Bitget Wallet Research Institute: Rumors of RMB stablecoin thaw—mere speculation or a signal of policy shift?

TechFlow Selected TechFlow Selected

Bitget Wallet Research Institute: Rumors of RMB stablecoin thaw—mere speculation or a signal of policy shift?

Take you on a journey through the history and evolution of the RMB stablecoin.

Author: Lacie Zhang, Researcher at Bitget Wallet

Introduction: On August 20, 2025, a rumor about "China possibly considering the issuance of a RMB stablecoin" reported by Reuters quickly sparked widespread speculation across global cryptocurrency and financial markets. Although this appears more like hearsay, the mere fact that such a long-taboo topic has stirred significant waves is itself an important policy signal. This development is no coincidence—it is the inevitable outcome of years of grassroots exploration combined with cautious official observation. The Bitget Wallet Research Institute will guide you through the past and present of the RMB stablecoin.

1. Testing the Red Line: The Evolution of RMB Stablecoin Exploration

Before examining official intentions, we must first understand a fundamental context: RMB stablecoins are not new; their exploration has been ongoing in the market's "gray zone" for several years. The key to understanding this lies in distinguishing two core concepts—onshore RMB (CNY) and offshore RMB (CNH). In short, CNY is China’s domestic legal tender, subject to strict capital controls, while CNH refers to RMB circulating outside mainland China, with a more market-driven exchange rate, providing fertile ground for early stablecoin experimentation.

Based on this, what has truly circulated in the market so far are essentially stablecoins pegged 1:1 to offshore RMB (CNH)—Coingecko’s statistics on RMB stablecoins only cover offshore RMB (CNH). Reviewing its development history, three distinct types of players emerge, each representing a different approach.

Global giants' tentative forays: Tether, a major stablecoin player, and TrustToken from the U.S. (now renamed Archblock), launched CNHt and TCNH in 2019 and 2022 respectively. These were strategic probes into a potentially lucrative market, aiming to unlock small-scale cross-border payments. However, constrained by China’s stringent regulatory environment, they did not invest heavily in promotion, resulting in limited impact and gradual disappearance from mainstream view. Their combined market cap today totals only a few million dollars.

Mainland teams' failed attempts: CNHC, founded by a Chinese team, was once seen as the most promising contender in this space, backed by high-profile investors including KuCoin Ventures, members of Circle’s founding team, and IDG. However, just as the project was gaining momentum, its Shanghai office was raided by police in May 2023, with key members detained, abruptly halting the project. This became a landmark event highlighting mainland China’s strict regulation of crypto-related activities.

Circumvention under the "Belt and Road" framework: Following the CNHC incident, AnchorX—a Hong Kong fintech firm jointly incubated by Conflux and Hopu Investment—was established, with reports suggesting close ties to the former CNHC team. They chose a more indirect path: in February 2025, securing a "fiat-backed stablecoin issuance" license in Kazakhstan, focusing on cross-border trade settlements along Central Asian "Belt and Road" routes, and have since initiated sandbox testing.

Overview of Offshore RMB (CNH) Stablecoin Cases

Data source: Coingecko, CoinMarketCap, Token Radar

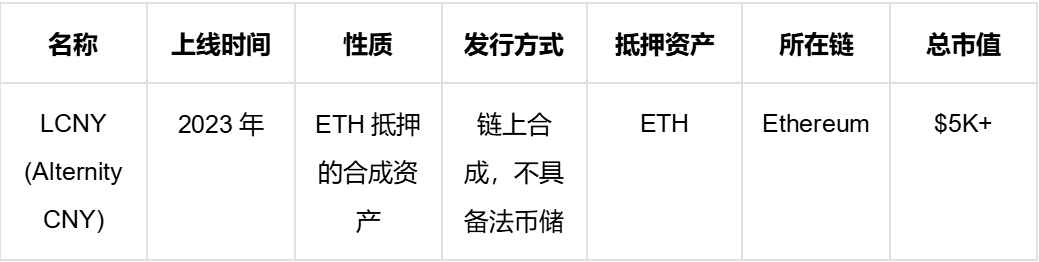

While exploration in the offshore market has experienced ups and downs, attempts at onshore RMB (CNY) stablecoins remain nearly nonexistent. A few projects like LCNY and bitCNY are essentially synthetic assets generated by collateralizing cryptocurrencies, not backed by real fiat reserves. The logic is clear: within China’s strict foreign exchange control system, any fiat-backed stablecoin directly tied to onshore RMB would be tantamount to openly challenging the nation’s core financial defenses.

Overview of Onshore RMB (CNY) Stablecoin Cases

Data source: Defilama

These varied attempts—some successful, others not—collectively paint a realistic picture of RMB stablecoin development and reveal several underlying patterns:

1. "Offshore" is the only viable path; "onshore" remains a red line. All effective efforts have focused on the CNH domain, clearly indicating that any official or semi-official project in the foreseeable future will be strictly confined to offshore markets to ensure risk isolation from the domestic financial system.

2. Feasibility has been proven, but scalability remains a huge challenge. Technical implementation and small-scale pilots have shown that issuing RMB stablecoins is technically achievable. Yet, with a current total market cap of merely millions of dollars compared to the hundreds of billions in dollar-pegged stablecoins, it’s a drop in the ocean. Finding genuine, large-scale use cases will be key to its success.

3. Strategic focus is shifting from "globalization" to "geopolitical localization." While early projects held vague ambitions of serving a global audience, AnchorX’s launch in Kazakhstan marks a pivotal shift: serving specific geopolitical and economic goals like the "Belt and Road" initiative is becoming the most practical application scenario for RMB stablecoins.

2. Opportunities and Challenges: Three Critical Questions Behind the Grand Narrative

Against this backdrop, the idea of an RMB stablecoin undoubtedly carries immense strategic potential. It could not only create a "Digital Silk Road" independent of SWIFT for "Belt and Road" trade, reshaping regional settlement systems, but also rival dollar-pegged stablecoins in the global crypto economy, competing for "seigniorage rights" in the digital age—this is precisely the core motivation driving official reevaluation.

Yet beneath this grand vision lie three critical real-world challenges—three essential questions that must be answered and key obstacles to overcome before any stablecoin can be issued.

First Question: How to balance monetary innovation with financial stability?

Even offshore RMB stablecoins will inevitably develop complex links with the onshore financial system. How can innovation be encouraged and the international influence of the RMB expanded without enabling capital outflows through a "Trojan horse"? Establishing effective risk isolation and regulatory oversight mechanisms remains the "Sword of Damocles" hanging over all industry participants.

Second Question: How to overcome the shortage of reserve assets?

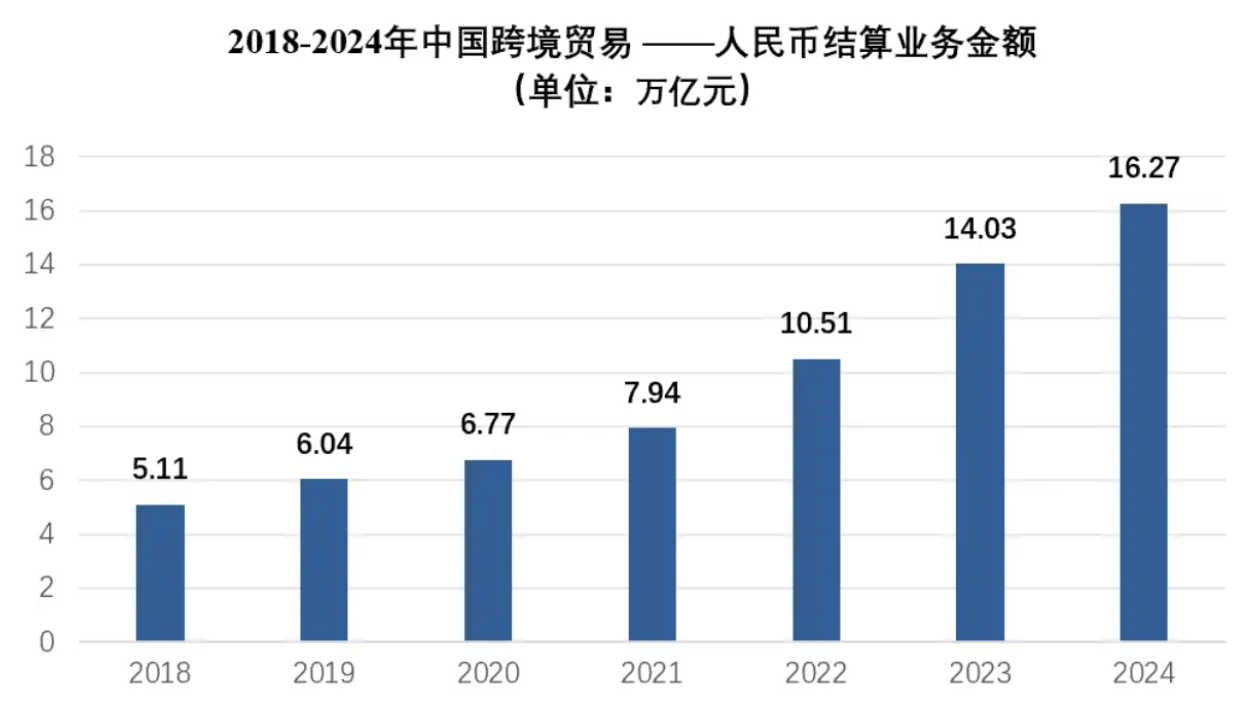

A core contradiction exists: while potential demand for RMB stablecoins is enormous, qualified reserve assets are extremely scarce. A recent quantitative study by Professor Fang Xiang of the University of Hong Kong highlights this issue: based on the 16 trillion yuan in cross-border RMB settlements in 2024, assuming only 20% shifts to stablecoin-based settlement and using the dollar stablecoin velocity of 6.8, the required stablecoin scale would exceed 400 billion yuan. However, by the end of 2024, the total available offshore RMB high-quality short-term bonds amounted to only a few hundred billion yuan. This more-than-tenfold supply-demand gap is an unavoidable bottleneck on the path of RMB stablecoin development.

Data source: People’s Bank of China “Financial Statistics Report,” chart by author

Third Question: How to break the monopoly of dollar-pegged stablecoins?

Dollar-pegged stablecoins, after years of development, have built a vast user base, deep liquidity, and mature ecosystems globally. New offshore RMB stablecoins must not only build user trust from scratch but also overcome powerful network effects. Convincing global users and developers to "switch from dollars to RMB" will be an exceptionally difficult battle.

3. "Tacit Approval" and "Overseas Expansion": The Future Roadmap for RMB Stablecoins

Regardless of the rumor’s authenticity, given this complex landscape, it is foreseeable that the official strategy will not be a blunt "full liberalization," but rather a careful and sophisticated "combination punch," which can be understood through three dimensions.

First, in terms of official stance, a shift from "strict prohibition" to "tacit approval followed by timely guidance" is likely. From the open secret of Yiwu merchants widely using USDT to AnchorX obtaining a compliance license in Central Asia, these seemingly isolated events point to subtle regulatory changes: exploration serving national strategies is shifting from strict suppression to observation and even tacit acceptance. This rumored deliberation may mark the central government’s intention to formally integrate these "gray-area explorations" into a broader, controllable top-level design.

Second, in issuance strategy, a "public front, hidden maneuver" approach may emerge. Hong Kong will serve as the visible "front route"—a publicly recognized pilot zone for limited sandbox testing. The real strategic pivot, however, lies in the "hidden route" along "Belt and Road" nations—encouraging compliant teams to obtain licenses in friendly countries, adopting a "one license, global service" model to establish compliant footholds for the RMB’s global "expansion."

Finally, the long-term goal is to build a "new cross-border digital financial infrastructure." Issuing a stablecoin is just the first step. The Chinese government’s long-standing objective remains unchanged: to create a global cross-border payment network independent of SWIFT—only now the technological foundation is shifting from traditional systems to blockchain. It is foreseeable that more public chains with official backing will emerge, deeply integrating into "Belt and Road" trade networks, connecting with central banks and commercial banking systems in partner countries, ultimately forming a regional trade settlement ecosystem centered on the RMB, multi-currency coordinated, and highly efficient.

4. Conclusion

With the issuance of a Hong Kong dollar stablecoin already on the agenda and offshore RMB stablecoins quietly undergoing pilot tests in Central Asian trade, mainland China’s renewed scrutiny of this field is both natural and increasingly urgent. Whether the Reuters report is mere speculation or an intentional leak by authorities remains unclear. But one thing is certain: discussions around RMB stablecoins have moved from behind the scenes to center stage. How policies will eventually materialize—especially the clear demarcation between "onshore" and "offshore"—will not only shape the future form of digital RMB but also serve as a crucial window into China’s strategic ambitions amid the global financial transformation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News