5 Years, 20x: The Birth of America's Most Expensive Lucky Stock

TechFlow Selected TechFlow Selected

5 Years, 20x: The Birth of America's Most Expensive Lucky Stock

In this increasingly dangerous world, America needs Palantir.

By David & Liam, TechFlow

On August 8, 2025, Palantir Technologies (PLTR) reached a share price of $187.99, with its market capitalization surpassing $443 billion—higher than the combined value of defense giants Lockheed Martin, Raytheon, and Northrop Grumman.

Since its direct listing in September 2020 at $10 per share, PLTR has rebounded from a low of $5.92, achieving a cumulative gain of 31 times; even measured from its listing price, it has delivered nearly 19-fold returns.

From the beginning of 2025 to date, PLTR has risen another 145%.

This AI data company does not manufacture chips, train large models, or produce consumer-grade products.

Yet its client list reads like a cast from the movie "Mission: Impossible": CIA, FBI, NSA, Pentagon, Israeli Defense Forces, UK MI5.

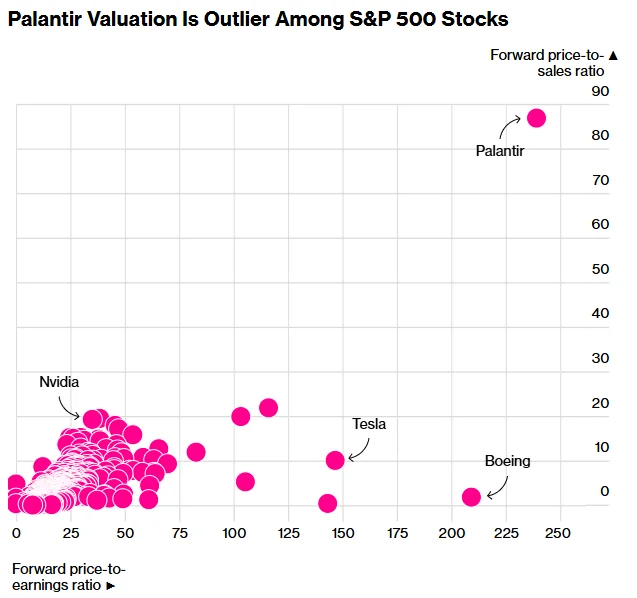

Even more puzzling is its valuation. PLTR's forward P/E ratio stands at a staggering 245x, while the industry average is only 24x. By comparison, Nvidia, sometimes called the "AI bubble," trades at a P/E of just 35x.

Where does this faith come from?

The data firm founded by PayPal Mafia godfather Peter Thiel and once backed by Wang Sicong, was once shunned by Silicon Valley as an "evil company." Today, it has transformed into the hottest star of the AI era and a proxy stock for America’s national destiny.

Times have changed, sir.

9/11, CIA, and the Crystal Ball

September 11, 2001—the Twin Towers collapsed, and America’s sense of security was permanently altered.

In Silicon Valley, young billionaire Peter Thiel, who had just cashed out $1 billion from PayPal, pondered a different question:

Could the methods PayPal used to combat transaction fraud be extended to other domains—like fighting terrorism?

At the time, they had built the world’s most advanced commercial anti-fraud system, identifying anomalies through transaction pattern analysis. What if the same logic could be applied to national security?

But Thiel needed someone special to lead this company and realize his vision. He thought of his Stanford Law School classmate, Alex Karp.

Karp is the most un-CEO-like CEO in Silicon Valley. He studied philosophy at Haverford College, earned a law degree from Stanford, then went to Germany’s Goethe University Frankfurt to pursue a PhD in neo-classical social theory, writing his dissertation on "Aggression in the Lifeworld."

In 2004, Thiel officially hired Karp as CEO.

The same year, they assembled an unusual founding team: 24-year-old Stanford prodigy Joe Lonsdale, Thiel’s Stanford roommate Stephen Cohen, and PayPal engineer Nathan Gettings—the man who built PayPal’s original anti-fraud prototype.

The company was named “Palantir,” derived from Tolkien’s “seeing stone” in The Lord of the Rings—a magical orb capable of piercing time and space to reveal hidden truths. In the novels, whoever controls the Palantír holds the advantage in information.

Fittingly, the company even named its offices after locations from Middle-earth: Palo Alto became “The Shire,” McLean, Virginia became “Rivendell,” and Washington D.C. became “Minas Tirith.”

The startup funding was equally unconventional: $2 million came from the CIA’s venture arm, In-Q-Tel, and $30 million from Thiel himself and his fund, Founders Fund.

In the following decade-plus, Palantir raised over $3 billion, drawing investments from top-tier U.S. VCs and some controversial individuals—including Chinese celebrity heir Wang Sicong, who invested $4 million via Prominent Capital in 2014, valuing the company around $9 billion.

Their mission was especially clear in post-9/11 America.

As CEO Karp later put it, Palantir does “the finding of hidden things”: the next potential terrorist attack.

Hunting Bin Laden

From 2003 to 2006, Palantir virtually disappeared from public view.

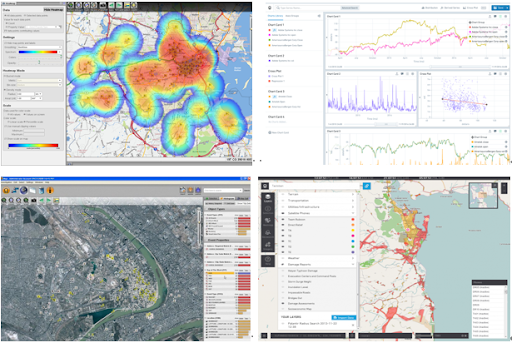

No product launches, no media coverage, not even office signage. Engineers worked in an unassuming building, developing software codenamed “Gotham” for U.S. intelligence agencies.

Yes, that Gotham—the city guarded by Batman.

In Afghanistan in 2010, U.S. forces faced an invisible enemy. That year alone, over 200 American soldiers died from roadside bombs (IEDs)—more than the previous three years combined.

That’s when Gotham proved its worth, piecing together seemingly unrelated fragments into a coherent picture:

A local man wearing a purple hat triggered an alert—the color being extremely rare in local culture. By tracking this trait alongside mobile signals, movement patterns, and social networks, the system identified him as the mine-layer.

Another widely known achievement was the 2011 killing of Osama bin Laden.

Though never officially confirmed, multiple sources suggest Palantir played a pivotal role. In Mark Bowden’s book “The Finish,” detailing the operation, he describes Palantir as a “true killer app.”

The Gotham system analyzed years of accumulated data—phone records, financial transactions, personnel movements, social connections—and ultimately traced the线索 to that seemingly ordinary compound.

The company born in the CIA’s basement had become a powerful data weapon for the U.S. government.

Silicon Valley Outcast

Government contracts are a double-edged sword.

For Palantir, reliance on government work provided early revenue but also branded it indelibly as a “government company.” This invisible stigma shadowed its entire commercial journey.

In 2009, Palantir attempted its first move beyond intelligence circles—JPMorgan Chase became its first major commercial client.

They used Palantir’s technology for internal risk control—monitoring traders’ emails, GPS locations, printing and downloads, even analyzing transcribed phone calls to detect improper trading.

In 2011, the company launched Foundry, an enterprise platform integrating sales, inventory, finance, and operations data into a single analytical hub for cross-departmental use. But deployment took months, each project required heavy customization, and costs were high—making scalability difficult.

Many clients admired the tech but balked at cost and implementation time. In contrast, “lighter” platforms like Snowflake and Databricks gained favor.

Meanwhile, Palantir repeatedly drew political fire: aiding the CIA against WikiLeaks, participating in the “PRISM” surveillance program, using facial recognition to track undocumented immigrants and protesters.

In left-leaning Silicon Valley, it was seen as an “evil company” enabling oppression. Protesters repeatedly demonstrated outside Palantir’s headquarters and the homes of founders Thiel and Karp.

In 2020, shortly before going public, Palantir severed ties with Silicon Valley, relocating to Denver.

In an open letter, CEO Karp expressed frustration: “We provide software to defend America’s national security, yet face constant criticism—while internet companies selling consumer data for ad profits do so without scrutiny.”

In September that year, Palantir went public.

The media slapped it with negative labels:

17 years old, never profitable: Lost $580 million in 2019, and the IPO prospectus warned it might never achieve sustained profitability.

Over-reliance on government contracts: Government clients accounted for 53.5% of revenue in the first half of 2020, down to 45% last year.

Unusually aggressive governance: Palantir disclosed in SEC filings that founders could unilaterally adjust voting rights.

It opened at $10 on its first trading day, then fell to $5.92 two years later.

To outsiders, this was a company dependent on government work, struggling commercially, showing no path to profit, and widely despised in Silicon Valley—hardly an investment prospect.

Yet just a few years later, its market cap soared past $400 billion, joining the ranks of the world’s most valuable tech firms.

How did Palantir pull off this reversal?

The Turnaround

November 30, 2022—ChatGPT arrived, and the world began talking about an AI revolution.

But for most enterprises, excitement gave way to a practical dilemma: ChatGPT can write poetry and chat, but it doesn’t understand my business data, my workflows, or how to connect to my core systems.

This dilemma became Palantir’s opportunity. Karp saw what others missed.

Less than five months after ChatGPT’s release, Palantir launched AIP (Artificial Intelligence Platform).

AIP is essentially an AI Agent platform, enabling large language models to understand and act upon real enterprise data—learning your business processes, understanding your data structures, mastering your operational logic—ultimately becoming an AI employee who truly knows your company.

It can analyze ERP systems, CRM databases, financial reports, and execute actions.

When you ask, “Which production line should be prioritized for maintenance?” it won’t give theoretical advice like GPT. Instead, based on real-time equipment status, maintenance history, and production schedules, it delivers specific recommendations—and can even automatically issue work orders.

This leverages Palantir’s core competency built over decades: data integration and automated decision-making.

For 20 years, it processed intelligence data for the CIA and FBI, battlefield data for the Pentagon—always solving one problem: turning complex data into executable actions.

AI made automation possible. While ChatGPT lets everyone talk to AI, AIP lets every company make AI work for them.

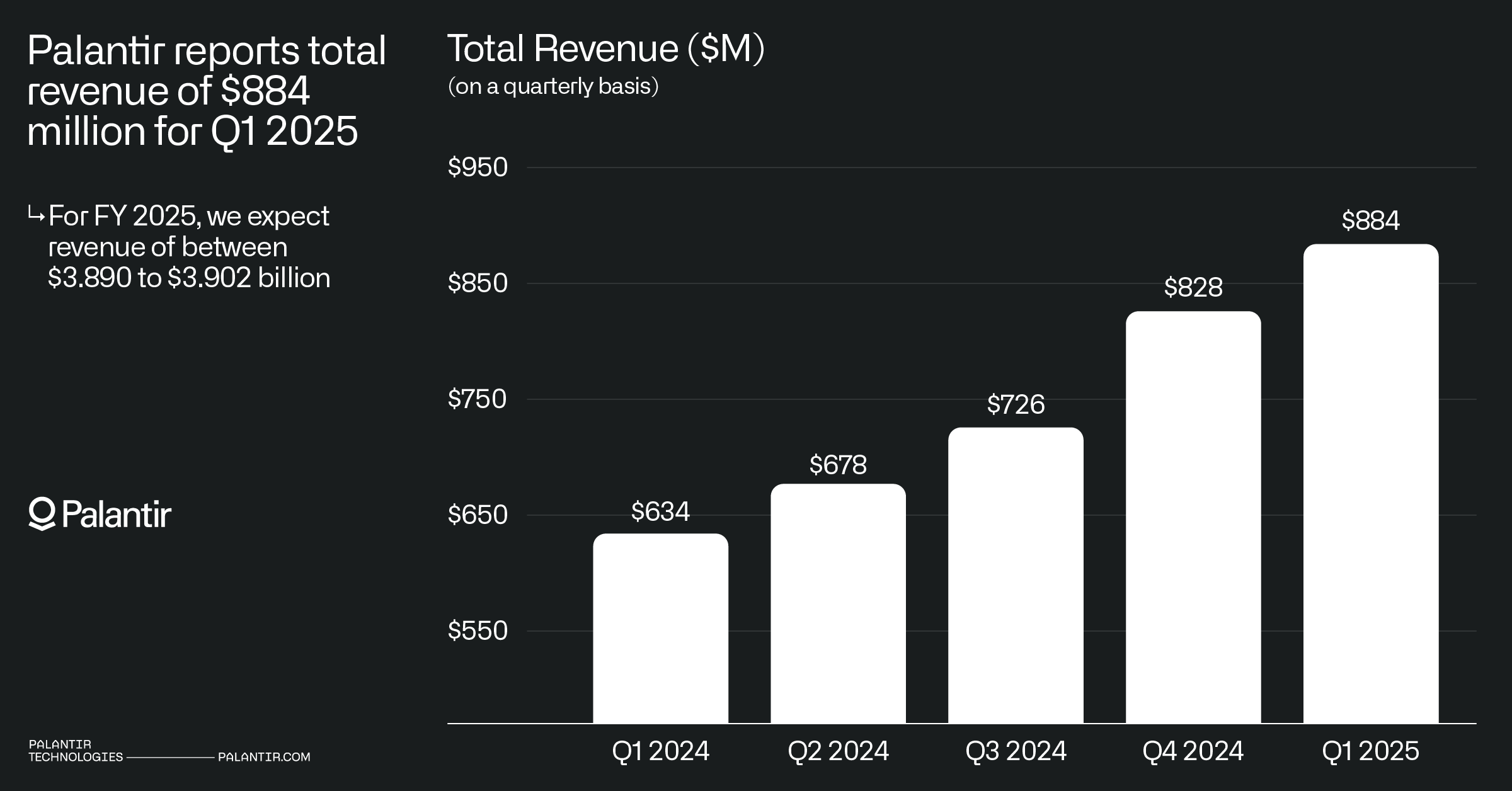

The financials quickly reflected this shift. In Q1 2023, before AIP’s launch, Palantir’s revenue growth hit a historic low of 13%. After AIP launched, growth surged—23% for all of 2024.

In 2025, explosive growth arrived: Q1 revenue reached $884 million, up 39% year-over-year; Q2 hit $1.01 billion, up 48%.

More importantly, customer composition shifted. In Q4 2023, U.S. commercial customers grew 55% year-over-year. By Q4 2024, total customers reached 711, up 43%, with commercial revenue growing 64%—outpacing government revenue growth of 45%.

The long-criticized “government dependency” was healing. From Chevron to Airbus, from Santander Bank to Wenzel Spine, companies across industries lined up to deploy AIP.

From government contractor to Silicon Valley outcast to AI-era darling, Palantir completed a stunning transformation with AIP.

The AI Arms Dealer

The AI revolution isn’t confined to chat windows—it’s happening on real battlefields.

In defense, Palantir has become the Western world’s “AI arms dealer.”

In 2022, Palantir CEO Karp, wearing tactical boots, appeared in Kyiv, signing cooperation agreements with the Ukrainian government.

Soon after, the Gotham system entered combat: commanders input target coordinates, algorithms calculate firing parameters, and assign tasks to the “most cost-effective” weapons. Palantir became a key participant in modern warfare.

Palantir is now embedded in the U.S. and broader Western defense infrastructure.

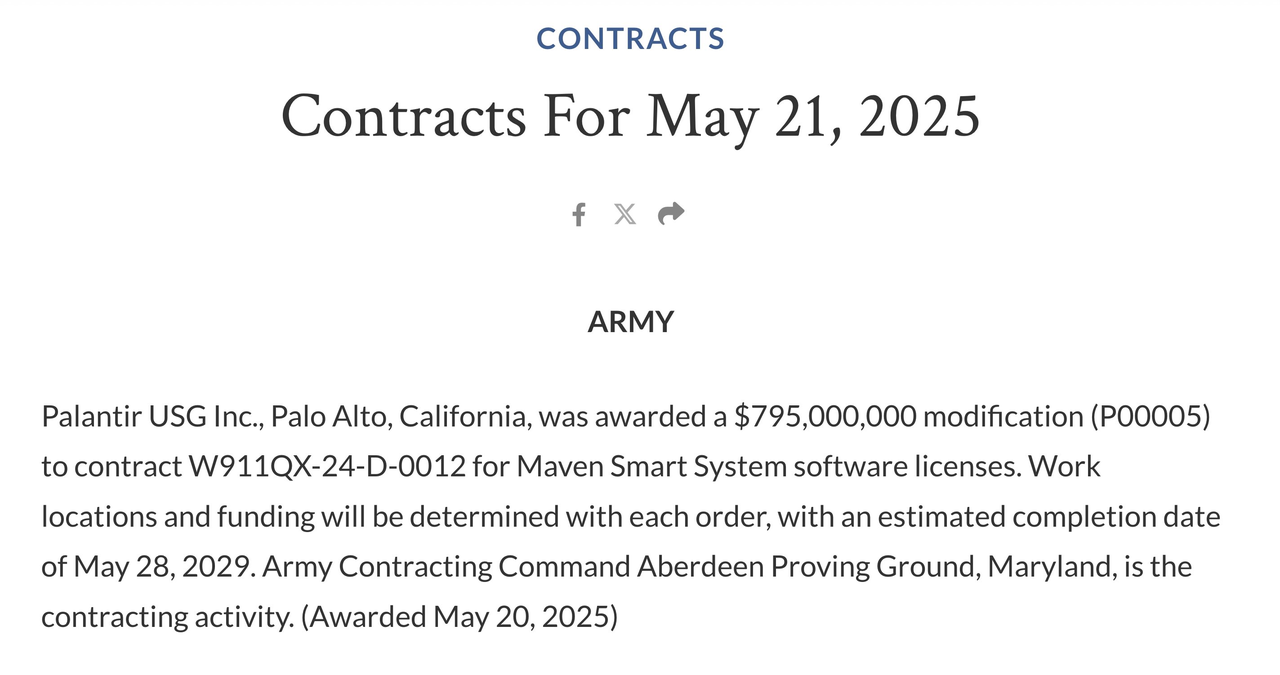

After Google exited Project Maven in 2019, Palantir immediately took over this critical Pentagon AI contract. In the years since, contracts poured in: in Q3 2024, Palantir secured a $218 million Space Force contract to build an integrated air-space combat system; in August 2025, the U.S. Army signed a 10-year, $10 billion deal with Palantir.

In April 2025, a symbolic milestone: NATO officially procured Palantir’s Maven Smart System, deploying it at Allied Command Operations to enhance multinational coordination. This cemented Palantir’s technology as the de facto standard within Western military alliances.

As Palantir CEO Karp told The Washington Post: “The power of advanced algorithmic warfare is so overwhelming, it’s like having tactical nuclear weapons against an opponent with only conventional arms.”

At the end of 2024, Palantir released a social media ad titled “The battle hasn’t begun, but the outcome is already decided.” It wasn’t just marketing—it was a declaration.

Behind Palantir is more than just Peter Thiel. Elon Musk, another PayPal Mafia member, is co-building an unprecedented AI-military ecosystem with Thiel: Palantir provides battlefield data analytics, SpaceX’s Starlink handles communications, and X (Twitter) dominates information and propaganda warfare.

This emerging military-industrial complex is redefining the nature of 21st-century warfare.

The Birth of a Faith Stock

AIP’s breakout and a string of major defense wins sent Palantir’s stock on a meteoric rise:

$20 in May 2023, $60 when it joined the S&P 500 in November 2024, peaking at $187.99 in August 2025—a nearly tenfold increase in just over two years.

In the SaaS industry, the “Rule of 40” measures company health: revenue growth rate plus profit margin exceeding 40% is considered strong.

In Q1 2025, Palantir’s figure was 83%.

Then came the retail investors.

Reddit’s r/PLTR forum gathered 108,000 “believers,” dissecting every earnings report, parsing CEO statements, even giving the company nicknames. To them, Palantir is not just a software company—it’s an extension of America’s national destiny.

For these retail investors, buying PLTR isn’t betting on a company—it’s betting on a world order. So long as America maintains global military dominance, Palantir will thrive.

CEO Alex Karp makes no secret of his political stance. He has publicly stated: “We’ve always held pro-Western views, believing the West offers superior ways of life and organization.”

In his 2024 shareholder letter, he quoted historian Samuel Huntington: “The West’s rise was not due to the superiority of its ideas or values, but because of its superiority in applying organized violence.”

In early 2025, Karp published a book: *The Technological Republic*.

In it, he challenges Silicon Valley’s tech firms:

“Why do Silicon Valley companies care only about food delivery and social media, not national security?”

In his view, the responsibility of tech companies isn’t just to make money, but to actively shape the world’s political order.

This raw technological nationalism is rare in Silicon Valley. When Google pulled out of Project Maven due to employee protests, Palantir stepped in without hesitation, openly declaring itself America’s “digital arms dealer” in the AI arms race.

In August 2025, Palantir’s market cap hit $443.55 billion, ranking it the 21st most valuable company globally. What does this mean?

It surpassed the combined market caps of Lockheed Martin, Raytheon, and Northrop Grumman—three traditional defense giants whose total value couldn’t match this software firm with fewer than 4,000 employees.

A P/E ratio of 245x reveals the essence of a faith stock: it’s not about cash flows or valuation models, but a simple belief—in an increasingly dangerous world, America needs Palantir.

Will the stock keep rising? No one knows. But one thing is certain: in an age of geopolitical realignment, betting on “America’s fate” has become the simplest investment logic across the Pacific, and Palantir has emerged as the perfect stock vehicle for that bet.

Perhaps it’s the most expensive “national destiny stock” ever—but to believers, that’s precisely its value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News