Why are struggling companies increasingly buying Bitcoin?

TechFlow Selected TechFlow Selected

Why are struggling companies increasingly buying Bitcoin?

Investing in companies that hold significant amounts of cryptocurrency may be more tax-efficient than holding cryptocurrency directly.

By: Nikou Asgari

Translated by: Block unicorn

Three months ago, George Karras never imagined his semiconductor company would start buying bitcoin.

His New York-listed company had long suffered from depressed stock prices. After reading news about a healthcare firm's share price surging following its purchase of digital currency, Karras became interested in bitcoin. "I was looking for ways to unlock value in the company," he said, after a failed deal scared off investors.

After consulting with the board and some investors, Karras decided to launch a bitcoin strategy. Sequans Communications raised $384 million through debt and equity markets to buy the world’s most popular cryptocurrency. Its shares surged 160% after the announcement.

"I wouldn't have said this last year, but today I fully believe... I am 100% convinced that bitcoin will be around forever," said Karras.

The crypto novice owes much to the transformation driven by bitcoin evangelist Michael Saylor. Since 2020, the American crypto tycoon has spent billions weekly on bitcoin purchases and held conferences encouraging others to follow suit. His software company, Strategy, now valued at approximately $115 billion—nearly double the value of its bitcoin holdings—has attracted a flood of investors. Last week, Strategy bought $2.5 billion worth of bitcoin, its third-largest purchase on record. Its stock has soared over 3,000% in five years.

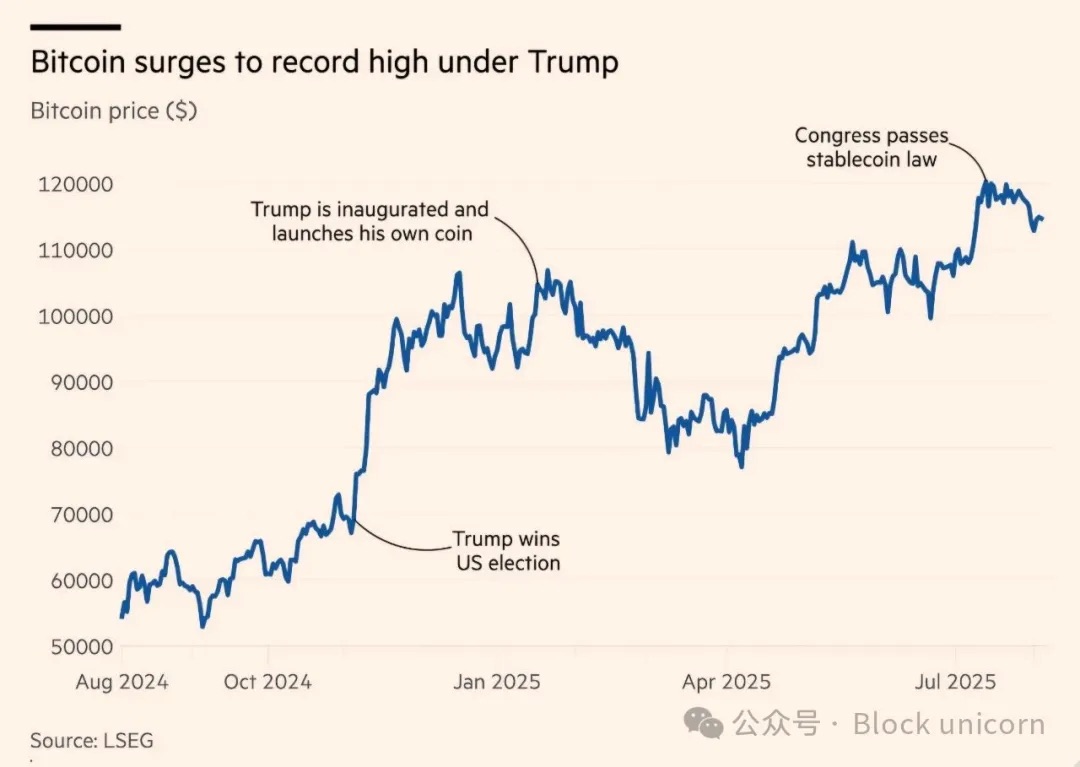

This success, combined with full-throated support from U.S. President Donald Trump for the digital asset industry, has fueled a surge in so-called "crypto treasury companies" worldwide.

Biotech firms, mining companies, hotel operators, electric vehicle makers, and e-cigarette manufacturers are rushing to buy cryptocurrencies, backed by investors seeking exposure to crypto market gains without directly holding digital assets.

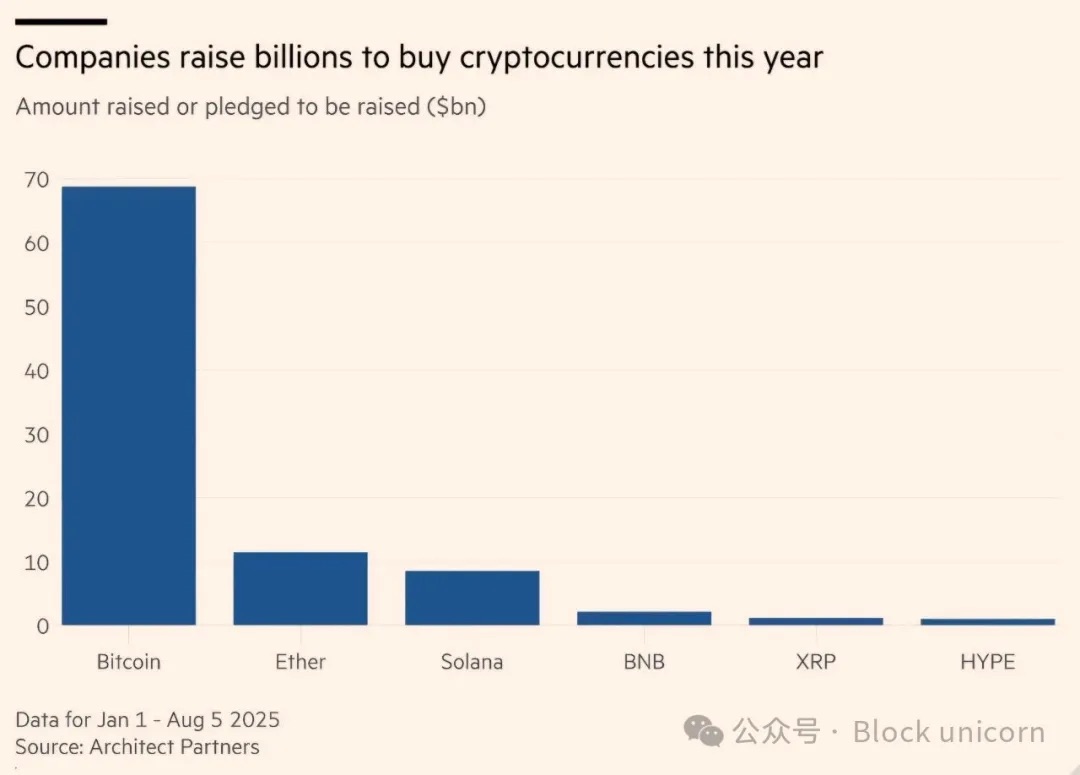

According to crypto advisory firm Architect Partners, about 154 public companies raised or committed to raise a total of $98.4 billion for cryptocurrency purchases in the year ending August 5. Prior to that, only 10 companies had raised $33.6 billion.

Some companies have followed Strategy’s lead, changing their website colors to Bitcoin orange and providing data showing how much crypto they hold, its value, and other key metrics important to investors.

Even Trump himself joined the trend—his family’s media company raised $2 billion in July to buy bitcoin and related assets.

In a year when both bitcoin and major stock indices hit record highs, traditional investment institutions are scrambling to find the best way to participate in the new digital asset world, fueling the rise of crypto accumulation.

But many doubt whether this trend can last. The rapid growth has already sparked concerns among some investors about overheating. Brian Estes, CEO of Off The Chain Capital who has invested in multiple bitcoin treasury firms, said: “This is similar to the internet bubble of 1998,” when companies rushed to reposition themselves as internet-first businesses to attract attention.

The surge in new entrants has also raised fears about a potential crypto price crash and its ripple effects. Companies that borrowed billions to buy crypto could soon find themselves unable to repay creditors.

Eric Benoist, Natixis CIB’s technology and data expert in investment banking, said: “The risk is a bitcoin crash.” In such a scenario, stock prices would fall too, and if companies cannot pay bondholders, investors will suffer losses. “This could have systemic implications for the bitcoin ecosystem,” he added. “Whenever there’s even a small market panic, the entire market drops.”

Kevin de Patoul, CEO of crypto market maker Keyrock, said investors should remain realistic. “You’re injecting massive risk into a system that ultimately rests on almost nothing except the continuous appreciation of the asset.”

For struggling companies, buying cryptocurrency appears to be a foolproof way to attract investor attention and boost stock prices—at least temporarily.

Aidan Bishop, founder of London-listed Bluebird Mining Ventures, said: “If we hadn’t taken this path, it would have been difficult to raise future funding; we were like a dying company.” The firm raised £2 million in June to buy bitcoin. Before that, “I had to go door-to-door begging for money,” he added.

Bitcoin evangelist Michael Saylor has spent billions buying bitcoin since 2020 and held conferences urging others to follow. His company Strategy’s stock has surged over 3,000% in five years. Source: Travis P Ball/Sipa/Reuters

Most newcomers are ordinary businesses with no prior crypto experience, yet their digital asset holdings far exceed their actual revenues.

For example, U.S. thermal energy firm KULR Technology has a market cap of about $211 million despite posting an operating loss of $9.4 million in the first quarter of this year. But it holds $118 million worth of bitcoin.

In the UK, web design company The Smarter Web Company made just £93,000 in net profit over six months through April, but has a market cap of about £560 million due to its £238 million in bitcoin holdings.

The premium investors are willing to pay highlights their valuation of these crypto-holding firms.

Companies that demonstrate commitment to continuously raising funds to buy more crypto are rewarded by investors, whose valuations of their stocks often exceed the value of the bitcoin they hold. To actually buy these tokens, companies typically raise capital via debt or equity issuance, then funnel the funds into crypto purchases through exchanges like Coinbase.

Speed is critical. “Ultimately, it’s about speed,” said Estes. “The goal is to increase bitcoin per share, and the companies doing this fastest get high premiums.”

For investors, “bitcoin per share”—the amount of bitcoin held per company share—is the measure of success. When companies quickly buy more tokens, equity investors indirectly gain more crypto per share—the reason early investors are willing to pay a premium, hoping to own more bitcoin per share in the future.

Most bitcoin-buying companies also operate real businesses, but a new wave of deals involves shell companies that are either buying or pledging to buy large amounts of crypto. These operate as special purpose acquisition companies (Spacs), raising capital to acquire or merge with existing firms.

Rob Halford, general partner at venture firm Dragonfly Capital, said that when a company with an actual business buys bitcoin, operational risks “are often actually higher”: “You have an existing management team whose goals may shift over time, potentially conflicting with core business priorities.”

Executives are now starting to buy other tokens as the trend expands beyond bitcoin. These tools also offer those holding large crypto amounts a way to extract value without selling.

ReserveOne, a $1 billion deal backed by investors including exchanges Kraken and Blockchain.com, plans to buy bitcoin as well as other crypto tokens Ethereum and Solana. Ether Machine raised $1.5 billion to buy Ethereum. Former Barclays CEO Bob Diamond raised $888 million through a Spac merger with a biotech firm to buy HYPE tokens. Crypto billionaire Changpeng Zhao’s venture firm led a $500 million deal helping a Canadian e-cigarette manufacturer buy BNB, the token of Binance, the exchange co-founded by Zhao.

“We are clearly witnessing an irrational gold rush,” said Halford. “It feels unnecessary to create investment vehicles for all these different tokens.”

For retail and institutional investors alike, crypto treasury companies offer an alternative route to gain token exposure without directly holding them.

Some investors achieve this through U.S. exchange-traded funds (ETFs) launched by major asset managers like BlackRock, Fidelity, and Invesco. These regulated products have amassed over $100 billion in investments.

But others cannot do so. In countries like the UK and Japan, crypto ETFs are banned as regulators try to protect investors from the volatility of digital assets. Thus, treasury companies serve as proxy instruments, offering investors indirect access to crypto through tradable securities.

“Many institutions simply can’t invest in ETFs or directly hold crypto,” said Taylor Evans, co-founder of UTXO Management. “We believe bitcoin treasury companies fill this gap by issuing securities compliant with investment mandates.” His $430 million fund allocates 95% of its investments to bitcoin treasury firms.

Investors are also exploiting tax arbitrage opportunities between holding crypto assets and stocks in certain countries. In Japan, crypto gains are taxed up to 55%, while stock gains are taxed at 20%. In Brazil, crypto gains are taxed at 17.5%, compared to 15% for stocks traded on exchanges.

U.S. President Donald Trump’s full support for the digital asset industry has spurred the global boom in “crypto treasury companies.” Source: May James/SOPA/Getty Images

Therefore, investing in companies holding large amounts of crypto may be more tax-efficient than holding crypto directly.

Eager investors are searching globally for new jurisdictions with favorable tax structures to capitalize on. “The U.S. market is already saturated… we’re looking for opportunities outside the U.S.,” said Estes.

The new alliance between crypto and capital markets is ironic, given crypto’s original mission to disrupt traditional finance and escape the scrutiny of large institutions.

Raising debt and equity from investors—core to Strategy’s model—is essential to keep the engine running. Companies that fail to buy crypto fast enough have already seen their stock prices decline.

Although Sequans Communications saw its stock jump 160% after starting bitcoin purchases, its shares have since fallen back to pre-purchase levels, reflecting investor dissatisfaction with its pace.

“You’re combining Wall Street and crypto—you need the market to sustain this harvest,” said Estes.

To scale further, many such companies are planning to move beyond merely being crypto pools listed on global stock exchanges.

Diamond said his HYPE-focused investment vehicle might acquire other crypto treasury companies. “If they get into trouble, we can buy and rebuild them,” he said. “This creates opportunities for the strongest players—to be honest, to scoop up poorly managed or underfunded firms.”

Meanwhile, Japan’s Metaplanet, the world’s fifth-largest corporate bitcoin buyer, plans to borrow against its vast token reserves and transform into a crypto financial services firm.

U.S. thermal energy firm KULR is also exploring “bitcoin-backed financial services” like lending, while Panther Metals CEO Darren Hazelwood said he plans to use the company’s bitcoin holdings to fund future exploration projects.

“The natural evolution is financial services, because you can back your financial commitments with a pile of bitcoin,” said Benoist of Natixis CIB.

Attendees pose for photos after U.S. Vice President JD Vance delivered a keynote speech at the Bitcoin Conference in Las Vegas. Companies failing to buy crypto fast enough have seen their stock prices begin to fall. Source: Ethan Miller/Getty Images

But crypto lending is a high-risk business. In 2022, the lending market collapsed amid falling prices triggering a chain of defaults, leading to the downfall of exchange FTX.

“My main concern with this strategy,” added Benoist, “is that I don’t quite see how it ends. Companies enter a cycle where they must keep buying more to sustain it, returning to the market again and again—this cycle must continue to justify the premium.”

The biggest risk is how deep the damage could run if—or when—crypto prices crash. Inevitably, a downturn in crypto markets means companies whose stock prices are tied to tokens will also fall.

Companies that borrowed heavily face even greater risks, as they must pay interest to investors and could be forced to raise more capital or sell their crypto holdings to meet debt obligations.

“If you’re borrowing to pay off existing debt, this structure is very unhealthy and makes me very uneasy,” said a crypto hedge fund manager. “You could face systemic risk, as too many fragile structures need to be unwound completely or partially, putting pressure on the market.”

He added: “I hope regulators step in, rather than everyone assuming the market will rise forever while building these treasuries.”

Investors say they are aware of the risks but eager to profit during the boom. Evans of UTXO Management, who sits on boards of several crypto treasury firms, said he is pushing CEOs “to have cash-generating operations during downturns and find ways to extract value from bitcoin beyond just raising capital.”

Yet even industry stakeholders are growing increasingly skeptical. “This will end in a bubble burst,” said Estes. “They can rise as fast as they fall.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News