The man who shorted $LIBRA and $MELANIA just made another $12 million on $YZY

TechFlow Selected TechFlow Selected

The man who shorted $LIBRA and $MELANIA just made another $12 million on $YZY

In the big casino of MEME, the habitual offender remains the same, while the wounded韭菜may have been replaced over and over again.

By David, TechFlow

Do you recognize the guy in this picture?

The crypto world has its own painful memories. Any retail investor who keeps losing money surely knows him: Hayden Davis (a.k.a. Kelsier), founder of the crypto investment firm Kelsier Ventures.

He profited massively from insider trading and liquidity manipulation in celebrity token projects, leaving retail investors with nothing. His most infamous schemes include $MELANIA, linked to Trump’s wife, and $LIBRA, tied to Argentine President Milei.

Davis personally admitted to helping design the launch strategy for $MELANIA. On-chain data shows insiders had already accumulated positions before the public launch, then dumped precisely when prices surged.

In the case of $LIBRA, launched on Valentine's Day this year, Davis wasn't just a key promoter—he claimed to be Argentine President Milei’s "blockchain and AI advisor."

The result? $LIBRA lost $4.6 billion in market cap within six hours. The team pulled 87 million USDC and SOL from the liquidity pool and made an additional $6 million through insider dumping.

According to a recent post by on-chain analytics platform Bubblemaps exposing new activity, this guy has likely struck again: making $12 million overnight from Kanye West’s (Ye) newly launched $YZY token.

This isn’t the first time Davis has pulled such a stunt.

From MELANIA to LIBRA, and now YZY—his playbook remains unchanged: early positioning, lightning execution, profit-taking.

$YZY Launch: My Funds “Just Happened” to Unfreeze

On August 20, 2025, a U.S. court unfroze $57.6 million in USDC previously tied to the $LIBRA collapse.

The funds belonged to Hayden Davis and his associates. The court cited “no evidence of flight risk, no proof of irreparable harm, and low likelihood of winning the case.”

Interestingly, BubbleMaps uncovered a curious timing:

Just one day later, on August 21, Kanye West (Ye) announced the launch of $YZY.

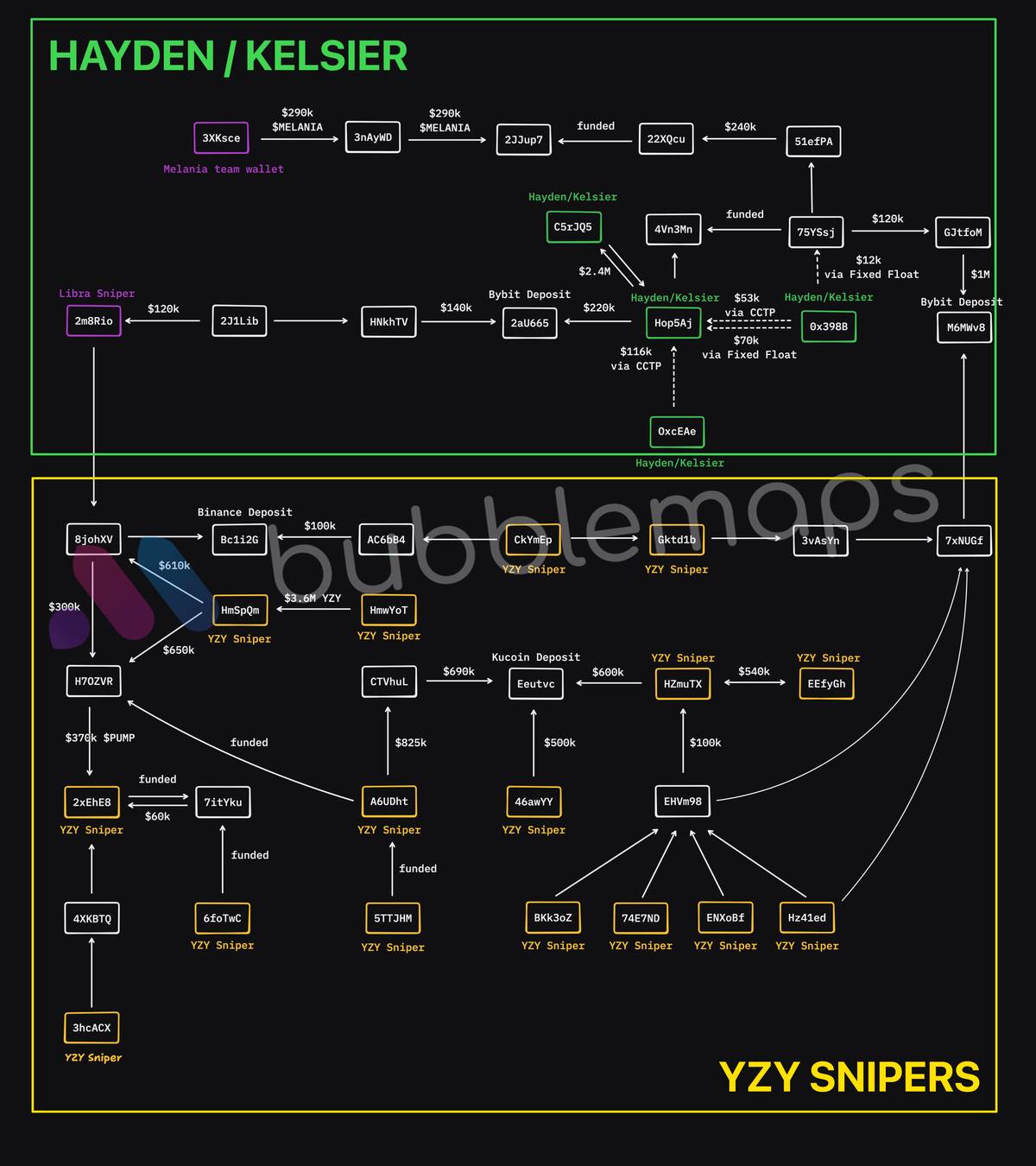

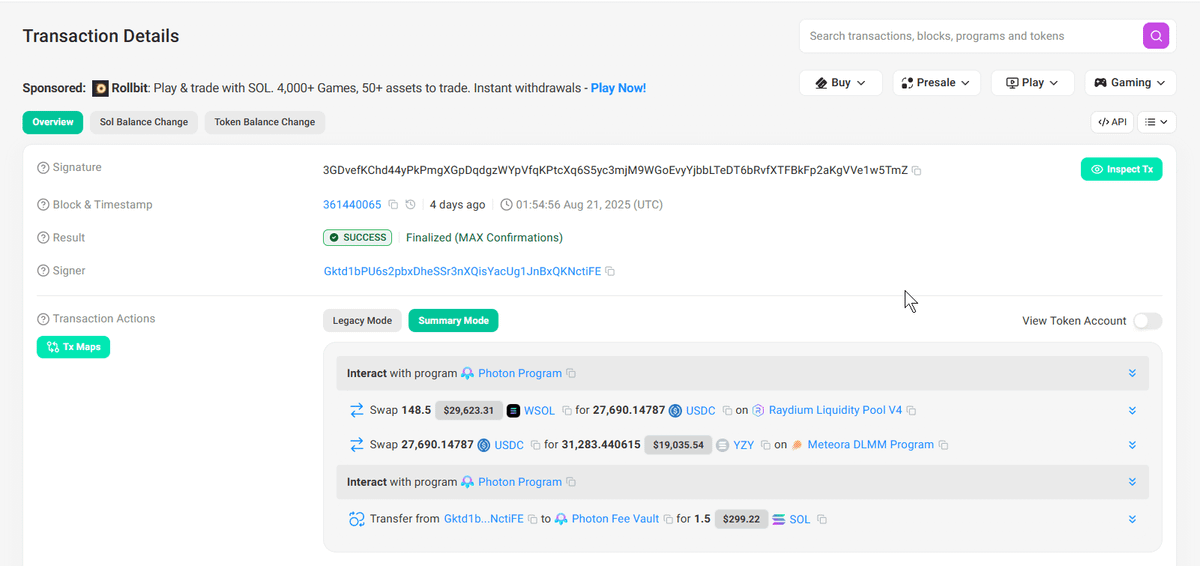

Even more coincidentally, 14 wallet addresses received funds from centralized exchanges exactly 24 hours before the launch. Through fund transfers, CCTP (Cross-Chain Transfer Protocol), and shared deposits, these wallets directly trace back to addresses previously linked to Hayden Davis.

These addresses formed a sniper cluster, fully prepared to strike at $YZY’s launch.

While we can't confirm whether Davis had insider information or direct ties to the $YZY team, these 14 sniper addresses began buying just one minute after Kanye’s announcement (at 01:54 UTC), ultimately netting $12 million in profits.

Right when $YZY launched, my funds just happened to be unfrozen; I didn’t say I was involved, but all those $YZY sniper addresses are connected to me.

The Same Old Playbook

Putting these coincidences together, it’s impossible to claim Davis had no involvement in the $YZY snipe. At the very least, the actual controllers or team behind these addresses are closely tied to this veteran celebrity-token sniper.

In the comments under Bubblemaps’ original post, some users go further, speculating that Davis didn’t just snipe $YZY—he may have been involved in its issuance, even engaging in self-theft.

This theory isn’t baseless. Davis has a well-documented history of insider trading on projects like LIBRA and MELANIA. Retail investors might forget their losses, but on-chain data remembers:

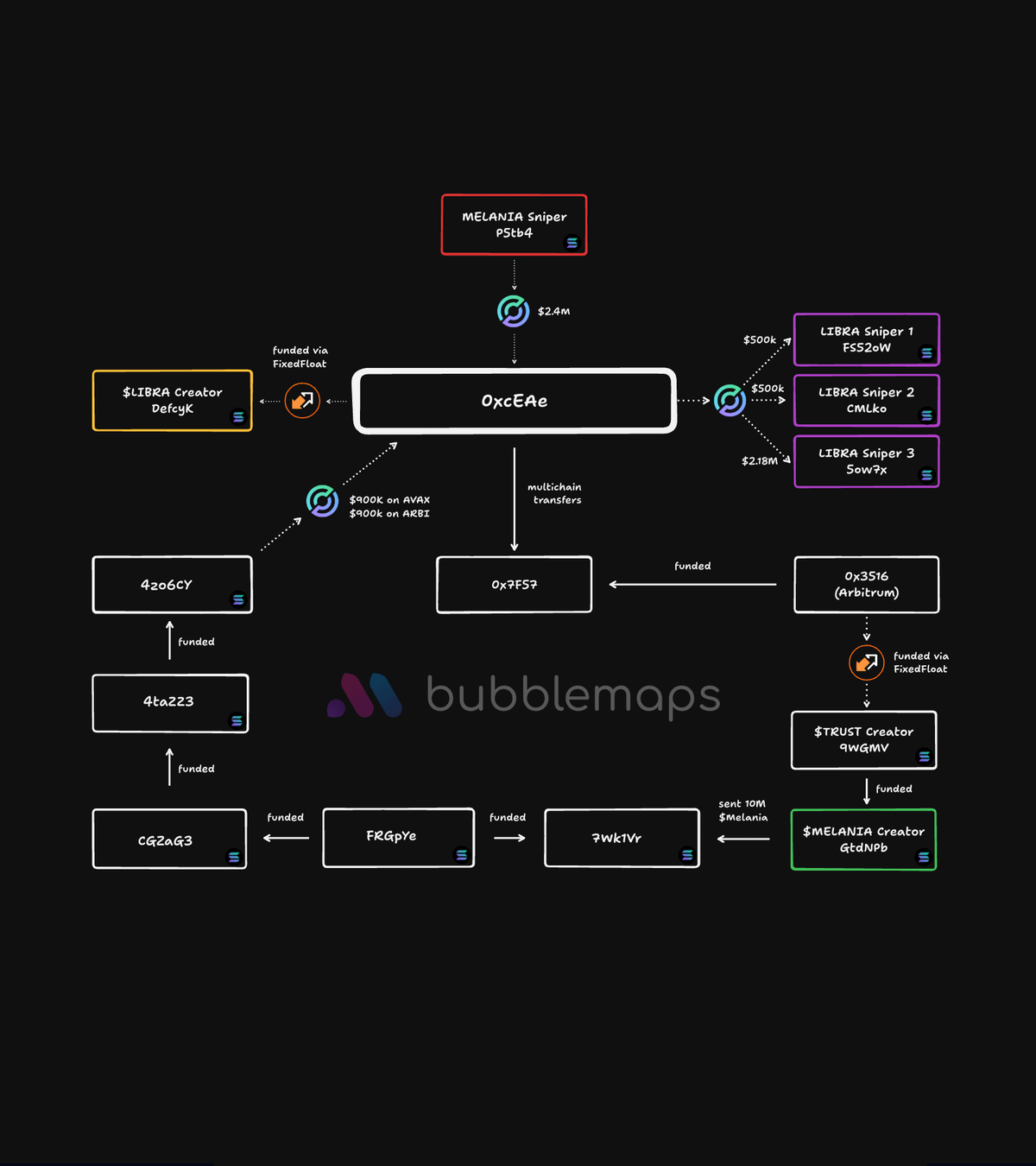

Previously, address (P5tb4) earned $2.4 million from the $MELANIA snipe and transferred funds to 0xcEA (creator of the Melania token), who then funded DEfcyK—the $LIBRA creator—and made $6 million from sniping $LIBRA.

Beyond these, this network of addresses has also participated in other pump-and-dump tokens like $TRUST, $KACY, $VIBES, and $HOOD, collectively earning over $100 million.

The on-chain trail reveals a consistent financial network operated by a repeat offender in celebrity token insider trading. Combined with Davis’s prior public admissions about his role in launches like LIBRA, it points to a systematic pattern of “crime”:

Use celebrities (like Milei’s brief endorsement of $LIBRA) to create hype, extract value, and leave behind chaos.

Earlier, in an interview with Coffeezilla, Davis openly admitted to insider trading, sniping, and market manipulation. He even stated publicly:

"It’s an insider’s game. It’s an unregulated casino."

In the meme coin casino, the repeat offender remains the same. The injured retail players? Just replaced, wave after wave.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News