The unluckiest twin brothers from The Social Network, turned coin trading into a public company

TechFlow Selected TechFlow Selected

The unluckiest twin brothers from The Social Network, turned coin trading into a public company

A past defeat was reversed by another wave of technological advancement.

By Jaleel, BlockBeats

Following Bullish's recent NYSE listing, making it the second publicly traded cryptocurrency exchange in the U.S., Gemini has finally made its move. The long-standing, compliance-focused American native exchange is now vying for position as the third such platform to go public.

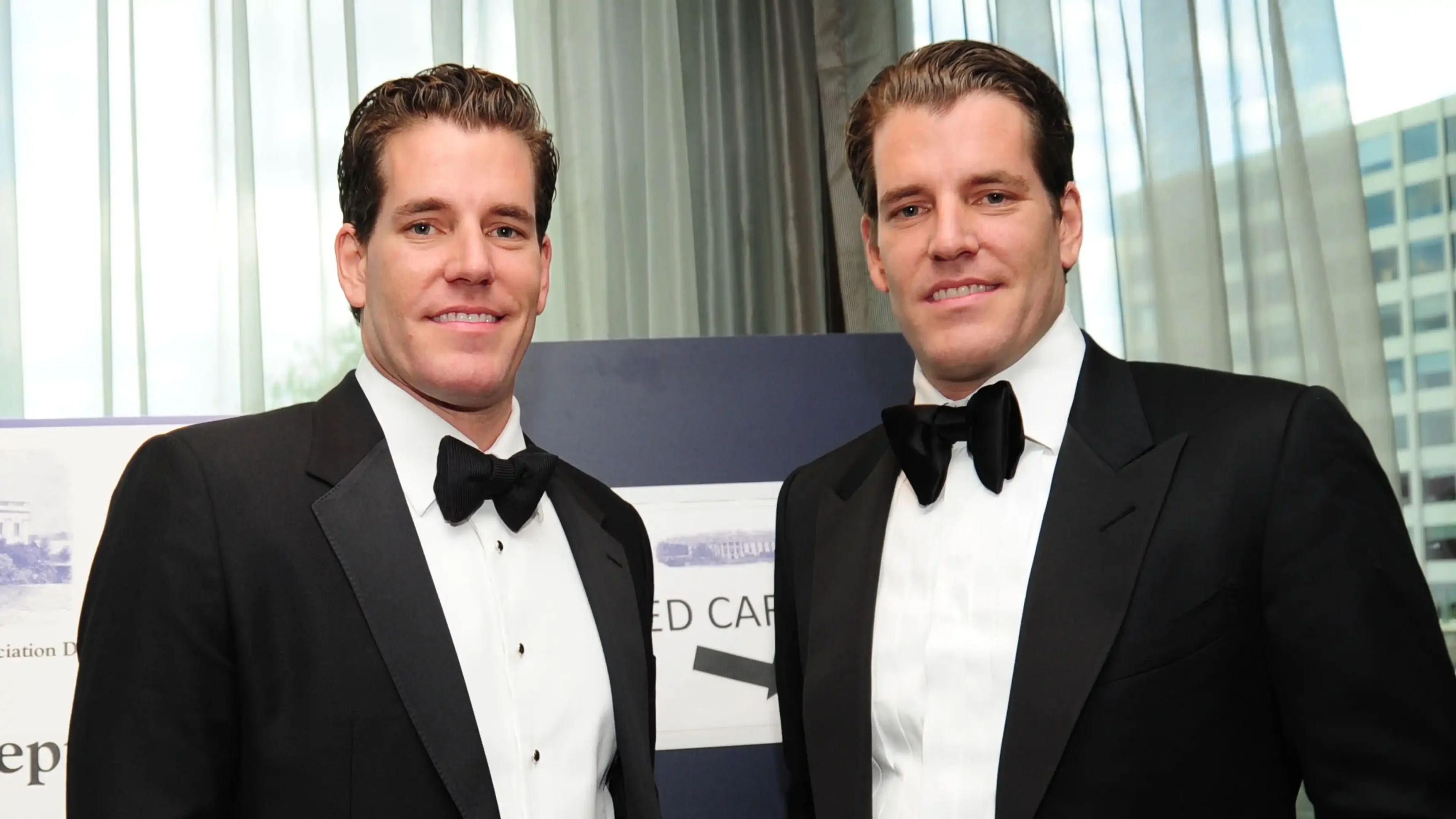

This time, the spotlight falls on a pair of twin brothers already written into American entrepreneurial history—Tyler and Cameron Winklevoss. Over a decade ago, they rose to global fame through a lawsuit against Mark Zuckerberg; a decade later, they’ve become among the earliest major investors to bet big on Bitcoin amid the crypto wave.

Today, Gemini’s IPO isn’t just symbolic of further “compliance” within the CEX space—it’s also a moment of redemption for the twins in a new round of America’s capital markets. They may have lost the social network battle, but gained in the crypto revolution.

Image source: Bloomberg

IPO Season: Gemini’s Public Market Push

According to the latest news, Gemini officially filed a registration statement (Form S-1) with the U.S. Securities and Exchange Commission (SEC) on August 15, 2025, aiming to list on the Nasdaq Global Select Market under the ticker symbol GEMI. Prior to this public filing, Gemini had submitted a confidential IPO application in February 2025.

The documents show that Gemini will pursue a traditional IPO, with Goldman Sachs and Citigroup serving as lead underwriters, joined by Morgan Stanley, Cantor Fitzgerald, and other institutions in the underwriting syndicate. However, the offering price range and exact number of shares have not yet been disclosed. SEC approval is still pending, and the listing date remains unconfirmed.

Renaissance Capital estimates Gemini’s IPO could raise approximately $400 million. Additionally, the company has secured a $75 million credit facility from Ripple, intended to enhance liquidity via the RLUSD stablecoin, though it has not yet been drawn upon.

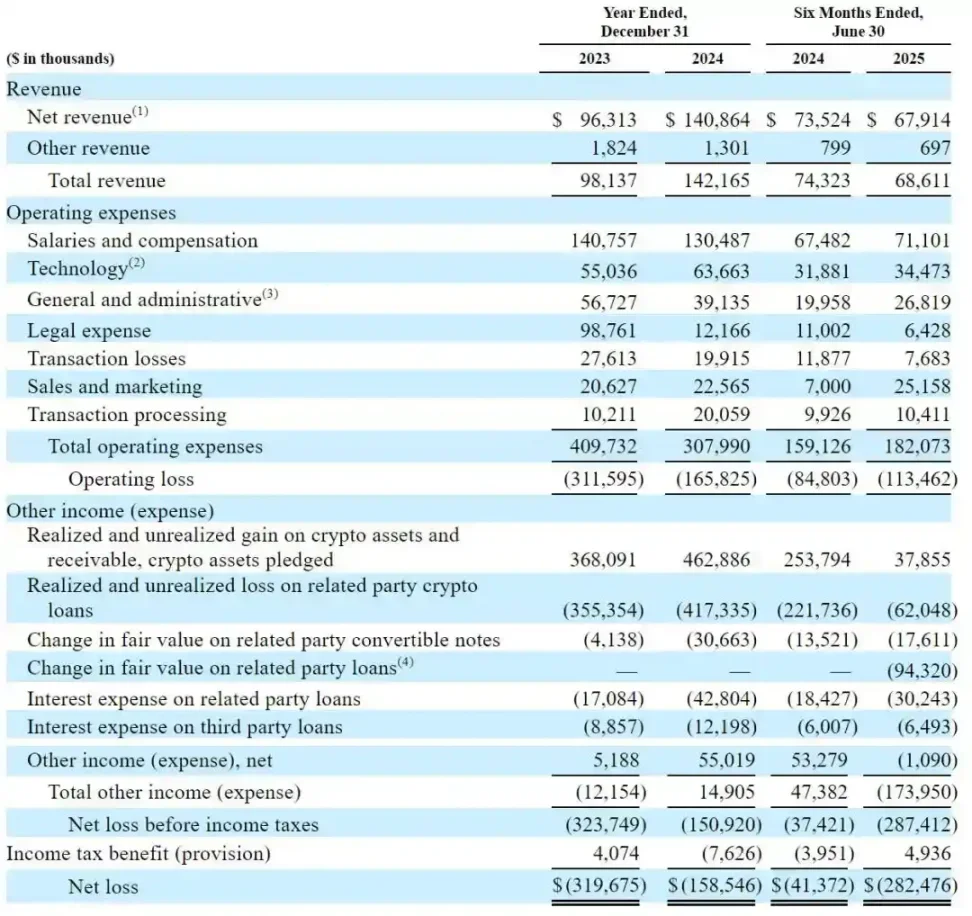

Notably, Gemini is currently undergoing financial strain. According to the S-1 filing, for the six months ended June 2025, the company reported revenue of $68.6 million but suffered a net loss of $282.5 million—far exceeding last year’s $41.4 million loss. Trading fees remain the primary revenue source, accounting for about 66% of total revenue in the first half of 2025. Gemini also offers custody, staking, and stablecoin issuance services through GUSD.

This IPO takes place amid a broader recovery in the U.S. IPO market, particularly for digital asset firms. Circle (a stablecoin issuer) and Bullish (a crypto exchange) went public several months ago and last week respectively, while Coinbase has been added to the S&P 500 index, significantly boosting market confidence in regulated exchanges.

Wall Street’s Most Synchronized Twins

Yet beyond Gemini itself, the founders’ story might be even more compelling.

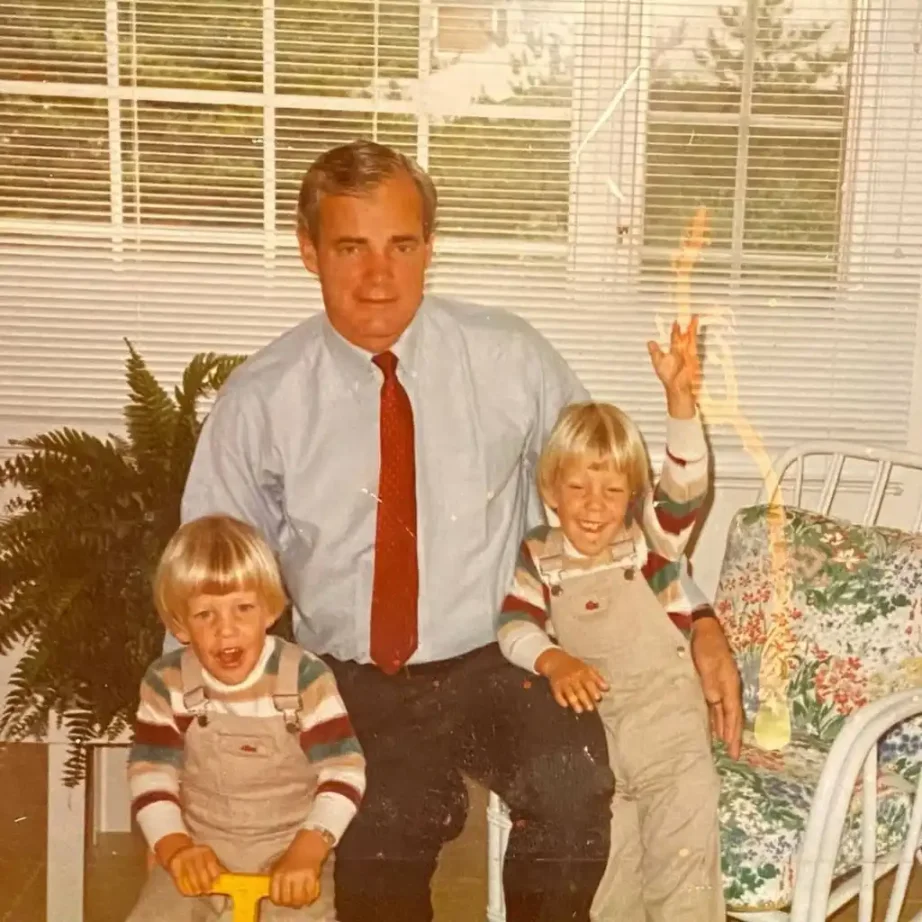

In the summer of 1981, Tyler and Cameron Winklevoss were born into a family rich in both academic prestige and wealth. Their father, Howard, was an actuarial science professor at the University of Pennsylvania’s Wharton School and also an investor. The brothers grew up in Greenwich, Connecticut—a quiet, affluent town where manicured lawns and yacht marinas are part of everyday life.

The Winklevoss brothers with their father

The teenage Winklevoss twins were nearly a "perfect" prototype: academically gifted, physically striking, and endlessly energetic. They taught themselves programming, tinkering with websites by age thirteen or fourteen, and played guitar and drums in a band. Their mother often said they were mirror images from birth—the same blue eyes, high cheekbones, and even cries that seemed rhythmically synchronized.

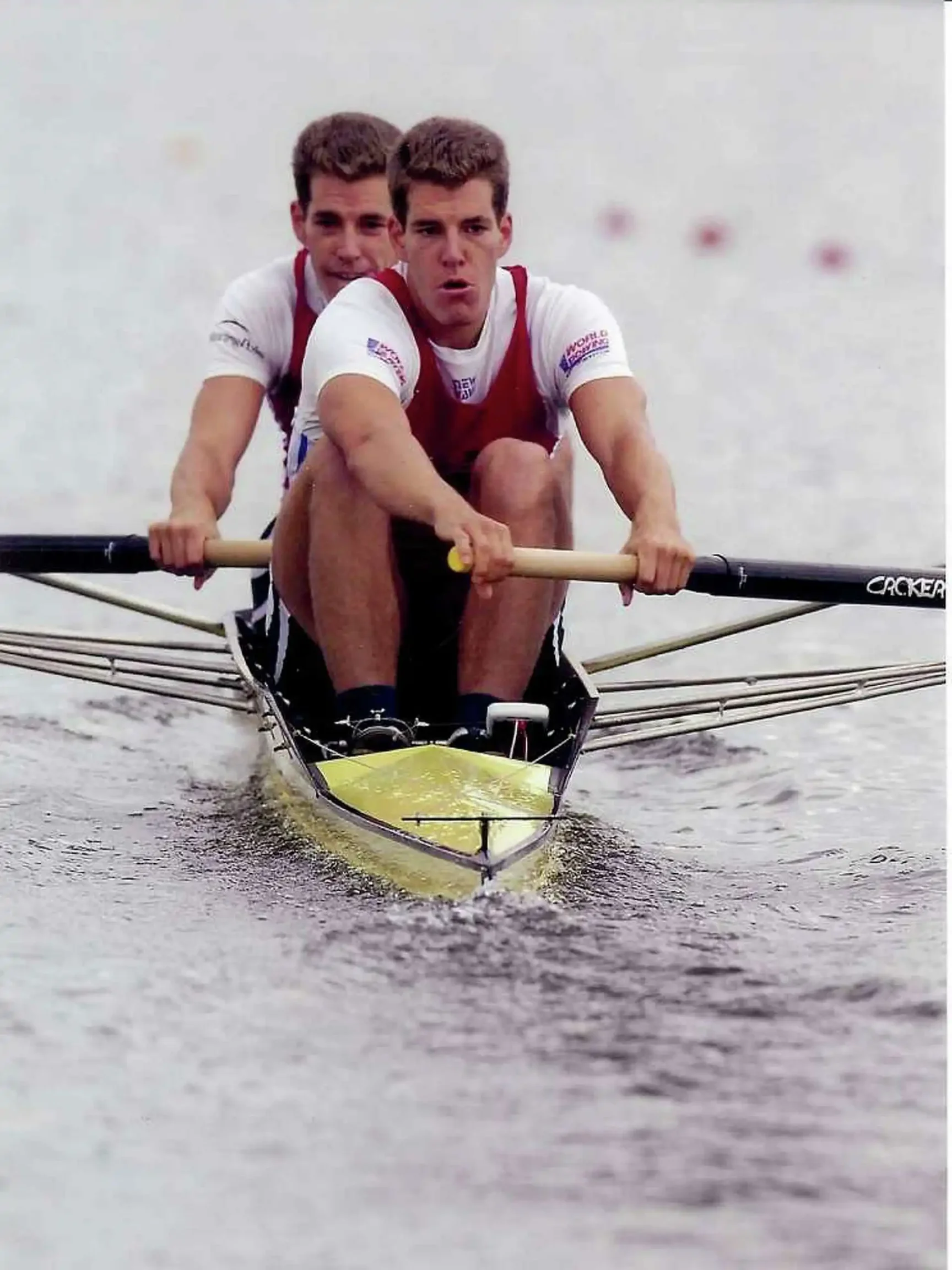

Their youth unfolded in near-perfect parallel: undergraduate studies in economics at Harvard, graduate studies at Oxford, and a rowing career etched into sports history. At Harvard, they were core members of the varsity crew team, earning the nickname "God Squad" from teammates due to their perfectly synchronized strokes.

The Winklevoss brothers rowing

In 2008, they represented the United States at the Beijing Olympics in the men’s coxless pair, finishing sixth. Though they missed the podium, years of synchronized breathing, muscle coordination, and unified willpower laid the foundation for their future collaborative approach to entrepreneurship.

The Feud with Zuckerberg

During their junior year at Harvard, they launched a campus social networking site called HarvardConnection. It was a concept they’d long nurtured: what if Harvard students’ profiles, photos, and social connections could all be brought together online? It might create an entirely new kind of social experience.

This idea later became entangled with Mark Zuckerberg.

The brothers were rowing stars—experts at driving oars into water—but equally passionate about technology. However, they weren’t top-tier coders, so they enlisted classmate Divya Narendra to help develop the site. During this process, they brought in a sophomore to assist with coding—his name was Mark Zuckerberg.

The story unfolded more dramatically than fiction. Initially, the brothers placed great trust in Zuckerberg, believing he could deliver the site’s core functionality. But weeks passed with dwindling updates and stalled progress. He offered constant excuses: heavy coursework, system bugs, need for more time. Then one day, the brothers discovered Zuckerberg had quietly launched a website called TheFacebook. Its interface bore striking resemblance to their envisioned HarvardConnection—only the name and domain were different.

Outrage quickly led to litigation. In 2004, the brothers and Narendra sued Zuckerberg, accusing him of stealing their concept and source code. The legal battle dragged on, during which Zuckerberg’s Facebook exploded in growth, becoming one of Silicon Valley’s hottest startups.

This saga was later dramatized in the Hollywood film *The Social Network*.

In 2008, the dispute concluded with a $65 million settlement, including a substantial amount of Facebook stock. At the time, they were seen as the ones who "lost Facebook." Yet fate enjoys irony: a few years later, that very sum became their ticket into the world of cryptocurrency.

In 2012, they first encountered Bitcoin. Few then truly understood the technology, but the twins sensed its potential. A portion of their settlement proceeds was used to purchase Bitcoin, accumulating around 70,000 BTC at one point—roughly 1% of the total supply. What seemed like a modest bet back then has since grown into a multi-billion-dollar legend.

Some joke that without the Facebook dispute, there might never have been a Gemini.

In 2014, Gemini was born. Determined not to repeat their "missed Facebook" mistake, the brothers resolved to seize control in this new technological wave. Unlike exchanges then growing wildly in gray zones, Gemini embraced regulation from day one—applying for a trust charter from the New York State Department of Financial Services (NYDFS), strictly adhering to Wall Street compliance standards. They even introduced a daily Bitcoin auction mechanism, mimicking Nasdaq-style trading rules, aiming to reassure institutional investors.

Internal roles gradually took shape. Tyler leaned toward internal operations and strategy, excelling in management and meticulous execution; Cameron became the public face, comfortable in media appearances and storytelling. One inward, one outward—their roles distinct, their synergy almost instinctive.

Compared to Binance or OKX, Gemini lacks explosive, storm-like expansion; compared to Coinbase, it lacks Silicon Valley’s engineer-driven romanticism. Their identity remains firmly “compliance-first”—regularly appearing in suits at congressional hearings and media interviews, advocating for institutionalization and legal frameworks in crypto.

Today, according to Bloomberg estimates, each brother holds over 5% of Gemini, with individual net worth reaching $7.5 billion—$15 billion combined. Their names are no longer defined solely by their feud with Zuckerberg, but deeply tied to Bitcoin’s rise and the emergence of regulated crypto exchanges.

A past defeat, reversed by a new wave of technology.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News