Capital-driven compliance? Understanding Polymarket's global regulatory challenges and survival strategies

TechFlow Selected TechFlow Selected

Capital-driven compliance? Understanding Polymarket's global regulatory challenges and survival strategies

Polymarket's story reveals a compliance pathway driven by capital.

Author: Gui Ruofei

Traditional U.S. polling institutions never imagined that what would replace them wouldn't be advanced artificial intelligence, but a Web3 prediction platform. During the 2024 election, most polling agencies' data indicated Harris held a clear lead over Trump in support ratings. However, Polymarket's prediction results diverged significantly from those of traditional pollsters, consistently showing Trump far ahead of Harris in terms of winning probability. Ultimately, as Trump swept Harris with overwhelming advantage to win the 2024 presidential election, Polymarket gained instant fame and entered the public spotlight.

Yet behind Polymarket’s rapid growth, compliance issues and regulatory pressures have persistently loomed, becoming the biggest obstacle to its further expansion. Faced with aggressive scrutiny from regulators worldwide, Polymarket has carved out a unique compliance path of its own. This article will provide an in-depth analysis—from professional perspectives within the Web3 industry and cross-border compliance—of Polymarket’s current regulatory landscape, compliance risks, and compliance strategies, offering reference for future Web3 entrepreneurs and project teams.

CNN published an article on Polymarket, the prediction market that shone during the U.S. presidential election

1. What Exactly Is Polymarket?

As an emerging Web3 prediction market platform, since its founding in 2020, Polymarket has quickly established itself as the leading player in the sector thanks to blockchain-based features such as transparency and decentralization. Polymarket covers a remarkably broad range of events, spanning political affairs, capital markets, economic indicators, sports competitions, and even sociocultural incidents. The wide scope of predictable events is key to attracting large numbers of users, yet it also increases complexity regarding classification and regulation across different jurisdictions. On Polymarket, users primarily make predictions by purchasing event-specific outcome tokens, whose prices fluctuate between $0 and $1. Thus, the price of these event tokens reflects in real time the collective market perception of the likelihood of a specific outcome occurring.

The core value proposition of Polymarket lies in leveraging blockchain innovation to transform abstract predictive opinions into priced, tradable digital assets, enabling users to profit from them. For example, during the 2024 election, the token price for betting on "Trump wins" rose steadily from an initial $0.30 to $0.92, eventually settling at $1 when the election results were confirmed. This price movement precisely captured the actual shift in public sentiment during the election and generated significant wealth effects for successful predictors.

Polymarket’s rapid rise in the Web3 prediction market space has also earned favor from capital markets. To date, Polymarket has successfully completed two funding rounds, raising over $70 million in total. Its investors include well-known figures such as Ethereum co-founder Vitalik Buterin and Founders Fund led by Peter Thiel.

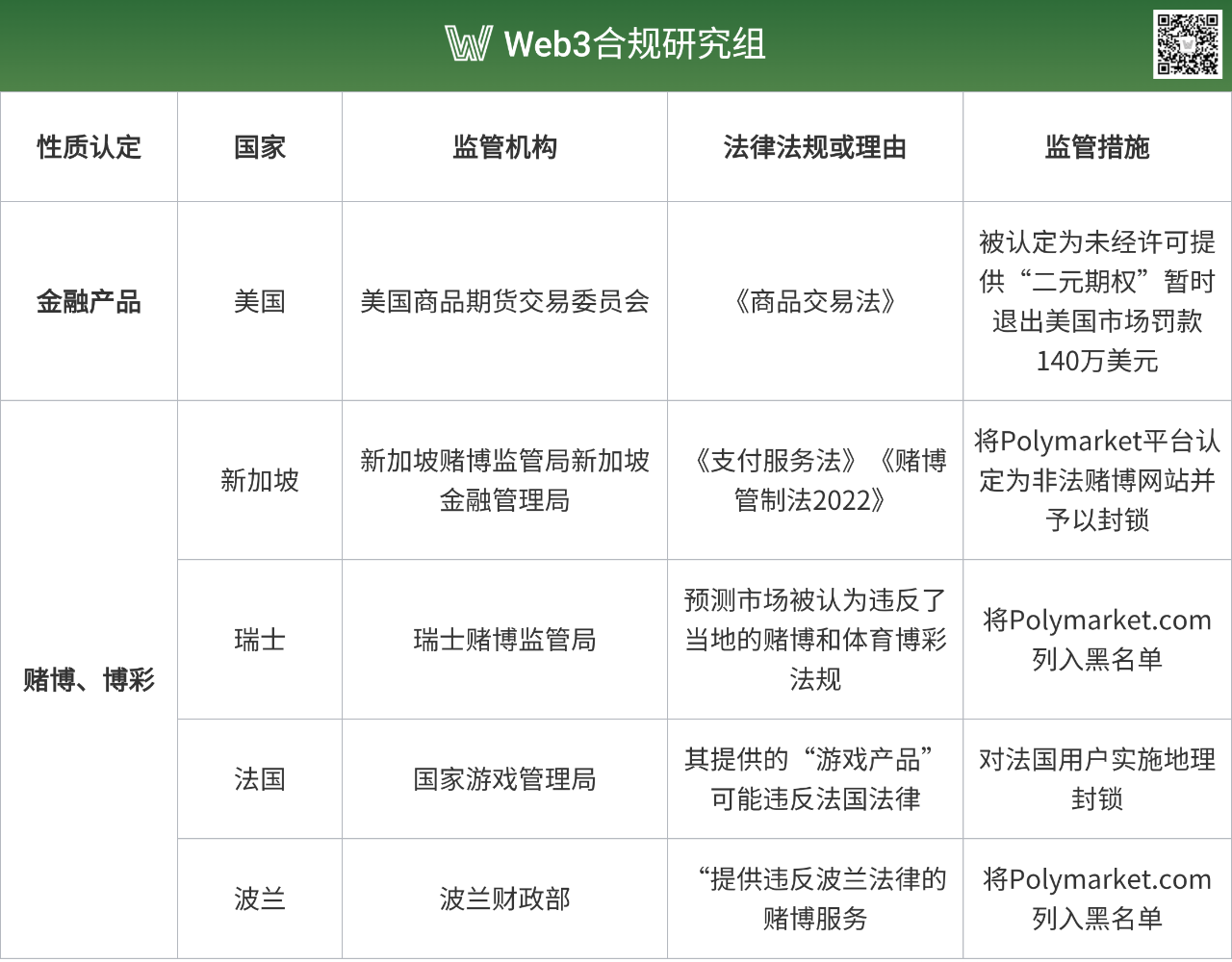

2. A Brief Analysis of Polymarket’s Global Regulatory Challenges

1. United States: Classified as Binary Options, Eventually Reaching Settlement with CFTC

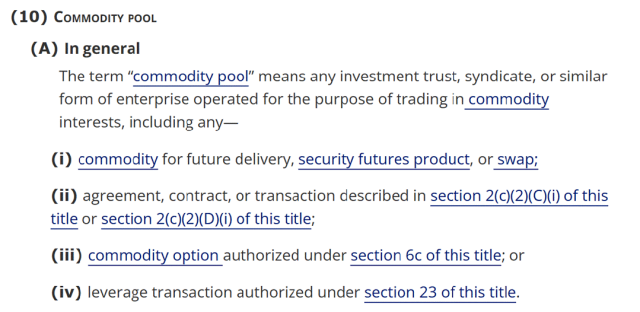

In the U.S. market, Polymarket’s earliest compliance challenge stemmed from strict enforcement actions by the Commodity Futures Trading Commission (CFTC). In January 2022, the CFTC imposed a $1.4 million civil penalty on Polymarket and issued a cease-and-desist order. According to relevant provisions of the U.S. Commodity Exchange Act (CEA), the CFTC determined that the “Event Contracts” offered on Polymarket fall within the jurisdiction defined by the Act.The Commodity Exchange Act explicitly grants the CFTC authority to regulate “futures, options, and swaps markets” (Future delivery, Security futures product, or Swap).

Therefore, when prediction markets allow users to bet on outcomes such as election results or economic indicators, the CFTC tends to classify such products as binary options or swap contracts, thereby bringing them under its exclusive jurisdiction over derivatives markets. In other words, the CFTC views Polymarket’s “Event Contracts” as financial derivatives under its purview rather than gambling or betting activities. Hence, the central allegation was that Polymarket operated an unregistered derivatives trading platform, having failed to register with the CFTC as a Swap Execution Facility (SEF) or Designated Contract Market (DCM), as required by the Commodity Exchange Act.

The image above shows Section 1a(10) of the Commodity Exchange Act defining Commodity Pool

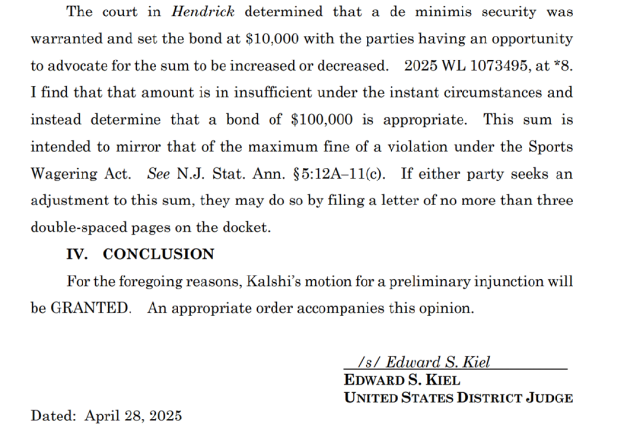

Beyond this, the prediction market where Polymarket operates also faces a "tug-of-war" between federal and state regulatory authorities. While the CFTC attempts to assert exclusive jurisdiction over prediction markets via the Commodity Exchange Act, treating them as “event contracts,” some state gambling regulators view prediction markets as “illegal gambling” and have filed lawsuits accordingly. For instance, on March 27, 2025, New Jersey’s gaming enforcement agency issued a cease-and-desist order to Kalshi, a direct competitor of Polymarket, prohibiting it from offering sports betting services without authorization.

Kalshi has since engaged in prolonged legal battles with gambling regulators in New Jersey and elsewhere. Although Judge Edward Kiel of the U.S. District Court for New Jersey ruled that Kalshi’s sports event contracts fall under the exclusive regulatory authority of the CFTC and ordered state regulators to stop interfering with Kalshi’s operations, these disputes remain unresolved. Such jurisdictional conflicts between federal and state levels further amplify uncertainty in the U.S. regulatory environment for prediction markets.

Thus, for platforms like Polymarket, even obtaining federal-level approval may still expose them to legal challenges and litigation risks at the state level. This coexistence of “dual regulation” and “regulatory vacuums” not only increases compliance costs but also hinders comprehensive expansion in the U.S. market.

The image above shows Judge Edward Kiel’s ruling granting Kalshi’s motion for a preliminary injunction against the gaming enforcement agency

2. Europe: Classified as Gambling, Placed on Blacklists

However, Polymarket’s compliance challenges are not limited to the United States. In other global jurisdictions, Polymarket similarly faces severe regulatory pressure. Within the European Union, the Markets in Crypto-Assets Regulation (MiCA) establishes a unified regulatory framework for crypto-asset service providers (CASP), covering asset-referenced tokens (ARTs), electronic money tokens (EMTs), and other crypto-assets not covered by existing financial services legislation. However, MiCA does not explicitly bring prediction markets under its regulatory scope, leaving room for individual countries to independently regulate based on their national gambling laws. Therefore, even though MiCA provides a harmonized authorization framework for crypto-asset services in the EU, prediction market platforms still face fragmented regulation across European nations.

In Europe, multiple national regulators have taken regulatory actions against Polymarket between November 2024 and January 2025. The Swiss Gambling Supervisory Authority blacklisted Polymarket.com on November 26, 2024, citing violations of local gambling and sports betting regulations. On November 29, 2024, France’s National Gaming Authority announced that after investigation, Polymarket had agreed to implement geo-blocking for French users, as its “gaming products” could violate French law.

Reports indicate that French regulators’ actions were partly triggered by concerns arising from a French trader placing substantial bets on the U.S. election through Polymarket. Subsequently, Poland’s Ministry of Finance officially blocked access to Polymarket.com for Polish residents on January 8, 2025, citing “providing gambling services that violate Polish law.”

This indicates that European countries generally adopt a conservative and cautious approach toward prediction markets led by Polymarket, with most regulators classifying such platforms as gambling activities and imposing strict controls and restrictions under respective national gambling laws.

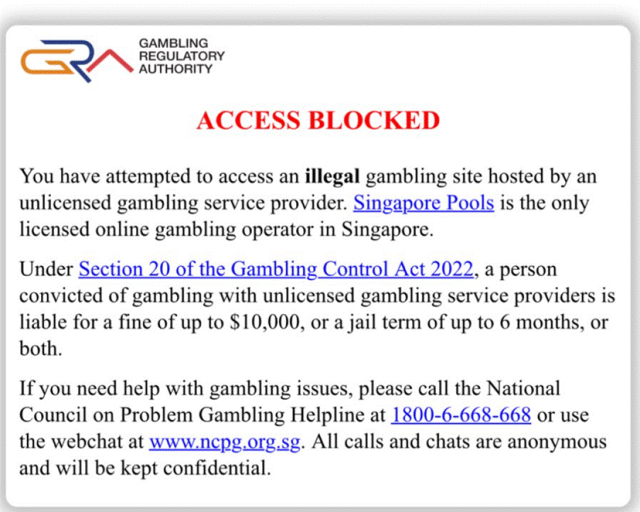

3. Singapore: Violating Two Acts

Singapore’s regulatory framework for prediction markets combines the Payment Services Act and the Gambling Control Act 2022, targeting Polymarket from multiple angles. First, the Monetary Authority of Singapore (MAS) strictly licenses and regulates digital payment token service providers under the Payment Services Act. MAS asserts that Polymarket operated a digital payment token service without proper authorization, posing serious anti-money laundering / counter-terrorism financing (AML/CFT) risks, while lacking investor protection mechanisms and user dispute resolution systems.

Meanwhile, Singapore’s Gambling Regulatory Authority classified Polymarket as an illegal gambling website under the Gambling Control Act 2022 and blocked it. The Gambling Control Act 2022 clearly states that only nationally licensed platforms (such as Singapore Pools) are permitted to offer online gambling services in Singapore. Therefore, Polymarket faces dual compliance challenges in Singapore: meeting licensing and regulatory requirements for digital payment token services under the Payment Services Act, while avoiding breaches of the stringent market entry restrictions set forth in the Gambling Control Act 2022.

The image above shows the official notice issued by Singapore’s Gambling Regulatory Authority after blocking Polymarket

From the comparative analysis of regulations across these jurisdictions, it is evident that global regulators exhibit a clear dichotomy of “financialization” versus “gamblification” in regulating prediction markets. For example, the U.S. CFTC tends to treat prediction markets as “Event Contracts” under the Commodity Exchange Act (CEA), attempting to incorporate them into the regulatory frameworks governing financial derivatives such as options and swaps. This classification acknowledges the potential value of prediction markets in information discovery and risk hedging, but also imposes rigorous financial market obligations, including registration with the CFTC, KYC/AML procedures, and reporting suspicious transactions.

However, in certain European countries (e.g., Switzerland, France, Poland) and Singapore, regulators explicitly categorize platforms like Polymarket as “illegal gambling” and have imposed blocks. This reflects these jurisdictions’ emphasis on controlling speculation, potential societal harm, and moral hazards associated with prediction markets, thus subjecting them to typically stricter gambling controls and consumer protection frameworks.

The challenge for Polymarket lies in having to adopt customized compliance strategies tailored to varying requirements across different jurisdictions, all within a global environment lacking uniform regulatory standards, which undoubtedly greatly increases operational complexity and compliance costs. This divergence in characterizing the nature of prediction markets is no accident—it reflects the delicate balance different regulatory bodies strike among financial innovation, consumer protection, and public morality.

3. Surviving Against the Odds: How Polymarket Navigates Compliance Challenges

1. United States: Proactive Compliance, Returning via Acquisition

Facing strong enforcement from the CFTC, Polymarket demonstrated full cooperation throughout the investigation, exhibiting a proactive attitude of “substantial cooperation.” This cooperative stance and open communication helped Polymarket secure a relatively low fine. In January 2022, Polymarket formally signed a settlement agreement with the CFTC, acknowledging that certain of its trading activities constituted binary option transactions under CFTC jurisdiction and agreeing to pay approximately $1.4 million in penalties.

One key term of the settlement required Polymarket to cease providing platform services to U.S. users starting in 2022 and to implement geo-blocking for U.S. IP addresses. Following this, Polymarket moved its core prediction business offshore to avoid domestic U.S. regulatory constraints and compliance risks. Notably, despite Polymarket’s claims of geo-restrictions, reports suggest some U.S. users continued participating via technical means such as VPNs. This phenomenon highlights both the limitations of IP-based geo-blocking technology and the solid user base underlying prediction markets.

To better adapt to the U.S. regulatory environment and prepare for re-entry, in May 2022, Polymarket appointed J. Christopher Giancarlo, former CFTC commissioner, as chairman of its advisory board. Reports indicate this move aims to leverage Giancarlo’s deep understanding of CFTC operations and regulatory logic to help Polymarket better chart its compliance path and establish effective communication channels with regulators. The practice of “hiring former regulatory officials for compliance consulting” is common among companies in sectors such as pharmaceuticals and finance in the United States.

However, in November 2024, controversy around Polymarket’s compliance resurfaced. The Federal Bureau of Investigation (FBI) raided the New York home of Polymarket CEO Shayne Coplan, seizing his phone and other electronic devices, although he was not arrested. The FBI’s primary objective was to investigate whether Polymarket violated its prior settlement agreement with the CFTC by allegedly failing to prevent U.S. users from continuing to trade on the platform using tools like VPNs.

Recently, however, with the incoming Trump administration and its crypto-friendly policy direction, Polymarket’s compliance outlook in the U.S. has seen a major turning point. On July 15, 2025, official reports confirmed that the U.S. Department of Justice (DOJ) and the CFTC have formally closed their investigations into Polymarket without filing any new charges. This development marks the effective resolution of the legal allegations and regulatory uncertainties Polymarket has faced since the 2022 CFTC penalty and the 2024 FBI enforcement action against Shayne Coplan.

Shortly thereafter, on July 21, 2025, Polymarket officially announced the acquisition of QCEX—a CFTC-licensed derivatives exchange and clearinghouse—for $112 million. Polymarket’s founder and CEO, Shayne Coplan, hailed this strategic acquisition as a symbolic step “bringing Polymarket back home,” aimed at establishing a “fully regulated and compliant framework” for its U.S. operations. Coincidentally, QCEX received formal Designated Contract Market (DCM) approval from the CFTC on July 9, 2025—just 12 days before Polymarket completed the acquisition. Leveraging QCEX’s ready-made DCM license, Polymarket can now legally reopen to U.S. users and temporarily free itself from compliance-related concerns.

On the surface, Polymarket appears to have resolved its compliance issues simply by acquiring QCEX, which holds a DCM license, thereby returning to the U.S. market. In reality, however, the changes and compromises Polymarket has made for compliance go much deeper. Among them, Polymarket’s shift in attitude toward KYC/AML represents a pivotal aspect of its compliance transformation. In its early days, Polymarket was characterized by KYC-free “anonymity” and “decentralized” trading. These very features enabled Polymarket to quickly gain a foothold and expand rapidly in the competitive prediction market landscape. Yet this operational strategy brought risks of “regulatory uncertainty” and “market manipulation.” Now, with Polymarket’s return to the U.S. market via the acquisition of QCEX, it is highly likely to adopt the strict KYC/AML policies required of CFTC-licensed entities like QCEX.

Specifically, CFTC-regulated entities must conduct Customer Identification Programs (CIP), Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD), along with ongoing transaction monitoring and suspicious activity reporting. This signifies that Polymarket must continuously balance decentralization with regulatory compliance. This transformation is not merely about meeting regulatory demands; it marks the inevitable evolution of Polymarket from a Web3 “wild west” growth model toward becoming a regulated financial services institution.

2. Other Regions: Conservative Strategy + Active Retreat

Compared to the U.S., Polymarket’s compliance strategy in other regions has been relatively conservative. In response to Europe and Singapore classifying prediction markets as “gambling” and imposing bans, Polymarket has raised no objections, instead agreeing to geo-block countries like France and Singapore and withdrawing from those local markets.

4. Key Takeaways for Web3 Entrepreneurs

After thoroughly analyzing Polymarket’s arduous compliance journey, I believe other Web3 entrepreneurs should at least learn the following lessons:

1. The Web3 industry has gradually moved beyond the phase of “unregulated growth.” More and more projects are entering mainstream visibility and markets. For Web3 projects aiming to grow large and achieve mainstream success, compliant operations are an inevitable trend.

2. Whether a Web3 project can truly achieve compliance depends not only on corporate compliance strategies but also closely relates to national policy directions and regulatory intensity. Polymarket’s eventual achievement of compliant operations owes much to the incoming Trump administration and its policy shift.

3. Polymarket’s story reveals a “capital-driven compliance” pathway. In the initial stage of platform operation, project teams may defer compliance, prioritizing scale and first-mover advantages. With early momentum secured, they raise funds and use capital leverage to proactively pursue compliance transformation through acquisitions, achieving business legalization and further expansion. This is not just a compliance strategy, but also a business strategy.

4. The window for regulatory arbitrage in the global Web3 industry is rapidly closing, and overall compliance costs are rising. As crypto markets mature, global regulators are strengthening cooperation and closing loopholes, making strategies based solely on “regulatory arbitrage” or “offshore operations” increasingly ineffective. Polymarket’s “grow first, comply later” approach may no longer work in the evolving regulatory landscape. Web3 project teams and entrepreneurs alike must develop a deeper understanding of the importance of compliance. Future competition in the Web3 industry will extend beyond technology and products to include compliance capability and capital strength.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News