Gemini IPO Approaches, Founder Brothers Reportedly Stockpiled 120,000 Bitcoins at $10 Each

TechFlow Selected TechFlow Selected

Gemini IPO Approaches, Founder Brothers Reportedly Stockpiled 120,000 Bitcoins at $10 Each

If this listing is successful, Gemini will become the third cryptocurrency exchange to enter the U.S. stock market, following Coinbase and Bullish.

Compilation | Prospectus Zhenxing Capital Financial News

Editor | Echo

*This article is for informational purposes only and does not constitute any investment advice

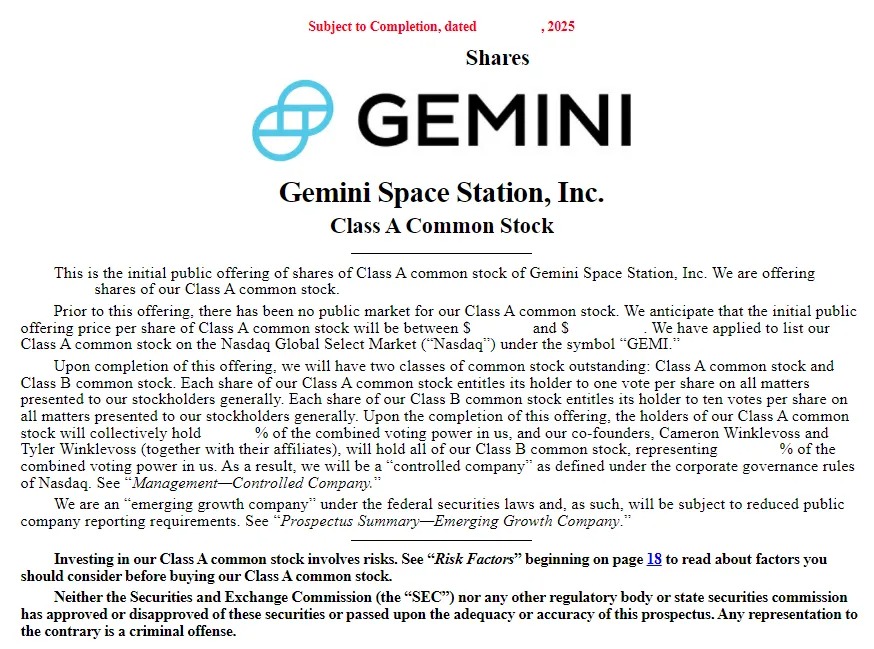

Amid favorable cryptocurrency policy developments and heightened IPO activity in the U.S. stock market, crypto exchange Gemini has recently filed its prospectus, preparing to list on the Nasdaq under the ticker "GEMI", with Goldman Sachs and Citigroup serving as lead underwriters, following stablecoin issuer Circle and cryptocurrency exchange Bullish.

Gemini was founded in 2014 by the Winklevoss twins. Cameron Winklevoss serves as President, while Tyler Winklevoss is CEO.

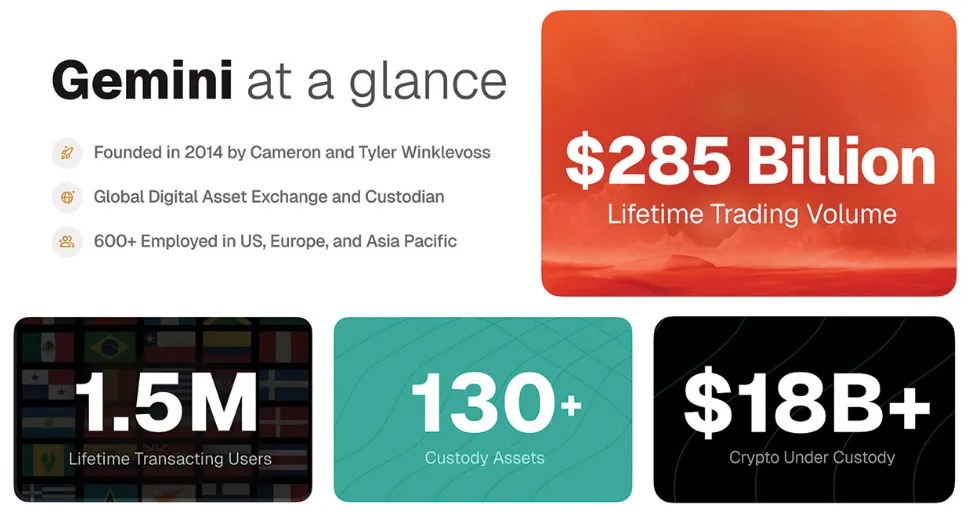

According to data provider Kaiko, Gemini ranks among the larger crypto trading platforms in the U.S. by trading volume, currently holding approximately $18 billion in custodied assets and having achieved a cumulative historical trading volume of around $285 billion. Its business spans over-the-counter (OTC) trading, credit cards for U.S. customers, and trading in assets such as Bitcoin, Ethereum, and various stablecoins, serving both retail and institutional clients, with primary revenue derived from transaction fees based on trading volume.

In addition to operating a cryptocurrency exchange, Gemini offers crypto staking services and a crypto rewards credit card, and provides crypto custody and OTC trading services for institutions.

Currently, Gemini has over 13 million users and manages $50 billion in custodied assets, placing it among the top ten global crypto custody platforms.

Gemini issues the Gemini Dollar (GUSD), a stablecoin pegged 1:1 to the U.S. dollar. Gemini also supports more than 70 cryptocurrencies and operates in over 60 countries and regions.

If successfully listed, Gemini will become the third cryptocurrency exchange—after Coinbase and Bullish—to go public on the U.S. stock market.

The prospectus reveals that Gemini's revenues were $98.14 million and $142 million in 2023 and 2024 respectively, with operating losses of $312 million and $166 million, and net losses of $320 million and $159 million during the same periods.

In the first half of 2025, Gemini generated revenue of $68.61 million, down 7.6% year-on-year from $74.23 million; operating loss was $113 million compared to $84.8 million in the same period last year; net loss reached $282 million versus $41.37 million in the prior-year period.

Notably, at the end of 2002, twins Cameron and Tyler Winklevoss sought to launch ConnectU, a social network targeting American university students. They reportedly enlisted Mark Zuckerberg to help develop the website. In 2004, they accused Zuckerberg of copying their concept for Facebook and using source code developed during his employment.

Reports indicate Facebook eventually settled the lawsuit with a "cash + stock" package valued at $65 million. The brothers reportedly used part of the settlement to accumulate Bitcoin and now hold 70,000 BTC, worth over $8 billion.

The Winklevoss twins also competed in the men's coxless pair rowing event at the 2008 Beijing Olympics, finishing sixth.

After Trump announced support for cryptocurrencies, the Winklevoss brothers became supporters and donated Bitcoin exceeding the legal maximum limit to Trump’s campaign (the excess amount was returned). They also attended Trump’s July ceremony signing the stablecoin bill, during which Trump publicly promoted the Gemini exchange.

Despite significant financial pressure, Gemini's IPO timing is still seen as strategic. In the first half of 2025, the overall crypto market rebounded, with Bitcoin prices stabilizing above $80,000 and a surge in DeFi applications following Ethereum upgrades, creating a favorable window for crypto company listings.

In recent years, the U.S. SEC has intensified regulation of the crypto industry, and Gemini's BitLicense and SOC 2 compliance certifications serve as key moats for its IPO. Market analysts estimate Gemini's IPO valuation could range between $5 billion and $10 billion, depending on roadshow performance and market sentiment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News