After reviewing outlooks for 2026 from 8 top investment banks, Gemini provides these summaries

TechFlow Selected TechFlow Selected

After reviewing outlooks for 2026 from 8 top investment banks, Gemini provides these summaries

The timing of U.S. fiscal stimulus will determine the pace in the first half of 2026.

Author: szj capital

Translation: TechFlow

It's year-end again, and major institutions are rolling out their market outlooks for the coming year.

Recently, overseas netizens compiled annual outlook reports from eight top investment banks including Goldman Sachs, BlackRock, Barclays, and HSBC, and had Gemini Pro3 conduct a comprehensive interpretation and analysis.

Below is the full translation, helping you save time and grasp key economic trends for next year at a glance.

Executive Summary: Navigating the "K-Shaped" New World Order

2026 is set to become a period of profound structural transformation, characterized not by a single synchronized global cycle but by a complex matrix of diverse economic realities, policy divergence, and thematic disruption. This comprehensive research report aggregates forward-looking strategies and economic forecasts from leading global financial institutions, including J.P. Morgan Asset Management, BlackRock, HSBC Global Private Banking, Barclays Private Bank, BNP Paribas Asset Management, Invesco, T. Rowe Price, and Allianz.

These institutions collectively depict a global economy that is “bent but not broken”: the era of “easy money” over the past decade has been replaced by a new paradigm defined by “higher for longer” interest rates, fiscal dominance, and technological disruption. The core theme for 2026, dubbed “The Interpretation Game” by Barclays Private Bank, refers to an environment where economic data is contradictory and narratives shift rapidly—requiring market participants to actively interpret conflicting signals rather than rely on passive investing.

One of the defining pillars of 2026 is the stark divergence between the United States and other nations. J.P. Morgan and T. Rowe Price believe the U.S. economy, driven by artificial intelligence (AI) capital expenditure and fiscal stimulus known as the “One Big Beautiful Bill Act” (OBBBA), will generate unique growth momentum. This stimulus is expected to deliver a growth “shot in the arm” of over 3% early in 2026 before gradually fading; meanwhile, Allianz and BNP Paribas anticipate a “beauty in mediocrity” recovery pattern across the eurozone.

However, beneath the surface-level growth figures lies a more turbulent reality. Allianz warns that global corporate bankruptcy rates will reach “record highs,” rising by 5% in 2026—a delayed impact of high interest rates finally hitting “zombie companies.” This scenario sketches a “K-shaped” expansion: large-cap tech and infrastructure sectors thrive due to the “AI Mega Force” (a concept from BlackRock), while leveraged small businesses face existential threats.

Consensus on asset allocation is undergoing a dramatic shift. The traditional 60/40 portfolio (60% equities, 40% bonds) is being redefined. BlackRock proposes the idea of a “New Continuum,” arguing that the boundary between public and private markets is dissolving, requiring investors to permanently allocate to private credit and infrastructure assets. Invesco and HSBC recommend fixed-income investments return to “quality,” favoring investment-grade bonds and emerging market debt while shunning high-yield bonds.

This report analyzes each institution’s investment themes, covering “Physical AI” trades, the “Electrotech Economy,” the rise of protectionism and tariffs, and strategic priorities for investors navigating this fragmented world.

Part One: Macroeconomic Landscape — A World of Divergent Growth

In the post-pandemic era, the long-anticipated synchronized global recovery has failed to materialize. 2026 presents a landscape defined by distinct growth drivers and policy divergence, with major economies advancing at different speeds due to their own fiscal, political, and structural forces.

1.1 United States: The Global Economy’s “North Star” and OBBBA Stimulus

The United States remains the undisputed engine of the global economy, but its growth dynamics are shifting. No longer relying solely on organic consumer demand, growth is increasingly dependent on government fiscal policy and corporate capital spending on artificial intelligence.

The “One Big Beautiful Bill” (OBBBA) Phenomenon

A key finding highlighted by J.P. Morgan Asset Management and T. Rowe Price in their 2026 outlook is the anticipated impact of the “One Big Beautiful Bill” (OBBBA). This legislative framework is seen as the defining fiscal event of 2026.

-

Mechanics: J.P. Morgan notes that OBBBA is a broad legislative package extending key provisions of the 2017 Tax Cuts and Jobs Act (TCJA), while introducing new spending items. It includes approximately $170 billion for border security (enforcement, deportations) and $150 billion for defense (such as the “Iron Dome” missile defense system and shipbuilding). Additionally, the bill raises the debt ceiling by $5 trillion, signaling continued fiscal loosening.

-

Economic Impact: T. Rowe Price believes this bill, combined with AI-related spending, will help pull the U.S. economy out of late-2025 growth fears. J.P. Morgan forecasts OBBBA will drive real GDP growth to around 1% in Q4 2025 and accelerate to over 3% in the first half of 2026, as tax rebates and expenditures flow directly into the economy. However, this growth is viewed as temporary—a reversal of a “fiscal cliff”—with growth expected to revert to a 1–2% trend line in the second half as stimulus effects fade.

-

Tax Implications: The bill is expected to permanently extend the 37% top individual income tax rate and restore 100% bonus depreciation and R&D expense deductibility for corporations. Morgan Stanley points out this represents a massive supply-side incentive, potentially reducing effective corporate tax rates in certain industries to as low as 12%, fueling a “capex supercycle” in manufacturing and technology.

The Labor Market Paradox: “Economic Drift”

Despite fiscal stimulus, the U.S. economy faces a major structural headwind: labor supply. J.P. Morgan describes this environment as “economic drift,” noting that a sharp decline in net migration is expected to lead to an absolute reduction in the working-age population.

-

Impact on Growth: This supply constraint implies only about 50,000 new jobs per month in 2026. This is not a failure of demand but a supply-side bottleneck.

-

Ceiling on Unemployment: As a result, unemployment is expected to remain low, peaking at 4.5%. This “full employment” dynamic, while preventing deep recessions, imposes a hard ceiling on potential GDP growth, reinforcing the sense of economic “drift”—a feeling of stagnation despite positive headline data.

1.2 Eurozone: The Beauty in Mediocrity

In contrast to the volatile, fiscally dramatic narrative in the U.S., the eurozone is emerging as a symbol of stability. Allianz and BNP Paribas believe Europe may exceed expectations and perform strongly in 2026.

Germany’s “Fiscal Reset”

BNP Paribas highlights that Germany is undergoing a critical structural shift. Moving away from its traditional “Black Zero” fiscal austerity, Germany is expected to significantly increase spending on infrastructure and defense. This fiscal expansion is projected to have a multiplier effect across the eurozone, boosting economic activity in 2026.

Consumer Support Policies

In addition, BNP Paribas mentions policies such as the permanent reduction of VAT in the restaurant sector and energy subsidies, which will support consumer spending and prevent a collapse in demand.

Growth Forecast

Allianz expects eurozone GDP growth in 2026 to range between 1.2% and 1.5%. While modest compared to the U.S.’s OBBBA-driven surge, this represents a solid and sustainable recovery from the stagnation of 2023–2025. Barclays shares this view, suggesting the eurozone could “deliver positive surprises.”

1.3 Asia and Emerging Markets: “Extended Runway” and Structural Slowdown

Asia’s outlook shows clear polarization: a maturing, slowing China versus a dynamic, accelerating India and ASEAN region.

China: Orderly Deceleration

Major institutions broadly agree that China’s era of high-speed growth has ended.

-

Structural Headwinds: BNP Paribas predicts China’s growth rate will slow to below 4% by the end of 2027. T. Rowe Price adds that although stimulus measures will be implemented, they are unlikely to deliver “substantial uplift” due to deep-rooted issues in real estate and demographics.

-

Targeted Stimulus: Rather than blanket “full-throttle” stimulus, Chinese authorities are expected to focus support on “advanced manufacturing” and strategic sectors. This shift aims to move the economy up the value chain but at the expense of short-term consumption growth. Barclays forecasts China’s consumption growth at just 2.2% in 2026.

India and ASEAN: Growth Engines

In contrast, HSBC and S&P Global see South and Southeast Asia becoming the new global growth champions.

-

India’s Growth Trajectory: HSBC projects India’s GDP growth at 6.3% in 2026, making it one of the fastest-growing major economies. However, HSBC issues a tactical warning: despite strong macro performance, near-term corporate earnings momentum is relatively weak, creating a potential disconnect with high valuations that may affect equity investors.

-

AI Supply Chain: Both J.P. Morgan and HSBC emphasize the significant boost from the “AI theme” to Asian emerging markets, particularly Taiwan and Korea (in semiconductors) and ASEAN countries (in data center assembly and component manufacturing). The “extension” of AI trade is a key driver for the region.

1.4 Global Trade: The “Tax Effect” of Tariffs

A looming shadow in the 2026 outlook is the resurgence of protectionism. HSBC explicitly downgraded its global growth forecast from 2.5% to 2.3%, primarily due to U.S.-initiated “multi-purpose tariffs.”

Stagnant Trade Growth

HSBC forecasts global trade growth of just 0.6% in 2026. This near-stagnation reflects a world where supply chains are shortening (“nearshoring”) and reconfiguring to avoid tariff barriers.

Inflationary Pressures

T. Rowe Price warns these tariffs will act like a consumption tax, causing U.S. inflation to remain “persistently above target.”

Part Two: The Puzzle of Inflation and Interest Rates

The “Great Moderation” era of the pre-2020s has given way to a new normal of volatility. Stubborn inflation in the U.S. coexists with deflationary pressures in Europe, driving a “Great Decoupling” in central bank policies.

2.1 Inflation Divergence

-

U.S.: Persistent and Structural

T. Rowe Price and BNP Paribas believe U.S. inflation will remain elevated due to the combined effects of OBBBA fiscal stimulus and tariffs. J.P. Morgan offers a more nuanced analysis: inflation is expected to peak near 4% in the first half of 2026 due to tariffs but will fall back to 2% by year-end as the economy absorbs the shock.

-

Europe: Deflationary Surprise

In contrast, BNP Paribas notes Europe will face deflationary pressure, partly due to a renewed influx of “cheap Chinese exports” into European markets. This could push inflation below the European Central Bank’s (ECB) target, sharply contrasting with U.S. inflation trends.

2.2 Central Bank Policy Decoupling

Divergent inflation dynamics directly lead to monetary policy divergence, creating opportunities for macro investors.

-

Fed (“Slow” Path)

The Federal Reserve is expected to remain constrained. J.P. Morgan believes the Fed may cut rates only two to three times in 2026. T. Rowe Price takes a more hawkish stance, warning that if OBBBA causes overheating, the Fed might not cut rates at all in the first half of 2026.

-

European Central Bank (“Dovish” Path)

Facing weak growth prospects and deflationary pressure, the ECB is expected to cut rates aggressively. Allianz and BNP Paribas forecast ECB rates falling to 1.5%–2.0%, significantly lower than current market expectations.

-

FX Market Implications

This widening interest rate gap (high U.S. rates, falling eurozone rates) suggests structural dollar strength against the euro—contradicting the usual consensus that the dollar weakens as the economic cycle matures. However, Invesco holds the opposite view, betting on dollar weakness to support emerging market assets.

Part Three: Thematic Deep Dive — “Mega Forces” and Structural Change

Investment strategy in 2026 is no longer centered on traditional business cycles but revolves around structural “mega forces” (a concept introduced by BlackRock) that transcend quarterly GDP data.

3.1 Artificial Intelligence: From “Hype” to “Physical Reality”

The AI narrative is shifting from software (e.g., large language models) to hardware and infrastructure (“Physical AI”).

-

“Capex Supercycle”: J.P. Morgan notes data center investment already accounts for 1.2%–1.3% of U.S. GDP and continues to rise. This is not a fleeting trend but a substantial expansion in steel, concrete, and silicon-based technologies.

-

“Electrotech Economy”: Barclays introduces the concept of the “Electrotech Economy.” AI’s energy demands are insatiable. Investing in power grids, renewable energy generation, and utilities is seen as the safest way to participate in the AI wave. HSBC agrees, recommending portfolio shifts toward utilities and industrials—sectors that will “power” this revolution.

-

Contrarian View (HSBC’s Warning): Contrary to market optimism, HSBC expresses deep skepticism about the financial viability of current AI model leaders. Internal analysis suggests companies like OpenAI could face up to $1.8 trillion in compute leasing costs by 2030, resulting in massive funding gaps. HSBC argues that while AI is real, the profitability of model creators is questionable—reinforcing its advice to invest in “tools and equipment” (e.g., chipmakers, utilities) rather than model developers.

3.2 Private Markets’ “New Continuum”

BlackRock’s 2026 outlook centers on the evolution of private markets. They argue the traditional binary split between “public markets” (liquid) and “private markets” (illiquid) is obsolete.

-

Rise of the Continuum: Through evergreen structures, European Long-Term Investment Funds (ELTIFs), and secondary markets, private assets are becoming semi-liquid. This democratization allows more investors access to the “liquidity premium.”

-

Private Credit 2.0: BlackRock sees private credit evolving from traditional leveraged buyout financing to “Asset-Based Financing” (ABF). This model uses real assets (e.g., data centers, fiber networks, logistics hubs) as collateral, not just corporate cash flows. They see this as offering “profound incremental opportunities” in 2026.

3.3 Demographics and Labor Shortages

J.P. Morgan and BlackRock view demographics as a slow but unstoppable force.

-

Migration Cliff: J.P. Morgan predicts declining net migration in the U.S. will become a key growth constraint. Labor will remain scarce and expensive—not only supporting wage inflation but also further incentivizing corporate investment in automation and AI to replace human workers.

Part Four: Asset Allocation Strategy — “60/40+” and the Return of Alpha

Multiple institutions agree that 2026 will not suit the passive “buy-the-market” strategies popular in the 2010s. Investors must instead rely on active management, diversification into alternative assets, and a focus on “quality.”

4.1 Portfolio Construction: The “60/40+” Model

J.P. Morgan and BlackRock explicitly call for reform of the traditional 60% stocks / 40% bonds portfolio.

-

The “+” Component: Both advocate a “60/40+” model, allocating roughly 20% of portfolios to alternative assets (private equity, private credit, real assets). This aims to provide returns uncorrelated with traditional assets and reduce overall portfolio volatility amid rising stock-bond correlations.

4.2 Equity Markets: Quality and Rotation

-

U.S. Equities: BlackRock and HSBC overweight U.S. stocks, driven by AI themes and economic resilience. However, HSBC recently reduced its U.S. equity allocation due to stretched valuations. They suggest rotating from “mega-cap tech” to broader beneficiaries (e.g., financials and industrials).

-

International Value: J.P. Morgan sees strong opportunities in European and Japanese value stocks. These markets are undergoing a “corporate governance revolution” (including increased buybacks and dividends) and trade at historic valuation discounts relative to the U.S.

-

Emerging Markets: Invesco is most bullish on emerging markets. They bet on dollar weakness (contrary to other institutions) to unlock EM asset value.

4.3 Fixed Income: The Revival of Yield

The role of bonds is changing—no longer reliant on capital appreciation (betting on rate cuts)—but returning to their core function of generating “yield.”

-

Credit Quality: Given Allianz’s warnings on rising corporate bankruptcies, HSBC and Invesco strongly prefer investment-grade (IG) bonds over high-yield (HY) bonds. The risk premium in HY is deemed insufficient to compensate for the upcoming default cycle.

-

Duration Positioning: Invesco is overweight duration (especially UK gilts), expecting faster-than-expected rate cuts by central banks. J.P. Morgan advises staying “flexible,” trading within ranges rather than making large directional bets.

-

CLOs (Collateralized Loan Obligations): Invesco explicitly includes AAA-rated CLOs in its model portfolio, citing their enhanced yield and structural safety over cash holdings.

4.4 Alternatives and Hedging Tools

-

Infrastructure: Infrastructure investment is the most confident “real asset” play. BlackRock calls it a “generation-spanning opportunity,” offering inflation protection and direct exposure to the AI capex wave.

-

Gold: HSBC and Invesco view gold as a key portfolio hedge. Amid geopolitical fragmentation and potential inflation volatility, gold serves as essential “tail risk” insurance.

Part Five: Risk Assessment — The Shadow of Bankruptcy

While the U.S. macro outlook appears strong due to fiscal stimulus, credit data reveals a darker picture. Allianz provides a sobering counterpoint to market optimism.

5.1 Bankruptcy Wave

Allianz forecasts global corporate bankruptcy rates will rise 6% in 2025 and another 5% in 2026.

-

“Lagged Trauma”: This rise stems from the delayed impact of high interest rates. Firms that locked in low rates during 2020–2021 will face a “maturity wall” in 2026, forced to refinance at significantly higher costs.

-

“Tech Bubble Burst” Scenario: Allianz explicitly models a downside case where the “AI bubble” bursts. In this scenario, the U.S. could see 4,500 additional bankruptcies, Germany 4,000, and France 1,000.

5.2 Vulnerable Sectors

The report identifies several sectors particularly exposed to shocks:

-

Construction: Highly sensitive to interest and labor costs.

-

Retail/Discretionary Consumption: Squeezed by “K-shaped” consumption trends, with low-income consumers cutting spending sharply.

-

Automotive: Facing multiple pressures from high capital costs, supply chain restructuring, and tariff wars.

This risk assessment further supports the “quality-first” bias in asset allocation. The report warns investors to avoid “zombie” companies that survive only due to cheap funding.

Part Six: Comparative Analysis of Institutional Views

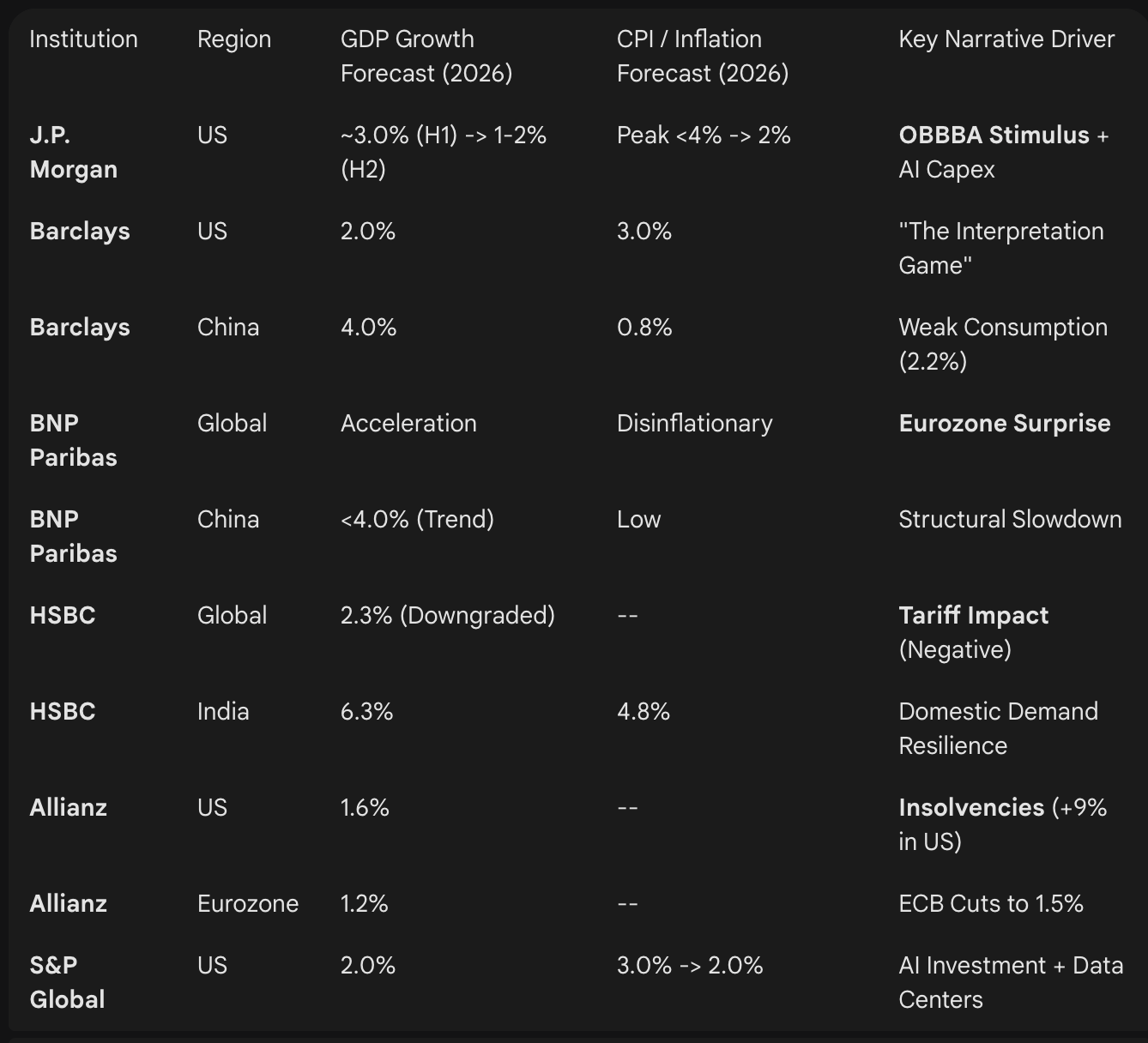

The table below synthesizes specific 2026 GDP and inflation forecasts from institutional reports, highlighting areas of divergence.

Conclusion: Strategic Imperatives for 2026

The 2026 investment landscape is defined by the tension between two forces: fiscal and technological optimism (U.S. OBBBA, AI) versus credit and structural pessimism (bankruptcy waves, demographic challenges).

For professional investors, the path forward requires moving beyond broad index investing. The “K-shaped” nature of the economy—data centers booming while construction firms go bankrupt—demands active sector selection.

Key Strategic Takeaways:

-

Track the Pulse of “OBBBA”: The timing of U.S. fiscal stimulus will dictate the pace of the first half of 2026. Developing tactical strategies around the “stimulus effect” in U.S. assets during Q1–Q2 and a potential slowdown in H2 is prudent (J.P. Morgan).

-

Invest in AI’s “Tools and Equipment”: Avoid valuation risks in pure AI model plays (per HSBC’s warning); instead, focus on physical infrastructure such as utilities, power grids, and data center REITs (Barclays, BlackRock).

-

Diversify via Private Markets: Leverage the “New Continuum” to access private credit and infrastructure, ensuring these assets are “asset-backed” to withstand the bankruptcy wave (BlackRock, Allianz).

-

Hedge the “Interpretation Game”: In a fast-changing narrative environment, maintain structural hedges like gold and employ a “barbell strategy” (growth stocks + high-quality income assets) to manage volatility (HSBC, Invesco).

2026 will not be a year for passive investing—it will belong to those who can skillfully interpret market signals.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News