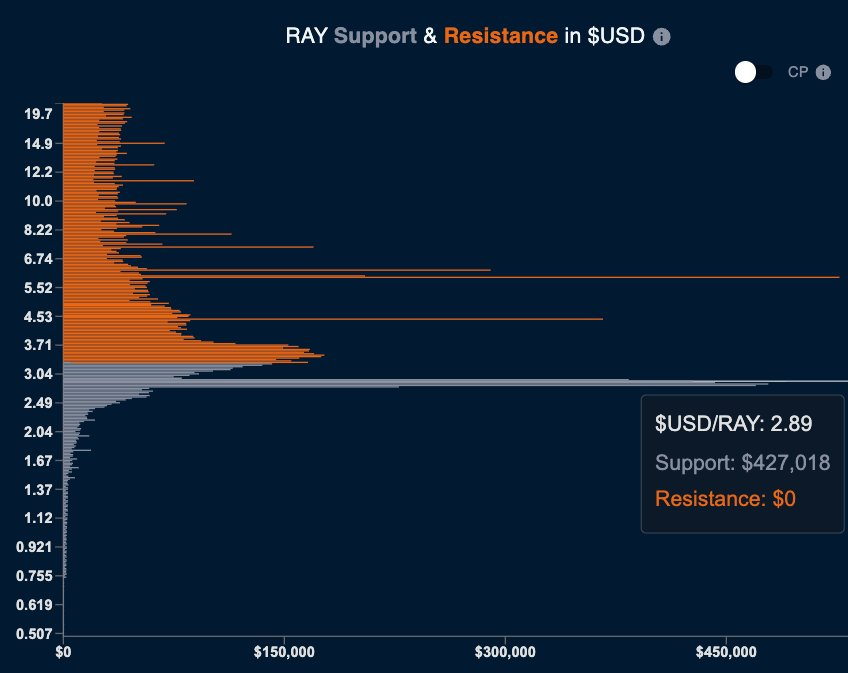

Raydium ($RAY): Programmatic buybacks combined with unilateral SOL liquidity experiments. The latter adopts a healthier approach by establishing a price floor instead of chasing price increases.

Unilateral liquidity created massive passive buybacks at the $2.89 price level.

-

BNB Burn: The largest and most consistent buyback/burn model in crypto (programmatic burns funded by CEX revenue, cumulatively burning $35B worth of BNB). This works because Binance generates billions annually in trading fees, providing sustainable funding.

-

MakerDAO surplus auctions and burns: Protocol revenue used to buy and burn MKR.

Buybacks can become unprofitable during market pullbacks, so effective treasury management is needed to optimize ROI.

Investor Perspective: Where Does the Buyback Money Come From?

Smart money looks beyond the surface. The strength hierarchy of buyback signals is:

-

Funded by sustainable revenue → Strong signal

-

Programmatic buybacks tied to fees → Medium signal

-

Opportunistic buybacks funded by treasury → Weak signal

-

One-time burn using treasury funds → Bearish signal

Buybacks funded by protocol revenue are positive signals; those depleting treasury reserves are red flags.

For example, a Solana project with a $5M FDV manually executes a buyback plan (each orange line represents 0.5% of total token supply bought back). Through buybacks, the project's portfolio value increased fourfold, which it then actively uses to manage liquidity.

Three Rules for Effective Token Buybacks

-

Must be supported by sustainable revenue (not one-time treasury burns).

-

Must be aligned with fundamentals (e.g., product launches, partnerships, or user growth).

-

Must be transparent and predictable, allowing holders to build confidence instead of selling during short-term price swings.

Final Takeaway: In stock markets, buybacks amplify fundamentals. In crypto, buybacks can create scarcity—but scarcity does not equal attractiveness. Unless protocols establish stickiness, recurring revenue, and utility on the demand side, buybacks remain mostly narrative tools. When paired with real fundamentals, buybacks can be powerful signals; when used for optics alone, they simply facilitate someone else’s exit.

Additional Examples:

$RAY Buyback and price trend from July 2022 to July 2025

$PUMP Buyback and price trend from July 17 to August 4

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News