AI wealth creation, at record-breaking speed

TechFlow Selected TechFlow Selected

AI wealth creation, at record-breaking speed

"Looking back at the data from the past 100 years, we have never seen wealth creation on such a scale and at such a speed—it is unprecedented."

By: Li Xiaoyin

Artificial intelligence is creating wealth at an unprecedented speed and scale, giving rise to a new wave of billionaires.

According to CB Insights data, there are currently 498 AI "unicorn" companies worldwide valued at over $1 billion, with a combined valuation of $2.7 trillion. Among them, 100 were founded in or after 2023, and more than 1,300 companies are now valued above $100 million.

At the heart of this wealth boom lies the extraordinary fundraising ability and soaring valuations of AI startups. Anthropic is negotiating a $5 billion funding round at a $170 billion valuation—nearly triple its March valuation. Thinking Machines Lab, founded by former OpenAI CTO Mira Murati, secured $2 billion in seed funding in July, setting a record for the largest seed round in history.

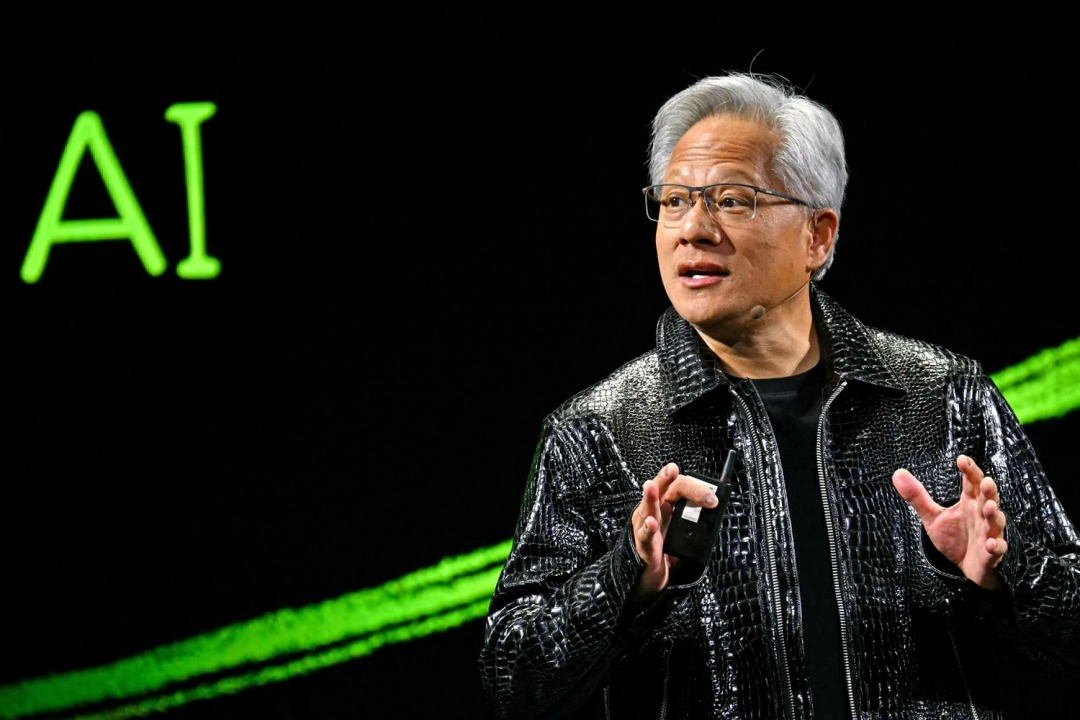

This wave of wealth creation extends beyond startups. Soaring stock prices of public tech giants like Nvidia, Meta, and Microsoft, along with the rapid growth of infrastructure firms such as data centers, collectively paint the full picture of this AI-driven financial explosion.

Andrew McAfee, principal research scientist at MIT, said:

"Looking back at 100 years of data, we have never seen wealth creation on this scale and at this speed. It’s unprecedented."

A New Wave of Billionaires Emerges Rapidly

This year's major funding rounds are generating new billionaires in bulk. According to Bloomberg's estimate from March, the four largest private AI companies had already created at least 15 billionaires, with a total net worth of $38 billion. Since then, over a dozen more unicorns have emerged.

Media reports citing sources indicate that Dario Amodei, CEO of Anthropic AI, and his six co-founders are likely now all billionaires with net worths in the billions of dollars. Additionally, Anysphere reached a $9.9 billion valuation in June, and weeks later reportedly received offers valuing it between $18 billion and $20 billion—potentially making its 25-year-old founder and CEO, Michael Truell, a billionaire.

Notably, most AI wealth today remains in the form of "paper wealth" within privately held companies, making it difficult for founders and equity holders to cash out immediately.

Unlike the late 1990s internet bubble, when many companies rushed to IPO, today’s AI startups can remain private for longer periods thanks to continuous funding from venture capital, sovereign wealth funds, family offices, and other tech investors.

Although IPO channels have narrowed, AI elites do have alternative paths to convert paper wealth into liquidity. The rapid development of secondary markets provides opportunities to sell shares, and structured secondary sales or tender offers are becoming increasingly common.

OpenAI’s ongoing secondary share sale negotiations serve as a prime example, aimed at providing employees with cash. Moreover, many founders can also secure loans through equity pledging.

Mergers and acquisitions represent another key liquidity event. According to CB Insights, there have been 73 liquidity events in the AI sector since 2023, including M&A deals, IPOs, reverse mergers, or corporate majority stake acquisitions.

For instance, after Meta invested $14.3 billion in Scale AI, its founder Alexandr Wang joined Meta’s AI team. Meanwhile, Lucy Guo, co-founder of Scale AI who left the company in 2018, used her equity wealth to purchase a luxury mansion in Hollywood Hills, Los Angeles, for approximately $30 million.

Wealth Creation Highly Concentrated in the Bay Area

This AI boom is geographically concentrated in the San Francisco Bay Area, reminiscent of Silicon Valley during the internet era.

According to the Silicon Valley Institute for Regional Studies, Silicon Valley companies received over $35 billion in venture capital last year. Another report by New World Wealth and Henley & Partners shows that San Francisco now has 82 billionaires, surpassing New York’s 66. Over the past decade, the Bay Area’s millionaire population has doubled, while New York’s grew by 45%.

The influx of wealth has directly boosted the local economy. According to Sotheby’s International Realty data, last year saw a record number of homes sold in San Francisco for over $20 million. A city once facing a "doom loop" just a few years ago is now experiencing sharp increases in rent, home prices, and demand driven by AI-fueled growth.

McAfee said:

"The geographic concentration of this AI wave is astonishing. All the people who know how to start, fund, and grow tech companies are still there. For 25 years I’ve heard people say 'This is the end of Silicon Valley' or that some place is the 'next Silicon Valley,' but Silicon Valley is still Silicon Valley."

Wealth Management Industry Faces New Opportunities and Challenges

Over time and with potential future IPOs, the massive wealth generated by today’s private AI companies will eventually become more liquid, presenting historic opportunities for the wealth management industry.

According to tech consultants speaking to media, all major private banks, large brokerages, and boutique investment banks are actively reaching out to AI elites, hoping to win their business.

However, serving this new class of wealthy individuals is no easy task. Simon Krinsky, Executive Managing Director at Pathstone, pointed out that most AI wealth remains locked in illiquid private company equity. He believes that compared to employees who worked at large publicly traded companies like Meta or Google in the past, the proportion of illiquid wealth among new AI millionaires is significantly higher.

Krinsky expects that AI billionaires will follow patterns similar to those of 1990s internet-era newcomers: initially using excess liquidity to invest in tech ventures through personal networks, and after experiencing high volatility and concentrated risks in speculative industries, ultimately turning to professional wealth management services for diversification and protection.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News