New Evidence: Unraveling MSTR's Ponzi Structure

TechFlow Selected TechFlow Selected

New Evidence: Unraveling MSTR's Ponzi Structure

For speculators: the pursuit is greater gains, not who holds more Bitcoin.

By: Sima Cong, AI Channel

There is no foolproof strategy in the financial world.

The failure path of MicroStrategy does not require a sharp decline in Bitcoin price—and in fact, MicroStrategy itself is not even worried about Bitcoin price drops.

For speculators: the pursuit is greater price appreciation, not who holds more Bitcoin.

We must clarify a widely overlooked fact: what investors are truly trading is MicroStrategy’s stock. Saylor’s relentless promotion on social media platforms—declaring Bitcoin as the promised land—is not driven by faith, but rather a clever use of conceptual equivalence and substitution techniques. He redirects investor expectations from stock price to Bitcoin's future. The financing providers behind MicroStrategy are fully aware of this dynamic and tacitly accept it. Whether through convertible bonds, preferred shares, or common equity, they all return to one fundamental truth: the stock price requires a next round of buyers.

In an era of information overload and scarce belief, capital no longer chases profit alone—it chases “the securitizability of narratives.”

Meanwhile, I will systematically explain why MicroStrategy consistently buys Bitcoin at its price peaks.

Preface

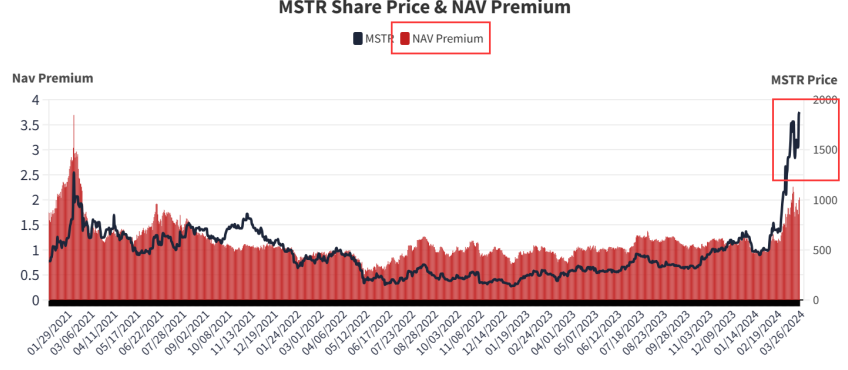

Recently, discussions have emerged across social media platforms suggesting that MicroStrategy’s model may be nearing collapse—a widespread sense of déjà vu triggered by the shrinking mNAV metric, falling stock price, and concerns over financing difficulties potentially bringing the entire operation to a halt.

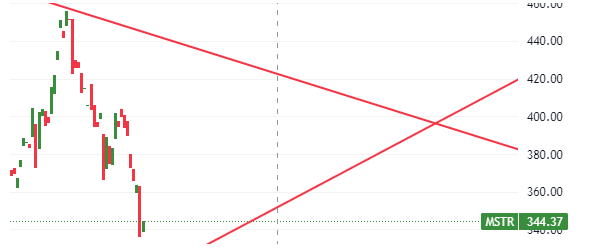

The most immediate issue is its continuously declining stock price, which has not risen alongside its Bitcoin purchases. Compared to its July peak, it has already dropped over 20%.

Yet Bitcoin’s price during the same period did not fall significantly.

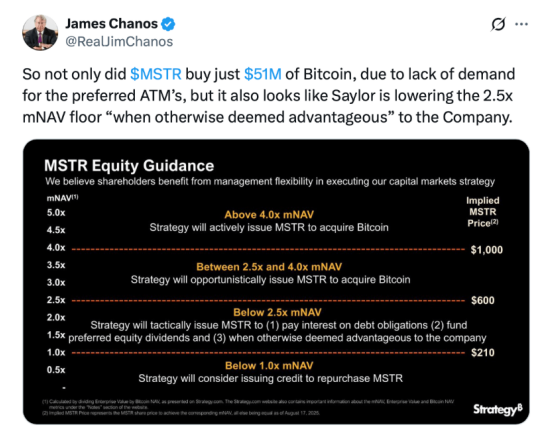

During the Q2 2025 earnings call, the company pledged not to issue new common shares unless under specific obligations if mNAV falls below 2.5x. Many viewed this commitment as protecting shareholders from excessive dilution.

But the reversal came swiftly.

On August 18, 2025, observers claimed the company abruptly abandoned this protective measure. Its new policy allows share issuance even when mNAV is below 2.5x, "if management deems it beneficial." This announcement sparked strong investor backlash, seen as a bait-and-switch that significantly increases dilution risk—especially given the recently reported mNAV of just 1.68x.

On August 20, Strategy (MSTR) announced it would lower the threshold for stock offerings to raise more funds for Bitcoin purchases.

A class action lawsuit filed this year accuses the company of making misleading statements regarding its Bitcoin strategy and financial condition. At the end of last year, critics like investment analyst Michael Lebowitz accused Strategy of using optimistic Bitcoin rhetoric to "plunder investors," thereby increasing stock volatility and enabling cheaper financing.

As for why the company abandoned a promise made seemingly just yesterday, the likely reason is limited market demand for MicroStrategy’s preferred shares.

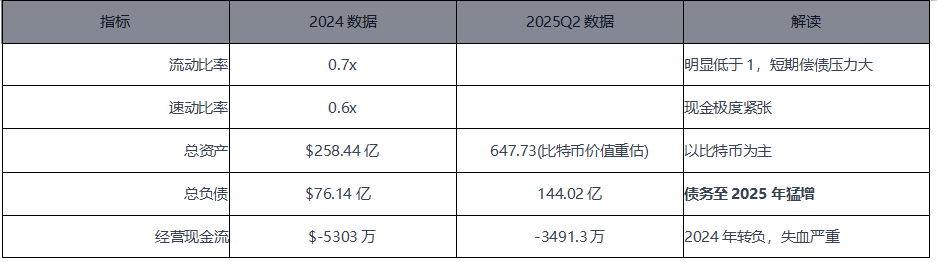

First, examine MicroStrategy’s financial situation

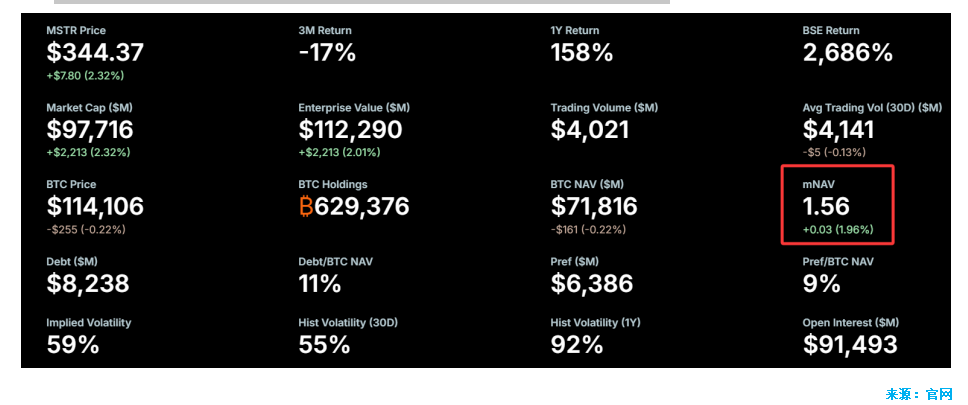

MicroStrategy’s mNAV has sharply contracted from 3.89x in November 2024 to 1.56x in August 2025.

Now let’s look at its financial data:

Taking 2024 as an example:

-

EBITDA: -$1.85 billion (significant loss, reflecting pressure from core operations and extreme Bitcoin volatility)

-

Levered free cash flow: -$66.51 million (actual cash outflow from the company—“cash deficit” after interest and investment expenses)

This shows that even with negative EBITDA, the company still has to pay interest and capital expenditures, further straining cash flow and increasing risk.

EBITDA reflects the “pure profitability of core operations,” before deducting any capital expenditures, interest, or taxes. Levered free cash flow represents the actual money “going into shareholders’ pockets,” after subtracting operating taxes, capital expenditures (e.g., equipment purchases, R&D), and all debt interest payments.

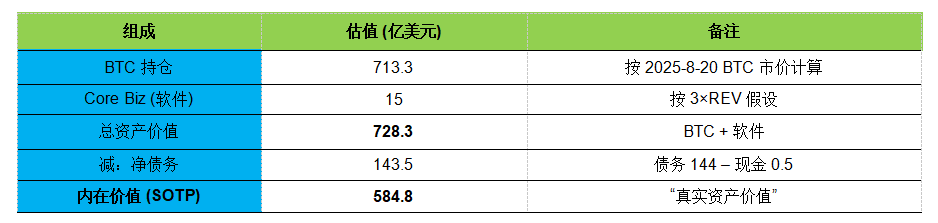

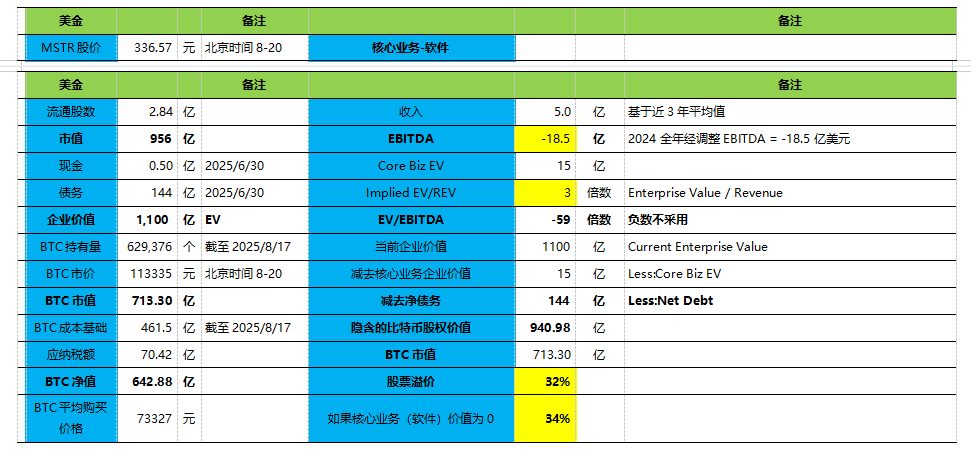

Valuation Analysis

Next, we use two methods to value the company based on the latest data.

SOTP

Implied Bitcoin Equity Value

EV/Revenue multiples for SaaS/software companies: 2–6x for slow-growth traditional software. MSTR’s software business has nearly zero growth, so valued at 3x.

Conclusion:

-

MSTR’s implied Bitcoin value ($94.1B) is clearly higher than actual BTC market cap ($71.3B);

-

If core business (software) value is $0, there’s a 34% premium;

-

Implied BTC EV = $108.5B vs. actual BTC market cap $71.3B → 52% premium;

-

MSTR stock needs to fall 24% (from 336.57 to 256.4) to eliminate the premium;

-

Assuming constant holdings, Bitcoin would need to rise to $150K to eliminate the premium (was $113,335 on Aug 20), requiring a 32.35% increase;

-

Even if MicroStrategy stops buying Bitcoin and holdings and stock price remain unchanged, if Bitcoin falls to $70K, the premium remains at 112%;

-

But if holdings stay constant and Bitcoin remains at $120K, if MSTR stock drops to $200, it becomes negatively priced;

An undeniable phenomenon

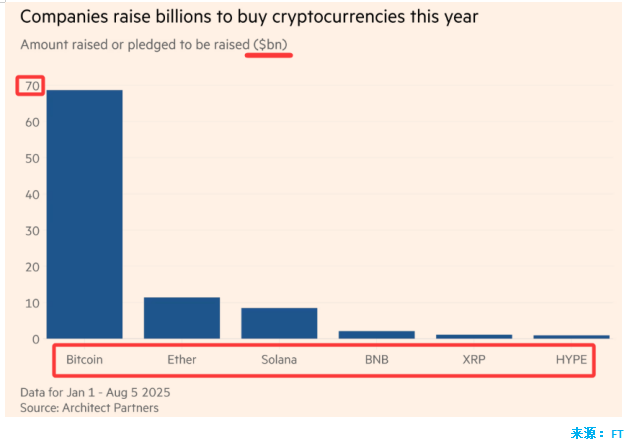

As of May 2025, 199 entities collectively hold 3.01 million BTC (approximately $315 billion), and this number is growing rapidly.

According to Bitcointreasuries.net, 199 entities currently hold 3.01 million BTC ($315B), including 147 private and public companies holding 1.1 million BTC ($115B).

Recently, a wave of companies announced new Bitcoin treasury strategies. These include diversified balance sheet firms and dedicated Bitcoin treasury companies, spanning various countries and industries.

By the first half of 2025, over 40 companies had publicly announced adopting Bitcoin on their balance sheets, raising tens of billions of dollars to execute these strategies, differing in industry, geography, execution models, and listing paths.

Notable examples include:

· Metaplanet (Japan): One of the earliest international participants, leveraging Japan’s ultra-low interest rate environment;

· Semler Scientific and GameStop (USA): Their Bitcoin treasury strategies attracted mainstream media attention;

· Twenty One Capital: A dedicated firm backed by Tether and Cantor;

· Strive and Nakamoto: Rapidly listed via reverse mergers.

The expansion of Bitcoin treasury companies is still in early stages—but this model is already extending to other crypto assets—

For example: Solana: DeFi Development Corp (market cap $100M, holds over 420K SOL), Upexi and Sol Strategies; Ethereum: SharpLink Gaming, raised $425M in a Consensys-led funding round.

A very concrete fact: massive stock price surge

Metaplanet, dubbed the “Japanese version of MicroStrategy,” saw its stock rise 145.59% YTD in 2025.

Sequans Communications surged 160% after announcing it raised $384 million through debt and equity markets to buy the world’s most popular token. But this is an obscure semiconductor company.

To a large extent, credit goes to Bitcoin evangelist Michael Saylor. Since 2020, this U.S. cryptocurrency giant has spent billions weekly buying Bitcoin and held conferences encouraging others to follow. Saylor’s company Strategy, originally a software firm, has transformed into a Bitcoin hoarder, with its stock surging over 3000% in the past five years.

Biotech firms, gold mining companies, hotel operators, EV makers, and e-cigarette manufacturers are all rushing to buy crypto tokens.

As of August 5, approximately 154 public companies have raised or committed to raise a total of $98.4 billion for cryptocurrency purchases. Prior to this year, only 10 companies had raised $33.6 billion.

Trump’s family media company raised $2 billion in July to buy Bitcoin and related assets.

Companies that can demonstrate a commitment to continuously raising funds to buy crypto are favored by investors, who value their stocks higher than the Bitcoin they actually hold.

Underestimated risks that could trigger severe volatility

MicroStrategy’s collapse may not require a significant drop in Bitcoin price.

Why do investors pay a premium early on? They hope to gain more Bitcoin per share in the future. If the company can quickly buy more Bitcoin, equity investors indirectly own more BTC per share.

More public companies are stepping forward to announce such reserve strategies, expanding from Bitcoin to other cryptocurrencies.

These two points reveal a significantly underestimated reality: a potential crisis pathway.

MicroStrategy premium convergence → financing difficulty → forced use of Bitcoin → signal effect spreads → market chain reaction—forms a potential crisis path.

-

Starting point: premium convergence — the premium of MSTR’s stock relative to its BTC holdings gradually disappears.

-

Middle stage: MSTR constrained — MSTR can no longer finance additional BTC purchases at “high premiums,” leading the market to expect drying up of buying pressure.

-

Direct transmission: reduced demand — as a major buyer, MSTR loses its leveraged purchasing power, amplifying the demand-side gap for BTC.

-

End point: BTC declines — deteriorating investor expectations lead to systemic BTC price drop.

-

Feedback loop — BTC falls → MSTR asset shrinks → stock price drops further → premium turns into discount → accelerates market panic.

When the market sees other similar “Bitcoin proxy stocks” with higher returns, speculative capital naturally flows to higher-returning assets. As the former exclusive proxy, MicroStrategy’s scarcity is being diluted by imitators and more direct ETFs.

MicroStrategy’s financing structure includes interest-bearing liabilities like convertible bonds. These debts require fixed interest payments. When equity financing stalls, the company’s most direct option to maintain operations and debt servicing is to leverage its most valuable asset—Bitcoin—through collateralized loans.

If Bitcoin price doesn’t rise significantly, or if the company cannot secure new loans to “pay old debts with new debt,” it will eventually face rigid debt repayment or interest obligations. Selling Bitcoin becomes the only option. This scenario is entirely possible. MicroStrategy’s financial model is essentially a massive, one-way long call option on Bitcoin—if the underlying doesn’t rise, it faces a liquidity crisis.

It’s not about quantity. For a company that treats “buy and never sell” as dogma and positions itself as a Bitcoin believer, selling even 1,000 BTC carries symbolic weight far exceeding its financial impact.

-

Belief collapse: it signals to the market that Saylor’s faith is not unconditional, that the company’s model is not invincible, and that they too will yield under pressure.

-

Model collapse: it triggers a trust crisis in all “Bitcoin proxy stocks” and crypto lending models, because once the leader falls, the entire model comes under scrutiny.

In the game of “who holds the most wins,” MSTR is replaceable—it’s merely a “leveraged BTC custodian.” The ultimate winner isn’t the earliest entrant, but the one with the deepest pockets, strongest fundraising ability, and best storytelling skills.

What people chase is whose stock rises faster and offers greater speculation. The real competition isn’t “who believes more in BTC,” but “who can raise more funds and whose stock climbs faster.”

Although Saylor preaches Bitcoin’s “promised land,” investors ultimately seek speculative stock gains. When MicroStrategy’s stock lags behind peers—or even Bitcoin itself—investors will abandon it, as its speculative value has vanished.

For speculators: the goal is “higher and more exciting stock returns,” not who holds more Bitcoin.

This speculative chase decouples the company’s fate from Bitcoin’s price, instead tying it tightly to its relative stock performance.

If hoarding Bitcoin is the promised land, then having more money is the answer.

MicroStrategy’s model lacks any moat. Its core competitiveness is merely “starting first,” with no patents, technology, or brand barriers. Any company with sufficient capital can replicate this: issue stock, borrow, buy Bitcoin.

The fact that 154 public companies have already raised or committed $98.4 billion for crypto purchases fully validates this.

MicroStrategy’s potential failure point is not Bitcoin’s price itself, but the erosion of its stock-based model’s appeal. When it can no longer attract capital through “stock arbitrage,” the model automatically halts—or worse, triggers reverse liquidation due to fixed expenses. Bitcoin is merely its “chip”; the true core lies in whether the market is still willing to pay a premium for its stock.

-

Fragility of corporate financial structures;

-

Leverage effect of market belief;

-

Nonlinear risks within the crypto asset ecosystem;

This is precisely the classic prelude to a “black swan” event: a seemingly localized problem (MSTR’s financing difficulty) could trigger global shockwaves through signaling effects.

This might even be a fatal trap

This is no longer about “MicroStrategy” or “Saylor’s” personal beliefs, but about the mathematical and human logic inherent in the business model itself.

It’s a “race to see who rises faster”: MicroStrategy’s business model relies on its first-mover advantage to get the market to pay a stock premium. But as more players enter, the race shifts to whose stock appreciates faster and is more attractive. If MicroStrategy’s stock growth is surpassed, it loses speculator favor—and thus its sole source of funding.

Separation between core assets and value sources:

-

The company’s core asset is Bitcoin.

-

But its value source is speculative premium.

-

These two are not directly linked. Bitcoin’s price can stagnate, but if the market finds newer, more speculative alternatives, MicroStrategy’s premium will be drained.

MSTR’s “rationality” rests on “relative performance advantage,” not absolute value.

Investors won’t say: “BTC rose, MSTR rose too, good enough.”

They’ll say: “BTC rose 30%, MSTR only 10%—why not just buy BTC?”

Its survival doesn’t depend on Bitcoin’s price, but on:

Whether speculators continue to treat it as a “leveraged version of Bitcoin” for speculation.

Once the market stops believing it’s the best proxy for Bitcoin’s “promised land,” it enters a path of automatic shutdown → reverse liquidation.

Why MicroStrategy keeps buying Bitcoin at price peaks

This has always seemed counterintuitive. Even as Saylor proclaims Bitcoin as the future, why buy at high prices when Bitcoin has a public market?

The answer: MicroStrategy’s model inherently demands buying at peaks.

The act of “buying” is the most crucial part of its business model, serving purposes far beyond simply increasing Bitcoin holdings.

For a company highly dependent on financing, balance sheet scale is critical.

After raising funds through high-premium stock or bond issuance, MicroStrategy converts that capital into Bitcoin. This rapidly expands the company’s total assets, magnifies income statement elasticity (recognizing gains when BTC rises, attracting speculative capital). On paper, the company appears “larger” and “more powerful.”

This scale effect makes it easier to secure the next round of financing—whether bank loans (using expanded assets as collateral) or capital market stock offerings. After completing a funding round, the company has already transferred risk to new investors. Unless Bitcoin crashes to insolvency levels, the company is safe in the short term.

This “buying at peaks” behavior is the most effective non-verbal marketing.

When retail investors hesitate—“Is this a top?”—Saylor and MicroStrategy give a clear answer through action: “No.”

It’s a sophisticated marketing tactic that reinforces narrative through action. It sends the market a signal:

-

“We are confident enough to buy aggressively, even at current prices.”

-

“Compared to Bitcoin’s future value, today’s price is negligible.”

-

“Don’t worry—just follow us.”

This peak-buying behavior exists solely to attract new “bag holders.” By demonstrating fearless “faith,” it alleviates fears of new investors, ensuring continuous capital inflow. It creates the illusion among retail investors that “timing doesn’t matter,” using “we dare to buy high” as a demonstration → reinforcing belief.

Two direct pieces of evidence

First, Saylor constantly posts on X platform reporting his Bitcoin holdings and total market value. Second, he repeatedly emphasizes the unrealized profits achieved.

1. Balance Sheet Expansion

Digital assets (BTC) recorded at fair value on the balance sheet:

BTC price rises → asset value surges → total assets and shareholder equity rise → improved debt-to-asset ratio (appears safer);

2. Income Statement “Beautification”

If BTC price rises → generates “unrealized gains” → booked under “other income” → offsets minor profits or losses from software business → net profit turns positive → appears “highly profitable”;

But note: these gains are unrealized, non-cash, and unsustainable—merely paper wealth, yet sufficient to support stock price and financing.

So now you understand why MicroStrategy consistently buys Bitcoin at price peaks—and why Saylor dares to predict extremely high future Bitcoin prices.

December 14, 2000

The U.S. Securities and Exchange Commission (SEC) today said that two executives of MicroStrategy Inc. and its former chief financial officer have agreed to pay a total of $11 million to settle civil accounting fraud charges related to the restatement of the software vendor's financial results in March last year.

The SEC said MicroStrategy has indeed agreed to a cease-and-desist order and committed to “significant” internal changes to ensure compliance with securities laws in the future. In addition, the company’s corporate controller and accounting manager agreed to separate cease-and-desist orders for violations of reporting and recordkeeping requirements.

As part of a settlement agreement with the SEC, MicroStrategy CEO Michael Saylor, along with COO Sanju Bansal and Mark Lynch, resigned earlier this year from their roles as CFO of the data analytics software developer.

According to the SEC, the three executives neither admitted nor denied the accounting fraud allegations. However, the commission stated they agreed to each pay a $350,000 civil penalty and “disgorge” a total of $10 million, with Saylor contributing $8.3 million. Lynch also agreed to an order barring him from practicing accounting for at least three years.

The SEC launched its investigation after revealing in March that MicroStrategy had overstated revenues and earnings over the previous two years, necessitating a restatement of financial results.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News